UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2024

Commission

File Number: 001-41480

Starbox

Group Holdings Ltd.

VO2-03-07,

Velocity Office 2, Lingkaran SV, Sunway Velocity, 55100

Kuala

Lumpur, Malaysia

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Starbox

Group Holdings Ltd. |

| |

|

|

| Date:

February 8, 2024 |

By: |

/s/

Lee Choon Wooi |

| |

Name: |

Lee

Choon Wooi |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Starbox

Group Holdings Ltd. Announces Financial Results for Fiscal Year 2023

Kuala

Lumpur, Malaysia, February 8, 2024 /PRNewswire/ — Starbox Group Holdings Ltd. (Nasdaq: STBX) (“Starbox” or the “Company”),

a service provider of cash rebates, advertising, and payment solutions, has unveiled its financial results for the fiscal year ended

September 30, 2023.

Mr.

Lee Choon Wooi, Chief Executive Officer and Chairman of the Board of Directors at Starbox, remarked, “As we reflect on fiscal year

2023, it becomes apparent that Starbox Group has solidified its position as a key player in advertising, cash rebates, and payment solutions,

and become a technology solutions provider in Southeast Asia. I am pleased to announce a remarkable 63.2% increase in our total revenue,

reaching $11.7 million from $7.2 million in fiscal year 2022. This growth underscores our innovative strategies and diversified approach,

particularly evident in technology-driven operations and our recent acquisitions, which have expanded our business. Despite challenges

in digital advertising, our strategic acquisitions have significantly bolstered our competitiveness and market presence, contributing

an additional $2.2 million in revenue from advertising design and consultation services. The consistent expansion of our member and merchant

bases on the GETBATS platform reflects the progress in performance and market coverage. Looking forward, our focus remains on enhancing

our comprehensive technology services and solutions and platform capabilities to deliver enduring value to our clients and shareholders.”

Fiscal

Year 2023 Financial Highlights

| ● | Total

revenue was $11.7 million in fiscal year 2023, an increase of 63.2% from $7.2 million

in fiscal year 2022. |

| ● | Income

from operations was $4.6 million in fiscal year 2023, compared to $5.0 million in fiscal

year 2022. |

| ● | Net

income was $2.1 million in fiscal year 2023 compared to $3.6 million in fiscal year 2022. |

Fiscal

Year 2023 Operational Highlights

| ● | Number

of advertisers was 31 as of September 30, 2023, compared to 63 as of September 30, 2022. |

| ● | Number

of members on the GETBATS website and mobile app was 2,523,802 as of September 30, 2023,

compared to 2,513,658 as of September 30, 2022. |

| ● | Number

of merchants on the GETBATS website and mobile app was 841 as of September 30, 2023,

compared to 820 as of September 30, 2022. |

| ● | Number

of transactions facilitated through GETBATS website and mobile app was 264,600 as of

September 30, 2023, compared to 338,940 as of September 30, 2022. |

| ● | Completed

the acquisition of 51% equity interests in One Eighty Holdings Ltd on June 26, 2023. |

About

Starbox Group Holdings Ltd.

Headquartered

in Malaysia, Starbox Group Holdings Ltd. is a technology-driven, rapidly growing company with innovation as its focus. Starbox is aiming

to be a comprehensive technology solutions provider within Southeast Asia and also engages in building a cash rebate, advertising, and

payment solution business ecosystem targeting micro, small, and medium enterprises that lack the bandwidth to develop an in-house data

management system for effective marketing. The Company connects retail merchants with retail shoppers to facilitate transactions through

cash rebates offered by retail merchants on its GETBATS website and mobile app. The Company provides digital advertising services to

advertisers through its SEEBATS website and mobile app, GETBATS website and mobile app and social media. The Company also provides payment

solution services to merchants. For more information, please visit the Company’s website: https://ir.starboxholdings.com.

Forward-Looking

Statements

Certain

statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and

uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes

may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking

statements by words or phrases such as “approximates,” “assesses,” “believes,” “hopes,”

“expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,”

“will,” “would,” “should,” “could,” “may” or similar expressions. The Company

undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances,

or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these

forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions

investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that

may affect its future results in the Company’s registration statement and other filings with the U.S. Securities and Exchange Commission

..

For

more information, please contact:

Starbox

Group Holdings Ltd.

Investor

Relations Department

Email:

ir@starboxholdings.com

Ascent

Investors Relations LLC

Tina

Xiao

Phone:

+1 646-932-7242

Email:

investors@ascent-ir.com

STARBOX

GROUP HOLDINGS LTD. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

| | |

As

of September

30, 2023 | | |

As

of September

30, 2022 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and equivalents | |

$ | 2,524,957 | | |

$ | 17,778,895 | |

| Accounts receivable, net | |

| 9,405,155 | | |

| 2,032,717 | |

| Prepaid expenses and other current assets | |

| 16,067,467 | | |

| 4,269,611 | |

| Short-term deposits | |

| 125,298 | | |

| - | |

| Due from related parties | |

| 112,281 | | |

| 1,473 | |

| Total current assets | |

| 28,235,158 | | |

| 24,082,696 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS | |

| | | |

| | |

| Property and equipment, net | |

| 2,523,181 | | |

| 13,380 | |

| Intangible assets, net | |

| 39,666,050 | | |

| 903,768 | |

| Right-of-use assets, net | |

| 144,901 | | |

| 42,574 | |

| Long-term deposits | |

| 213,047 | | |

| - | |

| Goodwill | |

| 82,244,248 | | |

| - | |

| Total non-current assets | |

| 124,791,427 | | |

| 959,722 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 153,026,585 | | |

$ | 25,042,418 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 1,088,982 | | |

$ | - | |

| Taxes payable | |

| 339,350 | | |

| 1,404,128 | |

| Deferred revenue | |

| 393,615 | | |

| - | |

| Accrued liabilities and other current liabilities | |

| 1,271,087 | | |

| 541,050 | |

| Operating lease liabilities, current | |

| 47,537 | | |

| 15,833 | |

| Due to related parties | |

| 246,836 | | |

| 7,361 | |

| Total current liabilities | |

| 3,387,407 | | |

| 1,968,372 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES | |

| | | |

| | |

| Deferred tax liabilities, net | |

| 6,412,919 | | |

| - | |

| Operating lease liabilities, non-current | |

| 97,364 | | |

| 26,741 | |

| Loans payable | |

| 2,070,563 | | |

| - | |

| Total non-current liabilities | |

| 8,580,846 | | |

| 26,741 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 11,968,253 | | |

| 1,995,113 | |

| | |

| | | |

| | |

| COMMITMENT AND CONTINGENCY | |

| | | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred shares, par value $0.001125, 5,000,000 shares authorized, no shares issued

and outstanding | |

| - | | |

| - | |

| Ordinary shares, par value $0.001125, 883,000,000 shares authorized, 71,885,000 shares and

45,375,000 shares issued and outstanding as of September 30, 2023 and 2022, respectively | |

| 80,871 | | |

| 51,047 | |

| Additional paid in capital | |

| 81,902,805 | | |

| 18,918,303 | |

| Accumulated other comprehensive loss | |

| (1,061,958 | ) | |

| (607,052 | ) |

| Retained earnings | |

| 8,872,207 | | |

| 4,685,007 | |

| Total shareholders’ equity attributable to the Company | |

| 89,793,925 | | |

| 23,047,305 | |

| | |

| | | |

| | |

| Noncontrolling interest | |

| 51,264,407 | | |

| - | |

| | |

| | | |

| | |

| TOTAL EQUITY | |

| 141,058,332 | | |

| 23,047,305 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 153,026,585 | | |

$ | 25,042,418 | |

STARBOX

GROUP HOLDINGS LTD. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSHIVE INCOME

| |

|

FISCAL

YEARS ENDED SEPTEMBER 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Advertising

services |

|

|

5,307,280 |

|

|

|

7,174,050 |

|

|

|

3,158,520 |

|

| Cash

rebate and payment solution services and media booking |

|

|

84,592 |

|

|

|

20,137 |

|

|

|

7,708 |

|

| Software

licensing |

|

|

5,715,333 |

|

|

|

- |

|

|

|

- |

|

| Production

income |

|

|

362,040 |

|

|

|

- |

|

|

|

- |

|

| Marketing

and promotional campaign service |

|

|

271,607 |

|

|

|

- |

|

|

|

- |

|

| Total

operating revenue |

|

|

11,740,852 |

|

|

|

7,194,187 |

|

|

|

3,166,228 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost

of revenue |

|

|

834,614 |

|

|

|

6,383 |

|

|

|

19,874 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

10,906,238 |

|

|

|

7,187,804 |

|

|

|

3,146,354 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling

expenses |

|

|

376,899 |

|

|

|

97,939 |

|

|

|

120,515 |

|

| General

and administrative expenses |

|

|

5,931,350 |

|

|

|

2,139,428 |

|

|

|

885,950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

operating expenses |

|

|

6,308,249 |

|

|

|

2,237,367 |

|

|

|

1,006,465 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income

from operations |

|

|

4,597,989 |

|

|

|

4,950,437 |

|

|

|

2,139,889 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income, net |

|

|

750 |

|

|

|

- |

|

|

|

- |

|

| Other

income (expenses), net |

|

|

(4,924 |

) |

|

|

59,377 |

|

|

|

166 |

|

| Total

other income (expenses), net |

|

|

(4,174 |

) |

|

|

59,377 |

|

|

|

166 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income

before income tax |

|

|

4,593,815 |

|

|

|

5,009,814 |

|

|

|

2,140,055 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income

tax expense |

|

|

2,134,082 |

|

|

|

1,407,449 |

|

|

|

692,405 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income

before noncontrolling interest |

|

|

2,459,733 |

|

|

|

3,602,365 |

|

|

|

1,447,650 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Less:

Income attributable to noncontrolling interest |

|

|

311,497 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to the Company |

|

$ |

2,148,236 |

|

|

$ |

3,602,365 |

|

|

$ |

1,447,650 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign

currency translation loss attributable to the Company |

|

|

(223,726 |

) |

|

|

(585,619 |

) |

|

|

(19,063 |

) |

| Foreign

currency translation loss attributable to noncontrolling interest |

|

|

(21,790 |

) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

income attributable to the Company |

|

$ |

1,924,510 |

|

|

$ |

3,016,746 |

|

|

$ |

1,428,587 |

|

| Comprehensive

income attributable to noncontrolling interest |

|

$ |

289,707 |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income per share - basic and diluted |

|

$ |

0.04 |

|

|

$ |

0.09 |

|

|

$ |

0.04 |

|

| Weighted

average number of ordinary shares outstanding - basic and diluted |

|

$ |

56,469,014 |

|

|

$ |

40,544,863 |

|

|

$ |

40,000,000 |

|

STARBOX

GROUP HOLDINGS LTD. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

FISCAL YEARS ENDED SEPTEMBER 30, | |

| | |

2023 | | |

2022 | | |

2021 | |

| | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | | |

| | |

| Net income | |

$ | 2,459,733 | | |

$ | 3,602,365 | | |

$ | 1,447,650 | |

| Adjustments to reconcile net income to net cash used in operating activities: | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 1,840,302 | | |

| 161,267 | | |

| 2,568 | |

| Amortization of right-of-use assets | |

| 41,090 | | |

| 56,690 | | |

| 7,274 | |

| Changes in deferred tax | |

| 857,381 | | |

| - | | |

| - | |

| Changes in operating assets / liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable | |

| (5,124,396 | ) | |

| (864,099 | ) | |

| (1,100,053 | ) |

| Prepaid expenses and other current assets | |

| (11,265,056 | ) | |

| (4,754,970 | ) | |

| (39,190 | ) |

| Deferred revenue | |

| (217,533 | ) | |

| (778,701 | ) | |

| 688,979 | |

| Taxes payable | |

| (545,753 | ) | |

| 661,359 | | |

| 870,528 | |

| Operating lease liabilities | |

| (41,090 | ) | |

| (56,690 | ) | |

| (7,274 | ) |

| Accrued expenses and other current liabilities | |

| 467,154 | | |

| 740,415 | | |

| 13,413 | |

| | |

| | | |

| | | |

| | |

| Net cash (used in) provided by operating activities | |

| (11,528,168 | ) | |

| (1,232,364 | ) | |

| 1,883,895 | |

| | |

| | | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | | |

| | |

| Cash acquired from acquisition of subsidiaries | |

| 932,893 | | |

| - | | |

| - | |

| Purchase of fixed assets | |

| (14,864 | ) | |

| (6,669 | ) | |

| (5,203 | ) |

| Purchase of intangible assets | |

| (17,679,247 | ) | |

| (1,129,260 | ) | |

| - | |

| Cash advances to a related party | |

| - | | |

| - | | |

| (387,945 | ) |

| Collection of cash advances from a related party | |

| - | | |

| - | | |

| 387,945 | |

| | |

| | | |

| | | |

| | |

| Net cash used in investing activities | |

| (16,761,218 | ) | |

| (1,135,929 | ) | |

| (5,203 | ) |

| | |

| | | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | | |

| | |

| Capital contribution by shareholders | |

| - | | |

| - | | |

| 200,000 | |

| Proceeds from equity financing | |

| 11,766,810 | | |

| 18,769,326 | | |

| - | |

| Repayment of loans | |

| (32,331 | ) | |

| - | | |

| - | |

| Borrowing from (repayment to) related parties | |

| 328,546 | | |

| (729,521 | ) | |

| (125,875 | ) |

| | |

| | | |

| | | |

| | |

| Net cash provided by financing activities | |

| 12,063,025 | | |

| 18,039,805 | | |

| 74,125 | |

| | |

| | | |

| | | |

| | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | |

| 972,423 | | |

| (187,894 | ) | |

| (28,792 | ) |

| | |

| | | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH & EQUIVALENTS | |

| (15,253,938 | ) | |

| 15,483,618 | | |

| 1,924,025 | |

| | |

| | | |

| | | |

| | |

| CASH & EQUIVALENTS, BEGINNING OF FISCAL YEAR | |

| 17,778,895 | | |

| 2,295,277 | | |

| 371,252 | |

| | |

| | | |

| | | |

| | |

| CASH & EQUIVALENTS, END OF FISCAL YEAR | |

| 2,524,957 | | |

| 17,778,895 | | |

| 2,295,277 | |

| | |

| | | |

| | | |

| | |

| Supplemental Cash Flow Data: | |

| | | |

| | | |

| | |

| Income tax paid | |

$ | 2,382,705 | | |

$ | 934,910 | | |

$ | 15,747 | |

| Interest paid | |

$ | 26,454 | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| Supplemental disclosure of non-cash investing and financing activities | |

| | | |

| | | |

| | |

| Right-of-use assets obtained in exchange for operating lease liabilities | |

$ | 167,667 | | |

$ | 52,934 | | |

$ | 317,170 | |

| Shares issued for acquisition of One Eighty Ltd | |

$ | 53,055,300 | | |

$ | - | | |

$ | - | |

| Goodwill acquired in business acquisition | |

$ | 82,244,248 | | |

$ | - | | |

$ | - | |

| Identifiable intangible assets acquired in business acquisition | |

$ | 23,500,000 | | |

$ | - | | |

$ | - | |

| Net assets acquired in business acquisition | |

$ | 21,785,752 | | |

$ | - | | |

$ | - | |

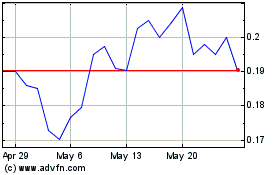

StarBox (NASDAQ:STBX)

Historical Stock Chart

From Apr 2024 to May 2024

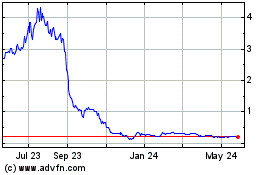

StarBox (NASDAQ:STBX)

Historical Stock Chart

From May 2023 to May 2024