Staffing 360 Solutions Announces Reverse Stock Split to Maintain NASDAQ Listing

June 30 2021 - 12:30PM

Staffing 360 Solutions, Inc. (NASDAQ: STAF), a company executing an

international buy-integrate-build strategy through the acquisition

of staffing organizations in the United States and the United

Kingdom, announced today that it intends to effect a reverse stock

split of its common stock at a ratio of 1 post-split share for

every 6 pre-split shares. The reverse stock split will become

effective at 5:00 p.m. on Wednesday, June 30, 2021. Staffing 360’s

common stock will continue to be traded on the NASDAQ Capital

Market under the symbol STAF and will begin trading on a

split-adjusted basis when the market opens on Thursday, July 1,

2021.

At a special meeting of stockholders held on

June 21, 2021, Staffing 360’s stockholders granted the Company’s

Board of Directors the discretion to effect a reverse stock split

of Staffing 360’s common stock through an amendment to its

Certificate of Incorporation at a ratio of not less than 1-for-2

and not more than 1-for-20, such ratio to be determined by the

Company’s Board of Directors.

At the effective time of the reverse stock

split, every six shares of Staffing 360’s issued and outstanding

common stock will be converted automatically into one issued and

outstanding share of common stock without any change in the par

value per share. Stockholders holding shares through a brokerage

account will have their shares automatically adjusted to reflect

the 1-for-6 reverse stock split. It is not necessary for

shareholders holding shares of the Company’s common stock in

certificated form to exchange their existing stock certificates for

new stock certificates of the Company in connection with the

reverse stock split, although stockholders may do so if they

wish.

The reverse stock split will affect all

stockholders uniformly and will not alter any stockholder’s

percentage interest in the Company’s equity, except to the extent

that the reverse stock split would result in a stockholder owning a

fractional share. Any fractional share of a stockholder resulting

from the reverse stock split will be rounded up to the nearest

whole number of shares. The reverse stock split will reduce the

number of shares of Staffing 360’s common stock outstanding from

39,166,528 million shares to approximately 6,527,755 million

shares. Proportional adjustments will be made to the number of

shares of Staffing 360’s common stock issuable upon exercise or

conversion of Staffing 360’s equity awards, convertible preferred

stock and warrants, as well as the applicable exercise price.

Stockholders with shares in brokerage accounts should direct any

questions concerning the reverse stock split to their broker; all

other stockholders may direct questions to the Company’s transfer

agent, Continental Stock Transfer & Trust Company, at

877-634-5370.

Brendan Flood, Chairman and Chief Executive

Officer said, “We are effecting this reverse stock split to raise

Staffing 360’s common stock price in order to regain compliance

with the NASDAQ Capital Market’s $1.00 per share minimum bid

continued listing requirement. We believe the trading of our shares

on a national market increases our visibility in the marketplace,

improves liquidity, broadens and diversifies our shareholder base,

and ultimately enhances long-term shareholder value.

“The recent full forgiveness of our largest PPP

loan of $10 million, along with building business momentum in Q1

and anticipated 20% revenue growth in Q2, are important steps in

our continuing fiscal recovery from the COVID-19 pandemic. Over the

next few quarters, we expect that the overall economic benefits of

the mostly vaccinated populations in the US and UK will help to

fuel our growth as we seek to establish sustainable profitable

growth on our way toward our goal to build a profitable $500

million revenue company,” Flood concluded.

About Staffing 360 Solutions,

Inc.Staffing 360 Solutions, Inc. is engaged in the

execution of an international buy-integrate-build strategy through

the acquisition of domestic and international staffing

organizations in the United States and United Kingdom. The Company

believes that the staffing industry offers opportunities for

accretive acquisitions and as part of its targeted consolidation

model, is pursuing acquisition targets in the finance and

accounting, administrative, engineering, IT, and light industrial

staffing space. For more information, visit

http://www.staffing360solutions.com. Follow Staffing 360 Solutions

on Facebook, LinkedIn and Twitter.

Forward-Looking StatementsThis

press release contains forward-looking statements, which may be

identified by words such as "expect," "look forward to,"

"anticipate," "intend," "plan," "believe," "seek," "estimate,"

"will," "project" or words of similar meaning. Forward-looking

statements are not guarantees of future performance, are based on

certain assumptions and are subject to various known and unknown

risks and uncertainties, many of which are beyond the Company's

control, and cannot be predicted or quantified; consequently,

actual results may differ materially from those expressed or

implied by such forward-looking statements. Such risks and

uncertainties include, without limitation, our ability to retain

our listing on the Nasdaq Capital Market; market and other

conditions; the geographic, social and economic impact of COVID-19

on the Company’s ability to conduct its business and raise capital

in the future when needed; weakness in general economic conditions

and levels of capital spending by customers in the industries the

Company serves; weakness or volatility in the financial and capital

markets, which may result in the postponement or cancellation of

customer capital projects or the inability of the Company’s

customers to pay the Company’s fees; the termination of a major

customer contract or project; delays or reductions in U.S.

government spending; credit risks associated with the Company’s

customers; competitive market pressures; the availability and cost

of qualified labor; the Company’s level of success in attracting,

training and retaining qualified management personnel and other

staff employees; changes in tax laws and other government

regulations, including the impact of health care reform laws and

regulations; the possibility of incurring liability for the

Company’s business activities, including, but not limited to, the

activities of the Company’s temporary employees; the Company’s

performance on customer contracts; negative outcome of pending and

future claims and litigation; government policies, legislation or

judicial decisions adverse to the Company’s businesses; the

Company’s ability to access the capital markets by pursuing

additional debt and equity financing to fund its business plan and

expenses on terms acceptable to the Company or at all; the

Company’s ability to achieve loan forgiveness under Paycheck

Protection Program; and the Company’s ability to comply with its

contractual covenants, including in respect of its debt agreements,

as well as various additional risks, many of which are now unknown

and generally out of the Company’s control, and which are detailed

from time to time in reports filed by the Company with the SEC,

including quarterly reports on Form 10-Q, reports on Form 8-K and

annual reports on Form 10-K. Staffing 360 Solutions does not

undertake any duty to update any statements contained herein

(including any forward-looking statements), except as required by

law.

Investor Relations Contact:Terri MacInnis, VP

of IRBibicoff + MacInnis, Inc.818.379.8500 x 2

terri@bibimac.com

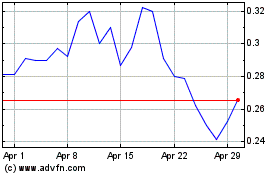

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Jul 2023 to Jul 2024