0001090009

false

0001090009

2023-10-19

2023-10-19

0001090009

dei:FormerAddressMember

2023-10-19

2023-10-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported) |

October

19, 2023 |

Southern First Bancshares, Inc.

(Exact name of registrant as specified in its charter)

South Carolina

(State or other jurisdiction of incorporation)

| 000-27719 |

|

58-2459561 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

| 6 Verdae Boulevard, Greenville, SC |

|

29607 |

| (Address of principal executive offices) |

|

(Zip Code) |

(864) 679-9000

(Registrant's telephone number, including area code)

100 Verdae Boulevard, Suite 100, Greenville,

SC

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

SFST |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02. Results of Operations and Financial Condition.

On October 19, 2023, Southern First Bancshares, Inc., holding company

for Southern First Bank, issued a press release announcing its financial results for the period ended September 30, 2023. The press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

ITEM 7.01 Regulation FD Disclosure.

A copy of a slide presentation also highlighting

Southern First Bancshares, Inc. financial results for the period ended September 30, 2023 is furnished as Exhibit 99.2 to this Current

Report on Form 8-K. The slide presentation also will be available on our website, www.southernfirst.com, under the “Investor

Relations” section.

ITEM 9.01. Financial Statements and Exhibits.

| (d) Exhibits | The following exhibit index lists the exhibits that are either

filed or furnished with the Current Report on Form 8-K. |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SOUTHERN FIRST BANCSHARES, INC. |

| |

|

|

| |

By: |

/s/ D. Andrew Borrmann |

| |

Name: |

D. Andrew Borrmann |

| |

Title: |

Chief Financial Officer |

October 19, 2023

Exhibit

99.1

Southern

First Reports Results for Third Quarter 2023

Greenville, South Carolina, October 19, 2023 – Southern

First Bancshares, Inc. (NASDAQ: SFST), holding company for Southern First Bank, today announced its financial results for the three-month

period ended September 30, 2023.

“Our team generated improved performance over the prior

quarter as evidenced by the growth in book value, general margin stability, capital accretion, and outstanding credit quality,”

stated Art Seaver, the Company’s Chief Executive Officer. “While the monetary policy of the Federal Reserve has increased

interest rates dramatically and resulted in a significant decline in loan demand, we are proud of our efforts to grow client relationships

and support the needs of our clients and communities.”

2023 Third Quarter Highlights

| · | Net

income was $4.1 million and diluted earnings per common share were $0.51 for Q3 2023 |

| · | Core

deposits remained at $2.9 billion at Q3 2023, compared to Q2 2023 and increased 5% from Q3

2022 |

| · | Total

loans increased 2% (annualized) to $3.6 billion at Q3 2023, compared to Q2 2023 and increased

17%, from $3.0 billion at Q3 2022 |

| · | Book

value per common share increased to $37.57 at Q3 2023, or 4%, over Q3 2022 |

| · | Credit

quality remains strong with nonperforming assets to total assets of 0.11% and past due loans

to total loans of 0.13% at Q3 2023 |

| · | Net

interest margin was 1.97% for Q3 2023, compared to 2.05% for Q2 2023 and 3.19% for Q3 2022 |

| · | Improvement

in common equity tier 1 and risk-based capital ratios during Q3 2023, compared to Q2 2023 |

| |

|

Quarter Ended |

| |

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

| |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Earnings ($ in thousands, except per share data): |

|

|

|

|

|

|

| Net income available to common shareholders |

$ |

4,098 |

2,458 |

2,703 |

5,492 |

8,413 |

| Earnings per common share, diluted |

|

0.51 |

0.31 |

0.33 |

0.68 |

1.04 |

| Total revenue(1) |

|

22,094 |

21,561 |

22,468 |

25,826 |

28,134 |

| Net interest margin (tax-equivalent)(2) |

|

1.97% |

2.05% |

2.36% |

2.88% |

3.19% |

| Return on average assets(3) |

|

0.40% |

0.26% |

0.30% |

0.63% |

1.00% |

| Return on average equity(3) |

|

5.35% |

3.27% |

3.67% |

7.44% |

11.57% |

| Efficiency ratio(4) |

|

78.31% |

80.67% |

76.12% |

63.55% |

57.03% |

| Noninterest expense to average assets (3) |

|

1.69% |

1.82% |

1.89% |

1.87% |

1.92% |

| Balance Sheet ($ in thousands): |

|

|

|

|

|

|

| Total loans(5) |

$ |

3,553,632 |

3,537,616 |

3,417,945 |

3,273,363 |

3,030,027 |

| Total deposits |

|

3,347,771 |

3,433,018 |

3,426,774 |

3,133,864 |

3,001,452 |

| Core deposits(6) |

|

2,866,574 |

2,880,507 |

2,946,567 |

2,759,112 |

2,723,592 |

| Total assets |

|

4,019,957 |

4,002,107 |

3,938,140 |

3,691,981 |

3,439,669 |

| Book value per common share |

|

37.57 |

37.42 |

37.16 |

36.76 |

35.99 |

| Loans to deposits |

|

106.15% |

103.05% |

99.74% |

104.45% |

100.95% |

| Holding Company Capital Ratios(7): |

|

|

|

|

|

|

| Total risk-based capital ratio |

|

12.56% |

12.40% |

12.67% |

12.91% |

13.58% |

| Tier 1 risk-based capital ratio |

|

10.58% |

10.42% |

10.66% |

10.88% |

11.49% |

| Leverage ratio |

|

8.17% |

8.48% |

8.80% |

9.17% |

9.44% |

| Common equity tier 1 ratio(8) |

|

10.17% |

10.00% |

10.23% |

10.44% |

11.02% |

| Tangible common equity(9) |

|

7.56% |

7.53% |

7.60% |

7.98% |

8.37% |

| Asset Quality Ratios: |

|

|

|

|

|

|

| Nonperforming assets/ total assets |

|

0.11% |

0.08% |

0.12% |

0.07% |

0.08% |

| Classified assets/tier one capital plus allowance for credit losses |

|

4.72% |

4.68% |

5.10% |

4.71% |

5.24% |

| Loans 30 days or more past due/ loans(5) |

|

0.13% |

0.07% |

0.11% |

0.11% |

0.07% |

| Net charge-offs (recoveries)/average loans(5) (YTD annualized) |

|

0.01% |

0.03% |

0.01% |

(0.05%) |

(0.06%) |

| Allowance for credit losses/loans(5) |

|

1.16% |

1.16% |

1.18% |

1.18% |

1.20% |

| Allowance for credit losses/nonaccrual loans |

|

953.25% |

1,363.11% |

854.33% |

1,470.74% |

1,388.87% |

[Footnotes to table located on page 6]

income statements

– Unaudited

| |

|

|

|

|

|

| |

|

Quarter Ended |

| |

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

| (in thousands, except per share data) |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Interest income |

|

|

|

|

|

|

| Loans |

$ |

43,542 |

41,089 |

36,748 |

33,939 |

29,752 |

| Investment securities |

|

1,470 |

706 |

613 |

562 |

506 |

| Federal funds sold |

|

2,435 |

891 |

969 |

525 |

676 |

| Total interest income |

|

47,447 |

42,686 |

38,330 |

35,026 |

30,934 |

| Interest expense |

|

|

|

|

|

|

| Deposits |

|

25,130 |

21,937 |

17,179 |

10,329 |

5,021 |

| Borrowings |

|

2,972 |

1,924 |

727 |

578 |

459 |

| Total interest expense |

|

28,102 |

23,861 |

17,906 |

10,907 |

5,480 |

| Net interest income |

|

19,345 |

18,825 |

20,424 |

24,119 |

25,454 |

| Provision for (reversal of) credit losses |

|

(500) |

910 |

1,825 |

2,325 |

950 |

| Net interest income after provision for credit losses |

|

19,845 |

17,915 |

18,599 |

21,794 |

24,504 |

| Noninterest income |

|

|

|

|

|

|

| Mortgage banking income |

|

1,208 |

1,337 |

622 |

291 |

1,230 |

| Service fees on deposit accounts |

|

356 |

331 |

325 |

316 |

318 |

| ATM and debit card income |

|

588 |

536 |

555 |

558 |

542 |

| Income from bank owned life insurance |

|

349 |

338 |

332 |

344 |

315 |

| Other income |

|

248 |

194 |

210 |

198 |

275 |

| Total noninterest income |

|

2,749 |

2,736 |

2,044 |

1,707 |

2,680 |

| Noninterest expense |

|

|

|

|

|

|

| Compensation and benefits |

|

10,231 |

10,287 |

10,356 |

9,576 |

9,843 |

| Occupancy |

|

2,562 |

2,518 |

2,457 |

2,666 |

2,442 |

| Outside service and data processing costs |

|

1,744 |

1,705 |

1,629 |

1,521 |

1,529 |

| Insurance |

|

1,243 |

897 |

689 |

551 |

507 |

| Professional fees |

|

504 |

751 |

660 |

788 |

555 |

| Marketing |

|

293 |

335 |

366 |

282 |

338 |

| Other |

|

725 |

900 |

947 |

1,029 |

832 |

| Total noninterest expenses |

|

17,302 |

17,393 |

17,104 |

16,413 |

16,046 |

| Income before provision for income taxes |

|

5,293 |

3,258 |

3,539 |

7,088 |

11,138 |

| Income tax expense |

|

1,195 |

800 |

836 |

1,596 |

2,725 |

| Net income available to common shareholders |

$ |

4,098 |

2,458 |

2,703 |

5,492 |

8,413 |

| |

|

|

|

|

|

|

| Earnings per common share – Basic |

$ |

0.51 |

0.31 |

0.34 |

0.69 |

1.06 |

| Earnings per common share – Diluted |

|

0.51 |

0.31 |

0.33 |

0.68 |

1.04 |

| Basic weighted average common shares |

|

8,053 |

8,051 |

8,026 |

7,971 |

7,972 |

| Diluted weighted average common shares |

|

8,072 |

8,069 |

8,092 |

8,071 |

8,065 |

[Footnotes to table located on page 6]

Net income for the third quarter of 2023 was $4.1 million,

or $0.51 per diluted share, a $1.6 million increase from the second quarter of 2023 and a $4.3 million decrease from the third quarter

of 2022. Net interest income increased $520 thousand for the third quarter of 2023, compared to the second quarter of 2023, and decreased

$6.1 million, compared to the third quarter of 2022. The increase in net interest income from the prior quarter was primarily driven by

an increase in interest income on loans and federal funds sold. The decrease in net interest income from the prior year was driven primarily

by an increase in interest expense on our deposit accounts related to the Federal Reserve’s 525-basis point interest rate hikes

during the past 19 months.

There was a reversal of the provision for credit losses of

$500 thousand for the third quarter of 2023, compared to a provision of $910 thousand for the second quarter of 2023 and a provision of

$950 thousand for the third quarter of 2022. The provision reversal during the third quarter of 2023 includes a $100 thousand reversal

of the provision for credit losses and a $400 thousand reversal of the reserve for unfunded commitments. The reversal of the provision

for credit losses was driven by lower expected loss rates, while the reversal of the reserve for unfunded commitments was driven by a

decrease in the balance of unfunded commitments at September 30, 2023, compared to the previous quarter and year.

Noninterest income was $2.7 million for each of the third quarter

of 2023, the second quarter of 2023, and the third quarter of 2022. Mortgage banking income continues to be the largest component of our

noninterest income at $1.2 million for the third quarter of 2023, $1.3 million for the second quarter of 2023, and $1.2 million for the

third quarter of 2022.

Noninterest expense for the third quarter of 2023 was $17.3

million, a $91 thousand decrease from the second quarter of 2023, and a $1.3 million increase from the third quarter of 2022. The decrease

in noninterest expense from the previous quarter was driven by decreases in professional fees and other noninterest expenses, while the

increase from the prior year related to increases in compensation and benefits, outside service and data processing costs, and insurance

expenses. Compensation and benefits expenses increased from the previous year, driven by annual salary increases and the hiring of new

team members. Outside service and data processing costs increased due to an increase in software licensing and maintenance costs, while

insurance costs increased due to higher FDIC insurance premiums.

Our effective tax rate was 22.6% for the third quarter of 2023,

24.6% for the second quarter of 2023, and 24.5% for the third quarter of 2022. The lower tax rate in the third quarter of 2023 as compared

to the previous quarters of 2023 relates primarily to the effect of equity compensation transactions and return to provision differences

on our tax rate during the quarter.

Net interest income and margin - Unaudited

| |

|

|

|

| |

|

For

the Three Months Ended |

| |

September

30, 2023 |

June

30, 2023 |

September

30,2022 |

| (dollars

in thousands) |

Average

Balance |

Income/

Expense |

Yield/

Rate(3) |

Average

Balance |

Income/

Expense |

Yield/

Rate(3) |

Average

Balance |

Income/

Expense |

Yield/

Rate(3) |

| Interest-earning

assets |

|

|

|

|

|

|

|

|

|

| Federal

funds sold and interest-bearing deposits |

$ 181,784 |

$ 2,435 |

5.31% |

$ 71,004 |

$ 891 |

5.03% |

$ 122,071 |

$ 676 |

2.20% |

| Investment

securities, taxable |

148,239 |

1,429 |

3.82% |

93,922 |

623 |

2.66% |

91,462 |

449 |

1.95% |

| Investment

securities, nontaxable(2) |

7,799 |

55 |

2.77% |

10,200 |

108 |

4.24% |

10,160 |

74 |

2.89% |

| Loans(10) |

3,554,478 |

43,542 |

4.86% |

3,511,225 |

41,089 |

4.69% |

2,941,350 |

29,752 |

4.01% |

| Total

interest-earning assets |

3,892,300 |

47,461 |

4.84% |

3,686,351 |

42,711 |

4.65% |

3,165,043 |

30,951 |

3.88% |

| Noninterest-earning

assets |

159,103 |

|

|

155,847 |

|

|

159,233 |

|

|

| Total

assets |

$4,051,403 |

|

|

$3,842,198 |

|

|

$3,324,726 |

|

|

| Interest-bearing

liabilities |

|

|

|

|

|

|

|

|

|

| NOW

accounts |

$ 297,028 |

620 |

0.83% |

$ 297,234 |

537 |

0.72% |

$ 361,500 |

178 |

0.20% |

| Savings

& money market |

1,748,638 |

16,908 |

3.84% |

1,727,009 |

15,298 |

3.55% |

1,417,181 |

3,663 |

1.03% |

| Time

deposits |

648,949 |

7,602 |

4.65% |

573,095 |

6,102 |

4.27% |

361,325 |

1,180 |

1.30% |

| Total

interest-bearing deposits |

2,694,615 |

25,130 |

3.70% |

2,597,338 |

21,937 |

3.39% |

2,140,006 |

5,021 |

0.93% |

| FHLB

advances and other borrowings |

264,141 |

2,414 |

3.63% |

135,922 |

1,382 |

4.08% |

1,357 |

10 |

2.92% |

| Subordinated

debentures |

36,278 |

558 |

6.10% |

36,251 |

542 |

6.00% |

36,169 |

449 |

4.93% |

| Total

interest-bearing liabilities |

2,995,034 |

28,102 |

3.72% |

2,769,511 |

23,861 |

3.46% |

2,177,532 |

5,480 |

1.00% |

| Noninterest-bearing

liabilities |

752,433 |

|

|

771,388 |

|

|

858,202 |

|

|

| Shareholders’

equity |

303,936 |

|

|

301,299 |

|

|

288,542 |

|

|

| Total

liabilities and shareholders’ equity |

$4,051,403 |

|

|

$3,842,198 |

|

|

$3,324,276 |

|

|

| Net

interest spread |

|

|

1.12% |

|

|

1.19% |

|

|

2.88% |

| Net

interest income (tax equivalent) / margin |

|

$19,359 |

1.97% |

|

$18,850 |

2.05% |

|

$25,471 |

3.19% |

| Less: tax-equivalent

adjustment(2) |

|

14 |

|

|

25 |

|

|

17 |

|

| Net

interest income |

|

$19,345 |

|

|

$18,825 |

|

|

$25,454 |

|

[Footnotes to table located on page 6]

Net interest income was $19.3 million for the third quarter

of 2023, a $520 thousand increase from the second quarter of 2023, driven by a $4.8 million increase in interest income, partially offset

by a $4.2 million increase in interest expense, on a taxable basis. The increase in interest income was driven by $205.9 million growth

in average interest-earning assets at an average rate of 4.84%, a 19-basis points increase over the previous quarter, partially offset

by $225.5 million growth in average interest-bearing liabilities at an average cost of 3.72%, an increase of 26-basis points from the

second quarter of 2023. In comparison to the third quarter of 2022, net interest income decreased $6.1 million, resulting primarily from

$554.6 million growth in average interest-bearing deposit balances during the 12 months ended September 30, 2023, combined with a 277-basis

point increase in deposit rates. Our net interest margin, on a tax-equivalent basis, was 1.97% for the third quarter of 2023, an 8-basis

point decrease from 2.05% for the second quarter of 2023 and a 122-basis point decrease from 3.19% for the third quarter of 2022. As a

result of the Federal Reserve’s 300-basis point interest rate hikes during the past 12 months, the rate on our interest-bearing

liabilities has increased by 272-basis points during the third quarter of 2023 in comparison to the third quarter of 2022. However, the

yield on our interest-earning assets, driven by our loan portfolio, has increased by only 96-basis points during the same time period,

resulting in the lower net interest margin during the third quarter of 2023.

Balance sheets - Unaudited

| |

|

|

|

|

| |

|

Ending Balance |

| |

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

| (in thousands, except per share data) |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Assets |

|

|

|

|

|

|

| Cash and cash equivalents: |

|

|

|

|

|

|

| Cash and due from banks |

$ |

17,395 |

24,742 |

22,213 |

18,788 |

16,530 |

| Federal funds sold |

|

127,714 |

170,145 |

242,642 |

101,277 |

139,544 |

| Interest-bearing deposits with banks |

|

7,283 |

10,183 |

7,350 |

50,809 |

4,532 |

| Total cash and cash equivalents |

|

152,392 |

205,070 |

272,205 |

170,874 |

160,606 |

| Investment securities: |

|

|

|

|

|

|

| Investment securities available for sale |

|

144,035 |

91,548 |

94,036 |

93,347 |

91,521 |

| Other investments |

|

19,600 |

12,550 |

10,097 |

10,833 |

5,449 |

| Total investment securities |

|

163,635 |

104,098 |

104,133 |

104,180 |

96,970 |

| Mortgage loans held for sale |

|

7,117 |

15,781 |

6,979 |

3,917 |

9,243 |

| Loans (5) |

|

3,553,632 |

3,537,616 |

3,417,945 |

3,273,363 |

3,030,027 |

| Less allowance for credit losses |

|

(41,131) |

(41,105) |

(40,435) |

(38,639) |

(36,317) |

| Loans, net |

|

3,512,501 |

3,496,511 |

3,377,510 |

3,234,724 |

2,993,710 |

| Bank owned life insurance |

|

52,140 |

51,791 |

51,453 |

51,122 |

50,778 |

| Property and equipment, net |

|

95,743 |

96,964 |

97,806 |

99,183 |

99,530 |

| Deferred income taxes |

|

13,078 |

12,356 |

12,087 |

12,522 |

18,425 |

| Other assets |

|

23,351 |

19,536 |

15,967 |

15,459 |

10,407 |

| Total assets |

$ |

4,019,957 |

4,002,107 |

3,938,140 |

3,691,981 |

3,439,669 |

| Liabilities |

|

|

|

|

|

|

| Deposits |

$ |

3,347,771 |

3,433,018 |

3,426,774 |

3,133,864 |

3,001,452 |

| FHLB Advances |

|

275,000 |

180,000 |

125,000 |

175,000 |

60,000 |

| Subordinated debentures |

|

36,295 |

36,268 |

36,241 |

36,214 |

36,187 |

| Other liabilities |

|

56,993 |

51,307 |

50,775 |

52,391 |

54,245 |

| Total liabilities |

|

3,716,059 |

3,700,593 |

3,638,790 |

3,397,469 |

3,151,884 |

| Shareholders’ equity |

|

|

|

|

|

|

| Preferred stock - $.01 par value; 10,000,000 shares authorized |

|

- |

- |

- |

- |

- |

| Common Stock - $.01 par value; 10,000,000 shares authorized |

|

81 |

81 |

80 |

80 |

80 |

| Nonvested restricted stock |

|

(4,065) |

(4,051) |

(4,462) |

(3,306) |

(3,348) |

| Additional paid-in capital |

|

121,757 |

120,912 |

120,683 |

119,027 |

118,433 |

| Accumulated other comprehensive loss |

|

(15,255) |

(12,710) |

(11,775) |

(13,410) |

(14,009) |

| Retained earnings |

|

201,380 |

197,282 |

194,824 |

192,121 |

186,629 |

| Total shareholders’ equity |

|

303,898 |

301,514 |

299,350 |

294,512 |

287,785 |

| Total liabilities and shareholders’ equity |

$ |

4,019,957 |

4,002,107 |

3,938,140 |

3,691,981 |

3,439,669 |

| Common Stock |

|

|

|

|

|

|

| Book value per common share |

$ |

37.57 |

37.42 |

37.16 |

36.76 |

35.99 |

| Stock price: |

|

|

|

|

|

|

| High |

|

30.18 |

31.34 |

45.05 |

49.50 |

47.16 |

| Low |

|

24.22 |

21.33 |

30.70 |

41.46 |

41.66 |

| Period end |

|

26.94 |

24.75 |

30.70 |

45.75 |

41.66 |

| Common shares outstanding |

|

8,089 |

8,058 |

8,048 |

8,011 |

7,997 |

| |

|

|

|

|

|

|

|

[Footnotes to table located on page 6]

Asset quality measures

- Unaudited

| |

|

Quarter Ended |

| |

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Nonperforming Assets |

|

|

|

|

|

|

| Commercial |

|

|

|

|

|

|

| Non-owner occupied RE |

$ |

1,615 |

754 |

1,384 |

247 |

253 |

| Commercial business |

|

404 |

137 |

1,196 |

182 |

79 |

| Consumer |

|

|

|

|

|

|

| Real estate |

|

1,228 |

1,053 |

1,075 |

1,099 |

904 |

| Home equity |

|

1,068 |

1,072 |

1,078 |

1,099 |

1,379 |

| Total nonaccrual loans |

|

4,315 |

3,016 |

4,733 |

2,627 |

2,615 |

| Other real estate owned |

|

- |

- |

- |

- |

- |

| Total nonperforming assets |

$ |

4,315 |

3,016 |

4,733 |

2,627 |

2,615 |

| Nonperforming assets as a percentage of: |

|

|

|

|

|

|

| Total assets |

|

0.11% |

0.08% |

0.12% |

0.07% |

0.08% |

| Total loans |

|

0.12% |

0.09% |

0.14% |

0.08% |

0.09% |

| Classified assets/tier 1 capital plus allowance for credit losses |

|

4.72% |

4.68% |

5.10% |

4.71% |

5.24% |

| |

|

Quarter Ended |

| |

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Allowance for Credit Losses |

|

|

|

|

|

|

| Balance, beginning of period |

$ |

41,105 |

40,435 |

38,639 |

36,317 |

34,192 |

| Loans charged-off |

|

(42) |

(440) |

(161) |

- |

- |

| Recoveries of loans previously charged-off |

|

168 |

15 |

102 |

22 |

1,600 |

| Net loans (charged-off) recovered |

|

126 |

(425) |

(59) |

22 |

1,600 |

| Provision for (reversal of) credit losses |

|

(100) |

1,095 |

1,855 |

2,300 |

525 |

| Balance, end of period |

$ |

41,131 |

41,105 |

40,435 |

38,639 |

36,317 |

| Allowance for credit losses to gross loans |

|

1.16% |

1.16% |

1.18% |

1.18% |

1.20% |

| Allowance for credit losses to nonaccrual loans |

|

953.25% |

1,363.11% |

854.33% |

1,470.74% |

1,388.87% |

| Net charge-offs to average loans QTD (annualized) |

|

0.01% |

0.03% |

0.01% |

0.00 % |

(0.22 %) |

Total nonperforming assets increased by $1.3 million during

the third quarter of 2023, representing 0.11% of total assets, compared to 0.08% for both the second quarter of 2023 and the third quarter

of 2022. The increase in nonperforming assets during the third quarter of 2023 resulted primarily from four commercial loan relationships

and two consumer loan relationships that were added to nonaccrual status. In addition, our classified asset ratio increased slightly to

4.72% for the third quarter of 2023 from 4.68% in the second quarter of 2023 and from 5.24% in the third quarter of 2022.

At both September 30, 2023 and June 30, 2023, the allowance

for credit losses was $41.1 million, or 1.16% of total loans, compared to $36.3 million, or 1.20% of total loans, at September 30, 2022.

We had net recoveries of $126 thousand, or 0.01% annualized, for the third quarter of 2023, compared to net charge-offs of $425 thousand

for the second quarter of 2023 and net recoveries of $1.6 million for the third quarter of 2022. There was a reversal of the provision

for credit losses of $100 thousand for the third quarter of 2023, compared to a provision of $1.1 million for the second quarter of 2023

and a provision of $525 thousand for the third quarter of 2022. The provision reversal was driven by lower expected loss rates resulting

from low charge-offs, combined with stable loan portfolio balances during the quarter.

LOAN COMPOSITION - Unaudited

| |

| |

|

Quarter Ended |

| |

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Commercial |

|

|

|

|

|

|

| Owner occupied RE |

$ |

637,038 |

613,874 |

615,094 |

612,901 |

572,972 |

| Non-owner occupied RE |

|

937,749 |

951,536 |

928,059 |

862,579 |

799,569 |

| Construction |

|

119,629 |

115,798 |

94,641 |

109,726 |

85,850 |

| Business |

|

500,253 |

511,719 |

495,161 |

468,112 |

419,312 |

| Total commercial loans |

|

2,194,669 |

2,192,927 |

2,132,955 |

2,053,318 |

1,877,703 |

| Consumer |

|

|

|

|

|

|

| Real estate |

|

1,074,679 |

1,047,904 |

993,258 |

931,278 |

873,471 |

| Home equity |

|

180,856 |

185,584 |

180,974 |

179,300 |

171,904 |

| Construction |

|

54,210 |

61,044 |

71,137 |

80,415 |

77,798 |

| Other |

|

49,218 |

50,157 |

39,621 |

29,052 |

29,151 |

| Total consumer loans |

|

1,358,963 |

1,344,689 |

1,284,990 |

1,220,045 |

1,152,324 |

| Total gross loans, net of deferred fees |

|

3,553,632 |

3,537,616 |

3,417,945 |

3,273,363 |

3,030,027 |

| Less—allowance for credit losses |

|

(41,131) |

(41,105) |

(40,435) |

(38,639) |

(36,317) |

| Total loans, net |

$ |

3,512,501 |

3,496,511 |

3,377,510 |

3,234,724 |

2,993,710 |

DEPOSIT COMPOSITION - Unaudited

| |

| |

|

Quarter Ended |

| |

|

September 30 |

June

30 |

March

31 |

December 31 |

September 30 |

| (dollars in thousands) |

|

2023 |

2023 |

2023 |

2022 |

2022 |

| Non-interest bearing |

$ |

675,409 |

698,084 |

740,534 |

804,115 |

791,050 |

| Interest bearing: |

|

|

|

|

|

|

| NOW accounts |

|

306,667 |

308,762 |

303,743 |

318,030 |

357,862 |

| Money market accounts |

|

1,685,736 |

1,692,900 |

1,748,562 |

1,506,418 |

1,452,958 |

| Savings |

|

34,737 |

36,243 |

39,706 |

40,673 |

42,335 |

| Time, less than $250,000 |

|

125,506 |

114,691 |

106,679 |

89,877 |

79,387 |

| Time and out-of-market deposits, $250,000 and over |

|

519,716 |

582,338 |

487,550 |

374,751 |

277,860 |

| Total deposits |

$ |

3,347,771 |

3,433,018 |

3,426,774 |

3,133,864 |

3,001,452 |

Footnotes to tables:

(1) Total revenue is the sum of net interest income and noninterest income.

(2) The tax-equivalent adjustment to net interest income adjusts the yield for assets

earning tax-exempt income to a comparable yield on a taxable basis.

(3) Annualized for the respective three-month period.

(4) Noninterest expense divided by the sum of net interest income and noninterest

income.

(5) Excludes mortgage loans held for sale.

(6) Excludes out of market deposits and time deposits greater than $250,000.

(7) September 30, 2023 ratios are preliminary.

(8) The common equity tier 1 ratio is calculated as the sum of common equity divided

by risk-weighted assets.

(9) The tangible common equity ratio is calculated as total equity less preferred

stock divided by total assets.

(10) Includes mortgage loans held for sale.

About Southern First Bancshares

Southern First Bancshares, Inc., Greenville, South Carolina

is a registered bank holding company incorporated under the laws of South Carolina. The company’s wholly owned subsidiary,

Southern First Bank, is the second largest bank headquartered in South Carolina. Southern First Bank has been providing financial services

since 1999 and now operates in 12 locations in the Greenville, Columbia, and Charleston markets of South Carolina as well as the Charlotte,

Triangle and Triad regions of North Carolina and Atlanta, Georgia. Southern First Bancshares has consolidated assets of approximately

$4.0 billion and its common stock is traded on The NASDAQ Global Market under the symbol “SFST.” More information can

be found at www.southernfirst.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this news release contain “forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to future plans

and expectations, and are thus prospective. Such forward-looking statements are identified by words such as “believe,”

“expect,” “anticipate,” “estimate,” “preliminary”, “intend,” “plan,”

“target,” “continue,” “lasting,” and “project,” as well as similar expressions. Such

statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking

statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, we can give no assurance that the

results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information

should not be construed as a representation by our company or any person that the future events, plans, or expectations contemplated by

our company will be achieved.

The following factors, among others, could cause actual results

to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) competitive pressures

among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third-party relationships

and revenues; (2) the strength of the United States economy in general and the strength of the local economies in which the company conducts

operations may be different than expected; (3) the rate of delinquencies and amounts of charge-offs, the level of allowance for credit

loss, the rates of loan and deposit growth as well as pricing of each product, or adverse changes in asset quality in our loan portfolio,

which may result in increased credit risk-related losses and expenses; (4) changes in legislation, regulation, policies, or administrative

practices, whether by judicial, governmental, or legislative action, including, but not limited to, changes affecting oversight of the

financial services industry or consumer protection; (5) the impact of changes to Congress on the regulatory landscape and capital markets;

(6) adverse conditions in the stock market, the public debt market and other capital markets (including changes in interest rate conditions)

could continue to have a negative impact on the company; (7) changes in interest rates, which may continue to affect the company’s

net income, interest expense, prepayment penalty income, mortgage banking income, and other future cash flows, or the market value of

the company’s assets, including its investment securities; (8) elevated inflation which causes adverse risk to the overall economy,

and could indirectly pose challenges to our clients and to our business; (9) any increase in FDIC assessments which have increased and

may continue to increase our cost of doing business; and (10) changes in accounting principles, policies, practices, or guidelines. Additional

factors that could cause our results to differ materially from those described in the forward-looking statements can be found in our reports

(such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available

at the SEC’s Internet site (http://www.sec.gov). All subsequent written and oral forward-looking statements concerning

the company or any person acting on its behalf is expressly qualified in its entirety by the cautionary statements above. We do not undertake

any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking

statements are made, except as required by law.

FINANCIAL & MEDIA CONTACT:

ART SEAVER 864-679-9010

WEB SITE: www.southernfirst.com

v3.23.3

Cover

|

Oct. 19, 2023 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 19, 2023

|

| Entity File Number |

000-27719

|

| Entity Registrant Name |

Southern First Bancshares, Inc.

|

| Entity Central Index Key |

0001090009

|

| Entity Tax Identification Number |

58-2459561

|

| Entity Incorporation, State or Country Code |

SC

|

| Entity Address, Address Line One |

6 Verdae Boulevard

|

| Entity Address, City or Town |

Greenville

|

| Entity Address, State or Province |

SC

|

| Entity Address, Postal Zip Code |

29607

|

| City Area Code |

864

|

| Local Phone Number |

679-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SFST

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

100 Verdae Boulevard

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Greenville

|

| Entity Address, State or Province |

SC

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

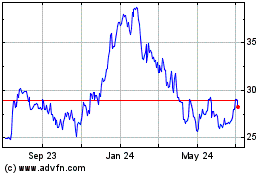

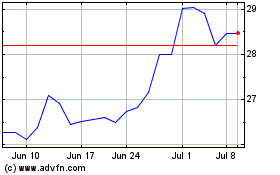

Southern First Bancshares (NASDAQ:SFST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southern First Bancshares (NASDAQ:SFST)

Historical Stock Chart

From Apr 2023 to Apr 2024