Society Pass Inc. (

Nasdaq: SOPA)

(“

SoPa” or the “

Company”),

Southeast Asia’s (SEA) next generation, data-driven, loyalty,

fintech and e-commerce ecosystem, announces that Litchfield Hills

Research (“

Litchfield Hills”) has initiated equity

research coverage on SOPA.

Click Here (on Society Pass

website) to view the full Litchfield Hills Equity Research

Report.

Summary Points:•

Investment Thesis: SOPA is a high-growth

acquisitive internet services company offering advertising, travel,

retail, telecom and fintech services in fast-growing SEA.

Litchfield Hills forecasts positive EBITDA as SOPA shifts from its

early growth strategy to a focus on profitability under its new

CEO.

• SEA Countries are Young and Booming

and are Hottest Economies on the Planet: SEA market is the

world’s fastest growing region over the next decade for the

following

reasons: 1) Movement

away from China 2) Young,

tech savvy populations

3) Business friendly governments

• Society Pass Ecosystem:

SOPA’s main subsidiaries

are: 1) Thoughtful

Media Group (TMG) – Bangkok – digital advertising

2) NusaTrip – Jakarta – online travel

booking 3) Next

Generation Retail (NGR) – Ho Chi Minh City – online retail

e-commerce 4) Gorilla

Mobile – Singapore – mobile telecom/e-sim services

5) Society Points – Manila – loyalty

points program

• Thoughtful Media Thriving with SEA

Focus: TMG provides digital advertising services to

companies utilizing social media platforms. Since July 2022

acquisition for $2.1 million, TMG had just 17 employees and $5.8

million of revenue in 2021 compared to 75 employees and $6.6

million in 2023. After attaining GAAP profitability of $750k in

2022 net income, Litchfield Hills forecasts revenue of $12 million

in 2024 and $18 million in 2025. At 5x 2025 revenue, it values TMG

at roughly $88 million.

• NusaTrip Provides Online Travel,

Customized for SEA Consumers: Founded in 2013 and acquired

in August 2022, NusaTrip targets SEA travel market and has

onboarded 650,000 hotels and over 500 airlines globally via its app

and website. It has direct links with travel global distribution

systems and its core SEA ultra-low-cost carrier airline partners.

NusaTrip’s new 17.0 Java software should allow for faster searches

and more features as well as add Gorilla Mobile eSim travel data

and the ability to earn Society Points in 1Q 2024. In April 2023,

NusaTrip acquired Vietnam-based VLeisure, which is a B2B hotel

management software company. NusaTrip generated gross merchandise

value (GMV) of $60 million, before the pandemic. GMV recovered to

$43 million in 2022 and has already hit $45 million for the first

nine months of 2023. So, it should have a record year this year,

and approach $100 million within the next two years. Litchfield

Hills forecasts net revenue of $2.0 million in 2023 and $4.5

million in 2024 as well as 73% gross margin in 2024, rising to 76%

in 2025. Applying a 5x 2025 revenue estimate of $6 million,

Litchfield Hills values NusaTrip at roughly $30 million. Applying

an ERG multiple of 38x, Litchfield Hills valuation increases to a

$65 million enterprise value.

• Two Upcoming 1H 2024 IPOs:

Litchfield Hills looks for SOPA to spinoff both TMG and NusaTrip

via Nasdaq IPOs in 1H 2004, which should generate significant

shareholder value for SOPA shareholders.

• New Management: Ray Liang,

Co-Founder and former CFO, was promoted to CEO in October 2023 and

has adopted a strategy focusing on profitability, even shedding

F&B business units and scaling back its unprofitable online

retail business. Corporate focus now is on getting to free cash

flow positive (which Litchfield Hills expects in 2024) and

profitability (which Litchfield Hills expects in 2025).

• Technology Roadmap: Key tech

milestones are as follows: 1)

Representing a massive leap in technology, by upgrading from

its 2002 Java 1.4 architecture to the 2021 17.0 version, NusaTrip

platform will run faster and more reliably and more easily add

enhancements like hotel bookings and Gorilla eSim cards.

2) Integrating Gorilla into

NusaTrip, travel eSIMs are a natural addition to the airfare and

hotels booking business. So, Litchfield Hills sees this as a

natural progression and group synergy.

3) Upgrading the Society Points loyalty app

and integrating with Gorilla, Leflair, NusaTrip and Gorilla as well

as opening loyalty platform up to numerous other merchants.

• Financials: Revenue is

quickly growing, and EBITDA nears breakeven. Achieving its initial

goal of rapid top line growth, SOPA has reduced its EBITDA losses.

Litchfield Hills expects revenue of $9.2 million in 2023, $17.1

million in 2024 and $25.1 million in 2025. Litchfield Hills

projects positive EBITDA in 2025, consuming less than half of the

$8 million cash on hand until then. Unlike loss-making microcap

peers, SOPA has the balance sheet to get to profitability.

• Comparables: As a super app,

Litchfield Research argues that SOPA comparables are Goto, Uber and

Grab. Averaging all these companies together, Litchfield Hills

estimates 2.9 x 2024 estimated revenue multiple and 27.5x estimated

growth.

• Valuation: SOPA has a

negligible enterprise value as its market cap is roughly equal to

its cash value. Given how well SoPa has deployed cash to date, SoPa

has been a frugal buyer of assets, buying at low valuations. Based

on an EV/Revenue multiple of 4.8 times its estimate 2025 revenue

estimate of $25.5 million, Litchfield Hills values SOPA at $123

million.

About Society Pass Inc.Founded

in 2018 as a data-driven loyalty, fintech and e-commerce ecosystem

in the fast-growing markets of Vietnam, Indonesia, Philippines,

Singapore and Thailand, which account for more than 80% of the SEA

population, and with offices located in Bangkok, Ho Chi Minh City,

Jakarta, Manila, and Singapore, Society Pass

Incorporated (Nasdaq: SOPA) is an

acquisition-focused holding company operating 5 interconnected

verticals (loyalty, digital media, travel, telecoms, and

lifestyle), which seamlessly connects millions of registered

consumers and hundreds of thousands of registered merchants/brands

across multiple product and service categories throughout SEA.

Society Pass completed an initial public

offering and began trading on the Nasdaq under the ticker SOPA in

November 2021.

SoPa acquires fast growing e-commerce companies

and expands its user base across a robust product and service

ecosystem. SoPa integrates these complementary businesses through

its signature Society Pass fintech platform and circulation of its

universal loyalty points or Society Points. Society Pass loyalty

program members earn and redeem Society Points and receive

personalised promotions based on SoPa’s data capabilities and

understanding of consumer shopping behaviour. SoPa has amassed more

than 3.7 million registered consumers and over 650,000 registered

merchants and brands. It has invested 2+ years building proprietary

IT architecture to effectively scale and support its consumers,

merchants, and acquisitions.

Society Pass leverages technology to tailor a

more personalised experience for customers in the purchase journey

and to transform the entire retail value chain in SEA. SoPa

operates Thoughtful Media Group, a Thailand-based, a social

commerce-focused, premium digital video multi-platform network;

NusaTrip, a leading Indonesia-based Online Travel Agency; VLeisure,

Vietnam’s leading provider of hotel management and payment

solutions; Gorilla Global, a Singapore-based, mobile network

operator; Leflair, Vietnam’s leading lifestyle e-commerce

platform.

For more information on Society Pass, please

visit:

Website at https://www.thesocietypass.com

orLinkedIn at https://www.linkedin.com/company/societypass

orFacebook at https://www.facebook.com/thesocietypass orTwitter at

https://twitter.com/society_pass orInstagram at

https://www.instagram.com/societypass/.

Cautionary Note Concerning

Forward-Looking StatementsThis press release may include

“forward-looking statements,” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements other

than statements of historical fact included in this press release

are forward-looking statements. When used in this press release,

words such as “anticipate”, “believe”, “estimate”, “expect”,

“intend” and similar expressions, as they relate to us or our

management team, identify forward-looking statements. Such

forward-looking statements are based on the beliefs of management,

as well as assumptions made by, and information currently available

to, the Company’s management. Actual results could differ

materially from those contemplated by the forward-looking

statements as a result of certain factors detailed in the Company’s

filings with the SEC. All subsequent written or oral

forward-looking statements attributable to us or persons acting on

our behalf are qualified in their entirety by this paragraph.

Forward-looking statements are subject to numerous conditions, many

of which are beyond the control of the Company, including those set

forth in the Risk Factors section of the Company’s registration

statement and prospectus relating to the Company’s initial public

offering filed with the SEC. The Company undertakes no obligation

to update these statements for revisions or changes after the date

of this release, except as required by law.

Media Contact:Rokas

SidlauskasChief Marketing Officerrokas@thesocietypass.com

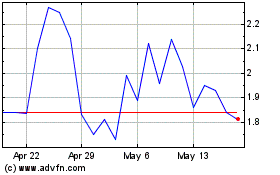

Society Pass (NASDAQ:SOPA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Society Pass (NASDAQ:SOPA)

Historical Stock Chart

From Nov 2023 to Nov 2024