SmileDirectClub, Inc. (Nasdaq: SDC), the next generation oral care

company with the first medtech platform for teeth straightening,

today announced its financial results for the third quarter ended

September 30, 2021.

Third Quarter 2021 Financial Highlights

- Total revenue of $138 million, a

decrease of 18.3% over the prior year period.

- Net loss of $(89) million, a

decrease of 105.6% over the prior year period.

- Adjusted EBITDA of $(54) million, a

decrease of $57 million over the prior year period.

- Diluted EPS of $(0.23), a decrease

of 109.1% over the prior year period.

Year-to-Date Third Quarter 2021 Financial

Highlights

- Total revenue of $511 million, an

increase of 8.3% over the prior year period.

- Net loss of $(240) million, an

improvement of 2.1% over the prior year period.

- Adjusted EBITDA of $(72) million,

an improvement of $13 million over the prior year period.

- Diluted EPS of $(0.62), a 3.1%

improvement over the prior year period.

Key Operating Metrics

- Third quarter unique aligner

shipments of 69,906.

- Third quarter average aligner gross

sales price (“ASP”) of $1,900 for the third quarter of 2021,

compared to $1,794 for the third quarter of 2020.

“We are disappointed with our third quarter

results driven by the macroeconomic headwinds that are influencing

the spending of our core demographic,” said David Katzman, Chief

Executive Officer and Chairman of SmileDirectClub. “While we could

not have anticipated the rapidly evolving nature of this impact on

our consumer, we have responded quickly to focus our marketing on

helping support them during this time, while we also move upstream

with higher income demographics through the Challenger Campaign and

investments in our Dental Partner Network. We remain incredibly

optimistic and believe that we are well positioned to continue to

capture the global opportunity in the rapidly expanding market for

clear aligners.”

SmileDirectClub Chief Financial Officer Kyle

Wailes added, “The third quarter results do not fully reflect the

investments we have made to grow our brand, as the macro-economic

environment for our core demographic, along with Apple privacy

changes earlier this year have presented significant challenges to

digitally native brands such as SmileDirectClub. We have a product

and service offering that is highly competitive with the incumbent

in our space at a significantly lower cost and is a true

differentiator compared with teledentistry competitors. The

liquidity in our balance sheet and the strengthening of our brand

will allow us to execute on our lead strategy and change the

composition of our marketing spend to more efficiently and

effectively drive long-term growth.”

Business Outlook

SmileDirectClub’s mission is to democratize

access to a smile each and every person loves and deserves by

making it affordable and convenient for everyone. Every decision

and investment the Company has made is to support and expand this

mission and enable its long-term growth potential. SmileDirectClub

possesses the unique assets and innovation to disrupt the

incumbents, the agility to adjust to the needs of its customer, and

a sustainable brand that is top of mind with consumers. The Company

has been issued 30 patents and counting for its innovations in

orthodontic treatment planning, aligner manufacturing, smile

scanning technologies, its proprietary telehealth platform and a

variety of other areas. The most recent patent was granted for the

Company’s SmileBus concept and there are many more pending and in

the pipeline in the US and abroad on various technologies relating

to data capture, 3D image capture, intraoral scanning, monitoring,

manufacturing, and consumer products. In addition, the Company has

enabled treatment for over 1.5 million customers, built the only

end-to-end vertically integrated platform for the consumer at

scale, created a Dental Partner Network with 735 global practices

that are live or pending training, created oral care products

available at over 12,900 retail stores worldwide, and remains the

strongest teledentistry brand in terms of aided and unaided

awareness.

When consumers are considering straightening

their teeth, they typically do one or all of the following: One,

they search online to understand their options; two, they might ask

a dentist; and three, they might ask a friend or family member

which option they should choose. Based on the Company’s research,

consumers have noted its product and customer experience is nearly

identical to Invisalign, 60% less expensive, and more convenient.

For other teledentistry platforms, its research showed that

significantly fewer customers would recommend those brands compared

with SmileDirectClub customers. The U.S. Brand Tracker third

quarter survey separately noted that the Company’s unaided and

aided brand awareness continued to increase from the second quarter

with further separation from its teledentistry competitors and

closer awareness compared with Invisalign on key topics such as “a

legitimate orthodontic option for straightening teeth” and “helps

transform individuals through confident smiles they love.”

In addition to these investments in influencing

consumer decision making, the Company will continue to make

strategic investments in international growth and in penetrating

new demographics to drive controlled growth, while also executing

against its profitability goals. Lastly, favorable industry

dynamics continue to increase with broader acceptance of telehealth

and specifically tele-dentistry, minimal penetration against the

total addressable market, a number of recent regulatory wins that

should help remove barriers to access to care, and clear aligners

gaining share in the overall industry.

Full Year 2021 Guidance

For the year ended December 31, 2021, the

Company expects total revenue to be in the range of $630 million to

$650 million. While macroeconomic trends persisted into October

2021 from a demand perspective, the Company notes that its business

can be highly variable on a month-to-month or quarter-to-quarter

basis.

The assumptions underlying the revenue estimate

include:

- Q4 revenue expected to be in the

range of $120-$140MM

- A continuation of the macroeconomic

headwind that was evident in Q3 into Q4

- A small ramp in Germany and Spain

as we continue to onboard more locations and increase marketing

investments.

- As we have continued to expand on

our Challenger Campaign, and as a result of the iOS security

changes on our targeting effectiveness, we have changed our lead

strategy to be more focused on higher funnel leads through

platforms such as TV; this strategy is expected to have an impact

on marketing effectiveness at driving near-term revenue but be more

effective and efficient at driving long-term revenue growth

The full year 2021 margin outlook is based on

the following:

- Gross margin (as a percentage of

total revenues) of ~70% for Q4 2021.

- Sales & marketing (as a

percentage of total revenues) in the range of 80%-90% for Q4

2021.

- Continued near-term rate headwinds

expected from lead-focused marketing strategy in the US and

Canada

- Accelerated marketing investments

to support relaunch ramp up and expansion in international

markets

- Added selling investment to support

planned growth in Partner Network

- G&A dollars expected to be

relatively flat to Q3 with slight pressure from seasonal

staffing.

- On liquidity, SmileDirectClub

retains approximately $263MM in accounts receivable and $308

million of cash on the balance sheet.

|

SmileDirectClub Third Quarter 2021 Conference Call

Details |

|

|

|

| Date: |

November 8, 2021 |

| Time: |

5:00 p.m. ET (2:00 p.m.

PT) |

|

Dial-In: |

1-877-407-9208 (domestic) or

1-201-493-6784 (international) |

|

Webcast: |

Visit “Events and

Presentations” section of the company’s IR page

at http://investors.smiledirectclub.com or a direct link

to the webcast. |

A replay of the call may be accessed

from 8:00 p.m. ET on Monday, November 8,

2021 until 11:59 pm ET on Monday,

November 15, 2021 by dialing 1-844-512-2921 (domestic) or

1-412-317-6671 (international) and entering the replay PIN:

13723311. A copy of the 2021 third quarter results supplemental

earnings presentation and an archived version of the call, when

completed, will also be available on the Investor Relations section

of SmileDirectClub’s website at investors.smiledirectclub.com.

Forward-Looking Statements

This earnings release contains forward-looking

statements. All statements other than statements of historical

facts may be forward-looking statements. Forward-looking statements

generally relate to future events and include, without limitation,

projections, forecasts and estimates about possible or assumed

future results of our business, financial condition, liquidity,

results of operations, plans, and objectives. Some of these

statements may include words such as “expects,” “anticipates,”

“believes,” “estimates,” “targets,” “plans,” “potential,”

“intends,” “projects,” and “indicates.”

Although they reflect our current, good faith

expectations, these forward-looking statements are not a guarantee

of future performance, and involve a number of risks,

uncertainties, estimates, and assumptions, which are difficult to

predict. Some of the factors that may cause actual outcomes and

results to differ materially from those expressed in, or implied

by, the forward-looking statements include, but are not necessarily

limited to: the ongoing assessment of the cyber incident, material

legal, financial and reputational risks resulting from such

incident and the related operational disruptions; the duration and

magnitude of the COVID-19 pandemic and related containment

measures; our management of growth; the execution of our business

strategies, implementation of new initiatives, and improved

efficiency; our sales and marketing efforts; our manufacturing

capacity, performance, and cost; our ability to obtain future

regulatory approvals; our financial estimates and needs for

additional financing; consumer acceptance of and competition for

our clear aligners; our relationships with retail partners and

insurance carriers; our R&D, commercialization, and other

activities and expenditures; the methodologies, models,

assumptions, and estimates we use to prepare our financial

statements, make business decisions, and manage risks; laws and

regulations governing remote healthcare and the practice of

dentistry; our relationships with vendors; the security of our

operating systems and infrastructure; our risk management

framework; our cash and capital needs; our intellectual property

position; our exposure to claims and legal proceedings; and other

factors described in our filings with the Securities and Exchange

Commission, including but not limited to our Annual Report on Form

10-K for the year ended December 31, 2020 and our Quarterly Report

on Form 10-Q for the quarter ended September 30, 2021.

New risks and uncertainties arise over time, and

it is not possible for us to predict all such factors or how they

may affect us. You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made. We are under no duty to update any of these

forward-looking statements after the date of this earnings release

to conform these statements to actual results or revised

expectations. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this earnings release.

About SmileDirectClub

SmileDirectClub, Inc. (Nasdaq: SDC)

(“SmileDirectClub”) is an oral care company and creator of the

first medtech platform for teeth straightening. Through its

cutting-edge telehealth technology and vertically integrated model,

SmileDirectClub is revolutionizing the oral care industry, offering

consumers the ability to get clinically safe and effective

treatment but without the 3x markup. SmileDirectClub’s mission is

to democratize access to a smile each and every person loves by

making it affordable and convenient for everyone. SmileDirectClub

is headquartered in Nashville, Tennessee and operates in the U.S.,

Canada, Australia, New Zealand, United Kingdom, Ireland, Germany,

Austria, Hong Kong, Singapore, Spain, Mexico and France. For more

information, please visit SmileDirectClub.com.

Investor Relations:Tripp

Sullivan SCR Partners, LLCinvestorrelations@smiledirectclub.com

Media Relations:Kim

AtkinsonVice President, Communicationspress@smiledirectclub.com

SmileDirectClub, Inc.Condensed

Consolidated Balance Sheets(in

thousands)

| |

September

30, |

|

December

31, |

|

|

2021 |

|

2020 |

|

ASSETS |

|

|

|

|

|

|

|

|

Cash |

$ |

307,648 |

|

|

$ |

316,724 |

|

| Accounts receivable |

195,778 |

|

|

221,973 |

|

| Inventories |

38,953 |

|

|

29,247 |

|

| Prepaid and other current

assets |

19,886 |

|

|

12,832 |

|

|

Total current assets |

562,265 |

|

|

580,776 |

|

| Accounts receivable,

non-current |

66,862 |

|

|

71,355 |

|

| Property, plant and equipment,

net |

218,412 |

|

|

189,995 |

|

| Operating lease right-of-use

asset |

24,103 |

|

|

31,176 |

|

| Other assets |

14,455 |

|

|

11,487 |

|

|

Total assets |

$ |

886,097 |

|

|

$ |

884,789 |

|

| LIABILITIES AND

EQUITY |

|

|

| Accounts payable |

$ |

19,909 |

|

|

$ |

36,848 |

|

| Accrued liabilities |

117,166 |

|

|

100,589 |

|

| Deferred revenue |

22,224 |

|

|

26,619 |

|

| Current portion of long-term

debt |

9,717 |

|

|

15,664 |

|

| Other current liabilities |

5,992 |

|

|

6,821 |

|

|

Total current liabilities |

175,008 |

|

|

186,541 |

|

| Long-term debt, net of current

portion |

733,184 |

|

|

392,939 |

|

| Operating lease liabilities,

net of current portion |

20,810 |

|

|

27,771 |

|

| Other long-term

liabilities |

2,811 |

|

|

43,400 |

|

|

Total liabilities |

931,813 |

|

|

650,651 |

|

| Commitment and

contingencies |

|

|

| Equity |

|

|

| Class A common stock, par

value $0.0001 and 119,103,923 shares issued and outstanding at

September 30, 2021 and 115,429,319 shares issued and

outstanding at December 31, 2020 |

12 |

|

|

11 |

|

| Class B common stock, par

value $0.0001 and 269,243,501 shares issued and outstanding at

September 30, 2021 and 270,908,566 shares issued and

outstanding at December 31, 2020 |

27 |

|

|

27 |

|

| Additional

paid-in-capital |

442,743 |

|

|

483,393 |

|

| Accumulated other

comprehensive income (loss) |

109 |

|

|

(102 |

) |

| Accumulated deficit |

(266,060 |

) |

|

(192,879 |

) |

| Noncontrolling interest |

(240,167 |

) |

|

(73,932 |

) |

| Warrants |

17,620 |

|

|

17,620 |

|

|

Total equity |

(45,716 |

) |

|

234,138 |

|

|

Total liabilities and equity |

$ |

886,097 |

|

|

$ |

884,789 |

|

SmileDirectClub, Inc.Condensed

Consolidated Statements of Operations(in

thousands, except share and per share amounts)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenue, net |

$ |

126,796 |

|

|

$ |

156,459 |

|

|

$ |

478,185 |

|

|

$ |

434,796 |

|

| Financing revenue |

10,887 |

|

|

12,042 |

|

|

33,140 |

|

|

37,428 |

|

|

Total revenues |

137,683 |

|

|

168,501 |

|

|

511,325 |

|

|

472,224 |

|

| Cost of revenues |

39,412 |

|

|

49,760 |

|

|

133,233 |

|

|

158,313 |

|

| Gross profit |

98,271 |

|

|

118,741 |

|

|

378,092 |

|

|

313,911 |

|

| Marketing and selling

expenses |

96,175 |

|

|

66,722 |

|

|

289,241 |

|

|

243,564 |

|

| General and administrative

expenses |

85,658 |

|

|

74,110 |

|

|

251,778 |

|

|

233,828 |

|

| Lease abandonment and

impairment of long-lived assets |

1,378 |

|

|

3,960 |

|

|

1,378 |

|

|

28,593 |

|

| Other store closure and

related costs |

95 |

|

|

1,714 |

|

|

1,759 |

|

|

6,190 |

|

|

Loss from operations |

(85,035 |

) |

|

(27,765 |

) |

|

(166,064 |

) |

|

(198,264 |

) |

| Interest expense |

1,772 |

|

|

15,555 |

|

|

21,277 |

|

|

29,627 |

|

| Loss on extinguishment of

debt |

— |

|

|

— |

|

|

47,631 |

|

|

13,781 |

|

| Other expense (income) |

2,695 |

|

|

(1,028 |

) |

|

3,737 |

|

|

2,131 |

|

|

Net loss before provision for income tax expense (benefit) |

(89,502 |

) |

|

(42,292 |

) |

|

(238,709 |

) |

|

(243,803 |

) |

| Provision for income tax

expense (benefit) |

(119 |

) |

|

1,190 |

|

|

1,576 |

|

|

1,745 |

|

|

Net loss |

(89,383 |

) |

|

(43,482 |

) |

|

(240,285 |

) |

|

(245,548 |

) |

| Net loss attributable to

noncontrolling interest |

(61,991 |

) |

|

(30,892 |

) |

|

(167,104 |

) |

|

(176,909 |

) |

|

Net loss attributable to SmileDirectClub, Inc. |

$ |

(27,392 |

) |

|

$ |

(12,590 |

) |

|

$ |

(73,181 |

) |

|

$ |

(68,639 |

) |

| |

|

|

|

|

| Earnings (loss) per

share of Class A common stock: |

|

|

|

|

| Basic |

$ |

(0.23 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.62 |

) |

|

$ |

(0.63 |

) |

| Diluted |

$ |

(0.23 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.62 |

) |

|

$ |

(0.64 |

) |

| |

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

| Basic |

118,918,072 |

|

111,703,080 |

|

118,081,711 |

|

108,459,488 |

| Diluted |

388,161,573 |

|

385,672,677 |

|

387,554,625 |

|

384,888,849 |

SmileDirectClub, Inc.Condensed

Consolidated Statements of Cash Flows(in

thousands)

| |

Nine Months Ended September 30, |

|

|

2021 |

|

2020 |

| Operating

Activities |

|

|

|

Net loss |

$ |

(240,285 |

) |

|

$ |

(245,548 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

Depreciation and amortization |

51,655 |

|

|

39,399 |

|

|

Deferred loan cost amortization |

4,069 |

|

|

3,021 |

|

|

Equity-based compensation |

37,659 |

|

|

38,189 |

|

|

Loss on extinguishment of debt |

47,631 |

|

|

13,594 |

|

|

Paid in kind interest expense |

3,324 |

|

|

5,118 |

|

|

Asset impairment and related charges |

1,378 |

|

|

30,903 |

|

|

Changes in ROU asset |

977 |

|

|

5,797 |

|

| Changes in operating assets

and liabilities: |

|

|

|

Accounts receivable |

30,845 |

|

|

43,755 |

|

|

Inventories |

(9,706 |

) |

|

(8,456 |

) |

|

Prepaid and other current assets |

(10,062 |

) |

|

(2,844 |

) |

|

Accounts payable |

(20,984 |

) |

|

(9,441 |

) |

|

Accrued liabilities |

9,827 |

|

|

(8,559 |

) |

|

Deferred revenue |

(4,395 |

) |

|

26,416 |

|

|

Net cash used in operating activities |

(98,067 |

) |

|

(68,656 |

) |

| Investing

Activities |

|

|

| Purchases of property,

equipment, and intangible assets |

(70,284 |

) |

|

(68,768 |

) |

|

Net cash used in investing activities |

(70,284 |

) |

|

(68,768 |

) |

| Financing

Activities |

|

|

| IPO proceeds, net of discount

and related fees |

— |

|

|

(1,155 |

) |

| Proceeds from warrant

exercise |

— |

|

|

922 |

|

| Repurchase of Class A shares

to cover employee tax withholdings |

(9,055 |

) |

|

(6,976 |

) |

| Proceeds from stock purchase

plan |

632 |

|

|

— |

|

| Repayment of HPS Credit

Facility |

(396,497 |

) |

|

— |

|

| Payment of extinguishment

costs |

(37,701 |

) |

|

— |

|

| Proceeds from HPS Credit

Facility and Warrants, net |

— |

|

|

388,000 |

|

| Borrowings of long-term

debt |

747,500 |

|

|

16,807 |

|

| Payments of issuance

costs |

(21,179 |

) |

|

(11,784 |

) |

| Purchase of capped call

transactions |

(69,518 |

) |

|

— |

|

| Final payment of Align

arbitration |

(43,400 |

) |

|

— |

|

| Principal payments on

long-term debt |

(4,609 |

) |

|

(187,579 |

) |

| Payments of finance

leases |

(8,046 |

) |

|

(7,543 |

) |

| Other |

684 |

|

|

1,319 |

|

|

Net cash provided by financing activities |

158,811 |

|

|

192,011 |

|

|

Effect of exchange rates change on cash and cash equivalents |

464 |

|

|

— |

|

| Increase (decrease) in

cash |

(9,076 |

) |

|

54,587 |

|

| Cash at beginning of

period |

316,724 |

|

|

318,458 |

|

|

Cash at end of period |

$ |

307,648 |

|

|

$ |

373,045 |

|

| |

|

|

|

|

|

|

|

Use of Non-GAAP Financial

Measures

This earnings release contains certain non-GAAP

financial measures, including adjusted EBITDA (“Adjusted EBITDA”).

We provide a reconciliation of this non-GAAP financial measure to

the most directly comparable GAAP financial measure below and in

our Current Report on Form 8-K announcing our quarterly earnings

results, which can be found on the SEC’s website at www.sec.gov and

our website at investors.smiledirectclub.com.

We utilize certain non-GAAP financial measures,

including Adjusted EBITDA, to evaluate our actual operating

performance and for planning and forecasting of future periods.

We define Adjusted EBITDA as net loss, plus

depreciation and amortization, interest expense, income tax expense

(benefit), equity-based compensation, loss on extinguishment of

debt, impairment of long-lived assets, abandonment and other

related charges and certain other non-operating expenses, such as

one-time store closure costs associated with our real estate

repositioning strategy, severance and other labor costs, and

unrealized foreign currency adjustments. We use Adjusted EBITDA

when evaluating our performance when we believe that certain items

are not indicative of operating performance. Adjusted EBITDA

provides useful supplemental information to management regarding

our operating performance, and we believe it will provide the same

to members/stockholders.

We believe that Adjusted EBITDA will provide

useful information to members/stockholders about our performance,

financial condition, and results of operations for the following

reasons: (i) Adjusted EBITDA is among the measures used by our

management team to evaluate our operating performance and make

day-to-day operating decisions and (ii) Adjusted EBITDA is

frequently used by securities analysts, investors, lenders, and

other interested parties as a common performance measure to compare

results or estimate valuations across companies in our

industry.

Adjusted EBITDA does not have a definition under

GAAP, and our definition of Adjusted EBITDA may not be the same as,

or comparable to, similarly titled measures used by other

companies. Adjusted EBITDA should not be considered in isolation

from, or as a substitute for, financial information prepared in

accordance with GAAP. A reconciliation of Adjusted EBITDA to net

loss, the most directly comparable GAAP financial measure, is set

forth below.

SmileDirectClub, Inc.Reconciliation of

Net Loss to Adjusted EBITDA(in

thousands)

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

(unaudited) |

|

Net loss |

$ |

(89,383 |

) |

|

$ |

(43,482 |

) |

|

$ |

(240,285 |

) |

|

$ |

(245,548 |

) |

| Depreciation and

amortization |

18,486 |

|

|

14,042 |

|

|

51,655 |

|

|

39,399 |

|

| Total interest expense |

1,772 |

|

|

15,555 |

|

|

21,277 |

|

|

29,627 |

|

| Income tax expense

(benefit) |

(119 |

) |

|

1,190 |

|

|

1,576 |

|

|

1,745 |

|

| Lease abandonment and

impairment of long-lived assets |

1,378 |

|

|

3,960 |

|

|

1,378 |

|

|

28,593 |

|

| Other store closure and

related costs |

95 |

|

|

1,714 |

|

|

1,759 |

|

|

6,190 |

|

| Loss on extinguishment of

debt |

— |

|

|

— |

|

|

47,631 |

|

|

13,781 |

|

| Equity-based compensation |

10,492 |

|

|

10,972 |

|

|

37,659 |

|

|

38,189 |

|

| Other non-operating general

and administrative losses (gains) |

3,264 |

|

|

(930 |

) |

|

5,777 |

|

|

3,775 |

|

|

Adjusted EBITDA |

$ |

(54,015 |

) |

|

$ |

3,021 |

|

|

$ |

(71,573 |

) |

|

$ |

(84,249 |

) |

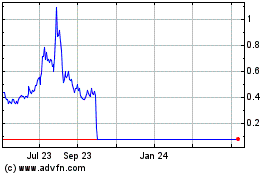

SmileDirectClub (NASDAQ:SDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

SmileDirectClub (NASDAQ:SDC)

Historical Stock Chart

From Jul 2023 to Jul 2024