In results after the bell, Cisco said earnings increased, but

revenue declined amid the CVID-19 pandemic. Jack in the Box saw its

profit halved amid social-distancing measures and SmileDirectClub

Inc. posted wider first-quarter losses.

In earnings reported in the morning session, the Covid-19

pandemic divided the earnings winners and losers based on how

reliant each company is on in-person contact.

Here is a rundown of the latest corporate earnings:

Cisco Systems Inc. showed stronger-than-expected resilience in

its earnings Wednesday, but the tech giant's sales are declining

amid the Covid-19 pandemic. The company said third-quarter revenue

declined 8% to $12 billion.

Jack in the Box Inc. reported a 54% decline in profit for its

latest quarter, as sales fell due to social-distancing measures

meant to combat the new coronavirus. Jack said same-store sales

across its company and franchisee-run locations fell 4.2% for its

fiscal second quarter that ended April 12.

SmileDirectClub Inc. posted wider first-quarter losses due to

higher expenses as the coronavirus pandemic has helped shift the

company's operations toward teledentistry and its completely remote

kit business to continue serving customers.

1Life Healthcare Inc., called One Medical, raised its guidance

for its ending membership count for 2020 by 5,000, but also said

the Covid-19 pandemic has hurt the company's ability to bring in

revenue. One Medical said it had a loss of $33.9 million, or 40

cents a share.

Earnings reported earlier Wednesday:

Arcos Dorados Holdings Inc. swung to a first-quarter loss after

pandemic restrictions lowered sales at its McDonald's Corp.

franchises in Latin America and the Caribbean.

Aston Martin Lagonda Global Holdings PLC sold 578 vehicles in

its first quarter, down from 1,057 a year ago. This prompted the

U.K. luxury car maker to report a wider pretax loss for the quarter

as revenue fell.

CP ALL PCL, which operates 7-Eleven stores in Thailand, saw its

first-quarter net profit fall 2.2% compared with the same period a

year earlier. The Thai conglomerate said the pandemic hurt its

businesses and the impact was accentuated in March by the

government's control measures.

OneSpaWorld Holdings Ltd., which provides health and wellness

products on cruises and at resorts, reported a larger loss in the

first quarter as many of the cruise lines and resorts the company

serves shut down during the pandemic.

However, Tencent Holdings Ltd. saw its first-quarter net profit

rise 6.2% on year, thanks to strong growth in the Chinese internet

company's gaming and online-advertising revenue.

E-commerce company Jumia Technologies AG didn't fare as well.

The German company, which focuses on African countries, said

revenue slipped in its first quarter as sellers using its platform

struggled to procure some items amid the pandemic.

Other earnings reported Wednesday, at a glance:

ABN AMRO Bank NV: The Dutch lender turned a net loss in the

first quarter of the year after booking a large impairment charge

due to Covid-19, oil prices and market developments.

A.P. Moeller-Maersk A/S: The Danish shipping company posted

better-than-expected first-quarter earnings as cost cuts and higher

freight rates helped offset a slump in demand from the Covid-19

pandemic, but Maersk warned second-quarter volumes could fall 20%

to 25%.

Ayala Corp.: The Philippine conglomerate's first-quarter net

profit fell 17% from a year earlier as the Covid-19 pandemic hurt

operations across its business units ranging from industrials to

finance.

Brewin Dolphin Holdings PLC: The FTSE 250 fund manager reported

a fall in pretax profit for the first half of fiscal 2020 after

suffering the effects of the coronavirus toward the end of the

second quarter.

Commerzbank AG: The German bank swung to a net loss in the first

quarter of 2020 as the pandemic led to a 479 million-euro ($518.9

million) hit on risk profit and in loan loss provisions.

Frasers Property Ltd.: The Singapore investment company, whose

asset classes including residential, retail and hospitality,

reported a 38% slide in second-quarter net profit as the pandemic

posed operational challenges.

Galaxy Entertainment Group Ltd.: The Hong Kong casino operator's

net revenue plunged in the first quarter due to a lower number of

visitors amid the Covid-19 pandemic.

Genting Singapore Ltd.: The casino operator said revenue fell by

more than a third in the first quarter due to the impact of the

pandemic.

Koninklijke Boskalis Westminster NV: The Dutch dredging and

heavy-lifting company said its first-quarter performance was above

management's expectations, with the negative effects of the

pandemic having been relatively limited.

Kotak Mahindra Bank Ltd.: One of India's largest private-sector

banks, Kotak Mahindra Bank reported its fourth-quarter net profit

fell 6.5% from a year earlier as it set aside more provisions for

the economic and financial uncertainty likely to be caused by

Covid-19.

KT Corp.: The South Korean telecom giant's first-quarter net

profit fell 13% as the coronavirus hurt its non-communications

business badly despite steady growth in its wireless segment.

Mediaset SpA: The Italian broadcaster said net profit and

revenue for the first quarter as the pandemic brought about a

slowdown in advertising in Italy and Spain from March.

Pilipinas Shell Petroleum Corp.: The company swung to loss in

the first quarter due to the collapse in global oil prices and a

slowdown in economic activity caused by the spread of Covid-19.

Sony Corp.: The Japanese electronics and entertainment company

said its fourth-quarter net profit fell 86%, as the pandemic hurt

its electronics and financial businesses despite stronger earnings

from its image-sensor business.

Ten Entertainment Group PLC: The U.K. entertainment-centers

operator reported a rise in pretax profit for 2019 on increased

revenue and said trading was strong until the lockdown.

TUI AG: The German travel group reported a sharply widened net

loss for the three months ended March 31 after suspending the

majority of its operations late in the quarter. It plans to

gradually resume travel activities and could cut up to 8,000 jobs

to reduce its overhead cost base by 30%.

(END) Dow Jones Newswires

May 13, 2020 18:16 ET (22:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

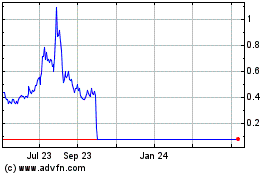

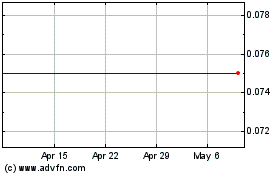

SmileDirectClub (NASDAQ:SDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

SmileDirectClub (NASDAQ:SDC)

Historical Stock Chart

From Jul 2023 to Jul 2024