false

0001269026

0001269026

2024-11-15

2024-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 15, 2024

SINTX

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-33624 |

|

84-1375299 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1885

West 2100 South

Salt

Lake City, UT 84119

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (801) 839-3500

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s): |

|

Name

of each exchange on which registered: |

| Common

Stock, par value $0.01 per share |

|

SINT |

|

The

NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Gregg

Honigblum has been appointed to serve as SINTX Technologies, Inc.’s (the “Company”) Chief Strategy Officer effective

November 15, 2024.

Prior

to being appointed as Chief Strategy Officer, from December 2023 to November 2024 Mr. Honigblum served as a Managing Director for FNEX

Capital, LLC, a global leader in Private Securities transaction and investment banking. From June 2021 to December 2023 Mr. Honigblum

served as a Managing Director for Westlake Securities, an investment banking firm focused on growth, merger and acquisitions, and capital

raising services for middle market companies. From August 2016 to December 2023 Mr. Honigblum was a co-founder and Director for HealthGrowth

Capital, LLC specializing in providing capital, strategic advisory services, and a Group Purchasing Organization Platform with large

wholesale pharmaceutical distributors. He earned a Bachelor of Arts degree in Economics from the University of Texas at Austin. Mr. Honigblum

holds Series 7, 24, and 63 securities licenses.

There

are no family relationships between Mr. Honigblum and any director or other executive officer of the Company. There are no transactions

to which the Company was or is a participant and in which Mr. Honigblum has a material interest subject to disclosure under Item 404(a)

of Regulation S-K.

There

are no arrangements or understandings between Mr. Honigblum and any other person pursuant to which he was selected as an officer of the

Company.

In

connection with Mr. Honigblum’s appointment, on November 15, 2024, the Company entered into an Executive Employment Agreement (the

“Agreement”) with Mr. Honigblum to serve as the Company’s Chief Strategy Officer. The Agreement has a term of six (6)

months and is subject to automatic renewal for additional six-month periods unless either the Company or Mr. Honigblum provides thirty

(30) days advance written notice of intent not to renew. The Agreement provides for a base salary of $137,500 for the six (6) month term.

Mr. Honigblum is eligible to receive annual cash bonuses, participate in awards under Company equity incentive plans, on terms and conditions

as determined by the Board and participate in such health, group insurance, welfare, pension, and other employee benefit plans, programs,

and arrangements as are made generally available from time to time to other employees of the Company. The Agreement also provides that,

in the event of a termination of Mr. Honigblum’s employment without cause or for good reason, he will be eligible to receive, in

addition to accrued salary and other benefits, severance payments equal to his base salary for a period equal to the longer of three

months or the remainder of the initial term of the Agreement. Under the Agreement, Mr. Honigblum’s receipt of such severance payments

is subject to his execution and delivery of a general release of claims in favor of the Company.

The

foregoing description of the Agreement is qualified in its entirety by reference to the full text of the Agreement, a copy of which is

filed as an exhibit to this Current Report on Form 8-K and is hereby incorporated by reference herein.

Item

8.01 Other Events.

On

November 19, 2024, the Company issued a press release announcing the appointment of Gregg Honigblum as Chief Strategy Officer. A copy

of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SINTX

Technologies, Inc. |

| |

|

|

| Date: |

November

19, 2024 |

By: |

/s/

Eric K. Olson |

| |

|

Eric

K. Olson |

| |

|

Chief

Executive Officer |

Exhibit

10.1

EXECUTIVE

EMPLOYMENT AGREEMENT

This

EXECUTIVE EMPLOYMENT AGREEMENT (“Agreement”) is made as of November 15, 2024 (the “Effective Date”),

by and between SINTX Technologies, Inc. (together with its successors and assigns, the “Company”), and Gregg R. Honigblum

(“Executive”).

RECITALS

WHEREAS,

the Company desires to employ Executive, and Executive desires to be employed by the Company, as the Company’s Chief Strategy Officer.

NOW,

THEREFORE, in consideration of the foregoing recitals, the mutual covenants and conditions herein, and other good and valuable consideration,

the receipt and adequacy of which is hereby acknowledged, the parties hereby agree as follows:

| 1. | Employment

and Term. The Company hereby agrees to employ Executive, and Executive hereby accepts

employment by the Company, on the terms and conditions hereinafter set forth. Executive’s

term of employment by the Company under this Agreement (the “Term”) shall

commence on the Effective Date and end on the six (6) month anniversary thereof (the “Initial

Term”), subject to automatic renewal of the Term for additional six-month periods

unless either the Company or Executive gives the other party written notice of intent not

to renew the Term not less than thirty (30) days before the date on which the Term otherwise

would automatically renew. Notwithstanding the foregoing, the Term may be terminated earlier

in accordance with Section 5. |

| 2. | Position,

Duties and Responsibilities, Location, and Commuting. |

| (a) | Position

and Duties. During the Term, the Company shall employ Executive as Chief Strategy Officer.

Executive shall report directly to the Company’s Chief Executive Officer (the “CEO”).

Executive shall perform on behalf of the Company the primary role and responsibilities as

set forth on Addendum A to this Agreement. |

| (b) | Exclusive

Services and Efforts. Executive agrees to devote his or her efforts, energies, and skill

to the discharge of the duties and responsibilities attributable to his or her position and,

except as set forth herein, agrees to devote all of his or her professional time and attention

to the business and affairs of the Company. |

| (c) | Compliance

with Company Policies. Executive shall be subject to the Bylaws, policies, practices,

procedures and rules of the Company, including those policies and procedures set forth in

the Company’s Code of Conduct and Ethics. Executive’s violation of the terms

of such documents shall be considered a breach of the terms of this Agreement. |

| (d) | Location

of Employment. Executive’s principal office, and principal place of employment,

shall be in Austin, Texas; provided that Executive may be required under business circumstances

to travel outside of such location in connection with performing his or her duties under

this Agreement. |

| (a) | Base

Salary. During the Term, the Company shall pay to Executive a six-month salary of $137,500

(“Base Salary”) payable in accordance with the Company’s regularly

scheduled payroll. The Compensation Committee of the Board (the “Committee”)

may increase or decrease the Base Salary, in its sole discretion, taking into account Company

and individual performance objectives. |

| (b) | Annual

Cash Bonus. During the Term, Executive shall be eligible to receive an annual cash bonus,

on terms and conditions as determined by the Committee in its sole discretion considering

Company and individual performance objectives. |

| (c) | Long-Term

Incentive Award. During the Term, Executive shall be eligible to participate in the Company’s

Equity Incentive Plan or any successor plan thereto, on terms and conditions as determined

by the Committee in its sole discretion taking into account Company and individual performance

objectives. |

| 4. | Employee

Benefits and Perquisites. |

| (a) | Benefits.

Executive shall be entitled to participate in such health, group insurance, welfare,

pension, and other employee benefit plans, programs, and arrangements as are made generally

available from time to time to other employees of the Company, subject to Executive’s

satisfaction of all applicable eligibility conditions of such plans, programs, and arrangements.

Nothing herein shall be construed to limit the Company’s ability to amend or terminate

any employee benefit plan or program in its sole discretion. |

| (b) | Fringe

Benefits, Perquisites, and Paid Time Off. During the Term, Executive shall be entitled

to participate in all fringe benefits and perquisites made available to other employees of

the Company, subject to Executive’s satisfaction of all applicable eligibility conditions

to receive such fringe benefits and perquisites. In addition, Executive shall be eligible

for up to twenty (20) days of paid time off (“PTO”) per calendar year

in accordance with the Company’s vacation and PTO policy, inclusive of vacation days

and sick days and excluding standard paid Company holidays, in the same manner as PTO days

for employees of the Company generally accrue. |

| (c) | Reimbursement

of Expenses. The Company shall reimburse Executive for all reasonable pre-approved business

and travel expenses incurred in the performance of his or her job duties, promptly upon presentation

of appropriate supporting documentation and otherwise in accordance with and subject to the

expense reimbursement policy of the Company. |

| (a) | General.

The Company may terminate Executive’s employment for any reason or no reason, and

Executive may terminate his or her employment for any reason or no reason, in either case

subject only to the terms of this Agreement; provided, however, that Executive is required

to provide to the Company at least forty-five (45) days’ written notice of intent to

terminate employment for any reason unless the Company specifies an earlier date of termination.

Upon termination of Executive’s employment, Executive shall be entitled to the compensation

and benefits described in this Section 5 and shall have no further rights to any compensation

or benefits from the Company. |

For

purposes of this Agreement, the following terms have the following meanings:

| (i) | “Accrued

Benefits” shall mean: (i) accrued but unpaid Base Salary through the Termination

Date, and any annual cash bonus earned but unpaid with respect to the year preceding the

year in which the Termination Date occurs, payable in accordance with Section 3(b); (ii)

reimbursement for any unreimbursed pre- approved reasonable business expenses incurred through

the Termination Date; (iii) accrued but unused PTO days; and (iv) all other payments, benefits,

or fringe benefits to which Executive shall be entitled as of the Termination Date under

the terms of any applicable compensation arrangement or benefit, equity, or fringe benefit

plan or program or grant. |

| (ii) | “Cause”

shall mean: (i) a breach by Executive of his or her fiduciary duties to the Company; (ii)

Executive’s breach of this Agreement, which, if curable, remains uncured or continues

after ten days’ notice by the Company thereof; (iii) the commission of (A) any crime

constituting a felony in the jurisdiction in which committed, (B) any crime involving moral

turpitude (whether or not a felony), or (C) any other criminal act involving embezzlement,

misappropriation of money, fraud, theft, or bribery (whether or not a felony); (iv) illegal

or controlled substance abuse or insobriety by Executive; (v) Executive’s material

negligence or dereliction in the performance of, or failure to perform Executive’s

duties of employment with the Company, which remains uncured or continues after ten days’

notice by the Company thereof; (vi) Executive’s refusal or failure to carry out a lawful

directive of any member of the Board or any of their respective designees, which directive

is consistent with the scope and nature of Executive’s responsibilities; or (vii) any

conduct, action or behavior by Executive that is, or is reasonably expected to be, materially

damaging to the Company, whether to the business interests, finance or reputation. In addition,

Executive’s employment shall be deemed to have terminated for Cause if, on the date

Executive’s employment terminates, facts and circumstances exist that would have justified

a termination for Cause, even if such facts and circumstances are discovered after such termination. |

| (iii) | “Good

Reason” shall mean a material breach by the Company of its obligations under this

Agreement, upon which Executive notifies the Board in writing of such material breach within

seven (7) days of such occurrence and such material breach shall have not been cured within

seven (7) days after the Board’s receipt of written notice thereof from Executive.

Executive’s resignation will not be treated as being for Good Reason unless Executive’s

resignation occurs during the one (1) month period following the end of the cure period. |

| (iv) | “Termination

Date” shall mean the date on which Executive’s employment hereunder terminates

in accordance with this Agreement. |

| 6. | Termination

Without Cause or Termination by Executive for Good Reason. In the event that Executive’s

employment hereunder is terminated by the Company without Cause or by Executive for Good

Reason, Executive shall be entitled to receive the Accrued Benefits. In addition, commencing

on the first payroll date following the Termination Date, the Company shall continue to pay

Executive his or her Base Salary, in accordance with customary payroll practices and subject

to applicable withholding and payroll taxes (the “Severance Payments”), for the

longer of three (3) months or the remainder of the Initial Term (the “Severance Period”);

provided, however, that the Severance Payments shall be conditioned upon the execution, non-revocation,

and delivery of a general release of claims by Executive, in a form reasonably satisfactory

to the Company. In the event that Executive fails to timely execute and deliver such a release,

the Company shall have no obligation to pay Severance Payments under this Agreement. |

| (a) | All

Other Terminations. In the event that Executive’s employment hereunder is terminated

by the Company for Cause, by Executive without Good Reason, or due to Executive’s death

or disability, Executive shall be entitled to receive the Accrued Benefits only. |

| (a) | Withholding.

The Company shall withhold all applicable federal, state, and local taxes, social security

and workers’ compensation contributions and other amounts as may be required by law

with respect to compensation payable to Executive pursuant to this Agreement. |

| (b) | Section

409A. Notwithstanding anything herein to the contrary, this Agreement is intended to

be interpreted and applied so that the payment of the benefits set forth herein shall either

be exempt from, or in the alternative, comply with, the requirements of Section 409A of the

Internal Revenue Code of 1986, as amended (the “Code”), and the published guidance

thereunder (“Section 409A”). A termination of employment shall not be deemed

to have occurred for purposes of any provision of this Agreement providing for the payment

of any amounts or benefits upon or following a termination of employment that are considered

“nonqualified deferred compensation” under Section 409A unless such termination

is also a “separation from service” within the meaning of Section 409A and, for

purposes of any such provision of this Agreement, references to a “termination,”

“Termination Date,” or like terms shall mean “separation from service.”

Notwithstanding any provision of this Agreement to the contrary, if Executive is a “specified

employee” within the meaning of Section 409A, any payments or arrangements due upon

a termination of Executive’s employment under any arrangement that constitutes a “nonqualified

deferral of compensation” within the meaning of Section 409A and which do not otherwise

qualify under the exemptions under Treas. Regs. Section 1.409A-1 (including without limitation,

the short-term deferral exemption or the permitted payments under Treas. Regs. Section 1.409A-

1(b)(9)(iii)(A)), shall be delayed and paid or provided on the earlier of (a) the date which

is six months after Executive’s “separation from service” for any reason

other than death, or (b) the date of Executive’s death. This Agreement may be amended

without requiring Executive’s consent to the extent necessary (including retroactively)

by the Company in order to preserve compliance with Section 409A. The preceding shall not

be construed as a guarantee of any particular tax effect for Executive’s compensation

and benefits and the Company does not guarantee that any compensation or benefits provided

under this Agreement will satisfy the provisions of Section 409A. |

| (c) | Separation

from Service. After any Termination Date, Executive shall have no duties or responsibilities

that are inconsistent with having a “separation from service” within the meaning

of Section 409A as of the Termination Date and, notwithstanding anything in the Agreement

to the contrary, distributions upon termination of employment of nonqualified deferred compensation

may only be made upon a “separation from service” as determined under Section

409A and such date shall be the Termination Date for purposes of this Agreement. Each payment

under this Agreement or otherwise shall be treated as a separate payment for purposes of

Section 409A. In no event may Executive, directly or indirectly, designate the calendar year

of any payment to be made under this Agreement which constitutes a “nonqualified deferral

of compensation” within the meaning of Section 409A and to the extent an amount is

payable within a time period, the time during which such amount is paid shall be in the discretion

of the Company. |

| (d) | Reimbursements.

All reimbursements and in-kind benefits provided under this Agreement shall be made or

provided in accordance with the requirements of Section 409A. To the extent that any reimbursements

are taxable to Executive, such reimbursements shall be paid to Executive on or before the

last day of Executive’s taxable year following the taxable year in which the related

expense was incurred. Reimbursements shall not be subject to liquidation or exchange for

another benefit and the amount of such reimbursements that Executive receives in one taxable

year shall not affect the amount of such reimbursements that Executive receives in any other

taxable year. |

| (e) | Parachute

Payments. If any payment, benefit, or distribution of any type to or for the benefit

of Executive, whether paid or payable, provided or to be provided, or distributed or distributable

pursuant to the terms of this Agreement or otherwise (collectively, the “Parachute

Payments”) would (as determined by the Company) subject Executive to the excise

tax imposed under Section 4999 of the Code (the “Excise Tax”), the Parachute

Payments shall be reduced so that the maximum amount of the Parachute Payments (after reduction)

shall be one dollar less than the amount which would cause the Parachute Payments to be subject

to the Excise Tax. The Company shall reduce or eliminate the Parachute Payments by first

reducing or eliminating any cash Parachute Payments that do not constitute deferred compensation

within the meaning of Section 409A, then by reducing or eliminating any other Parachute Payments

that do not constitute deferred compensation within the meaning of Section 409A, then by

reducing or eliminating all other Parachute Payments that do constitute deferred compensation

within the meaning of Section 409A, beginning with those payments last to be paid, subject

to and in accordance with all applicable requirements of Section 409A. |

| 8. | Non-Compete,

Non-Solicitation. Executive shall enter into Company’s standard Confidentiality,

Intellectual Property and Non-Solicitation Agreement. |

| 9. | Assurances

by Executive. Executive represents and warrants to the Company that he or she may enter

into and fully perform all of his or her obligations under this Agreement and as an employee

of the Company without breaching, violating, or conflicting with (i) any judgment, order,

writ, decree, or injunction of any court, arbitrator, government agency, or other tribunal

that applies to Executive or (ii) any agreement, contract, obligation, or understanding to

which Executive is a party or may be bound. |

| 10. | Termination

or Repayment of Severance Payments. In addition to the foregoing, and not in any way

in limitation thereof, or in limitation of any right or remedy otherwise available to the

Company, if Executive violates any provision of this Agreement, any obligation of the Company

to pay Severance Payments shall be terminated and of no further force or effect, and Executive

shall promptly repay to the Company any Severance Payments previously made to Executive,

in each case, without limiting or affecting Executive’s obligations under this Agreement

the Company’s other rights and remedies available at law or equity. |

| 11. | Publicity.

During the Term and for a three-month period thereafter, Executive hereby irrevocably

consents to any and all uses and displays of the Executive’s name, voice, likeness,

image, appearance, and biographical information by the Company and its agents, representatives,

and licensees for legitimate commercial or business purposes of the Company. |

| 12. | Notices.

Except as otherwise specifically provided herein, any notice, consent, demand, or other

communication to be given under or in connection with this Agreement shall be in writing

and shall be deemed duly given when delivered personally, when transmitted by facsimile transmission,

one day after being deposited with Federal Express or other nationally recognized overnight

delivery service, or three days after being mailed by first class mail, charges or postage

prepaid, properly addressed, if to the Company, at its principal office, and, if to Executive,

at his or her address set forth following his or her signature below. Either party may change

such address from time to time by notice to the other. |

| 13. | Governing

Law; Arbitration. This Agreement shall be governed by and construed and interpreted in

accordance with the laws of Utah, without giving effect to any choice of law rules or other

conflicting provision or rule that would cause the laws of any jurisdiction to be applied;

provided, however, that, to the fullest extent permitted by applicable law, any dispute,

controversy or claim arising out of or related to this Agreement shall be submitted to and

decided by binding arbitration, located in Salt Lake City, UT and administered and conducted

pursuant to the applicable rules and procedures of the American Arbitration Association as

well as any requirements imposed by applicable law. The parties hereby agree to accept the

arbitrator’s award as final and binding upon them. |

| 14. | Amendments;

Waivers. This Agreement may not be modified or amended or terminated except by an instrument

in writing, signed by Executive and a duly authorized representative of the Company (other

than Executive). By an instrument in writing similarly executed (and not by any other means),

either party may waive compliance by the other party with any provision of this Agreement

that such other party was or is obligated to comply with or perform; provided, however, that

such waiver shall not operate as a waiver of, or estoppel with respect to, any other or subsequent

failure. No failure to exercise and no delay in exercising any right, remedy, or power hereunder

shall operate as a waiver thereof, nor shall any single or partial exercise of any right,

remedy, or power hereunder preclude any other or further exercise thereof or the exercise

of any other right, remedy, or power provided herein or by law or in equity. To be effective,

any written waiver must specifically refer to the condition(s) or provision(s) of this Agreement

being waived. |

| 15. | Inconsistencies.

In the event of any inconsistency between any provision of this Agreement and any provision

of any Company arrangement, the provisions of this Agreement shall control, unless Executive

and the Company otherwise agree in a writing that expressly refers to the provision of this

Agreement that is being waived. |

| 16. | Assignment.

This Agreement is personal to Executive and without the prior written consent of the

Company shall not be assignable by Executive. The obligations of Executive hereunder shall

be binding upon Executive’s heirs, administrators, executors, assigns, and other legal

representatives. This Agreement shall be binding upon and shall inure to the benefit of and

be enforceable by the Company’s successors and assigns. |

| 17. | Voluntary

Execution; Representations. Executive acknowledges that (a) he or she has consulted with

or has had the opportunity to consult with independent counsel of his or her own choosing

concerning this Agreement and has been advised to do so by the Company, and (b) he or she

has read and understands this Agreement, is competent and of sound mind to execute this Agreement,

is fully aware of the legal effect of this Agreement, and has entered into it freely based

on his or her own judgment and without duress. |

| 18. | Headings.

The headings of the Sections and subsections contained in this Agreement are for convenience

only and shall not be deemed to control or affect the meaning or construction of any provision

of this Agreement. |

| 19. | Construction.

The language used in this Agreement shall be deemed to be the language chosen by the

parties to express their mutual intent, and no rule of strict construction shall be applied

against any party. |

| 20. | Beneficiaries/References.

Executive shall be entitled, to the extent permitted under applicable law, to select

and change a beneficiary or beneficiaries to receive any compensation or benefit hereunder

following Executive’s death by giving written notice thereof. In the event of Executive’s

death or a judicial determination of his or her incompetence, references in this Agreement

to Executive shall be deemed, where appropriate, to refer to his or her beneficiary, estate,

or other legal representative. |

| 21. | Survivorship.

Except as otherwise set forth in this Agreement, the respective rights and obligations

of the parties shall survive any termination of Executive’s employment. |

| 22. | Severability.

It is the desire and intent of the parties hereto that the provisions of this Agreement

be enforced to the fullest extent permissible under the laws and public policies applied

in each jurisdiction in which enforcement is sought. Accordingly, if any particular provision

of this Agreement shall be adjudicated by a court of competent jurisdiction or arbitrator

to be invalid, prohibited, or unenforceable for any reason, such provision, as to such jurisdiction,

shall be ineffective, without invalidating the remaining provisions of this Agreement or

affecting the validity or enforceability of such provision in any other jurisdiction. Notwithstanding

the foregoing, if such provision could be more narrowly drawn so as not to be invalid, prohibited,

or unenforceable in such jurisdiction, it shall, as to such jurisdiction, be so narrowly

drawn, without invalidating the remaining provisions of this Agreement or affecting the validity

or enforceability of such provision in any other jurisdiction. |

| 23. | Right

of Set Off. In the event of a breach by Executive of the provisions of this Agreement,

the Company is hereby authorized at any time and from time to time, to the fullest extent

permitted by law, and after ten days prior written notice to Executive, to set off and apply

any and all amounts at any time held by the Company on behalf of Executive and all indebtedness

at any time owing by the Company to Executive against any and all of the obligations of Executive

now or hereafter existing. |

| 24. | Counterparts.

This Agreement may be executed in any number of counterparts, each of which shall be

deemed an original, but all such counterparts shall together constitute one and the same

instrument. Signatures delivered by facsimile or PDF shall be effective for all purposes. |

| 25. | Entire

Agreement. This Agreement contains the entire agreement of the parties and supersedes

all prior or contemporaneous negotiations, correspondence, understandings and agreements

between the parties, regarding the subject matter of this Agreement. |

| SINTX TECHNOLOGIES, INC. |

|

| |

|

|

| By: |

|

|

| |

Eric

K. Olson, Chief Executive Officer |

|

| |

|

|

| Date: |

November

15, 2024 |

|

EXECUTIVE:

| By: |

|

|

| |

Gregg

Honigblum |

|

| |

|

|

| Date: |

November

15, 2024 |

|

Addendum

A

Chief

Strategy Officer Primary Role and Responsibilities

1.

Capital Raising and Financial Strategy

| ● | Close

on $10 million-dollar Private Investment for Public Entity (PIPE) on or before March 31st,

2025. Subscription Agreements totaling five million dollars ($5,000,000) will be executed

on or before January 31, 2025, and the final tranche of five million dollars ($5,000,000)

to be completed on or before March 31, 2025. |

| ● | Develop

and implement strategies for securing financing, including debt and equity raises, private

placements, public offerings, and other financing structures. |

| ● | Cultivate

and maintain relationships with investment banks, venture capital firms, private equity groups,

institutional investors, and high-net-worth individuals to ensure ongoing capital access. |

| ● | Lead

the process of financial structuring, negotiation, and execution of financing agreements. |

| ● | Assess

and execute potential M&A opportunities, joint ventures, and partnerships to drive growth. |

2.

Investor Relations and Communication

| ● | Serve

as the primary point of contact for current and potential investors, ensuring clear and consistent

communication about the company’s financial performance, strategy, and vision. |

| ● | Create,

implement, and oversee investor relations programs to enhance the company’s reputation

and attract new investors. |

| ● | Draft

and manage earnings releases, investor presentations, shareholder letters, and financial

reports. |

| ● | Organize

and lead investor meetings, roadshows, conferences, and quarterly earnings calls, addressing

investor inquiries and concerns. |

| ● | Develop

an in-depth understanding of investor expectations and market perceptions, relaying feedback

to the executive team. |

3.

Financial Analysis and Market Insights

| ● | Conduct

financial analysis and modeling to support strategic initiatives, capital-raising activities,

and valuation assessments. |

| ● | Monitor

and analyze the company’s financial performance relative to industry benchmarks, peer

companies, and market trends. |

| ● | Provide

insights and recommendations to the executive team on market conditions, industry developments,

and investor sentiment. |

| ● | Evaluate

and manage the impact of capital structure decisions on shareholder value and company liquidity. |

4.

Compliance and Regulatory Reporting

| ● | Ensure

all investor communications and disclosures are compliant with regulatory requirements, including

SEC filings (10-K, 10-Q, 8-K), and adhere to the standards of the NYSE, NASDAQ, or other

relevant exchanges. |

| ● | Coordinate

with legal and finance teams to maintain compliance with securities laws and regulations. |

| ● | Oversee

preparation and filing of required documentation related to financing activities, shareholder

communications, and public disclosures. |

5.

Corporate Branding and Public Relations

| ● | Collaborate

with executive team to align messaging and branding for a cohesive corporate image. |

| ● | Develop

strategies to enhance the company’s visibility in the financial community, ensuring

messaging is consistent and favorable. |

| ● | Act

as a spokesperson for the company on capital-raising efforts and investor relations matters,

representing the company at financial conferences, industry events, and media engagements. |

6.

Stakeholder Relationship Management

| ● | Build

and manage relationships with analysts, institutional investors, rating agencies, and industry

research firms to support the company’s valuation and investment appeal. |

| ● | Prepare

executive and board members for investor interactions, ensuring alignment and consistency

in messaging. |

| ● | Develop

and implement strategies to foster long-term investor relationships, including outreach to

retail shareholders and international investors. |

7.

Strategic Financial Planning and Budgeting

| ● | Support

the CEO and executive team in developing long-term financial plans, budgets, and capital

allocation strategies. |

| ● | Provide

input on financial forecasting, resource allocation, and cost management in alignment with

capital-raising goals and investor expectations. |

| ● | Track

and report on performance metrics related to capital-raising activities and investor relations,

ensuring transparency with internal stakeholders. |

8.

Risk Management and Mitigation

| ● | Identify

and mitigate financial and reputational risks related to investor relations and capital-raising

activities. |

| ● | Monitor

potential risks in financial markets that could impact the company’s ability to raise

capital or influence investor sentiment. |

| ● | Coordinate

with legal and compliance teams to manage risks associated with disclosures, shareholder

communications, and market volatility. |

9.

Board and Executive Collaboration

| ● | Work

closely with the CEO, CFO, and other executive team members to align investor relations and

capital-raising activities with overall corporate strategy. |

| ● | Provide

regular updates to the board of directors on investor relations, capital structure, and market

feedback. |

| ● | Support

board committees related to finance, audit, and governance with insights and data related

to investor engagement and capital markets. |

10.

Leadership and Team Development

| ● | Lead

and mentor a team of investor relations and capital markets professionals, if applicable,

ensuring they have the skills and resources to meet departmental goals. |

| ● | Foster

a culture of accountability, transparency, and responsiveness within the investor relations

team. |

| ● | Identify

and implement best practices for investor relations and capital-raising, continuously improving

strategies and processes. |

Exhibit

99.1

SINTX

Technologies Appoints Gregg R. Honigblum as Chief Strategy Officer

Seasoned

Healthcare Executive to Lead Strategic Growth Initiatives

Salt

Lake City, UT – November 19, 2024 (Globe NEWSWIRE) – SINTX Technologies, Inc. (NASDAQ: SINT) (“SINTX” or

the “Company”), an advanced ceramics company that develops and commercializes materials, components, and technologies for

medical and technical applications, is pleased to announce the appointment of Gregg R. Honigblum as Chief Strategy Officer (CSO). In

this role, Mr. Honigblum will oversee driving corporate strategy to support SINTX’s growth initiatives and enhancing investor relations.

Mr.

Honigblum brings over 35 years of experience as an executive for emerging growth companies, specializing in the healthcare sector. His

career began on Wall Street as a stockbroker, transitioning into investment banking roles at various firms in New York City. He co-founded

Creation Capital LLC and Creation Capital Advisors, investment banking firms with offices in New York and Austin, Texas, focusing on

founding and funding breakthrough healthcare technologies.

Throughout

his career, Mr. Honigblum has raised over half a billion dollars for various ventures. Notably, Mr. Honigblum was instrumental in providing

early-stage capital for Myriad Genetics, the first precision medicine diagnostic company credited with the discovery of BRCA1 and BRCA2

breast cancer genes. Additionally, he was an early-stage investor and financier for Acacia Biosciences, an early informational genomics

company that merged with Rosetta Inpharmatics and was subsequently acquired by Merck for $620 million.

“Gregg’s

appointment as Chief Strategy Officer reflects our confidence in his ability to elevate SINTX’s financial and strategic position,”

said Eric K. Olson, CEO of SINTX Technologies. “His successful career in emerging technologies and deep investment banking knowledge

will be invaluable as we pursue new development opportunities, strengthen investor relationships, and drive our corporate strategy and

revenue forward.”

Mr.

Honigblum’s deep understanding of the Company’s mission and strategic goals, coupled with his experience as a former member

of the board of Amedica, the predecessor of SINTX, positions him to drive the Company’s corporate strategy effectively.

“I

am honored to join SINTX at this pivotal juncture,” said Gregg R. Honigblum, Chief Strategy Officer. “The Company’s

ongoing development of pioneering technologies in the medical device sector positions it at the forefront of commercialization. I look

forward to contributing to the team’s efforts in enhancing shareholder value and drive the Company’s vision forward.”

For

more information, please visit www.sintx.com

About

SINTX Technologies, Inc.

SINTX

Technologies is an advanced ceramics company that develops and commercializes materials, components, and technologies for medical and

technical applications. SINTX is a global leader in the research, development, and manufacturing of silicon nitride, and its products

have been implanted in humans since 2008. Over the past several years, SINTX has utilized strategic acquisitions and alliances to enter

new markets. The Company has manufacturing and R&D facilities in Utah and Maryland. For more information on SINTX Technologies or

its materials platform, visit www.sintx.com.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”)

that are subject to a number of risks and uncertainties. Forward-looking statements can be identified by words such as: “anticipate,”

“believe,” “project,” “estimate,” “expect,” “strategy,” “future,”

“likely,” “may,” “should,” “will” and similar references to future periods. Examples

of forward-looking statements include, among others, statements we make regarding advancement of ceramic technologies and exploring new

avenues for growth and innovation, and the potential to pursue growth opportunities and explore strategic opportunities.

Readers

are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and

reflect management’s current estimates, projections, expectations and beliefs. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which

are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking

statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in

the forward-looking statements include, among others, difficulty in commercializing ceramic technologies and development of new product

opportunities. A discussion of other risks and uncertainties that could cause our actual results and financial condition to differ materially

from those indicated in the forward-looking statements can be found in SINTX’s Risk Factors disclosure in its Annual Report on

Form 10-K, filed with the SEC on March 27, 2024, and in SINTX’s other filings with the SEC. SINTX undertakes no obligation to publicly

revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report, except as

required by law.

Business

and Media Inquiries for SINTX:

SINTX

Technologies

801.839.3502

IR@sintx.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

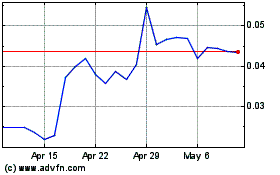

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Oct 2024 to Nov 2024

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Nov 2023 to Nov 2024