UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14A-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨

Definitive Proxy Statement

¨

Definitive Additional Materials

þ

Soliciting Material under § 240.14a-12

SILK ROAD MEDICAL,

INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

þ

No fee required

¨

Fee paid previously with preliminary materials

¨

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Key Messages and Master FAQ

Announcement of Silk

Road Medical Acquisition

By Boston Scientific

Key Messages and Master

FAQ

Key Messages

| · | Silk

Road Medical and Boston Scientific have announced that they have entered into a definitive

agreement for Boston Scientific to acquire Silk Road Medical. |

| · | Silk

Road Medical stockholders will receive cash consideration of $27.50 per share, corresponding

to a total equity value of approximately $1.26 billion. |

| · | The

transaction is expected to be completed in the second half of 2024, subject to the satisfaction

of customary closing conditions, including approval by Silk Road Medical’s stockholders

and applicable regulatory approvals. |

| · | Upon

the completion of the transaction, the Silk Road Medical business will become part of the

existing Boston Scientific Peripheral Interventions business. |

| · | We

anticipate that the addition of Silk Road Medical’s portfolio of products into Boston

Scientific’s Peripheral Interventions portfolio will expand access to the innovative

TCAR procedure. The addition of the Silk Road Medical portfolio will support Boston Scientific’s growth strategy

while expanding access to a less invasive procedure to treat carotid artery disease and prevent

stroke. |

| · | Until

the acquisition is completed, Silk Road Medical and Boston Scientific remain separate, independent

companies, and our priorities remain the same. That means it is business as usual, and Silk

Road Medical remains focused on our delivering business commitments and serving the needs

of customers and patients. |

| · | A

cross-functional team with representation from Boston Scientific and Silk Road Medical employees

will be put in place to plan for the integration of the companies, to be implemented after

the closing. The integration team will lead communications

between the two companies, and all contacts between Boston Scientific and Silk

Road Medical should be coordinated through the integration team efforts. |

STRATEGIC RATIONALE/OVERVIEW

What is the strategic rationale for Boston

Scientific’s acquisition of Silk Road Medical?

| · | The

Silk Road Medical board of directors regularly reviews all opportunities to maximize value,

and unanimously determined that the transaction is in the best interests of Silk Road Medical

and its stockholders. |

| · | The

Silk Road Medical board of directors concluded that the offer from Boston Scientific provides

its stockholders with compelling and certain near-term cash value. |

| · | We

anticipate that the addition of Silk Road Medical’s portfolio of products into Boston

Scientific’s Peripheral Interventions portfolio will expand access to the innovative

TCAR procedure. The addition of the Silk Road Medical portfolio will support Boston Scientific’s growth strategy

while expanding access to a less invasive procedure to treat carotid artery disease and prevent

stroke. |

FINANCIALS/DEAL TERMS/PROCESS

What are the terms of the acquisition?

| · | Silk

Road Medical and Boston Scientific have announced that they have entered into a definitive

agreement for Boston Scientific to acquire Silk Road Medical. |

| · | Boston

Scientific is acquiring Silk Road Medical for $27.50 per share in cash, corresponding to

a total equity value of approximately $1.26 billion. |

| · | The

acquisition price of $27.50 per share represents a premium of approximately 38% to the

weighted volume-weighted average price of Silk Road Medical’s common stock over the

past 60 days. |

| · | Completion

of the transaction is subject to subject to the satisfaction of customary closing conditions,

including approval by Silk Road Medical’s stockholders and applicable regulatory approvals. |

When will the deal close?

| · | The

transaction is expected to be completed in the second half of 2024, subject to customary

closing conditions, including approval by Silk Road Medical’s stockholders and applicable

regulatory approvals. |

| · | Upon

the completion of the transaction, the Silk Road Medical business will become part of the

existing Boston Scientific Peripheral Interventions business. |

BOSTON SCIENTIFIC AND SILK ROAD MEDICAL/PORTFOLIO

OVERVIEW

Can you tell me about Boston Scientific?

| · | Boston

Scientific transforms lives through innovative medical technologies that improve the health

of patients around the world. As a global medical technology leader for more than 40 years,

they advance science for life by providing a broad range of high-performance solutions that

address unmet patient needs and reduce the cost of healthcare. Their portfolio of devices

and therapies help physicians diagnose and treat complex cardiovascular, respiratory, digestive,

oncological, neurological, and urological diseases and conditions. |

| · | The

Boston Scientific Peripheral Interventions (PI) business offers a wide variety of products

for peripheral vascular disease, vessel trauma, and cancer. |

| · | The

Boston Scientific PI business’ Vascular franchise is positioned to provide physicians

with solutions to treat patients with a range of arterial and venous diseases, including

peripheral artery disease, deep vein thrombosis, and pulmonary embolism |

| · | Boston

Scientific is committed to developing new technologies in collaboration with vascular surgeons

to improve patient outcomes through greater procedural efficiency and less invasive diagnostic

and therapeutic options. |

What products will Boston Scientific acquire

from Silk Road Medical upon closing?

| · | Boston Scientific will acquire all of Silk Road Medical’s

business and products in the transaction. |

Where will Silk Road Medical fit into

the Boston Scientific structure, and who will lead it?

| · | Upon

the completion of the transaction, the Silk Road Medical business will become part of the

existing Boston Scientific Peripheral Interventions business. |

| · | A

cross-functional team with representation from Boston Scientific and Silk Road Medical employees

will be put in place to plan for the integration of Silk Road Medical into the Boston Scientific

PI business. These plans will be finalized over the weeks and months ahead and will be implemented

only after the transaction is completed. In the meantime, Silk Road Medical and Boston Scientific

remain separate, independent companies, and we will maintain business as usual. |

EMPLOYEE FAQs

Will Silk Road Medical employees become

Boston Scientific employees?

| · | Upon

the completion of the transaction, Silk Road Medical employees will also be Boston Scientific

employees. |

What are the plans for the Silk Road Medical

sites in Sunnyvale, California, and Plymouth, Minnesota?

| · | The

announcement does not impact Silk Road Medical’s operations, and we do not currently

expect changes to our business. |

| · | The

integration team will evaluate the needs of the combined organizations during the integration

process. As details are finalized through the integration planning, we will keep teams informed. |

| · | Integration

implementation will begin only upon the completion of the transaction. The integration

activities are anticipated to progress over a period of many months or even years post-close. |

What are the plans for the leadership

of Silk Road Medical?

| · | Until

the transaction is completed, Silk Road Medical will continue to operate as a separate, independent

company, and we will maintain business as usual. That means our roles and responsibilities

remain the same, as do reporting structures. |

| · | A

team will be assembled to commence integration planning to incorporate the Silk Road Medical

employees into Boston Scientific. This team will be implemented after the transaction closes.

We expect this to be a collaborative process. |

What are the plans for integration?

| · | The

announcement does not impact Silk Road Medical’s operations, and we do not currently

expect changes to our business. |

| · | A

team will be assembled to commence integration planning to incorporate the Silk Road Medical

employees into Boston Scientific, which will be implemented after the closing of the transaction.

We expect this to be a collaborative process. |

| · | Our

guiding principle throughout this integration is to ensure that we prioritize patients and

customers, as well as our commitment to quality, innovation, and operational excellence. |

Will there be any reductions in force

among employees?

| · | The

announcement does not impact Silk Road Medical’s operations, and we do not currently

expect changes to our business. |

| · | Silk

Road Medical has strong talent and important capabilities across its organization. Boston

Scientific recognizes that Silk Road Medical’s success is due to our collective talent,

our culture and our shared values. Their goal is to preserve and grow the value that Silk

Road Medical brings. |

| · | As

is common during acquisitions, there will be an integration process to evaluate and better

understand the business and ensure successful integration. As details are finalized through

integration planning, we will keep teams informed, and we appreciate the continued focus

by all employees to continue to serve customers and patients. |

Will my role change, and if so, when?

Will my reporting relationship change?

| · | Until

the transaction is completed, Silk Road Medical will continue to operate as a separate, independent

company, and we will maintain business as usual. That means our roles and responsibilities

remain the same, as do reporting structures. |

Will Silk Road Medical Employees be eligible

for commission and/or bonuses earned for 2024 under the Corporate Bonus Plan?

| · | Silk

Road Medical will continue to operate as a separate, independent company until the transaction

is completed. We do not currently expect any changes to our 2024 Corporate Bonus Plan or

sales commission plans, which will remain in effect until the transaction is completed. |

What will happen to my Silk Road Medical

compensation and benefits?

| · | In

the period between now and the completion of the transaction, your compensation and benefits

continue as normal, and you will be paid through your regular payroll process. |

What will happen to Silk Road Medical’s

employees’ equity grants?

| · | Upon

the completion of the transaction, any outstanding stock options and restricted stock units

(RSUs) granted to Silk Road Medical employees will vest in full and be cashed out at the

acquisition price of $27.50 per share (minus any applicable exercise price). If the exercise

price of a stock option exceeds the acquisition price, then the option will be canceled for

no consideration. You do not need to exercise your vested options to receive your consideration

in the transaction. |

| · | These

payments will be made through Silk Road Medical’s payroll within 30 days after the

closing of the transaction. |

Can our sales team discuss the acquisition

or Boston Scientific products with customers?

| · | Until

the transaction is completed, Silk Road Medical and Boston Scientific remain separate, independent

companies. |

| · | Silk

Road Medical employees should not promote or discuss Boston Scientific products with customers

before the closing of the transaction and any required training |

| · | At

the appropriate time, a commercial integration team will develop a go-forward strategy

for the sales organization. |

What should I say to a customer who asks

about the Boston Scientific acquisition?

Here’s a basic talk track to use with customers who inquire

about the deal:

| · | We

are excited about the transaction between Boston Scientific and Silk Road Medical. |

| · | This

is an important step forward to expand customer and patient access to Silk Road Medical’s

portfolio of innovative technologies |

| · | We

anticipate that the addition of Silk Road Medical devices to the Boston Scientific Peripheral

Interventions business will expand access to the TCAR procedure, a less invasive procedure

to treat carotid artery disease and prevent stroke |

| · | Boston

Scientific and Silk Road Medical will continue to operate as separate companies until the

transaction is completed, which we expect to occur in the second half of 2024, subject to

customary closing conditions, including approval by Silk Road Medical’s stockholders

and applicable regulatory approvals. |

| · | I

look forward to sharing more after the transaction is completed. |

Can I contact the Boston Scientific representative

in my area?

| · | No,

this announcement does not represent the completion of the transaction. In the period between

now and the close of the transaction, Boston Scientific and Silk Road Medical will continue

to operate as separate companies. The integration team will lead communications between the

two companies, and all contacts between Boston Scientific and Silk Road Medical should

be coordinated through the integration team efforts. |

| · | Upon

the completion of the transaction, we will be able to provide more direction. |

When will the full Silk Road Medical portfolio

be available for sale by Boston Scientific?

| · | In

the period between now and the completion of the transaction, Boston Scientific and Silk

Road Medical will continue to operate as separate companies, and Silk Road Medical products

will continue to be sold through their existing sales channels. |

| · | Following

the completion of the transaction, the companies will implement integration plans to bring

our sales organizations together to more broadly and collaboratively sell Silk Road Medical

products. |

Cautionary Statement Regarding Forward-Looking

Statements

This communication may contain forward-looking statements,

which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending acquisition

(the “Merger”) of Silk Road Medical, Inc. (“Silk Road”), the expected timing of the closing of the Merger

and other statements that concern Silk Road’s expectations, intentions or strategies regarding the future. There can be no assurance

that the Merger will in fact be consummated. Known and unknown risks and uncertainties could cause actual results to differ materially

from those indicated in the forward-looking statements, including, but not limited to: (i) the risk that the Merger may not be completed

on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including

the risk that required approvals from Silk Road’s stockholders for the Merger or required regulatory approvals to consummate the

Merger are not obtained, on a timely basis or at all; (iii) the occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the merger agreement with Boston Scientific Corporation and its affiliates (the “Merger

Agreement”), including in circumstances requiring Silk Road to pay a termination fee; (iv) the effect of the announcement

or pendency of the Merger on Silk Road’s business relationships, operating results and business generally; (v) risks that

the Merger disrupts Silk Road’s current plans and operations; (vi) Silk Road’s ability to retain and hire key personnel

and maintain relationships with key business partners, customers and others with whom it does business; (vii) the diversion of management’s

or employees’ attention during the pendency of the Merger from Silk Road’s ongoing business operations and other opportunities;

(viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the

Merger; (x) risks that the benefits of the Merger are not realized when or as expected; (xi) the risk that the price of Silk

Road’s common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed;

and (xii) other risks described in Silk Road’s filings with the U.S. Securities and Exchange Commission (the “SEC”),

including Silk Road’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and in Silk Road’s other

filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be

presented in the proxy statement on Schedule 14A that Silk Road will file with the SEC relating to the special meeting of Silk Road’s

stockholders called to adopt the Merger Agreement (among other things) (the “Special Meeting”) will be, considered representative,

no such list or discussion should be considered a complete statement of all potential risks and uncertainties. The forward-looking statements

speak only as of the date they are made. Except as required by applicable law or regulation, Silk Road undertakes no obligation to update

any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

Silk Road, the members of Silk Road’s board

of directors and certain of Silk Road’s executive officers are participants in the solicitation of proxies from stockholders in

connection with the Merger. Silk Road plans to file a proxy statement (the “Transaction Proxy Statement”) with the SEC in

connection with the solicitation of proxies to approve the Merger. Jack W. Lasersohn, Chas S. McKhann, Rick D. Anderson, Kevin J. Ballinger,

Tanisha V. Carino, Ph.D., Tony M. Chou, M.D., Elizabeth H. Weatherman and Donald J. Zurbay, all of whom are members of Silk Road’s

board of directors, and Lucas W. Buchanan, Silk Road’s Chief Operating Officer and Chief Financial Officer, Andrew S. Davis, Silk

Road’s Chief Commercial Officer, Kevin M. Klemz, Silk Road’s Executive Vice President, Chief Legal Officer and Secretary

and Richard M. Ruedy, Silk Road’s Executive Vice President of Regulatory and Clinical Affairs and Quality Assurance, are participants

in Silk Road’s solicitation. Information regarding such participants, including their direct or indirect interests, by security

holdings or otherwise, will be included in the Transaction Proxy Statement and other relevant documents to be filed with the SEC in connection

with the Merger. Additional information about such participants is available under the captions “Corporate Governance,” “Executive

Officers” and “Stock Ownership” in Silk Road’s definitive proxy statement in connection with its 2024 Annual

Meeting of Stockholders (the “2024 Proxy Statement”), which was filed with the SEC on April 26, 2024 (and is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/1397702/000139770224000024/silk-20240426xdef14a.htm). To the extent that holdings

of Silk Road’s securities have changed since the amounts printed in the 2024 Proxy Statement, such changes have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with the SEC (which are available at https://www.sec.gov/edgar/browse/?CIK=1397702&owner=exclude).

Information regarding Silk Road’s transactions with related persons is set forth under the caption “Certain Relationships

and Related Party Transactions” in the 2024 Proxy Statement. Certain illustrative information regarding the payments that may be

owed, and the circumstances in which they may be owed, to Silk Road named executive officers in a change of control of Silk Road is set

forth under the caption “Executive Compensation—Potential Post-Termination and Change in Control Payments” in the 2024

Proxy Statement.

Promptly

after filing the definitive Transaction Proxy Statement with the SEC, Silk Road will mail the definitive Transaction Proxy Statement

and a WHITE proxy card to each stockholder entitled to vote at the Special Meeting to consider the adoption of the Merger Agreement.

STOCKHOLDERS ARE URGED TO READ THE TRANSACTION PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT

DOCUMENTS THAT SILK ROAD WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders

may obtain, free of charge, the preliminary and definitive versions of the Transaction Proxy Statement, any amendments or supplements

thereto and any other relevant documents filed by Silk Road with the SEC in connection with the Merger at the SEC’s website (http://www.sec.gov).

Copies of Silk Road's definitive Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents

filed by Silk Road with the SEC in connection with the Merger will also be available, free of charge, at Silk Road’s investor relations

website (https://investors.silkroadmed.com/sec-filings), or by emailing Silk Road investor relations department (investors@silkroadmed.com).

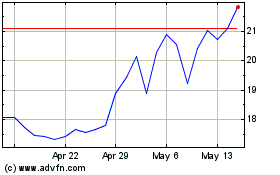

Silk Road Medical (NASDAQ:SILK)

Historical Stock Chart

From May 2024 to Jun 2024

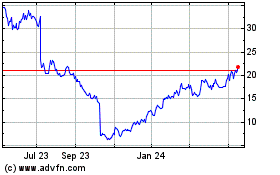

Silk Road Medical (NASDAQ:SILK)

Historical Stock Chart

From Jun 2023 to Jun 2024