0001038074

false

0001038074

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

November 1, 2023

SILICON LABORATORIES INC.

(Exact Name of Registrant as Specified in

Charter)

| Delaware |

|

000-29823 |

|

74-2793174 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

| 400 West Cesar Chavez, Austin, TX |

|

78701 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (512) 416-8500

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.0001 par value |

|

SLAB |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Exchange Act of

1934. ¨

Item 2.02. Results of Operations and Financial Condition

On November 1, 2023, Silicon Laboratories Inc. (“Silicon

Laboratories”) issued a press release announcing its results of operations for its fiscal quarter ended September 30, 2023.

A copy of the press release is attached as Exhibit 99 to this report.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

Use of Non-GAAP Financial Information

From time to time, Silicon Laboratories provides certain non-GAAP financial

measures as additional information relating to its operating results. The non-GAAP financial measurements provided in the press release

furnished herewith do not replace the presentation of Silicon Laboratories’ GAAP financial results. These additional measurements

merely provide supplemental information to assist investors in analyzing Silicon Laboratories’ financial position and results of

operations; however, these measures are not in accordance with, or an alternative to, GAAP and may be different from non-GAAP measures

used by other companies.

Non-GAAP financial measures used by Silicon Laboratories include non-GAAP

gross profit, non-GAAP gross margin, non-GAAP research and development expense and non-GAAP research and development expense as a percentage

of revenue, non-GAAP selling, general and administrative expense and non-GAAP selling, general and administrative as a percentage of revenue,

non-GAAP operating expenses and non-GAAP operating expenses as a percentage of revenue, non-GAAP operating income and non-GAAP operating

income as a percentage of revenue, non-GAAP income before income taxes and equity-method earnings (loss), non-GAAP tax expense, non-GAAP

tax rate, non-GAAP net income, and non-GAAP diluted earnings per share. Silicon Laboratories has chosen to provide this information to

investors because it believes that such supplemental information enables them to perform meaningful comparisons of past, present and future

operating results, and as a means to highlight the results of core ongoing operations.

Non-GAAP financial measures are adjusted by the following items:

| · |

Stock compensation expense

– represents charges for employee stock awards issued under Silicon Laboratories’ stock-based

compensation plans. Stock compensation expense is excluded from non-GAAP financial measures because it is a non-cash expense, and

excluding such expense provides meaningful supplemental information regarding core ongoing operations. |

| · |

Intangible asset amortization

– primarily represents charges for the amortization of intangibles assets, such as

core and developed technology, customer relationships and trademarks acquired in connection with business combinations. Intangible

asset amortization is excluded from non-GAAP financial measures because it is a non-cash expense, and excluding such expense provides

meaningful supplemental information regarding core ongoing operations. |

| · |

Acquisition and disposition related

items – primarily including the following: charges for the fair value write-up associated

with inventory acquired; adjustments to the fair value of acquisition-related contingent consideration; and acquisition-related costs

of a business combination or disposition-related costs of a business divestiture, such as costs for attorneys, investment bankers,

accountants and other third party service providers. Acquisition and disposition related items are excluded from non-GAAP financial

measures because excluding such amounts provides meaningful supplemental information regarding core ongoing operations. |

| · |

Termination costs, impairments,

and fair value and other adjustments – primarily include costs associated with certain

employee terminations, asset impairments, fair value adjustments resulting from observable price changes and other non-cash adjustments.

Termination costs, impairments, and fair value and other adjustments are excluded from non-GAAP financial measures because excluding

such amounts provides meaningful supplemental information regarding core ongoing operations. |

| · |

Equity-method investment adjustments

– primarily include the proportionate share of gains and/or losses from investments

accounted for by the equity method of accounting. Equity-method investment adjustments are excluded from non-GAAP financial measures

because these generally are non-cash, represent non-operating activity during the period of adjustment, relate to activity in entities

outside of the operational control of Silicon Laboratories, and excluding such expense/gain provides meaningful supplemental information

regarding core operations. |

| · |

Interest expense adjustments

– represents losses or gains on the extinguishment of convertible debt and losses

or gains on the termination of interest rate swap agreements. Such amounts are excluded from non-GAAP financial measures because

they are non-cash expenses and/or excluding such amounts provides meaningful supplemental information regarding core ongoing operations. |

| · |

Income tax adjustments

– primarily include the following: the current and deferred income tax effects of the above non-GAAP

adjustments; other indirect impacts of excluding stock-based compensation; and the income tax impact of certain intercompany license

arrangements for technology acquired in business combinations. Income tax adjustments are excluded from non-GAAP financial measures

because excluding such amounts provides meaningful supplemental information regarding core ongoing operations. |

Pursuant to the requirements of Regulation G, we have provided in

the press release furnished with this report a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP

financial measures.

The information in this report, including the exhibit hereto, shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liability of that section. The information contained therein and in the accompanying exhibit shall not be incorporated

by reference into any filing with the U.S. Securities and Exchange Commission made by Silicon Laboratories, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SILICON LABORATORIES INC. |

| |

|

|

| November 1,

2023 |

|

/s/

John C. Hollister |

| Date |

|

John C. Hollister |

| |

|

Senior Vice President

and |

| |

|

Chief Financial Officer |

| |

|

(Principal Financial

Officer) |

Exhibit 99

Silicon Labs

Reports Third Quarter 2023 Results

IoT leader delivers

solid results in a challenging market environment

AUSTIN,

Texas – November 1, 2023 – Silicon Labs (NASDAQ: SLAB), a leader in secure, intelligent wireless

technology for a more connected world, reported financial results for the third quarter, which ended September 30, 2023.

“The Silicon Labs team executed well in the third quarter, driving

revenue and EPS that exceeded the mid-point of our guidance,” said Matt Johnson, President and Chief Executive Officer at Silicon

Labs. “The current demand environment remains quite weak as we navigate this cyclical inventory correction, and end market visibility

continues to be challenging. That said, we are pleased with our record design win performance in the quarter and continued advancements

in our industry-leading platform. We believe this positions us well for growth and higher earnings power when the market recovers.”

Third Quarter Financial Highlights

| · | Revenue

was $204 million |

| · | Industrial &

Commercial revenue for the quarter was $121 million |

| · | Home &

Life revenue for the quarter was $83 million |

Results on a GAAP basis:

| · | GAAP

gross margin was 58.4% |

| · | GAAP

R&D expenses were $79 million |

| · | GAAP

SG&A expenses were $28 million |

| · | GAAP

operating income as a percentage of revenue was 6% |

| · | GAAP

diluted earnings per share were $0.32 |

Results on a non-GAAP basis, excluding the impact of stock compensation,

amortization of acquired intangible assets, and certain other items as set forth in the below GAAP to Non-GAAP reconciliation tables

were as follows:

| · | Non-GAAP

gross margin was 58.5% |

| · | Non-GAAP

R&D expenses were $64 million |

| · | Non-GAAP

SG&A expenses were $31 million |

| · | Non-GAAP

operating income as a percentage of revenue was 12% |

| · | Non-GAAP

diluted earnings per share were $0.62 |

Business Highlights

| · | Hosted

its fourth annual Works With Conference in August, which attracted thousands of top IoT developers

and included panels with partners from Amazon, Google, Samsung, and many more. The virtual

event covered a broad range of IoT technologies and trends, including Bluetooth, Wi-Fi, Matter,

Wi-Sun, and Amazon Sidewalk, as well as the latest developments in security and AI/ML. |

| · | Announced

its next-generation Series 3 platform, purpose-built for embedded IoT devices. Series 3

devices will be designed to offer industry-leading compute, wireless performance, scalability,

and energy efficiency with the highest levels of IoT security. Notably, new levels of compute

will bring more than 100x the processing capability of Series 2 and will include integrated

AI/ ML accelerators for edge devices, enabling consolidation of system processing into wireless

SoCs. Silicon Labs also announced the next version of their developer tool suite, Simplicity

Studio, to help developers and device manufacturers streamline and accelerate product designs. |

Business Outlook

The company expects fourth-quarter revenue to be between $70 to $100

million. The company also estimates the following results:

On a GAAP basis:

| · | GAAP

gross margin to be 53% |

| · | GAAP

operating expenses of approximately $123 million |

| · | GAAP

diluted earnings (loss) per share between $(2.39) to $(1.95) |

On a non-GAAP basis, excluding the impact of stock compensation, amortization

of acquired intangible assets, and certain other items as set forth in the reconciliation tables:

| · | Non-GAAP

gross margin to be 53% |

| · | Non-GAAP

operating expenses of approximately $94 million |

| · | Non-GAAP

diluted earnings (loss) per share between $(1.66) to $(1.22) |

Earnings Webcast and Conference Call

Silicon Labs

will host an earnings conference call to discuss the quarterly results and answer questions at 7:30 am CDT today. An audio webcast will

be available on Silicon Labs' website (www.silabs.com) under Investor Relations. In addition, the company will post

an audio recording of the event at investor.silabs.com and make a replay available through December 1, 2023.

About Silicon Labs

Silicon Labs

(NASDAQ: SLAB) is a leader in secure, intelligent wireless technology for a more connected world. Our integrated hardware

and software platform, intuitive development tools, thriving ecosystem, and robust support make us an ideal long-term

partner in building advanced industrial, commercial, home and life applications. We make it easy for developers to

solve complex wireless challenges throughout the product lifecycle and get to market quickly with innovative solutions

that transform industries, grow economies, and improve lives. silabs.com

Forward-Looking Statements

This press release contains forward-looking statements based on Silicon

Labs’ current expectations. The words “believe”, “estimate”, “expect”, “intend”,

“anticipate”, “plan”, “project”, “will”, and similar phrases as they relate to Silicon

Labs are intended to identify such forward-looking statements. These forward-looking statements reflect the current views and assumptions

of Silicon Labs and are subject to various risks and uncertainties that could cause actual results to differ materially from expectations.

Among the factors that could cause actual results to differ materially from those in the forward-looking statements are the following:

the competitive and cyclical nature of the semiconductor industry; the challenging macroeconomic environment, including disruptions in

the financial services industry; geographic concentration of manufacturers, assemblers, test service providers and customers in Asia

that subjects Silicon Labs’ business and results of operations to risks of natural disasters, epidemics or pandemics, war and political

unrest; risks that demand and the supply chain may be adversely affected by military conflict (including in the Middle East, and between

Russia and Ukraine), terrorism, sanctions or other geopolitical events globally (including in the Middle East, and conflict between Taiwan

and China); risks that Silicon Labs may not be able to maintain its historical growth; quarterly fluctuations in revenues and operating

results; difficulties developing new products that achieve market acceptance; risks associated with international activities (including

trade barriers, particularly with respect to China); intellectual property litigation risks; risks associated with acquisitions and divestitures;

product liability risks; difficulties managing and/or obtaining sufficient supply from Silicon Labs’ distributors, manufacturers

and subcontractors; dependence on a limited number of products; absence of long-term commitments from customers; inventory-related risks;

difficulties managing international activities; risks that Silicon Labs may not be able to manage strains associated with its growth;

credit risks associated with its accounts receivable; dependence on key personnel; stock price volatility; the impact of COVID-19 on

the U.S. and global economy; debt-related risks; capital-raising risks; the timing and scope of share repurchases and/or dividends; average

selling prices of products may decrease significantly and rapidly; information technology risks; cyber-attacks against Silicon Labs’

products and its networks and other factors that are detailed in the SEC filings of Silicon Laboratories Inc. Silicon Labs disclaims

any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events,

or otherwise. References in this press release to Silicon Labs shall mean Silicon Laboratories Inc.

Note to editors: Silicon Laboratories, Silicon Labs, the “S”

symbol, and the Silicon Labs logo are trademarks of Silicon Laboratories Inc. All other product names noted herein may be trademarks

of their respective holders.

CONTACT: Thomas Haws, Investor Relations Manager, (512) 416-8500,

investor.relations@silabs.com

Silicon Laboratories Inc.

Condensed Consolidated Statements of Income

(In thousands, except per share data)

(Unaudited)

| | |

Three Months

Ended | | |

Nine Months

Ended | |

| | |

September 30,

2023 | | |

October 1,

2022 | | |

September 30,

2023 | | |

October 1,

2022 | |

| Revenues | |

$ | 203,760 | | |

$ | 269,817 | | |

$ | 695,413 | | |

$ | 766,781 | |

| Cost of revenues | |

| 84,735 | | |

| 104,232 | | |

| 278,753 | | |

| 281,521 | |

| Gross profit | |

| 119,025 | | |

| 165,585 | | |

| 416,660 | | |

| 485,260 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 79,042 | | |

| 84,624 | | |

| 254,340 | | |

| 245,677 | |

| Selling, general and

administrative | |

| 27,766 | | |

| 50,738 | | |

| 113,363 | | |

| 144,398 | |

| Operating expenses | |

| 106,808 | | |

| 135,362 | | |

| 367,703 | | |

| 390,075 | |

| Operating income | |

| 12,217 | | |

| 30,223 | | |

| 48,957 | | |

| 95,185 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income and other, net | |

| 2,938 | | |

| 4,672 | | |

| 15,554 | | |

| 9,616 | |

| Interest expense | |

| (1,359 | ) | |

| (1,527 | ) | |

| (4,611 | ) | |

| (4,874 | ) |

| Income before income taxes | |

| 13,796 | | |

| 33,368 | | |

| 59,900 | | |

| 99,927 | |

| Provision for income taxes | |

| 3,388 | | |

| 14,188 | | |

| 23,479 | | |

| 36,871 | |

| Equity-method earnings (loss) | |

| (60 | ) | |

| 1,819 | | |

| (1,150 | ) | |

| 2,985 | |

| Net income | |

$ | 10,348 | | |

$ | 20,999 | | |

$ | 35,271 | | |

$ | 66,041 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.33 | | |

$ | 0.62 | | |

$ | 1.11 | | |

$ | 1.84 | |

| Diluted | |

$ | 0.32 | | |

$ | 0.60 | | |

$ | 1.07 | | |

$ | 1.79 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 31,796 | | |

| 34,079 | | |

| 31,789 | | |

| 35,935 | |

| Diluted | |

| 32,078 | | |

| 34,779 | | |

| 32,919 | | |

| 36,968 | |

Non-GAAP Financial Measurements

In addition to the GAAP results provided throughout

this document, Silicon Labs has provided non-GAAP financial measurements on a basis excluding non-cash and other charges and benefits.

Details of these excluded items are presented in the tables below, which reconcile the GAAP results to non-GAAP financial measurements.

The non-GAAP financial measurements do not replace

the presentation of Silicon Labs’ GAAP financial results. These measurements provide supplemental information to assist management

and investors in analyzing Silicon Labs’ financial position and results of operations. Silicon Labs has chosen to provide this

information to investors to enable them to perform meaningful comparisons of past, present and future operating results and as a means

to emphasize the results of core on-going operations.

Unaudited Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands, except per share data)

| | |

Three

Months Ended September 30,

2023 | |

| Non-GAAP Income Statement

Items | |

GAAP Measure | | |

GAAP Percent

of

Revenue | | |

Stock

Compensation

Expense | | |

Intangible

Asset

Amortization | | |

Termination

Costs | | |

Non-GAAP Measure | | |

Non-GAAP Percent

of

Revenue | |

| Revenues | |

$ | 203,760 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 119,025 | | |

| 58.4 | % | |

$ | 192 | | |

$ | -- | | |

$ | 18 | | |

$ | 119,235 | | |

| 58.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 79,042 | | |

| 38.8 | % | |

| 8,598 | | |

| 6,239 | | |

| 269 | | |

| 63,936 | | |

| 31.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 27,766 | | |

| 13.6 | % | |

| (3,000 | ) | |

| 19 | | |

| 8 | | |

| 30,739 | | |

| 15.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 12,217 | | |

| 6.0 | % | |

| 5,790 | | |

| 6,258 | | |

| 295 | | |

| 24,560 | | |

| 12.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Three

Months Ended September 30,

2023 | |

| Non-GAAP Earnings

Per Share | |

GAAP Measure | | |

Stock Compensation

Expense* | | |

Intangible

Asset

Amortization* | | |

Termination

Costs* | | |

Equity-Method Investment

Adjustments* | | |

Income Tax Adjustments | | |

Non- GAAP Measure | |

| Net income | |

$ | 10,348 | | |

$ | 5,790 | | |

$ | 6,258 | | |

$ | 295 | | |

$ | 60 | | |

$ | (2,778 | ) | |

$ | 19,973 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted shares outstanding | |

| 32,078 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 32,078 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings per share | |

$ | 0.32 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

$ | 0.62 | |

* Represents pre-tax amounts

Unaudited Forward-Looking Statements Regarding

Business Outlook

(In millions, except per share data)

| |

Three

Months Ending December 30,

2023 | |

| Business Outlook | |

| GAAP Measure | | |

| Non-GAAP Adjustments** | | |

| Non-GAAP Measure | |

| Gross margin | |

| 53 | % | |

| 0 | % | |

| 53 | % |

| | |

| | | |

| | | |

| | |

| Operating expenses | |

$ | 123 | | |

$ | (29 | ) | |

$ | 94 | |

| | |

| | | |

| | | |

| | |

| Diluted earnings (loss) per share - low | |

$ | (2.39 | ) | |

$ | 0.73 | | |

$ | (1.66 | ) |

| | |

| | | |

| | | |

| | |

| Diluted earnings (loss) per share - high | |

$ | (1.95 | ) | |

$ | 0.73 | | |

$ | (1.22 | ) |

** Non-GAAP adjustments include the following estimates: stock

compensation expense of $16.5 million, intangible asset amortization of $6.2 million, termination costs of $6.5 million, and the associated

tax impact from the aforementioned items.

Silicon Laboratories Inc.

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

(Unaudited)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 159,928 | | |

$ | 499,915 | |

| Short-term

investments | |

| 257,157 | | |

| 692,024 | |

| Accounts

receivable, net | |

| 102,142 | | |

| 71,437 | |

| Inventories | |

| 167,581 | | |

| 100,417 | |

| Prepaid

expenses and other current assets | |

| 86,727 | | |

| 97,570 | |

| Total current

assets | |

| 773,535 | | |

| 1,461,363 | |

| Property and

equipment, net | |

| 150,839 | | |

| 152,016 | |

| Goodwill | |

| 376,389 | | |

| 376,389 | |

| Other intangible

assets, net | |

| 65,744 | | |

| 84,907 | |

| Other

assets, net | |

| 108,555 | | |

| 94,753 | |

| Total

assets | |

$ | 1,475,062 | | |

$ | 2,169,428 | |

| | |

| | | |

| | |

| Liabilities

and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 48,086 | | |

$ | 89,860 | |

| Revolving

line of credit | |

| 45,000 | | |

| -- | |

| Deferred

revenue and returns liability | |

| 10,066 | | |

| 6,780 | |

| Other

current liabilities | |

| 61,991 | | |

| 89,136 | |

| Total current

liabilities | |

| 165,143 | | |

| 185,776 | |

| Convertible

debt, net | |

| -- | | |

| 529,573 | |

| Other

non-current liabilities | |

| 49,997 | | |

| 49,071 | |

| Total liabilities | |

| 215,140 | | |

| 764,420 | |

| Commitments

and contingencies | |

| | | |

| | |

| Stockholders’

equity: | |

| | | |

| | |

| Preferred stock – $0.0001

par value; 10,000 shares authorized; no shares issued | |

| -- | | |

| -- | |

| Common stock –

$0.0001 par value; 250,000 shares authorized; 31,779 and 31,994 shares issued and outstanding at September 30, 2023 and December 31,

2022, respectively | |

| 3 | | |

| 3 | |

| Retained

earnings | |

| 1,262,518 | | |

| 1,415,693 | |

| Accumulated

other comprehensive loss | |

| (2,599 | ) | |

| (10,688 | ) |

| Total

stockholders’ equity | |

| 1,259,922 | | |

| 1,405,008 | |

| Total

liabilities and stockholders’ equity | |

$ | 1,475,062 | | |

$ | 2,169,428 | |

Silicon Laboratories Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | |

Nine Months

Ended | |

| | |

September 30, 2023 | | |

October 1, 2022 | |

| Operating Activities | |

| | | |

| | |

| Net income | |

$ | 35,271 | | |

$ | 66,041 | |

| Adjustments

to reconcile net income to net cash provided by (used in) operating activities of continuing operations: | |

| | | |

| | |

| Depreciation of property and equipment | |

| 18,992 | | |

| 16,514 | |

| Amortization of other intangible assets | |

| 19,162 | | |

| 27,328 | |

| Amortization of debt issuance costs | |

| 960 | | |

| 1,492 | |

| Loss on extinguishment of convertible debt | |

| -- | | |

| 3 | |

| Stock-based compensation expense | |

| 37,167 | | |

| 43,213 | |

| Equity-method (earnings) loss | |

| 1,150 | | |

| (2,985 | ) |

| Deferred income taxes | |

| (5,881 | ) | |

| (13,126 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (30,706 | ) | |

| 21,641 | |

| Inventories | |

| (66,971 | ) | |

| (39,100 | ) |

| Prepaid expenses and other

assets | |

| 8,085 | | |

| (28,404 | ) |

| Accounts payable | |

| (37,039 | ) | |

| 26,694 | |

| Other current liabilities

and income taxes | |

| (39,155 | ) | |

| 17,962 | |

| Deferred revenue and returns

liability | |

| 3,286 | | |

| (2,144 | ) |

| Other

non-current liabilities | |

| 6,794 | | |

| (7,713 | ) |

| Net cash provided by (used in) operating activities of continuing

operations | |

| (48,885 | ) | |

| 127,416 | |

| | |

| | | |

| | |

| Investing Activities | |

| | | |

| | |

| Purchases of marketable securities | |

| (91,493 | ) | |

| (579,507 | ) |

| Sales of marketable securities | |

| 365,073 | | |

| 42,952 | |

| Maturities of marketable securities | |

| 171,766 | | |

| 597,399 | |

| Purchases of property and equipment | |

| (18,533 | ) | |

| (20,057 | ) |

| Purchases of other assets | |

| (395 | ) | |

| -- | |

| Net cash provided by investing activities of continuing operations | |

| 426,418 | | |

| 40,787 | |

| | |

| | | |

| | |

| Financing Activities | |

| | | |

| | |

| Proceeds from revolving line of credit | |

| 80,000 | | |

| -- | |

| Payments on debt | |

| (571,157 | ) | |

| (21 | ) |

| Repurchases of common stock | |

| (217,137 | ) | |

| (681,695 | ) |

| Payment of taxes withheld for vested stock awards | |

| (17,239 | ) | |

| (14,732 | ) |

| Proceeds from the issuance of common

stock | |

| 8,013 | | |

| 6,366 | |

| Net cash used in financing activities of continuing operations | |

| (717,520 | ) | |

| (690,082 | ) |

| | |

| | | |

| | |

| Discontinued Operations | |

| | | |

| | |

| Operating activities | |

| -- | | |

| (69,467 | ) |

| Net cash used in discontinued operations | |

| -- | | |

| (69,467 | ) |

| | |

| | | |

| | |

| Decrease in cash and cash equivalents | |

| (339,987 | ) | |

| (591,346 | ) |

| Cash and cash equivalents at beginning

of period | |

| 499,915 | | |

| 1,074,623 | |

| Cash and cash equivalents at end of

period | |

$ | 159,928 | | |

$ | 483,277 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

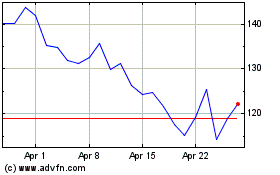

Silicon Labs (NASDAQ:SLAB)

Historical Stock Chart

From Apr 2024 to May 2024

Silicon Labs (NASDAQ:SLAB)

Historical Stock Chart

From May 2023 to May 2024