Sify reports Consolidated Financial Results for Q1 FY 2023-24. Revenues of INR 8547 Million. EBITDA of INR 1724 Million.

July 20 2023 - 7:54AM

HIGHLIGHTS

- Revenue was INR 8547

Million, an increase of 11% over the same quarter last

year.

- EBITDA was INR 1724 Million,

an increase of 13% over the same quarter last year.

- Profit before tax was INR

149 Million, a decrease of 62% over the same

quarter last year.

- Profit after tax was INR 95

Million, a decrease of 65% over the same quarter last

year.

- CAPEX during the quarter was

INR 1436 Million.

|

(IN INR MILLION) |

30.06.2023 |

31.03.2023 |

|

EQUITY |

17,210 |

17,146 |

|

BORROWINGS |

|

|

|

Long term |

14,897 |

13,818 |

|

Short term |

6,581 |

6,662 |

MANAGEMENT COMMENTARY

Mr. Raju Vegesna, Chairman,

said, “India is in one of its most exciting phases of growth. This

has to do with its recognition as a mature, stable destination, the

availability of relevant resources and tools, and significant

untapped demand from Indian enterprises.

“The government has been consistent in using IT

as an enablement tool to implement social measures, and this has

contributed to a very mature IT ecosystem.

“Our next phase of growth will leverage this

favorable environment by introducing innovative and cost-effective

digital services for our customers.”

Mr. Kamal Nath, CEO, said, “As

Enterprises are pursuing their digital transformation and

digitalisation objectives, they are also re-calibrating their

digital infrastructure across hybrid cloud, network, security and

edge infrastructures. This is a great opportunity for us to

monetise our infrastructures designed for Digital IT and transform

the way digital infrastructures are managed through our Digitalised

services. We are topping that up by continuously building our core

digital portfolio to support our customers innovation journey.

“This portfolio places Sify in a unique position

for all round customer engagement across their digital lifecycle

which we believe would augment our growth strategy.”

Mr. M P Vijay Kumar, ED & Group CFO,

said, “Sify and Sify Infinit Spaces Limited (“SIS”), a

wholly owned subsidiary of Sify which operates its data centers,

have entered into an agreement with KDCF on July 20, 2023, under

which KDCF will invest up to INR 6000 Million (approximately

USD 73 Million) in the form of compulsory convertible

debentures of SIS. SIS will use the proceeds from the issue of

these debentures for the expansion of new data centers,

including land acquisition for data centers, investment in

procuring alternate source of power and repayment of debt.

“Fiscal discipline will remain the cornerstone

of our growth strategy as we scale investments into Data Centers

and Networks. By judiciously allocating investments and resources,

we will seamlessly expand our infrastructure, invest in new

resources and build competencies and scale. While we expect to see

these investments impact profitability in the near term, they

should enable us to aggressively pursue digital transformation

engagements in the future.

“We will continue to prioritize resource

optimization and sustainability, fortifying our reputation as

India’s converged ICT leader.

“The cash balance at the end of the quarter was

INR 3240 Million.”

BUSINESS HIGHLIGHTS

- The Revenue split between the

businesses for the quarter was Data Center colocation services 32%,

Digital services 28% and Network services 40%.

|

Business Revenue (INR Millions) |

Q1 FY 2023-24 |

Q1 FY 2022-23 |

FY 2022-23 |

% Growth Q1 2023-24 vs Q1 2022-23 |

|

Data Center services |

2704 |

2616 |

10125 |

3 |

% |

|

Digital Services |

2416 |

2038 |

9988 |

19 |

% |

|

Network services |

3427 |

3055 |

13291 |

12 |

% |

|

TOTAL |

8547 |

7709 |

33404 |

|

- As of June

30,2023, Sify provides services via 910 fiber nodes across the

country, a 10% increase over same quarter last year.

- The network connectivity service has

now deployed 6541 SDWAN service points across the country.

- During the quarter, Sify invested

USD 193,000 in start-ups in the Silicon Valley area as part of our

Corporate Venture Capital initiative. To date, the cumulative

investment stands at USD 5.57 Million.

CUSTOMER ENGAGEMENTS

Among the most prominent new contracts during the quarter were

the following:

Data Center Services

- A Public sector trading platform and

an industrial chemicals major signed up for capacity at Sify’s Data

Centers.

- A Public sector housing lender and a

white goods manufacturer migrated from the competition to Sify Data

Center.

- A mobile engagement platform signed

up to migrate from their on-premise Data Center to Sify Data

Center.

Digital services

- A Public sector housing lender, a

private insurance major and multiple private players contracted to

migrate from their on-premise Data Center to Sify’s Cloud

platform.

- A Public sector bank commissioned a

private cloud at their on-premise Data Center.

- A Public sector insurance player, a

real-estate conglomerate and a private decorative laminates player

contracted for Greenfield Cloud implementation.

- One of the oldest media houses

signed up for our AI/ML led Digital asset management platform.

- One of the largest insurance players

signed up to migrate their entire SAP platform to Sify’s Data

Center environment, while a banking major signed up for Full Stack

Observability.

- A private chemicals manufacturer, a

State government eGovernance division, two insurance players and

multiple enterprises across verticals contracted for services such

as DRaaS, PaaS and IaaS.

- A Public sector bank, a Public

sector financial training institute, a State government department,

a private lending major and a Public sector insurance company

signed up for Disaster Recovery (DR) services.

- A Public sector bank and multiple

retail players contracted for Managed security services.

- Two Public sector banks, an oil

distribution major and a Public sector insurance player signed up

for collaboration services.

- A Union government division signed

up for online assessments, while a private retail major extended

its contract for Sify’s Cloud-based supply chain solution.

- Two state governments signed

multi-year contracts with Sify to build and operate on-premise Data

Centers.

Network Services

- A Public sector Insurance major

contracted for a multi-year Network build to support their digital

transformation.

- An Indian multinational consumer

goods company, an MNC food major and an insurance conglomerate

signed up for managed SASE.

- One of the top 4 accounting majors,

an American business television network, a new generation bank, a

personal and healthcare major and a digital transformation IT

consulting and services major singed up for CAAS services.

- A division of the Central bank

contracted to expand their network coverage.

- A steel manufacturing major

contracted to build a campus network at their manufacturing

premises.

- Sify commissioned its third

international gateway at Kolkata, which will enable network

connectivity into the neighbouring country of Bangladesh.

- Sify’s metro fiber network is now

available in 14 Indian cities.

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

Unaudited Consolidated Income Statement as per

IFRS |

|

(In INR millions) |

|

|

|

| |

Quarter

ended |

Quarter

ended |

Quarter

ended |

Year ended |

|

Description |

June |

June |

March |

March |

|

|

2023 |

2022 |

2023 |

2023 |

| |

|

|

|

(Audited) |

| |

|

|

|

|

|

Revenue |

8,547 |

|

7,709 |

|

8,861 |

|

33,404 |

|

|

Cost of Revenues |

(5,371 |

) |

(4,910 |

) |

(5,714 |

) |

(21,379 |

) |

|

Selling, General and Administrative Expenses |

(1,452 |

) |

(1,274 |

) |

(1,510 |

) |

(5,734 |

) |

| |

|

|

|

|

|

EBITDA |

1,724 |

|

1,525 |

|

1,637 |

|

6,291 |

|

| |

|

|

|

|

|

Depreciation and Amortisation expense |

(1,118 |

) |

(927 |

) |

(1,092 |

) |

(3,972 |

) |

|

Net Finance Expenses |

(471 |

) |

(281 |

) |

(367 |

) |

(1,430 |

) |

|

Other Income (including exchange gain) |

14 |

|

78 |

|

2 |

|

132 |

|

|

Other Expenses (including exchange loss) |

- |

|

- |

|

- |

|

- |

|

| |

|

|

|

|

|

Profit before tax |

149 |

|

395 |

|

180 |

|

1,021 |

|

|

Current Tax |

(147 |

) |

(163 |

) |

(105 |

) |

(526 |

) |

|

Deferred Tax |

93 |

|

39 |

|

(41 |

) |

179 |

|

|

Profit for the period |

95 |

|

271 |

|

34 |

|

674 |

|

| |

|

|

|

|

|

Profit attributable to: |

|

|

|

Reconciliation with Non-GAAP measure |

|

|

|

|

|

|

|

|

|

Profit for the period |

95 |

|

271 |

|

34 |

|

674 |

|

|

Add: |

|

|

|

|

|

Depreciation and Amortisation expense |

1,118 |

|

927 |

|

1,092 |

|

3,972 |

|

|

Net Finance Expenses |

471 |

|

281 |

|

367 |

|

1,430 |

|

|

Current Tax |

147 |

|

163 |

|

105 |

|

526 |

|

|

Less: |

|

|

|

|

|

Deferred Tax |

(93 |

) |

(39 |

) |

41 |

|

(179 |

) |

|

Other Income (including exchange gain) |

(14 |

) |

(78 |

) |

(2 |

) |

(132 |

) |

|

EBITDA |

1,724 |

|

1,525 |

|

1,637 |

|

6,291 |

|

|

|

|

|

|

|

About Sify TechnologiesA Fortune

India 500 company, Sify Technologies is India’s most comprehensive

ICT service & solution provider. With Cloud at the core of our

solutions portfolio, Sify is focussed on the changing ICT

requirements of the emerging Digital economy and the resultant

demands from large, mid and small-sized businesses.

Sify’s infrastructure comprising the largest

MPLS network, top-of-the-line DCs, partnership with global

technology majors, vast expertise in business transformation

solutions modelled on the cloud make it the first choice of

start-ups, incoming Enterprises and even large Enterprises on the

verge of a revamp.

More than 10000 businesses across multiple

verticals have taken advantage of our unassailable trinity of Data

Centers, Networks and Security services and conduct their business

seamlessly from more than 1600 cities in India. Internationally,

Sify has presence across North America, the United Kingdom and

Singapore.

Sify, www.sify.com, Sify Technologies, Sify

Infinit Spaces limited, Sify Digital Services limited and

www.sifytechnologies.com are registered trademarks of Sify

Technologies Limited.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. The forward-looking statements

contained herein are subject to risks and uncertainties that could

cause actual results to differ materially from those reflected in

the forward-looking statements. Sify undertakes no duty to update

any forward-looking statements.

For a discussion of the risks associated with

Sify’s business, please see the discussion under the caption “Risk

Factors” in the company’s Annual Report on Form 20-F for the year

ended March 31, 2023, which has been filed with the United States

Securities and Exchange Commission and is available by accessing

the database maintained by the SEC at www.sec.gov, and Sify’s other

reports filed with the SEC.

For further information, please contact:

|

Sify Technologies LimitedMr. Praveen

KrishnaInvestor Relations & Public Relations+91 44 22540777

(ext.2055)praveen.krishna@sifycorp.com |

Grayling Investor RelationsLucia

Domville+1-646-824-2856Lucia.Domville@grayling.com |

20:20 Media Nikhila Kesavan+91

9840124036nikhila.kesavan@2020msl.com |

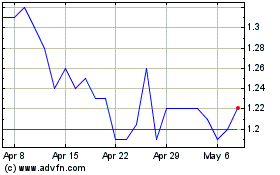

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Apr 2024 to May 2024

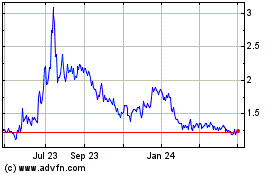

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From May 2023 to May 2024