Selecta Biosciences, Inc. (NASDAQ: SELB), a biotechnology

company leveraging its clinically validated ImmTOR™ platform to

develop tolerogenic therapies for autoimmune diseases and gene

therapies, today reported financial results for the first quarter

ended March 31, 2023 and provided a business update.

The Company also announced a program

prioritization and capital allocation strategy that is expected to

extend its cash runway into the second half of 2025.

“As the only immune tolerance platform with

positive Phase 3 data, we firmly believe in the potential of our

pipeline of candidates powered by our ImmTOR technology,”

said Carsten Brunn, Ph.D., President and Chief Executive

Officer of Selecta. “As we continue to navigate the current

market environment, we have undertaken the strategic decision to

focus our resources in the areas where we believe we have the

highest potential to succeed in delivering meaningful therapies to

the patients we aim to serve. In the near term, we look forward to

continuing to work with our partner, Sobi®, to advance SEL-212

(ImmTOR in combination with pegadricase) toward a Biologics License

Application (BLA), which we continue to expect in the first half of

2024, while also advancing our ImmTOR-IL combination for diseases

of the liver.”

Strategic Initiative

Overview

Following a comprehensive review of its

portfolio and capital resources, Selecta, in consultation with the

Company’s Board of Directors, plans to streamline operations and

prioritize investments in select programs. As part of this

initiative, the Company plans to:

- Advance SEL-212 in Patients

with Chronic Refractory Gout in Partnership with Sobi. In

March 2023, Selecta and its SEL-212 development partner, Sobi,

reported positive Phase 3 data from the Phase 3 DISSOLVE I & II

placebo controlled randomized clinical trials. Both trials met

their primary endpoint, and SEL-212 was observed to be safe and

well-tolerated. A BLA submission remains on track for the first

half of 2024. In June 2020, Sobi licensed SEL-212 from Selecta and

is responsible for development, regulatory, and commercial

activities in all markets outside of China.

- Prioritize Development of

the Combination of ImmTOR and Company’s Proprietary Treg-Selective

IL-2 (ImmTOR-IL). The combination of ImmTOR and IL-2

(ImmTOR-IL) represents an evolution of Selecta’s precision immune

tolerance platform. The Company remains on track to initiate

Investigational New Drug (IND)-enabling studies in 2023, while also

exploring multiple autoimmune indications that may be suitable for

study with ImmTOR-IL, with an initial focus on diseases of the

liver.

- Develop SEL-018 IgG

Protease (Xork) for LOPD in Partnership with Astellas Gene

Therapies. In January 2023, the Company announced an

exclusive licensing and development agreement for IdeXork (Xork), a

next-generation immunoglobulin G (IgG) protease, to be developed

for use with AT845, Astellas Gene Therapies’ investigational

adeno-associated virus (AAV)-based treatment for Late-Onset Pompe

disease (LOPD) in adults. Xork is designed to be differentiated by

its low-cross reactivity to pre-existing antibodies in human serum,

which the Company believes has the potential to expand access to

life-changing gene therapies for more patients.

- Advance Gene Therapy

Programs through Potential Partnerships. Selecta will

pause further development of its wholly-owned gene therapy

programs, including the ongoing Phase 1/2 clinical trial of

SEL-302, an AAV gene therapy combined with ImmTOR for the treatment

of methylmalonic acidemia (MMA). The Company is currently assessing

ways to support further development of these programs through

potential partnerships.

- Reduction in

Force. The Company reduced its headcount by approximately

25% in order to align its workforce with its updated priorities. As

a result of the reduction in force, the Company expects to incur a

cash charge of approximately $1.0 million related to severance and

benefit-related expenses.

Dr. Brunn added, “The decision to enact these

measures was extremely difficult, as we are losing many valued

colleagues who helped advance Selecta to where it is today. I would

like to express my sincere gratitude to all of these

individuals.”

First Quarter 2023 Financial

Results:

Cash

Position: Selecta had $127.5

million in cash, cash equivalents, restricted cash, and

marketable securities as of March 31, 2023, as compared to

cash, cash equivalents, restricted cash, and marketable securities

of $136.2 million as of December 31,

2022. Selecta believes that following the capital

efficiencies expected to be realized through its strategic

reprioritization, its available cash, cash equivalents, restricted

cash, and marketable securities, as well as the next anticipated

milestone payment related to SEL-212 development activities, will

be sufficient to meet its operating requirements into the second

half of 2025.

Collaboration and License

Revenue: Revenue for the first quarter of 2023

was $5.9 million, as compared to $34.0 million for

the same period in 2022. Revenue was primarily driven by the

shipment of clinical supply and the reimbursement of costs incurred

for the Phase 3 DISSOLVE clinical program under the license

agreement with Sobi.

Research and Development

Expenses: Research and development expenses for the

first quarter of 2023 were $18.6 million, as compared

to $17.7 million for the same period in 2022. The

increase was primarily the result of expenses incurred for contract

license and milestone payments and personnel expenses partially

offset by a decrease in expenses incurred for the SEL-212 clinical

program.

General and Administrative

Expenses: General and administrative expenses for the

first quarter of 2023 were $5.7 million, as compared

to $5.5 million for the same period in 2022. The increase was

primarily the result of increased personnel expenses.

Net (Loss) Income: For the

first quarter of 2023, Selecta reported net loss

of $21.7 million, or basic net loss per share of $(0.14).

For the first quarter of 2022, Selecta reported net

income of $28.8 million, or $0.23 per share.

Conference Call and Webcast

Reminder Selecta’s management will host a conference call

at 8:30 AM ET today to provide a corporate update and review the

Company’s first quarter 2023 financial results and strategic

initiatives. Individuals may participate in the live call via

telephone by dialing (844) 845-4170 (domestic) or (412) 717-9621

(international) and may access a teleconference replay for one week

by dialing (877) 344-7529 (domestic) or (412) 317-0088

(international) and using confirmation code 6836582. Investors and

the public can access the live and archived webcast of this call

and a copy of the presentation via the Investors & Media

section of the Company’s website, www.selectabio.com.

About Selecta Biosciences,

Inc.Selecta Biosciences Inc. (NASDAQ: SELB) is a

clinical stage biotechnology company leveraging its ImmTOR™

platform to develop tolerogenic therapies that selectively mitigate

unwanted immune responses. With a proven ability to induce

tolerance to highly immunogenic proteins, ImmTOR has the potential

to amplify the efficacy of biologic therapies, including redosing

of life-saving gene therapies, as well as restore the body’s

natural self-tolerance in autoimmune

diseases. Selecta has several proprietary and partnered

programs in its pipeline focused on enzyme therapies, gene

therapies, and autoimmune diseases. Selecta

Biosciences is headquartered in the Greater

Boston area. For more information, please

visit www.selectabio.com.

Selecta Forward-Looking

StatementsAny statements in this press release about the

future expectations, plans and prospects of Selecta

Biosciences, Inc. (the “Company”), including without

limitation, statements regarding the Company’s expected cash

runway; the Company’s strategic prioritization of SEL-212 and its

collaborations with Sobi and Astellas, the unique proprietary

technology platform of the Company and its partners, the potential

of ImmTOR to enable re-dosing of therapies and to mitigate

immunogenicity, the potential of ImmTOR and the Company’s product

pipeline to treat chronic refractory gout, MMA, liver diseases,

other autoimmune diseases, or any other disease, the anticipated

timing or the outcome of ongoing and planned clinical trials,

studies and data readouts, the anticipated timing or the outcome of

the FDA’s review of the Company’s regulatory filings, the Company’s

and its partners’ ability to conduct its and their clinical trials

and preclinical studies, the timing or making of any regulatory

filings, the anticipated timing or outcome of selection of

developmental product candidates, the ability of the Company to

consummate any expected agreements and licenses, the potential

treatment applications of product candidates utilizing the ImmTOR

platform in areas such as gene therapy, gout and autoimmune

disease, the ability of the Company and its partners where

applicable to develop gene therapy products using ImmTOR, the

novelty of treatment paradigms that the Company is able to develop,

the potential of any therapies developed by the Company to fulfill

unmet medical needs, the Company’s plan to apply its ImmTOR

technology platform to a range of biologics for rare and orphan

genetic diseases, the potential of the ImmTOR technology platform

generally, the Company’s ability to grow and maintain its strategic

partnerships, and enrollment in the Company's clinical trials and

other statements containing the words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “hypothesize,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “would,” and similar expressions, constitute

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995. Actual results may differ

materially from those indicated by such forward-looking statements

as a result of various important factors, including, but not

limited to, the following: the uncertainties inherent in the

initiation, completion and cost of clinical trials including proof

of concept trials, including uncertain outcomes, the availability

and timing of data from ongoing and future clinical trials and the

results of such trials, whether preliminary results from a

particular clinical trial will be predictive of the final results

of that trial and whether results of early clinical trials will be

indicative of the results of later clinical trials, the ability to

predict results of studies performed on human beings based on

results of studies performed on non-human subjects, the unproven

approach of the Company’s ImmTOR technology, potential delays in

enrollment of patients, undesirable side effects of the Company’s

product candidates, its reliance on third parties to manufacture

its product candidates and to conduct its clinical trials, the

Company’s inability to maintain its existing or future

collaborations, licenses or contractual relationships, its

inability to protect its proprietary technology and intellectual

property, potential delays in regulatory approvals, the

availability of funding sufficient for its foreseeable and

unforeseeable operating expenses and capital expenditure

requirements, the Company’s recurring losses from operations and

negative cash flows, substantial fluctuation in the price of the

Company’s common stock, risks related to geopolitical conflicts and

pandemics and other important factors discussed in the “Risk

Factors” section of the Company’s most recent Annual Report on Form

10-K and Quarterly Reports on Form 10-Q, and in other filings that

the Company makes with the Securities and Exchange Commission.

In addition, any forward-looking statements included in this press

release represent the Company’s views only as of the date of its

publication and should not be relied upon as representing its views

as of any subsequent date. The Company specifically disclaims any

intention to update any forward-looking statements included in this

press release, except as required by law.

For Investors and Media:Blaine

DavisChief Financial Officerbdavis@selectabio.com

|

Financial Tables |

|

Selecta Biosciences, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Amounts in thousands, except share data and par

value) |

| |

March 31, 2023 |

|

December 31, 2022 |

| |

(Unaudited) |

|

|

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

125,925 |

|

|

$ |

106,438 |

|

| Marketable securities |

|

— |

|

|

|

28,164 |

|

| Accounts

receivable |

|

6,839 |

|

|

|

6,596 |

|

| Unbilled

receivables |

|

1,843 |

|

|

|

3,162 |

|

| Prepaid

expenses and other current assets |

|

3,785 |

|

|

|

3,778 |

|

| Total

current assets |

|

138,392 |

|

|

|

148,138 |

|

|

Non-current assets: |

|

|

|

| Property

and equipment, net |

|

2,765 |

|

|

|

2,794 |

|

|

Right-of-use asset, net |

|

11,201 |

|

|

|

11,617 |

|

|

Long-term restricted cash |

|

1,311 |

|

|

|

1,311 |

|

| Investments |

|

2,000 |

|

|

|

2,000 |

|

| Other

assets |

|

24 |

|

|

|

26 |

|

|

Total assets |

$ |

155,693 |

|

|

$ |

165,886 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

| Accounts

payable |

$ |

1,063 |

|

|

$ |

316 |

|

| Accrued

expenses |

|

9,347 |

|

|

|

14,084 |

|

| Loan

payable |

|

10,218 |

|

|

|

8,476 |

|

| Lease

liability |

|

1,671 |

|

|

|

1,608 |

|

| Deferred

revenue |

|

4,232 |

|

|

|

593 |

|

| Total

current liabilities |

|

26,531 |

|

|

|

25,077 |

|

|

Non-current liabilities: |

|

|

|

| Loan

payable, net of current portion |

|

16,228 |

|

|

|

17,786 |

|

| Lease

liability, net of current portion |

|

9,617 |

|

|

|

10,055 |

|

| Deferred

revenue |

|

5,519 |

|

|

|

— |

|

| Warrant

liabilities |

|

23,219 |

|

|

|

19,140 |

|

|

Total liabilities |

|

81,114 |

|

|

|

72,058 |

|

| Stockholders’

equity: |

|

|

|

| Preferred stock, $0.0001 par

value; 10,000,000 shares authorized; no shares issued and

outstanding as of March 31, 2023 and December 31, 2022 |

|

— |

|

|

|

— |

|

| Common stock, $0.0001 par

value; 350,000,000 shares authorized as of March 31, 2023 and

December 31, 2022; 153,426,983 and 153,042,435 shares issued and

outstanding as of March 31, 2023 and December 31, 2022,

respectively |

|

15 |

|

|

|

15 |

|

|

Additional paid-in capital |

|

495,733 |

|

|

|

493,308 |

|

|

Accumulated deficit |

|

(416,600 |

) |

|

|

(394,937 |

) |

|

Accumulated other comprehensive loss |

|

(4,569 |

) |

|

|

(4,558 |

) |

| Total stockholders’

equity |

|

74,579 |

|

|

|

93,828 |

|

| Total liabilities and

stockholders’ equity |

$ |

155,693 |

|

|

$ |

165,886 |

|

|

Selecta Biosciences, Inc. and Subsidiaries |

|

Consolidated Statements of Operations and

Comprehensive Income (Loss) |

|

(Amounts in thousands, except share and per share

data) |

| |

Three Months Ended |

| |

March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

(Unaudited) |

| |

|

| Collaboration and license

revenue |

$ |

5,938 |

|

|

$ |

33,999 |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

18,624 |

|

|

|

17,689 |

|

|

General and administrative |

|

5,695 |

|

|

|

5,537 |

|

| Total operating expenses |

|

24,319 |

|

|

|

23,226 |

|

| Operating (loss) income |

|

(18,381 |

) |

|

|

10,773 |

|

| Investment income |

|

1,331 |

|

|

|

15 |

|

| Foreign currency transaction,

net |

|

19 |

|

|

|

28 |

|

| Interest expense |

|

(808 |

) |

|

|

(707 |

) |

| Change in fair value of

warrant liabilities |

|

(4,079 |

) |

|

|

18,515 |

|

| Other income, net |

|

255 |

|

|

|

154 |

|

| Net (loss) income |

$ |

(21,663 |

) |

|

$ |

28,778 |

|

| |

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

Foreign currency translation adjustment |

|

(22 |

) |

|

|

(32 |

) |

|

Unrealized gain on marketable securities |

|

11 |

|

|

|

— |

|

| Total comprehensive income

(loss) |

$ |

(21,674 |

) |

|

$ |

28,746 |

|

| |

|

|

|

| Net (loss) income per

share: |

|

|

|

|

Basic |

$ |

(0.14 |

) |

|

$ |

0.23 |

|

|

Diluted |

$ |

(0.14 |

) |

|

$ |

0.08 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

Basic |

|

153,345,554 |

|

|

|

124,232,799 |

|

|

Diluted |

|

153,345,554 |

|

|

|

127,573,485 |

|

| |

|

|

|

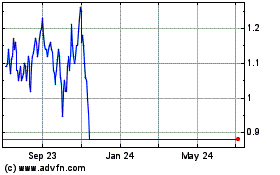

Selecta Biosciences (NASDAQ:SELB)

Historical Stock Chart

From Dec 2024 to Jan 2025

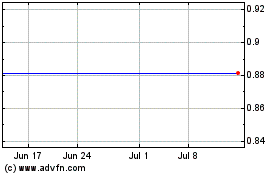

Selecta Biosciences (NASDAQ:SELB)

Historical Stock Chart

From Jan 2024 to Jan 2025