0001819113FALSE00018191132023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 7, 2023

SCIENCE 37 HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39727 | | 84-4278203 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

800 Park Offices Drive, Suite 3606 Research Triangle Park, NC | | 27709 |

| (Address of principal executive offices) | | (Zip Code) |

(984) 377-3737

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Shares of Common stock, par value $0.0001 per share | | SNCE | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2023, Science 37 Holdings, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the third quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) is furnished and not filed pursuant to Instruction B.2 of Form 8-K and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Science 37 Holdings, Inc. |

| | | |

| Date: | November 7, 2023 | By: | /s/ Mike Zaranek |

| | | Name: | Mike Zaranek |

| | | Title: | Chief Financial Officer |

Science 37 Reports Third Quarter 2023 Financial Results

Research Triangle Park, N.C., November 7, 2023 — Science 37 Holdings, Inc. (Nasdaq: SNCE), (“Science 37”), the industry-leading Metasite™, today reported its financial results for the quarter ended September 30, 2023.

“Our third quarter results were highlighted by continued quarterly improvements in our key profitability metrics and cash burn rate,” stated David Coman, Chief Executive Officer of Science 37. “We look forward to a strong finish to the year and positive momentum headed into 2024.”

Quarterly Financial Highlights

•Gross bookings were $17.9 million for the quarter ended September 30, 2023, a 50.6% increase compared to $11.9 million for the same period in 2022, and a 53.2% decrease compared to $38.2 million for the second quarter of 2023.

•Backlog was $163.1 million for the quarter ended September 30, 2023, compared to $170.4 million for the same period in 2022. Cancellations and realization adjustments were $8.7 million, representing 5.1% of beginning backlog for the quarter ended September 30, 2023, compared to $7.2 million and 3.9% of beginning backlog for the same period in 2022.

•Revenue was $14.9 million for the quarter ended September 30, 2023, an 8.4% decrease compared to $16.2 million for the same period in 2022, and a 3.0% decrease compared to $15.4 million for the second quarter of 2023.

•Gross profit was $5.9 million for the quarter ended September 30, 2023, a 44.6% increase compared to $4.1 million for the same period in 2022, and a 9.8% increase compared to $5.4 million for the second quarter of 2023.

•Gross margin was 39.7% for the quarter ended September 30, 2023, a 14.5 percentage point increase compared to 25.2% for the same period in 2022, and a 4.6 percentage point increase compared to 35.1% in the second quarter of 2023.

•Adjusted gross profit(1) was $6.1 million for the quarter ended September 30, 2023, a 32.1% increase compared to $4.6 million for the same period in 2022, and a 10.1% increase compared to $5.5 million in the second quarter of 2023. Adjusted gross margin(1) was 40.8% for the quarter ended September 30, 2023, a 12.5 percentage point increase compared to 28.3% for the same period in the prior year, and a 4.8 percentage point increase compared to 36.0% in the second quarter of 2023.

•Net loss was $13.9 million for the quarter ended September 30, 2023, resulting in loss per share of $0.12, compared to a net loss of $23.5 million in the same period in 2022, or loss per share of $0.20. Net loss improved 28.9% from the $19.6 million net loss reported in the second quarter of 2023.

•Adjusted net loss(1) was $5.4 million for the quarter ended September 30, 2023, a 72.3% improvement compared to an adjusted net loss of $19.5 million in the same period in 2022, and a 30.1% improvement compared to $7.7 million in the second quarter of 2023.

•Adjusted EBITDA(1) was $(5.2) million for the quarter ended September 30, 2023, a 64.2% improvement compared to $(14.6) million for the same period in 2022, and a 30.9% improvement compared to $(7.6) million for the second quarter of 2023.

•Cash burn (defined as the change in available cash in consecutive quarters as reported on the Company's Condensed Consolidated Balance Sheets) was $8.6 million for the quarter ended September 30, 2023, a 51.3% improvement compared to $17.6 million for the quarter ended June 30, 2023.

•Cash and Cash Equivalents as of September 30, 2023 were $56.4 million.

(1) Adjusted gross profit, adjusted gross margin, adjusted net loss and adjusted EBITDA are non-GAAP financial measures. For a reconciliation to the most directly comparable GAAP measure, please refer to the "Reconciliation of GAAP to non-GAAP measures" section included in this press release.

Full Year 2023 Financial Outlook

Science 37 is providing updated revenue guidance of between $58.0 million and $59.0 million and adjusted EBITDA guidance of approximately $(32.5) million for the fiscal year ending December 31, 2023.

Science 37 anticipates cash burn in the fourth quarter of 2023 to be less than $6.4 million, and expects to exit 2023 with more than $50.0 million of cash on hand.

The foregoing 2023 Financial Outlook statement represents management's current estimates as of the date of this release. Actual results may differ materially depending on a number of factors. Investors are urged to read the Cautionary Note Regarding Forward-Looking Statements included in this release. Management does not assume any obligation to update these estimates.

Science 37 has not provided a quantitative reconciliation of adjusted EBITDA guidance to net income (loss) on a forward-looking basis within this press release because the Company is unable, without unreasonable efforts, to provide reconciling information with respect to interest income, depreciation, amortization, stock-based compensation, restructuring costs, change in fair value of the earn-out liability, and other adjustments to adjusted EBITDA. These items, which could materially affect the computation of forward-looking GAAP net income (loss), are inherently uncertain and depend on various factors, some of which are outside of the Science 37’s control.

Webcast and Conference Call Details

Science 37 will host a conference call on November 7, 2023, at 8:30 a.m. Eastern Time to discuss its third quarter 2023 financial results. The call can be accessed by dialing 1-877-269-7751 (toll-free domestic) or 1-201-389-0908 (international) using the conference ID 13741458 or by utilizing the Call me™ feature using the following link to request a return call for instant telephone access to the event:

https://callme.viavid.com/viavid/?callme=true&passcode=13736111&h=true&info=company-email&r=true&B=6

The live webcast may be accessed via the investor relations section of the Science 37 website. A replay of the webcast will be available for approximately 90 days.

About Science 37

Science 37 Holdings, Inc.’s (Nasdaq: SNCE) mission is to accelerate clinical research by enabling universal trial access for patients. Through our Metasite™ we reach an expanded population beyond the traditional site, delivering on our goal of clinical research that works for everyone with greater patient diversity. Patients gain the flexibility to participate from the comfort of their own homes, at their local community provider, or at a traditional site when needed. Our Metasite is powered by a proprietary technology platform with in-house medical and operational experts that drive uniform study orchestration, enabling greater compliance and high-quality data. To learn more, visit www.science37.com, or email science37@science37.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding Science 37’s anticipated growth and profitability, the products offered by Science 37 and the markets in which it operates and revenue, adjusted EBITDA and expected cash burn guidance for fiscal year 2023. These forward-looking statements generally are identified by the words “believe,” “can,” “could,” “seek,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “position,” “may,” “might,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors, some of which are outside Science 37's control, could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: (i) the ability to maintain the listing of Science 37’s securities on The Nasdaq Stock Market LLC, (ii) volatility in the price of Science 37’s securities due to a variety of factors, including changes in the competitive and highly regulated industries in which Science 37 operates, variations in performance across competitors, changes in laws and regulations affecting Science 37’s business and changes in its capital structure, and general economic and financial market conditions, including fluctuations in currency exchange rates, economic instability, and inflationary conditions, (iii) the ability to

implement business plans, forecasts, and other expectations, and to identify and realize additional opportunities, (iv) the risk that Science 37 may never achieve or sustain profitability, (v) the risk that Science 37 will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all, (vi) failure to realize anticipated cost savings, and (vii) risks related to general economic and financial market conditions, including the possibility of an economic recession and geopolitical conditions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Science 37's Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 6, 2023 and in the other documents filed by Science 37 from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Science 37 assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Science 37 does not give any assurance that Science 37 will achieve its expectations.

Use of Non-GAAP Financial Measures and Key Performance Measures

In addition to the financial measures prepared in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"), this press release contains certain non-GAAP financial measures, including adjusted gross profit, adjusted gross margin, adjusted EBITDA and adjusted net income (loss). A “non-GAAP financial measure” is generally defined as a numerical measure of a company’s financial performance that excludes or includes amounts from the most directly comparable measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets, or statements of cash flows of the Company. Please refer to the reconciliations of the non-GAAP financial measures to their most directly comparable GAAP measures included in this press release and the accompanying tables contained at the end of this release.

The Company defines adjusted gross profit as gross profit excluding stock-based compensation expense. The Company defines adjusted gross margin as gross margin excluding stock-based compensation expense.

The Company defines adjusted net income (loss) as net income (loss) excluding transactions that the Company believes are not representative of its core operations, namely: restructuring and other costs; transaction and integration-related expenses; stock-based compensation expense; impairment losses; interest income; other income (expense), net; and gain or loss on extinguishment of debt.

EBITDA represents earnings before interest, taxes, depreciation, and amortization. The Company defines adjusted EBITDA as EBITDA, further adjusted to exclude expenses and transactions that the Company believes are not representative of its core operations, namely: restructuring and other costs; transaction and integration-related expenses; stock-based compensation expense; impairment losses; other income (expense), net; and gain or loss on extinguishment of debt.

Each of the non-GAAP measures noted above are used by management and the Board to evaluate the Company's core operating results because they exclude certain items for which fluctuations from period-to-period do not necessarily correspond to changes in the core operations of the business.

Management believes that adjusted gross profit, adjusted gross margin, adjusted EBITDA and adjusted net income (loss) are helpful to investors, analysts, and other interested parties because they can assist in providing a more consistent and comparable overview of our operations across our historical periods. In addition, these measures are frequently used by analysts, investors, and other interested parties to evaluate and assess performance.

Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company's results of operations as determined in accordance with GAAP. Also, other companies might calculate these measures differently.

This press release also contains certain key performance measures which we use to evaluate our business and results, measure performance, identify trends, formulate plans and make strategic decisions. We believe that the presentation of such metrics is useful to the Company’s investors because they are used to measure and model the performance of companies such as ours. Net bookings represent new business awards, net of contract modifications, contract cancellations, and other adjustments. Net bookings represent the minimum contractual value for the initial planned duration of a contract as of the contract execution date. The minimum fixed fees, upfront implementation fees and technology and support fees are included in net bookings. Estimates of variable revenue for utilization in excess of the contracted amounts are not included in the value of net bookings. Net bookings vary from period to period depending on numerous factors, including customer authorization volume, sales performance and the overall outlook of the life sciences industry, among others.

Contacts:

INVESTOR RELATIONS:

Steve Halper

LifeSci Advisors

shalper@lifesciadvisors.com

MEDIA INQUIRIES:

Science 37

Email: pr@science37.com

SCIENCE 37 HOLDINGS, INC. and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| (In thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Revenue | $ | 14,887 | | | $ | 16,249 | | | $ | 44,324 | | | $ | 54,210 | | | | | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Cost of revenue (exclusive of depreciation and amortization) | 8,972 | | | 12,157 | | | 30,048 | | | 41,985 | | | | | |

| Selling, general and administrative | 14,740 | | | 24,485 | | | 51,813 | | | 82,822 | | | | | |

| Impairment of long-lived assets | 5,533 | | | — | | | 19,013 | | | — | | | | | |

| Depreciation and amortization | 164 | | | 4,870 | | | 520 | | | 12,569 | | | | | |

| Restructuring costs | 22 | | | — | | | 3,624 | | | — | | | | | |

| Total operating expenses | 29,431 | | | 41,512 | | | 105,018 | | | 137,376 | | | | | |

| Loss from operations | (14,544) | | | (25,263) | | | (60,694) | | | (83,166) | | | | | |

| | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | |

| Interest income | 732 | | | 559 | | | 2,475 | | | 748 | | | | | |

| Sublease income | (2) | | | 240 | | | 64 | | | 719 | | | | | |

| Change in fair value of earn-out liability | — | | | 1,200 | | | 110 | | | 97,600 | | | | | |

| Other income (expense), net | (109) | | | (264) | | | (84) | | | (369) | | | | | |

| Total other income (expense), net | 621 | | | 1,735 | | | 2,565 | | | 98,698 | | | | | |

| Income (loss) before income taxes | (13,923) | | | (23,528) | | | (58,129) | | | 15,532 | | | | | |

| Income tax expense (benefit) | 1 | | | — | | | 1 | | | (1) | | | | | |

| Net income (loss) | $ | (13,924) | | | $ | (23,528) | | | $ | (58,130) | | | $ | 15,533 | | | | | |

| | | | | | | | | | | |

| (Loss) earnings per share: | | | | | | | | | | | |

| Basic | $ | (0.12) | | | $ | (0.20) | | | $ | (0.50) | | | $ | 0.13 | | | | | |

| Diluted | $ | (0.12) | | | $ | (0.20) | | | $ | (0.50) | | | $ | 0.12 | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | |

| Basic | 118,146 | | | 116,412 | | | 117,210 | | | 115,935 | | | | | |

| Diluted | 118,146 | | | 116,412 | | | 117,210 | | | 126,717 | | | | | |

| | | | | | | | | | | |

| Comprehensive (loss) income | | | | | | | | | | | |

| Net income (loss) | $ | (13,924) | | | $ | (23,528) | | | $ | (58,130) | | | $ | 15,533 | | | | | |

| Foreign currency translation | (8) | | | 125 | | | 14 | | | 152 | | | | | |

| Total comprehensive income (loss) | $ | (13,932) | | | $ | (23,403) | | | $ | (58,116) | | | $ | 15,685 | | | | | |

SCIENCE 37 HOLDINGS, INC. and SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| (unaudited) | | |

| (In thousands, except share data) | September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 56,407 | | | $ | 108,091 | |

| Accounts receivable and unbilled services, net | 12,591 | | | 10,992 | |

| Prepaid expenses and other current assets | 6,543 | | | 7,121 | |

| Total current assets | 75,541 | | | 126,204 | |

| Other assets | 186 | | | 244 | |

| Total assets | $ | 75,727 | | | $ | 126,448 | |

| | | |

| Liabilities, preferred stock and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 6,665 | | | $ | 7,206 | |

| Accrued expenses and other liabilities | 8,355 | | | 11,364 | |

| Deferred revenue | 3,084 | | | 4,606 | |

| Total current liabilities | 18,104 | | | 23,176 | |

| Non-current liabilities: | | | |

| Deferred revenue | 4,710 | | | 3,654 | |

| Operating lease liabilities | 47 | | | 716 | |

| Commissions payable | 1,062 | | | 1,336 | |

| Other long-term liabilities | 60 | | | 180 | |

| Total liabilities | 23,983 | | | 29,062 | |

| | | |

| Preferred stock: | | | |

Preferred stock, $0.0001 par value; 100,000,000 shares authorized, 0 issued and outstanding at September 30, 2023 and December 31, 2022, respectively | — | | | — | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value; 400,000,000 shares authorized, 119,118,653 and 116,432,029 issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 12 | | | 12 | |

| Additional paid-in capital | 362,755 | | | 350,247 | |

| Accumulated other comprehensive income | 207 | | | 193 | |

| Accumulated deficit | (311,230) | | | (253,066) | |

| Total stockholders’ equity | 51,744 | | | 97,386 | |

| Total liabilities, preferred stock and stockholders’ equity | $ | 75,727 | | | $ | 126,448 | |

SCIENCE 37 HOLDINGS, INC. and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (In thousands) | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (58,130) | | | $ | 15,533 | |

| Adjustments to reconcile net (loss) income to net cash used in operating activities: | | | |

| Depreciation and amortization | 520 | | | 12,569 | |

| Non-cash lease expense related to operating lease right-of-use assets | — | | | 859 | |

| Stock-based compensation | 12,286 | | | 19,425 | |

| Gain on change in fair value of earn-out liability | (110) | | | (97,600) | |

| Long-lived asset impairment | 19,013 | | | — | |

| Loss on foreign currency exchange rates | 76 | | | 282 | |

| Provision for doubtful accounts | 390 | | | 147 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable and unbilled services | (2,023) | | | 1,534 | |

| Prepaid expenses and other current assets | 566 | | | 745 | |

| Other assets | 14 | | | (72) | |

| Accounts payable | (902) | | | (8,100) | |

| Accrued expenses and other current liabilities | (3,589) | | | (6,329) | |

| Deferred revenue | (465) | | | 1,165 | |

| Operating lease liabilities | (474) | | | (449) | |

| Other, net | (297) | | | (86) | |

| Net cash used in operating activities | (33,125) | | | (60,377) | |

| Cash flows from investing activities: | | | |

| Payments related to capitalized software development costs | (17,639) | | | (24,627) | |

| Purchase of internal-use software | (750) | | | — | |

| Purchases of property and equipment | (31) | | | (162) | |

| Net cash used in investing activities | (18,420) | | | (24,789) | |

| Cash flows from financing activities: | | | |

| Proceeds from stock option exercises | 68 | | | 672 | |

| Proceeds from issuance of stock under the employee stock purchase plan | 119 | | | — | |

Payments related to tax withholdings for share-based compensation

| (343) | | | — | |

| Net cash (used in) provided by financing activities | (156) | | | 672 | |

| Effect of foreign currency exchange rate changes on cash | 17 | | | 132 | |

| Net decrease in cash and cash equivalents | (51,684) | | | (84,362) | |

| Cash and cash equivalents, beginning of period | 108,091 | | | 214,601 | |

| Cash and cash equivalents, end of period | $ | 56,407 | | | $ | 130,239 | |

| Supplemental disclosures of non-cash activities | | | |

| Balance in accounts payable, accrued expenses and other current liabilities, and capitalized stock-based compensation related to capitalized software and fixed asset additions | $ | (1,424) | | | $ | (3,482) | |

| Balance in prepaid expenses and other current assets related to stock option exercises | $ | — | | | $ | 5 | |

SCIENCE 37 HOLDINGS, INC. and SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP Measures

(Unaudited)

The following table provides reconciliation of adjusted gross profit and adjusted gross margin to gross profit and gross margin, the most directly comparable GAAP measures, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| (In thousands) | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 | | | | |

| Revenue | $ | 14,887 | | | $ | 15,351 | | | $ | 16,249 | | | $ | 44,324 | | | $ | 54,210 | | | | | |

| | | | | | | | | | | | | |

| Gross profit | $ | 5,915 | | | $ | 5,387 | | | $ | 4,092 | | | $ | 14,276 | | | $ | 12,225 | | | | | |

| Stock-based compensation (1) | $ | 159 | | | $ | 132 | | | $ | 505 | | | $ | 540 | | | $ | 1,481 | | | | | |

| Adjusted gross profit | $ | 6,074 | | | $ | 5,519 | | | $ | 4,597 | | | $ | 14,816 | | | $ | 13,706 | | | | | |

| | | | | | | | | | | | | |

| Gross margin | 39.7 | % | | 35.1 | % | | 25.2 | % | | 32.2 | % | | 22.6 | % | | | | |

| Adjusted gross margin | 40.8 | % | | 36.0 | % | | 28.3 | % | | 33.4 | % | | 25.3 | % | | | | |

The following table provides reconciliation of adjusted EBITDA to net income (loss), the most directly comparable GAAP measure:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| (In thousands) | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 | | | | |

| Net income (loss) | $ | (13,924) | | | $ | (19,579) | | | $ | (23,528) | | | $ | (58,130) | | | $ | 15,533 | | | | | |

| Interest income | (732) | | | (813) | | | (559) | | | (2,475) | | | (748) | | | | | |

| Depreciation and amortization | 164 | | | 143 | | | 4,870 | | | 520 | | | 12,569 | | | | | |

| Other income (2) | 111 | | | (9) | | | (1,176) | | | (90) | | | (97,950) | | | | | |

| Stock-based compensation | 3,578 | | | 3,601 | | | 5,739 | | | 12,286 | | | 19,425 | | | | | |

| Long-lived asset impairment | 5,533 | | | 5,679 | | | — | | | 19,013 | | | — | | | | | |

| Restructuring | 22 | | | 3,373 | | | — | | | 3,624 | | | — | | | | | |

| Franchise taxes | 24 | | | 44 | | | 50 | | | 114 | | | 229 | | | | | |

| Provision for income taxes | 1 | | | — | | | — | | | 1 | | | (1) | | | | | |

| Adjusted EBITDA | $ | (5,223) | | | $ | (7,561) | | | $ | (14,604) | | | $ | (25,137) | | | $ | (50,943) | | | | | |

The following table provides reconciliation of adjusted net loss to net income (loss), the most directly comparable GAAP measure:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| (In thousands) | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 | | | | |

| Net income (loss) | $ | (13,924) | | | $ | (19,579) | | | $ | (23,528) | | | $ | (58,130) | | | $ | 15,533 | | | | | |

| Interest income | (732) | | | (813) | | | (559) | | | (2,475) | | | (748) | | | | | |

| Other income (2) | 111 | | | (9) | | | (1,176) | | | (90) | | | (97,950) | | | | | |

| Stock-based compensation expense | 3,578 | | | 3,601 | | | 5,739 | | | 12,286 | | | 19,425 | | | | | |

| Long-lived asset impairment | 5,533 | | | 5,679 | | | — | | | 19,013 | | | — | | | | | |

| Restructuring | 22 | | | 3,373 | | | — | | | 3,624 | | | — | | | | | |

| Adjusted net loss | $ | (5,412) | | | $ | (7,748) | | | $ | (19,524) | | | $ | (25,772) | | | $ | (63,740) | | | | | |

_____________________________________

(1)Represents the portion of total stock-based compensation recorded within cost of revenues.

(2)Includes a gain of $0, $0, and $1.2 million recorded for the three months ended September 30, 2023, June 30, 2023 and September 30, 2022, respectively, and a gain of $0.1 million and $97.6 million for the nine months ended September 30, 2023 and 2022, respectively, associated with the change in the fair value of the earn-out liability.

v3.23.3

Cover

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity Registrant Name |

SCIENCE 37 HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39727

|

| Entity Tax Identification Number |

84-4278203

|

| Entity Address, Address Line One |

800 Park Offices Drive

|

| Entity Address, Address Line Two |

Suite 3606

|

| Entity Address, City or Town |

Research Triangle Park

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27709

|

| City Area Code |

984

|

| Local Phone Number |

377-3737

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Shares of Common stock, par value $0.0001 per share

|

| Trading Symbol |

SNCE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819113

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

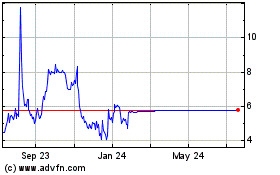

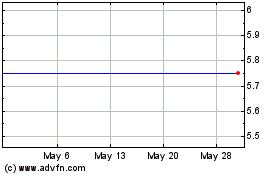

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Jul 2023 to Jul 2024