Safe & Green Holdings Corp. (NASDAQ: SGBX) ("Safe &

Green Holdings" or the "Company"), a leading developer,

designer, and fabricator of modular structures, reported results

for the year ended December 31, 2023.

Recent Highlights:

- Achieves 30%

year-over-year increase in construction services revenue for the

year ended December 31, 2023

- Executed a

Master Purchase Agreement (MPA) with Safe and Green Development

Corporation ("SG DevCo") (NASDAQ: SGD), the Company’s real estate

development subsidiary where SG DevCo has engaged SG Echo to

manufacture modular units for its planned real estate development

projects, including design, engineering, fabrication, delivery, and

installation of the modular systems; expected initial value of the

MPA to be in excess of $140 million in net revenue over a

multi-year period

- Received new

contract from a government contractor to refurbish 19 container

modules to be used by a major U.S. government agency that the

Company originally built

- Entered into a

non-binding Letter of Intent (LOI) to design, build, and operate an

800-unit supportive housing community for veterans, first

responders, and others who are disabled from their service and

interested in manufacturing work, as well as their families

- Entered into a

design-build contract with Hostel Cubed, to produce their first

modular camping cube for the California Coast, the "Coastal Camping

Cube"

- Received a

purchase order to provide additional modular units to an existing

infrastructure solutions customer

- Selected by the

Tunnel to Towers Foundation to construct a traveling modular home,

the Comfort Home Show model, designed to showcase the foundation’s

Homeless Veteran Program

"In 2023, Safe & Green Holdings experienced

a robust increase in revenue from construction services, achieving

a significant 30% increase compared to 2022," commented Paul

Galvin, Chairperson and Chief Executive Officer of Safe and Green

Holdings. "It was also an exciting year, and a year of celebration

for the Company, as we achieved a milestone event with the

successful spin-off of SG Development Corp. ("SG DevCo") into a

separate entity that now trades independently on the Nasdaq market

(NASDAQ: SGD). This strategic move came to fruition after more than

a year of relentless dedication and work by our team. At the time

of the spin-out, SG DevCo had a third-party fairness opinion that

valued SG DevCo's fair market value at $74 million."

"After the spin-out of SG DevCo, the Company

entered into a master purchase agreement ("MPA") with SG DevCo

engaging SG Echo to manufacture modular units for its planned real

estate development projects, including design, engineering,

fabrication, delivery, and installation of the units. The Company

believes the initial value of the MPA to be in excess of $140

million in net revenue to SG DevCo over a multi-year period and

that this is the first of several such agreements the Company may

enter into, to support SG DevCo’s upcoming development projects,

which currently total approximately 3,200 units with the potential

to generate in excess $500 million of gross revenue for Safe &

Green Holdings over the next several years. These projects are

expected to utilize SG Echo’s full manufacturing capacity, even if

no further projects were introduced."

"The Company is also experiencing solid growth

in our manufacturing sales pipeline. Based on an assessment of the

current sales pipeline alone, we expect to achieve a factory

utilization rate of more than 90% over the next two years. As a

result, we continue to expand our manufacturing capacity with our

Waldron Manufacturing site receiving its certificate of occupancy,

enhancing our production capabilities, and providing the Company

with two operational factories, with a third, the McLean

manufacturing facility in the design phase and a fourth in the

planning phase. Upon completion, these facilities are poised to

offer the Company more than 360,000 square feet of manufacturing

space within the United States. Looking at our projected growth, as

well as the scalability of our manufacturing operations, and

aggressive cost reductions allowing Safe and Green to focus on our

most profitable operations, we expect the Company to not only turn

cash flow positive by the end of 2024 but begin generating

meaningful cash flow throughout the balance of the year and beyond.

This has truly been a team effort, from our management team to our

employees in the factories."

"In 2023, the Company was honored with the

opportunity to partner with the Tunnel to Towers Foundation for the

creation of a portable modular home known as the Comfort Home Show

model. This project was aimed at highlighting the foundation's

initiative to assist homeless veterans. This collaboration expanded

to include the construction of three modular Comfort Homes in

Houston, Texas, further supporting the foundation's mission.

Additionally, we agreed in principle, through a non-binding Letter

of Intent (LOI) with Soldier On, to develop and manage an 800-unit

housing community specifically designed for veterans, first

responders, and their families, particularly those with

disabilities arising from their service. This unique project

envisions not just accommodating individuals with disabilities but

also incorporating an 80,000-square-foot manufacturing facility in

McClean, Oklahoma, compliant with the Americans with Disabilities

Act (ADA). This facility is intended to support the construction of

the 800 units as well as provide employment opportunities for

injured veterans. We take great pride in our involvement with

initiatives aimed at eradicating homelessness among veterans,

acknowledging their sacrifices, and facilitating job opportunities

for those with service-related disabilities. We are committed to

contributing to meaningful efforts that assist veterans in

reconstructing their lives, viewing it as both a privilege and a

responsibility."

"In addition, we recently received a new

contract from a government contractor to refurbish 19 modular units

that Safe and Green originally built, to be used by a major U.S.

government agency. This ongoing collaboration is yet another

testament to the exceptional quality of our products as well as our

proficiency in modular construction. Furthermore, we received an

order to provide additional units to an existing infrastructure

solutions customer, which we believe demonstrates even further

validation of the quality of our work, the strong value proposition

that Safe and Green provides, and the Company’s ability to deliver

units quickly, sustainably, and cost-effectively."

Tricia Kaelin, Chief Financial Officer at Safe

& Green Holdings, stated, "During 2023, the Company

successfully secured non-dilutive funding, which speaks to the

strength of our assets as well as our ability to fund future growth

without turning to the equity markets. For example, we entered into

an LOI for a sale-leaseback transaction involving our Waldron

manufacturing facility located in Durant, Oklahoma in a strategic

financial move expected to generate gross proceeds of $2 million to

the Company and we expect to receive our ERTC refund of $1.5M

subject to IRS final approval. The infusion of capital is intended

to free up working capital, providing further support for Safe

& Green Holdings' growing customer demand and facilitating its

aggressive expansion strategies. The decision to engage in a

sale-leaseback transaction further demonstrates our prudent

financial management and strategic planning capabilities. By

capitalizing on the strong market value of our real estate assets,

the Company is well-positioned to accelerate growth and build

shareholder value while maintaining a solid financial

foundation."

"In addition, the Company has undergone a

thorough review of our operations and has identified reductions of

more than $2.5 million in annualized expenses expected to be

realized in 2024. Adding these expected cost saves to other already

identified cost reductions, we anticipate that our annual operating

expense run rate in 2024 will be approximately $2.5 million, a

significant reduction from our 2023 run rate," concluded Ms.

Kaelin.

"As we look forward towards 2024, the prospects

for Safe & Green Holdings are brighter than ever thanks to the

number of projects that we are currently involved in which we

believe will keep our factory utilization rate above 90% over the

next several years. Revenue from construction services grew

substantially in 2023 and we are more confident than ever in the

scalability of our business model and eager to continue expanding

our presence across the United States. The Company remains

dedicated to prudently managing our expenses and enhancing

stockholder value for our loyal, long-term stockholders," concluded

Mr. Galvin.

Financial Results for the Twelve Months

Ended December 31, 2023

Revenue for the twelve months ended December 31,

2023, was $16.5 million, compared to $24.4 million for the twelve

months ended December 31, 2022, reflecting a decrease in medical

revenue due to the discontinuation of COVID-19 testing facilities,

offset by an increase in construction services revenue.

Gross profit (loss) for 2023 was ($2.6) million

compared to a gain of $3.3 million for 2022, reflecting the costs

associated with MedCo and our new factory.

Operating expenses for 2023 were $22.2 million,

compared to $10.5 million for 2022, due to the costs of activating

MedCo and our new factory.

The net loss attributable to common shareholders

was approximately ($26.3) million, or ($34.03) per share in 2023,

compared to a net loss of ($8.3) million, or $(12.48) per share for

2022.

The Company’s Adjusted EBITDA for the year ended

December 31, 2023, was approximately ($16.8) million as compared to

Adjusted EBITDA of approximately ($4.0) million for the year ended

December 31, 2023. Both EBITDA and Adjusted EBITDA are non-GAAP

financial measures. The Company defines EBITDA as GAAP net income

(loss) attributable to common stockholders before interest expense,

income tax benefit (expense), depreciation and amortization.

Adjusted EBITDA is defined as EBITDA before certain non-recurring,

unusual or non-operational items, such as litigation expense, stock

issuance expense and stock compensation expense. The Company

believes that adjusting EBITDA to exclude the effects of these

items that are not closely associated with ongoing corporate

operations provides management and investors with a meaningful

measure that increases period-to-period comparability of the

Company’s operating performance.

The Company believes the presentation of EBITDA

and Adjusted EBITDA is relevant and useful by enhancing the

readers’ ability to understand the Company’s operating performance.

The Company’s management utilizes EBITDA and Adjusted EBITDA as a

means to measure performance.

The Company’s measurements of EBITDA and

Adjusted EBITDA may not be comparable to similar titled

measurements reported by other companies. EBITDA and Adjusted

EBITDA are not measurements of financial performance under GAAP and

should not be considered as an alternative to net income (loss)

attributable to common stockholders or as an indication of

operating performance or any other measures of financial

performance derived in accordance with GAAP. The Company does not

consider these non-GAAP measures to be substitutes for or superior

to the information provided by its GAAP financial results. The

non-GAAP information should be read in conjunction with our

consolidated financial statements and related notes. These measures

also should not be construed as an inference that our future

results will be unaffected by the non-recurring, unusual or

non-operational items for which these non-GAAP measures make

adjustments.

The table below reconciles EBITDA and Adjusted

EBITDA, both non-GAAP measures, to GAAP net gain (loss)

attributable to common stockholders of Safe & Green Holdings

Corp.

| |

|

For the Year Ended December

31, 2023 |

|

|

For the Year Ended December

31, 2022 |

|

|

Net loss attributable to common stockholders of Safe & Green

Holdings Corp. |

|

$ |

(26,282,533 |

) |

|

$ |

(8,319,048 |

) |

|

Addback interest expense |

|

|

2,608,683 |

|

|

|

336,239 |

|

|

Addback interest income |

|

|

(119 |

) |

|

|

(73,821 |

) |

|

Addback depreciation and amortization |

|

|

3,459,286 |

|

|

|

615,191 |

|

| EBITDA (non-GAAP) |

|

|

(20,214,683 |

) |

|

|

(7,441,439 |

) |

| |

|

|

|

|

|

|

|

|

|

Addback loss on asset disposal |

|

|

— |

|

|

|

25,265 |

|

|

Addback litigation expense |

|

|

154,217 |

|

|

|

664,724 |

|

|

Addback stock-based compensation expense |

|

|

3,210,631 |

|

|

|

2,798,844 |

|

| Adjusted EBITDA

(non-GAAP) |

|

$ |

(16,849,835 |

) |

|

$ |

(3,952,606 |

) |

| |

|

|

|

|

|

|

|

|

At December 31, 2023, and December 31, 2022, the

Company had cash and cash equivalents of $17 thousand and $583

thousand, respectively. As of December 31, 2023, stockholders’

equity was ($6.3) million compared to $14.4 million as of December

31, 2022. Additionally, on May 6, 2024, the Company announced the

pricing of a $4 million private placement priced at-the-market

under Nasdaq rules.

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading

modular solutions company, operates under core capabilities which

include the development, design, and fabrication of modular

structures, meeting the demand for safe and green solutions across

various industries. The firm supports third-party and in-house

developers, architects, builders, and owners in achieving faster

execution, greener construction, and buildings of higher value. The

Company’s subsidiary, Safe and Green Development Corporation, is a

leading real estate development company. Formed in 2021, it focuses

on the development of sites using purpose-built, prefabricated

modules built from both wood and steel, sourced from one of SG

Holdings’ factories and operated by the SG Echo subsidiary. For

more information, visit https://www.safeandgreenholdings.com/ and

follow us at @SGHcorp on Twitter.

Safe Harbor Statement

Certain statements in this press release

constitute "forward-looking statements" within the meaning of the

federal securities laws. Words such as "may," "might," "will,"

"should," "believe," "expect," "anticipate," "estimate,"

"continue," "predict," "forecast," "project," "plan," "intend" or

similar expressions, or statements regarding intent, belief, or

current expectations, are forward-looking statements. These

forward-looking statements are based upon current estimates and

assumptions and include statements regarding the Company’s

financial results for year-end 2023, the Company’s Master Purchase

Agreement (MPA) with Safe and Green Development Corporation, the

Company’s new contract from a government contractor to refurbish 19

container modules to be used by a major U.S. government agency that

the Company originally built, the Company’s non-binding Letter of

Intent (LOI) to design, build, and operate an 800-unit supportive

housing community for veterans, first responders, and others who

are disabled from their service and interested in manufacturing

work, as well as their families, the Company’s design-build

contract with Hostel Cubed, to produce their first modular camping

cube for the California Coast, the "Coastal Camping Cube", the

Company’s receipt of a purchase order to provide additional modular

units to an existing infrastructure solutions customer, the Company

being selected by the Tunnels to Towers Foundation to construct a

traveling modular home, the Comfort Home Show model, designed to

showcase the foundation’s Homeless Veterans Program, and the

outlook for Safe & Green Holdings. These forward-looking

statements are subject to various risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Important factors that could cause actual results to differ

materially from current expectations include, among others, the

Company’s ability to execute on the MPA with Safe and Green

Development Corporation, the Company’s ability to refurbish the 19

container modules to be used by a major U.S. government agency, the

Company’s ability to design, build, and operate an 800-unit

supportive housing community per the Company’s non-binding LOI, the

Company’s ability to fulfill the design-build contract with Hostel

Cubed, to produce their first modular camping cube the "Coastal

Camping Cube", the Company’s ability to construct a traveling

modular home, the Comfort Home Show model, for the Tunnels to

Towers Foundation, the effect of government regulation, the

Company’s ability to maintain compliance with the NASDAQ listing

requirements, and the other factors discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022 and

its subsequent filings with the SEC, including subsequent periodic

reports on Forms 10-Q and 8-K. The information in this release is

provided only as of the date of this release, and we undertake no

obligation to update any forward-looking statements contained in

this release on account of new information, future events, or

otherwise, except as required by law.

Investor Relations:

Crescendo Communications, LLC(212)

671-1020sgbx@crescendo-ir.com

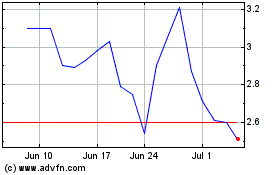

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Jan 2024 to Jan 2025