SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

This Schedule 14A filing consists of the following communications relating to the proposed acquisition of Rover Group, Inc. (“we”, “our”, “us”, “Rover” or the “Company”) by Biscuit Parent, LLC, a Delaware limited liability company (“Parent”), and Biscuit Merger Sub, LLC (“Merger Sub”), pursuant to the terms of an Agreement and Plan of Merger, dated November 29, 2023, by and among Parent, Merger Sub, and the Company:

| | | | | | | | |

| (ii) | Employee FAQs; |

| (iii) | Email to Employees after All Company Meeting; |

| | | | | | | | |

| (iv) | Reactive FAQ for Operations Agents; and |

Each item above was first used or made available on November 29, 2023.

(i) Email to Employees

From: Aaron Easterly

Date: November 29, 2023

To: global_team, goodpup

Subject: Rover Agrees to be Acquired by Blackstone

Confidential – For Internal Use Only

Team,

I’m excited to share that this morning we announced that we have agreed to be acquired by Blackstone for $2.3 billion, or $11.00 per share. Please see the press release we just issued for additional details.

For those of you who aren’t familiar, Blackstone is one of the world’s leading investment firms with a stellar reputation of backing successful companies and management teams to further expand their growth. Through this transaction, we expect to benefit from Blackstone’s operating capabilities and deep existing expertise in successfully scaling innovative technology businesses to accelerate their mission.

Following the completion of the proposed transaction, our stock will no longer be publicly listed and we will become a privately-held company. We’ve worked hard over the past few years to continue delivering value to our stakeholders, including all of you. Following a deliberate and thoughtful process, Rover’s board of directors has approved the transaction and recommended that Rover stockholders vote to approve the transaction, which is expected to deliver immediate and compelling value for Rover’s stockholders, including our employees.

On behalf of Rover’s senior leadership team, I want to express our deep appreciation for your many contributions to Rover. Blackstone was attracted to Rover in large part because of our strong brand and extraordinary employees and customers. It’s because of the work of each and every one of you that we continue growing and have the opportunity to celebrate milestones like this.

We currently expect the transaction to close in the first quarter of 2024, subject to Rover stockholder approval, required regulatory clearances and other customary closing conditions. We will continue providing pet parents with safe, high-quality pet care, all backed by our exceptional support.

To further discuss today’s announcement, we’ll be moving up our quarterly All Company Meeting to today, November 29 at 9:00am PT and we encourage all employees to attend. The calendar invite will be adjusted shortly.

Ahead of our quarterly All Company Meeting, I also wanted to share a few resources:

Questions

●To help address questions you may have, we’ve put together an Internal FAQ.

●For our customer-facing teams, we will distribute an external FAQ to you shortly to help you answer any questions you receive from pet parents or pet care providers. Please only leverage this resource to respond reactively to inquiries. Do not proactively reach out about this news.

Media/Press

●If you receive any press or media inquiries, do not respond and instead please forward the inquiry to Kristin Sandberg (kristin.sandberg@rover.com).

Investor/Stockholders or Analysts

●If you receive any investor/stockholder or analyst inquiries, in accordance with our External Communications Policy do not respond and instead please forward the inquiry to Walter Ruddy (walter.ruddy@rover.com).

Social Media

●Consistent with existing company policies, do not post about or share this announcement, engage in any online conversations, or provide your own commentary on what this means for Rover or the pet care industry. Also follow the other guidelines regarding social media postings related to this announcement set forth in the Internal FAQ.

This is excellent news for Rover’s stockholders and the future of Rover, and serves as another positive step on our journey to make it easier for everyone to experience the unconditional love of pets. Blackstone is acquiring Rover in large part because of their deep alignment with what we’ve spent the last 12+ years building as well as the incredible team, the easy-to-use product, the pet-obsessed community, and the opportunity to leverage Blackstone’s expertise and resources to support Rover’s continued expansion as a private company. Blackstone fundamentally believes in the formula we’ve built and is fully invested in helping Rover achieve our next phase of growth. This is an important milestone, not a destination. Our mission, our leadership team and our commitment to making it easier to find loving pet care remain unchanged.

With much appreciation,

Aaron

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending acquisition of the Company by private equity funds managed by Blackstone (the “Merger”) and the expected timing of the closing of the Merger and other statements that concern the Company’s expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made by, and information currently available to, the Company. Because such statements are based on

expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of required approval from the Company’s stockholders and required regulatory approval; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement with private equity funds managed by Blackstone, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) uncertainty as to timing of completion of the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s Class A common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement on Schedule 14A that the Company will file with the SEC relating to its special meeting of stockholders will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The information that can be accessed through hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This communication is being made in respect of the Merger. In connection with the proposed Merger, the Company will file with the SEC a proxy statement on Schedule 14A relating to its special meeting of stockholders and may file or furnish other documents with the SEC regarding the Merger. When completed, a definitive proxy statement will be mailed to the Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Company’s website at investors.rover.com under the link “Financials” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations department via e-mail at investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan Siegler, who are the non-employee members of the Company’s Board of Directors, Aaron Easterly, the Company’s Chief Executive Officer and Chairperson of the Board, Brent Turner, the Company’s President and Chief Operating Officer, and Charlie Wickers, the Company’s Chief Financial Officer, are participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information regarding the Company’s directors and executive officers (other than for Mr. Prusch), including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Board of Directors and Corporate Governance—Director Compensation,” and “Executive Compensation—Outstanding Equity Awards at Fiscal 2022 Year-End” contained in the Company’s 2023 annual proxy statement filed with the SEC on April 28, 2023 (the "2023 Proxy Statement"). To the extent that the Company’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC. Since the filing of the 2023 Proxy Statement, (1) Ms. Cohen received a grant of 19,417 restricted stock units (“RSUs”) and Mr. Gottesman, Ms. Leslie and Ms. Siegler each received a grant of 33,273 RSUs, which will each vest in full on the earlier of June 16, 2024 or the date of the next annual meeting of the Company’s stockholders, in each case subject to the applicable director continuing to be a non-employee director through the applicable vesting date, and (2) Mr. Prusch received a grant of 54,855 RSUs, which will vest 1/3 on each of September 7, 2024, September 7, 2025 and September 7, 2026, subject to him continuing to be a non-employee director through the applicable vesting dates. In the Merger, outstanding equity awards held by each non-employee director will fully vest immediately prior to the consummation of the Merger provided that the non-employee director continues to be a non-employee director through such date, and outstanding equity awards held by Mr. Easterly, Mr. Turner and Mr. Wickers will be treated in accordance with

their respective severance and change in control agreements and as described in the 2023 Proxy Statement under the caption “Executive Compensation—Potential Payments Upon Termination or Change in Control.” Additionally, pursuant to the Business Combination Agreement, dated as of February 10, 2021, by and among Nebula Caravel Acquisition Corp., Fetch Merger Sub, Inc., and A Place for Rover, Inc., an affiliate of Mr. Clammer has been issued restricted shares of the Company’s Class A common stock that will fully vest immediately prior to the consummation of the Merger and Mr. Easterly, Mr. Ganesan, Mr. Gottesman, Mr. Jacobson, Mr. Turner and their respective affiliates will be issued additional shares of the Company’s Class A common stock immediately prior to the consummation of the Merger. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement for the Company’s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of the Merger when they become available. These documents can be obtained free of charge from the sources indicated above.

(ii) Employee FAQs

FAQs – RELEASED NOVEMBER 29, 2023 to all Rover employees via email

Roverines, below are frequently asked questions regarding the announcement that we have entered into a definitive agreement to be acquired by funds affiliated with Blackstone (“Blackstone”). This list may be updated periodically with new questions and updates. Please carefully read the questions and answers below.

What was announced today?

●Rover entered into a definitive agreement to be acquired by Blackstone for $2.3 billion or $11.00 per share. This represents an approximately 61% premium over the 90 trading-day volume weighted average stock price as of November 28, 2023. More information on Blackstone and the proposed transaction is available in the public press release that was distributed this morning and is available here.

●Following a deliberate and thoughtful process, Rover’s board of directors approved the transaction, which is expected to deliver immediate and compelling value for Rover’s stockholders.

●The transaction is expected to close in the first quarter of 2024, subject to Rover stockholder approval, required regulatory clearances, and the satisfaction of other customary closing conditions.

●Today, Rover is still a publicly traded company, but upon the closing of the proposed transaction, our stock will no longer be publicly listed and Rover will become a privately held company.

●Until the transaction closes, Rover and Blackstone will remain separate and independent, with the company operating in the ordinary course.

Why did Rover and our board of directors decide to move forward with this transaction?

●Rover’s board of directors regularly evaluates opportunities to enhance stockholder value. The board reviewed Blackstone’s proposal against our strategic alternatives and undertook a robust evaluation process in consultation with its legal and financial advisors. Rover’s board firmly believes this transaction maximizes value for Rover stockholders.

○Following a deliberate and thoughtful process, Rover’s board determined that the transaction with Blackstone is in the best interests of Rover and its stockholders.

○Further details on our process will be available in Rover’s public filings that will be available in the coming weeks on www.sec.gov and investors.rover.com.

●Under the terms of the agreement, Rover stockholders will receive $11.00 in cash per share. This represents an approximately 61% premium over the 90 trading-day volume weighted average stock price.

●The long-term opportunity and vision for Rover will remain as compelling as ever. With new resources from Blackstone, and their expertise, we think we will become better, faster, smarter, and more efficient to reach the same goals we have always had.

Is this good for Rover?

●Yes! We believe the massive market opportunity we identified at our founding is still there for us, but we have a lot of work to do and investments to make in order to get there.

●Blackstone has an outstanding track record of creating value for technology companies and has deep knowledge of our space. We believe that this transaction will provide Rover with the benefits of Blackstone’s operating capabilities, including capital support and a strong track record of investing in high-growth companies.

●Blackstone is highly impressed by Rover’s innovation in digital pet services due to the Rover leadership team’s efforts.

●Our visions are aligned around strategy and what needs to be done to achieve our long-term strategy and vision. As a result of our alignment on our path forward, we are confident that this transaction will enable us to drive growth faster and accelerate our strategy.

Can I post about the transaction on social media?

●Do not post about the transaction and please refrain from engaging in online conversations, or providing your own commentary on what this means for Rover or the pet care industry.

●Do not share Rover’s posts on the transaction, comment on the transaction, or engage with others on social media (including likes or retweets) around the transaction using personal accounts.

●Do not share posts from other sites (for example, news sites/articles) about the transaction even if you do not include any commentary or additional content.

●All employees are subject to Rover’s external communications policy and social media guidelines.

Can I talk to anyone (family/friends/former co-workers) about this?

●You should only share publicly available information when discussing Rover and this transaction with non-employees. If you share material nonpublic information about Rover or non-public information about this transaction that is traded upon, you could subject yourself and the other person to criminal charges or civil liability for the violation of insider

trading laws. Please also remember that you are bound by confidentiality obligations that prohibit you from disclosing Rover's nonpublic information without authorization.

How will we communicate this to pet parents and pet care providers?

●Customer facing teams will be provided with materials and guidance for how to answer any questions they receive from customers, discuss the deal and next steps with pet parents and pet care providers. Please only leverage these materials to respond to inquiries. Do not proactively reach out to pet parents and pet care providers about this news.

●We believe that our partnership with Blackstone will improve the experience, offering, and innovation that we offer to pet parents and pet care providers, and we intend to communicate that clearly now and throughout this deal process.

What does this transaction mean for me?

●It is business as usual at Rover and we will continue to operate independently until the transaction closes. Everyone should continue to focus on their day-to-day responsibilities, working hard to deliver excellent product, support and service to our community.

●Until this transaction closes, we are still a publicly traded company and will continue to operate in the ordinary course as such.

●Roverines have been and will continue to be critical to the success of the company.

●This is the beginning of a collaborative partnership that will enhance and accelerate our opportunities for growth.

When will the acquisition close?

●The transaction is expected to close in the first quarter of 2024, subject to Rover stockholder approval, required regulatory clearances, and the satisfaction of other customary closing conditions.

What are the steps of the process to go from a public company to a private company? What happens next?

●It is business as usual at Rover. Everyone should continue to focus on their day-to-day responsibilities, working hard to deliver excellent product, support and service to our community.

●Until this transaction closes, we will still be a publicly traded company and will continue to operate independently in the ordinary course as such.

●The transaction is expected to close in the first quarter of 2024, subject to Rover stockholder approval, required regulatory clearances, and the satisfaction of other customary closing conditions.

●In the coming weeks, we will file a proxy statement with the U.S. Securities and Exchange Commission (“SEC”), which will include additional information about the proposed transaction and the upcoming special meeting of stockholders where stockholders will vote on the proposed transaction.

●When the transaction closes, we’ll become a privately-held company with the support, resources and insights that we believe will help accelerate our product innovation and provide our customers with the product, support, and service that they deserve.

Who is Blackstone?

●Blackstone is a leading investment firm with an outstanding reputation for investing in leading technology companies to accelerate their growth. Their investment philosophy is to invest in great companies with excellent management teams.

●They collaborate closely with the companies they acquire, with a focus on supporting management teams as they execute on their missions. Critically, Blackstone has had deep experience successfully scaling digital companies and is highly regarded in the broader technology market.

●Blackstone was attracted to Rover because of our strong brand and extraordinary customers and employees, and is excited about investing in our mission to make it possible for everyone to experience the love of a pet in their lives.

●The transaction is a validation of our team’s outstanding work, and without the success that everyone has helped us achieve, Blackstone would not have been interested in acquiring us.

●The transaction is also the start of an exciting new chapter and it is thanks to you that we reached this significant milestone and we should all feel proud of this accomplishment. You can learn more about Blackstone by visiting their website at www.blackstone.com.

Did we seek out a buyer or did they approach us?

●Details of the background of the transaction will be disclosed in the proxy statement and other documents to be filed with the SEC.

Will Rover continue to operate under the same name and brand?

●Yes! Rover is the world’s largest online marketplace for pet care. Blackstone was attracted to Rover because of our strong brand and extraordinary customers and employees. Together with Blackstone, we intend to grow and improve our business to ensure that the Rover brand becomes even more well-known, recognizable, and successful.

●Importantly, we do not intend to change the company’s broad business model or strategy. Blackstone will serve as an experienced partner to help Rover achieve its long-term vision and financial goals.

●The primary change is that we will be a private company rather than owned by many public stockholders.

How will Rover’s internal culture change?

●Our internal culture has been and will remain a key part of what makes Rover successful as a business.

●We will continue to work with Blackstone on scaling our culture as our company transitions from public to private.

●A big part of that will be a continued focus on hiring and retaining key talent, and continuing to make Rover a great place to work.

How will Blackstone be involved in our business?

●Following the close of the transaction, Blackstone intends to provide their expertise and partner with the leadership team to help us deliver on our vision and drive plans and strategies in pursuit of that. We believe that the Rover leadership team will benefit from new perspectives, networks, and expertise that the Blackstone team will provide.

How does this affect Rover’s executive team?

●One of the important reasons Blackstone was attracted to Rover was the talent of our team, and the success we have achieved together.

●This transaction is first and foremost about accelerating Rover’s strategy and growth opportunity. Blackstone and Rover are very aligned on the opportunity and the desire to make that a reality.

Will there be any broad structural changes to the organization or workforce?

●While we can never guarantee the future, we’re not anticipating major changes. It’s just business as usual for all of us. Blackstone intends to acquire Rover in large part because of their belief in Rover’s long-term opportunity driven by our strong brand, loyal customer base, robust platform, and global reach. Blackstone is committed to investing in our mission to make it possible for everyone to experience the love of a pet in their lives. But most importantly, they intend to acquire us because of the success that our incredible employees and tenured leadership team have achieved to date.

Does this transaction impact our growth and hiring?

●Attracting and retaining the best talent has always been important at Rover and that will not change with this transaction. We are continuing to hire at Rover, and the Blackstone team is interested in Rover because of our strength and path for continued growth. However, please confirm with your manager before proceeding with your hiring plans and follow the normal approval process.

Will anything change with respect to my pay, bonus or benefits?

●Attracting and retaining the best talent has always been important at Rover and that will not change with this proposed transaction.

●The details of our compensation structure, including any long-term incentive compensation, will naturally change as we will no longer be a publicly traded company. We will continue to focus on competitive compensation and benefits to ensure we can continue to attract, retain and incentivize the best talent as a private company.

●Blackstone has made it clear that they are investing in Rover in large part because of the success that our talented team has achieved. They are focused on growth and know that competitive compensation and benefits are essential for our success.

How does this deal affect promotions and raises this year?

●There will be no impact to our upcoming salary review process.

●The Annual Performance Review process that will kick off in early January is not changing at this time. More details to come later in December on specific timelines and key dates.

●We will benefit from Blackstone’s operational and competitive intelligence during this process, as they assist our People leadership to make the process better for Roverines and the company.

How will Rover continue a long-term incentive program for performance in the absence of equity if the transaction closes?

●Go forward incentive compensation arrangements will be determined in collaboration with Blackstone following the closing of the transaction.

●We will continue to focus on competitive compensation and benefits to ensure we can continue to attract, retain and incentivize the best talent as a private company.

How will my stock received as a result of any settled vested RSU or exercised option be treated?

●If you hold stock received as a result of any settled vested RSUs or exercised option, you will receive $11.00 in cash for each share of Rover stock you own.

What will happen to my equity awards?

●Prior to closing of the transaction, outstanding equity awards will continue to vest and settle according to their normal vesting schedule.

●At transaction close, any vested and unsettled or unexercised equity awards will be converted into the right to receive an amount in cash, subject to applicable withholding

taxes, equal to the product of (i) the number of shares of stock subject to such equity award and (ii) $11.00 (less any applicable exercise price).

●At transaction close, any unvested equity awards will be converted into the right to receive an amount in cash, subject to applicable withholding taxes, equal to the product of (i) the number of shares of stock subject to such unvested equity award and (ii) $11.00 (less applicable any exercise price). Such cash payment will be subject to your continued service with Rover through the same vesting dates as the underlying equity award and will vest and be payable at the same time and under the same conditions as the underlying equity award for which such cash payment was exchanged, subject to the terms and conditions of the applicable award agreement and equity plan pursuant to which such equity award was granted.

●Any cash payments made pursuant to any equity award will be executed through Rover’s payroll and will be taxed as ordinary income.

How will I be taxed on my equity holdings?

●The tax consequences vary depending on the type of equity (stock, RSUs or stock options), your personal circumstances, and where you live. Please consult with your tax advisor for any tax questions.

What will happen to my equity awards if the transaction does not close?

●If the transaction does not close, your equity awards will continue to vest according to the established vesting schedule and will continue to cover shares of Rover’s common stock.

If I want specific information about how to manage my stock and equity awards, who should I speak to?

●Rover does not give financial advice to our employees. We suggest you speak to a financial advisor if you have specific questions.

What will happen to our benefits, 401K, etc.?

●Employees will remain on their existing benefits, employee plans, and programs for the time being.

●If we choose to make changes, any changes to your current benefits will be thoroughly communicated as we move forward.

Who can I talk to if I have other questions about my equity and Shareworks?

●Please contact equity@rover.com.

Can I continue to buy and/or sell shares of Rover stock prior to the transaction closing?

●Yes. Unless you have been specifically notified that you are not allowed to trade, if the trading window is open, you are permitted to both buy and sell Rover shares that you own as long as the trades are in compliance with Rover’s Insider Trading Policy (including that you do not possess material nonpublic information at the time of the trade), including any pre-clearance requirements that may apply to you, and you are not trading while in possession of material nonpublic information. The current trading window is open until Friday, December 15, 2023. Until the acquisition closes, we expect trading windows to open and close in accordance with our normal practice. If you have questions about the Insider Trading Policy or if you need help evaluating whether you have material nonpublic information regarding Rover, please reach out to the legal department at complianceofficer@rover.com.

Who should I contact with questions about the transaction?

●If you have any questions about this transaction, please speak with your manager or a member of our leadership team.

An investor/ stockholder, analyst, or member of the press has reached out to me. What should I do?

●If you receive any investor/stockholder or analyst inquiries, in accordance with our External Communications Policy do not respond and forward the inquiry to Walter Ruddy (walter.ruddy@rover.com).

●If you receive any press or media inquiries, do not respond and forward the inquiry to Kristin Sandberg (kristin.sandberg@rover.com).

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending acquisition of the Company by private equity funds managed by Blackstone (the “Merger”) and the expected timing of the closing of the Merger and other statements that concern the Company’s expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made by, and information currently available to, the Company. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not

be completed on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of required approval from the Company’s stockholders and required regulatory approval; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement with private equity funds managed by Blackstone, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) uncertainty as to timing of completion of the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s Class A common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement on Schedule 14A that the Company will file with the SEC relating to its special meeting of stockholders will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The information that can be accessed through hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This communication is being made in respect of the Merger. In connection with the proposed Merger, the Company will file with the SEC a proxy statement on Schedule 14A relating to its special meeting of stockholders and may file or furnish other documents with the SEC regarding the

Merger. When completed, a definitive proxy statement will be mailed to the Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Company’s website at investors.rover.com under the link “Financials” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations department via e-mail at investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan Siegler, who are the non-employee members of the Company’s Board of Directors, Aaron Easterly, the Company’s Chief Executive Officer and Chairperson of the Board, Brent Turner, the Company’s President and Chief Operating Officer, and Charlie Wickers, the Company’s Chief Financial Officer, are participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information regarding the Company’s directors and executive officers (other than for Mr. Prusch), including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Board of Directors and Corporate Governance—Director Compensation,” and “Executive Compensation—Outstanding Equity Awards at Fiscal 2022 Year-End” contained in the Company’s 2023 annual proxy statement filed with the SEC on April 28, 2023 (the "2023 Proxy Statement"). To the extent that the Company’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC. Since the filing of the 2023 Proxy Statement, (1) Ms. Cohen received a grant of 19,417 restricted stock units (“RSUs”) and Mr. Gottesman, Ms. Leslie and Ms. Siegler each received a grant of 33,273 RSUs, which will each vest in full on the earlier of June 16, 2024 or the date of the next annual meeting of the Company’s stockholders, in each case subject to the applicable director continuing to be a non-employee director through the applicable vesting date, and (2) Mr. Prusch received a grant of 54,855 RSUs, which will vest 1/3 on each of September 7, 2024, September 7, 2025 and September 7, 2026, subject to him continuing to be a non-employee director through the applicable vesting dates. In the Merger, outstanding equity awards held by each non-employee director will fully vest immediately prior to the consummation of the Merger provided that the non-employee director continues to be a non-employee director through such date, and outstanding equity awards held by Mr. Easterly, Mr. Turner and Mr. Wickers will be treated in accordance with their respective severance and change in control agreements and as described in the 2023 Proxy Statement under the caption “Executive Compensation—Potential Payments Upon Termination or Change in Control.” Additionally, pursuant to the Business Combination Agreement, dated as of

February 10, 2021, by and among Nebula Caravel Acquisition Corp., Fetch Merger Sub, Inc., and A Place for Rover, Inc., an affiliate of Mr. Clammer has been issued restricted shares of the Company’s Class A common stock that will fully vest immediately prior to the consummation of the Merger and Mr. Easterly, Mr. Ganesan, Mr. Gottesman, Mr. Jacobson, Mr. Turner and their respective affiliates will be issued additional shares of the Company’s Class A common stock immediately prior to the consummation of the Merger. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement for the Company’s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of the Merger when they become available. These documents can be obtained free of charge from the sources indicated above.

(iii) Email to Employees after All Company Meeting

From: Comms Alias

To: global_team, goodpup

Subject: Rover & Blackstone - Next Steps

Date: November 29, 2023

Team,

Thank you to those who were able to join our All Company Meeting this morning. I hope you can tell how optimistic we are about the next phase of the Rover story. While it’s normal to have some questions, it's also exciting to think about the doors that can be unlocked with the knowledge, expertise and capital that comes with an acquisition by Blackstone. We truly believe this development is a validation of our hard work to date, and a strong indication of the positive things to come.

Today’s announcement is the first step in the acquisition process. It will be business-as-usual before closing as Rover will remain an independent public company until that time. As the transaction proceeds, we’ll update the team as appropriate. In the interim, we want to make sure all pertinent information is accessible and have created a page on confluence where we’ll host our FAQs and key reminders.

For any team members unable to attend the All Company Meeting, please let your manager know and they’ll set up time with you to answer any questions you may have.

On behalf of the entire leadership team, thank you again for your continued commitment to making it possible for everyone to experience the unconditional love of pets.

Warmly,

Rover Senior Leadership

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending acquisition of the Company by private equity funds managed by Blackstone (the “Merger”) and the expected timing of the closing of the Merger and other statements that concern the Company’s expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made by, and information currently available to, the Company. Because such statements are based on

expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of required approval from the Company’s stockholders and required regulatory approval; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement with private equity funds managed by Blackstone, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) uncertainty as to timing of completion of the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s Class A common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement on Schedule 14A that the Company will file with the SEC relating to its special meeting of stockholders will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The information that can be accessed through hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This communication is being made in respect of the Merger. In connection with the proposed Merger, the Company will file with the SEC a proxy statement on Schedule 14A relating to its special meeting of stockholders and may file or furnish other documents with the SEC regarding the Merger. When completed, a definitive proxy statement will be mailed to the Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Company’s website at investors.rover.com under the link “Financials” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations department via e-mail at investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan Siegler, who are the non-employee members of the Company’s Board of Directors, Aaron Easterly, the Company’s Chief Executive Officer and Chairperson of the Board, Brent Turner, the Company’s President and Chief Operating Officer, and Charlie Wickers, the Company’s Chief Financial Officer, are participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information regarding the Company’s directors and executive officers (other than for Mr. Prusch), including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Board of Directors and Corporate Governance—Director Compensation,” and “Executive Compensation—Outstanding Equity Awards at Fiscal 2022 Year-End” contained in the Company’s 2023 annual proxy statement filed with the SEC on April 28, 2023 (the "2023 Proxy Statement"). To the extent that the Company’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC. Since the filing of the 2023 Proxy Statement, (1) Ms. Cohen received a grant of 19,417 restricted stock units (“RSUs”) and Mr. Gottesman, Ms. Leslie and Ms. Siegler each received a grant of 33,273 RSUs, which will each vest in full on the earlier of June 16, 2024 or the date of the next annual meeting of the Company’s stockholders, in each case subject to the applicable director continuing to be a non-employee director through the applicable vesting date, and (2) Mr. Prusch received a grant of 54,855 RSUs, which will vest 1/3 on each of September 7, 2024, September 7, 2025 and September 7, 2026, subject to him continuing to be a non-employee director through the applicable vesting dates. In the Merger, outstanding equity awards held by each non-employee director will fully vest immediately prior to the consummation of the Merger provided that the non-employee director continues to be a non-employee director through such date, and outstanding equity awards held by Mr. Easterly, Mr. Turner and Mr. Wickers will be treated in accordance with

their respective severance and change in control agreements and as described in the 2023 Proxy Statement under the caption “Executive Compensation—Potential Payments Upon Termination or Change in Control.” Additionally, pursuant to the Business Combination Agreement, dated as of February 10, 2021, by and among Nebula Caravel Acquisition Corp., Fetch Merger Sub, Inc., and A Place for Rover, Inc., an affiliate of Mr. Clammer has been issued restricted shares of the Company’s Class A common stock that will fully vest immediately prior to the consummation of the Merger and Mr. Easterly, Mr. Ganesan, Mr. Gottesman, Mr. Jacobson, Mr. Turner and their respective affiliates will be issued additional shares of the Company’s Class A common stock immediately prior to the consummation of the Merger. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement for the Company’s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of the Merger when they become available. These documents can be obtained free of charge from the sources indicated above.

(iv) Reactive FAQs for Operations Agents

Reactive FAQ - Ops

●For calls

●For chat

●For email

General:

●What was announced?

○On November 29, 2023, Rover announced that it agreed to be acquired by funds affiliated with Blackstone.

●Who is Blackstone?

○Blackstone is a leading investment firm with a stellar reputation for investing in technology companies with great management teams to accelerate their growth.

●Is this good news for Rover?

○Yes. This is the beginning of a collaborative partnership that will enhance and accelerate our opportunities for growth.

●Does this mean that Rover will no longer be a public company?

○Yes. Once the transaction officially closes, our shares will no longer be publicly listed and we will become a private company.

●What if I have additional questions regarding the transaction?

○Further details can be found in Rover’s public filings, which will be posted on investors.rover.com.

●Where can I learn more about this change in ownership?

○On November 29, 2023, Rover issued a press release about this announcement. You can read the press release on investors.rover.com.

Pet Care Providers/Sitters:

●What does this mean for me as a sitter? Does it change how I am paid?

○Our relationships with pet care providers will not change because of this transaction. Blackstone is fully committed to our vision, our team and our commitment to our customers.

○Our day-to-day operations will remain business as usual. Rover will continue to provide high-quality service to its pet care providers. While Rover’s ownership will change upon the close of the transaction, you’ll experience the same service and support that you have come to expect from Rover.

Pet Parents/Owners:

●What does this mean for me as a pet owner on the Rover platform? What changes?

○Our relationships with pet parents will not change because of this transaction. Blackstone is fully committed to our vision, our team and our commitment to our customers.

○Our day-to-day operations will remain business as usual. Rover will continue to provide high-quality service to its pet parents. While Rover’s ownership will change upon the close of the transaction, you’ll experience the same service and support that you have come to expect from Rover.

Chat + Email Reactive:

Snippet:

Thank you for reaching out. The morning of November 29, 2023, Rover issued a press release about an agreement to be acquired by funds affiliated with Blackstone. The best place to find further information about this announcement is at www.sec.gov or investors.rover.com.

Best,

[agent name]

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending acquisition of the Company by private equity funds managed by Blackstone (the “Merger”) and the expected timing of the closing of the Merger and other statements that concern the Company’s expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made by, and information currently available to, the Company. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of required approval from the Company’s stockholders and required regulatory approval; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement with private equity funds managed by Blackstone, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others

with whom it does business; (vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) uncertainty as to timing of completion of the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s Class A common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement on Schedule 14A that the Company will file with the SEC relating to its special meeting of stockholders will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The information that can be accessed through hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This communication is being made in respect of the Merger. In connection with the proposed Merger, the Company will file with the SEC a proxy statement on Schedule 14A relating to its special meeting of stockholders and may file or furnish other documents with the SEC regarding the Merger. When completed, a definitive proxy statement will be mailed to the Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Company’s website at investors.rover.com under the link “Financials”

and then under the link “SEC Filings” or by contacting the Company’s Investor Relations department via e-mail at investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan Siegler, who are the non-employee members of the Company’s Board of Directors, Aaron Easterly, the Company’s Chief Executive Officer and Chairperson of the Board, Brent Turner, the Company’s President and Chief Operating Officer, and Charlie Wickers, the Company’s Chief Financial Officer, are participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information regarding the Company’s directors and executive officers (other than for Mr. Prusch), including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Board of Directors and Corporate Governance—Director Compensation,” and “Executive Compensation—Outstanding Equity Awards at Fiscal 2022 Year-End” contained in the Company’s 2023 annual proxy statement filed with the SEC on April 28, 2023 (the "2023 Proxy Statement"). To the extent that the Company’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC. Since the filing of the 2023 Proxy Statement, (1) Ms. Cohen received a grant of 19,417 restricted stock units (“RSUs”) and Mr. Gottesman, Ms. Leslie and Ms. Siegler each received a grant of 33,273 RSUs, which will each vest in full on the earlier of June 16, 2024 or the date of the next annual meeting of the Company’s stockholders, in each case subject to the applicable director continuing to be a non-employee director through the applicable vesting date, and (2) Mr. Prusch received a grant of 54,855 RSUs, which will vest 1/3 on each of September 7, 2024, September 7, 2025 and September 7, 2026, subject to him continuing to be a non-employee director through the applicable vesting dates. In the Merger, outstanding equity awards held by each non-employee director will fully vest immediately prior to the consummation of the Merger provided that the non-employee director continues to be a non-employee director through such date, and outstanding equity awards held by Mr. Easterly, Mr. Turner and Mr. Wickers will be treated in accordance with their respective severance and change in control agreements and as described in the 2023 Proxy Statement under the caption “Executive Compensation—Potential Payments Upon Termination or Change in Control.” Additionally, pursuant to the Business Combination Agreement, dated as of February 10, 2021, by and among Nebula Caravel Acquisition Corp., Fetch Merger Sub, Inc., and A Place for Rover, Inc., an affiliate of Mr. Clammer has been issued restricted shares of the Company’s Class A common stock that will fully vest immediately prior to the consummation of the Merger and Mr. Easterly, Mr. Ganesan, Mr. Gottesman, Mr. Jacobson, Mr. Turner and their respective affiliates will be issued additional shares of the Company’s Class A common stock immediately prior to the consummation of the Merger. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement for the Company’s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of

the Merger when they become available. These documents can be obtained free of charge from the sources indicated above.

(v) LinkedIn Post

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the pending acquisition of the Company by private equity funds managed by Blackstone (the “Merger”) and the expected timing of the closing of the Merger and other statements that concern the Company’s expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made by, and information currently available to, the Company. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number

of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of required approval from the Company’s stockholders and required regulatory approval; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement with private equity funds managed by Blackstone, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) uncertainty as to timing of completion of the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s Class A common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement on Schedule 14A that the Company will file with the SEC relating to its special meeting of stockholders will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The information that can be accessed through hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This communication is being made in respect of the Merger. In connection with the proposed Merger, the Company will file with the SEC a proxy statement on Schedule 14A relating to its special meeting of stockholders and may file or furnish other documents with the SEC regarding the Merger. When completed, a definitive proxy statement will be mailed to the Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Company’s website at investors.rover.com under the link “Financials” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations department via e-mail at investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan Siegler, who are the non-employee members of the Company’s Board of Directors, Aaron Easterly, the Company’s Chief Executive Officer and Chairperson of the Board, Brent Turner, the Company’s President and Chief Operating Officer, and Charlie Wickers, the Company’s Chief Financial Officer, are participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information regarding the Company’s directors and executive officers (other than for Mr. Prusch), including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Board of Directors and Corporate Governance—Director Compensation,” and “Executive Compensation—Outstanding Equity Awards at Fiscal 2022 Year-End” contained in the Company’s 2023 annual proxy statement filed with the SEC on April 28, 2023 (the "2023 Proxy Statement"). To the extent that the Company’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as of” date disclosed in the 2023 Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC. Since the filing of the 2023 Proxy Statement, (1) Ms. Cohen received a grant of 19,417 restricted stock units (“RSUs”) and Mr. Gottesman, Ms. Leslie and Ms. Siegler each received a grant of 33,273 RSUs, which will each vest in full on the earlier of June 16, 2024 or the date of the next annual meeting of the Company’s stockholders, in each case subject to the applicable director continuing to be a non-employee director through the applicable vesting date, and (2) Mr. Prusch received a grant of 54,855 RSUs, which will vest 1/3 on each of September 7, 2024, September 7, 2025 and September 7, 2026, subject to him continuing to be a non-employee director through the applicable vesting dates. In the Merger, outstanding equity awards held by each non-employee director will fully vest immediately prior to the consummation of the Merger provided that the non-employee director continues to be a non-employee director through such date, and outstanding equity awards held by Mr. Easterly, Mr. Turner and Mr. Wickers will be treated in accordance with their respective severance and change in control agreements and as described in the 2023 Proxy Statement under the caption “Executive Compensation—Potential Payments Upon Termination or Change in Control.” Additionally, pursuant to the Business Combination Agreement, dated as of February 10, 2021, by and among Nebula Caravel Acquisition Corp., Fetch Merger Sub, Inc., and A Place for Rover, Inc., an affiliate of Mr. Clammer has been issued restricted shares of the Company’s Class A common stock that will fully vest immediately prior to the consummation of the Merger and Mr. Easterly, Mr. Ganesan, Mr. Gottesman, Mr. Jacobson, Mr. Turner and their respective affiliates will be issued additional shares of the Company’s Class A common stock immediately prior to the consummation of the Merger. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the proxy statement for the Company’s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of the Merger when they become available. These documents can be obtained free of charge from the sources indicated above.

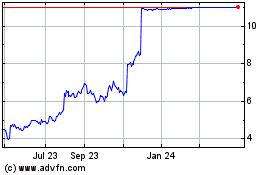

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Apr 2024 to May 2024

Rover (NASDAQ:ROVR)

Historical Stock Chart

From May 2023 to May 2024