false

0001427570

0001427570

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December

11, 2024

RESHAPE LIFESCIENCES

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

1-37897 |

26-1828101 |

|

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification

Number) |

| |

|

|

|

18 Technology Drive, Suite 110,

Irvine, CA |

92618 |

| (Address of principal executive offices) |

(Zip Code) |

| |

|

|

|

(949) 429-6680

(Registrant’s

telephone number, including area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of Class |

Trading

Symbol |

Name

of Exchange on which Registered |

| Common stock, $0.001 par value per share |

RSLS |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

Representatives of ReShape Lifesciences Inc. (the “Company”)

and Vyome Therapeutics, Inc. intend to make presentations at investor conferences and in other forums and these presentations may

include the information contained in Exhibit 99.1 attached to this Current Report on Form 8-K. A copy of the presentation slides

containing such information that may be disclosed by the Company is attached as Exhibit 99.1 to this report and the information set

forth therein is incorporated herein by reference and constitutes a part of this report.

The Company is furnishing the information contained in Exhibit 99.1

pursuant to Regulation FD and Item 7.01 of Form 8-K promulgated by the Securities and Exchange Commission (“SEC”). This

information shall not be deemed to be “filed” with the SEC for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set

forth by specific reference in such filing.

The information contained in Exhibit 99.1 is summary information

that is intended to be considered in the context of the Company’s SEC filings and other public announcements that the Company may

make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the

information contained in Exhibit 99.1, although it may do so from time to time as its management believes is warranted. Any such

updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

By filing this report and furnishing this information, the Company makes no admission as to the materiality of any information contained

in this report, including Exhibit 99.1.

Additional Information

In connection with the proposed merger with Vyome Therapeutics, Inc.

(the “Merge”) and sale of assets to Biorad Medisys of an affiliate thereof (the “Asset Sale”), ReShape plans to

file with the Securities and Exchange Commission (the “SEC”) and mail or otherwise provide to its stockholders a joint proxy

statement/prospectus and other relevant documents in connection with the proposed Merger and Asset Sale. Before making a voting decision,

ReShape’s stockholders are urged to read the joint proxy statement/prospectus and any other documents filed by ReShape with the

SEC in connection with the proposed Merger and Asset Sale or incorporated by reference therein carefully and in their entirety when they

become available because they will contain important information about ReShape, Vyome and the proposed transactions. Investors and stockholders

may obtain a free copy of these materials (when they are available) and other documents filed by ReShape with the SEC at the SEC’s

website at www.sec.gov, at ReShape’s website at www.reshapelifesciences.com, or by sending a written request to ReShape at 18 Technology

Drive, Suite 110, Irvine, California 92618, Attention: Corporate Secretary.

Participants in the Solicitation

This document

does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities of ReShape and

its directors, executive officers and certain other members of management and employees may be deemed to be participants in soliciting

proxies from its stockholders in connection with the proposed Merger and Asset Sale. Information regarding the persons who may, under

the rules of the SEC, be considered to be participants in the solicitation of ReShape’s stockholders in connection with the

proposed Merger and Asset Sale will be set forth in joint proxy statement/prospectus if and when it is filed with the SEC by ReShape and

Vyome. Security holders may obtain information regarding the names, affiliations and interests of ReShape’s directors and officers

in ReShape’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 1,

2024. To the extent the holdings of ReShape securities by ReShape’s directors and executive officers have changed since the amounts

set forth in ReShape’s proxy statement for its most recent annual meeting of stockholders, such changes have been or will be reflected

on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding these individuals and any direct

or indirect interests they may have in the proposed Merger and Asset Sale will be set forth in the joint proxy statement/prospectus when

and if it is filed with the SEC in connection with the proposed Merger and Asset Sale, at ReShape’s website at www.reshapelifesciences.com.

Forward-Looking Statements

Certain statements contained in this filing may be considered forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Merger and Asset

Sale and the ability to consummate the Merger and Asset Sale. These forward-looking statements generally include statements that are predictive

in nature and depend upon or refer to future events or conditions, and include words such as “believes,” “plans,”

“anticipates,” “projects,” “estimates,” “expects,” “intends,” “strategy,”

“future,” “opportunity,” “may,” “will,” “should,” “could,” “potential,”

or similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based

on current beliefs and assumptions that are subject to risks and uncertainties. Forward-looking statements speak only as of the date they

are made, and ReShape undertakes no obligation to update any of them publicly in light of new information or future events. Actual results

could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation:

(1) ReShape may be unable to obtain stockholder approval as required for the proposed Merger and Asset Sale; (2) conditions

to the closing of the Merger or Asset Sale may not be satisfied; (3) the Merger and Asset Sale may involve unexpected costs, liabilities

or delays; (4) ReShape’s business may suffer as a result of uncertainty surrounding the Merger and Asset Sale; (5) the

outcome of any legal proceedings related to the Merger or Asset Sale; (6) ReShape may be adversely affected by other economic, business,

and/or competitive factors; (7) the occurrence of any event, change or other circumstances that could give rise to the termination

of the Merger Agreement or Asset Purchase Agreement; (8) the effect of the announcement of the Merger and Asset Purchase Agreement

on the ability of ReShape to retain key personnel and maintain relationships with customers, suppliers and others with whom ReShape does

business, or on ReShape’s operating results and business generally; and (9) other risks to consummation of the Merger and Asset

Sale, including the risk that the Merger and Asset Sale will not be consummated within the expected time period or at all. Additional

factors that may affect the future results of ReShape are set forth in its filings with the SEC, including ReShape’s most recently

filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings

with the SEC, which are available on the SEC’s website at www.sec.gov, specifically under the heading “Risk Factors.”

The risks and uncertainties described above and in ReShape’s most recent Annual Report on Form 10-K are not exclusive and further

information concerning ReShape and its business, including factors that potentially could materially affect its business, financial condition

or operating results, may emerge from time to time. Readers are urged to consider these factors carefully in evaluating these forward-looking

statements, and not to place undue reliance on any forward-looking statements. Readers should also carefully review the risk factors described

in other documents that ReShape files from time to time with the SEC. The forward-looking statements in these materials speak only as

of the date of these materials. Except as required by law, ReShape assumes no obligation to update or revise these forward-looking statements

for any reason, even if new information becomes available in the future.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

ENTEROMEDICS INC. |

| |

|

| |

By: |

/s/ Paul F. Hickey |

| |

|

Paul F. Hickey |

| |

|

Chief Executive Officer |

Dated: December 11, 2024

Exhibit 99.1

| Vyome

A US-India healthcare platform with clinical-stage immuno-inflammation assets

PENDING MERGER $RSLS TO $HIND

CORPORATE PRESENTATION DECEMBER 2024 |

| VYOME THERAPEUTICS, INC. (“Vyome”)

Any statements contained in this presentation that do not describe historical facts may constitute forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “believe,” “expect,” “may,”

“plan,” “potential,” “will,” and similar expressions, and are based on Vyome’s current beliefs and expectations. These forward-looking statements

include expectations regarding Vyome’s development of its drug candidates, including the timing of its clinical trials and regulatory

submissions. These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such

statements. Risks and uncertainties that may cause actual results to differ materially include uncertainties inherent in the conduct of clinical

trials, Vyome's reliance on third parties over which it may not always have full control, public health crises, epidemics and pandemics such as

the COVID-19 pandemic, including its impact on the timing of Vyome’s regulatory and research and development activities, Any forward-looking statements speak only as of the date of this presentation and are based on information available to Vyome as of the date of this

presentation. and Vyome assumes no obligation to, and does not intend to, update any forward-looking statements, whether as a result of new

information, future events or otherwise.

This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other

data about our industry. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such

estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which

we operate are necessarily subject to a high degree of uncertainty and risk. References to any publications, reports, surveys or articles prepared

by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in

any such publication, report, surveys or article is not incorporated by reference in this presentation.

2 |

| Vyome is building a 3-pillared healthcare

platform in the US-India innovation corridor

..We intend to list on Nasdaq via reverse merger with $RSLS under the ticker $HIND

We have invested nearly a decade and millions of

dollars to build a set of immuno-inflammatory

assets with several 12-24 month catalysts

DID YOU KNOW…

an ancient name

for India

$125B+ by 2028*

The immuno-inflammatory

market is expected to be

HIND Cambridge, MA HQ

Home to MIT and Harvard

3

*Allied Market Research – Anti-Inflammatory Therapeutics Market Review |

| At Vyome, we are passionate about transforming healthcare based on

world-class science & talent leveraging the US-India innovation corridor

Pharma Medical devices AI in healthcare

VYOME ($RSLS -> $HIND)

US INDIA

4

Vyome has a 3-pillar plan

and it intends to build, acquire, or partner with assets in each pillar |

| 1

2

3

Lower-risk biotech

assets with significant

catalysts in the next

12-24 months

Compelling

valuation based on

comparable

transactions; no debt

Powerful US-India

value capture

opportunity at the

optimal time

• Vyome has been developing Indian research

talent for a decade

• US-India relationship expected to grow significantly,

especially under the Trump-Modi governments,

leading to further capital markets and innovation

opportunities to capture

• Using known drugs for new unmet

indications (reduces risk)

• Going after indications that offer low regulatory bar

for approval (lower cash need)

• Large market opportunity with near-term catalysts

• A significant discount to a well-supported valuation

• No debt and clean capital structure

• At the intersection of several positive public

investor themes: biotech, innovation, global macro,

and emerging markets

Why

invest in

Vyome?

We believe we would be the first

venture-backed Indo-US

biopharma to list on the Nasdaq

5 |

| US-India special relationship and our positioning unlocks

significant capital markets and innovation opportunity

Ambassador Frank Wisner

Former US Ambassador to India &

Vyome Board Member to-be

Act on emerging health tech

opportunities through deal-making

Create cost arbitrage opportunities

for capital efficiency

Access capital markets looking for

plays on US/India innovation

6 |

| The current biotech assets offer a low-risk way to

unlock significant value over the next 12-24 months

Malignant Fungating Wound

Uveitis (steroid replacement)

Inflammatory acne*

$2.5B1

Market

size

$6M

Capital

required

2027

Potential value

inflection timeline

$2.6B2 $3M

$6.0B3 -

(pivotal data)

by 2032

2026

Phase 1

by 2028*

2025

Potential partnership deal

1 Based on 60-100K patients in U.S. (10% of ~600K cancer deaths per year in U.S.), and 1M patients globally (10% of ~10M advanced cancer patients). Based on average of 5-15% incidence of

cancer patients developing MFW (from The Microbiome, Malignant Fungating Wounds, and Palliative Care. Front. Cell. Infect. Microbiol., November 2019).

2. https://www.imarcgroup.com/uveitis-treatment-market

3. Total global acne market is forecasted to grow to $11.6B by 2028. https://www.marketdataforecast.com/market-reports/acne-medication-market

Inflammatory acne comprises over 50% of the acne market. https://www.verifiedmarketresearch.com/product/acne-medication-market/

Vyome

assets

7 |

| What is MFW?

MFW is a non-healing wound that occurs when cancer

breaks through the skin, causing infection and inflammation.

Patients suffer from extreme odor, pain, low self-esteem, and

social isolation.

MFW afflicts ~10%* of terminal cancer patients & generates

a strong odor that dramatically impairs quality of life and

care for a patient’s final years

No approved drug and thus potential orphan designation with faster track to development

Why is Vyome best-positioned?

Malignant Fungating Wound (MFW) is $1B/year unmet need with no

approved drug; the latest data on Vyome’s drug shows strong efficacy1

New data released in December 2024 shows a

75%+ reduction in odor and 50%+ increase in

quality of life

60,0002new patients/year

$10-20K3 lifetime value per patient US market opportunity

~$1B4/year

Vyome’s lead drug has the right mechanism

to treat the symptoms of MFW

The company will actively engage with the FDA

in 2025 as it plans an efficient pivotal trial

8

* The Microbiome, Malignant Fungating Wounds, and Palliative Care. Front. Cell. Infect.

Microbial., November 2019, EASED study (2023).

1. Investigator-initiated proof of concept phase 2 clinical study of VT-1953

2 The Microbiome, Malignant Fungating Wounds, and Palliative Care. Front. Cell. Infect. Microbial., November 2019, EASED study (2023)

https://acsjournals.onlinelibrary.wiley.com/doi/10.3322/caac.21820

3. Average 60 days of treatment needed per patient: (From Kuge et al, Jpn J Clin Oncol, 1995). Total cost per patient: $200 ×60 Days= $12,000.. $200 per day

arrived at using the cost of an average gel tube cost and the amount of gel needed per day (Watanabe et al, Support Care Cancer. 2016; 24: 2583–2590),

assuming average MFW size of 57cm² (Pen and Dai et al,J of Int. Med Res, 2019 )..

4. 60K patients multiplied by an average of $16K pricing will come ot ~$1B |

| Vyome’s 2 biotech asset areas form a pipeline

addressing large unmet markets

Use an unmet orphan indication for low-risk and cost-efficient development to open larger opportunities

Our strategy

Pivotal studies in 2024

MFW

A DNA Gyr/MD2-TLR inhibitor

Potential FDA filing for MFW in 2027

Topical inflammatory diseases

~$15.8B

by 20322

Diabetic

foot ulcer

~$6B

by 20283

Inflammatory

Acne

1. https://www.skyquest.com/report/pressure-ulcers-treatment-market#:~:text=Global%20Pressure%20Ulcers%20Treatment%20Market%20Insights,period%20(2023%2D2030).

2. https://www.gminsights.com/industry-analysis/diabetic-ulcers-treatment-market

3 Total global acne market is forecasted to grow to $11.6B by 2028. https://www.marketdataforecast.com/market-reports/acne-medication-market

Inflammatory acne comprises over 50% of the acne market. https://www.verifiedmarketresearch.com/product/acne-medication-market/

~$9.5B

by 2030¹

Pressure

sores

~$8.73Bc

by 2033

Post-operative

cataract surgery

inflammation

IMPDH inhibitor

Uveitis

Potential FDA filing for uveitis in 2029

Steroid replacement for inflammatory ophthalmic diseases

~$13Bb

by 2030

Dry-eye-disease

~$4.7Ba

by 2030

Scleritis

Phase 1 in Q3 2026

~$2.3Bd

by 2031

Blepharitis

9

a. Market Research Future – Scleritis Market.

b. Fortune Business Insights – Dry Eye Syndrome Market

c. Future Market Insights – Post Operative Cataract Surgery Inflammation Market.

d. Business Research Insights – Blepharitis Market Report. |

| Vyome is focused on unlocking multiple value inflection points

from its core pharma assets over the next 12-24 months

MFW Program (anticipated milestones)

Uveitis Program (anticipated milestones)

Q1 2025 Q2/Q3 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026

IIT study

interim

read outs

Appointment

of CRO for

pivotal

study. Full

readout of IIT

study.

Pivotal trial

protocol

approved

by FDA

First patient

recruitment

25%

of patient

recruitment

completed

50%

of patient

recruitment

completed

75%

recruitment

completed

100%

recruitment

completed

Pivotal

study

Readouts

Q4 2024

Pre-IND

meeting, IIT

study start

Pre-IND

Tox

Tox, CMC IND filing First patient

recruitment

Last patient

Anticipated close recruitment

of Nasdaq

reverse-merger

Key catalysts

FDA

approval of

Phase 1 & 2

study

protocol

Q2 2026

Study

Readouts

Q1 2027

10 |

| Vyome has a compelling entry valuation, no debt,

and a narrative appealing to several types of investors

merger valuation

$120M

market comparables

valuation

$400M+

debt

$0M

Themes investors

allocate

4

Healthcare

India

Innovation

Global macro

11 |

| Notes: Stage / Phase, Modality, and Market Size refer to that of the Company’s Lead Program / Platform.

1) Vyome market capitalization is based on the implied value attributed to the Company in the reverse merger process.

Additional sources: Company websites, press releases, presentations, reports, and filings, FactSet market data as of 11/01/2024.

Lead Indication

Stage / Phase

Market Size

Program Stages

Market Cap

($MM)

Metastatic

Castrate Resistant

Prostate Cancer

Phase 1/2

~$13B

(2023)

3 clinical

0 pre-clinical

$134

Pulmonary

Arterial

Hypertension

Phase 2

~$7B

(2023)

1 clinical

0 pre-clinical

$198

Chronic

Granulomatous

Disease (CGD)

Phase 1/2

~1.3B

(2023)

1 clinical

5 pre-clinical

$529

Psoriasis

Phase 2

~$25B

(2023)

3 clinical

2 pre-clinical

$534

Severe Asthma,

CRSwNP, & COPD

Phase 2

~7.5B

(2023)

3 clinical

0 pre-clinical

$1,271

Myasthenia

Gravis & Thyroid

Eye Disease

Phase 3

~$4B

(2023)

4 clinical

1 pre-clinical

$4,314

~$3B

(Current)

2 clinical

1 pre-clinical

$120

Malignant fun

gating wound

Phase 2

(1)

Denotes aspirational comparable company

12

Public Comparables

Average Market Cap. of $419M (not including Immunovant)

Inflammation & Immunology Market Players |

| Notes: 1) Represents the market capitalizations on the trading day before it was announced that each respective company was to be acquired, unless otherwise noted. 2) Vyome market capitalization is based on the implied value attributed to the Company in the reverse merger process. 3) Landos Biopharma’s market capitalization represents

the aggregate transaction value of the Company’s pending acquisition by AbbVie at $20.42 per share in cash upon closing (~$137.5MM) plus one non-tradable contingent value right per share with a value of up to $11.14 per share (an additional ~$75MM), subject to the achievement of a clinical development milestone. 4) Escient

Pharmaceutical’s market capitalization represents the aggregate transaction cost that Incyte acquired the Company and its assets for plus its net cash remaining at the close of the transaction, subject to customary adjustments.

Additional sources: Company websites, press releases, presentations, reports, and filings, FactSet market data.

Inflammatory

bowel disease

Phase 2

~$30B

(Current)

1 clinical

0 pre-clinical

$5,419

Lead Indication

Stage / Phase

Market Size

Program Stages

Market Cap

($MM)

Atopic

dermatitis

Phase 2

~$9.3B

(2023)

2 clinical

0 pre-clinical

$750

~$3B

(Current)

2 clinical

1 pre-clinical

$120

Ulcerative

colitis

Phase 2

~$9B

(2031)

1 clinical

3 pre-clinical

$213

Inflammatory

bowel disease

Phase 2

~$30B

(Current)

1 clinical

0 pre-clinical

$1,595

Ulcerative colitis

Phase 3

~$9B

(2031)

4 clinical

1 pre-clinical

$3,063

Systemic lupus

erythematosus

Phase 2

~$3B

(2025)

2 clinical

2 pre-clinical

$2,553

Psoriasis

Phase 2

~$25B

(2023)

1 clinical

3 pre-clinical

$1,616

Malignant fun

gating wound

Phase 2

(1) (2) (3) (4)

Denotes private company at time of acquisition

13

Precedent M&A Comparables Acquired Inflammation & Immunology Market Players

Average Market Cap. of $2.8B (includes Morphic, DICE, Alpine, Arena, Prometheus) and

Transaction Price of $482M (includes Landos and Escient) |

| Vyome has an ideal team to execute its plan

Deep expertise in building and scaling companies; scientific thought leaders in drug development; extensive US-India crossborder experience

Dr. S Sengupta,Ph.D Venkat Nelabhotla Krishna Gupta Mohanjit Jolly

Co-Founder CEO & Co-Founder Chairman Board Member

Associate Prof. of Medicine,

Harvard Medical School

Expert in drug discovery

AIIMS Gold Medalist

Board member of Famygen,

acquired by Viatris for $300M

25+ yrs of business

experience

Led and scaled $1+ billion

companies in the healthcare &

life sciences space

Ex-CEO at Emami

$2.5B company

CEO of Remus Capital

Contrarian investor at Presto,

Allurion, EquipmentShare, Ginger

Experienced at McKinsey & JPM

2 BS degrees from MIT

Founding partner at Iron Pillar

Served as a Partner at Draper

Fisher Jurvetson for 9 years

Partner at Garage Tech Ventures

MBA from The Anderson

School, B.S. and M.S. from MIT

Board of The SETI Institute

14 |

| Disclaimer

This Presentation has been provided to you by Chardan Capital Markets, LLC ( “Chardan”) and may not be used or relied upon for any purpose

without the written consent of Chardan. The information contained herein (the “Information”) is confidential. By accepting this Information, you agree

that you and your directors, partners, officers, employees, attorney(s), agents and representatives agree to use it for informational purposes only and

will not divulge any such Information to any other party. Reproduction of this Information, in whole or in part, is prohibited. These contents are

proprietary and a product of Chardan. The Information contained herein is not an offer to buy or sell or a solicitation of an offer to buy or sell any

corporate advisory services or security or to participate in any corporate advisory services or trading strategy. Any decision regarding corporate

advisory services or to invest in the investments described herein should be made after, as applicable, reviewing such definitive offering

memorandum, conducting such investigations as you deem necessary and consulting the investor’s own investment, legal, accounting and tax

advisors in order to make an independent determination of the suitability and consequences of an investment or service.

The information used in preparing these materials may have been obtained from or through you or your representatives or from public sources.

Chardan assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate

in all material respects. To the extent such information includes estimates and/or forecasts of future financial performance (including estimates of

potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential

transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on

bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained

from public sources, represent reasonable estimates). Chardan has no obligation (express or implied) to update any or all of the Information or to

advise you of any changes; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept

responsibility for errors. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees,

representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the

transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you

relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed US federal income tax

treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed US

federal income tax treatment of the transaction.

15 |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

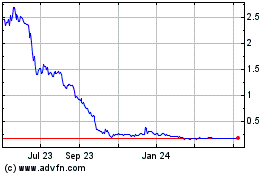

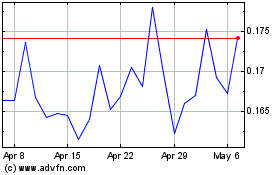

ReShape Lifesciences (NASDAQ:RSLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

ReShape Lifesciences (NASDAQ:RSLS)

Historical Stock Chart

From Dec 2023 to Dec 2024