Republic First Bancorp: Strong Buy - Analyst Blog

September 05 2012 - 11:24AM

Zacks

Upward estimate revisions on the back of strong second quarter

results – including a 300% earnings surprise – have helped

Republic First Bancorp Inc. (FRBK) achieve a Zacks

#1 Rank (Strong Buy) on September 4. Moreover, this commercial and

retail banking service provider has delivered positive earnings

surprises in three of the last four quarters.

With a solid year-to-date return of 31.1%, this stock offers an

attractive investment opportunity.

The Rank Driver

Better-than-expected second quarter earnings, solid loan growth and

fundamental strength – including strong credit quality and capital

ratios – are the primary rank drivers for this stock.

Republic First Bancorp reported its second quarter results on July

24 with earnings per share of 4 cents, beating the Zacks Consensus

Estimate of a penny significantly by 300%. It also compared

favorably with the year-ago loss of 2 cents. Robust results for the

reported quarter were primarily aided by higher non-interest

income, elevated net interest income and reduced provision for loan

losses.

Net interest margin, which contracted 2 basis points on a year-over

year basis to 3.59%, was the downside for the quarter.

Net interest income increased 6.7% to $8.0 million from $7.5

million in the year-ago quarter. The rise was primarily due to

lower cost of funds. Non-interest income jumped 19.0% year over

year to $2.5 million. Provision for loan losses skidded 66.7% from

the year-ago quarter to $0.5 million. Non-interest expense remained

almost in line with the prior-year quarter at $9.0 million.

Credit quality continued to exhibit improvement. Non-performing

loans were $10.9 million, sliding down from $38.9 million as of

June 30, 2011. Non-performing assets for the quarter were $17.0

million, plummeting significantly from $52.0 million in the

year-ago quarter. Allowance for loan losses as a percentage of

period-end loans declined to 1.55% from 2.36% in the prior-year

quarter.

As of June 30, 2012, Republic First Bancorp's total risk-based

capital ratio was 12.87%, Tier 1 risk-based capital ratio was

11.62% and Tier 1 leverage ratio was 8.99%. Tangible book value per

share came in at $2.59.

Earnings Estimate Revisions

One of two estimates has moved higher over the last 30 days for

2012 and 2013 each.

The Zacks Consensus Estimate for this year is up 50.0% to 12

cents per share, while the Zacks Consensus Estimate for the next

year gained 25.0% to reach 10 cents. The Zacks Consensus Estimate

for 2012 reflects a year-over-year improvement of about 112.6%.

Valuation

Republic First Bancorp currently trades at a forward P/E of 17.6x,

in line with the peer group average. On a price-to-book basis, the

shares are trading at 0.8x, a 20.0% discount to the peer group

average of 1.0x. Given the company's strong fundamentals, the

valuation looks reasonable.

About the Company

Headquartered in Philadelphia, Pennsylvania, Republic First Bancorp

is a bank holding company. It operates through 13 offices located

in Abington, Ardmore, Bala Cynwyd, Plymouth Meeting, Media, and

Philadelphia in Pennsylvania and Voorhees and Haddonfield in New

Jersey through its subsidiary – Republic First Bank, which offers

an array of credit and depository banking services. The company,

which was founded in 1987, has a market capitalization of roughly

$54.8 million.

Old Second Bancorp Inc. (OSBC) is also a Zacks #1

Rank bank stock.

REPUBLIC FST BC (FRBK): Free Stock Analysis Report

OLD SECOND BCP (OSBC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

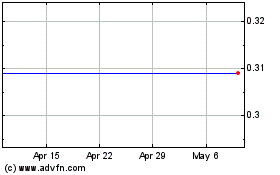

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

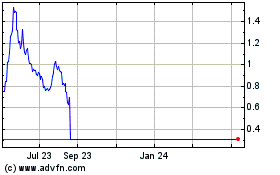

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024