0001811115Q3false--06-3000-0000000truehttp://fasb.org/us-gaap/2023#LiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityNoncurrent0001811115us-gaap:OfficeEquipmentMember2024-03-310001811115rnlx:NonInstrumentSpecificCreditRiskMember2022-07-012023-03-310001811115us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001811115us-gaap:CommonStockMember2023-07-012023-09-300001811115us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-03-3100018111152023-01-012023-03-310001811115rnlx:NonInstrumentSpecificCreditRiskMember2023-07-012024-03-310001811115rnlx:TestingServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-07-012023-03-3100018111152023-12-310001811115rnlx:AmericanDepositarySharesMemberus-gaap:IPOMemberus-gaap:SubsequentEventMember2024-04-080001811115rnlx:FirstSalesMilestoneMember2024-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012023-12-310001811115us-gaap:RetainedEarningsMember2022-12-310001811115rnlx:IcahnSchoolOfMedicineAtMountSinaiMember2023-07-012024-03-310001811115rnlx:ISSMSAndSRAMembersrt:MaximumMemberrnlx:MountSinaiMember2023-07-012024-03-3100018111152022-04-070001811115us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001811115rnlx:LabSpaceSaltLakeCityUtMember2024-03-310001811115rnlx:PharmaceuticalServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-07-012024-03-310001811115us-gaap:RetainedEarningsMember2024-01-012024-03-310001811115rnlx:RenalytixAiPlcShareOptionPlanMember2023-01-012023-03-310001811115rnlx:EmployeeSharePurchasePlanmemberMembersrt:MaximumMember2023-07-012024-03-310001811115rnlx:LabSpaceStPetersburgFlMember2023-07-012024-03-310001811115rnlx:ISSMSAndSRAMemberrnlx:MountSinaiMember2023-01-012023-03-310001811115rnlx:ISSMSAndSRAMemberrnlx:MilestoneOneMemberrnlx:KidneyIntelxMember2023-07-012024-03-310001811115us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012024-03-310001811115rnlx:IcahnSchoolOfMedicineAtMountSinaiMember2023-01-012023-03-310001811115us-gaap:PrivatePlacementMember2024-03-122024-03-120001811115us-gaap:CommonStockMember2022-07-012022-09-300001811115rnlx:IsmmsMemberrnlx:MountSinaiClinicalTrialAgreementMember2023-07-012024-03-310001811115us-gaap:CommonStockMember2022-12-310001811115rnlx:RenalytixAiPlcShareOptionPlanMember2023-03-310001811115us-gaap:CommonStockMember2023-06-300001811115stpr:UT2023-11-012023-11-300001811115rnlx:ChristopherMillsMemberus-gaap:PrivatePlacementMember2024-03-120001811115rnlx:NewOrdinarySharesMember2024-03-122024-03-120001811115us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:IPOMemberus-gaap:SubsequentEventMember2024-04-080001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001811115stpr:UT2024-02-290001811115us-gaap:AdditionalPaidInCapitalMember2023-03-310001811115us-gaap:RetainedEarningsMember2023-01-012023-03-310001811115rnlx:IsmmsMemberrnlx:MountSinaiClinicalTrialAgreementMember2023-01-012023-03-310001811115rnlx:IsmmsMemberrnlx:MountSinaiClinicalTrialAgreementMember2021-07-012021-07-310001811115rnlx:VericiDxLimitedMember2024-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012022-12-310001811115us-gaap:CustomerConcentrationRiskMemberrnlx:MountSinaiMemberus-gaap:ServiceMemberus-gaap:SalesRevenueNetMember2022-07-012023-03-310001811115us-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMemberrnlx:TwentyFivePercentVestOnTheThirdYearAnniversaryMember2023-07-012024-03-3100018111152022-04-050001811115us-gaap:RetainedEarningsMember2022-10-012022-12-310001811115us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012023-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001811115rnlx:NonInstrumentSpecificCreditRiskMember2023-01-012023-03-310001811115rnlx:ISSMSAndSRAMemberrnlx:MilestoneTwoMemberrnlx:MountSinaiMember2024-03-310001811115us-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMemberrnlx:OneTwelvethMember2023-07-012024-03-3100018111152023-02-090001811115us-gaap:SubsequentEventMember2024-04-102024-04-100001811115rnlx:ClinicalTrialAgreementMemberrnlx:WakeForestAtriumHealthMember2023-03-310001811115us-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:IcahnSchoolOfMedicineAtMountSinaiMemberus-gaap:PrivatePlacementMember2024-03-120001811115rnlx:VericiDxLimitedMember2024-03-012024-03-310001811115rnlx:FirstSalesMilestoneMember2023-03-310001811115us-gaap:RetainedEarningsMember2024-03-310001811115us-gaap:LeaseholdImprovementsMember2024-03-310001811115rnlx:TestingServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2024-01-012024-03-310001811115rnlx:AmericanDepositorySharesMember2022-04-050001811115us-gaap:MachineryAndEquipmentMember2024-03-310001811115us-gaap:RelatedPartyMember2024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-310001811115us-gaap:AdditionalPaidInCapitalMember2023-12-310001811115rnlx:AmericanDepositarySharesMemberus-gaap:SubsequentEventMember2024-04-102024-04-100001811115rnlx:ClinicalTrialAgreementMemberrnlx:WakeForestAtriumHealthMember2024-01-012024-03-310001811115rnlx:InstrumentSpecificCreditRiskMember2022-07-012023-03-310001811115rnlx:JoslinLicenseMember2023-07-012024-03-310001811115us-gaap:NonrelatedPartyMember2024-03-310001811115rnlx:ISSMSAndSRAMemberrnlx:MountSinaiMember2024-01-012024-03-310001811115us-gaap:CustomerConcentrationRiskMemberrnlx:KidneyIntelxMemberus-gaap:ServiceMemberus-gaap:SalesRevenueNetMember2023-07-012024-03-310001811115us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-04-080001811115us-gaap:RestrictedStockUnitsRSUMember2023-07-012024-03-310001811115rnlx:EkfDiagnosticsMember2023-07-012024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2023-09-300001811115us-gaap:AdditionalPaidInCapitalMember2022-10-012022-12-310001811115us-gaap:RestrictedStockUnitsRSUMember2023-06-300001811115us-gaap:RetainedEarningsMember2023-07-012023-09-300001811115us-gaap:FurnitureAndFixturesMember2024-03-310001811115rnlx:RenalytixAiPlcShareOptionPlanMember2024-01-012024-03-310001811115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001811115rnlx:PharmaceuticalServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-03-310001811115us-gaap:AdditionalPaidInCapitalMember2023-06-300001811115rnlx:VestedOnVestingCommencementDateMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:VericiDxLimitedMember2023-01-012023-03-310001811115us-gaap:RelatedPartyMember2023-06-300001811115us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001811115us-gaap:PrivatePlacementMember2024-03-120001811115us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-04-240001811115us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-03-310001811115rnlx:SafeharborplanMember2023-01-012023-03-310001811115us-gaap:CommonStockMember2023-12-310001811115rnlx:MilestoneThreeMemberrnlx:JoslinLicenseMember2023-07-012024-03-310001811115rnlx:OneThirdVestOnTheOneYearAnniversaryMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115us-gaap:RetainedEarningsMember2022-09-300001811115us-gaap:MachineryAndEquipmentMember2023-06-300001811115rnlx:SafeharborplanMember2023-07-012024-03-310001811115rnlx:EmployeeSharePurchasePlanmemberMembersrt:MinimumMember2023-07-012024-03-310001811115us-gaap:EmployeeStockOptionMember2022-07-012023-03-3100018111152023-12-012023-12-310001811115us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:IPOMemberus-gaap:SubsequentEventMember2024-04-222024-04-220001811115rnlx:MilestoneOneMemberrnlx:JoslinLicenseMember2024-03-310001811115rnlx:NewOrdinarySharesMemberus-gaap:PrivatePlacementMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-03-1200018111152023-07-012023-09-3000018111152023-07-012024-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001811115rnlx:AmericanDepositarySharesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:SubsequentEventMember2024-04-082024-04-080001811115rnlx:IcahnSchoolOfMedicineAtMountSinaiMember2024-01-012024-03-310001811115rnlx:EkfDiagnosticsMember2022-07-012023-03-310001811115us-gaap:CommonStockMember2023-03-3100018111152022-12-310001811115rnlx:IsmmsMemberrnlx:MountSinaiClinicalTrialAgreementMember2024-01-012024-03-310001811115rnlx:InstrumentSpecificCreditRiskMember2023-01-012023-03-310001811115us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:IPOMemberus-gaap:SubsequentEventMember2024-04-082024-04-0800018111152024-05-140001811115rnlx:LabSpaceNewYorkCityNyMember2024-03-310001811115rnlx:FiftyPercentVestOnSecondYearAnniversaryMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:InstrumentSpecificCreditRiskMember2023-07-012024-03-310001811115rnlx:LicensedProductsMemberrnlx:JoslinLicenseMemberrnlx:MilestoneTwoMember2023-07-012024-03-310001811115rnlx:VericiDxLimitedMember2024-03-310001811115rnlx:ClinicalTrialAgreementMemberrnlx:WakeForestAtriumHealthMember2024-03-310001811115rnlx:NewOrdinarySharesMemberus-gaap:PrivatePlacementMembersrt:MaximumMember2024-03-120001811115rnlx:VericiDxLimitedMember2024-01-012024-03-310001811115rnlx:InstrumentSpecificCreditRiskMember2024-01-012024-03-310001811115us-gaap:RestrictedStockUnitsRSUMember2023-07-012024-03-310001811115us-gaap:EmployeeStockOptionMember2023-07-012024-03-310001811115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001811115rnlx:ISSMSAndSRAMemberrnlx:MountSinaiMember2023-07-012024-03-3100018111152022-09-300001811115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001811115rnlx:TestingServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-03-310001811115us-gaap:RetainedEarningsMember2022-06-300001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001811115us-gaap:RetainedEarningsMember2022-07-012022-09-300001811115rnlx:EkfDiagnosticsMember2023-01-012023-03-310001811115us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001811115us-gaap:CommonStockMember2024-01-012024-03-310001811115rnlx:AmericanDepositorySharesMember2023-07-012023-07-310001811115srt:MaximumMember2024-03-310001811115us-gaap:FurnitureAndFixturesMember2023-06-3000018111152022-10-012022-12-310001811115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001811115rnlx:NewOrdinarySharesMemberus-gaap:PrivatePlacementMember2024-03-120001811115rnlx:VericiDxLimitedMember2023-06-300001811115rnlx:PharmaceuticalServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2022-07-012023-03-3100018111152022-04-052022-04-050001811115rnlx:NonInstrumentSpecificCreditRiskMember2024-01-012024-03-310001811115us-gaap:RestrictedStockUnitsRSUMember2024-03-310001811115rnlx:LabSpaceSaltLakeCityUtMember2024-01-012024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001811115rnlx:SafeharborplanMember2022-07-012023-03-310001811115rnlx:VericiDxLimitedMember2023-06-300001811115rnlx:VericiDxLimitedMember2022-07-012023-03-310001811115rnlx:JoslinLicenseMemberrnlx:MilestoneTwoMember2024-03-310001811115us-gaap:RetainedEarningsMember2023-09-300001811115rnlx:WakeForestAtriumHealthMember2023-07-012024-03-3100018111152022-07-012023-06-300001811115us-gaap:LeaseholdImprovementsMember2023-06-300001811115us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-01-012024-03-3100018111152024-01-012024-03-310001811115rnlx:ClinicalTrialAgreementMemberrnlx:WakeForestAtriumHealthMember2023-01-012023-03-310001811115us-gaap:CommonStockMember2023-10-012023-12-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-3100018111152023-09-300001811115us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001811115us-gaap:CommonStockMember2022-06-300001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001811115rnlx:JoslinLicenseMember2024-03-310001811115rnlx:ISSMSAndSRAMemberrnlx:KidneyIntelxMemberrnlx:MilestoneTwoMember2023-07-012024-03-310001811115us-gaap:CustomerConcentrationRiskMemberrnlx:OtherPartyPayorsMemberus-gaap:ServiceMemberus-gaap:SalesRevenueNetMember2023-07-012024-03-310001811115rnlx:IcahnSchoolOfMedicineAtMountSinaiMember2022-07-012023-03-3100018111152023-10-012023-10-3100018111152024-03-142024-03-1400018111152023-07-012023-07-310001811115us-gaap:CommonStockMember2022-09-300001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001811115rnlx:SafeharborplanMember2024-01-012024-03-310001811115rnlx:EmployeeSharePurchasePlanmemberMember2024-03-310001811115srt:MinimumMember2023-07-012024-03-310001811115rnlx:VestTwelveMonthsAfterTheVestingCommencementDateMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-3100018111152024-03-310001811115us-gaap:CustomerConcentrationRiskMemberrnlx:ThirdPartyPayorsMemberus-gaap:AccountsReceivableMemberus-gaap:ServiceMember2022-07-012023-03-310001811115us-gaap:CostOfSalesMember2023-07-012024-03-310001811115us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001811115us-gaap:RetainedEarningsMember2023-03-3100018111152023-10-012023-12-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001811115rnlx:AmericanDepositarySharesMember2023-07-012024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001811115rnlx:ISSMSAndSRAMemberrnlx:MountSinaiMember2022-07-012023-03-310001811115us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-04-252024-04-250001811115rnlx:EmployeeSharePurchasePlanmemberMember2023-07-012024-03-310001811115us-gaap:RetainedEarningsMember2023-12-310001811115srt:MaximumMemberus-gaap:PrivatePlacementMember2024-03-120001811115srt:MaximumMember2024-05-152024-05-150001811115rnlx:OrdinarySharesMember2023-10-172023-10-1700018111152023-06-300001811115rnlx:ISSMSAndSRAMemberrnlx:MilestoneThreeMembersrt:MinimumMemberrnlx:MountSinaiMember2023-07-012024-03-310001811115rnlx:RenalytixAiPlcShareOptionPlanMember2022-07-012023-03-310001811115us-gaap:AdditionalPaidInCapitalMember2024-03-310001811115us-gaap:ShareBasedCompensationAwardTrancheTwoMemberrnlx:NewOrdinarySharesMemberus-gaap:PrivatePlacementMember2024-03-120001811115rnlx:IsmmsMemberrnlx:MountSinaiClinicalTrialAgreementMember2022-07-012023-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001811115rnlx:ISSMSAndSRAMembersrt:MinimumMemberrnlx:MountSinaiMember2023-07-012024-03-310001811115rnlx:EquityIncentivePlanMember2024-03-310001811115rnlx:LicensedProductsMemberrnlx:MilestoneOneMemberrnlx:JoslinLicenseMember2023-07-012024-03-310001811115rnlx:TwentyFivePercentVestAtTheEndOfTheFirstQuarterMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:VericiDxLimitedMember2023-07-012024-03-310001811115us-gaap:CostOfSalesMember2023-01-012023-03-310001811115us-gaap:CostOfSalesMember2022-07-012023-03-310001811115rnlx:RenalytixAiPlcShareOptionPlanMember2023-07-012024-03-3100018111152023-04-070001811115rnlx:TestingServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2023-07-012024-03-310001811115us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-07-012023-03-310001811115us-gaap:NonrelatedPartyMember2023-06-300001811115rnlx:EmployeeSharePurchasePlanmemberMember2023-01-012023-03-310001811115us-gaap:RestrictedStockUnitsRSUMember2022-07-012023-03-310001811115rnlx:JoslinLicenseMember2023-03-310001811115rnlx:ISSMSAndSRAMemberrnlx:MilestoneOneMemberrnlx:MountSinaiMember2024-03-310001811115us-gaap:OfficeEquipmentMember2023-06-3000018111152022-07-012022-09-300001811115rnlx:OrdinarySharesMember2023-12-012023-12-310001811115us-gaap:AdditionalPaidInCapitalMember2022-09-3000018111152022-07-012023-03-310001811115rnlx:LabSpaceSaltLakeCityUtMember2023-07-012024-03-310001811115us-gaap:CustomerConcentrationRiskMemberus-gaap:ServiceMemberus-gaap:SalesRevenueNetMemberrnlx:MedicareClaimsMember2022-07-012023-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001811115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001811115rnlx:EmployeeSharePurchasePlanmemberMember2024-01-012024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2022-12-310001811115us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012023-03-310001811115us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:SubsequentEventMember2024-04-2400018111152022-06-300001811115rnlx:TwentyFivePercentVestOnTheOneYearAnniversaryMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:LabSpaceStPetersburgFlMember2024-03-310001811115us-gaap:CommonStockMember2023-01-012023-03-310001811115rnlx:SeventyFivePercentVestOnTheOneYearAnniversaryMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115us-gaap:CommonStockMember2024-03-310001811115us-gaap:AdditionalPaidInCapitalMember2022-06-300001811115rnlx:EmployeeSharePurchasePlanmemberMember2022-07-012023-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001811115us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-3000018111152022-04-072022-04-070001811115us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012024-03-310001811115rnlx:PharmaceuticalServicesRevenueMemberus-gaap:TransferredAtPointInTimeMember2024-01-012024-03-3100018111152023-03-310001811115us-gaap:RetainedEarningsMember2023-06-300001811115rnlx:IcahnSchoolOfMedicineAtMountSinaiMemberrnlx:AccruedExpensesOtherCurrentLiabilitiesAndAccountsPayableMember2024-03-310001811115us-gaap:CommonStockMember2023-09-300001811115rnlx:EkfDiagnosticsMember2024-01-012024-03-310001811115stpr:FL2024-02-012024-02-290001811115rnlx:VestedQuarterlyOverTwoYearsMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:VericiDxLimitedMember2022-07-012023-06-300001811115us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-07-012024-03-310001811115us-gaap:ConvertibleDebtSecuritiesMember2023-07-012024-03-310001811115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001811115us-gaap:CostOfSalesMember2024-01-012024-03-310001811115rnlx:OrdinarySharesMemberus-gaap:SubsequentEventMember2024-04-102024-04-100001811115us-gaap:ConvertibleDebtSecuritiesMember2022-07-012023-03-310001811115rnlx:RenalytixAiPlcShareOptionPlanMember2024-03-310001811115us-gaap:RetainedEarningsMember2023-10-012023-12-310001811115rnlx:AmericanDepositorySharesMember2023-10-012023-10-310001811115rnlx:ISSMSAndSRAMemberrnlx:MilestoneThreeMembersrt:MaximumMemberrnlx:MountSinaiMember2023-07-012024-03-310001811115rnlx:TwentyFivePercentVestOnFirstAndThirdYearAnniversaryAndFiftyPercentVestOnSecondYearAnniversaryMemberus-gaap:RestrictedStockMemberrnlx:EquityIncentivePlanMember2023-07-012024-03-310001811115rnlx:VericiDxLimitedMember2023-07-012024-03-31xbrli:pureiso4217:GBPxbrli:sharesxbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-39387

Renalytix plc

(Exact name of Registrant as specified in its Charter)

|

|

England and Wales |

Not Applicable |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

2 Leman Street

London, United Kingdom |

E1W 9US |

(Address of principal executive offices) |

(Zip Code) |

+44 20 3139 2910

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

American Depositary Shares, each representing two ordinary shares, nominal value £0.0025 per share |

|

RNLX |

|

The Nasdaq Stock Market, LLC |

Ordinary shares, nominal value £0.0025 per share |

|

* |

|

The Nasdaq Stock Market, LLC* |

* Not for trading, but only in connection with the registration of the American Depositary Shares.

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 14, 2024, there were 154,368,191 ordinary shares, nominal value £0.0025 per share, outstanding, which if all were held in ADS form would be represented by 77,184,096 American Depositary Shares, each representing two ordinary shares.

RENALYTIX PLC

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q for the three months ended March 31, 2024 (this “Quarterly Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “goal,” “target,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements and opinions contained in this Quarterly Report are based upon information available to us as of the date of this Quarterly Report and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Forward-looking statements include statements about:

•the timing and plans for commercialization of KidneyIntelX;

•the timing and plans for regulatory filings and decisions;

•our plans to maintain regulatory approval of kidneyintelX.dkd and obtain and maintain regulatory approvals for other products from our KidneyIntelX platform;

•the potential benefits of KidneyIntelX;

•the market opportunities for KidneyIntelX and our ability to maximize those opportunities;

•our business strategies and goals;

•our ability and plans to establish and maintain partnerships and projections related to future test volume as part of those partnerships;

•our ability and plans to drive adoption of KidneyIntelX and integrate KidneyIntelX into clinical workflow;

•estimates of our sales, revenue, expenses, cash runway and capital requirements and our need for and ability to obtain additional financing;

•our ability to continue as a going concern;

•third-party payor reimbursement and coverage decisions;

•the performance of our third-party suppliers and manufacturers,

•our expectations regarding our ability to obtain, maintain and enforce intellectual property protection for our diagnostic products and our ability to operate our business without infringing on the intellectual property rights of others;

•our expectations regarding regulatory classification of KidneyIntelX, as well as the regulatory response to the marketing and promotion of KidneyIntelX;

•the impact of guidelines and recommendations published by various organizations on the use of our products;

•our expectations regarding developments relating to our competitors;

•our ability to identify, recruit and retain key personnel;

•the potential for breaches of data privacy, or disruptions in our information technology systems;

•the potential direct or indirect impact of COVID-19 and the Russia-Ukraine or Hamas-Israel armed conflict on the global economy and our business or operations;

•our ability to satisfy the listing requirements of the NASDAQ Global Market;

•the progress and potential outcome of our formal sale process (as referred to in Note 2 on Rule 2.6 of the City Code on Takeovers and Mergers);

•our expectation that we will not be an investment company under applicable SEC interpretations;

•the sufficiency of our existing cash, cash equivalents and short-term investments to fund our operations and capital expenditure requirements;

•any other factors which may impact our financial results or future trading prices of our ADSs and ordinary shares and the impact of securities analysts’ reports on these prices; and

•risks detailed under the caption “Risk Factors” in this Quarterly Report and in our other reports filed with the U.S. Securities and Exchange Commission (“SEC”), from time to time hereafter.

You should refer to the section titled "Part I, Item 1A. Risk Factors" contained in the Company's Annual Report on Form 10-K for the year ended June 30, 2023 (the “Annual Report on Form 10-K”) and the sections of this Quarterly Report titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Quarterly Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law, applicable regulations or the rules of the Nasdaq Stock Market LLC.

You should read this Quarterly Report, the documents that we reference in this Quarterly Report and the documents we have filed as exhibits to this Quarterly Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

RENALYTIX PLC

CONSOLIDATED BALANCE SHEETS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except share and per share data) |

|

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

$ |

4,704 |

|

|

$ |

24,682 |

|

Accounts receivable |

|

|

|

|

554 |

|

|

|

776 |

|

Prepaid expenses and other current assets |

|

|

|

|

1,082 |

|

|

|

1,424 |

|

Total current assets |

|

|

|

|

6,340 |

|

|

|

26,882 |

|

Property and equipment, net |

|

|

|

|

230 |

|

|

|

1,027 |

|

Right of Use Asset |

|

|

|

|

— |

|

|

|

159 |

|

Investment in VericiDx |

|

|

|

|

1,060 |

|

|

|

1,460 |

|

Other Assets |

|

|

|

|

1,139 |

|

|

|

1,101 |

|

Total assets |

|

|

|

$ |

8,769 |

|

|

$ |

30,629 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

|

|

$ |

2,101 |

|

|

$ |

1,485 |

|

Accounts payable – related party |

|

|

|

|

3,027 |

|

|

|

1,451 |

|

Accrued expenses and other current liabilities |

|

|

|

|

4,273 |

|

|

|

6,644 |

|

Accrued expenses – related party |

|

|

|

|

1,060 |

|

|

|

1,963 |

|

Current lease liability |

|

|

|

|

78 |

|

|

|

130 |

|

Convertible notes-current |

|

|

|

|

4,449 |

|

|

|

4,463 |

|

Total current liabilities |

|

|

|

|

14,988 |

|

|

|

16,136 |

|

Convertible notes-noncurrent |

|

|

|

|

4,892 |

|

|

|

7,485 |

|

Noncurrent lease liability |

|

|

|

|

— |

|

|

|

41 |

|

Total liabilities |

|

|

|

|

19,880 |

|

|

|

23,662 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

|

Ordinary shares, £0.0025 par value per share: 128,042,743 shares

authorized; 119,916,187 and 93,781,478 shares issued and

outstanding at March 31, 2024 and June 30, 2023, respectively |

|

|

|

|

368 |

|

|

|

286 |

|

Additional paid-in capital |

|

|

|

|

194,786 |

|

|

|

186,456 |

|

Accumulated other comprehensive loss |

|

|

|

|

(1,558 |

) |

|

|

(1,450 |

) |

Accumulated deficit |

|

|

|

|

(204,707 |

) |

|

|

(178,325 |

) |

Total shareholders’ (deficit) equity |

|

|

|

|

(11,111 |

) |

|

|

6,967 |

|

Total liabilities and shareholders’ (deficit) equity |

|

|

|

$ |

8,769 |

|

|

$ |

30,629 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RENALYTIX PLC

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

For the Nine Months Ended March 31, |

|

(in thousands, except share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

535 |

|

|

$ |

724 |

|

|

$ |

1,703 |

|

|

$ |

2,885 |

|

Cost of revenue |

|

|

601 |

|

|

|

603 |

|

|

|

1,583 |

|

|

|

2,010 |

|

Gross profit (loss) |

|

|

(66 |

) |

|

|

121 |

|

|

|

120 |

|

|

|

875 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,216 |

|

|

|

3,943 |

|

|

|

8,228 |

|

|

|

11,026 |

|

General and administrative |

|

|

3,854 |

|

|

|

7,095 |

|

|

|

15,252 |

|

|

|

22,155 |

|

Impairment loss on property, equipment and other long-lived assets |

|

|

417 |

|

|

|

— |

|

|

|

723 |

|

|

|

— |

|

Performance of contract liability to affiliate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19 |

) |

Total operating expenses |

|

|

6,487 |

|

|

|

11,038 |

|

|

|

24,203 |

|

|

|

33,162 |

|

Loss from operations |

|

|

(6,553 |

) |

|

|

(10,917 |

) |

|

|

(24,083 |

) |

|

|

(32,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in net losses of affiliate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9 |

) |

Foreign currency gain (loss), net |

|

|

15 |

|

|

|

(461 |

) |

|

|

215 |

|

|

|

238 |

|

Fair value adjustment to VericiDx investment |

|

|

40 |

|

|

|

129 |

|

|

|

(205 |

) |

|

|

(1,070 |

) |

Fair value adjustment to convertible notes |

|

|

(1,196 |

) |

|

|

(1,168 |

) |

|

|

(2,517 |

) |

|

|

(1,898 |

) |

Other (expense) income, net |

|

|

(49 |

) |

|

|

310 |

|

|

|

212 |

|

|

|

521 |

|

Net loss before income taxes |

|

|

(7,743 |

) |

|

|

(12,107 |

) |

|

|

(26,378 |

) |

|

|

(34,505 |

) |

Income tax (expense) benefit |

|

|

— |

|

|

|

1 |

|

|

|

(4 |

) |

|

|

2 |

|

Net loss |

|

$ |

(7,743 |

) |

|

$ |

(12,106 |

) |

|

$ |

(26,382 |

) |

|

$ |

(34,503 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share—basic |

|

$ |

(0.08 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.44 |

) |

Net loss per ordinary share—diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.44 |

) |

Weighted average ordinary shares—basic |

|

|

97,654,961 |

|

|

|

85,560,783 |

|

|

|

98,184,650 |

|

|

|

78,366,984 |

|

Weighted average ordinary shares—diluted |

|

|

97,654,961 |

|

|

|

85,560,783 |

|

|

|

98,184,650 |

|

|

|

78,366,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in the fair value of the convertible notes |

|

$ |

155 |

|

|

$ |

593 |

|

|

$ |

230 |

|

|

$ |

70 |

|

Foreign exchange translation adjustment |

|

|

21 |

|

|

|

505 |

|

|

|

(338 |

) |

|

|

6 |

|

Comprehensive loss |

|

$ |

(7,567 |

) |

|

$ |

(11,008 |

) |

|

$ |

(26,490 |

) |

|

$ |

(34,427 |

) |

The accompanying notes are an integral part of these consolidated financial statements.

RENALYTIX PLC

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (DEFICIT) (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

|

Additional

paid-in |

|

|

Accumulated

other

comprehensive |

|

|

Accumulated |

|

|

Total

shareholders’ |

|

(in thousands, except share and per share data) |

|

Shares |

|

|

Amount |

|

|

capital |

|

|

income (loss) |

|

|

deficit |

|

|

equity (deficit) |

|

Balance at July 1, 2023 |

|

|

93,781,478 |

|

|

$ |

286 |

|

|

$ |

186,456 |

|

|

$ |

(1,450 |

) |

|

$ |

(178,325 |

) |

|

$ |

6,967 |

|

Shares issued for repayment of convertible bond |

|

|

1,052,422 |

|

|

|

3 |

|

|

|

1,051 |

|

|

|

— |

|

|

|

— |

|

|

|

1,054 |

|

Vesting of RSUs |

|

|

185,540 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

524 |

|

|

|

— |

|

|

|

— |

|

|

|

524 |

|

Currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

42 |

|

|

|

— |

|

|

|

42 |

|

Changes in the fair value of the convertible notes at fair value through other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

75 |

|

|

|

— |

|

|

|

75 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,154 |

) |

|

|

(10,154 |

) |

Balance at September 30, 2023 |

|

|

95,019,440 |

|

|

$ |

290 |

|

|

$ |

188,031 |

|

|

$ |

(1,333 |

) |

|

$ |

(188,479 |

) |

|

$ |

(1,491 |

) |

Shares issued for repayment of convertible bond |

|

|

4,835,388 |

|

|

|

15 |

|

|

|

1,928 |

|

|

|

— |

|

|

|

— |

|

|

|

1,943 |

|

Shares issued under employee stock purchase program |

|

|

75,328 |

|

|

|

— |

|

|

|

93 |

|

|

|

— |

|

|

|

— |

|

|

|

93 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

385 |

|

|

|

— |

|

|

|

— |

|

|

|

385 |

|

Currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(401 |

) |

|

|

— |

|

|

|

(401 |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,485 |

) |

|

|

(8,485 |

) |

Balance at December 31, 2023 |

|

|

99,930,156 |

|

|

$ |

305 |

|

|

$ |

190,437 |

|

|

$ |

(1,734 |

) |

|

$ |

(196,964 |

) |

|

$ |

(7,956 |

) |

Shares issued in March 2024 Private placement, net |

|

|

19,986,031 |

|

|

|

63 |

|

|

|

3,964 |

|

|

|

— |

|

|

|

— |

|

|

|

4,028 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

385 |

|

|

|

— |

|

|

|

— |

|

|

|

385 |

|

Changes in the fair value of the convertible notes at fair value through other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

155 |

|

|

|

— |

|

|

|

155 |

|

Currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21 |

|

|

|

— |

|

|

|

21 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,743 |

) |

|

|

(7,743 |

) |

Balance at March 31, 2024 |

|

|

119,916,187 |

|

|

$ |

368 |

|

|

$ |

194,787 |

|

|

$ |

(1,558 |

) |

|

$ |

(204,708 |

) |

|

$ |

(11,111 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

|

Additional

paid-in |

|

|

Accumulated

other

comprehensive |

|

|

Accumulated |

|

|

Total

shareholders’ |

|

(in thousands, except share and per share data) |

|

Shares |

|

|

Amount |

|

|

capital |

|

|

income (loss) |

|

|

deficit |

|

|

equity (deficit) |

|

Balance at July 1, 2022 |

|

|

74,760,432 |

|

|

$ |

228 |

|

|

$ |

164,012 |

|

|

$ |

(915 |

) |

|

$ |

(132,718 |

) |

|

$ |

30,607 |

|

Shares issued under the employee share purchase program |

|

|

131,412 |

|

|

|

1 |

|

|

|

115 |

|

|

|

— |

|

|

|

— |

|

|

|

116 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

763 |

|

|

|

— |

|

|

|

— |

|

|

|

763 |

|

Currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,087 |

) |

|

|

— |

|

|

|

(1,087 |

) |

Changes in the fair value of the convertible notes at fair value through other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

397 |

|

|

|

— |

|

|

|

397 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,953 |

) |

|

|

(11,953 |

) |

Balance at September 30, 2022 |

|

|

74,891,844 |

|

|

$ |

229 |

|

|

$ |

164,890 |

|

|

$ |

(1,605 |

) |

|

$ |

(144,671 |

) |

|

$ |

18,843 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

818 |

|

|

|

— |

|

|

|

— |

|

|

|

818 |

|

Currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

588 |

|

|

|

— |

|

|

|

588 |

|

Changes in the fair value of the convertible notes at fair value through other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(920 |

) |

|

|

— |

|

|

|

(920 |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,444 |

) |

|

|

(10,444 |

) |

Balance at December 30, 2022 |

|

|

74,891,844 |

|

|

$ |

229 |

|

|

$ |

165,708 |

|

|

$ |

(1,937 |

) |

|

$ |

(155,115 |

) |

|

$ |

8,885 |

|

Shares issued under the February 2023 private placement |

|

|

18,722,960 |

|

|

|

57 |

|

|

|

19,248 |

|

|

|

— |

|

|

|

— |

|

|

|

19,305 |

|

Shares issued under the employee share purchase program |

|

|

166,674 |

|

|

|

— |

|

|

|

145 |

|

|

|

— |

|

|

|

— |

|

|

|

145 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

770 |

|

|

|

— |

|

|

|

— |

|

|

|

770 |

|

Currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

593 |

|

|

|

— |

|

|

|

593 |

|

Changes in the fair value of the convertible notes through other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

505 |

|

|

|

— |

|

|

|

505 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,106 |

) |

|

|

(12,106 |

) |

Balance at March 31, 2023 |

|

|

93,781,478 |

|

|

$ |

286 |

|

|

$ |

185,871 |

|

|

$ |

(839 |

) |

|

$ |

(167,221 |

) |

|

$ |

18,097 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RENALYTIX PLC

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended March 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(26,382 |

) |

|

$ |

(34,503 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

304 |

|

|

|

388 |

|

Impairment loss on property, equipment and other long-lived assets |

|

|

723 |

|

|

|

— |

|

Stock-based compensation |

|

|

1,291 |

|

|

|

2,358 |

|

Equity in losses of affiliate |

|

|

— |

|

|

|

9 |

|

Reduction of Kantaro liability |

|

|

— |

|

|

|

(55 |

) |

Fair value adjustment to VericiDx investment |

|

|

205 |

|

|

|

1,070 |

|

Unrealized foreign exchange loss |

|

|

— |

|

|

|

327 |

|

Realized loss on sale of ordinary shares in VericiDx |

|

|

94 |

|

|

|

— |

|

Realized foreign exchange gain |

|

|

(144 |

) |

|

|

— |

|

Fair value adjustment to convertible debt, net interest paid |

|

|

2,255 |

|

|

|

1,898 |

|

Non cash lease expense |

|

|

67 |

|

|

|

78 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

222 |

|

|

|

154 |

|

Prepaid expenses and other current assets |

|

|

310 |

|

|

|

(77 |

) |

Accounts payable |

|

|

617 |

|

|

|

358 |

|

Accounts payable – related party |

|

|

1,576 |

|

|

|

370 |

|

Accrued expenses and other current liabilities |

|

|

(2,519 |

) |

|

|

2,704 |

|

Accrued expenses – related party |

|

|

(904 |

) |

|

|

(485 |

) |

Deferred revenue |

|

|

— |

|

|

|

(46 |

) |

Net cash used in operating activities |

|

|

(22,285 |

) |

|

|

(25,452 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of equipment |

|

|

(3 |

) |

|

|

— |

|

Payment for long term deferred expense |

|

|

— |

|

|

|

(59 |

) |

Net cash used in investing activities |

|

|

(3 |

) |

|

|

(59 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Payment of convertible notes principal |

|

|

(1,660 |

) |

|

|

(3,262 |

) |

Proceeds from issuance of ordinary shares in Private Placement |

|

|

5,072 |

|

|

|

20,296 |

|

Payment of offering costs |

|

|

(1,044 |

) |

|

|

(666 |

) |

Proceeds from purchase of ordinary shares under employee share

purchase plan |

|

|

93 |

|

|

|

116 |

|

Net cash provided by financing activities |

|

|

2,461 |

|

|

|

16,484 |

|

Effect of exchange rate changes on cash |

|

|

(151 |

) |

|

|

721 |

|

Net decrease in cash and cash equivalents |

|

|

(19,978 |

) |

|

|

(8,306 |

) |

Cash and cash equivalents, beginning of period |

|

|

24,682 |

|

|

|

41,333 |

|

Cash and cash equivalents, end of period |

|

$ |

4,704 |

|

|

$ |

33,027 |

|

Supplemental noncash investing and financing activities: |

|

|

|

|

|

|

Cash paid for interest on convertible debt |

|

$ |

249 |

|

|

$ |

— |

|

The accompanying notes are an integral part of these consolidated financial statements.

RENALYTIX PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

1. Business and risks

Renalytix PLC and its wholly-owned subsidiaries, (the “Company” or "Renalytix") is an artificial intelligence-enabled in vitro diagnostics company, focused on optimizing clinical management of kidney disease to drive improved patient outcomes and significantly lower healthcare costs. KidneyIntelX, the Company’s first-in-class diagnostic platform, employs a proprietary artificial intelligence-enabled algorithm that combines diverse data inputs, including validated blood-based biomarkers, inherited genetics and personalized patient data from EHR systems, to generate a unique patient risk score. Additionally, the Company plans to pursue collaborations with pharmaceutical companies and make ‘Pharmaceutical Services Revenue’ a core part of the business going forward with the goal of improving guideline-based standard-of-care for optimal utilization of existing and novel therapeutics using the KidneyIntelX testing platform and proprietary care management software.

Since inception in March 2018, the Company has focused primarily on organizing and staffing the Company, raising capital, developing the KidneyIntelX platform, conducting clinical validation studies for KidneyIntelX, establishing and protecting its intellectual property portfolio and commercial laboratory operations, pursuing regulatory clearance and developing a reimbursement strategy. The Company has funded its operations primarily through equity and debt financings.

The Company is subject to risks and uncertainties common to early-stage companies in the diagnostics industry, including, but not limited to, ability to secure additional capital to fund operations, compliance with governmental regulations, development by competitors of new technological innovations, dependence on key personnel and protection of proprietary technology. To achieve widespread usage, KidneyIntelX and additional diagnostic products currently under development will require extensive clinical testing and validation prior to regulatory approval and commercialization. These efforts require significant amounts of additional capital, adequate personnel, and infrastructure, and extensive compliance-reporting capabilities.

2. Liquidity and Going Concern

The Company has incurred recurring losses and negative cash flows from operations since inception and had an accumulated deficit of $204.7 million as of March 31, 2024. The Company anticipates incurring additional losses until such time, if ever, that it can generate significant sales of KidneyIntelX or any future products currently in development.

As a result of its losses and projected cash needs, substantial doubt exists about the Company’s ability to continue as a going concern. Substantial additional capital will be necessary to fund the Company's operations, expand its commercial activities and develop other potential diagnostic related products. The Company is seeking additional funding through public or private equity offerings, debt financings, other collaborations, strategic alliances and licensing arrangements. The Company may not be able to obtain financing on acceptable terms, or at all, and the Company may not be able to enter into strategic alliances or other arrangements on favorable terms, or at all. The terms of any financing may adversely affect the holdings or the rights of the Company’s shareholders. If the Company is unable to obtain funding, the Company may not be able to meet its obligations and could be required to delay, curtail or discontinue research and development programs, product portfolio expansion or commercialization efforts, which could adversely affect its business prospects.

The Company’s ability to continue as a going concern is contingent upon successful execution of management’s intended plan over the next twelve months to improve the Company’s liquidity and profitability, which includes, without limitation:

•Seeking additional capital through public or private equity offerings, debt financings, other collaborations, strategic alliances and licensing arrangements

•Implementation of various additional operating cost reduction options that are available to the Company

•The achievement of a certain volume of assumed revenue

The consolidated financial statements do not include any adjustments that may result from the outcome of this going concern uncertainty.

3. Basis of presentation and summary of significant accounting policies

The accompanying consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States (“U.S. GAAP”). Any reference in these notes to applicable guidance is meant to refer to U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”). In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments, which include only normal recurring adjustments necessary for the fair statement of the balances and results for the periods presented.

Principles of consolidation

The consolidated financial statements include the accounts of Renalytix plc, and its wholly-owned subsidiaries. All inter-company balances and transactions have been eliminated in consolidation. The Company accounts for investments in which it has significant influence but not a controlling financial interest using the equity method of accounting.

Use of estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of expenses during the reporting period. Actual results could differ from those estimates. Due to the uncertainty of factors surrounding the estimates or judgments used in the preparation of the consolidated financial statements, actual results may materially vary from these estimates.

Estimates and assumptions are periodically reviewed, and the effects of revisions are reflected in the consolidated financial statements in the period they are determined to be necessary. Significant areas that require management’s estimate include the assumptions used in determining the fair value of share-based awards, determining the fair value of the bonds, recording the prepaid/accrual and associated expense for research and development activities performed for the Company by third parties and determining useful lives of property and equipment and capitalized software.

The Company manages its operations as a single operating segment for the purposes of assessing performance and making operating decisions. The Company’s singular focus is to make significant improvements in kidney disease diagnosis and prognosis, clinical care, patient stratification for drug clinical trials, and drug target discovery.

The Company’s consolidated financial statements are presented in U.S. dollars, the reporting currency of the Company. The functional currency of Renalytix plc and Renalytix AI Limited is GB Pounds. The functional currency of Renalytix AI, Inc. is the U.S. dollar. Assets and liabilities of Renalytix plc and Renalytix AI Limited are translated at the rate of exchange at period-end, while the statements of operations are translated at the weighted average exchange rates in effect during the reporting period. The net effect of these translation adjustments is shown as a component of accumulated other comprehensive loss. Transaction gains and losses resulting from exchange rate changes on transactions denominated in currencies other than the functional currency are included in income in the period in which the change occurs and reported in the consolidated statements of operations and comprehensive loss.

Concentrations of credit risk and major customers

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and accounts receivable balances. Periodically, the Company maintains deposits in accredited financial institutions in excess of federally insured limits. The Company deposits its cash in financial institutions that it believes have high credit quality and are not exposed to any unusual credit risk beyond the normal credit risk associated with commercial banking relationships and has not experienced any losses on such accounts.

The Company’s accounts receivables are derived from revenue earned from customers located in the U.S. For the nine months ended March 31, 2024, approximately 47% of all receivables related to KidneyIntelX testing revenue related to two customers and the remaining 53% of receivables were due from other third party payors. For the nine months ended March 31, 2023, approximately 73% of all receivables related to Mount Sinai, approximately 15% of all receivables related to Medicare claims and the remaining 12% of receivables were due from other third party payors. The Company performs initial and ongoing credit reviews on customers, which involve consideration of the customers’ financial information, their location, and other factors to assess the customers’ ability to pay and reserved for $0.1 million of receivables as of March 31, 2024.

Fair value of financial instruments

At March 31, 2024 and June 30, 2023, the Company’s financial instruments included accounts receivable, prepaid expenses and other current assets, accounts payable, accrued expenses and other current liabilities. The carrying amounts of these assets and liabilities approximates fair value due to their short-term nature. The convertible notes are recorded at their estimated fair value.

Fair value option

Under the Fair Value Option Subsections of ASC subtopic 825-10, Financial Instruments – Overall, the Company has the irrevocable option to report most financial assets and financial liabilities at fair value on an instrument-by-instrument basis, with changes in fair value reported in earnings (see Note 5). The Company has elected to measure and record the convertible notes at their estimated fair value.

Cash and cash equivalents

The Company considers all highly liquid investments purchased with an original maturity of 90 days or less to be cash equivalents. As of March 31, 2024 and June 30, 2023, the Company had cash and cash equivalents of $4.7 million and $24.7 million, respectively.

Accounts receivable

Accounts receivable are recorded at the invoice amount and are non-interest bearing. The Company estimates expected credit losses of its accounts receivable by assessing the risk of loss and available relevant information about collectability, including historical credit losses, existing contractual payment terms, actual payment patterns of its customers, individual customer circumstances, and reasonable and supportable forecast of economic conditions expected to exist throughout the contractual life of the receivable. The Company reserved for $0.1 million of receivables as of March 31, 2024. The Company reserved for $0.1 million of receivables as of June 30, 2023.

Property, equipment and other long-lived assets

Property and equipment are recorded at cost. Depreciation is determined using the straight-line method over the estimated useful lives ranging from three to ten years. Expenditures for maintenance and repairs are expensed as incurred while renewals and betterments are capitalized. When property and equipment are sold or otherwise disposed of, the cost and related accumulated depreciation are eliminated from the accounts and any resulting gain or loss is reflected in operations. In November 2023, the Company consolidated lab operations which resulted in a $0.3 million impairment of property and equipment at the Company's Utah lab. In February 2024, the Company performed a recoverability assessment and determined the entire $0.1 million right-of-use asset related to the Utah lease to be impaired, and in addition the Company further consolidated lab operations which resulted in a $0.3 million impairment of property and equipment at the Company's Florida lab. The Company recorded a $0.4 million impairment of property, equipment and other long-lived assets for the three months ended March 31, 2024 and a $0.7 million impairment for the nine months ended March 31, 2024. There was no impairment loss on property, equipment and other long-lived assets in the nine months ended March 31, 2023.

Investments

VericiDx plc

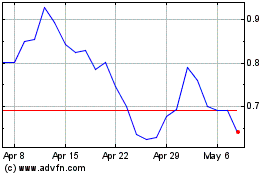

The Company accounts for its ownership of VericiDx securities at fair value in accordance with ASC 321, Investments-Equity Securities, with changes in fair value recorded in earnings as the fair value of VericiDx's ordinary shares is readily determinable via the London Stock Exchange. Based on the closing stock price of VericiDx, the fair value of the investment in VericiDx was $1.1 million and $1.5 million at March 31, 2024 and June 30, 2023, respectively.

In March 2024, the Company sold 750,000 ordinary shares of VericiDx for net proceeds of $0.1 million and a realized loss of $0.1 million. The Company did not sell any shares during the three and nine months ended March 31, 2023. During the three months ended March 31, 2024 and 2023, the Company recorded an increase in fair value of $0.04 million and $0.1 million, respectively, in the consolidated statements of operations and comprehensive loss. During the nine months ended March 31, 2024 and 2023, the Company recorded a decrease in fair value of $0.2 million and $1.1 million, respectively, in the consolidated statements of operations and comprehensive loss. The Company owned 3.7% of the ordinary shares of VericiDx at March 31, 2024, and owned 5.8% of ordinary shares of VericiDx at June 30, 2023.

The Company evaluates its investments that are in unrealized loss positions, if any, and equity method investments for other-than-temporary impairment on a quarterly basis (see Note 5). Such evaluation involves a variety of considerations, including assessments of the risks and uncertainties associated with general economic conditions and distinct conditions affecting specific issuers or investees. Factors considered by the Company include (i) the length of time and the extent to which an investment’s fair value has been below its cost; (ii) the financial condition, credit worthiness, and near-term prospects of the issuer; (iii) the length of time to maturity; (iv) future economic conditions and market forecasts; (v) the Company’s intent and ability to retain its investment for a period of time sufficient to allow for recovery of market value; (vi) an assessment of whether it is more likely than not that the Company will be required to sell its investment before recovery of market value; and (vii) whether events or changes in circumstances indicate that the investment’s carrying amount might not be recoverable.

Software development costs

The Company follows the provisions of ASC 985, Software, which requires software development costs for software marketed externally to be expensed as incurred until the establishment of technological feasibility, at which time those costs are capitalized until the software is available for general release and amortized over its estimated useful life of ten years. For the three and nine months ended March 31, 2024 and 2023, there was no capitalization of research and development expenses related to software development to record. Technological feasibility is established upon the completion of a working model that has been validated.

Revenue recognition

Pursuant to ASC 606, Revenue from Contracts with Customers, the Company recognizes revenue when a customer obtains control of promised goods or services. The Company records the amount of revenue that reflects the consideration that it expects to receive in exchange for those goods or services. The Company applies the following five-step model in order to determine this amount: (i) identification of the promised goods or services in the contract; (ii) determination of whether the promised goods or services are performance obligations, including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance obligations; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

The Company only applies the five-step model to contracts when it is probable that it will collect the consideration to which it is entitled in exchange for the goods or services that it transfers to the customer. Once a contract is determined to be within the scope of ASC 606 at contract inception, the Company reviews the contract to determine which performance obligations it must deliver and which of these performance obligations are distinct. Certain contracts have options for the customer to acquire additional services. The Company evaluates these options to determine if a material right exists. If, after that evaluation, it determines a material right does exist, it assigns value to the material right based upon the renewal option approach. The Company recognizes as revenue the amount of the transaction price that is allocated to each performance obligation when that performance obligation is satisfied or as it is satisfied. The Company uses the present right to payment principle and customer acceptance as indicators to determine the transfer of control to the customer occurs at a point in time. Sales tax and other similar taxes are excluded from revenues.

Cost of revenue consists of costs directly attributable to the services rendered, including labor, rent, lab consumables, depreciation, amortization and sample collection costs directly related to revenue generating activities.

Research and development expenses

Research and development costs consist primarily of internal and external labor costs incurred in connection with the development of KidneyIntelX as well as expenses related to studies and clinical trials to further the clinical value, performance and utility of KidneyIntelX. Research and development costs are expensed as incurred.

Share-based compensation

The Company measures equity classified share-based awards granted to employees and nonemployees based on the estimated fair value on the date of grant and recognizes compensation expense of those awards over the requisite service period, which is the vesting period of the respective award. The Company accounts for forfeitures as they occur. For share-based awards with service-based vesting conditions, the Company recognizes compensation expense on a straight-line basis over the service period. The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option-pricing model, which requires inputs based on certain subjective assumptions, including the expected stock price volatility, the expected term of the option, the risk-free interest rate for a period that approximates the expected term of the option, and the Company’s expected dividend yield. The Company was a

privately-held organization prior to November 2018 and has been a publicly-traded company for a limited period of time and therefore lacks company-specific historical and implied volatility information for its shares. Therefore, it estimates its expected share price volatility based on the historical volatility of publicly-traded peer companies and expects to continue to do so until such time as it has adequate historical data regarding the volatility of its own traded share price. The expected term of the Company’s stock options has been determined utilizing the “simplified” method for awards that qualify as “plain-vanilla” options. The risk-free interest rate is determined by reference to the U.S. Treasury yield curve in effect at the time of grant of the award for time periods approximately equal to the expected term of the award. Expected dividend yield is none based on the fact that the Company has never paid cash dividends on ordinary shares and does not expect to pay any cash dividends in the foreseeable future.

The Company classifies share-based compensation expense in its consolidated statement of operations and comprehensive loss in the same manner in which the award recipient’s payroll costs are classified or in which the award recipient’s service payments are classified.

Income taxes