Relay Therapeutics, Inc. (Nasdaq: RLAY), a clinical-stage precision

medicine company transforming the drug discovery process by

combining leading-edge computational and experimental technologies,

today reported fourth quarter and full year 2023 financial results

and corporate highlights.

“We made important progress across our portfolio during 2023,

advancing multiple clinical programs and continuing to invest

significantly in our research engine – the Dynamo platform,” said

Sanjiv Patel, M.D., President and Chief Executive Officer of Relay

Therapeutics. “We are very pleased with the RLY-2608 data disclosed

to-date and how its clinical profile continued to mature throughout

last year. Our clinical team is focused on advancing this program

in the near term in both a doublet and a triplet combination, and

we look forward to sharing additional data in the second half of

2024. Our Dynamo platform continues to demonstrate precision and

productivity with each target we’ve chosen to-date, and we are

excited to disclose at least one new program that has come out of

it later this year, which is being designed to have first-in-class

potential.”

Recent Corporate Highlights

PI3Kα

- RLY-2608 doublet

- Completed enrollment in initial dose

expansion cohort of RLY-2608 600mg BID + fulvestrant in patients

with PI3Kα-mutant, HR+, HER2- locally advanced or metastatic breast

cancer

- Initiated two additional dose

expansion cohorts of RLY-2608 in combination with fulvestrant – a

second 600mg BID cohort as well as one at 400mg BID

- Published RLY-2608 preclinical

profile and clinical proof-of-concept in Cancer Discovery

(Discovery and Clinical Proof-of-Concept of RLY-2608, a

First-in-Class Mutant-Selective Allosteric PI3Kα Inhibitor That

Decouples Antitumor Activity from Hyperinsulinemia) with vignettes

from two patients with advanced HR+ breast cancer with kinase or

helical mutations, with no observed wildtype PI3Kα-related

toxicities

- RLY-2608 triplet

- Initiated RLY-2608 + fulvestrant +

ribociclib triplet combination in patients with PI3Kα-mutant, HR+,

HER2- locally advanced or metastatic breast cancer

- RLY-5836

- Deprioritized further clinical

development

Lirafugratinib (RLY-4008)

- Presented initial clinical data in

patients with FGFR2-altered solid tumors at the 2023 AACR-NCI-EORTC

International Conference on Molecular Targets and Cancer

Therapeutics

- As previously disclosed, the company

will minimize resource allocation in 2024 to allow data to mature

and inform future clinical development decisions

Anticipated 2024 Milestones

- RLY-2608

- RLY-2608 + fulvestrant data update in the second half of

2024

- RLY-2608 + fulvestrant + ribociclib initial safety data in the

second half of 2024

- Lirafugratinib: tumor agnostic data and regulatory update in

the second half of 2024

- Pre-clinical: disclose new program(s) in 2024

Fourth Quarter and Full Year 2023 Financial

Results

Cash, Cash Equivalents and Investments: As of

December 31, 2023, cash, cash equivalents and investments totaled

$750.1 million compared to approximately $1 billion as of December

31, 2022. The company expects its current cash, cash equivalents

and investments will be sufficient to fund its current operating

plan into the second half of 2026.

Revenue: There was no material revenue for the

fourth quarter of 2023 or 2022. Revenue was $25.5 million for the

full year 2023, as compared to $1.4 million for the full year 2022.

The increase was primarily due to the recognition of previously

received milestone payments under the company’s Collaboration and

License Agreement with Genentech, Inc.

R&D Expenses: Research and development

expenses were $77.5 million for the fourth quarter of 2023, as

compared to $67.3 million for the fourth quarter of 2022. The

increase was primarily due to additional clinical trial expenses

and employee-related costs, which were offset by a decrease in

other external research costs. Research and development expenses

were $330.0 million for the full year 2023, as compared to $246.4

million for the full year 2022. The increase was primarily due to

$50.0 million of additional external costs in connection with our

clinical trials and $32.4 million of additional employee costs from

increased headcount in our research and development functions,

which includes $17.7 million of additional stock compensation

expense.

G&A Expenses: General and administrative

expenses were $16.8 million for the fourth quarter of 2023, as

compared to $16.4 million for the fourth quarter of 2022. The

increase was primarily due to additional stock compensation

expense. General and administrative expenses were $75.0 million for

the full year 2023, as compared to $66.0 million for the full year

2022. The increase was primarily due additional stock compensation

expense.

Net Loss: Net loss was $83.5 million for the

fourth quarter of 2023, or a net loss per share of $0.67, as

compared to a net loss of $67.5 million for the fourth quarter of

2022, or a net loss per share of $0.56. Net loss was $342.0 million

for the full year 2023, or a net loss per share of $2.79, as

compared to a net loss of $290.5 million for the full year 2022, or

a net loss per share of $2.59.

About Relay

Therapeutics

Relay Therapeutics (Nasdaq: RLAY) is a

clinical-stage precision medicine company transforming the drug

discovery process by combining leading-edge computational and

experimental technologies with the goal of bringing life-changing

therapies to patients. As the first of a new breed of biotech

created at the intersection of complementary techniques and

technologies, Relay Therapeutics aims to push the boundaries of

what’s possible in drug discovery. Its Dynamo™ platform integrates

an array of leading-edge computational and experimental approaches

designed to drug protein targets that have previously been

intractable or inadequately addressed. Relay Therapeutics’ initial

focus is on enhancing small molecule therapeutic discovery in

targeted oncology and genetic disease indications. For more

information, please visit www.relaytx.com or follow us on

Twitter.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended, including,

without limitation, implied and express statements regarding Relay

Therapeutics’ strategy, business plans and focus; the progress and

timing of the clinical development of the programs across Relay

Therapeutics’ portfolio, including the expected therapeutic

benefits of its programs, potential efficacy and tolerability, and

the timing and success of interactions with and approval of

regulatory authorities; the timing of a clinical data update for

the PI3Kα franchise, the progress of doublet and triplet

combinations for RLY-2608, the timing of clinical updates for

RLY-2608, the timing of a clinical data and regulatory update for

lirafugratinib, and the timing of disclosure of additional

pre-clinical programs; expectations regarding Relay Therapeutics’

pipeline, operating plan, use of capital, expenses and other

financial results; and Relay Therapeutics’ cash runway projection.

The words “may,” “might,” “will,” “could,” “would,” “should,”

“plan,” “anticipate,” “intend,” “believe,” “expect,” “estimate,”

“seek,” “predict,” “future,” “project,” “potential,” “continue,”

“target” and similar words or expressions, or the negative thereof,

are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words.

Any forward-looking statements in this

press release are based on management's current expectations and

beliefs and are subject to a number of risks, uncertainties and

important factors that may cause actual events or results to differ

materially from those expressed or implied by any forward-looking

statements contained in this press release, including, without

limitation, risks associated with: the impact of global economic

uncertainty, geopolitical instability and conflicts, or public

health epidemics or outbreaks of an infectious disease on countries

or regions in which Relay Therapeutics has operations or does

business, as well as on the timing and anticipated results of its

clinical trials, strategy, future operations and profitability; the

delay or pause of any current or planned clinical trials or the

development of Relay Therapeutics’ drug candidates; the risk that

the preliminary results of its pre-clinical or clinical trials may

not be predictive of future or final results in connection with

future clinical trials of its product candidates; Relay

Therapeutics’ ability to successfully demonstrate the safety and

efficacy of its drug candidates; the timing and outcome of its

planned interactions with regulatory authorities; and obtaining,

maintaining and protecting its intellectual property. These and

other risks and uncertainties are described in greater detail in

the section entitled “Risk Factors” in Relay Therapeutics’ most

recent Annual Report on Form 10-K and Quarterly Report on Form

10-Q, as well as any subsequent filings with the Securities and

Exchange Commission. In addition, any forward-looking statements

represent Relay Therapeutics' views only as of today and should not

be relied upon as representing its views as of any subsequent date.

Relay Therapeutics explicitly disclaims any obligation to update

any forward-looking statements. No representations or warranties

(expressed or implied) are made about the accuracy of any such

forward-looking statements.

Contact:Megan

Goulart617-545-5526 mgoulart@relaytx.com

Media:Dan

Budwick1AB973-271-6085dan@1abmedia.com

|

|

|

Relay Therapeutics, Inc.Condensed Consolidated Statements of

Operations and Comprehensive Loss(In thousands, except share and

per share data)(Unaudited) |

|

|

|

|

Three Months EndedDecember

31, |

|

Twelve Months Ended December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

License and other revenue |

$ |

— |

|

|

$ |

253 |

|

|

$ |

25,546 |

|

|

$ |

1,381 |

|

| Total revenue |

|

— |

|

|

|

253 |

|

|

|

25,546 |

|

|

|

1,381 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

$ |

77,496 |

|

|

$ |

67,277 |

|

|

$ |

330,018 |

|

|

$ |

246,355 |

|

|

Change in fair value of contingent consideration liability |

|

(2,066 |

) |

|

|

(10,544 |

) |

|

|

(6,422 |

) |

|

|

(11,677 |

) |

|

General and administrative expenses |

|

16,766 |

|

|

|

16,371 |

|

|

|

74,950 |

|

|

|

65,978 |

|

| Total operating expenses |

|

92,196 |

|

|

|

73,104 |

|

|

|

398,546 |

|

|

|

300,656 |

|

| Loss from operations |

|

(92,196 |

) |

|

|

(72,851 |

) |

|

|

(373,000 |

) |

|

|

(299,275 |

) |

| Other income: |

|

|

|

|

|

|

|

|

|

|

Interest income |

|

8,700 |

|

|

|

5,372 |

|

|

|

31,045 |

|

|

|

8,786 |

|

|

Other income (expense) |

|

1 |

|

|

|

(24 |

) |

|

|

(18 |

) |

|

|

(20 |

) |

| Total other income, net |

|

8,701 |

|

|

|

5,348 |

|

|

|

31,027 |

|

|

|

8,766 |

|

| Net loss |

$ |

(83,495 |

) |

|

$ |

(67,503 |

) |

|

$ |

(341,973 |

) |

|

$ |

(290,509 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.67 |

) |

|

$ |

(0.56 |

) |

|

$ |

(2.79 |

) |

|

$ |

(2.59 |

) |

| Weighted average shares of common

stock, basic and diluted |

|

124,752,843 |

|

|

|

120,966,401 |

|

|

|

122,576,527 |

|

|

|

112,233,649 |

|

| Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

Unrealized holding gain (loss) |

|

3,210 |

|

|

|

(2,969 |

) |

|

|

10,224 |

|

|

|

(9,332 |

) |

|

Total other comprehensive gain (loss) |

|

3,210 |

|

|

|

(2,969 |

) |

|

|

10,224 |

|

|

|

(9,332 |

) |

| Total comprehensive loss |

$ |

(80,285 |

) |

|

$ |

(64,534 |

) |

|

$ |

(331,749 |

) |

|

$ |

(299,841 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relay Therapeutics, Inc.Selected Condensed Consolidated Balance

Sheet Data(In thousands)(Unaudited) |

|

|

|

|

December 31,2023 |

|

December 31,2022 |

|

Cash, cash equivalents and investments |

$ |

750,086 |

|

|

$ |

998,917 |

|

| Working capital (1) |

|

739,834 |

|

|

|

955,796 |

|

| Total assets |

|

843,980 |

|

|

|

1,099,771 |

|

| Total liabilities |

|

91,977 |

|

|

|

149,553 |

|

| Total stockholders’ equity |

|

752,003 |

|

|

|

950,218 |

|

| Restricted cash |

|

2,707 |

|

|

|

2,578 |

|

(1) Working capital is defined as current assets less current

liabilities.

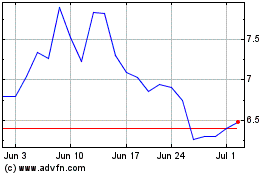

Relay Therapeutics (NASDAQ:RLAY)

Historical Stock Chart

From Apr 2024 to May 2024

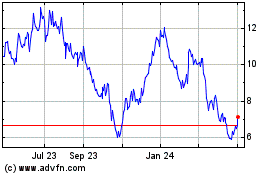

Relay Therapeutics (NASDAQ:RLAY)

Historical Stock Chart

From May 2023 to May 2024