Regency Centers Announces Tax Information for Regency Centers 2024 Distributions

January 21 2025 - 4:15PM

Regency Centers Corporation (“Regency Centers” or the “Company”)

(Nasdaq:REG) today announced the federal income tax treatment of

its 2024 distributions to holders of its Common and Preferred

stock.

Regency Centers

Corporation:

|

Common Stock: Symbol REG CUSIP #: 758849103 |

|

Record Date |

Payable Date |

Total Distribution Per Share |

Distribution Allocated to 2024 |

Total Ordinary Dividends |

Qualified Dividends (Included in Total Ordinary

Div) |

Section 199A Dividends(1) |

Total Capital Gain Distribution (2) |

Unrecapt Section 1250 Gain |

Section 897 Ordinary Dividends |

Section 897 Capital Gain |

Nontaxable Distributions |

|

12/14/2023 |

1/3/2024 |

$0.670000 |

$0.128000 |

$0.127078 |

$0.000000 |

$0.127078 |

$0.000922 |

$0.000000 |

$0.000000 |

$0.000596 |

$0.000000 |

|

3/13/2024 |

4/3/2024 |

$0.670000 |

$0.670000 |

$0.665176 |

$0.000000 |

$0.665176 |

$0.004824 |

$0.000000 |

$0.000000 |

$0.003122 |

$0.000000 |

|

6/12/2024 |

7/3/2024 |

$0.670000 |

$0.670000 |

$0.665176 |

$0.000000 |

$0.665176 |

$0.004824 |

$0.000000 |

$0.000000 |

$0.003122 |

$0.000000 |

|

9/12/2024 |

10/3/2024 |

$0.670000 |

$0.670000 |

$0.665176 |

$0.000000 |

$0.665176 |

$0.004824 |

$0.000000 |

$0.000000 |

$0.003122 |

$0.000000 |

|

12/16/2024 |

1/3/2025 |

$0.705000 |

$0.705000 |

$0.699924 |

$0.000000 |

$0.699924 |

$0.005076 |

$0.000000 |

$0.000000 |

$0.003285 |

$0.000000 |

|

TOTALS |

|

$3.385000 |

$2.843000 |

$2.822530 |

$0.000000 |

$2.822530 |

$0.020470 |

$0.000000 |

$0.000000 |

$0.013247 |

$0.000000 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Series A Cumulative Redeemable Preferred: Symbol REGCP

CUSIP #: 758849889 |

|

Record Date |

Payable Date |

Total Distribution Per Share |

Distribution Allocated to 2024 |

Total Ordinary Dividends |

Qualified Dividends (Included in Total Ordinary

Div) |

Section 199A Dividends(1) |

Total Capital Gain Distribution (2) |

Unrecapt Section 1250 Gain |

Section 897 Ordinary Dividends |

Section 897 Capital Gain |

Nontaxable Distributions |

|

1/16/2024 |

1/31/2024 |

$0.390625 |

$0.390625 |

$0.387813 |

$0.000000 |

$0.387813 |

$0.002812 |

$0.000000 |

$0.000000 |

$0.001820 |

$0.000000 |

|

4/15/2024 |

4/30/2024 |

$0.390625 |

$0.390625 |

$0.387813 |

$0.000000 |

$0.387813 |

$0.002812 |

$0.000000 |

$0.000000 |

$0.001820 |

$0.000000 |

|

7/16/2024 |

7/31/2024 |

$0.390625 |

$0.390625 |

$0.387813 |

$0.000000 |

$0.387813 |

$0.002812 |

$0.000000 |

$0.000000 |

$0.001820 |

$0.000000 |

|

10/16/2024 |

10/31/2024 |

$0.390625 |

$0.390625 |

$0.387813 |

$0.000000 |

$0.387813 |

$0.002812 |

$0.000000 |

$0.000000 |

$0.001820 |

$0.000000 |

|

TOTALS |

|

$1.562500 |

$1.562500 |

$1.551252 |

$0.000000 |

$1.551252 |

$0.011248 |

$0.000000 |

$0.000000 |

$0.007280 |

$0.000000 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Series B

Cumulative Redeemable Preferred:Symbol REGCO CUSIP

#: 758849871 |

|

Record Date |

Payable Date |

Total Distribution Per Share |

Distribution Allocated to 2024 |

Total Ordinary Dividends |

Qualified Dividends (Included in Total Ordinary

Div) |

Section 199A Dividends(1) |

Total Capital Gain Distribution (2) |

Unrecapt Section 1250 Gain |

Section 897 Ordinary Dividends |

Section 897 Capital Gain |

Nontaxable Distributions |

|

1/16/2024 |

1/31/2024 |

$0.367200 |

$0.367200 |

$0.364556 |

$0.000000 |

$0.364556 |

$0.002644 |

$0.000000 |

$0.000000 |

$0.001711 |

$0.000000 |

|

4/15/2024 |

4/30/2024 |

$0.367200 |

$0.367200 |

$0.364556 |

$0.000000 |

$0.364556 |

$0.002644 |

$0.000000 |

$0.000000 |

$0.001711 |

$0.000000 |

|

7/16/2024 |

7/31/2024 |

$0.367200 |

$0.367200 |

$0.364556 |

$0.000000 |

$0.364556 |

$0.002644 |

$0.000000 |

$0.000000 |

$0.001711 |

$0.000000 |

|

10/16/2024 |

10/31/2024 |

$0.367200 |

$0.367200 |

$0.364556 |

$0.000000 |

$0.364556 |

$0.002644 |

$0.000000 |

$0.000000 |

$0.001711 |

$0.000000 |

|

TOTALS |

|

$1.468800 |

$1.468800 |

$1.458224 |

$0.000000 |

$1.458224 |

$0.010576 |

$0.000000 |

$0.000000 |

$0.006844 |

$0.000000 |

|

(1) |

This amount represents dividends eligible for the 20% qualified

business income deduction under Section 199A, and is included in

Ordinary Dividends. |

| (2) |

Section 1061 is generally applicable to direct and indirect holders

of “applicable partnership interests.” Pursuant to Treasury

Regulation Section 1.1061-6(c), the “One Year Amounts Disclosure”

is 100% of the capital gain distributions allocated to each

shareholder and “Three Year Disclosure” is 64.75% of the capital

gain distributions allocated to each shareholder. |

Please note, of the $0.67000 per share dividend

declared for Common holders of record on December 14, 2023 and paid

on January 3, 2024, $0.54200 was reported for income tax purposes

in 2023 with the remaining $0.12800 reported for tax year 2024 as

set forth in the above table.

Of the $0.70500 per share dividend declared for

the Common holders of record on December 16, 2024 and paid on

January 3, 2025, $0.70500 is reported for income tax purposes in

2024.

This information is being provided to assist

shareholders with tax reporting related to distributions made by

the Company. It represents the Company’s understanding of the U.S.

federal income tax laws and regulations and does not constitute tax

advice. It does not purport to be complete or to describe the

consequences that may apply to specific types of shareholders.

Shareholders should review the tax statements that they will

receive from their brokerage firms or other institutions to ensure

that the statements agree with the information posted. Tax

treatment of 2024 distributions is not necessarily indicative of

taxability of future distributions, as tax treatment may change

from year to year. The information provided herein should not be

construed as tax advice or relied upon as such, and shareholders

are strongly encouraged to consult with their tax advisors as to

tax treatment of the Company's distributions specific to their

individual situations.

About Regency Centers Corporation

(Nasdaq: REG)

Regency Centers is a preeminent national owner,

operator, and developer of shopping centers located in suburban

trade areas with compelling demographics. Our portfolio includes

thriving properties merchandised with highly productive grocers,

restaurants, service providers, and best-in-class retailers that

connect to their neighborhoods, communities, and customers.

Operating as a fully integrated real estate company, Regency

Centers is a qualified real estate investment trust (REIT) that is

self-administered, self-managed, and an S&P 500 Index member.

For more information, please visit RegencyCenters.com.

Christy McElroy904 598

7616ChristyMcElroy@regencycenters.com

This press release was published by a CLEAR® Verified

individual.

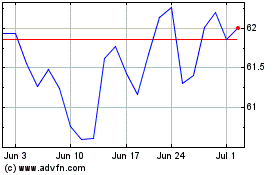

Regency Centers (NASDAQ:REG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Regency Centers (NASDAQ:REG)

Historical Stock Chart

From Jan 2024 to Jan 2025