Exhibit 2

SALE AND PURCHASE AGREEMENT

THIS SALE AND PURCHASE

AGREEMENT (this “Agreement”) is entered into on March 10, 2025 by and between Digital Mobile Venture Ltd.,

a British Virgin Islands company (the “Seller”) and Regencell (BVI) Limited, a British Virgin Islands company

(the “Purchaser”).

WHEREAS, the Seller

is the legal and beneficial owner of 652,982 ordinary shares, par value $0.00001 per share, of Regencell Bioscience Holdings Limited

(the “Ordinary Shares”), a Cayman Islands exempted company with limited liability (the “Company”);

WHEREAS, pursuant to

the terms of this Agreement, the Seller desires to irrevocably sell and transfer to the Purchaser, and the Purchaser desires to irrevocably

purchase and accept from the Seller, an aggregate of 652,982 Ordinary Shares (the “Shares”).

NOW, THEREFORE, in

consideration of the foregoing and for other good and valuable consideration, the adequacy of which is hereby acknowledged, the parties

hereto agree as follows:

1

Sale and Purchase. Subject to the terms and conditions of this Agreement, the Seller hereby absolutely, irrevocably

and unconditionally sells, conveys and transfers to the Purchaser all of its right, title and interest in and to the Shares, free of all

liens, charges or other encumbrances, at a purchase price of US$9.50 per Share for a total consideration of US$6,203,329 (the “Purchaser

Price”), on March 10, 2025 (the “Trade Date”). The Purchaser accepts such sale of the Shares.

2

Closing Date. On March 13, 2025, or at such other time and/or date as the Seller and the Purchaser may agree

(the “Closing Date”), the Seller shall credit the Shares in registered form to the account of the Purchaser’s

prime broker with the Depository Trust and Clearing Corporation listed below, through its Deposit Withdrawal Agent Commission (DWAC) system:

Settlement Instructions:

| Brokerage Firm: |

[ ] |

| DTC Participant number: |

[ ] |

| Account Name: |

REGENCELL (BVI) LIMITED |

| Account Number: |

[ ] |

3

Purchase Price. Against and immediately after delivery of the Shares in accordance with Section 2

above, the Purchaser shall pay the Purchase Price to the Seller by wire transfer on the Closing Date to the account listed below:

| PAY TO: |

[ ] |

| CREDIT Account Name: |

[ ] |

| Account Number: |

[ ] |

| FURTHER CREDIT: |

Digital Mobile Venture Ltd |

| CLIENT A/C NO: |

[ ] |

4

Additional Documents. The Seller agrees to take such further action to execute and deliver, or cause to be

executed and delivered, any and all other documents which are, in the opinion of the Purchaser’s counsel, necessary or desirable

to carry out the terms and conditions of the sale of the Shares.

5

Effective Date and Counterpart Signature. This Agreement shall be effective as of the date hereof. This Agreement,

and acceptance of the same, may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument. Confirmation of execution by email or pdf, or telex or by telecopy or telefax of a facsimile

signature page shall be binding upon that party so confirming.

6

Taxes. The Seller undertakes with the Purchaser that the Seller shall bear and pay any stamp or other duties

or taxes on or in connection with the sale and transfer of the Shares by the Seller to the Purchaser hereunder; provided, however,

that the Seller and the Purchaser shall bear their own legal costs in connection with the transaction contemplated hereby.

7

Representations and Warranties of the Seller. The Seller hereby represents, warrants and covenants to the

Purchaser that each of the following is true and accurate as of the date hereof, as of the Trade Date and as of the Closing Date (except

for the representations and warranties that speak as of a specific date, which shall be made as of such date) and that such representations,

warranties and covenants shall survive the execution and delivery of this Agreement.

(a)

Organization; Authority. The Seller is an entity duly organized, validly existing and in good standing under the laws of

the British Virgin Islands with full right, corporate, partnership or other applicable power and authority to enter into and to consummate

the transactions contemplated by this Agreement and otherwise to carry out its obligations thereunder, and the execution, delivery and

performance by the Seller of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate or similar

action on the part of the Seller. This Agreement, when executed and delivered by the Seller, will constitute a valid and legally binding

obligation of the Seller, enforceable against the Seller in accordance with its terms, except (i) as limited by applicable bankruptcy,

insolvency, reorganization, moratorium, fraudulent conveyance, and any other laws of general application affecting enforcement of creditors’

rights generally, or (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable

remedies.

(b)

Ownership. The Seller is the sole and exclusive legal and beneficial owner of the Shares and is conveying to the Purchaser

all of its right, title and interest to the Shares free and clear of any liens, mortgages, pledges, security interests, encumbrances or

charges of any kind or description and upon consummation of the transaction contemplated herein good title in and to such Shares. The

Seller has continuously held the Shares being sold and transferred hereunder (and each of them) since July 16, 2021.

(c)

No Consents, Approvals, Violations or Breaches. The execution, delivery and performance by Seller of this Agreement and

any other document executed and delivered pursuant hereto, and the consummation of the transactions contemplated hereby and thereby do

not and will not (i) require any consent, approval, authorization or permit of, or filing, registration or qualification with or prior

notification to, any governmental or regulatory authority under any law applicable to the Seller, (ii)result in a violation or

breach of, or constitute (with or without due notice or lapse of time or both) a default under, any of the terms, conditions or provisions

of any note, bond, mortgage, indenture, lease, license, contract, agreement or other instrument or obligation to which Seller is a party

or (iii) violate any order, writ, injunction, decree, law or regulation applicable to the Seller.

(d)

Sophisticated Seller. The Seller (i) is a sophisticated entity familiar with transactions similar to those contemplated

by this Agreement, (ii) has adequate information concerning the business and financial condition of the Company to make an informed

decision regarding the sale of the Shares, and (c) has independently and without reliance upon the Purchaser or the Company, and

based on such information and the advice of such advisors as the Seller has deemed appropriate, made its own analysis and decision to

enter into this Agreement. The Seller acknowledges that none of the Company, the Purchaser or their respective affiliates is acting as

a fiduciary or financial or investment adviser to the Seller, and that none of the Company, the Purchaser or their respective affiliates

has given the Seller any investment advice, opinion or other information on whether the sale of the Shares is prudent. The Seller understands

that the Company’s plans for the future, if successful, may result in the Company’s shares becoming significantly more valuable

than, and the future value of the Shares could far exceed, the Purchase Price the Seller will receive under this Agreement. In addition,

the Seller acknowledges and understands that the Company may pursue various acquisitions and liquidity events. The Seller acknowledges

that (A) the Purchaser currently may have, and later may come into possession of, information with respect to the Company or the

Shares that is not known to the Seller and that may be material to a decision to sell the Shares (“Seller Excluded Information”),

(B) the Seller has determined to sell the Shares notwithstanding its lack of knowledge of the Seller Excluded Information and (C) the

Purchaser shall have no liability to the Seller, and the Seller waives and releases any claims that it might have against the Purchaser,

whether under applicable securities laws or otherwise, with respect to the nondisclosure of the Seller Excluded Information in connection

with the sale of the Shares and the transactions contemplated by this Agreement. The Seller understands that the Purchaser will rely on

the accuracy and truth of the foregoing representations, and the Seller hereby consents to such reliance.

(e)

Litigation. There is no action, suit, proceeding or investigation pending, or currently threatened, against the Seller that

questions the validity of this Agreement or the right of the Seller to enter into this Agreement, or to consummate the transactions contemplated

hereby.

(f)

No Continuing Rights. The Seller hereby acknowledges that, solely with respect to the Shares, Seller shall hereinafter have

no rights as a stockholder of the Company with respect to any future exchange, conversion, sale, acquisition, merger, liquidation, dissolution,

public offering or other corporate event regarding the Company or its assets (any of the foregoing, a “Corporate Event”)

by reason of the Seller’s ownership of the Shares prior to the sale of the Shares pursuant to this Agreement. The Seller further

agrees that Seller will not make any claim or assert any right or interest, against the Purchaser, Company, or any officer, director,

stockholder, employee, representative, advisor or current attorney of the Company, or their successors, predecessors or assigns (collectively,

the “Parties”), in the capacity of a shareholder or former shareholder, by reason of Seller’s ownership of the

Shares prior to the Closing Date, and hereby forever irrevocably, unconditionally and forever acquits, releases and discharges the Parties

from any and all claims, losses, costs, liabilities or demands, in law or in equity, asserted or unasserted, express or implied, known

or unknown, matured or unmatured, contingent or vested, liquidated or unliquidated, of any kind or nature or description whatsoever that

the Seller had, presently has or may hereafter have or claim or assert to have against the Parties, with respect to or as a result of

any such assets, funds, proceeds, enhanced value (or with respect to the Corporate Event to which such assets, funds, proceeds or enhanced

value relate), or otherwise, by reason of the Seller’s ownership of the Shares prior to the Closing Date (all of the foregoing,

collectively, “Claims”). The foregoing release is intended to be complete, global and all-encompassing and specifically

includes claims that are known, unknown, fixed, contingent or conditional; provided, however, for the avoidance of doubt,

the foregoing release excludes any Claims arising under, and subject to the limitations contained in, the express terms of this Agreement.

(g)

Tax Matters. Seller has had opportunity to review with the Seller’s own tax advisors the federal, state and local

tax consequences of the sale of the Shares and the transactions contemplated by this Agreement. The Seller is relying solely on such advisors

and not on any statements or representations of the Company, the Purchaser or any of their respective representatives, agents, advisors

or legal counsel. The Seller understands that the Seller (and not the Company nor the Purchaser) shall be responsible for Seller’s

own tax liability that may arise as a result of the transactions contemplated by this Agreement.

(h)

Access to Information. The Seller hereby acknowledges and agrees that the Seller has had an opportunity to discuss the Company’s

business, management and financial affairs with the Company’s management and the opportunity to inspect Company facilities and such

books and records and material contracts as Seller deemed necessary to its determination to sell the Shares.

(i)

Money Laundering. The operations of the Seller are and have been conducted at all times in compliance with applicable financial

record-keeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, applicable money

laundering statutes and applicable rules and regulations thereunder (collectively, the “Money Laundering Laws”), and

no action or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Seller with respect

to the Money Laundering Laws is pending or, to the knowledge of the Seller or any of its affiliates, threatened.

(j)

Manipulation of Price. Neither the Seller nor any of its affiliates has, directly or indirectly, and, to the knowledge of

the Seller, no person acting on its behalf has, directly or indirectly, (i) taken any action designed to cause or to result in the stabilization

or manipulation of the price of any security of the Company or any of its subsidiaries to facilitate the sale or resale of any of the

Shares, (ii) sold, bid for, purchased, or paid any compensation for soliciting purchases of, any of the Shares, or (iii) paid or agreed

to pay to any person any compensation for soliciting another to purchase any other securities of the Company or any of its subsidiaries.

(k)

The above representations and warranties shall survive, notwithstanding any investigation by or on behalf of the Purchaser, for

a period of twelve (12) months following the Closing Date.

8

Representations and Warranties of the Purchaser. The Purchaser hereby represents, warrants and covenants to

the Seller that each of the following is true and accurate as of the date hereof, and as of the Closing Date (except for the representations

and warranties that speak as of a specific date, which shall be made as of such date) and that such representations, warranties and covenants

shall survive the execution and delivery of this Agreement.

(a)

Organization: Authority. The Purchaser is duly organized, validly existing and in good standing under the laws of the British

Virgin Islands and has the requisite corporate power and authority to enter into and perform its obligations under this Agreement and

to subscribe for or acquire securities in accordance with the terms hereof. The decision to invest and the execution and delivery of this

agreement by the Purchaser, the performance by the Purchaser of its obligations under this agreement and the consummation by the Purchaser

of the transactions contemplated by this agreement have been duly authorized and require no other proceedings on the part of the Purchaser.

The undersigned has the right, power and authority to execute and deliver this agreement and all other instruments on behalf of the Purchaser

or its shareholders. This agreement has been duly executed and delivered by the Purchaser and, assuming the execution and delivery hereof

and acceptance thereof by the Seller, will constitute the legal, valid and binding obligations of the Purchaser, enforceable against the

Purchaser in accordance with its terms.

(b)

Investment Experience: Access to Information and Preexisting Relationship. The Purchaser (i) either alone or together with

its representatives, has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and

risks of the purchase of the Shares and make an informed decision to so invest, and has so evaluated the risks and merits of such investment,

(ii) has the ability to bear the economic risks of this investment and can afford a complete loss of such investment, (iii) understands

the terms of and risks associated with the acquisition of the Shares, (iv) has had the opportunity to review such disclosure regarding

the Company, its business, its financial condition and its prospects as the Purchaser has determined to be necessary in connection with

the sale of the Shares.

(c)

General Solicitation. Neither the Purchaser, nor any of its affiliates, nor any person acting on its behalf is entering

into this Agreement as a result of any general solicitation or general advertising (within the meaning of Regulation D) in connection

with the offer or sale of the Shares.

(d)

No Conflicts; Advice. Neither the execution and delivery of this Agreement, nor the consummation of the transactions contemplated

hereby, does or will violate any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge or other

restriction of any government, governmental agency, or court to which the Purchaser is subject or any provision of its organizational

documents or other similar governing instruments, or conflict with, violate or constitute a default (or an event which with notice or

lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation

of, any agreement, credit facility, debt or other instrument or understanding to which the Purchaser is a party. The Purchaser has consulted

such legal, tax and investment advisors as it, in its sole discretion, has deemed necessary or appropriate in connection with the sale

of the Shares.

(e)

Understandings or Arrangements. The Purchaser is acquiring the Shares hereunder as principal for its own account and has

no direct or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of such the Shares

hereunder. Such Purchaser is acquiring the Securities hereunder in the ordinary course of its business.

(f)

Consents. No authorization, consent, approval or other order of, or declaration to or filing with, any governmental agency

or body or other Person is required for the valid authorization, execution, delivery and performance by the Purchaser of this Agreement

and the consummation of the transactions contemplated hereby.

(g)

Money Laundering. The operations of Purchaser are and have been conducted at all times in compliance with applicable Money

Laundering Laws, and no action or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving

the Purchaser with respect to the Money Laundering Laws is pending or, to the knowledge of the Purchaser, threatened.

9

Governing Law: Submissions to Jurisdiction. THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE

WITH THE LAWS OF NEW YORK, WITHOUT REGARD TO CONFLICT OF LAW PRINCIPLES. EACH PARTY AGREES THAT ANY ACTION OR PROCEEDING ARISING OUT OF

OR RELATING IN ANY WAY TO THIS AGREEMENT SHALL BE BROUGHT IN A COURT OF COMPETENT JURISDICTION SITTING IN THE STATE OR FEDERAL COURTS

OF NEW YORK, EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION

OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

10

Amendments. No provision hereof may be waived or modified other than by an instrument in writing signed by

the party against whom enforcement is sought.

11

Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent

jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth

herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use

their reasonable best efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated

by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would

have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared

invalid, illegal, void or unenforceable.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have

executed this Agreement as of the date first above written.

| |

SELLER: |

| |

|

| |

Digital Mobile Venture Ltd. |

| |

|

| |

By: |

/s/ [ ] |

| |

Name: |

[ ] |

| |

Title: |

Director |

[Signature Page to Sale and Purchase Agreement]

IN WITNESS WHEREOF,

the parties hereto have executed this Agreement as of the date first above written.

| |

PURCHASER: |

| |

|

| |

Regencell (BVI) Limited |

| |

|

| |

By: |

/s/ Yat-Gai Au |

| |

Name: |

Yat-Gai Au |

| |

Title: |

Director |

[Signature Page to Sale and Purchase Agreement]

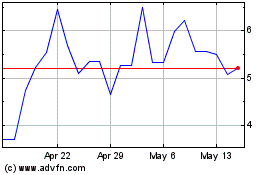

Regencell Bioscience (NASDAQ:RGC)

Historical Stock Chart

From Feb 2025 to Mar 2025

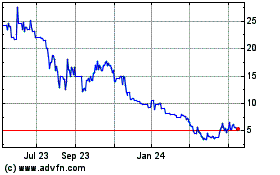

Regencell Bioscience (NASDAQ:RGC)

Historical Stock Chart

From Mar 2024 to Mar 2025