Qifu Technology, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qifu Technology”

or the “Company”), a leading Credit-Tech platform in China, today

issues the following preliminary responses to the key claims made

in a report (the “Report”) by Grizzly Research, a short seller, on

September 26, 2024.

The Company believes that the Report is without merit and

contains inaccurate information, flawed analyses, misleading

conclusions and interpretations regarding information relating to

the Company. Specifically:

The SAMR (SAIC) Financial Data Used in the Report is

Completely Wrong.

The Report makes material mistakes in referring to incorrect

financial data (i.e. the combined revenues and net profits) from

the filings with the State Administration for Market Regulation

(“SAMR”), formerly known as the State Administration for Industry

and Commerce (“SAIC”) submitted by the operating entities of the

Company. In fact, as the Company’s SAMR filing records demonstrate,

the Company’ s major operating entities in China collectively

reported total revenues of RMB 17.0 billion in 2022 and RMB 16.0

billion in 2023, with corresponding net profits of RMB 5.2 billion

and RMB 4.7 billion, respectively. These revenues and net profits

were recorded under PRC GAAP.

According to the Company’s filings with the U.S. Securities and

Exchange Commission (the “SEC”), for the years 2022 and 2023, under

U.S. GAAP and on a consolidated basis, the Company recorded total

revenues of RMB16.6 billion and RMB16.3 billion, respectively, and

net profits of RMB4.0 billion and RMB4.3 billion, respectively. The

differences in total revenues and net profits between the filings

with the SAMR and those with the SEC are primarily attributable to

differences in accounting treatments under PRC GAAP and U.S. GAAP,

as well as the fact that the Company’s major operating entities in

China reflected in the SAMR filings do not represent all of the

Company’s subsidiaries and consolidated affiliated entities in

China.

The Company has consistently generated robust operating cash

flow in recent years and delivered significant returns to

shareholders through dividends and stock repurchases. As of the

date of this press release, in 2024, the Company has spent more

than US$300 million to repurchase its America Depositary Shares

(ADSs) on the open market and distributed approximately US$180

million cash dividends to shareholders. The Company’s strong

commitment to, and proven track record of, shareholder returns

further underscore the baseless nature of the claims made in the

Report.

Rebuttal of Unsubstantiated Media Reports about the

Company’s Regional Headquarters

The Report cites certain media reports about the Company’s

regional headquarters in Shanghai that are false and

unsubstantiated. In fact, as disclosed in the Company’s filings

with the SEC, in October 2020, the Company established a joint

venture in Shanghai, together with one of 360 Group entities and an

independent third party, to build its regional headquarters and an

affiliated industrial park to support the future operations of the

Company and 360 Group. The Company and the 360 Group entity held

40% and 30% of the equity interest in the joint venture,

respectively. In December 2021, considering the Company’s

significant business expansion in Shanghai, the Company acquired

the entire 30% equity interest held by the 360 Group entity in the

joint venture. Consequently, these facilities will enable the

Company to consolidate all its Shanghai-based departments and

employees, who are currently dispersed across different locations,

into a single office space. The Company believes this will further

reduce administrative costs and improve operational efficiency.

Both the co-investment with the 360 Group in October 2020 and

the acquisition of the equity interest in the joint venture from

the 360 Group in December 2021 were negotiated and conducted at

arm’s length and were approved by the board of directors and the

audit committee of the Company.

The Report also makes a false claim that the Company has

acquired another piece of land in the Huangpu District of Shanghai.

In fact, the Company did not acquire any land in the Huangpu

District of Shanghai.

Rebuttal of Unsubstantiated Financial Manipulation Claim

and Relationship between Shanghai Qibutianxia and the

Company

The claim made in the Report that the Company uses Shanghai

Qibutianxia Information Technology Co., Ltd. (“Shanghai

Qibutianxia,” formerly known as Beijing Qibutianxia Technology Co.,

Ltd.) to manipulate its financial statements is false and

unsubstantiated.

In fact, Shanghai Qibutianxia was the holding company for the

Company’s operating entities in China prior to the Company’s

reorganization in 2018 for financing and offshore listing on

Nasdaq. In July 2016, as a spin-off from 360 Group, Shanghai

Qibutianxia incorporated Shanghai Qiyu Information & Technology

Co., Ltd. (“Shanghai Qiyu”), and thereafter, the Company started

operating independently under Shanghai Qiyu.

In April 2018, to facilitate the Company’s financing and

offshore listing on Nasdaq, a holding company under the Company’s

former name, 360 Finance, Inc. was incorporated in the Cayman

Islands. As part of the reorganization, the Cayman holding company

incorporated an indirectly wholly-owned subsidiary in China, namely

Shanghai Qiyue Information & Technology Co., Ltd. (“Shanghai

Qiyue”). Shanghai Qiyue entered into a series of “VIE” contractual

arrangements with the Company’s three major operating entities in

China and their shareholder Shanghai Qibutianxia. As a result,

these major operating entities in China became the Company’s VIEs,

and Shanghai Qibutianxia remained the nominal shareholder of these

VIEs. The contractual arrangements enable the Company to exercise

effective control over the Company’s VIEs; receive substantially

all of the economic benefits and powers to exercise voting rights

of the Company’s VIEs from Shanghai Qibutianxia, and have an

exclusive option to purchase all or part of the equity interests in

and assets of them when and to the extent permitted by PRC law.

In addition, the Report erroneously claims that the Company

utilized the back-to-back guarantee arrangement with Shanghai

Qibutianxia to manipulate its financial statements. In fact, prior

to 2023, certain financial institutions required the nominal

shareholder of our operating entities (i.e., Shanghai Qibutianxia)

to supplementally provide back-to-back guarantees for certain loans

facilitated and guaranteed by the Company’s operating entities.

Specifically, Shanghai Qibutianxia committed to cover any shortfall

if the Company’s operating entities fail to meet its guaranteed

repayment obligations to the banks on time. This back-to-back

guarantee arrangement did not increase the Company’s risk

exposures, nor did it transfer any interest to Shanghai

Qibutianxia. As of the date of this press release, there is no

outstanding balance under this arrangement.

The Report erroneously states that Mr. Hongyi Zhou is the

controlling shareholder of the Company. In fact, The Company does

not have a controlling shareholder. According to the Company’s

annual report on Form 20-F filed with the SEC on April 26, 2024,

Mr. Hongyi Zhou beneficially owned approximately 13.8% of total

ordinary shares of the Company as of February 29, 2024. Mr. Hongyi

Zhou was the chairman of the board directors of the Company, but

has not been involved day-to-day operations of the company. As

announced by the Company on August 13, 2024, Mr. Hongyi Zhou has

resigned as a director and the chairman of the board of directors

of the Company.

Rebuttal of Unsubstantiated Claim about Delinquency

Rates and Provisions

The claim made in the Report in relation to the Company’s

delinquency rates and provision booking exhibits a fundamental

misunderstanding of the Company’s financial practices and the

relevant accounting standards. Specifically:

- The Report inaccurately calculated

the Company’s provision ratios by using the total reported

provisions to calculate the provision ratio for each period.

- The Report erroneously included

provisions for contingent liabilities in the analysis of

receivables provisioning.

- The Report’s focus on a

backward-looking 90 day+ delinquency rate is misplaced.

- The Report’s claim that the

Company’s reported profits are fabricated to account for the

missing cash is completely false and unsubstantiated.

Provision Ratios

The Report inaccurately calculated the Company’s provision

ratios by using the total reported provisions to calculate the

provision ratio for each period, which is fundamentally incorrect.

According to the accounting standards under U.S. GAAP, each

reported provision item reflects the net result of new provisions

booked for current period loans and the revision of provisions for

existing loans. The Company maintains clear and distinct categories

for provisions related to the Company’s loan products: (i)

provision for loan receivable, relating solely to the Company’s

on-balance sheet loans; (ii) provision for financial assets

receivable, relating to the guarantee service fees; (iii) provision

for accounts receivable and contract assets, relating to, relating

to the loan facilitation service fees;; and (iv) provision for

contingent liabilities, relating to the off-balance sheet loans for

which the Company provides guarantee services.

The following chart delineates the components of the Company’s

reported provisions for 2022, 2023, and the first half of 2023 and

2024, demonstrating compliance with accounting standards:

|

(RMB in millions) |

2022 |

|

2023 |

|

First Halfof 2023 |

|

First Halfof 2024 |

|

|

New Provisions for Current Period New Loans |

7,355 |

|

7,647 |

|

3,573 |

|

2,694 |

|

|

Revision of Previous Provisions (write-back) |

(771 |

) |

(1,880 |

) |

(936 |

) |

(489 |

) |

|

Net Provisions |

6,584 |

|

5,767 |

|

2,636 |

|

2,205 |

|

|

Provision for Loans Receivable |

1,580 |

|

2,151 |

|

1,002 |

|

1,697 |

|

|

Provision for Financial Assets Receivable |

398 |

|

386 |

|

151 |

|

169 |

|

|

Provision for Accounts Receivable and Contract Assets |

238 |

|

176 |

|

45 |

|

235 |

|

|

Provision for Contingent Liabilities |

4,368 |

|

3,054 |

|

1,438 |

|

103 |

|

|

New Provisions Booking Ratio |

|

|

|

|

|

|

|

|

|

Provision Ratio for Loan Receivable1 |

2.9 |

% |

2.9 |

% |

2.8 |

% |

3.4 |

% |

|

Provision Ratio for Contingent Liabilities2 |

4.1 |

% |

4.0 |

% |

3.7 |

% |

4.1 |

% |

|

|

|

|

|

|

|

|

|

|

__________________Notes:1. "Provision Ratio for Loan Receivable"

refers to the total amount of new provisions for loan receivable

for a specific period divided by the loan facilitation volume of

on-balance sheet loans for that period.2. "Provision Ratio for

Contingent Liabilities" refers to the total amount of new

provisions for contingent liabilities for a specific period divided

by capital-heavy loan facilitation volume for that period.

Provisions for Contingent Liabilities

In addition, the Report erroneously included provisions for

contingent liabilities in the analysis of receivables provisioning.

In fact, provisions for contingent liabilities pertain only to

off-balance sheet loans that the Company guarantees. These

provisions are entirely separate from receivables on the balance

sheet and should not be conflated. In fact, the Company has

consistently applied a prudent approach to managing business risks

and financial provisions. The historical data listed above also

showcases the Company’s commitment to maintaining appropriate

provision ratios against the Company’s risk-bearing loans.

Delinquency Rate

The Report’s focus on a backward-looking 90 day+ delinquency

rate1 is misplaced. The Company prioritizes leading risk indicators

that provide a proactive view of credit risk, such as: (i) Day-1

delinquency rate2, which measures delinquency based on the day

before the reporting period, offering a real-time risk assessment;

and (ii) 30 day collection rate3, which tracks the efficiency of

collections within a short timeframe, enabling timely

interventions. These forward-looking metrics provide a more

accurate and actionable assessment of credit risk compared to

traditional delinquency rates. In fact, the Company’s D-1

delinquency rate and 30 day collection rate in the past two

quarters both indicate the improving quality of the Company’s loan

portfolios.

Decreases in Cash

The Report’s claim that the Company’s reported profits are

fabricated to account for the missing cash is completely false and

unsubstantiated. The Company’s cash and cash equivalent decreased

from RMB10.5 billion as of December 31, 2022 to RMB 8.4 billion as

of June 30, 2024 primarily because the growth in the Company’s

on-balance sheet loans, cash dividends distributed to shareholders,

and stock repurchase program. Specifically, the Company’s

on-balance sheet loan balances increased from RMB19.5 billion as of

December 31, 2022 to RMB32.1 billion as of June 30, 2024. In

addition, from December 31, 2022 to June 30, 2024, the Company has

distributed approximately RMB3.6 billion to shareholders through

dividends and share buybacks, resulting in a reduction in cash and

cash equivalent.

Non-Risk-Bearing Loans are Irrelevant to Leverage

Ratio

The claim made in the Report that the Company’s is secretly

overleveraged lacks factual basis and misunderstands the Company’s

financial structure and risk management strategies. Specifically,

the Report erroneously uses the total outstanding loan balances

facilitated by the Company for calculating its leverage ratio. By

definition, the leverage ratio is relevant only to risk-bearing

assets, which include both on-balance sheet loans and capital-heavy

loan facilitation. As disclosed in the Company’s filings with the

SEC, the outstanding balances of the Company’s risk-bearing loans

accounted for only 34.2% of the total outstanding loan balances

facilitated by the Company as of June 30, 2024. As of the same

date, the Company’s leverage ratio was 2.4, reaching a historical

low. The company employs robust risk management frameworks to

monitor and control leverage, ensuring sustainability and financial

stability.

Rebuttal of Unsubstantiated Claim About Loan Annual

Interest Rates

The claim made in the Report that the Company issues loans at

rates that exceed legal limits is categorically false and

misleading. For example, the Report falsely claimed that regulatory

guidance in China stipulates that the interest rate for the

Company’s businesses should not exceed four times the one-year Loan

Prime Rate at the time of the establishment of an agreement (the

“Quadruple LPR Limit”). In fact, the Chinese Supreme People’s Court

issued a guidance in December 2020, stipulating that the Quadruple

LPR Limit does not apply to disputes arising from engagement in

relevant financial businesses of certain financial institutions,

including micro-lending companies and financing guarantee

companies, such as the Company’s operating entities. The Company

operates in strict compliance with all regulatory requirements that

governs loan annual interest rate limits.

The Company emphasizes its continued and unwavering commitment

to maintaining high standards of corporate governance and internal

control, as well as transparent and timely disclosure in compliance

with applicable rules and regulations. To protect the

interests of the Company and its shareholders, the Company will

vigorously defend itself against false and baseless claims made by

short seller reports.

The Company’s board of directors (the “Board”),

including the audit committee, is reviewing the allegations and

considering the appropriate course of action to protect the

interests of all shareholders. The Company will make additional

disclosures in due course consistent with the requirements of

applicable rules and regulations of the U.S. Securities and

Exchange Commission, The Nasdaq Stock Market, and The Stock

Exchange of Hong Kong Limited.

About Qifu Technology

Qifu Technology is a leading Credit-Tech platform in China that

provides a comprehensive suite of technology services to assist

financial institutions and consumers and SMEs in the loan

lifecycle, ranging from borrower acquisition, preliminary credit

assessment, fund matching and post-facilitation services. The

Company is dedicated to making credit services more accessible and

personalized to consumers and SMEs through Credit-Tech services to

financial institutions.

For more information, please

visit: https://ir.qifu.tech.

Safe Harbor Statement

Any forward-looking statements contained in this announcement

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” and similar statements. Among other things, the

business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. Qifu Technology may also

make written or oral forward-looking statements in its periodic

reports to the SEC, in announcements made on the website of The

Stock Exchange of Hong Kong Limited (the “Hong Kong Stock

Exchange”), in its annual report to shareholders, in press releases

and other written materials and in oral statements made by its

officers, directors or employees to third parties. Statements that

are not historical facts, including the Company’s business outlook,

beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, which factors include but not limited to the following:

the Company’s growth strategies, the Company’s cooperation with 360

Group, changes in laws, rules and regulatory environments, the

recognition of the Company’s brand, market acceptance of the

Company’s products and services, trends and developments in the

credit-tech industry, governmental policies relating to the

credit-tech industry, general economic conditions in China and

around the globe, and assumptions underlying or related to any of

the foregoing. Further information regarding these and other risks

and uncertainties is included in Qifu Technology’s filings with the

SEC and announcements on the website of the Hong Kong Stock

Exchange. All information provided in this press release is as of

the date of this press release, and Qifu Technology does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

For more information, please contact:

Qifu Technology

E-mail: ir@360shuke.com

_____________________________________1 “90 day+ delinquency

rate” refers to the outstanding principal balance of on- and

off-balance sheet loans that were 91 to 180 calendar days past due

as a percentage of the total outstanding principal balance of on-

and off-balance sheet loans across our platform as of a specific

date. Loans that are charged-off and loans under “ICE” and other

technology solutions are not included in the delinquency rate

calculation.2 “Day-1 delinquency rate” is defined as (i) the total

amount of principal that became overdue as of a specified date,

divided by (ii) the total amount of principal that was due for

repayment as of such specified date.3 “30 day collection rate” is

defined as (i) the amount of principal that was repaid in one month

among the total amount of principal that became overdue as of a

specified date, divided by (ii) the total amount of principal that

became overdue as of such specified date.

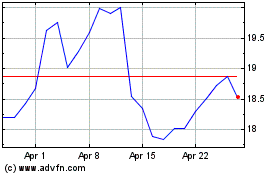

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

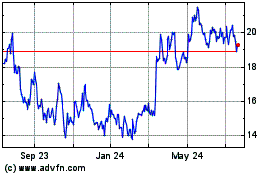

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Dec 2023 to Dec 2024