- Net cash used in operating and investing activities was $45.2

million and $102.5 million for the third quarter and first nine

months of 2024, respectively; quarter-end cash and restricted cash

position was $520.1 million

- PRX012, a potential single-injection once-monthly subcutaneous

treatment, is designed to address the unmet need of millions of

patients with presymptomatic or early symptomatic Alzheimer's

disease; Prothena expects to report multiple clinical readouts

starting in mid-2025 and continuing throughout the year from the

ongoing Phase 1 ASCENT clinical trials

- Results from partner Roche evaluating prasinezumab in patients

with early Parkinson’s disease from the Phase 2 PASADENA OLE

clinical trial published in Nature Medicine

- In collaboration with Bristol Myers Squibb, Prothena has

initiated a Phase 1 clinical trial for PRX019, a potential

treatment for neurodegenerative diseases

- With partner Novo Nordisk, Phase 1 clinical trial results for

coramitug (formerly PRX004) in patients with ATTR amyloidosis

published in Amyloid, the official journal of the ISA

- Prothena appointed Chad J. Swanson, Ph.D., as Chief Development

Officer

Prothena Corporation plc (NASDAQ:PRTA), a late-stage clinical

biotechnology company with a robust pipeline of investigational

therapeutics built on protein dysregulation expertise, today

reported financial results for the third quarter and first nine

months of 2024 and provided business highlights.

“Within the next several quarters we expect meaningful data

readouts on four clinical programs in our robust R&D pipeline

that have the potential to significantly improve the lives of

millions of individuals with neurodegenerative or rare peripheral

amyloid diseases and their families,” said Gene Kinney, Ph.D.,

President and Chief Executive Officer, Prothena. “From our

wholly-owned programs we expect to complete our confirmatory Phase

3 AFFIRM-AL clinical trial evaluating birtamimab, which is being

conducted under a SPA agreement with the FDA at a significance

level of 0.10, in 1H 2025. We also expect to announce multiple

clinical readouts from our ongoing Phase 1 ASCENT clinical trials

evaluating PRX012 for Alzheimer’s disease starting in mid-2025 and

continuing throughout the year. In collaboration with Roche, we

expect results from the Phase 2b PADOVA clinical trial evaluating

prasinezumab for Parkinson’s disease in 4Q 2024 and with Novo

Nordisk, we expect results from the Phase 2 signal-detection

clinical trial evaluating coramitug for ATTR amyloidosis with

cardiomyopathy in 1H 2025.”

Third Quarter, Recent Business Highlights and Upcoming

Milestones

Neurodegenerative Diseases

Portfolio

Alzheimer’s Disease

PRX012, a wholly-owned potential best-in-class,

single-injection once-monthly antibody delivered subcutaneously for

the treatment of Alzheimer’s disease that targets a key epitope at

the N-terminus of amyloid beta (Aβ) with high binding potency. The

U.S. Food and Drug Administration (FDA) has granted Fast Track

designation for PRX012 for the treatment of Alzheimer’s

disease.

- Designed as a potential single-injection once-monthly

subcutaneous treatment to address the unmet need of millions of

patients with presymptomatic or early symptomatic Alzheimer's

disease, Prothena expects to report multiple clinical readouts

starting in mid-2025 and continuing throughout the year from the

ongoing Phase 1 ASCENT clinical trials

- Prothena has currently enrolled approximately 260 patients in

the ASCENT clinical trials

- Poster presentation at CTAD 2024 highlighted the clinical trial

design and patient demographic diversity of the ongoing ASCENT

clinical trials

BMS-986446 (formerly PRX005), a potential best-in-class

antibody for the treatment of Alzheimer’s disease that specifically

targets a key epitope within the microtubule binding region (MTBR)

of tau, a protein implicated in the causal pathophysiology of

Alzheimer’s disease.

- Bristol Myers Squibb continues to enroll the ongoing Phase 2

clinical trial in approximately 475 patients with early Alzheimer’s

disease; primary completion expected in 2027 (NCT06268886)

- Bristol Myers Squibb is responsible for all development,

manufacturing, and commercialization

- Oral encore presentation by partner Bristol Myers Squibb at

CTAD 2024 highlighted the design of the ongoing Phase 2 TargetTau-1

clinical trial

PRX123, a wholly-owned potential first-in-class dual

Aβ/tau vaccine designed for the treatment and prevention of

Alzheimer’s disease, is a dual-target vaccine targeting key

epitopes within the N-terminus of Aβ and MTBR-tau designed to

promote amyloid clearance and block the transmission of pathogenic

tau. The FDA cleared the investigational new drug (IND) application

and granted Fast Track designation for PRX123 for the treatment of

Alzheimer’s disease.

- Continuing to optimize capital allocation across our robust

R&D pipeline, Prothena expects to update plans for Phase 1

clinical trial in 2025

Parkinson’s Disease

Prasinezumab, a potential first-in-class antibody for the

treatment of Parkinson’s disease that is designed to target key

epitopes within the C-terminus of alpha-synuclein and is the focus

of a worldwide collaboration with Roche.

- PASADENA Open Label Extension Phase 2 clinical trial results

published in Nature Medicine showed a continued reduction in motor

and functional progression compared to real-world data after 4

years

- Topline results from Phase 2b PADOVA clinical trial in patients

with early Parkinson’s disease, which has completed enrollment of

586 patients, expected in 4Q 2024 (NCT04777331)

Neurodegenerative Diseases

PRX019, a potential treatment of neurodegenerative

diseases in development in collaboration with Bristol Myers

Squibb.

- Prothena has initiated a Phase 1 first-in-human clinical trial

to evaluate the safety, tolerability, immunogenicity, and

pharmacokinetics of single ascending and multiple doses in healthy

adults

Rare Peripheral Amyloid Diseases

Portfolio

AL Amyloidosis

Birtamimab, a wholly-owned potential best-in-class

anti-amyloid antibody for the treatment of AL amyloidosis designed

to directly neutralize soluble toxic light chain aggregates and

promote clearance of amyloid that causes organ dysfunction and

failure. Among patients with AL amyloidosis, a rare, progressive,

and fatal disease, newly diagnosed individuals with cardiac

involvement are at the highest risk for early death. Birtamimab has

been granted Fast Track designation by the FDA and has been granted

Orphan Drug Designation by both the FDA and European Medicines

Agency. A significant survival benefit was observed in the post hoc

analysis of birtamimab-treated patients categorized as Mayo Stage

IV at baseline in the previous Phase 3 VITAL clinical trial (Blood

2023).

- The ongoing confirmatory Phase 3 AFFIRM-AL clinical trial is

being conducted under a Special Protocol Assessment (SPA) agreement

with the FDA with a primary endpoint of all-cause mortality

(time-to-event) at a significance level of 0.10

- Topline results from confirmatory AFFIRM-AL Phase 3 clinical

trial expected in 1H 2025 (NCT04973137)

ATTR Amyloidosis

Coramitug (formerly PRX004), a potential first-in-class

amyloid depleter antibody for the treatment of ATTR amyloidosis

with cardiomyopathy (ATTR-CM) designed to deplete the pathogenic,

non-native forms of the transthyretin (TTR) protein, is being

developed by Novo Nordisk as part of its up to $1.2 billion

acquisition of Prothena’s ATTR amyloidosis business and

pipeline.

- Phase 1 clinical trial results for coramitug in patients with

ATTR amyloidosis published in Amyloid, the official journal of the

International Society of Amyloidosis

- Ongoing Phase 2 signal-detection clinical trial in patients

with ATTR-CM is being conducted by Novo Nordisk

- Phase 2 clinical trial has completed enrollment of

approximately 99 patients with topline data expected in 1H 2025

(NCT05442047)

Corporate Highlight

- Prothena announced the appointment of Chad J. Swanson, Ph.D.,

as Chief Development Officer in September 2024, leading all

clinical development and medical functions. Dr. Swanson is a

neuropharmacologist with over 20 years industry experience and

joined Prothena as Senior Vice President and Head of Clinical

Development in January 2023 from Eisai, Inc. where he was the

Executive Director of Clinical Research in the Alzheimer’s Disease

Brain Health group.

Third Quarter and First Nine Months of 2024 Financial

Results

For the third quarter and first nine months of 2024, Prothena

reported net loss of $59.0 million and $64.4 million, respectively,

as compared to a net income of $21.9 million and net loss of $79.6

million for the third quarter and first nine months of 2023,

respectively. Net loss per share was $1.10 and $1.20 for the third

quarter and first nine months of 2024, as compared to a net income

per share on a diluted basis of $0.38 and a net loss per share of

$1.50 for the third quarter and first nine months of 2023,

respectively.

Prothena reported total revenue of $1.0 million and $133.0

million for the third quarter and first nine months of 2024,

respectively, as compared to total revenue of $84.9 million and

$91.1 million for the third quarter and first nine months of 2023,

respectively. Total revenue for the third quarter and first nine

months of 2024 was primarily from collaboration revenue from

Bristol Myers Squibb as compared to total revenue for the third

quarter and first nine months of 2023 that was also primarily from

collaboration revenue from Bristol Myers Squibb.

Research and development (R&D) expenses totaled $50.7

million and $172.3 million for the third quarter and first nine

months of 2024, respectively, as compared to $57.9 million and

$158.7 million for the third quarter and first nine months of 2023,

respectively. The decrease in R&D expenses for the third

quarter compared to the same period in the prior year was primarily

due to lower manufacturing expenses. The increase in R&D

expenses for the first nine months of 2023, compared to the same

period in the prior year was primarily due to higher clinical trial

expenses and higher personnel related expenses; offset in part by

lower manufacturing and other R&D expenses. R&D expenses

included non-cash share-based compensation expense of $5.1 million

and $16.2 million for the third quarter and first nine months of

2024, respectively, as compared to $4.9 million and $14.2 million

for the third quarter and first nine months of 2023,

respectively.

General and administrative (G&A) expenses totaled $16.8

million and $50.4 million for the third quarter and first nine

months of 2024, respectively, as compared to $16.6 million and

$44.9 million for the third quarter and first nine months of 2023,

respectively. The increase in G&A expenses for the first nine

months of 2024 compared to the same period in the prior year was

primarily related to higher personnel related expenses. G&A

expenses included non-cash share-based compensation expense of $5.9

million and $19.2 million for the third quarter and first nine

months of 2024, respectively, as compared to $6.0 million and $15.7

million for the third quarter and first nine months of 2023,

respectively.

Total non-cash share-based compensation expense was $11.0

million and $35.4 million for the third quarter and first nine

months of 2024, respectively, as compared to $10.9 million and

$29.8 million for the third quarter and first nine months of 2023,

respectively.

As of September 30, 2024, Prothena had $520.1 million in cash,

cash equivalents and restricted cash, and no debt.

As of November 6, 2024, Prothena had approximately 53.8 million

ordinary shares outstanding.

2024 Financial Guidance

The Company continues to expect full year 2024 net cash used in

operating and investing actives to be $148 to $160 million and

expects to end the year with approximately $468 million (midpoint)

in cash, cash equivalents and restricted cash. The estimated full

year 2024 net cash used from operating and investing activities is

primarily driven by an estimated net loss of $120 to $135 million,

which includes an estimated $48 million of non-cash share-based

compensation expense.

About Prothena

Prothena Corporation plc is a late-stage clinical biotechnology

company with expertise in protein dysregulation and a pipeline of

investigational therapeutics with the potential to change the

course of devastating neurodegenerative and rare peripheral amyloid

diseases. Fueled by its deep scientific expertise built over

decades of research, Prothena is advancing a pipeline of

therapeutic candidates for a number of indications and novel

targets for which its ability to integrate scientific insights

around neurological dysfunction and the biology of misfolded

proteins can be leveraged. Prothena’s pipeline includes both

wholly-owned and partnered programs being developed for the

potential treatment of diseases including AL amyloidosis, ATTR

amyloidosis with cardiomyopathy, Alzheimer’s disease, Parkinson’s

disease and a number of other neurodegenerative diseases. For more

information, please visit the Company’s website at www.prothena.com

and follow the Company on Twitter @ProthenaCorp.

Forward-Looking Statements

This press release contains forward-looking statements. These

statements relate to, among other things, the sufficiency of our

cash position to fund advancement of a broad pipeline and

completion of our ongoing clinical trials; the continued

advancement of our discovery, preclinical, and clinical pipeline,

and expected milestones in 2024, 2025, and beyond; the treatment

potential, designs, proposed mechanisms of action, and potential

administration of PRX012, BMS-986446/PRX005, PRX123, prasinezumab,

PRX019, birtamimab, and coramitug/PRX004; plans for ongoing and

future clinical trials of PRX012, BMS-986446/PRX005, PRX123,

prasinezumab, PRX019, birtamimab, and coramitug/PRX004; the

expected timing of reporting data from clinical trials, including

multiple clinical readouts starting in mid- 2025 and continuing

throughout the year from our ongoing Phase 1 clinical trials

evaluating PRX012 and topline study results for our Phase 3

AFFIRM-AL clinical trial between in 1H 2025; our anticipated net

cash burn from operating and investing activities for 2024 and

expected cash balance at the end of 2024; and our estimated net

loss and non-cash share-based compensation expense for 2024. These

statements are based on estimates, projections and assumptions that

may prove not to be accurate, and actual results could differ

materially from those anticipated due to known and unknown risks,

uncertainties and other factors, including but not limited to those

described in the “Risk Factors” sections of our Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission (SEC)

on November 12, 2024, and discussions of potential risks,

uncertainties, and other important factors in our subsequent

filings with the SEC. We undertake no obligation to update publicly

any forward-looking statements contained in this press release as a

result of new information, future events, or changes in our

expectations.

PROTHENA CORPORATION

PLC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited - amounts in

thousands except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Collaboration revenue

$

970

$

84,866

$

132,984

$

91,004

Revenue from license and intellectual

property

—

—

50

50

Total revenue

970

84,866

133,034

91,054

Operating expenses:

Research and development

50,723

57,913

172,347

158,680

General and administrative

16,760

16,645

50,351

44,895

Total operating expenses

67,483

74,558

222,698

203,575

Income (loss) from operations

(66,513

)

10,308

(89,664

)

(112,521

)

Total other income, net

6,677

8,507

20,235

22,659

Income (loss) before income taxes

(59,836

)

18,815

(69,429

)

(89,862

)

Benefit from income taxes

(835

)

(3,092

)

(5,075

)

(10,310

)

Net income (loss)

$

(59,001

)

$

21,907

$

(64,354

)

$

(79,552

)

Basic net income (loss) per ordinary

share

$

(1.10

)

$

0.41

$

(1.20

)

$

(1.50

)

Diluted net income (loss) per ordinary

share

$

(1.10

)

$

0.38

$

(1.20

)

$

(1.50

)

Shares used to compute basic net income

(loss) per share

53,790

53,559

53,757

53,064

Shares used to compute diluted net income

(loss) per share

53,790

58,004

53,757

53,064

PROTHENA CORPORATION

PLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited - amounts in

thousands)

September 30,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

519,262

$

618,830

Restricted cash, current

—

1,352

Prepaid expenses and other current

assets

15,722

19,100

Total current assets

534,984

639,282

Property and equipment, net

3,254

3,836

Operating lease right-of-use assets

11,400

12,162

Restricted cash, non-current

860

860

Other non-current assets

44,756

40,242

Total non-current assets

60,270

57,100

Total assets

$

595,254

$

696,382

Liabilities and Shareholders’

Equity

Accrued research and development

10,340

14,724

Deferred revenue, current

8,832

—

Lease liability, current

2,613

1,114

Other current liabilities

24,637

41,053

Total current liabilities

46,422

56,891

Deferred revenue, non-current

5,589

67,405

Lease liability, non-current

8,881

10,721

Total non-current liabilities

14,470

78,126

Total liabilities

60,892

135,017

Total shareholders’ equity

534,362

561,365

Total liabilities and shareholders’

equity

$

595,254

$

696,382

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112238826/en/

Investors Mark Johnson, CFA, Vice President, Investor Relations

650-417-1974, mark.johnson@prothena.com

Media Michael Bachner, Senior Director, Corporate Communications

609-664-7308, michael.bachner@prothena.com

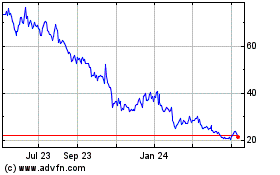

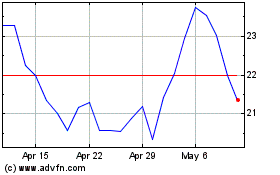

Prothena (NASDAQ:PRTA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Prothena (NASDAQ:PRTA)

Historical Stock Chart

From Feb 2024 to Feb 2025