Current Report Filing (8-k)

March 08 2023 - 1:10PM

Edgar (US Regulatory)

0001080657

false

0001080657

2023-03-07

2023-03-07

0001080657

SQFT:SeriesCommonStock0.01ParValuePerShareMember

2023-03-07

2023-03-07

0001080657

SQFT:Sec9.375SeriesDCumulativeRedeemablePerpetualPreferredStock0.01ParValuePerShareMember

2023-03-07

2023-03-07

0001080657

SQFT:SeriesCommonStockPurchaseWarrantsToPurchaseSharesOfCommonStockMember

2023-03-07

2023-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): March 7, 2023

Presidio

Property Trust, Inc.

(Exact

name of registrant as specified in its charter)

| Maryland |

|

001-34049 |

|

33-0841255 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

4995

Murphy Canyon Road, Suite 300

San

Diego, California 92123

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (760) 471-8536

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Series

A Common Stock, $0.01 par value per share |

|

SQFT |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

|

| 9.375%

Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

SQFTP |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

|

| Series

A Common Stock Purchase Warrants to Purchase Shares of Common Stock |

|

SQFTW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

March 7, 2023, Murphy Canyon Acquisition Corp. (the “SPAC”) issued a promissory note (the “Note”) in the principal

amount of up to $1,500,000 to Murphy Canyon Acquisition Sponsor, LLC (the “Sponsor”), a wholly owned subsidiary of Presidio

Property Trust, Inc. (the “Company”) which serves as the sponsor for the SPAC, in connection with the extension of the termination

date for the SPAC’s initial business combination (the “Initial Business Combination”) from February 7, 2023, to February

7, 2024, on a month-to-month basis. The Note bears no interest and is repayable in full upon the earlier of (i) the date on which the

SPAC consummates its Initial Business Combination and (ii) the date that the winding up of the SPAC is effective. Pursuant to the Note,

on March 7, 2023 the Sponsor loaned the SPAC $300,000 to fund its trust account and pay for operating expenses.

The

SPAC is deemed to be controlled by the Company as a result of the Company’s equity ownership stake, the overlap of certain officers

and directors, and the significant influence that the Company currently exercises over the SPAC.

The

foregoing description is qualified in its entirety by reference to the Note, which is attached as Exhibit 10.1 hereto and is incorporated

herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Description |

| 10.1 |

|

Form of Note |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PRESIDIO

PROPERTY TRUST, INC. |

| |

|

|

| |

By: |

/s/

Jack K. Heilbron |

| |

Name: |

Jack

K. Heilbron |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| Dated:

March 8, 2023 |

|

|

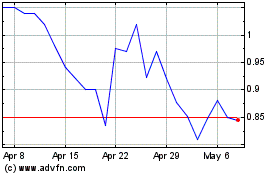

Presidio Property (NASDAQ:SQFT)

Historical Stock Chart

From Nov 2024 to Dec 2024

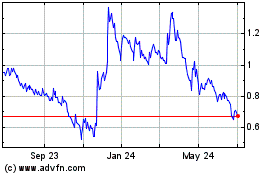

Presidio Property (NASDAQ:SQFT)

Historical Stock Chart

From Dec 2023 to Dec 2024