Predictive Oncology Inc. (NASDAQ: POAI) today announced the

financial results for its third quarter ended September 30, 2022,

which continue to reflect revenue growth and increased gross profit

margin as compared to prior year periods. Highlights from the

quarter include:

- Raymond F. Vennare, has been

appointed as Chief Executive Officer and Chairman of the Board. An

accomplished executive with more than three decades of experience,

Mr. Vennare has a long history of building, launching and leading

biotech companies.

- Predictive Oncology continues to

gain traction with potential partners with its breakthrough

solution at a pivotal time in drug discovery that enables

pharmaceutical and biotech companies to expedite drug development

and speed time to market.

- The company is leveraging

its novel platform technology that has the power to impact a

billion-dollar biopharmaceutical landscape in a way that has never

been done before. Pairing the largest privately held biobank

of more than 150,000 tumor samples with artificial

intelligence, Predictive Oncology is able to help drug

developers make higher confidence predictions of which molecules

will (and won’t ) be successful and ultimately leads to greater

chances of commercial success.

- Other developments include the

announcement that the company’s GMP lab is available for business

which opens the opportunity to help clients move from pre-clinical

drug development to the investigational new drug (IND)

qualification, including phase 1 clinical trials.

- The appointment of key team members

including strategic advisor Dr. Kamal Egodage who brings over 25

years of experience and has supported over 75 pharmaceutical

products to market, as well as the board appointment of Mr. David

Smith, a life sciences and intellectual property attorney and

leading authority on the legal issues surrounding the therapeutic

use of human tissue and cells.

Q3 2022 Financial results

The consolidated reportable segments of Predictive Oncology’s

recognized revenue is $455,827 for the quarter, which has increased

from $313,663 to the comparative three-month period of 2021, which

depicts a revenue growth of 45%.

Helomics reported an improvement in its net losses primarily due

to a decrease in impairment charges in 2022.

The gross profit margin has grown during the quarter ended

September 30, 2022 to 76% compared to 65% in the comparable 2021

period, which represents a material upward movement of 11%.

Research and development costs reduced to $116,763 in the

quarter ended September 30, 2022, from $234,357 in the quarter

ended September 30, 2021 which represents a positive change of 50%,

due to the consolidation of the company’s lab to Pittsburgh.

General and administrative expenses increased to $3,287,918 for

the three months ended September 30, 2022, from $2,061,458 for the

three months ended September 30, 2021, which was primarily due to

higher payroll resulting from the acquisition of zPREDICTA and

costs related to the consolidation of the Massachusetts

TumorGenesis division to Pittsburgh and the accrued expenses for

the retirement of our CEO.

Operations expenses have increased to $857,130 from $648,935 in

the three months ended September 30, 2022 as compared to the same

quarter of 2021, primarily due to higher costs related to staff

including the increased headcount at zPREDICTA, partially offset by

lower research and development expenses .

Net cash used in operating activities was $9,135,812 and

$8,464,821 for the nine months ended September 30, 2022, and

September 30, 2021, respectively. This represents an incremental

increase of 8% as compared to the same period of 2021, primarily

because of the increase in working capital. Furthermore, net cash

provided by financing activities has substantially dropped to

$6,739,031 from $50,378,237, an 87% decrease due to the large cash

raises in 2021.

The quarterly sales and marketing expenses have increased to

$333,377 in September 2022, from $172,869 in the quarter ended

September 2021, driven by increased marketing and business

development initiatives in the current year.

The company incurred a net loss of $17,821,524 for the nine

months ended September 30, 2022, compared to a $11,900,662 loss for

the nine months ended September 30, 2021. The $5,920,862 difference

is predominantly due to the goodwill impairment charge of

$7,231,093 related to zPREDICTA recognized in 2022 as compared to

the goodwill impairment charge of $2,813,792 related to Helomics

recognized in 2021. On September 30, 2022, the company had

$25,393,738 in cash and cash equivalents.

About Predictive Oncology Inc.

Predictive Oncology (NASDAQ: POAI) is a science-driven company

focused on applying artificial intelligence (AI) to develop optimal

cancer therapies, which can lead to more effective treatments and

improved patient outcomes. Through AI, Predictive

Oncology uses a biobank of 150,000+ cancer tumors, categorized

by patient type, against drug compounds to help the drug discovery

process and increase the probability of success. The company

offers a suite of solutions for oncology drug development from

early discovery to clinical trials.

Forward-Looking Statement:

Certain matters discussed in this release contain

forward-looking statements. These forward-looking statements

reflect our current expectations and projections about future

events and are subject to substantial risks, uncertainties and

assumptions about our operations and the investments we make. All

statements, other than statements of historical facts, included in

this press release regarding our strategy, future operations,

future financial position, future revenue and financial

performance, projected costs, prospects, changes in management,

plans and objectives of management are forward-looking statements.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “would,” “target” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Our

actual future performance may materially differ from that

contemplated by the forward-looking statements as a result of a

variety of factors including, among other things, factors discussed

under the heading “Risk Factors” in our filings with the SEC.

Except as expressly required by law, the Company disclaims any

intent or obligation to update these forward-looking

statements.

PREDICTIVE ONCOLOGY

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

September 30, 2022 |

|

December 31,2021 |

|

| |

(unaudited) |

|

(audited) |

|

|

ASSETS |

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

Cash and Cash Equivalents |

$ |

25,393,738 |

|

|

$ |

28,202,615 |

|

| Accounts Receivable |

|

324,708 |

|

|

|

354,196 |

|

| Inventories |

|

493,722 |

|

|

|

387,684 |

|

| Prepaid Expense and Other

Assets |

|

645,153 |

|

|

|

513,778 |

|

| Total Current Assets |

|

26,857,321 |

|

|

|

29,458,273 |

|

| |

|

|

|

|

|

|

| Fixed Assets, net |

|

2,202,102 |

|

|

|

2,511,571 |

|

| Intangibles, net |

|

3,701,603 |

|

|

|

3,962,118 |

|

| Lease Right-of-Use Assets |

|

329,565 |

|

|

|

814,454 |

|

| Other Long-Term Assets |

|

75,618 |

|

|

|

167,065 |

|

| Goodwill |

|

- |

|

|

|

6,857,790 |

|

| Total Assets |

$ |

33,166,209 |

|

|

|

43,771,271 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

| Accounts Payable |

$ |

917,271 |

|

|

$ |

1,021,774 |

|

| Accrued Expenses and other

liabilities |

|

1,813,580 |

|

|

|

1,262,641 |

|

| Derivative Liability |

|

22,099 |

|

|

|

129,480 |

|

| Contract Liabilities |

|

495,365 |

|

|

|

186,951 |

|

| Lease Liability |

|

219,763 |

|

|

|

639,662 |

|

| Total Current Liabilities |

|

3,468,078 |

|

|

|

3,240,508 |

|

| |

|

|

|

|

|

|

| Lease Liability – Net of

current portion |

|

5,483 |

|

|

|

239,664 |

|

| Other long-term

liabilities |

|

99,770 |

|

|

|

25,415 |

|

| Total Liabilities |

|

3,573,331 |

|

|

|

3,505,587 |

|

| |

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

| Preferred Stock, 20,000,000

authorized inclusive of designated below |

|

|

|

|

|

|

| Series B Convertible Preferred

Stock, $.01 par value, 2,300,000 shares authorized, 79,246 shares

outstanding |

|

792 |

|

|

|

792 |

|

| Common Stock, $.01 par value,

200,000,000 shares authorized, 78,407,473 and 65,614,597

outstanding |

|

784,074 |

|

|

|

656,146 |

|

| Additional paid-in

capital |

|

174,669,817 |

|

|

|

167,649,028 |

|

| Accumulated Deficit |

|

(145,861,805 |

) |

|

|

(128,040,282 |

) |

| Total Stockholders’

Equity |

|

29,592,878 |

|

|

|

40,265,684 |

|

| |

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

$ |

33,166,209 |

|

|

$ |

43,771,271 |

|

| |

|

|

|

|

|

|

|

PREDICTIVE ONCOLOGY

INC.CONDENSED CONSOLIDATED STATEMENTS OF NET

LOSS(Unaudited)

|

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenue |

$ |

455,827 |

|

|

$ |

313,663 |

|

|

$ |

1,141,986 |

|

|

$ |

944,187 |

|

| Cost of goods sold |

|

108,151 |

|

|

|

110,165 |

|

|

|

351,669 |

|

|

|

350,800 |

|

| Gross profit |

|

347,676 |

|

|

|

203,498 |

|

|

|

790,317 |

|

|

|

593,387 |

|

| |

|

|

|

|

|

|

|

| General and administrative

expense |

|

3,287,918 |

|

|

|

2,061,458 |

|

|

|

8,063,265 |

|

|

|

7,410,208 |

|

| Operations expense |

|

857,130 |

|

|

|

648,935 |

|

|

|

2,657,314 |

|

|

|

1,791,543 |

|

| Sales and marketing

expense |

|

333,377 |

|

|

|

172,869 |

|

|

|

908,867 |

|

|

|

447,298 |

|

| Loss on goodwill

impairment |

|

- |

|

|

|

2,813,792 |

|

|

|

7,231,093 |

|

|

|

2,813,792 |

|

| Total operating loss |

|

(4,130,749 |

) |

|

|

(5,493,556 |

) |

|

|

(18,070,222 |

) |

|

|

(11,869,454 |

) |

| Other income |

|

63,047 |

|

|

|

58,830 |

|

|

|

146,524 |

|

|

|

144,122 |

|

| Other expense |

|

(2,001 |

) |

|

|

(7,413 |

) |

|

|

(5,207 |

) |

|

|

(244,214 |

) |

| Gain (loss) on derivative

instruments |

|

10,219 |

|

|

|

4,122 |

|

|

|

107,381 |

|

|

|

68,884 |

|

| Net loss |

$ |

(4,059,484 |

) |

|

$ |

(5,438,017 |

) |

|

$ |

(17,821,524 |

) |

|

$ |

(11,900,662 |

) |

| Net loss attributable to

common shareholders per common shares-basic and diluted |

$ |

(4,059,484 |

) |

|

$ |

(5,438,017 |

) |

|

$ |

(17,821,524 |

) |

|

$ |

(11,900,662 |

) |

| |

|

|

|

|

|

|

|

| Loss per common share basic

and diluted |

$ |

(0.05 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.23 |

) |

| |

|

|

|

|

|

|

|

| Weighted average shared used

in computation – basic and diluted |

|

78,383,878 |

|

|

|

65,406,312 |

|

|

|

71,084,454 |

|

|

|

51,272,960 |

|

| |

|

|

|

|

|

|

|

Media relations contact:Predictive OncologyTheresa

Ferguson630-566-2003tferguson@predictive-oncology.com

Investor relations contact: Landon Capital Keith Pinder (404)

995-6671kpinder@landoncapital.net

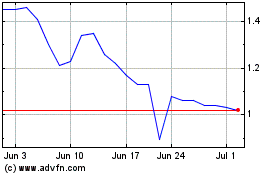

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

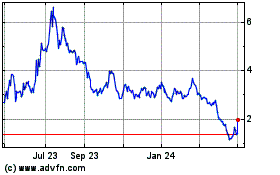

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Apr 2023 to Apr 2024