- Total revenue of USD 2.5 billion in 2022, an increase of 84%

year on year

- 51,491 cars delivered in 2022, compared to 28,677 in 2021, an

increase of 80%

- Cash and cash equivalents of USD 974 million as of December 31,

2022

Polestar Automotive Holding UK PLC (“Polestar” or the “Company,”

Nasdaq: PSNY), the Swedish electric performance car brand, reports

its preliminary unaudited financial and operational results for the

year ended December 31, 2022.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230302005406/en/

Polestar 3 with LiDAR from Luminar

(Photo: Business Wire)

Thomas Ingenlath, Polestar CEO, comments: “We left 2022 having

exceeded our 50,000 delivery target, grown revenue over 80 percent

and with strengthened liquidity. We are focused on business

execution and have had a busy start to this year with a major

update to Polestar 2, excellent reception for Polestar 3, and

welcomed additional sustainability partners for our ambitious

Polestar 0 project. Our business will continue to gain momentum

through the year as we start producing Polestar 3 - and with

Polestar 4 in the starting blocks.”

Key financial highlights

The below table summarises key financial results for the year

ended December 31, 2022.

(in millions of U.S. dollars)

(unaudited)

Dec 31, 2022

Dec 31, 2021

% Change

Revenue

2,461.9

1,337.2

84

Cost of sales

(2,342.5

)

(1,336.3

)

75

Gross profit

119.4

0.9

n/m

Gross margin (%)

4.9

0.1

n/m

Selling, general and administrative

expenses

(864.6

)

(714.7

)

21

Research and development expenses

(171.0

)

(232.9

)

(27

)

Other operating expenses and income,

net

2.2

(48.1

)

(105

)

Listing expense(1)

(372.3

)

-

100

Operating loss

(1,286.3

)

(994.8

)

29

Adjusted operating loss(2)

(914.0

)

(994.8

)

(8

)

(1)

The listing expense represents a

non-recurring, non-cash, share-based listing charge, incurred in

connection with the business combination with Gores Guggenheim, Inc

(GGI). on June 23, 2022.

(2)

Non-GAAP measure. See Appendix B for

details and a reconciliation of adjusted metrics to the nearest

GAAP measure.

- Revenue increased USD 1,124.7 million, or 84%, mainly driven by

higher Polestar 2 vehicle sales with continued commercial expansion

across markets.

- Gross profit increased USD 118.5 million, as the result of

higher Polestar 2 sales and lower fixed manufacturing costs. This

growth was partially offset by foreign exchange rates which led to

higher cost of sales, and product and market mix.

- Selling, general and administrative expenses increased USD

149.9 million, or 21%. This increase primarily reflects Polestar’s

international business expansion partially offset by active cost

management.

- Research and development expenses decreased USD 62.0 million,

or 27% due to the absence of Polestar 1 amortisation. This decrease

was partially offset by continued investments in future vehicles

and technologies.

- Operating loss increased USD 291.5 million, or 29%, impacted by

a Q2 2022 one-time share-based listing charge of USD 372.3

million.

- Adjusted operating loss decreased USD 80.8 million, or 8%,

benefiting from higher gross profit and active cost

management.

The below table summarises key financial results for the quarter

ended December 31, 2022.

(in millions of U.S. dollars)

(unaudited)

Dec 31, 2022

Dec 31, 2021

% Change

Revenue

985.2

589.5

67

Cost of sales

(923.2)

(589.7)

57

Gross profit

61.9

(0.2)

n/m

Gross margin (%)

6.3

-0.0

n/m

Selling, general and administrative

expenses

(239.2)

(236.6)

1

Research and development expenses

(47.6)

(75.5)

(37)

Other operating expenses and income,

net

20.1

(25.0)

(181)

Operating loss

(204.7)

(337.3)

(39)

Variances for Q4 2022 versus Q4 2021 largely followed the trends

outlined for 2022 versus 2021, with the following notable

exceptions:

- Selling, general and administrative expenses were kept flat due

to active cost management.

- Operating loss decreased USD 132.6 million, or 39%, benefiting

from higher gross profit and active cost management.

Cash flow highlights

The below table summarises cash flow for the year ended December

31, 2022.

(in millions of U.S. dollars)

(unaudited)

Dec 31, 2021

756.7

Operating

(1,088.3

)

Investing

(716.0

)

Financing

2,087.7

Foreign exchange effect on cash and cash

equivalents

(66.2

)

Dec 31, 2022

973.9

- Operating cash outflow of USD 1,088.3 million, mainly driven by

operating loss, working capital increase in inventories and trade

receivables as a result of higher production and sales, and

interest expenses due to increased financial debt during 2022.

- Investing cash outflow of USD 716.0 million, predominantly

driven by intellectual property investments for Polestar 2,

Polestar 3 and Polestar 4.

- Financing cash inflow mainly comprised of equity proceeds of

USD 1,418.0 million from the merger with GGI in June 2022 and a net

increase in short-term borrowings of USD 723.5 million to support

the continued growth of the company.

Key operational highlights

The below table summarises key preliminary operational results

as of and for the year ended December 31, 2022.

(unaudited)

Dec 31, 2022

Dec 31, 2021

% Change

Global volumes (1)

51,491

28,677

80

- including external vehicles with

repurchase obligations

1,296

2,836

- including internal vehicles

1,664

2,081

Dec 31, 2022

Dec 31, 2021

Change

Markets (2)

27

19

+8

Locations (3)

158

103

+55

Service points (4)

1,116

811

+305

(1)

Represents total volumes of new vehicles

delivered, including external sales with recognition of revenue at

time of delivery, external sales with repurchase commitments and

internal sales of vehicles transferred for demonstration and

commercial purposes as well as vehicles transferred to Polestar

employees at time of registration. Transferred vehicles for

demonstration and commercial purposes are owned by Polestar and

included in Inventory.

(2)

Represents the markets in which Polestar

operates.

(3)

Represents Polestar retail and handover

locations, including Polestar Spaces, Polestar Destinations and

Polestar Test Drive Centers.

(4)

Represents Volvo Cars service centres

which provide customers access to service points worldwide in

support of Polestar’s international expansion.

- Global volumes increased 22,814 to 51,491 cars in 2022, an

increase of 80% year on year.

- Polestar has added eight new markets since the start of 2022:

United Arab Emirates, Kuwait, Hong Kong, Ireland, Israel, Italy,

Spain and Portugal.

- Polestar has 158 retail locations and 1,116 service points

across its markets, up 55 and 305 respectively, since the end of

2021.

2023 outlook

- As previously announced, Polestar anticipates global volumes to

increase by nearly 60% to approximately 80,000 cars, predominantly

driven by Polestar 2 sales.

- For the year as a whole, the Company expects gross margin to be

broadly in line with 2022, with volume and product mix supporting

margin progression later in the year.

- While liquidity has strengthened, including a cash balance of

approximately USD 1 billion as of December 31, 2022, the Company

continues to explore potential equity or debt offerings to raise

additional capital to fund operations and business growth.

Recent developments – design, innovation,

sustainability

- In early January, Polestar announced that its vehicles will

benefit from the latest enhancements and developments by Google.

Developments include Google’s new HD map that will debut in

Polestar 3, and the roll-out of remote actions for Polestar 2. The

company also showcased Polestar 3 for the first time in the US at

CES 2023 in Las Vegas, together with Smart Eye, supplier of premium

driver monitoring technology which is included as standard.

- In late January, Polestar announced a major update to Polestar

2. The 2024 model year will feature a new high-tech front end that

reflects the design language premiered by Polestar 3, substantial

performance increases with all-new electric motors, even more

powerful batteries, longer range, sustainability improvements and,

for the first time in a Polestar, rear-wheel drive.

- In February, Polestar signed up eight additional sustainability

partners to the ambitious Polestar 0 project – to create a truly

climate-neutral car by 2030 – bringing the total to 24, as well as

initiated a collaboration with Rivian on the Pathway Report in

response to the climate crisis. The Company also announced Polestar

3 with Luminar LiDAR is available to order, and an expanded

partnership with Luminar to work on the integration of LiDAR in

Polestar 5.

Upcoming reporting and other events

- Polestar’s Annual Report on Form 20-F is expected to be filed

with the U.S. Securities and Exchange Commission (the "SEC") on

March 30, 2023.

- Polestar’s 2022 Sustainability Report is expected to be

published in April 2023.

- Polestar expects to post its unaudited financial results for

the quarter ended March 31, 2023 on Thursday, May 11, 2023, before

market opening in the USA.

Polestar management will hold a live audio webcast today, March

2, 2023 at 08:00 ET (14:00 CET) to discuss the Company’s results

and outlook. The live webcast will be available at

https://edge.media-server.com/mmc/p/gp4rk9mk.

Following the completion of the call, a replay will be available

shortly at https://investors.polestar.com/.

Statement Regarding Preliminary Unaudited Financial and

Operational Results

The unaudited financial and operational information published in

this press release is preliminary and subject to potential

adjustments. Potential adjustments to operational and consolidated

financial information may be identified from work performed during

Polestar’s year-end audit. This could result in differences from

the unaudited operational and financial information published

herein. For the avoidance of doubt, the preliminary unaudited

operational and financial information published in this press

release should not be considered a substitute for the financial

information to be filed with the SEC in Polestar’s Annual Report on

Form 20-F for the year ended December 31, 2022.

About Polestar

Polestar (Nasdaq: PSNY) is the Swedish electric performance car

brand determined to improve society by using design and technology

to accelerate the shift to sustainable mobility. Headquartered in

Gothenburg, Sweden, its cars are available online in 27 markets

globally across North America, Europe and Asia Pacific. The company

plans to create a truly climate-neutral production car, without

offsetting, by 2030.

Polestar 2 launched in 2019 as the electric performance fastback

with avant-garde Scandinavian design and up to 350 kW. Polestar 3

launched in late 2022 as the SUV for the electric age – a large

high-performance SUV that delivers sports car dynamics with a low

stance and spacious interior. Polestar plans to release three more

electric performance vehicles through to 2026.

Forward-Looking Statements

Certain statements in this press release (“Press Release”) may

be considered “forward-looking statements” as defined in the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or the future

financial or operating performance of Polestar. Guidance on

revenue, volumes, gross margin and other financial or operating

metrics, such as the ones included in the 2023 outlook described in

this press release, are forward-looking statements. In some cases,

you can identify forward-looking statements by terminology such as

“may”, “should”, “expect”, “intend”, “will”, “estimate”,

“anticipate”, “believe”, “predict”, “potential”, “forecast”,

"outlook," "guidance", “plan”, “seek”, “future”, “propose” or

“continue”, or the negatives of these terms or variations of them

or similar terminology. Such forward-looking statements are subject

to risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Polestar and its

management, as the case may be, are inherently uncertain. Factors

that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) Polestar’s

ability to maintain agreements or partnerships with its strategic

partners, Volvo Cars and Geely, and to develop new agreements or

partnerships; (2) Polestar’s ability to maintain relationships with

its existing suppliers, and source new suppliers for its critical

components, and to complete building out its supply chain, while

effectively managing the risks due to such relationships; (3)

Polestar’s reliance on its partnerships with vehicle charging

networks to provide charging solutions for its vehicles and its

reliance on strategic partners for servicing its vehicles and their

integrated software; (4) Polestar’s reliance on its partners to

manufacture vehicles at a high volume, some of which have limited

experience in producing electric vehicles, and on the allocation of

sufficient production capacity to Polestar by its partners in order

for Polestar to be able to increase its vehicle production

capacities; (5) competition, the ability of Polestar to grow and

manage growth profitably, maintain relationships with customers and

suppliers and retain its management and key employees; (6)

Polestar’s estimates of expenses and profitability; (7) increases

in costs, disruption of supply or shortage of materials, in

particular for lithium-ion cells or semiconductors; (8) the

possibility that Polestar may be adversely affected by other

economic, business, and/or competitive factors; (9) the effects of

competition and the high barriers to entry in the automotive

industry, and the pace and depth of electric vehicle adoption

generally on Polestar’s future business; (10) changes in regulatory

requirements, governmental incentives and fuel and energy prices;

(11) the outcome of any legal proceedings that may be instituted

against Polestar or others; (12) the ability to meet stock exchange

listing standards; (13) risks associated with changes in applicable

laws or regulations and with Polestar’s international operations;

(14) Polestar’s ability to establish its brand and capture

additional market share, and the risks associated with negative

press or reputational harm, including from lithium-ion battery

cells catching fire or venting smoke; (15) delays in the design,

manufacture, launch and financing of Polestar’s vehicles and

Polestar’s reliance on a limited number of vehicle models to

generate revenues; (16) Polestar’s ability to continuously and

rapidly innovate, develop and market new products; (17) risks

related to future market adoption of Polestar’s offerings; (18)

risks related to Polestar’s distribution model; (19) the impact of

the global COVID-19 pandemic, inflation, interest rate changes, the

ongoing conflict between Ukraine and Russia, supply chain

disruptions and logistical constraints on Polestar, Polestar’s

projected results of operations, financial performance or other

financial and operational metrics, or on any of the foregoing

risks; and (20) other risks and uncertainties set forth in the

sections entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in Polestar’s Form 20-F, and other

documents filed, or to be filed, with the SEC by Polestar. There

may be additional risks that Polestar presently does not know or

that Polestar currently believes are immaterial that could also

cause actual results to differ from those contained in the

forward-looking statements.

Nothing in this Press Release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Polestar assumes no

obligation to update these forward-looking statements, even if new

information becomes available in the future.

Appendix A

Polestar Automotive Holding UK

PLC

Preliminary Unaudited Condensed

Consolidated Statement of Loss

(in thousands of U.S. dollars unless

otherwise stated)

For the three months ended

December 31,

For the year ended December

31,

2022

2021

2022

2021

Revenue

985,151

589,507

2,461,897

1,337,181

Cost of sales

(923,183

)

(589,707

)

(2,342,454

)

(1,336,321

)

Gross profit (loss)

61,968

(200

)

119,443

860

Selling, general, and administrative

expense

(239,174

)

(236,580

)

(864,598

)

(714,724

)

Research and development expense

(47,634

)

(75,522

)

(170,987

)

(232,922

)

Other operating income (expense), net

20,143

(24,993

)

2,182

(48,053

)

Listing expense

—

—

(372,318

)

—

Operating loss

(204,697

)

(337,295

)

(1,286,278

)

(994,839

)

Finance income

7,066

8,169

8,551

32,970

Finance expense

3,531

(16,738

)

(108,435

)

(45,249

)

Fair value change – Earn-out rights

(63,600

)

—

902,068

—

Fair value change - Class C Shares

(500

)

—

35,090

—

Loss before income taxes

(258,200

)

(345,864

)

(449,005

)

(1,007,118

)

Income tax expense

(4,240

)

9,078

(16,783

)

(336

)

Net loss

(262,440

)

(336,786

)

(465,789

)

(1,007,454

)

Polestar Automotive Holding UK

PLC

Preliminary Unaudited Condensed

Consolidated Statement of Financial Position

(in thousands of U.S. dollars unless

otherwise stated)

December 31, 2022

December 31, 2021

Assets

Non-current assets

Intangible assets and goodwill

1,391,828

1,368,356

Property, plant and equipment

262,593

208,193

Vehicles held under operating lease

92,198

120,626

Other non-current assets

15,395

5,532

Total non-current assets

1,762,014

1,702,707

Current assets

Cash and cash equivalents

973,877

756,677

Marketable securities

—

1,258

Trade receivables external and trade

receivables and accrued income – related parties

370,164

177,544

Inventories

657,882

545,743

Other current assets

178,516

125,764

Total current assets

2,180,439

1,606,986

Total assets

3,942,453

3,309,693

Equity

Share capital

(21,156

)

(1,865,909

)

Other contributed capital

(3,582,589

)

(35,231

)

Accumulated deficit & Foreign currency

translation reserve

3,737,089

1,778,644

Total equity

133,344

(122,496

)

Liabilities

Non-current liabilities

Other non-current provisions and

liabilities

(139,428

)

(79,906

)

Earn-out liability

(598,570

)

—

Other non-current interest-bearing

liabilities

(85,556

)

(66,575

)

Total non-current liabilities

(823,554

)

(146,481

)

Current liabilities

Trade payables external and trade payables

and accrued expenses - related parties

(1,184,142

)

(1,857,730

)

Advance payments from customers

(40,868

)

(36,415

)

Liabilities to credit institutions

(1,328,752

)

(642,338

)

Interest-bearing current liabilities

(38,235

)

(24,072

)

Class C Shares liability

(28,000

)

—

Other current provisions and

liabilities

(632,246

)

(480,161

)

Total current liabilities

(3,252,243

)

(3,040,716

)

Total liabilities

(4,075,797

)

(3,187,197

)

Total equity and liabilities

(3,942,453

)

(3,309,693

)

Polestar Automotive Holding UK

PLC

Preliminary Unaudited Condensed

Consolidated Statement of Cash Flows

(in thousands of U.S. dollars unless

otherwise stated)

For the year ended December

31,

2022

2021

Cash flows from operating

activities

Net loss

(465,789

)

(1,007,454

)

Adjustments to reconcile Net loss to net

cash flows

Depreciation and amortization

185,057

239,164

Finance income and expense

99,884

12,280

Listing expense

372,318

—

Income tax expense

16,783

336

Other non-cash expense and income

(839,595

)

106,658

Change in operating assets and

liabilities

(378,526

)

357,505

Interest net paid & tax paid

(78,481

)

(20,645

)

Cash used for operating

activities

(1,088,349

)

(312,156

)

Cash flows from investing

activities

Additions to property, plant and

equipment

(32,269

)

(24,701

)

Additions to intangible assets

(681,204

)

(104,971

)

Other

(2,500

)

—

Cash used for investing

activities

(715,973

)

(129,672

)

Cash flows from financing

activities

Change in restricted cash

—

48,830

Proceeds from short-term borrowings

2,146,396

698,882

Principal repayments of short-term

borrowings

(1,422,862

)

(411,950

)

Principal repayments of lease

liabilities

(14,905

)

(8,578

)

Proceeds from the issuance of share

capital and other contributed capital

1,417,973

582,388

Transaction costs

(38,903

)

—

Cash provided by financing

activities

2,087,699

909,572

Effect of foreign exchange rate changes on

cash and cash equivalents

(66,177

)

(27,491

)

Net increase in cash and cash

equivalents

217,200

440,253

Cash and cash equivalents at beginning

of period

756,677

316,424

Cash and cash equivalents at end of

period

973,877

756,677

Appendix B

Polestar Automotive Holding UK PLC

Non-GAAP Financial Measures

Polestar uses both generally accepted accounting principles

("GAAP," i.e., IFRS) and non-GAAP (i.e., non-IFRS) financial

measures to evaluate operating performance, for internal

comparisons to historical performance, and for financial

decision-making purposes. Polestar believes non-GAAP financial

measures are helpful to investors as they provide useful

perspective on underlying business trends and assist in period on

period comparisons.

These non-GAAP measures are presented for supplemental

information purposes only and should not be considered a substitute

for financial information presented in accordance with GAAP. The

measures are not presented under a comprehensive set of accounting

rules and, therefore, should only be read in conjunction with

financial information reported under GAAP when understanding

Polestar's operating performance.

The measures may not be the same as similarly titled measures

used by other companies due to possible differences in calculation

methods and items or events being adjusted. A reconciliation

between non-GAAP financial measures and the most comparable GAAP

performance measures is provided below.

Non-GAAP financial measures include adjusted operating loss,

adjusted EBITDA, adjusted net loss, and free cash flow.

Adjusted Operating Loss

Polestar defines adjusted operating loss as operating loss,

adjusted to exclude listing expense. This measure is reviewed by

management and provides a relevant measure for understanding the

ongoing operating performance of the business prior to the impact

of the non-recurring adjusting item.

Adjusted EBITDA

Adjusted EBITDA is calculated as listing expense, fair value

change of earn-out rights, fair value change of Class C Shares,

interest income, interest expense, income tax expense,

depreciation, and amortization, subtracted from net loss. This

measure is reviewed by management and is relevant measure for

understanding the underlying operating results and trends of the

business prior to the impact of any adjusting items.

Adjusted Net Loss

Adjusted net loss is calculated as net loss, adjusted to exclude

listing expense, fair value change of earn-out rights, and fair

value change of Class C Shares. This measure is reviewed by

management and is a relevant measure for understanding the

underlying performance of Polestar's recurring core business

operations.

Free Cash Flow

Free cash flow is calculated by subtracting cash flows used for

tangible assets and intangible assets from cash used for operating

activities. This measure is reviewed by management and is a

relevant measure for understanding cash sourced from operating

activities that is available to repay debts, fund capital

expenditures, and spend on other strategic initiatives.

Unaudited Reconciliation of GAAP and

Non-GAAP Results

Adjusted Operating Loss

(in millions of U.S. dollars)

For the year ended December

31,

2022

2021

Operating loss

(1,286.3

)

(994.8

)

Listing expense

372.3

—

Adjusted operating loss

(non-GAAP)

(914.0

)

(994.8

)

Adjusted EBITDA

(in millions of U.S. dollars)

For the year ended December

31,

2022

2021

Net loss

(465.8

)

(1,007.5

)

Listing expense

372.3

—

Fair value change - Earn-out rights

(902.1

)

—

Fair value change - Class C Shares

(35.1

)

—

Interest income

(7.7

)

(1.4

)

Interest expenses

77.5

44.9

Income tax expense

16.8

0.3

Depreciation and amortization

185.1

239.2

Adjusted EBITDA (non-GAAP)

(759.0

)

(724.5

)

Adjusted Net Loss

(in millions of U.S. dollars)

For the year ended December

31,

2022

2021

Net loss

(465.8

)

(1,007.5

)

Listing expense

372.3

—

Fair value change - Earn-out rights

(902.1

)

—

Fair value change - Class C Shares

(35.1

)

—

Adjusted net loss (non-GAAP)

(1,030.7

)

(1,007.5

)

Free Cash Flow

(in millions of U.S. dollars)

For the year ended December

31,

2022

2021

Net cash used for operating activities

(1,088.3

)

(312.2

)

Investing cash flows used for tangible

assets

(32.3

)

(24.7

)

Investing cash flows used for intangible

assets

(681.2

)

(105.0

)

Free cash flow (non-GAAP)

(1,801.8

)

(441.8

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230302005406/en/

Bojana Flint Investor Relations bojana.flint@polestar.com

Tanya Ridd Global Head of Communications & PR

tanya.ridd@polestar.com

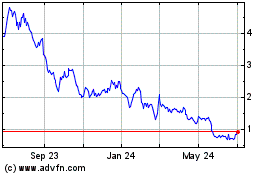

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Jan 2024 to Jan 2025