Live Nation Entertainment (NYSE:LYV) – The U.S.

Department of Justice plans to initiate an antitrust lawsuit

against Live Nation next month, citing its control over the live

event market. Its subsidiary Ticketmaster faced criticism for its

management during Taylor Swift’s tour, fueling the investigation.

Shares fell 6.8% in Tuesday’s pre-market trading.

Ericsson (NASDAQ:ERIC) – Ericsson’s sales fell

14% to $4.8 billion in the first quarter of 2024. The company said

the slowdown in 5G infrastructure construction in India impacted

sales. Net profit increased by 66%, reaching 2.6 billion Swedish

kronor, driven by profit margins of 42.7%. For the second half,

Ericsson forecasts profit margins between 42-44%. The company cut

8,500 jobs globally in January. Shares are trading 7.3% higher in

Tuesday’s pre-market.

Telefonica SA (NYSE:TEF) – The Spanish

government has increased its stake in Telefonica SA to 5%, becoming

the company’s largest shareholder, surpassing Saudi Telecom Co. The

state-owned Sepi increased its stake from 3% to 5% in March, valued

at about $1.2 billion.

Apple (NASDAQ:AAPL) – Apple plans to increase

spending with suppliers from Vietnam, boosting the Asian country as

an electronics hub. CEO Tim Cook expressed the commitment during a

meeting with the Vietnamese Prime Minister. The company seeks to

diversify its production outside China, exploring locations such as

India and Vietnam.

Microsoft (NASDAQ:MSFT) – Microsoft is

investing $1.5 billion in the UAE-based artificial intelligence

company G42, obtaining a minority stake and a seat on the board.

The deal aims to deepen ties and ensure the secure development of

AI, amid global concerns about technology and geopolitics. G42

agreed to divest in China and switch to American technology, in

exchange for continued access to U.S. technology for its AI

applications.

Adobe (NASDAQ:ADBE) – Adobe is exploring the

integration of third-party AI tools, such as OpenAI’s Sora, into

its video editing software, Premiere Pro. This aims to add AI-based

features such as scene filling and distraction removal, while

ensuring user ethics and safety.

Baidu (NASDAQ:BIDU) – China’s Baidu revealed

that its artificial intelligence chatbot “Ernie Bot” has surpassed

200 million users, successfully competing in the market for

chatbots similar to China’s popular ChatGPT. The number of users

has doubled since December, boosting daily API usage.

Meta Platforms (NASDAQ:META) – Judge Yvonne

Gonzalez Rogers dismissed claims against Meta CEO Mark Zuckerberg,

citing a lack of proof of his personal duty in platform safety.

Hundreds of pending lawsuits claim damages to children through

social media use, seeking compensation and the suspension of

harmful practices, involving other companies as well. Additionally,

Meta announced on Monday that it would temporarily suspend its

social media service Threads in Turkey from April 29, complying

with a provisional order from the Turkish competition authority.

This will not affect other Meta platforms such as Facebook,

Instagram, and WhatsApp in Turkey.

Reddit (NYSE:RDDT) – Reddit’s shares, after

their debut on the New York Stock Exchange on March 21 at $34, rose

48% on the first day but have since fallen about 16%. Analysts from

Needham and Roth MKM initiated coverage with buy recommendations,

highlighting the potential of artificial intelligence. Analysts

from JP Morgan maintained a neutral position, citing the current

valuation and growth challenges as reasons for caution. Shares are

up 0.30% at $40.00 in Tuesday’s pre-market, after falling 5.6% to

$39.89 on Monday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media shares fell 18% on Monday, extending losses since

their debut last month. The company announced it could sell

millions of shares in the coming months, including all of former

President Trump’s stake, affecting its volatile trajectory since

listing.

Alphabet (NASDAQ:GOOGL) – Google’s head of

artificial intelligence (AI), Demis Hassabis, revealed plans to

invest over $100 billion in the field, highlighting the growing

competition for investments in Silicon Valley. He discussed the

need for massive computational resources to achieve general

artificial intelligence (AGI), highlighting the partnership with

Google due to its superior computational capacity. Hassabis also

recognized the global interest shown by OpenAI’s ChatGPT as a sign

of the public’s readiness to adopt AI systems, despite their

current limitations.

Broadcom (NASDAQ:AVGO) – Broadcom is under EU

antitrust investigation due to changes in VMware

(NYSE:VMW) licensing terms. European business groups and CISPE

criticized the changes. Broadcom defended itself, lowering VMware

Cloud Foundation prices and standardizing price metrics across

cloud providers.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC, a leader in chip production, forecasts a 5%

increase in first-quarter profits, driven by high demand.

Benefiting from growing AI, TSMC has outperformed the slowdown in

electronic demand.

Tesla (NASDAQ:TSLA) – Tesla is reducing its

global workforce by more than 10%, cutting jobs in the US and China

due to falling sales and a price war in electric vehicles. Many

employees have already been laid off. Drew Baglino, Senior VP of

Powertrain and Energy Engineering, announced his departure after 18

years at Tesla in a post on X. Rohan Patel, VP of Public Policy and

Business Development, is also leaving Tesla. In other news,

regulators in North Carolina approved a mining license for Tesla

and Piedmont Lithium (NASDAQ:PLL), aiming to

develop one of the largest lithium sources in the US for EV

batteries, despite local financial and regulatory challenges.

Rivian Automotive (NASDAQ:RIVN) – Rivian

Automotive received a rating upgrade from UBS, changing from Sell

to Neutral, while the price target remained unchanged at $9.

Honda Motor (NYSE:HMC) – Honda plans to launch

six next-generation electric vehicle models under the Ye brand in

China by 2027, in addition to 10 models under the Honda brand,

aiming for 100% EV sales by 2035.

General Motors (NYSE:GM) – In 2025, General

Motors will move its headquarters to downtown Detroit, transferring

to the new Hudson’s building. CEO Mary Barra emphasized the

importance of keeping Detroit as home. Additionally, the NHTSA

initiated a preliminary evaluation of complaints about loss of

brake assist in 3,322 Cadillac Lyriq electric vehicles from GM.

Reports include a hard brake pedal and a “Brake System Failure”

message. GM is developing an update to alert drivers about the

issue.

Boeing (NYSE:BA) – Boeing stated on Monday that

it found no fatigue cracks in 787 jets after heavy maintenance.

While the manufacturer defends its twin-aisle aircraft program, a

whistleblower alleged assembly failures, with safety concerns being

debated in the U.S. Senate.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

won a $17 billion contract to develop next-generation interceptors,

aimed at defending the US against intercontinental ballistic

missile threats. The program seeks to modernize ground-based

missile defense and represents a boost for Lockheed following other

canceled projects.

Equinor (NYSE:EQNR), EQT

Corporation (NYSE:EQT) – EQT will sell 40% of its

non-operated natural gas assets in Pennsylvania to Equinor USA,

exchanging for onshore assets from Equinor in the Appalachian basin

and $500 million. Low natural gas prices drive EQT’s strategy,

aiming to reduce debt and increase returns. Equinor is also

reviewing assets, focusing on offshore operations.

Warner Bros Discovery (NASDAQ:WBD) – New

Zealand’s Stuff Group announced a partnership with Warner Bros

Discovery to provide a daily news program. This comes after

concerns about the reduction of television news options in the

country. Warner Bros Discovery chose Stuff from several

proposals.

MGM Resorts International (NYSE:MGM) – MGM

filed a lawsuit against the Federal Trade Commission, seeking to

end an investigation into its response to a cyberattack. The

company claims that FTC Chair Lina Khan should recuse herself from

the case. The investigation arose after an incident at the MGM

Grand in Las Vegas.

Procter & Gamble (NYSE:PG) – The increase

in personal hygiene product prices threatens North American

shopping habits, impacting P&G, a leader in the sector. P&G

has raised prices by more than 1% in the last nine quarters. This

consistent price increase was accompanied by a notable nearly 16%

jump in sales over the last three fiscal years. Wall Street, based

on data from LSEG, is anticipating that P&G’s revenues will

continue to rise, reflecting confidence in the company’s

performance despite price increases. P&G’s quarterly earnings,

expected on Friday, are crucial, influencing companies like

Unilever (NYSE:UL) and Clorox (NYSE:CLX).

Tapestry (NYSE:TPR), Capri Holdings (NYSE:CPRI)

– The $8.5 billion deal between Tapestry, owner of Coach, and Capri

Holdings, owner of Michael Kors, received regulatory approval in

the EU and Japan. The merger still awaits authorization in the US,

after a request for additional information by the FTC in November.

The closing of the deal is expected in 2024.

UnitedHealth Group (NYSE:UNH) – UnitedHealth

reported robust financial results for the first quarter, surpassing

expectations with an adjusted earnings per share of $6.91, compared

to the $6.61 predicted by LSEG analysts. Revenue reached $99.8

billion, also above the $99.3 billion expected. These gains occur

despite difficulties from a cyberattack on its subsidiary Change

Healthcare and a $7 billion expense from selling operations in

Brazil, reflecting a net loss of $1.53 per share for the

period.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson exceeded Wall Street expectations in the first

quarter, with an adjusted earnings per share of $2.71, beating the

forecast of $2.64. Revenue totaled $21.38 billion, virtually in

line with the $21.4 billion estimate. Increased demand for

non-urgent surgeries drove growth in the medical devices

segment.

Regeneron Pharmaceuticals (NASDAQ:REGN) –

Regeneron Pharmaceuticals denied accusations from the U.S.

Department of Justice regarding the incorrect disclosure of the

average selling price of its Eylea medication for macular

degeneration. The company states that credit card fee

reimbursements do not affect the price of the medication.

JPMorgan Chase (NYSE:JPM) – JPMorgan CEO Jamie

Dimon completed the sale of about $33 million of his bank shares,

as part of a previous plan to sell 1 million shares. This is the

first time Dimon has sold shares since becoming CEO in 2005.

Additionally, JPMorgan analysts acknowledged their mistake in

adopting a cautious stance on European bank shares, one of the

best-performing sectors in the region this year. Favorable economic

trends and interest rates have boosted a 16% improvement in

price/earnings across the sector, as noted by Kian Abouhossein and

his team. They have now shifted their focus to a bottom-up stock

selection approach, discarding the previous view.

UBS Group AG (NYSE:UBS) – Swiss Finance

Minister Karin Keller-Sutter confirmed estimates that UBS would

need an additional $15 billion to $25 billion in capital under

government proposals as plausible. The Swiss government proposed

stricter regulations for “too big to fail” banks like UBS.

Charles Schwab (NYSE:SCHW) – Charles Schwab

exceeded first-quarter revenue expectations, driven by an increase

in client assets to a record $9.1 trillion. However, profits fell

15% to $1.36 billion due to higher interest rates on deposits and

loans.

BlackRock (NYSE:BLK) – Jio Financial Services

announced a new joint venture with BlackRock to establish a wealth

management and brokerage business in India, targeting the lucrative

wealth market of the country. The partnership seeks to democratize

access to investments and awaits regulatory approval.

Blackstone (NYSE:BX) – Blackstone’s real estate

arm is again considering selling G6 Hospitality, owner of Motel 6

and Studio 6. After an unsuccessful effort in late 2021, the

company is seeking potential buyers. Blackstone acquired G6 in 2012

for $1.9 billion.

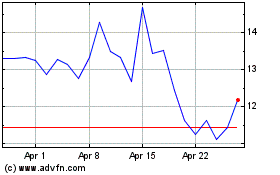

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Nov 2023 to Nov 2024