false

0000914122

0000914122

2023-10-02

2023-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

_______________________

Date of Report (Date of earliest event reported): October 2, 2023

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-32530

|

36-3922969

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification No.)

|

24900 Pitkin Road, Suite 309, Spring, Texas, 77386

(Address of principal executive offices, including zip code)

(847) 966-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value per share

|

PPIH

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

The information required by this Item is included in Item 5.02 below and is incorporated into this Item 1.01 by reference.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On September 29, 2023, Mr. David Bryan Norwood provided notice to Perma-Pipe International Holdings, Inc. (the “Company”) of his intent to retire as the Company’s Vice President and Chief Financial Officer, Secretary and Treasurer effective October 2, 2023.

On October 2, 2023, the Company appointed Matthew Lewicki, age 41, as Vice President and Chief Financial Officer, Secretary and Treasurer of the Company. Effective October 2, 2023, Mr. Lewicki will no longer serve as the Company’s Chief Accounting Officer.

Mr. Lewicki, age 41, has served as the Company’s Chief Accounting Officer since May 2023. Prior to joining the Company, he served as Corporate Controller for HMT Holdings Corp, Inc., a global oil and gas infrastructure services company, from June 2019 to April 2023. Prior thereto, from June 2013 to May 2019, Mr. Lewicki served as a Senior Manager of Financial Planning and Reporting for Quanta Services, Inc., an electric and oil and gas infrastructure services company. Mr. Lewicki is a Certified Public Accountant in the State of Texas.

In connection with Mr. Lewicki’s appointment as Vice President and Chief Financial Officer, Secretary and Treasurer of the Company, the Company entered into an Executive Employment Agreement with Mr. Lewicki, effective as of October 2, 2023 (the “Employment Agreement”). Pursuant to the Employment Agreement, Mr. Lewicki will receive an initial annual base salary of $275,000 and a short-term annual incentive bonus opportunity with a target incentive equal to 45% of his base salary. In addition, Mr. Lewicki will also be eligible to receive certain long-term incentives, including a cash performance award and restricted stock grants with a total target annual award equal to 45% of his base salary, with pro-rata vesting of such awards over a three-year period. The Employment Agreement is for an initial term of one year, with automatic one-year renewal provisions.

The Employment Agreement, which is filed as Exhibit10.1 hereto, is incorporated herein by reference. The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to such exhibit.

| Item 7.01 |

Regulation FD Disclosure. |

On October 2, 2023, the Company issued a press release announcing the retirement of Mr. Norwood and the appointment of Mr. Lewicki as Vice President and Chief Financial Officer, Secretary and Treasurer of the Company. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits. The following exhibits are filed or furnished herewith:

Exhibit

Number

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

|

|

|

|

|

|

|

|

October 2, 2023

|

By:

|

/s/ Matthew E. Lewicki

|

|

|

|

|

Matthew E. Lewicki

|

|

|

|

|

Vice President and Chief Financial Officer

|

|

Exhibit 10.1

Execution Version

Executive Employment Agreement

This Employment Agreement is entered into as of October 2, 2023, by and between Perma-Pipe International Holdings, Inc, (PPIH), a Delaware corporation ("PPIH" or "the Company"), and Matthew Lewicki ("Employee").

In consideration of the mutual promises and covenants set forth herein, and other good and valuable consideration, the sufficiency of which is hereby acknowledged, PPIH and Employee hereby agree as follows:

| |

1.

|

Position of Employment.

|

|

|

The Company will appoint the Employee to the position of Vice President and Chief Financial Officer, Secretary and Treasurer, PPIH, and, in that position, Employee will report to the President and Chief Executive Officer. PPIH retains the right to change Employee's title, duties, and reporting relationships as may be determined to be in the best interests of the Company; provided, however, that any such change in Employee's duties shall be reasonably consistent with Employee's training, experience, and qualifications. During his employment, the Employee must conduct himself in a manner (in all forums) as not to undermine the Company’s reputation. The employment term shall be considered to start on the date indicated in this Employment Agreement.

|

|

|

The terms and conditions of the Employee's employment shall, to the extent not addressed or described in this Employment Agreement, be governed by the PPIH Policies and Procedures and existing practices. In the event of a conflict between this Employment Agreement and the PPIH Policies and Procedures or existing practices, the terms of this Employment Agreement shall govern.

|

|

|

Employee's employment with PPIH shall begin on October 2, 2023 and shall continue for a period of 1-year (the “Initial Term”), and then automatically renew annually for successive one-year terms (each, a “Renewal Term”, together with the Initial Term, the “Term”) unless;

|

| |

a.

|

Either party gives the other party written notice otherwise at least ninety (90) days before the end of the initial term or a Renewal Term; or

|

| |

b.

|

Employee's employment is terminated by either party in accordance with the terms of Section 5 of this Employment Agreement; or

|

| |

c.

|

Such term of employment is extended or shortened by a subsequent agreement duly executed by each of the parties to this Employment Agreement, in which case such employment shall be subject to the terms and conditions contained in the subsequent written agreement.

|

| |

3.

|

Compensation and Benefits.

|

| |

a.

|

Base Salary. Employee shall be paid a base salary of $10,577 bi-weekly, which is $275,000 annually ("Base Salary"), subject to applicable federal, state, and local withholding, such Base Salary to be paid to Employee in the same manner and on the same payroll schedule in which all exempt PPIH employees receive payment. Salary will be reviewed annually and adjusted by the President and Chief Executive Officer and upon approval by the Board of Directors based on performance and external benchmarking of market compensation for equivalent positions. Timing of any adjustments will be aligned to the overall corporate annual salary review.

|

| |

b.

|

Incentive Compensation. Employee shall be eligible to participate in incentive compensation programs available to other similarly-situated executives of PPIH as outlined below. Nothing in this Employment Agreement shall be deemed to require the payment of bonuses, awards, or incentive compensation to Employee.

|

| |

i)

|

Short Term Incentive (STI). Employee will be eligible to receive Short Term Incentive in the form of an annual cash bonus opportunity with a target incentive set at 45% of base salary. Performance measures applicable to the STI bonus will be based on Company performance metrics aligned to financial and strategic plans approved by the Board. Bonus payment award and timing will align with corporate annual bonus payouts following completion of annual financial calendar. For the first fiscal year of the Term, bonus eligibility will be pro-rata for the portion of the fiscal year 2023 worked and based on part year metrics for the same time period.

|

| |

ii)

|

Long Term Incentive (LTI). Employee will be eligible to receive Long Term Incentive in the form of Restricted Stock and Cash Payments with a target annual award of 45% of base salary. Under the Company’s current plan, Restricted Stock and Cash Awards would be granted that vest over a three (3) year period, with 1/3 vesting at the end of each anniversary of the grant. The actual award may be adjusted up or down based on compensation benchmarking and/or performance as determined in good faith by the Board. The Board reserves the right to amend the LTI program and terms as deemed necessary.

|

| |

c.

|

Employee Benefits. Employee shall be eligible to participate in all employee benefit plans, policies, programs, or perquisites made available by the Company to similarly-situated employees. Notwithstanding anything herein to the contrary, the terms and conditions of Employee's participation in PPIH's employee benefit plans, policies, programs, or perquisites shall be governed by the terms of each such plan, policy, or program. Complete details of the plans including Health, Dental, Retirement, and Incentives will be provided separately.

|

| |

d.

|

Vacation. Employee will be entitled to four (4) weeks of paid vacation annually.

|

| |

4.

|

Duties and Performance.

|

|

|

The Employee acknowledges and agrees that he is being offered a position of employment by PPIH with the understanding that the Employee possesses a unique set of skills, abilities, and experiences which will benefit the Company, and he agrees that his continued employment with the Company, whether during the Term of this Employment Agreement or thereafter, is contingent upon his successful performance of his duties in his position as noted above, or in such other position to which additional or different duties may be assigned.

|

| |

a.

|

Employee shall render to the very best of Employee's ability, on behalf of the Company, services to and on behalf of the Company, and shall undertake diligently all duties assigned to him by the Company.

|

| |

b.

|

Employee shall devote his full time, energy and skill to the performance of the services in which the Company is engaged, at such time and place as the Company may direct. Employee shall not undertake, either as an owner, director, shareholder, employee or otherwise, the performance of services for compensation (actual or expected) for any other entity without the express written consent of the President and CEO or Board of Directors. Such consent will not be unreasonably withheld for a paid Board of Directors position offered to Employee as long as such role is not in conflict with Employee’s role and position in the Company.

|

| |

c.

|

Employee shall faithfully and industriously assume and perform with skill, care, diligence and attention all responsibilities and duties connected with his employment on behalf of the Company.

|

| |

d.

|

Employee shall have no authority to enter into any contracts binding upon the Company, or to deliberately create any obligations on the part of the Company, except as may be specifically authorized by the President and CEO, Board of Directors of PPIH and as outlined in the Company Delegation of Authority.

|

| |

e.

|

Foster a Company with underlying values in safety, integrity and ethics.

|

| |

a.

|

Oversee the organization’s capital structure with a focus on minimizing the cost of capital.

|

| |

b.

|

Evaluate and participate in strategic business development opportunities resulting in top line growth and mitigation of the effect of economic volatility.

|

| |

c.

|

Raise capital to support the Company’s growth, including negotiating and finalizing financing agreements, and monitor, assess and manage Company risk.

|

| |

d.

|

Serve as the Corporate Secretary and/or Treasurer, or have a direct report or reports in those roles.

|

| |

e.

|

Serve as the Principal Financial Officer and Principal Accounting Officer of the Company as such offices are defined under applicable law and all statutory requirements.

|

| |

f.

|

Develop quarterly and annual operating targets.

|

| |

g.

|

Lead a high performance, results driven culture that meets or exceeds commitments.

|

| |

h.

|

Ensure a system is in place which drives operational excellence and continuous improvement.

|

| |

i.

|

Prioritize the best growth and investment strategies to pursue given limited resources.

|

| |

j.

|

Provide visibility and strong communication skills to internal and external stakeholders.

|

| |

5.

|

Termination of Employment. Employee's employment with the Company may be terminated in accordance with any of the following provisions:

|

| |

a.

|

Termination by Employee. The Employee may terminate employment at any time during the course of this Employment Agreement by giving ninety (90) days’ notice in writing to the President & CEO of PPIH. During the notice period, Employee must fulfill all duties and responsibilities set forth above and use his best efforts to train and support his replacement, if any. Failure to comply with this requirement may result in Termination for Cause described below, but otherwise Employee's salary and benefits will remain unchanged during the notification period.

|

| |

b.

|

Termination by the Company Without Cause. PPIH may terminate Employee's employment at any time during the course of this Employment Agreement by giving ninety (90) days’ notice in writing to the Employee. During the notice period, Employee must fulfill all of Employee's duties and responsibilities set forth above and use Employee's best efforts to train and support Employee's replacement, if any. Failure of Employee to comply with this requirement may result in Termination for Cause described below, but otherwise Employee's salary and benefits will remain unchanged during the notification period. Should PPIH terminate Employee’s employment without Cause, contingent on Employee signing a release of claims, Employee will receive twelve (12) months of Severance plus pro rata STI for the year of termination at 100% of target, and retain all rights to vested Restricted Stock, and any unvested Restricted Stock and RSUs and any other equity awards will be forfeited except that Restricted Stock due to vest in the current year will vest pro rata for the number of months Employee was employed in that year.

|

| |

c.

|

Termination by Employee for Good Reason. Employee may terminate his employment with the Company for Good Reason (as defined below) by giving ninety (90) days’ notice in writing to the Company. During the notice period, Company shall have the right to cure any Good Reason as defined in this Agreement. If requested by the Company, Employee must fulfill all of Employee's duties and responsibilities set forth above during the ninety (90) day notice period and use Employee's best efforts to train and support Employee's replacement, if any. Failure of Employee to comply with this requirement may result in Termination for Cause described below, but otherwise Employee's salary and benefits will remain unchanged during the notification period. Should Company fail to cure Employee’s stated Good Reason within ninety (90) days and, as a result, termination for Good Reason occurs, contingent on Employee signing a release of claims, Employee will receive twelve (12) months of Severance plus pro rata STI for the year of termination at 100% of target, and retain all rights to vested Restricted Stock, and any unvested Restricted Stock and RSUs and any other equity awards will be forfeited except that Restricted Stock due to vest in the current year will vest pro rata for the number of months Employee was employed in that year. For the purposes of this Agreement, “Good Reason” is defined as material diminution in Employee's compensation or material negative changes by the Company affecting the Employee’s duties, responsibilities, reporting or authority as outlined in this Employment Agreement. Good Reason shall not exist at any time that the Employee could be terminated for Cause.

|

| |

d.

|

Termination by the Company for Cause. The Company may, at any time and without notice, terminate the Employee for "Cause". Termination for "Cause" shall include but not be limited to termination based upon any of the following: (a) repeated failure to perform the duties of the Employee's position in a satisfactory manner; (b) fraud, misappropriation, embezzlement or acts of similar dishonesty; (c) conviction of or entrance of a plea of no contest for a felony involving moral turpitude; (d) illegal use of drugs or excessive use of alcohol in the workplace; (e) intentional and willful misconduct that may subject the Company to criminal or civil liability; (f) breach of the Employee's duty of loyalty, including the diversion or usurpation of corporate opportunities properly belonging to the Company; (g) willful disregard of Company policies and procedures; (h) breach of any of the material terms of the Employment Agreement; and (i) insubordination or deliberate refusal to follow the lawful instructions of the Board of Directors of PPIH. Termination for Cause will result in immediate termination, no Severance, no STI for the year of termination, and forfeiture of all unvested Restricted Stock, RSUs and any other equity awards. Cause shall not exist under subsections (a), (f), or (h) unless the Employee fails to cure the alleged misconduct, breach or violation after being given thirty (30) days' written notice by the Company of the alleged misconduct, breach or violation that is asserted as the basis for Cause.

|

| |

e.

|

Termination by Death or Disability. The Employee's employment and rights to compensation under this Employment Agreement shall terminate if the Employee is unable to perform the duties of his position due to death, or disability lasting more than ninety (90) days, taking into consideration the accommodation obligations under the Americans with Disabilities Act or parallel state law based on the applicable facts of any such disability, and the Employee's heirs, beneficiaries, successors, or assigns shall not be entitled to any of the compensation or benefits to which Employee is entitled under this Employment Agreement, except: (a) to the extent specifically provided in this Employment Agreement (b) to the extent required by law; or (c) to the extent that such benefit plans or policies under which Employee is covered provide a benefit to the Employee's heirs, beneficiaries, successors, or assigns.

|

| |

f.

|

Change in Control (CIC). CIC is defined by a change in ownership or a sale of substantially all of the Company’s assets and a material diminution of Employee’s duties, responsibilities, reporting or authority within twelve (12) months following such ownership change. In the event of a CIC, Employee may terminate his employment with Good Reason. In addition, all RSU vesting will be accelerated. For purposes of determining whether a CIC has occurred, Company shall mean PPIH, Inc.

|

| |

g.

|

Severance. Severance means a payment equal to Employee’s Annual Base Salary plus continuation of group health and welfare benefits via COBRA for the Severance period. Severance will be paid in equal installments for the length of the Severance period, beginning with the first payroll period on or after thirty (30) days after Employee signs the release of claims referenced herein.

|

| |

h.

|

Release. Any post-termination Severance or benefits are subject to Employee signing a release of claims prior to receipt.

|

| |

6.

|

Confidentiality. To the fullest extent permitted by applicable law, the terms of the Confidentiality Agreement executed by the Employee are incorporated by reference into this Employment Agreement and are made a part hereto as if they appeared in this Employment Agreement itself. The terms of such Confidentiality Agreement, as incorporated herein, will extend for the duration of any Severance period.

|

| |

7.

|

Non-Solicitation/Non-Compete. To the fullest extent permitted by applicable law, the terms of the Non-Solicitation/Non-Compete Agreement executed by the Employee are incorporated by reference into this Employment Agreement and are made a part hereto as if they appeared in this Employment Agreement. The terms of such Non-Solicitation/Non-Compete Agreement, as incorporated herein, will extend for the duration of any Severance period.

|

| |

8.

|

Code of Conduct and Compliance with Laws. Employee agrees to be bound by the provisions of the PPIH Code of Conduct and Global Anti-Corruption Policy and Procedure. Employee asserts he has no conflict of interest in any other business dealings with PPIH. In the event a potential conflict of interest arises, Employee will promptly notify the CEO in writing.

|

| |

9.

|

Assignment of Inventions, Improvements and Developments. The Employee hereby assigns and agrees to assign to the Company the entire worldwide right, in all inventions, improvements and developments, patentable or unpatentable, which, during his employment by the Company he shall have made or conceived or hereafter may make or conceive, either solely or jointly with others (a) with the use of the Company’s time, equipment, materials, supplies, facilities, or trade secrets or confidential business information or (b) resulting from or suggested by his work for the Company or (c) contemplated business of the Company, including, but not limited to, pre-insulated and/or secondarily contained piping systems for district heating and cooling systems, pipelines for the transportation of oil, gas, chemicals or similar products and materials. All such inventions, improvements and developments shall automatically and immediately be deemed to be the property of the Company as soon as made or conceived. This assignment includes all rights to claim for any patent application for such inventions, improvements and developments the full benefits and priority rights under the Patent Cooperation Treaty, the Paris Convention, and any other international intellectual property agreement. This assignment includes all rights to sue for all infringements, including those which may have occurred before this assignment. It is understood that this Employment Agreement does not apply to an invention for which no equipment, supplies, facility or trade secret information of the Company was used and which was developed entirely in the Employee’s own time, unless the invention (i) is related to the business of the Company, (ii) is related to the Company’s actual or demonstrably anticipated research or development, or (iii) results from any work performed by the Employee for the Company.

|

| |

10.

|

Disclosure. Employee agrees to disclose promptly to the Company all such inventions, improvements and developments when made or conceived. Upon termination of his employment for any reason, Employee shall immediately give to the Company all written records of such inventions, improvements and developments and make all full disclosures thereof, whether or not they have been reduced to writing.

|

| |

11.

|

Aid and Assistance. The Employee agrees: (a) to execute all documents necessary to protect inventions, improvement and developments assigned pursuant to Section 9, and to obtain, maintain, modify, or enforce any United States or foreign patent on such invention, improvements or developments; and (b) to cooperate with the Company in every reasonable way possible in obtaining evidence for use in any such proceedings to obtain, maintain, modify or enforce any such patent.

|

| |

12.

|

Office Location: You will be based at the PPIH offices at 24900 Pitkin Road, Spring, Texas or similar Company location.

|

| |

13.

|

Parachute Payment Limitation. Notwithstanding any contrary provision above, if Employee is a "disqualified individual" (as defined in Section 280G of the Internal Revenue Code), and the CIC Benefits, together with any other payments which the Employee has the right to receive from the Company, would constitute a "parachute payment" (as defined in Section 280G of the Code), the payments and benefits provided under this Agreement shall be either (i) reduced (but not below zero) so that the aggregate present value of such payments and benefits received by the Employee from the Company shall be $1.00 less than three times Employee's "base amount" (as defined in Section 280G of the Code) and so that no portion of such payments received by Employee shall be subject to the excise tax imposed by Section 4999 of the Code, or (ii) paid in full, whichever produces the better net after-tax result for Employee (taking into account any applicable excise tax under Section 4999 of the Code and any applicable income tax). If a reduced payment is made to Employee pursuant to clause (i) above and through error or otherwise that payment, when aggregated with other payments from the Company used in determining if a parachute payment exists, exceeds $1.00 less than three times Employee's base amount, Employee must immediately repay such excess to the Company upon notification that an overpayment has been made.

|

| |

14.

|

Indemnification and Insurance. The Company will defend, indemnify and hold Employee, his heirs, executors and administrators harmless against and in respect of any and all damages, losses, obligations, liabilities, claims, deficiencies, costs and expenses (including, but not limited to, attorneys’ fees and other costs and expenses incident to any suit, action, investigation, claim or proceeding) suffered, sustained, incurred or required to be paid by Employee by reason of or on account of Employee’s performance of work on behalf of the Company, except to the extent due to any act or omission by Employee that constitutes a breach of this Employment Agreement or is outside the scope of his authority under this Employment Agreement. In addition, the Company will maintain directors and officer’s liability insurance in place, with reasonable and customary limits, pursuant to which Employee shall be a named, additional or covered insured. Employee shall cooperate with reasonable requests of the Company in connection with any indemnifiable claim and shall provide such documentation or information which is reasonably necessary to defend the indemnifiable claim.

|

| |

a.

|

Notices. All notices and other communications required or permitted by this Employment Agreement to be delivered by PPIH or Employee to the other party shall be delivered in writing to the address shown below, either personally, or by registered, certified or express mail, return receipt requested, postage prepaid, to the address for such party specified below or to such other address as the party may from time to time advise the other party, and shall be deemed given and received as of actual personal delivery, or upon the date or actual receipt shown on any return receipt if registered, certified or express mail is used, as the case may be.

|

|

|

PPIH, Inc.:

24900 Pitkin Road, Suite 309

Spring, TX 77386

|

| |

b.

|

Amendments and Termination; Entire Agreement. This Employment Agreement may not be amended or terminated except in writing executed by all of the parties hereto. This Employment Agreement constitutes the entire agreement of PPIH and Employee relating to the subject matter hereof and supersedes all prior oral and written understandings and agreements relating to such subject matter.

|

| |

c.

|

Existing Agreements. The Employee represents to the Company that he is not subject or a party to any employment or consulting agreement, confidentiality, non-competition covenant or other agreement, covenant or understanding which might prohibit him from executing this Employment Agreement or limit his ability to fulfill his responsibilities hereunder.

|

| |

d.

|

Successors and Assigns. The rights and obligations of the parties hereunder are not assignable to another person without prior written consent; provided, however, that PPIH, without obtaining Employee's consent, may assign its rights and obligations hereunder to a wholly-owned subsidiary and provided further that any post-employment restrictions shall be assignable by PPIH to any entity which purchases all or substantially all of the Company's assets. In addition, in the event of any sale, transfer or other disposition of all or substantially all of the Company’s assets or business, whether by merger, consolidation or otherwise, the Company may assign this Employment Agreement and its rights hereunder without obtaining Employee’s consent, provided that the assignee assumes all of the obligations of the Company hereunder, and upon such assignment and assumption, the Employee shall have no right to look to the Company for obligations arising hereunder after the effective date of such assignment.

|

| |

e.

|

Severability Provisions Subject to Applicable Law. All provisions of this Employment Agreement shall be applicable only to the extent that they do not violate any applicable law, and are intended to be limited to the extent necessary so that they will not render this Employment Agreement invalid, illegal or unenforceable under any applicable law. If any provision of this Employment Agreement or any application thereof shall be held to be invalid, illegal or unenforceable, the validity, legality and enforceability of other provisions of this Employment Agreement or of any other application of such provision shall in no way be affected thereby.

|

| |

f.

|

Waiver of Rights. No waiver by PPIH or Employee of a right or remedy hereunder shall be deemed to be a waiver of any other right or remedy or of any subsequent right or remedy of the same kind.

|

|

|

g.

|

Definitions, Headings, and Number. A term defined in any part of this Employment Agreement shall have the defined meaning wherever such term is used herein. The headings contained in this Employment Agreement are for reference purposes only and shall not affect in any manner the meaning or interpretation of this Employment Agreement. Where appropriate to the context of this Employment Agreement, use of the singular shall be deemed also to refer to the plural, and use of the plural to the singular.

|

| |

h.

|

Counterparts. This Employment Agreement may be executed in separate counterparts, each of which shall be deemed an original but both of which taken together shall constitute but one and the same instrument.

|

| |

i.

|

Governing Laws and Forum. This Employment Agreement shall be governed by, construed, and enforced in accordance with the laws of the State of Texas. The Company and Employee agree that any claim, dispute, or controversy arising under or in connection with the Employment Agreement, or otherwise in connection with Employee’s employment by the Company (including, without limitation, any such claim, dispute, or controversy arising under any federal, state, or local statute, regulation, or ordinance or any of the Company's employee benefit plans, policies, or programs) shall be resolved solely and exclusively by final and binding arbitration. The arbitration shall be held in the city of Houston, Texas (USA) and the language shall be English. The arbitration shall be conducted in accordance with the Rules of the American Arbitration Association (the "AAA") in effect at the time of the arbitration and each party shall appoint one arbitrator of its own choosing with a third arbitrator on a panel of three (3) being appointed by the parties’ respective arbitrators. All fees and expenses of the arbitration, including a transcript if either requests, shall be borne equally by the parties. Any judgement upon the award rendered by the arbitrators may be entered in any court having jurisdiction thereof.

|

IN WITNESS WHEREOF, PPIH and Employee have executed and delivered this Employment Agreement as of the date written below.

|

|

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 2, 2023

|

By:

|

/s/ Matthew E. Lewicki

|

|

|

|

|

Matthew E. Lewicki

|

|

|

|

|

Vice President and Chief Financial Officer

|

|

|

|

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 2, 2023

|

By:

|

/s/ David J. Mansfield

|

|

|

|

|

David J. Mansfield

|

|

|

|

|

President and Chief Executive Officer

|

|

Exhibit 99.1

COMPANY: Perma-Pipe International Holdings, Inc.

CONTACTS: David Mansfield, President and CEO

Perma-Pipe Investor Relations

847.929.1200

investor@permapipe.com

Perma-Pipe International Holdings Announces the Appointment of Matthew Lewicki as Vice President and Chief Financial Officer, Secretary and Treasurer

Company Release – 10/2/23 12:07 PM ET

SPRING, Texas--(BUSINESS WIRE)

Perma-Pipe International Holdings, Inc. (Nasdaq: PPIH) today announced the appointment of Matthew Lewicki to Vice President and Chief Financial Officer, Secretary and Treasurer (“CFO”) replacing long time financial executive D. Bryan Norwood who informed the Board of his intention to retire effective October 2, 2023. As CFO, Matthew is charged with leadership, oversight and execution of all PPIH financial matters and will serve as a key business advisor to the senior leadership team and Board of Directors. Mr. Norwood will transition his responsibilities to Mr. Lewicki while assuming the role of Vice President, Strategy until his retirement on March 31, 2024.

Mr. Lewicki joined PPIH in 2023 and has served as the Chief Accounting Officer. Matthew has 20 years of progressive finance and accounting experience, most of those years at Oil and Gas infrastructure services organizations. Prior to joining Perma-Pipe, Matthew served as Senior Manager of Financial Reporting and Financial Planning at Quanta Services, Inc. and most recently as Corporate Controller of the Global Organization at HMT Holding Corp, Inc. and Subsidiaries. Matthew has a Master of Business Administration in Accounting and Finance from Lamar University and is a Certified Public Accountant.

President and CEO David Mansfield commented, “I am pleased that Matt has agreed to assume the role of CFO to lead the company’s finance group. In addition to his financial responsibilities, Matt will provide leadership to the IT, Legal, and Risk Management functions, serve as member of the Ethics and Compliance Committee and acts as Corporate Secretary to the Board. Matt has already had a notable impact with us in the role of Chief Accounting Officer, and I am sure his technical capability, leadership skills and sense of urgency will complement our vision and impact our continued growth and success in our industry.”

Chairman of the Board Jerome T. Walker commented: "On behalf of the Board, we are grateful for Bryan’s contributions as Company CFO for the past 5 years and congratulate him on an outstanding career and his upcoming retirement plans. It has been a pleasure to get to know Matt over the past several months since he joined Perma-Pipe, and the Board looks forward to having his financial talent, passion and leadership in the CFO chair. Having both of these outstanding financial leaders working together at the Company for the next six months provides us ample opportunity to ensure a smooth and seamless transition as the Company continues execution of its strategic growth plans."

Mr. Lewicki commented: “I am thankful for this opportunity and for the confidence and trust that David, Bryan, and the Board of Directors have in me. Perma-Pipe has achieved remarkable success which reflects Bryan’s leadership as CFO. I am honored to build on that success and to continue working with Perma-Pipe’s leadership team to extend our market leadership in the years to come and drive long-term value for our employees and stockholders.”

President and CEO David Mansfield further commented on Bryan Norwood’s retirement: “I have worked with Bryan for more than 25 years and have always found him to be a loyal and dependable partner. He joined Perma-Pipe in 2018 as Vice President and Chief Financial Officer, Secretary and Treasurer, and has played an instrumental role in many of the changes impacting the Company. Bryan has played a vital role in the ongoing growth, and development of the business, and has provided valuable leadership and contributions to our strategic development through some transformational times. It has been a pleasure working with Bryan over the years and he will be missed. We wish him all the best in his well-deserved retirement.”

Perma-Pipe International Holdings, Inc.

Perma-Pipe International Holdings, Inc. (Nasdaq: PPIH) is a global leader in pre-insulated piping and leak detection systems for oil and gas gathering, district heating and cooling, and other applications. It uses its extensive engineering and fabrication expertise to develop piping solutions that solve complex challenges regarding the safe and efficient transportation of many types of liquids. In total, Perma-Pipe has operations at thirteen locations in six countries.

Perma-Pipe International Holdings, Inc.

David Mansfield, President and CEO

Perma-Pipe Investor Relations

investor@permapipe.com

847.929.1200

Source: Perma-Pipe International Holdings, Inc.

v3.23.3

Document And Entity Information

|

Oct. 02, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 02, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32530

|

| Entity, Tax Identification Number |

36-3922969

|

| Entity, Address, Address Line One |

24900 Pitkin Road

|

| Entity, Address, Address Line Two |

Suite 309

|

| Entity, Address, City or Town |

Spring

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77386

|

| City Area Code |

847

|

| Local Phone Number |

966-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PPIH

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000914122

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

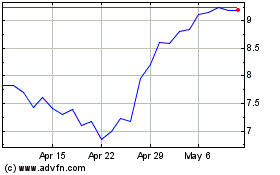

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Apr 2024 to May 2024

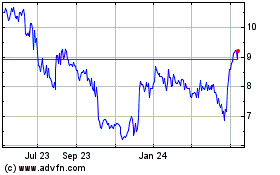

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From May 2023 to May 2024