Perion Network Ltd. (NASDAQ: PERI), today announced financial

results for the second quarter and six months ended June 30,

2012.

Q2 2012 non-GAAP Financial Highlights Include:

- Quarterly revenues increased 53%

year-over-year to $12.3 million;

- Product and other advertising revenues

tripled year-over-year, reaching $5.9 million;

- Search revenue increased sequentially

15% to $6.4 million;

- EBITDA was $2.7 million, or 22% of

revenues; and

- Net income totaled $1.8 million, or 15%

of revenues;

First Six Months 2012 non-GAAP Financial Highlights

Include:

- Year-to-date revenues increased 41%

year-over-year to $23.6 million;

- Combined product and other advertising

revenues tripled year-over-year, reaching $11.6 million and

accounted for almost half of the revenues in the first half of

2012;

- EBITDA was $5.3 million, or 22% of

revenues; and

- Net income totaled $4.0 million, or 17%

of revenues;

“Based on strong second quarter results and ongoing operational

improvements, we are increasing our outlook for the full year,”

commented Chief Executive Officer Josef Mandelbaum. “We

currently expect a better than 50% increase in revenues in the

second half of this year compared to the second-half of last

year.”

“In particular, our search business showed a 15% growth from the

first quarter and is on a significant upward trajectory as we begin

to reap the benefits of our investments in infrastructure and

systems over the past year,” added Mr. Mandelbaum. “In addition, as

we approach the one year anniversary of our Smilebox acquisition, I

am pleased to report that it continues to be profitable with 30%

top-line growth. Looking forward, we continue to invest in our

future, and are on track to launch our revolutionary iPad email app

at the end of the third quarter as well as major improvements to

our Smilebox iPhone app during the quarter.”

Non-GAAP Financial Comparison for the Second Quarter and

First Six Months of 2012:

Revenue: Q2’12 revenues were $12.3 million, increasing 9%

over the prior quarter and 53% compared to the second quarter of

2011. This was primarily as a result of the consolidation of

Smilebox revenues and growth in product and other advertising

revenues derived from Perion’s IncrediMail product. The increase in

IncrediMail premium product revenue was primarily due to the

continued shifting from a service offering to a product offering, a

process management plans to continue in future periods. Search

revenue was up as well. As a result of steps taken and improvements

made in the beginning of the quarter, the decrease in the first

months was more than offset by record monetization in the last

month of the quarter, and management believes this trend of

increased monetization will continue in the second half and

beyond.

In the first half of 2012, revenues increased 41%, reaching

$23.6 million, compared to $16.7 million in the first half of 2011.

This increase was due to our increasing product sales four-fold,

partially offset by a small decrease in search generated revenues

experienced in the first quarter of 2012 and since remedied.

Gross Profits: Gross profit in the second quarter of 2012

was $11.5 million, up 10% sequentially and up 51% from the second

quarter of 2011. The gross profit margin remained healthy at 93%

this last quarter, compared to 94% in the second quarter of 2011.

In the first six months of 2012, gross profit increased 38%,

reaching $22.0 million, or 93% of sales, compared to $15.9 million,

or 95% of revenues in the first half of 2011.

Customer Acquisition Costs (“CAC”): In the second quarter

of 2012, Perion invested $3.9 million in CAC, compared to $2.6

million last quarter and $1.7 million in the second quarter of

2011. The increase in CAC was in conjunction with the improvement

in the return on this investment, credited to the Company’s

enhanced back-end systems and improved methodology. The marketing

investment in the second quarter generated a return of more than

50% in revenues during the second quarter, and the remaining return

on investment is expected primarily in the third and fourth quarter

of this year. In the first half of 2012, CAC was $6.5 million,

compared to $2.3 million in the first half of 2011.

EBITDA: In the second quarter of 2012, EBITDA was $2.7

million, increasing 13% compared to the same quarter last year,

despite the $2.2 million increase in CAC, as the return on this

investment started to take effect. In the first half of 2012 EBITDA

was $5.3 million, decreasing $0.8 million from $6.1 million in the

first half of 2011, primarily due to the $4.2 million increase in

CAC.

Net Income: In the second quarter of 2012, net income was

$1.8 million or $0.18 per share, compared to $1.9 million, or $0.19

per share in the second quarter of 2011. In the first half of 2012

net income was $4.0 million, or $0.40 per share, compared to $4.9

million, or $0.48 per share, in the first half of 2011.

Cash Flow from Operations: Based on reports in U.S. GAAP,

in the first half of 2012, cash flow from operations was $2.5

million, compared to $4.1 million in the first half of 2011. The

decrease in cash flow from operations is primarily due to the

increase in CAC and search revenues receivable in the second

quarter of 2012.

Outlook: Management is raising non-GAAP guidance for 2012

with revenues in the range of $50 - $52 million, EBITDA of $10.5 -

$11.5 million and Net Income projected to be $7.5 - $8.5

million.

Conference CallPerion will host a conference call to

discuss the results today, August 8th at 10 a.m. EDT (17 p.m.

Israel Time). To listen to the call please visit the Investor

Relations section of Perion’s website at

www.perion.com/events-presentations. Click on the link provided for

the webcast, or dial 1-866-744-5399. Callers from Israel may access

the call by dialing (03) 918-0685. The webcast will be archived on

the company’s website for seven days.

About Perion Network Ltd.,

Perion Network, Ltd. (NASDAQ: PERI) is a global internet

consumer software company that develops applications to make the

online experience of its users simple, safe and enjoyable. Perion’s

two main award winning consumer brands are: IncrediMail and

Smilebox. Together these products have had over 150 million

downloads and have an installed base of over 18 million.

IncrediMail, is a streamlined e-mail and Facebook

application with an easy-to-use interface that allows for more

personalized communications sold in over 100 countries in 10

languages and Smilebox, a leading photo sharing and social

expression product and service that lets customers quickly turn

life's moments into digital creations to share and connect with

friends and family in a fun and personal way. Perion’s applications

are monetized through a freemium model. Free versions of our

applications are monetized primarily through our toolbar which

generates search revenue, and advertising revenue generated through

impressions, while a more advanced feature rich version is

available with a premium upgrade. Perion also offers and develops a

range of products for mobile phones and tablets to answer its users

increasing mobile demands. For more information on Perion please

visit www.perion.com.

Non-GAAP measures

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude: Valuation adjustment on acquired deferred

product revenues, amortization of acquired intangible assets,

share-based compensation expenses, acquisition related expenses,

deferred finance expenses and non-recurring tax benefits. The

purpose of such adjustments is to give an indication of our

performance exclusive of non-cash charges and other items that are

considered by management to be outside of our core operating

results. Our non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Our management regularly uses our supplemental non-GAAP financial

measures internally to understand, manage and evaluate our business

and make operating decisions. These non-GAAP measures are among the

primary factors management uses in planning for and forecasting

future periods. Business combination accounting rules requires us

to recognize a legal performance obligation related to a revenue

arrangement of an acquired entity. The amount assigned to that

liability should be based on its fair value at the date of

acquisition. The non-GAAP adjustment is intended to reflect the

full amount of such revenue. We believe this adjustment is useful

to investors as a measure of the ongoing performance of our

business. We believe these non-GAAP financial measures provide

consistent and comparable measures to help investors understand our

current and future operating cash flow performance. These non-GAAP

financial measures may differ materially from the non-GAAP

financial measures used by other companies. Reconciliation between

results on a GAAP and non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of the

Company. The words “believe,” “expect,” “intend,” “plan,” “should”

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the current views, assumptions

and expectations of the Company with respect to future events and

are subject to risks and uncertainties. Many factors could cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements, including, among others, potential

litigation associated with the transaction, risks that the

transaction disrupts current plans and operations and the potential

difficulties in employee retention as a result of the transaction

and in integrating the acquired business, the distraction of

management and the Company resulting from the transaction, changes

in the markets in which the Company operates and in general

economic and business conditions, loss of key customers and

unpredictable sales cycles, competitive pressures, market

acceptance of new products, inability to meet efficiency and cost

reduction objectives, changes in business strategy and various

other factors, whether referenced or not referenced in this press

release. Various other risks and uncertainties may affect the

Company and its results of operations, as described in reports

filed by the Company with the Securities and Exchange Commission

from time to time, including its annual report on Form 20-F for the

year ended December 31, 2011. The Company does not assume any

obligation to update these forward-looking statements.

Source: Perion Network Ltd.

PERION NETWORK LTD. NON-GAAP SUMMARY FINANCIAL METRICS U.S. dollars

in thousands (except per share data), unaudited

Quarter ended June 30, Six months ended June 30,

2012 2011 2012 2011

Revenues: Search $ 6,398 $ 6,249 $ 11,950 $ 13,052 Product 5,062

1,189 10,033 2,510 Other 845 613 1,578

1,176 Total revenues $ 12,305 $ 8,051 $ 23,561 $ 16,738 Gross

Profit $ 11,494 $ 7,595 $ 21,986 $ 15,900 Operating Income $ 2,425

$ 2,177 $ 4,823 $ 5,736 Net Income $ 1,840 $ 1,926 $ 4,016 $ 4,855

Diluted EPS $ 0.18 $ 0.19 $ 0.40 $ 0.48

PERION NETWORK LTD.

GAAP FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF INCOME

U.S. dollars and number of shares in

thousands (except per share data), (unaudited)

Quarter ended June 30, Six months ended

June 30, 2012 2011 2012

2011 Revenues: Search $ 6,398 $ 6,249 $ 11,950 $

13,052 Product 4,740 1,189 9,114 2,510 Other 845

613 1,578 1,176 Total

revenues 11,983 8,051 22,642 16,738 Cost of revenues 1,064

459 2,087 843

Gross profit 10,919 7,592 20,555

15,895 Operating expenses: Research and

development, net 2,464 1,465 5,147 3,341 Selling and marketing

1,543 887 3,224 1,749 Customer acquisition costs 3,925 1,681 6,538

2,333 General and administrative 1,524 1,911

3,515 3,546 Total operating

expenses 9,456 5,944 18,424

10,969 Operating income 1,463 1,648 2,131

4,926 Financial income (expense), net (248 ) 57

(196 ) 134 Income before taxes

on income 1,215 1,705 1,935 5,060 Taxes on income (credit)

337 (509 ) 687 (396 ) Net income

$ 878 $ 2,214 $ 1,248 $ 5,456

Basic earnings per share $ 0.09 $ 0.23 $ 0.13

$ 0.56 Diluted earnings per share $ 0.09 $ 0.22

$ 0.12 $ 0.54 Basic weighted number of

shares 9,984 9,740 9,950

9,726 Diluted weighted number of shares 10,022

10,022 10,015 10,017

PERION NETWORK LTD. RECONCILIATION OF GAAP TO

NON-GAAP RESULTS U.S. dollars and number of shares in thousands

(except per share data), unaudited

Quarter endedJune 30,

Six months endedJune 30,

2012 2011 2012 2011 GAAP

revenues $ 11,983 $ 8,051 $ 22,642 $ 16,738 Valuation

adjustment on acquired deferred product revenues 322

- 919 - Non-GAAP revenues $ 12,305 $

8,051 $ 23,561 $ 16,738 GAAP gross profit $ 10,919 $

7,592 $ 20,555 $ 15,895 Valuation adjustment on acquired deferred

product revenues 322 -- 919 - Share based compensation 3 3 12 5

Amortization of acquired intangible assets 250 --

500 - Non-GAAP gross profit $ 11,494 $

7,595 $ 21,986 $ 15,900 GAAP operating expenses $

9,456 $ 5,944 $ 18,424 $ 10,969 Acquisition related expenses - 221

313 221 Share based compensation 178 305 529 584 Amortization of

acquired intangible assets 209 - 419

- Non-GAAP operating expenses $ 9,069 $ 5,418

$ 17,163 $ 10,164 GAAP operating income $ 1,463 $ 1,648

$ 2,131 $ 4,926 Valuation adjustment on acquired

deferred product revenues 322 - 919 - Acquisition related expenses

- 221 313 221 Share based compensation 181 308 541 589 Amortization

of acquired intangible assets 459 - 919

- Operating income adjustments 962 529

2,692 810 Non-GAAP operating income $

2,425 $ 2,177 $ 4,823 $ 5,736 GAAP Net income $ 878 $

2,214 $ 1,248 $ 5,456 Operating income adjustments 962 529 2,692

810 Deferred finance expenses - - 76 - Non-recurring tax benefits

- (817 ) - (1,411 ) Non-GAAP net income $

1,840 $ 1,926 $ 4,016 $ 4,855 GAAP diluted earnings

per share $ 0.09 $ 0.22 $ 0.12 $ 0.54 Non-GAAP

diluted earnings per share $ 0.18 $ 0.19 $ 0.40 $ 0.48

Shares used in computing US GAAP and Non-GAAP diluted

earnings per share 10,022 10,022 10,015

10,017 Non-GAAP net income $ 1,840 $ 1,926 $ 4,016 $

4,855 Income tax expense (credit) 337 (509 ) 687 (396 )

Non-recurring tax benefits - 817 - 1,411 Interest expense (income),

net 248 (57 ) 120 (134 ) Depreciation and amortization 225

169 444 349 Non-GAAP EBITDA $

2,650 $ 2,346 $ 5,267 $ 6,085 PERION NETWORK

LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share data)

June

30, December 31, 2012 2011

Unaudited ASSETS CURRENT ASSETS: Cash and cash equivalents $

16,330 $ 11,260 Trade receivables 4,100 3,265 Other receivables and

prepaid expenses 6,320 6,459 Total current assets

26,750 20,984 LONG-TERM ASSETS: Severance pay fund

402 484 Property and equipment, net 1,335 1,300 Other intangible

assets, net 6,039 6,606 Goodwill 24,753 24,753 Other assets

1,028 777 Total long-term assets 33,557 33,920

Total assets $ 60,307 $ 54,904 LIABILITIES AND SHAREHOLDERS'

EQUITY CURRENT LIABILITIES: Current maturities of long-term debt $

2,300 $ - Trade payables 3,734 3,207 Deferred revenues 4,761 4,280

Payment obligation related to acquisition - 6,574 Accrued expenses

and other liabilities 6,920 6,950 Total current

liabilities 17,715 21,011 LONG-TERM LIABILITIES:

Long-term debt 7,700 - Deferred revenues - 1,120 Deferred tax

liability 61 12 Accrued severance pay 866 946 Total

long-term liabilities 8,627 2,078

SHAREHOLDERS' EQUITYShares authorized:

40,000,000Shares issued and outstanding: 9,987,325 and 9,916,194 as

of June 30, 2012 and December 31, 2011, respectively;

33,965 31,815 Total liabilities and shareholders'

equity $ 60,307 $ 54,904

PERION NETWORK LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands, (unaudited)

Six months ended June 30, 2012

2011

Cash flows from

operating activities:

Net income $ 1,248 $ 5,456 Adjustments required to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 1,363 349 Stock based compensation expense 541 589

Accretion of payment obligation related to acquisition 76 -

Adjustment of payment obligation related to acquisition 313

Amortization of premium and accrued interest on marketable

securities - 30 Loss from marketable securities, net - 48 Deferred

taxes, net 22 35 Accrued severance pay, net 2 65 Net changes in

operating assets and liabilities: Trade receivables (835 ) 335

Other receivables and prepaid expenses 166 (2,789 ) Other long-term

assets (251 ) 2 Trade payables 527 588 Deferred revenues (639 )

(137 ) Accrued expenses and other liabilities (30 )

(453 ) Net cash provided by operating activities 2,503

4,118

Cash flows from

investing activities:

Purchase of property and equipment (361 ) (140 ) Long term

restricted cash - 100 Capitalization of software development and

content costs (447 ) (310 ) Acquisition of subsidiary (6,626 ) -

Proceeds from sales of marketable securities - 8,180 Investment in

marketable securities - (11,915 ) Net cash

used in investing activities (7,434 ) (4,085 )

Cash flows from

financing activities:

Exercise of share options 1 29 Proceeds from long-term loans 10,000

- Dividend paid - (3,885 ) Net cash provided

by (used in) financing activities 10,001

(3,856 ) Increase (Decrease) in cash and cash equivalents 5,070

(3,823 ) Cash and cash equivalents at beginning of year

11,260 16,055 Cash and cash equivalents at end

of period $ 16,330 $ 12,232

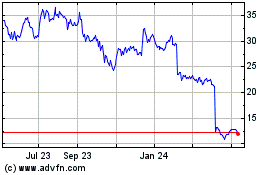

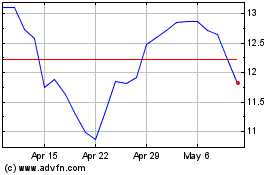

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024