Perion Network Ltd. (NASDAQ: PERI), formerly IncrediMail Ltd.,

today announced results for the third quarter ending September 30,

2011.

Third Quarter 2011 non-GAAP Financial Highlights

Include:

- Record revenues increased 20%

year-over-year to $9.0 million;

- Premium and other revenues increased

87% year over year to $3.0 million;

- Net income totaled $1.8 million,

compared to $2.8 million in the third quarter of 2010;

- Year to date cash flow from operations

totaled $5.4 million, cash balance of $9.5 million;

- Secured $20 million long term bank

credit facility, still unutilized.

Commenting on the results, Josef Mandelbaum, Perion’s CEO, said,

“With one month of consolidated activity included in our Q3

results, we can already see the positive impact that Smilebox has

had on our operations and results. We had record revenues and most

importantly, significant growth in premium and advertising sales,

which provides us with a more balanced revenue mix. While our net

income was lower on a year over year basis we are extremely pleased

with our customer acquisition effort, which was the largest factor

in our lower net income, and expect it to drive future revenue

growth and profitability.”

Third Quarter 2011 Operating Metrics:

- Total downloads for the quarter were

4.0 million versus 2.9 million in Q3 2010

- Installed base was 9.6 million at the

end of Q3, a 31% increase from the end of Q3 2010

- Total search queries for the quarter

were 276 million, a 6% decrease from Q3 2010

- Premium subscribers increased to

370,000 a 125% increase from Q3 2010

Third Quarter 2011 Operational Highlights Include:

- Successfully completed Smilebox

acquisition;

- Launched beta of webmail version for

IncrediMail;

- Launched Smilebox mobile app on

iPhone;

- Integrated Facebook photos into

PhotoJoy;

- Expanded into new computer safety and

security category with beta launch of Fixie.

“In addition,” Mandelbaum continued, “the integration with

Smilebox is proceeding as planned and I am happy to report that on

a non-GAAP basis Smilebox should be breakeven in Q4 of this year

and we are confident that it will be profitable in Q1 of 2012, well

ahead of plan. We continue to make good progress on our strategy

and with our name change to Perion, the addition of Smilebox and

launch of new organic products we continue to be excited about our

broader landscape and the future it holds.”

Updated Fiscal Year 2011 Guidance:

With the addition of Smilebox, we are updating our guidance for

2011 and projecting non-GAAP revenue of $37 million and non-GAAP

net income of approximately $8 million for this year.

Non-GAAP Financial Comparison for the Third Quarter and Nine

Months Ended September 30, 2011:

Revenue: Third quarter revenue reached a record $9.0

million, primarily as a result of the consolidation of Smilebox

revenues and growth in other revenues from our IncrediMail product.

In the first nine months of 2011 revenues were a record $25.7

million, up 19% compared to the same period last year. The year to

date growth is primarily attributable to: the ongoing increase in

search generated revenues, an increase in other revenues from our

IncrediMail product, and the addition of Smilebox beginning in

September.

Gross Profits: Third quarter gross profit was $8.4

million, up 18% from $7.1 million in the third quarter of 2010. For

the first nine months of 2011 gross profits reached $24.3 million,

increasing 18% compared to the first nine months of 2010. With the

incorporation of revenues and the premium content licensing costs

of our Smilebox product, the gross profit margin slightly decreased

in the third quarter of 2011 compared to prior periods, and was

approximately 93% of sales.

Customer Acquisition Costs: Third quarter CAC were $2.6

million, compared to $0.4 million in the third quarter of 2010, and

in the first nine months of 2011 CAC were $4.9 million, compared to

$1.3 million in the same period last year. This increase is a

direct result of our growing media buying efforts, and the addition

of the customer acquisition activities related to Smilebox.

EBITDA: Third quarter EBITDA decreased from $3.8 million

in 2010 to $2.4 million this year, and for the first nine months of

2011 EBITDA was $8.5 million, compared to $10.5 million in the same

period last year. The decrease in both the three and nine month

measures is primarily a result of our increased CAC which was

partially offset by the increase in gross profit.

Net Income: Third quarter net income decreased from $2.8

million in 2010 to $1.8 million this year, and for the first nine

months of 2011 net income was $6.7 million, compared to $7.6

million in the same period last year. The decrease was primarily

attributable to the increased investment in CAC with the expected

delay in subsequent revenues, and was partially offset by the

increase in revenues from advertising and search.

Cash Flow from Operations: Year to date cash flow from

operations was $5.4 million compared to $7.3 million in the third

quarter of 2010. This was largely due to the increase in trade

accounts receivables of $1.7 million, which was received shortly

after the end of the quarter, as well as the aforementioned lower

net income which was due primarily to investments in CAC which had

increased $2.2 million.

Conference Call

Perion will host a conference call to discuss the results today,

November 14th at 10:00 AM EST (17:00 PM Israel Time). To listen to

the call and view the accompanying slide presentation, please visit

the Investor Relations section of Perion’s website at

www.perion.com. Click on the link provided for the webcast, or dial

1-(866)-744-5399. Callers from Israel may access the call by

dialing (03) 918-0685. The webcast will be archived on the

company’s website for seven days.

About Perion Network Ltd.

Founded in 2000, Perion (NASDAQ:PERI) is a digital media company

that provides products and services to consumers to help make their

everyday life simpler and more enjoyable. Focusing on an

underserved market of second wave adopters who value their time

online, Perion offers a growing portfolio of easy-to-use products.

The Company’s products include: IncrediMail Premium, an award

winning e-mail product sold in over 100 countries in 10 different

languages; Smilebox, a leading photo sharing and social expression

product and service that lets customers quickly turn life’s moments

into digital creations to share and connect with friends and family

in a fun and personal way; PhotoJoy, a photo discovery and sharing

screensaver & wallpaper product; and Fixie, a PC optimization

product. For more information on Perion (NASDAQ:PERI), visit

www.perion.com.

Non-GAAP measures

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude: Valuation adjustment on acquired deferred

product revenues, amortization of acquired intangible assets,

share-based compensation expenses, acquisition related expenses,

one time compensation expenses, non-recurring tax benefits. The

purpose of such adjustments is to give an indication of our

performance exclusive of non-cash charges and other items that are

considered by management to be outside of our core operating

results. Our non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Our management regularly uses our supplemental non-GAAP financial

measures internally to understand, manage and evaluate our business

and make operating decisions. These non-GAAP measures are among the

primary factors management uses in planning for and forecasting

future periods. Business combination accounting rules requires us

to recognize a legal performance obligation related to a revenue

arrangement of an acquired entity. The amount assigned to that

liability should be based on its fair value at the date of

acquisition. The non-GAAP adjustment is intended to reflect the

full amount of such revenue. We believe this adjustment is useful

to investors as a measure of the ongoing performance of our

business. We believe these non-GAAP financial measures provide

consistent and comparable measures to help investors understand our

current and future operating cash flow performance. These non-GAAP

financial measures may differ materially from the non-GAAP

financial measures used by other companies. Reconciliation between

results on a GAAP and non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of the

Company. The words “believe,” “expect,” “intend,” “plan,” “should”

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the current views, assumptions

and expectations of the Company with respect to future events and

are subject to risks and uncertainties. Many factors could cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements, including, among others, potential

litigation associated with the transaction, risks that the proposed

transaction disrupts current plans and operations and the potential

difficulties in employee retention as a result of the proposed

transaction and in integrating the acquired business, the

distraction of management and the Company resulting from the

proposed transaction, changes in the markets in which the Company

operates and in general economic and business conditions, loss of

key customers and unpredictable sales cycles, competitive

pressures, market acceptance of new products, inability to meet

efficiency and cost reduction objectives, changes in business

strategy and various other factors, whether referenced or not

referenced in this press release. Various other risks and

uncertainties may affect the Company and its results of operations,

as described in reports filed by the Company with the Securities

and Exchange Commission from time to time, including its annual

report on Form 20-F for the year ended December 31, 2010. The

Company does not assume any obligation to update these

forward-looking statements.

PERION NETWORK LTD. NON-GAAP SUMMARY FINANCIAL METRICS U.S. dollars

and number of shares in thousands (except per share data),

unaudited

Quarter endedSeptember

30,

Nine months endedSeptember

30,

2011 2010 2011 2010

Revenues: Search $ 5,955 $ 5,862 $ 19,007 $ 16,764 Product 2,006

1,282 4,516 4,133 Other 1,031 346 2,207

801 Total revenues $ 8,992 $ 7,490 $ 25,730 $ 21,698 Gross Profit $

8,389 $ 7,108 $ 24,284 $ 20,544 Operating Income $ 2,042 $ 3,570 $

7,778 $ 9,900 Net Income $ 1,817 $ 2,812 $ 6,672 $ 7,597 Diluted

EPS $ 0.18 $ 0.29 $ 0.67 $ 0.78

PERION NETWORK LTD.

GAAP FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

U.S. dollars and number of shares in

thousands (except per share data), unaudited

Quarter endedSeptember

30,

Nine months endedSeptember

30,

2011 2010 2011

2010 Revenues: Search $ 5,955 $ 5,862 $ 19,007 $ 16,764

Product 1,445 1,282 3,955 4,133 Other 1,031 346

2,207 801 Total revenues 8,431 7,490 25,169

21,698 Cost of revenues 686 382 1,529

1,154 Gross profit 7,745 7,108 23,640

20,544 Operating expenses: Research and development

1,726 1,707 5,067 4,895 Selling and marketing 712 715 2,477 2,391

Customer acquisition costs 2,625 405 4,942 1,322 General and

administrative 2,437 1,373 5,983

3,060 Total operating expenses 7,500 4,200

18,469 11,668 Operating income 245 2,908 5,171 8,876

Financial income, net 100 186 234

275 Income before taxes on income 345 3,094 5,405

9,151 Taxes (benefit) on income 325 944 (71 )

2,578 Net income $ 20 $ 2,150 $ 5,476 $ 6,573

Basic earnings per share $ 0.00 $ 0.22 $ 0.56 $ 0.68 Diluted

earnings per share $ 0.00 $ 0.22 $ 0.55 $ 0.67 Basic

weighted number of shares 9,817 9,634 9,757

9,599 Diluted weighted number of shares 10,013

9,724 10,016 9,785 PERION

NETWORK LTD. RECONCILIATION OF GAAP TO NON-GAAP RESULTS U.S.

dollars in thousands (except per share data), unaudited

Quarter endedSeptember

30,

Nine months endedSeptember

30,

2011 2010 2011

2010 GAAP revenues $ 8,431 $ 7,490 $ 25,169 $ 21,698

Valuation adjustment on acquired deferred product revenues

561 - 561 -

Non-GAAP revenues $ 8,992 $ 7,490 $ 25,730 $

21,698 GAAP gross profit $ 7,745 $ 7,108 $ 23,640 $

20,544 Valuation adjustment on acquired deferred product revenues

561 - 561 - Amortization of acquired intangible assets 83

- 83 - Non-GAAP

gross profit $ 8,389 $ 7,108 $ 24,284 $ 20,544

GAAP operating expenses $ 7,500 $ 4,200 $ 18,469 $

11,668 Acquisition related expenses 809 - 1,030 - Share based

compensation 326 212 915 574

One time compensation expenses

- 450 - 450 Amortization of acquired intangible assets 68 - 68 -

Other (50 ) - (50 ) -

Non-GAAP operating expenses $ 6,347 $ 3,538 $ 16,506

$ 10,644 GAAP operating income $ 245 $ 2,908 $

5,171 $ 8,876 Valuation adjustment on acquired deferred product

revenues 561 - 561 - Acquisition related expenses 809 - 1,030 -

Share based compensation 326 212 915 574 One time compensation

expenses - 450 - 450 Amortization of acquired intangible assets 151

- 151 - Other (50 ) - (50 ) -

Operating income adjustments 1,797 662

2,607 1,024 Non-GAAP operating

income $ 2,042 $ 3,570 $ 7,778 $ 9,900

GAAP Net income $ 20 $ 2,150 $ 5,476 $ 6,573 Operating

income adjustments 1,797 662 2,607 1,024 Non-recurring tax benefits

- - (1,411 ) - Non-GAAP net

income $ 1,817 $ 2,812 $ 6,672 $ 7,597

GAAP diluted earnings per share $ 0.00 $ 0.22

$ 0.55 $ 0.67 Non-GAAP diluted earnings per

share $ 0.18 $ 0.29 $ 0.67 $ 0.78

Shares used in computing US GAAP diluted earnings per share

10,013 9,724 10,016

9,785 Shares used in computing Non-GAAP diluted

earnings per share 10,013 9,724

10,016 9,785 Non-GAAP net income $

1,817 $ 2,812 $ 6,672 $ 7,597 Income tax expense (credit) 326 944

(71 ) 2,578 Non-recurring tax benefits - - 1,411 - Interest income,

net (100 ) (186 ) (234 ) (275 ) Depreciation and amortization

333 193 683 587

Non-GAAP EBITDA $ 2,376 $ 3,763 $ 8,461

$ 10,487 PERION NETWORK LTD. CONDENSED CONSOLIDATED

BALANCE SHEETS U.S. dollars in thousands (except share data),

unaudited

September 30,

December 31, 2011 2010 Unaudited ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 9,517 $ 16,055

Marketable securities - 14,973 Trade receivables 5,580 2,795

Deferred taxes, net 258 - Other receivables and prepaid expenses

2,857 4,485 Total current assets 18,212

38,308 LONG-TERM ASSETS: Severance pay fund 707 877 Deferred taxes,

net - 102 Other long-term assets 534 478 Property and equipment,

net 1,328 1,381 Goodwill and other intangible assets, net

32,060 202 Total long-term assets 34,629 3,040

Total assets $ 52,841 $ 41,348 LIABILITIES AND SHAREHOLDERS'

EQUITY CURRENT LIABILITIES: Trade payables $ 2,290 $ 1,831 Deferred

revenues 3,182 2,204 Accrued expenses and other liabilities

13,455 6,206 Total current liabilities 18,927

10,241 LONG-TERM LIABILITIES: Deferred revenues 1,267 1,576 Accrued

severance pay 1,231 1,379 Other 52 - Total long-term

liabilities 2,550 2,955

SHAREHOLDERS' EQUITY

Shares authorized: 15,000,000 and

40,000,000 and Shares issued and outstanding: 9,912,971 and

9,701,750 as of September 30, 2011 and December 31, 2010,

respectively;

31,364 28,152 Total liabilities and shareholders'

equity $ 52,841 $ 41,348

PERION NETWORK LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

U.S. dollars in thousands, unaudited

Nine months ended September 30,

2011 2010

Cash flows from

operating activities:

Net income $ 5,476 $ 6,573 Adjustments required to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 683 587 Stock based compensation expense 915 574

Amortization of premium and accrued interest on marketable

securities 37 52 Loss (gain) from marketable securities, net 48

(140 ) Deferred taxes, net 163 (655 ) Accrued severance pay, net 22

(16 ) Net changes in operating assets and liabilities: Trade

receivables (2,698 ) (179 ) Other receivables and prepaid expenses

980 1,513 Other long-term assets 293 18 Trade payables (809 ) (83 )

Deferred revenues 97 (471 ) Accrued expenses and other liabilities

144 (511 ) Net cash provided by operating

activities 5,351 7,262

Cash flows from

investing activities:

Purchase of property and equipment (193 ) (176 ) Long term

restricted deposit 100 - Capitalization of software development and

content costs (1,020 ) (159 ) Acquisition of subsidiary, net of

acquired cash (21,708 ) - Proceeds from sales of marketable

securities 26,703 7,995 Investment in marketable securities

(11,915 ) (18,384 ) Net cash used in investing activities

(8,033 ) (10,724 )

Cash flows from

financing activities:

Exercise of share options 29 375 Dividend paid (3,885 )

(4,130 ) Net cash used in financing activities (3,856

) (3,755 ) Decrease in cash and cash equivalents (6,538 )

(7,217 ) Cash and cash equivalents at beginning of period

16,055 24,368 Cash and cash equivalents at end

of period $ 9,517 $ 17,151

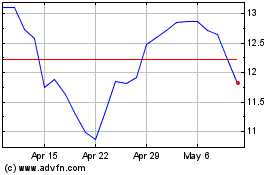

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

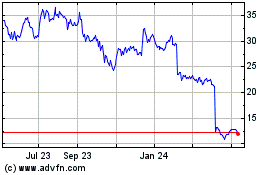

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024