false

0001056943

0001056943

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: November 7, 2024

(Date of earliest event reported)

PEOPLES FINANCIAL SERVICES CORP.

(Exact name of registrant as specified in its Charter)

| PA |

|

001-36388 |

|

23-2391852 |

| (State or other jurisdiction |

|

(Commission file number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

150 North Washington Avenue, Scranton, Pennsylvania 18503-1848

(Address of Principal Executive Offices) (Zip Code)

(570) 346-7741

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $2.00 par value |

|

PFIS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

The

management of Peoples Financial Services Corp. (the “Company”) anticipates meetings with investors during 2024. A copy of

presentation materials will be made available on the investor relations section of the Company's website (https://ir.psbt.com/investor-resources/presentations/default.aspx)

and is furnished as exhibit 99.1 to this report. All information included in this presentation is presented as of the dates indicated,

and the Company does not assume any obligation to correct or update such information in the future. The Company disclaims any inferences

regarding the materiality of such information which otherwise may arise as a result of it furnishing such information under Item 7.01

of this Form 8-K.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

The following exhibits are filed with this form

8-K:

| Exhibit

No. |

|

Description |

| 99.1 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| | PEOPLES FINANCIAL SERVICES CORP. |

| | |

| | By: |

/s/ John R. Anderson, III |

| | |

John R. Anderson, III |

| | |

Executive Vice President and Chief

Financial Officer |

| | |

(Principal Financial Officer and Principal

Accounting Officer) |

| | |

| Dated: November 7, 2024 | |

Exhibit 99.1

Nasdaq: PFIS INVESTOR PRESENTATION 2024 Third Quarter Earnings psbt.com

Nasdaq: PFIS 2 CAUTIONARY NOTE ABOUT FORWARD - LOOKING STATEMENTS: We make statements in this presentation, and we may from time to time make other statements regarding our outlook or expectat ion s for future financial or operating results and/or other matters regarding or affecting Peoples Financial Services Corp., Peoples Security Ba nk and Trust Company, and its subsidiaries (collectively, “Peoples”) and other statements that are not historical fact that are considered “forward - lo oking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as ame nded. Such forward - looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “est ima ted,” “intend” and “potential.” For these statements, Peoples claims the protection of the statutory safe harbors for forward - looking statements. Peoples cautions you that undue reliance should not be placed on forward - looking statements and that a number of important facto rs could cause actual results to differ materially from those currently anticipated in any forward - looking statement. Such factors include, but are not limited to: macroeconomic trends, including interest rates and inflation; the effects of any recession in the United States; the impact o n f inancial markets from geopolitical conflicts such as the military conflict between Russia and Ukraine and the conflict in Israel; risks associated wit h business combinations, including the possibility that the parties may be unable to achieve expected synergies and operating efficiencies of the merg er with FNCB Bancorp, Inc. (“ FNCB ”) within the expected timeframes or at all; the possibility that we may be unable to successfully integrate operations of FNCB or that the integration may be more difficult, time consuming or costly than expected; the FNCB merger may divert management’s attention from ongoing business operations and opportunities; effects of the FNCB merger on our ability to retain customers, to retain and hire key personnel and to maintain relationships with our vendors, and on our operating results and business generally; the outcome of any legal proceedings tha t m ay be threatened or instituted against Peoples; changes in interest rates; economic conditions, particularly in our market area; legislative and reg ulatory changes and the ability to comply with the significant laws and regulations governing the banking and financial services business; monetary a nd fiscal policies of the U.S. government, including policies of the U.S. Department of Treasury and the Federal Reserve System; adverse developments in the fi nancial industry generally, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs , a nd related impacts on customer and client behavior; credit risk associated with lending activities and changes in the quality and composition of ou r loan and investment portfolios; demand for loan and other products; deposit flows; competition; changes in the values of real estate and other co lla teral securing the loan portfolio, particularly in our market area; changes in relevant accounting principles and guidelines; inability of third part y s ervice providers to perform; our ability to prevent, detect and respond to cyberattacks; and other factors that may be described in our Annual Reports on For m 10 - K and Quarterly Reports on Form 10 - Q as filed with the Securities and Exchange Commission from time to time. These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance should not be pla ced on such statements The forward - looking statements are made as of the date of this presentation, and, except as may be required by applic able law or regulation, Peoples assumes no obligation to update the forward - looking statements or to update the reasons why actual results c ould differ from those projected in the forward - looking statements. USE OF NON - GAAP FINANCIAL MEASURES: In addition to evaluating our results of operations in accordance with accounting principles generally accepted in the United St ates of America (“GAAP”), we routinely supplement our evaluation with an analysis of certain non - GAAP financial measures, such as tangible stock holders’ equity and tangible assets and core net income ratios. We believe the reported non - GAAP financial measures provide information useful to in vestors in understanding our operating performance and trends. Where non - GAAP disclosures are used in this presentation, a reconciliation t o the comparable GAAP measure is provided herein or in the quarterly earnings press releases, filed as current reports on Form 8 - K with the SEC, and available on our website, www.psbt.com, under “Investor Relations.” The non - GAAP financial measures we use may differ from the non - GAAP financia l measures of other financial institutions.

Nasdaq: PFIS I. Corporate Profile II. Investor Thesis A. Transformational Strategic Transaction B. Consistently Strong Performance Even During the Great Recession C. Strong Core Deposit Franchise D. Strong Credit Quality E. High Dividend Payer III. Appendix A. Financials B. Asset Quality PRESENTATION AGENDA 3

Nasdaq: PFIS Peoples Financial Services Corp. Corporate Profile as of September 30, 2024 • Banking Subsidiary Founded in 1905 • Total Assets: $5.36 billion • Total Deposits: $4.64 billion • Total Loans: $4.07 billion • Listed on NASDAQ under ticker: PFIS • Shares Outstanding: 9,994,648 • Market Cap: $469 million • Average Daily Trading Volume: 18,315 • Market Price: $46.88 • Price to TBV: 1.29x • Price to LTM Core EPS: 13.8x • Annual Dividend & Yield: $2.47/5.27% 4

Nasdaq: PFIS 5 Corporate Profile Management Craig W. Best CEO & Director Gerard A. Champi President John R. Anderson III EVP & CFO Neal D. Koplin Sr. EVP, Chief Banking Officer Mr . Best has served as the CEO of the Bank since its 2013 merger with Penseco Financial Services Corporation where he served as President and CEO . Prior to joining Penseco , Mr . Best served as the COO of First Commonwealth Bank from 2000 to 2005 . Mr. Koplin has served as a Senior EVP and Chief Banking Officer at the Bank since 2019 and has served in various executive positions at the Bank and predecessor organizations since 1982. Mr. Champi has served as President of the Bank since July 1, 2024. Prior to that, he served as President and Chief Executive Officer and a member of the Board of Directors of FNCB Bancorp, Inc. and the FNCB Bank since July 1, 2016. Mr. Champi has worked in the banking industry for over forty years. Mr. Anderson has served as EVP and CFO of the Bank since 2018, after serving as the Senior Vice President and Interim Principal Financial and Accounting Officer since April 2016. He has worked in banking in Pennsylvania for 34 years. Thomas P. Tulaney Sr. EVP, Chief Operating Officer Mr . Tulaney serves as Senior EVP and Chief Operating Officer since July 1 , 2024 . Prior to that, he served as the President and COO of the Bank since 2020 and has served as the COO since 2017 . Prior to that, he served as the Chief Lending Officer of the Bank, the same position he held at Penseco . He has worked in banking in Pennsylvania for 41 years . James M. Bone, Jr. EVP & Chief Operations Officer Mr . Bone has served as EVP and Chief Operations Officer of the Bank since July 1 , 2024 . Prior to that, he served as Executive Vice President and Chief Financial Officer/Treasurer of FNCB and the Bank, a position he held since September 2012 . Mr . Bone is a licensed Certified Public Accountant a nd has worked in banking for 38 years .

Nasdaq: PFIS 6 Corporate Profile Management Jeffrey A. Drobins EVP, Chief Lending Officer Amy E. Vieney SVP, Chief Human Resources Officer Mr . Drobins has served as EVP, Chief Lending Officer of the Bank since 2022 . Prior to that, he served as the Lehigh Valley Market President of the Bank . Mr . Drobins has worked in Banking in Pennsylvania for 18 years . Ms . Vieney has served as the SVP, Chief Human Resources Officer of the Bank since 2022 . Prior to joining the Bank, Ms . Vieney served in various Human Resources leadership positions in the health care industry throughout 25 years . Susan L. Hubble EVP, CIO Ms . Hubble has served as EVP and Chief Information Officer of the Bank since 2019 . She has worked in banking in Pennsylvania for 25 years . Timothy H. Kirtley EVP, CRO & Secretary Mr . Kirtley has served as an EVP and the CRO of the Bank since 2020 , prior to which he served as the CCO since joining the bank in 2016 . Prior to joining the Bank, he was a CCO for 7 years at two Ohio - based community banks . Mary Griffin Cummings, Esq. EVP, General Counsel Ms . Cummings has served as an EVP and General Counsel of the Bank since July 1 , 2024 . Prior to that she served as EVP and General Counsel of FNCB Bank, a position she held since 2012 . Ms . Cummings is a licensed attorney and admitted to practice law in the Courts of the Commonwealth of Pennsylvania and the United States District Court for the Middle District of Pennsylvania .

Nasdaq: PFIS • 39 Community branch offices located in twelve counties in Pennsylvania, one county in New Jersey and one county in New York • Corporate headquarters in Scranton, Lackawanna County, Pennsylvania • 7 th Largest bank headquartered in Pennsylvania • Expanded into larger and faster growing markets Corporate Profile Market Area Branch location Legacy market 7 Source: Company Documents, S&P Global Market Intelligence. Includes banks with under $20 billion in total assets and financia l d ata as of September 30, 2024. Expansion market

Nasdaq: PFIS Actual Close July 1, 2024 Updated as of March 31, 2024 & June 30, 2024 Close $ in millions $(69.1) $(52.6) Loans Fair value marks (4.2) --- Securities (AFS and HTM) (2.4) (1.5) Time deposits (3.1) (2.5) Borrowings/Trust Preferred (14.3) (10.2) Reserve on non - PCD loans CECL Reserves 36.6 34.6 Core deposits Intangible assets 1.0 - Wealth management 13.6 13.0 Goodwill • Increase in the loan fair value mark resulted from higher Non - PCD balances due to re - codification of FNCB’s risk ratings coupled with higher discount rates on the interest rate and general credit fair value. • Increase in core deposit intangibles ("CDI") was primarily due to higher alternative cost of funds at close • Liquidated $241 million of FNCB investments at close and used proceeds to pay off FNCB’s Short - Term Overnight Borrowings Purchase accounting adjustments 8

Nasdaq: PFIS 9 Projected Actuals Total Thereafter 2029 2028 2027 2026 2025 4Q24 3Q24 $ thousands 66,160 13,005 3,772 5,339 8,448 11,485 15,055 4,342 4,654 Accretion of loan marks 2,405 0 4 43 134 199 697 494 834 Accretion of CD mark 3,168 1,641 154 150 170 199 484 191 179 Borrowing 60,587 11,364 3,614 5,146 8,144 11,087 13,874 3,657 3,641 Net NII Impact 36,630 8,325 3,663 4,329 4,995 5,661 6,327 1,665 1,665 Amortization of CDI 990 225 99 117 135 153 171 45 45 Amort. of wealth intangibles 22,967 2,814 (148) 700 3,014 5,273 7,376 1,947 1,931 Total pre - tax income impact Estimated accretion schedule of loan discounts based on loan amortization method (spread over loan amortization period including prepayment assumption.) Purchase accounting projections

Nasdaq: PFIS Merger Financials Comments Actual Results Updated as of March 31, 2024 & June 30, 2024 Close Metric Total merger consideration based on $45.54 PFIS closing price on June 28, 2024 versus $48.40 at December 31, 2023 $133.7 million $142.5 million Deal Value Consideration Each FNCB share exchanged for 0.146 shares of PFIS 2.93 million 2.96 million Shares Issued One - time merger charges totaled $12.7 million with an additional $3.4 million paid by FNCB prior to close $19.5 million One - time Charges Earnings 30% Annual Cost Savings EPS accretion supported by fair mark accretion that exceeds original estimates Tangible book value per share supported by greater than anticipated 52.7% 28.7% EPS Accretion (GAAP) EPS Accretion (Exclude PA) Tangible common equity supported by the above benefits of higher accretion and lower assets due to sale of a portion of FNCB investment portfolio and payoff of overnight borrowings $36.24 $35.67 TBVPS Capital 6.90% 6.47% TCE / TA 10

Nasdaq: PFIS 11 Third Quarter 2024 Results ($ in thousands except per share data) 3Q 2024 2Q 2024 3Q2023 Net Interest Income 39,244$ 18,916$ 21,277$ Provision for (credit to) credit losses 14,458$ 596$ (166)$ Net Income (4,337)$ 3,282$ 6,746$ Earnings per average diluted common share (0.43)$ 0.46$ 0.95$ Core net income¹ 16,489$ 4,231$ 7,471$ Core earnings per average diluted common share¹ 1.64$ 0.59$ 1.05$ Pre-tax pre-provision net revenue (PPNR)¹ 8,679$ 4,102$ 7,903$ Adjusted PPNR¹ 18,332$ 5,173$ 8,772$ Return on average assets (ROAA) -0.33% 0.37% 0.72% Core ROAA¹ 1.24% 0.47% 0.79% PPNR ROAA¹ 0.65% 0.46% 0.84% Adjusted PPNR ROAA¹ 1.38% 0.58% 0.93% Average Assets 5,291,194$ 3,609,066$ 3,730,043$ Net interest margin 3.26% 2.29% 2.44% Allowance for credit losses coverage ratio 0.97% 0.81% 0.80% Non-interest expense (NIE) / Average assets 2.67% 2.02% 1.81% Adjusted NIE / Average assets² 1.82% 1.90% 1.72% Common equity tier 1 (Bank) 10.68% 13.09% 13.13% Tangible common equity per share¹ 36.24$ 39.31$ 37.07$ Average Noninterest-bearing deposits as % of average deposits 15.8% 19.9% 21.0% ¹ Non-GAAP measure. See reconciliation. ² Excludes acquisition related expenses and amortization of intangibles.

Nasdaq: PFIS Income Statement Comparison Financials For the Nine Months Ended September 30, 2024 Financial Results 12 9/30/2024 9/30/2023 ($) (%) (1) Net interest income 77,478$ 66,485$ 10,993$ 16.5% (2) Provision for (credit to) credit losses 15,762 (1,103) 16,865 -1529.0% (3) Net interest income after provision 61,716 67,588 (5,872) -8.7% (4) Noninterest income: (5) Other noninterest income 9,437 7,538 1,899 25.2% (6) Interest rate swap revenue 25 512 (487) -95.1% (7) Wealth management income¹ 3,203 2,868 335 11.7% (8) Total noninterest income 12,665 10,918 1,747 16.0% (9) Total Revenue 90,143 77,403 12,740 16.5% (10) Noninterest expense: (11) Salaries and employee benefits expense 30,459 26,346 4,113 15.6% (12) Net occupancy and equipment 15,745 12,678 3,067 24.2% (13) Acquisition related expenses 11,210 990 10,220 1032.3% (14) Other expenses 14,314 10,208 4,106 40.2% (15) Total Noninterest expense 71,728 50,222 21,506 42.8% (16) Pre-tax Net Income 2,653 28,284 (25,631) -90.6% (17) Provision for income tax expense 242 4,534 (4,292) -94.7% (18) Net income - Reported 2,411$ 23,750$ (21,339)$ -89.8% (19) Reported EPS - basic 0.30$ 3.33$ (20) Reported EPS - diluted 0.30$ 3.31$ (21) Net Income - Operating 25,619$ 24,517$ (22) Operating EPS - basic 3.19$ 3.44$ (23) Operating EPS - diluted 3.17$ 3.42$ ¹Includes commissions and fees on fiduciary activities. VARIANCE Actual '24A v. '23A » Net Interest Margin 2.69% vs. 2.62% » $3.7MM of net benefit from accretion of loan marks partially offset by deposit and borrowing marks » Provision for Non - PCD loans (CECL Double Count) acquired in FNCB merger $14.3MM » Market value gain on equities » Decreased swap volume » Addition of 195 FTEs from merger » Initial addition of 16 offices; IT upgrades & facility costs » Amortization of intangibles $1.7MM

Nasdaq: PFIS PFIS Source: Earnings Release, 10K Peer Source: S&P Global Mid - Atlantic: DE, NJ, NY, MD, PA banks $5 - 10 Billion in Assets * Merger of PFIS and PFNS Consistent High Performance Even During the Great Recession 0.00% 0.50% 1.00% 1.50% 2006 2007 2008 2009 2010 2011 2012 2013* 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD 09 24 YTD 09 24 Return on Average Assets PFIS PEER 0.00% 2.00% 4.00% 2006 2007 2008 2009 2010 2011 2012 2013* 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD 09 24 Non - Performing Loans to Total Loans PFIS PEER Peoples has delivered consistent results over multiple business cycles while maintaining credit discipline and a steadily - increasing dividend $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2006 2007 2008 2009 2010 2011 2012 2013* 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD 09 24 Annual Dividend 13 Year - to - Date Annualized * *Core Return on Average Assets

Nasdaq: PFIS Financials $926 $918 $1,688 $1,742 $1,819 $1,999 $2,169 $2,289 $2,475 $2,884 $3,369 $3,554 $3,742 $5,360 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 Total Assets ($ Millions) Assets $632 $624 $1,177 $1,210 $1,341 $1,533 $1,693 $1,823 $1,938 $2,178 $2,329 $2,730 $2,850 $4,070 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 Loans Loans $721 $722 $1,380 $1,426 $1,456 $1,589 $1,719 $1,875 $1,971 $2,437 $2,963 $3,047 $3,279 $4,638 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 Deposits Deposits $32,319 $32,229 $33,201 $57,314 $57,004 $61,733 $65,544 $71,339 $75,513 $79,801 $84,635 $95,749 $86,754 $116,720 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 Net - Interest Income Before Provision (Annualized) 14

Nasdaq: PFIS $17,649 $17,723 $19,583 $18,457 $24,920 $25,736 $29,354 $43,519 $33,917 $38,090 $27,380 $17,411 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 2014 2015 2016 2017* 2018 2019 2020 2021 2021 2022 2023 09 30 24 Net Income (Reported) Reported Net Income EPS (diluted) * Tax Cuts and Jobs Act of 2017 impact of $.35 per share **Reported Net Income with VISA Sale Financials 16.61% 14.80% 10.30% 16.71% 1.57% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 09 30 24 Return on Average Tangible Common Equity PFIS PEER PFIS Source: Earnings Release, 10K Peer Source: S&P Global Mid - Atlantic: DE, NJ, NY, MD, PA banks $5 - 10 Billion in Assets 55.32% 55.90% 64.15% 64.21% 40% 50% 60% 70% 80% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 Operating Efficiency PFIS PEER 15 ** *** ***Reported Net Income without VISA Sale * *Core Return on Average Tangible Common Equity

Nasdaq: PFIS Sources of Liquidity at September 30, 2024 16 Financials Total Available At September 30, 2024 Total Available Outstanding for Future Liquidity FHLB advances 1,446,345$ 477,617$ 968,728$ Federal Reserve - Discount Window & Bank Term Funding Program 569,771 25,000 544,771 Correspondent bank lines of credit 18,000 18,000 Other sources of liquidity: Brokered deposits 804,021 391,560 412,461 Unencumbered securities 298,519 298,519 Total sources of contingent liquidity 3,136,656$ 894,177$ 2,242,479$ Cash and cash equivalents at September 30, 2024 285,469 Total cash and cash equivalents and contingent liquidity 2,527,948 Percentage of Total Assets 47.2% Percentage of Total Deposits 54.5%

Nasdaq: PFIS Peoples Security Bank Capital 17 11.64% 13.74% 13.76% 12.27% 13.01% 10.68% 6.50% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2019 Y 2020 Y 2021 Y 2022 Y 2023 Y 09 30 24 Common Equity Tier 1 Capital to Risk Weighted Assets (%) Common Equity Tier 1 Capital to Risk Weighted Assets (%) Well-Capitalized 11.64% 13.74% 13.76% 12.27% 13.01% 10.68% 8.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2019 Y 2020 Y 2021 Y 2022 Y 2023 Y 09 30 24 Tier 1 Capital to Risk - Weighted Assets (%) Tier 1 Capital to Risk-Weighted Assets (%) Well-Capitalized 12.78% 14.99% 15.01% 13.26% 13.82% 11.68% 10.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2019 Y 2020 Y 2021 Y 2022 Y 2023 Y 09 30 24 Total Capital to Risk - Weighted Assets (%) Total Capital Ratio Well-Capitalized 9.91% 10.08% 9.58% 9.69% 9.34% 8.23% 5.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2019 Y 2020 Y 2021 Y 2022 Y 2023 Y 09 30 24 Tier 1 Leverage Ratio (%) Tier 1 Leverage Ratio Well-Capitalized

Nasdaq: PFIS 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09 30 24 Net Charge - Offs (NCOs) to Average Loans PFIS PEER Asset Quality PFIS Source: Earnings Release, 10K Peer Source: S&P Global Mid - Atlantic: DE, NJ, NY, MD, PA banks $5 - 10 Billion in Assets 0.00% 0.40% 0.80% 1.20% 1.60% 2.00% 2.40% 2.80% 3.20% 3.60% 4.00% NPAs as a % of Loans & OREO PFIS PEER 18

Nasdaq: PFIS Pre - provision net revenue (PPNR) (non - GAAP reconciliation) 19 Sept 30 Jun 30 Mar 31 Dec 31 Sept 30 2024 2024 2024 2023 2023 Pre-provision net revenue to average assets: Income before taxes (GAAP) $ -4,994$ 3,703$ 3,944$ 4,217$ 8,081 Plus: Provision for (credit to) credit losses 14,458 596 708 1,669 -166 Plus: Provision for (credit to) credit losses on unfunded commitments -785 -197 487 -2 -12 Total pre-provision net revenue (non-GAAP) 8,679 4,102 5,139 5,884 7,903 Total (annualized) (non-GAAP) $ 34,527$ 16,498$ 20,669$ 23,344$ 31,354 Average assets $ 5,291,194$ 3,609,066$ 3,676,756$ 3,774,388$ 3,730,043 Pre-Provision Net Revenue to Average Assets (non-GAAP) 0.65% 0.46% 0.56% 0.62% 0.84% Sept 30 Jun 30 Mar 31 Dec 31 Sept 30 2024 2024 2024 2023 2023 Adjusted pre-provision net revenue to average assets: Income before taxes (GAAP) $ -4,994$ 3,703$ 3,944$ 4,217$ 8,081 Plus: Acquisition related expenses 9,653 1,071 486 826 869 Plus: Provision for (credit to) credit losses 14,458 596 708 1,669 -166 Plus: Provision for (credit to) credit losses on unfunded commitments -785 -197 487 -2 -12 Total adjusted pre-provision net revenue (non-GAAP) 18,332 5,173 5,625 6,710 8,772 Total (annualized) (non-GAAP) $ 72,929$ 20,806$ 22,624$ 26,621$ 34,802 Average assets $ 5,291,194$ 3,609,066$ 3,676,756$ 3,774,388$ 3,730,043 Pre-Provision Net Revenue to Average Assets (non-GAAP) 1.38% 0.58% 0.62% 0.71% 0.93% Sept 30 Jun 30 Mar 31 Dec 31 Sept 30 2024 2024 2024 2023 2023 Core net income pre-provision net revenue per share: Income before taxes (GAAP) $ -4,994$ 3,703$ 3,944$ 4,217$ 8,081 Plus: Acquisition related expenses 9,653 1,071 486 826 869 Plus: Provision for (credit to) credit losses 14,458 596 708 1,669 -166 Plus: Provision for (credit to) credit losses on unfunded commitments -785 -197 487 -2 -12 Total adjusted pre-provision net revenue (non-GAAP) $ 18,332$ 5,173$ 5,625$ 6,710$ 8,772 Average common shares outstanding - diluted 10,044,449 7,114,115 7,102,112 7,091,015 7,120,685 Core net income (PPNR) per share (non-GAAP) $ 1.83$ 0.73$ 0.79$ 0.95$ 1.23

Nasdaq: PFIS Non - GAAP Reconciliation 20 Sept 30 Jun 30 Mar 31 Dec 31 Sept 30 2024 2024 2024 2023 2023 Core net income per share: Net income GAAP $ -4,337$ 3,282$ 3,466$ 3,630$ 6,746 Adjustments: Add: ACL provision for FNCB acquired legacy loans 14,328 Less: ACL provision for FNCB acquired legacy loans tax adjustment 1,885 Add: Acquisition related expenses 9,653 1,071 486 826 869 Less: Acquisition related expenses tax adjustment 1,270 122 59 115 144 Core net income $ 16,489$ 4,231$ 3,893$ 4,341$ 7,471 Average common shares outstanding - diluted 10,044,449 7,114,115 7,102,112 7,091,015 7,120,685 Core net income per share $ 1.64$ 0.59$ 0.55$ 0.61$ 1.05 Sept 30 Jun 30 Mar 31 Dec 31 Sept 30 2024 2024 2024 2023 2023 Tangible common equity per share: Total stockholders’ equity $ 475,051$ 340,807$ 339,992$ 340,422$ 324,390 Less: Goodwill 76,958 63,370 63,370 63,370 63,370 Less: Other intangible assets, net 35,907 19 Total tangible stockholders’ equity $ 362,186$ 277,437$ 276,622$ 277,052$ 261,001 Common shares outstanding 9,994,648 7,057,258 7,057,258 7,040,852 7,040,852 Tangible book value per share $ 36.24$ 39.31$ 39.20$ 39.35$ 37.07 Sept 30 Jun 30 Mar 31 Dec 31 Sept 30 2024 2024 2024 2023 2023 Core return on average assets: Net (loss) income GAAP $ -4,337$ 3,282$ 3,466$ 3,630$ 6,746 Adjustments: Add: ACL provision for FNCB acquired legacy loans 14,328 Less: ACL provision for FNCB acquired legacy loans tax adjustment 1,885 Add: Acquisition related expenses 9,653 1,071 486 826 869 Less: Acquisition related expenses tax adjustment 1,270 122 59 115 144 Core net income $ 16,489 4,231 3,893 4,341 7,471 Average assets 5,291,194 3,609,066 3,676,750 3,774,388 3,730,043 Core return on average assets 1.24% 0.47% 0.43% 0.46% 0.79%

Nasdaq: PFIS Non - Owner Occupied CRE Loans (June 30, 2024 – PFIS only) CRE Loans (June 30, 2024 – PFIS only) Classified Balance # of Loans Avg Int Rate % of Total Loans Balance ($millions) Classified Balance # of Loans Avg Int Rate % of Total Loans Balance ($millions) Category 233 5.0% 14.7% $422.0 233 5.0% 14.7% $422.0 Multifamily 1.0 104 5.2% 5.7% 164.2 3.0 221 5.5% 7.7% 221.4 Office 117 5.4% 4.9% 139.4 176 5.4% 7.0% 200.4 Industrial / Warehouse 49 4.9% 4.6% 131.9 0.5 187 5.8% 6.2% 177.8 Retail - Unanchored 1.1 51 5.3% 2.5% 73.0 1.1 52 4.9% 4.8% 139.0 Retail - Anchored 22 5.9% 2.2% 62.7 1.3 39 4.5% 2.3% 66.4 Medical Office Building 18 4.4% 1.7% 48.2 29 6.0% 2.3% 64.9 Healthcare 19 5.2% 1.3% 36.8 0.7 149 6.1% 2.2% 62.8 Other 10 5.2% 0.9% 24.6 58 4.8% 2.0% 58.1 Gas Station / Convenience Store 19 5.7% 0.8% 23.8 21 5.1% 1.3% 37.2 Hospitality 4 6.3% 0.6% 16.9 2.7 22 3.9% 1.3% 37.1 School 21 6.4% 0.6% 16.5 65 6.0% 1.1% 31.9 Restaurant / Bar 29 7.6% 0.6% 16.5 11 5.2% 0.9% 24.6 Self Storage 23 7.7% 0.6% 16.5 37 5.4% 0.7% 20.2 Recreational 1.3 39 7.5% 0.5% 14.6 1.3 32 7.4% 0.6% 17.3 Land Acq & Dev - Commercial 23 6.6% 0.4% 10.5 4 6.3% 0.6% 16.9 Student Housing 34 5.9% 0.3% 9.6 23 7.7% 0.6% 16.5 Land Acq & Dev - Residential 17 7.9% 0.3% 8.2 39 7.5% 0.5% 14.6 Land - Unimproved 5 6.1% 0.2% 6.2 23 6.6% 0.4% 10.5 Farmland 5 3.9% 0.2% 5.5 0.2 22 7.9% 0.3% 8.7 1 - 4 Family Residential 3 6.1% 0.0% 0.5 0.1 11 7.2% 0.3% 8.5 Dealership 1 9.5% 0.0% 0.1 5 6.1% 0.2% 6.2 Mobile Home Park 1 4.3% 0.0% 0.1 4 5.5% 0.2% 5.3 Parking Lot 43.5% $1,248.3 58.1% $1,668.4 Total Balances Commercial Real Estate Loans as of June 30, 2024 21

Nasdaq: PFIS 22 Loan Portfolio Maturity / Re - Pricing* As of June 30, 2024 $34 $25 $117 $142 $251 $209 $106 $39 $529 $160 $23 $86 $126 $238 $115 $103 $16 $131 $- $100 $200 $300 $400 $500 $600 $700 3Q24 4Q24 2025 2026 2027 2028 2029 2030 >2030 Loan Balance (in Millions) Fixed Adjustable $194 $203 $48 $268 $489 $209 $324 $55 $660 *Variable Rate Loans = $423

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

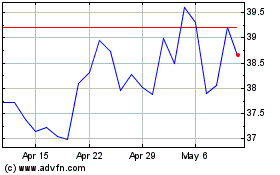

Peoples Financial Services (NASDAQ:PFIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Peoples Financial Services (NASDAQ:PFIS)

Historical Stock Chart

From Nov 2023 to Nov 2024