| 22

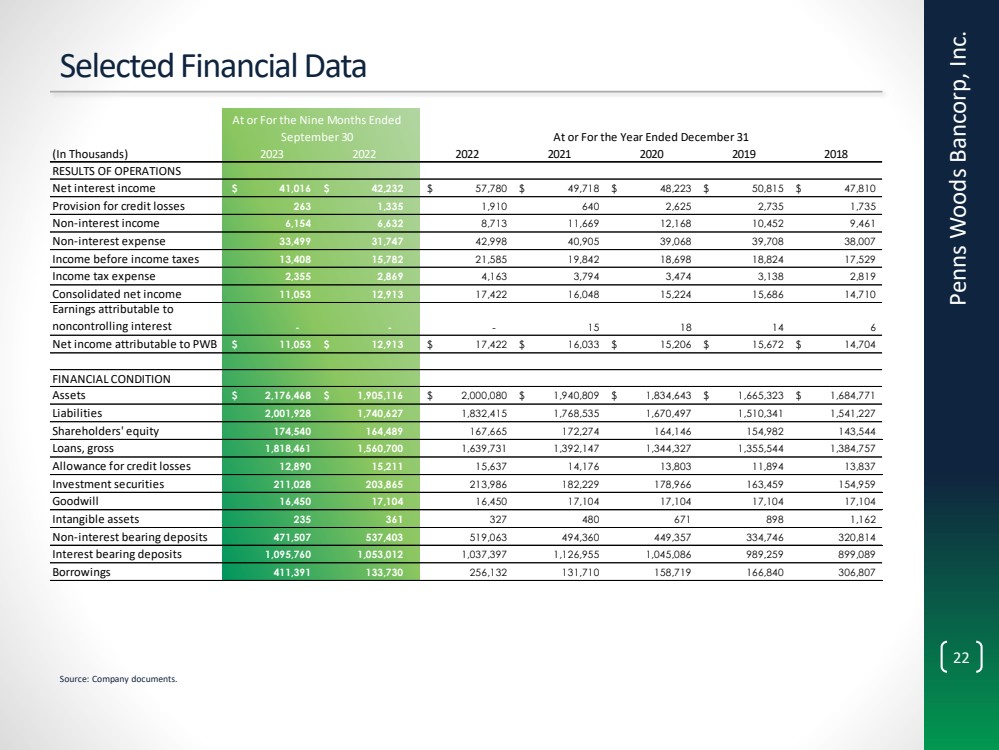

Selected Financial Data

Penns Woods Bancorp, Inc.

Source: Company documents.

(In Thousands) 2023 2022 2022 2021 2020 2019 2018

RESULTS OF OPERATIONS

Net interest income $ 41,016 $ 42,232 $ 57,780 $ 49,718 $ 48,223 $ 50,815 $ 47,810

Provision for credit losses 263 1,335 1,910 640 2,625 2,735 1,735

Non-interest income 6,154 6,632 8,713 11,669 12,168 10,452 9,461

Non-interest expense 33,499 31,747 42,998 40,905 39,068 39,708 38,007

Income before income taxes 13,408 15,782 21,585 19,842 18,698 18,824 17,529

Income tax expense 2,355 2,869 4,163 3,794 3,474 3,138 2,819

Consolidated net income 11,053 12,913 17,422 16,048 15,224 15,686 14,710

Earnings attributable to

noncontrolling interest - - - 1 5 1 8 1 4 6

Net income attributable to PWB $ 11,053 $ 12,913 $ 17,422 $ 16,033 $ 15,206 $ 15,672 $ 14,704

FINANCIAL CONDITION

Assets $ 2,176,468 $ 1,905,116 $ 2,000,080 $ 1,940,809 $ 1,834,643 $ 1,665,323 $ 1,684,771

Liabilities 2,001,928 1,740,627 1,832,415 1,768,535 1,670,497 1,510,341 1,541,227

Shareholders' equity 174,540 164,489 167,665 172,274 164,146 154,982 143,544

Loans, gross 1,818,461 1,560,700 1,639,731 1,392,147 1,344,327 1,355,544 1,384,757

Allowance for credit losses 12,890 15,211 15,637 14,176 13,803 11,894 13,837

Investment securities 211,028 203,865 213,986 182,229 178,966 163,459 154,959

Goodwill 16,450 17,104 16,450 17,104 17,104 17,104 17,104

Intangible assets 235 361 327 480 671 898 1,162

Non-interest bearing deposits 471,507 537,403 519,063 494,360 449,357 334,746 320,814

Interest bearing deposits 1,095,760 1,053,012 1,037,397 1,126,955 1,045,086 989,259 899,089

Borrowings 411,391 133,730 256,132 131,710 158,719 166,840 306,807

At or For the Nine Months Ended

September 30 At or For the Year Ended December 31 |