|

Registration

|

Valid signature

|

|

Corporate Accounts

|

|

|

(1)

ABC Corp

|

ABC Corp.

|

|

|

John Doe, Treasurer

|

|

(2)

ABC Corp

|

John Doe, Treasurer

|

|

(3)

ABC Corp. c/o John Doe, Treasurer

|

John Doe

|

|

(4)

ABC Corp. Profit Sharing Plan

|

John Doe, Trustee

|

|

Partnership Accounts

|

|

|

(1)

The XYZ Partnership

|

Jane B. Smith, Partner

|

|

(2)

Smith and Jones, Limited Partnership

|

Jane B. Smith, General Partner

|

|

Trust Accounts

|

|

|

(1)

ABC Trust Account

|

Jane B. Doe, Trustee

|

|

(2)

Jane B. Doe, Trustee u/t/d 12/18/98

|

Jane B. Doe

|

|

Custodial or Estate Accounts

|

|

|

(1)

John B. Smith, Cust. f/b/o

|

|

|

John B. Smith Jr. UGMA/UTMA

|

John B. Smith

|

|

(2)

Estate of John B. Smith

|

John B. Smith, Jr., Executor

|

Series S

One North Wacker Drive

Chicago, Illinois 60606

_________________________________

PROXY STATEMENT

Special Meeting of Shareholders to be held on [April 10], 2013

_________________________________

This proxy statement (the “Proxy Statement”) is being furnished to holders of shares of beneficial interest (“Shareholders”) of the above-listed investment portfolio (the “Fund”) of SMA Relationship Trust (the “Trust”) in connection with the solicitation by the Board of Trustees of the Trust (the “Board” or the “Trustees”) of proxies to be used at a special meeting of Shareholders to be held at [12:00] p.m. (Central time) on [April 10], 2013, at the Trust’s principal executive offices at One North Wacker Drive, Chicago, Illinois 60606, or at any postponement, adjournment or adjournments thereof (the “Meeting”). This Proxy Statement will first be mailed to Shareholders on or about [_____ ], 2013.

The Trust is an open-end investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”), and is organized as a Delaware statutory trust. The Trust consists of five (5) investment portfolios, one (1) of which, the Fund, is included in this Proxy Statement. The Meeting is being held to consider and vote on the adoption of a “manager of managers” investment advisory structure for the Fund; to consider and vote on the approval of an amended Investment Advisory Agreement (the “Amended Investment Advisory Agreement”) for the Fund to add provisions regarding the responsibilities of UBS Global Asset Management (Americas) Inc. (“UBS Global AM” or the “Advisor”) for subadvisors in a manager-of-managers investment advisory structure as the Fund’s primary investment advisor; and to transact such other business as may properly come before the Meeting or any adjournment thereof (e.g., adjourning the Meeting).

|

Table of Contents

|

|

|

Voting Information

Quorum

Required Vote for Adoption of the Proposals

Adjournment

Abstentions and Method of Tabulation

Revocation of Proxy

Reports to Shareholders and Financial Statements

Proposal 1. Adoption of “Manager of Managers” Structure

Proposal 2. Amended Investment Advisory Agreement on Behalf of the Fund

Additional Information About Voting and the Meeting

Solicitation of Proxies

Beneficial Ownership of Shares

Shareholder Proposals and Communications

Additional Information About the Fund

Investment Advisor and Administrator

Underwriter

Transfer Agent

Custodian

Other Business

Exhibit Index

|

|

Voting Information

Shareholders of record at the close of business on February 5, 2013 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. Each whole share outstanding is entitled to one vote and each fractional share outstanding is entitled to a proportionate fractional vote. The number of shares of the Fund that were issued and outstanding as of the Record Date is ___________.

Quorum

The presence, in person or by proxy, of forty percent (40%) of the holders of shares entitled to vote on the Proposals on the Record Date constitutes a quorum for the transaction of business at the Meeting.

Required Vote for Adoption of the Proposals

Proposal 1 (adoption of a “manager of managers” investment advisory structure) and Proposal 2 (approval of an Amended Investment Advisory Agreement) each requires an affirmative vote of the lesser of: (A) 67% or more of the voting securities of the Fund present at such meeting, if the holders of more than 50% of the outstanding voting securities of such Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of such Fund, as required by the 1940 Act (a “1940 Act Majority Vote”).

Adjournment

The Meeting, whether or not a quorum is present, may be adjourned from time to time for any reason whatsoever by vote of the holders of shares entitled to vote holding not less than a majority of the shares present in person or by proxy at the meeting, or by the chairperson of the Board, the president of the Trust, in the absence of the chairperson of the Board, or any vice president or other authorized officer of the Trust, in the absence of the president. Any adjournment may be made with respect to any business that might have been transacted at such meeting and any adjournment will not delay or otherwise affect the effectiveness and validity of any business transacted at the Meeting prior to adjournment. The persons named as proxies will vote in their discretion on questions of adjournment those shares for which proxies have been received that grant discretionary authority to vote on matters that may properly come before the Meeting.

Method of Tabulation

The Fund’s shares are used exclusively for separately managed accounts advised or subadvised by the Fund’s investment advisor, UBS Global AM, or its affiliates.

The individuals named as proxies on the enclosed proxy card will vote in accordance with your direction as indicated thereon, if your proxy card is received properly executed by you or by your duly appointed agent or attorney-in-fact. You may also vote through the Internet or by telephone by following the instructions on the enclosed proxy card. We encourage you to vote over the Internet or by telephone, using the voting control number that appears on your proxy card. If you sign, date and return the proxy card without voting instructions, your shares will be voted FOR the Proposals and FOR any other business that may properly arise at the Meeting (e.g., adjourning the Meeting).

Abstentions and Voting by Broker Dealers

Any abstentions will be counted as shares present for purposes of determining whether a quorum is present but will not be voted for or against any adjournment or Proposal, although abstentions will have the effect of a vote against a Proposal.

The rules of the Securities and Exchange Commission (the “SEC”) require that the Trust disclose in this proxy statement the effect of "broker non-votes." Broker non-votes are proxies from brokers or nominees indicating that such persons have not received voting instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power. Any shares of the Fund held by a broker-dealer or financial intermediary may, in certain circumstances, be voted by such broker-dealer or financial intermediary at its discretion. Broker non-votes will be counted as shares present for purposes of determining whether a quorum is present but will not be voted for or against any adjournment or the Proposals. Therefore, broker non-votes may have the same effect as a vote “against” the Proposals.

Revocation of Proxy

Any person giving a proxy has the power to revoke it at any time prior to its exercise by executing a superseding proxy or by submitting a written notice of revocation to the Trust’s secretary (the “Secretary”). To be effective, such revocation must be received by the Secretary prior to the Meeting. In addition, although mere attendance at the Meeting would not revoke a proxy, a Shareholder present at the Meeting may withdraw his or her proxy by voting in person.

Reports to Shareholders and Financial Statements

Copies of the Trust’s most recent annual report, including financial statements for the Fund, have previously been mailed to Shareholders. Shareholders may request additional copies of the Trust’s annual report and the most recent semiannual report, without charge, by writing the Fund c/o the Fund’s investment advisor, UBS Global Asset Management (Americas) Inc. at 1285 Avenue of the Americas, New York, NY 10019 or by calling toll free 1-800-647 1568.

Proposal 1. Adoption of “Manager of Managers” Structure

Overview of the Manager of Managers Structure

The “manager of managers” structure (as defined below) is intended to enable the Fund to operate with greater efficiency by allowing UBS Global AM to employ subadvisors best suited to the needs of the Fund without incurring the expense and delays associated with obtaining shareholder approval of subadvisors or subadvisory agreements. Ordinarily, federal law requires shareholders of a mutual fund to approve a new subadvisory agreement before it may become effective. Specifically, Section 15 of the 1940 Act makes it unlawful for any person to act as an investment advisor (including as a subadvisor) to a mutual fund, except pursuant to a written contract that has been approved by shareholders. Section 15 also requires that an investment advisory agreement (including a subadvisory agreement) provide that it will terminate automatically upon its "assignment," which, under the 1940 Act, generally includes the transfer of an advisory agreement itself or the transfer of control of the investment advisor through the transfer of a controlling block of the investment advisor's outstanding voting securities.

To comply with Section 15 of the 1940 Act, a fund must obtain shareholder approval of a subadvisory agreement in order to employ one or more subadvisors, replace an existing subadvisor, materially change the terms of a subadvisory agreement, or continue the employment of an existing subadvisor when that subadvisor's subadvisory agreement terminates because of an "assignment."

Pursuant to the current investment advisory agreement between the Trust and UBS Global AM (the "Current Investment Advisory Agreement"), UBS Global AM, subject to the supervision of the Board and approval of shareholders, serves as the Fund's investment advisor. As such, UBS Global AM currently is responsible for, among other things, managing the assets of the Fund and making decisions with respect to purchases and sales of securities on behalf of the Fund. UBS Global AM is permitted under the Current Investment Advisory Agreement, at its own expense, to select and contract with one or more subadvisors to perform some or all of the services for the Fund for which UBS Global AM is responsible under such Agreement. If UBS Global AM delegates investment advisory duties to a subadvisor, UBS Global AM remains responsible for all advisory services furnished by the subadvisor. Before UBS Global AM may engage a subadvisor for the Fund, however, shareholders of the Fund must approve the agreement with such subadvisor.

The proposed "manager of managers" structure would permit UBS Global AM, as the Fund’s investment advisor, to appoint and replace subadvisors, enter into subadvisory agreements, and amend and terminate subadvisory agreements on behalf of the Fund without shareholder approval (the "Manager of Managers Structure"). The subadvisory fees paid to any subadvisor hired in connection with the Manager of Managers Structure will be paid by UBS Global AM, and not the Fund.

1

The proposed employment of the Manager of Managers Structure for the Fund is based upon reliance on an exemptive order granted by the SEC to UBS Global AM on October 23, 2012, which permits the use of a Manager of Managers Structure for a fund that UBS Global AM or its affiliates manage if certain conditions are met, including approval by the fund’s shareholders of the Manager of Managers Structure prior to the structure’s implementation.

1

The Fund currently is part of a wrap fee program or other program advised or subadvised by UBS Global AM or its affiliates,

clients of which often pay a single aggregate fee to the program sponsor for all costs and expenses of the program.

Adoption and use by the Fund of the Manager of Managers Structure would only enable UBS Global AM to hire, terminate and replace a subadvisor (or materially amend a subadvisory agreement) without Shareholder approval. The Manager of Managers Structure would not: (a) permit UBS Global AM to charge management fees (or subadvisory fees) to the Fund without shareholder approval; or (b) change UBS Global AM's responsibilities to the Fund, including UBS Global AM's responsibility for all advisory services furnished by a subadvisor (except its responsibilities with respect to subadvisors in the Manager of Managers Structure).

At meetings of the Board held on December 6-7, 2012 and January 22, 2013, the Board, including a majority of the those Trustees that are not “interested persons” (as that term is defined in the 1940 Act) (the “Independent Trustees”), authorized seeking Shareholder approval to adopt the use of the Manager of Managers Structure. As noted above, the Manager of Managers Structure is intended to enable the Fund to operate with greater efficiency and without incurring the expense and delays associated with obtaining shareholder approval of subadvisors or subadvisory agreements. The adoption of the Manager of Managers Structure will allow UBS Global AM and the Board to hire one or more subadvisors to manage all or a portion of the Fund's portfolio in the future in the event they believe that doing so would benefit the Fund.

The employment of the Manager of Managers Structure will: (1) enable the Board to act more quickly to appoint an initial or a new subadvisor when UBS Global AM and the Board believe that such appointment would be in the best interests of the Fund's Shareholders; and (2) permit UBS Global AM to allocate and reallocate the Fund's assets among itself and one or more subadvisors when UBS Global AM and the Board believe that it would be in the best interests of the Fund's Shareholders.

Based on the above, the Board is hereby soliciting Shareholder approval of the adoption of the Manager of Managers Structure with respect to the Fund.

Effects on Shareholder Right to Vote on Subadvisory Agreements

If the Proposal is approved, UBS Global AM in the future would be permitted to appoint and replace subadvisors for the Fund and to enter into and approve amendments to subadvisory agreements without first obtaining the approval of Shareholders. Although approval of subadvisory agreements would not be subject to Shareholder approval under the Manager of Managers Structure, the Board, including a majority of the Independent Trustees, must approve new or amended subadvisory agreements. In addition, UBS Global AM, as the primary investment advisor, will remain responsible for managing or overseeing management of the Fund.

If this Proposal is not approved by the Fund's Shareholders, then UBS Global AM would enter into new or materially amend subadvisory agreements only with shareholder approval, causing delay and expense in making a change deemed beneficial by the Board to the Fund and its Shareholders.

Conditions of the Order

In the form of an exemptive order granted on October 23, 2012, UBS Global AM received approval from the SEC to employ a Manager of Managers Structure with respect to the mutual funds for which UBS Global AM serves as investment advisor (the “Order”).

The Order grants a fund relief from Section 15(a) of the 1940 Act and certain rules under the 1940 Act so that the Trust and UBS Global AM may employ the Manager of Managers Structure with respect to the Fund, subject to certain conditions, including the approval of this Proposal by the Fund's Shareholders. Neither the Fund nor UBS Global AM will rely on the Order unless all such conditions have been met. If t

he SEC adopts a rule under the 1940 Act providing substantially similar relief to that in the Order, the Order will expire on the effective date of that rule, and the Fund will comply with the rule’s final requirements.

The conditions for relief that are required by the Order are as follows:

|

(i)

|

Shareholders of the Fund will approve the use of the Manager of Managers Structure before the Fund relies on the Order.

|

|

(ii)

|

Disclosure will be included in the Fund’s prospectus describing (a) the existence, substance and effect of the Order; (b) how the Fund operates under the Manager of Managers Structure; and (c) that UBS Global AM bears the ultimate responsibility (subject to the Board’s oversight) to oversee and recommend hiring, termination and replacement of subadvisor(s) for the Fund.

|

|

(iii)

|

The Trust will inform all shareholders of the Fund, within 90 days of hiring any new subadvisor, of the hiring by providing an Information Statement.

|

|

(iv)

|

UBS Global AM will not enter into a subadvisory agreement with any subadvisor that is an affiliated person (as defined in Section 2(a)(3) of the 1940 Act) (“Affiliated Subadvisor”) of UBS Global AM, or the Fund, other than by reason of serving as subadvisor to the Fund, without such agreement being approved by shareholders of the Fund.

|

|

(v)

|

At all times, at least a majority of the Trust’s Trustees will be Independent Trustees, and the nomination of new or additional Independent Trustees will be placed within the discretion of the Independent Trustees.

|

|

(vi)

|

Independent Legal Counsel (as defined in Rule 0-1(a)(6) under the 1940 Act) will continue to be engaged to represent the Independent Trustees, and the selection of such counsel will be within the discretion of the Independent Trustees.

|

|

(vii)

|

With respect to a proposal to change the Fund’s Affiliated Subadvisor, the Board, including a majority of the Independent Trustees, will make a separate finding, reflected in the Trust’s Board minutes, that the subadvisor change is in the best interests of the Fund and its Shareholders and does not involve a conflict of interest from which UBS Global AM or the Affiliated Subadvisor derives an inappropriate advantage.

|

|

(viii)

|

Whenever a subadvisor is hired or terminated, UBS Global AM will provide to the Board information showing the expected impact on the profitability of UBS Global AM.

|

|

(ix)

|

UBS Global AM will provide the Board, no less frequently than quarterly, with information about the profitability of UBS Global AM on the Fund, reflecting the impact on profitability of the hiring or termination of any subadvisor during the applicable quarter.

|

|

(x)

|

UBS Global AM will provide general management and administrative services to the Fund, and, subject to review and approval by the Board, will: (a) set the Fund’s overall investment strategies; (b) evaluate, select and recommend subadvisors to manage all or a portion of the Fund’s assets; (c) allocate and, when appropriate, reallocate the Fund’s assets among the subadvisors; (d) monitor and evaluate the investment performance of subadvisors; and (e) implement procedures reasonably designed to ensure that the subadvisors comply with the Fund’s investment objectives, policies and restrictions.

|

|

(xi)

|

No Trustee or officer of the Trust or director or officer of UBS Global AM will own, directly or indirectly, any interest in a subadvisor except for (a) ownership of interests in UBS Global AM or in any entity that controls, is controlled by, or is under common control with UBS Global AM; or (b) ownership of less than 1% of the outstanding securities of any class of equity or debt of a publicly traded company that is either a subadvisor or an entity that controls, is controlled by, or is under common control with a subadvisor.

|

|

(xii)

|

The Fund will disclose in its registration statement (i) the aggregate fees paid to UBS Global AM and any Affiliated Subadvisors and (ii) the aggregate fees paid to subadvisors other than Affiliated Subadvisors.

|

|

(xiii)

|

In the event that the SEC adopts a rule under the 1940 Act providing substantially similar relief to that in the Order, the Order will expire on the effective date of that rule.

|

|

(xiv)

|

If the Fund were to pay fees to a subadvisor directly from Fund assets, any changes to a subadvisory agreement that would result in an increase in the total management and advisory fees payable by the Fund will be required to be approved by the Fund’s Shareholders.

|

The Benefits to the Fund

The Board believes that it is in the best interests of the Fund's Shareholders to allow UBS Global AM the flexibility to appoint, terminate and replace subadvisors and to amend subadvisory agreements without incurring the expense and potential delay of seeking Shareholder approval. The process of seeking shareholder approval is administratively expensive and may cause delays in executing changes that the Board and UBS Global AM have determined are necessary or desirable. If Shareholders approve the Proposal authorizing a Manager of Managers Structure for the Fund, UBS Global AM and the Board would be able to act more quickly to appoint a subadvisor, when the UBS Global AM and the Board believe that the appointment would be in the best interests of the Fund and its Shareholders.

Although Shareholder approval of new subadvisory agreements and amendments to existing subadvisory agreements is not required under the proposed Manager of Managers Structure, the Board, including a majority of the Independent Trustees, would continue to oversee the subadvisor selection process to help ensure that Shareholders' interests are protected whenever UBS Global AM would seek to select a subadvisor or modify or terminate a subadvisory agreement. Specifically, the Board, including a majority of the Independent Trustees, would still be required to evaluate and approve all subadvisory agreements as well as any modification to an existing subadvisory agreement. In reviewing new subadvisory agreements or modifications to existing subadvisory agreements, the Board will analyze all factors that it considers to be relevant to its determination, including the subadvisory fees, the nature, quality and scope of services to be provided by the subadvisor, the investment performance of the assets managed by the subadvisor in the particular style for which a subadvisor is sought, as well as the subadvisor's compliance with federal securities laws and regulations.

The Board’s Consideration of this Proposal

In determining that the Manager of Managers Structure was in the best interests of the Fund’s Shareholders, the Board, including a majority of the Independent Trustees, considered the factors below, and such other factors and information they deemed relevant, prior to approving and recommending the approval of the Manager of Managers Structure: (1) A Manager of Managers Structure will enable UBS Global AM to employ subadvisors when UBS Global AM and Board believe it could benefit the Fund; (2) A Manager of Managers Structure will enable UBS Global AM to allocate or reallocate Fund assets among itself and one or more subadvisors when necessary to benefit the Fund; (3) A Manager of Managers Structure will enable the Board to act more quickly, with less expense, in appointing new subadvisors when the Board and UBS Global AM believe that such appointment would be in the best interests of Fund Shareholders; (4) UBS Global AM would be responsible for (a) establishing procedures to monitor a subadvisor's compliance with the Fund's investment objectives and policies, (b) analyzing the performance of the subadvisor and (c) recommending allocations and reallocations of Fund assets among itself and one or more subadvisors; (5) No subadvisor could be appointed, removed or replaced without Board approval; and (6) UBS Global AM, not the Fund, would be responsible for paying subadvisory fees to a subadvisor. Further, the Independent Trustees were advised by Independent Legal Counsel with respect to these matters.

Required Vote

The adoption of the Manager of Managers Structure will be approved with respect to the Fund only if Shareholders of the Fund approve the Proposal. Such approval requires a 1940 Act Majority Vote.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ADOPTION OF THE MANAGER OF MANAGERS STRUCTURE.

Proposal 2. Amended Investment Advisory Agreement on Behalf of the Fund

Overview of the Proposal to Approve the Amended Investment Advisory Agreement

UBS Global AM provides portfolio management services for the Fund pursuant to an Investment Advisory Agreement between the Trust and UBS Global AM, on behalf of the Fund, which was entered into on April 26, 2011 and approved by the Fund’s initial shareholder (the “Current Investment Advisory Agreement”). Shareholders are being asked to approve the replacement of the Fund's Current Investment Advisory Agreement with an Amended Investment Advisory Agreement between the Trust and UBS Global AM, on behalf of the Fund. The Amended Investment Advisory Agreement is being proposed solely to revise and add certain material provisions to the Current Investment Advisory Agreement relating to UBS Global AM’s responsibilities with respect to subadvisors in a Manager of Managers Structure as the Fund’s primary investment advisor.

Differences between the Material Provisions of the Current Investment Advisory Agreement and the Amended Investment Advisory Agreement (collectively, the “Advisory Agreements”)

The majority of the Fund’s Current Investment Advisory Agreement and the Amended Investment Agreement are identical. The terms of the Amended Investment Advisory Agreement are identical to its Current Investment Advisory Agreement as the Advisory Agreements relate to: (i) the duties of the Advisor as investment advisor to the Fund (with the exception of its duties with respect to subadvisors); (ii) execution of portfolio transactions by the Advisor for the Fund; (iii) reports that the Advisor must furnish to the Fund; (iv) the standard of care that governs the Advisor in serving as investment advisor to the Fund; (v) the duration and termination of the Advisory Agreements; and (vi) certain other provisions that are not material to the present purposes. Significantly, the provision that provides that UBS Global AM will provide its advisory services without receipt of a fee from the Fund are also identical in the Advisory Agreements.

The Amended Investment Advisory Agreement only differs materially from the Fund’s Current Investment Advisory Agreement with respect to the section of the Agreement entitled “Delegation of Responsibilities to Sub-Advisors.” Unlike the Current Investment Advisory Agreement, the Amended Investment Advisory Agreement specifically delineates UBS Global AM’s responsibilities in delegating duties to subadvisors under a Manager of Managers Structure, including requiring UBS Global AM to:

(i) provide general management and administrative services to the Fund with respect to the Manager of Managers Structure;

(ii) subject to review and approval by the Board: (a) set the Fund’s overall investment strategies, (b) evaluate, select and recommend subadvisors to manage all or a part of the Fund’s assets, (c) allocate and, when UBS Global AM believes appropriate, reallocate the Fund’s assets among subadvisors, (d) monitor and evaluate the investment performance of subadvisors, and (e) implement or approve procedures reasonably designed to ensure that the subadvisors comply with the Fund’s investment objectives, policies and restrictions;

(iii) inform each subadvisor of the investment objective, policies and restrictions for the Fund, ascertain that each subadvisor is aware of legal and regulatory responsibilities with respect to the Fund and monitor that the subadvisors discharge their duties;

(iv) enter into a subadvisory agreement with each subadvisor in substantially the form approved by the Board;

(v) pay the fees to each subadvisor as specified in the respective subadvisory agreement from UBS Global AM’s own resources; and

(vi) maintain all books and records required to be maintained under the 1940 Act and the rules and regulations promulgated thereunder and furnishing the Board with periodic and special reports as the Board may reasonably request.

The discussion above is qualified in its entirety by reference to the Amended Advisory Agreement itself, a form of which is attached as

Exhibit A

to this Proxy Statement.

Other Material Provisions of the Advisory Agreements

As stated above, other than the provisions relating to the supervision of subadvisors, the other material provisions of the Advisory Agreements are identical. The Advisory Agreements provide that the Advisor will manage the investment and reinvestment of the assets of the Fund, and will continuously review, supervise and administer the investment programs of the Fund, to determine, in the Advisor's discretion, the assets to be held uninvested. The Advisor is responsible for providing the Trust with records regarding its investment advisory activities that the Trust is required to maintain, and for rendering regular reports to the Trust's officers and Board concerning the Advisor's discharge of its responsibilities under the Advisory Agreements. The Advisor will, at its own expense, provide office space, furnishings, equipment and personnel required for performing its duties under the Advisory Agreements. With respect to foreign securities, the Advisor also may obtain, at its own expense, statistical and other factual information and advice regarding economic factors and trends from its foreign subsidiaries and may obtain investment services from the investment advisory personnel of its affiliates located throughout the world to the extent permitted under interpretations of the federal securities laws.

The Advisory Agreements provide that decisions regarding the placement of portfolio brokerage are made by the Advisor, with the primary considerations being to ensure the best available price and most favorable execution of securities transactions for the Fund are obtained. The Advisory Agreements authorize the Advisor to place portfolio transactions for the Fund with broker-dealers for commissions that are greater than another broker or dealer might charge if the Advisor determines in good faith that the commission paid was reasonable in relation to the brokerage or research services provided by such member, broker or dealer, viewed in terms of that particular transaction or the Advisor's overall responsibilities with respect to the Fund and to other fund and advisory accounts for which the Advisor exercises investment discretion.

The Advisory Agreements are effective for two years from the date on which they are executed. The Advisory Agreements are renewable for successive one year periods if such continuance is approved at least annually by: (i) the Board; or (ii) by the vote of a majority of the Fund's outstanding voting securities as defined in the 1940 Act; and in either event by the vote of a majority of Trustees who are not parties to the Advisory Agreements or "interested persons," as defined in the 1940 Act, of any such party.

The Advisory Agreements may be terminated by the Trust at any time, without the payment of any penalty, by the Board of the Trust or by vote of the holders of a majority of the outstanding voting securities of the Fund on 60 days' written notice to UBS Global AM. The Advisory Agreements will automatically terminate in the event of their assignment.

Fees Paid to UBS Global AM and its Affiliates

The Fund did not pay any fees to UBS Global AM under the Current Investment Advisory Agreement during the most completed fiscal year, and paid no other fees to UBS Global AM, its affiliated persons or any affiliated persons of such persons, including brokers affiliated with UBS Global AM, during the most recently completed fiscal year.

UBS Global AM provides investment advisory or subadvisory services to one other fund that has the same investment strategies as the Fund. UBS Global AM serves as investment advisor to the UBS Small-Cap Equity Relationship Fund, which had $87.8 million in assets as of December 31, 2012. UBS Global AM does not receive an investment advisory fee for managing the UBS Small-Cap Equity Relationship Fund.

The Board’s Consideration of this Proposal

At the December 6-7, 2012 Board meeting (the “Board Meeting”), the Board, including the Independent Trustees, considered the approval of the Amended Investment Advisory Agreement between the Trust, on behalf of the Fund, and UBS Global AM, that has been submitted for approval by Shareholders at the Meeting. The Board reviewed the materials provided by UBS Global AM in connection with the additional provisions added to the Amended Investment Advisory Agreement with respect to UBS Global AM’s obligations with respect to subadvisors in the Manager of Managers Structure. The Board also considered the materials and factors that the Board considered when it last approved the Current Investment Advisory Agreement for the Fund at the Board of Trustees meeting held on June 7- 8, 2012. The Board also made reference to information and material that had been provided to the Trustees throughout the year at quarterly Board meetings.

At the Board Meeting, the Board considered a number of factors in connection with its deliberations concerning the Amended Investment Advisory Agreement for the Fund, including: (i) the nature, extent, and quality of the services provided by the Advisor to the Fund; (ii) the performance of the Fund and the Advisor; (iii) the Fund’s expenses, costs of the services to be provided and profits to be realized by the Advisor and its affiliates from the relationship with the Fund; and (iv) whether economies of scale are realized by the Advisor with respect to the Fund, as it grows larger, and the extent to which the economies of scale are reflected in the level of the management fees charged.

Nature, Extent, and Quality of Services

. In considering the nature, extent, and quality of the services provided by the Advisor to the Fund, the Board considered the material previously presented by the Advisor describing the various services provided to the Fund. The Board noted that in addition to investment management services, the Advisor provides the Fund with operational, legal, and compliance support. The Board also considered the scope and depth of the Advisor’s organization and the experience and expertise of the professionals currently providing investment management and other services to the Fund. The Board considered that the Advisor was a well-established investment management organization employing investment personnel with significant experience in the investment management industry. The Board also considered the Advisor’s in-house research capabilities, as well as other research services available to it, including research services available to the Advisor as a result of securities transactions effected for the Fund and the Advisor’s other investment management clients, and noted that the Advisor had extensive global research capabilities. The Board also considered the Advisor’s portfolio management process for the Fund, including the use of risk management techniques and the proprietary technologies utilized to structure the Fund’s portfolio. The Board noted that various presentations had been made by investment personnel at Board meetings throughout the year concerning the Fund’s investment performance and investment. The Board also considered the additional services the Advisor will be providing under the Amended Investment Advisory Agreement in connection with the supervision of subadvisors if the Manager of Managers Structure is employed. The Board noted that UBS Global AM manages a number of other funds pursuant to a Manager of Managers Structure and has significant experience monitoring subadvisory relationships.

The Board also noted and discussed the services that the Advisor and its affiliates provide to the Fund under other agreements with the Trust including administration services provided by the Advisor and underwriting services provided by UBS Global Asset Management (US) Inc. The Board also discussed the annual written compliance report from the Chief Compliance Officer and noted enhancements undertaken and planned with respect to the compliance program. After analyzing the services provided by the Advisor to date, as well as the additional services that would be provided in connection with a Manager of Managers Structure, including the impact of these services on investment performance, the Board concluded that the nature, extent, and quality of services that will be provided to Fund were consistent with the operational requirements of the Fund, and met the needs of the Fund’s shareholders.

Performance

. In evaluating the performance of the Fund, the Board considered the comparative performance information for the Fund. The Board noted that as of September 30, 2012, the Fund had outperformed its benchmark, the Russell 2000 Index, for the one-year period.

The Board determined, after analyzing the performance data, that the performance of the Fund was acceptable as compared with relevant performance standards, given the investment strategies and risk profile of the Fund, the expectations of the shareholder base, the current market environment and the limited performance history of the Fund.

Costs and Expenses

. The Board noted that the Fund will not pay advisory fees to the Advisor under the Amended Investment Advisory Agreement and that the Advisor assumes all the ordinary operating expenses for the Fund, including the expenses related to contracting one or more subadvisors under a Manager of Managers Structure.

Profitability

. In considering the profitability of the Fund to the Advisor and its affiliates, the Board noted that neither the Advisor nor its affiliates receive any compensation for providing advisory or administrative services to the Fund. The Board also considered “fall-out” or ancillary benefits to the Advisor or its affiliates as the result of their relationship with the Fund; for example, the ability to attract other clients due to the Advisor’s role as investment advisor to the Fund, including the investment by wrap fee clients in the Fund and the research services available to the Advisor through soft dollar brokerage commissions. Upon closely examining the information provided concerning the Advisor’s profitability, the Board concluded that the level of profits realized by the Advisor and its affiliates with respect to the Fund under the Current Investment Advisory Agreement and the anticipated level of profits to be realized by the Advisor and its affiliates under the Amended Investment Advisory Agreement, if any, was reasonable in relation to the nature and quality of the services that were provided.

Economies of Scale

. The Board also discussed whether economies of scale are realized by the Advisor with respect to the Fund as it grows larger, and the extent to which this is reflected in the level of advisory fees charged. The Board concluded that economies of scale and the reflection of such economies of scale in the level of advisory fees charged were inapplicable to the Fund because the Fund will be not charged an advisory fee under the Amended Investment Advisory Agreement.

After full consideration of the factors discussed above, with no single factor identified as being of paramount importance, the Board, including a majority of the Independent Trustees, with the assistance of Independent Counsel, concluded that the approval of the Amended Investment Advisory Agreement for the Fund was in the best interests of the Fund and its shareholders and recommended its approval by Shareholders.

Shareholders are being asked to approve the Amended Investment Advisory Agreement, which will become effective on _________. If this Proposal is not approved, then the Current Investment Advisory Agreement will remain unchanged and in effect and the Board will consider what additional action, if any, should be taken.

The Board of the Trust recommends that Shareholders of the Fund approve the Amended Investment Advisory Agreement for the Fund, substantially in the form attached to this Proxy Statement as

Exhibit A

.

Required Vote

The Amended Investment Advisory Agreement will be approved with respect to the Fund only if Shareholders of the Fund approve the Proposal. Such approval requires a 1940 Act Majority Vote.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE AMENDED ADVISORY AGREEMENT.

Additional Information About Voting and the Meeting

Solicitation of Proxies

The solicitation of proxies will be made primarily by mail. The Trust has also retained an outside firm, [Computershare Fund Services], that specializes in proxy solicitation to assist with the proxy solicitation process, the collection of the proxies, and with any necessary follow-up. All costs of solicitation, including (a) printing and mailing of this Proxy Statement and accompanying material, (b) the reimbursement of others for their expenses in forwarding solicitation material to the beneficial owners of the Fund’s shares, and (c) payment to Computershare Fund Services for its services as proxy solicitor (which is anticipated to amount to approximately $[ ______ ]), including solicitations to submit proxies by telephone, will be borne by the UBS Global AM.

Beneficial Ownership of Shares

A list of those persons who, to the knowledge of the Trust, owned beneficially 5% or more of the shares of the Fund as of the Record Date is set forth in

Exhibit B

. To the knowledge of the Trust, each of the executive officers and the trustees of the Trust individually and together as a group owned less than 1% of the outstanding shares of the Fund as of February 5, 2013.

]

Shareholder Proposals and Communications

As a general matter, the Trust does not hold regular annual or other meetings of Shareholders. Any Shareholder who wishes to submit proposals to be considered at a special meeting of the Trust’s Shareholders should send the proposals to Mark Kemper, Secretary of Trust c/o UBS Global Asset Management (Americas) Inc., One North Wacker Drive, Chicago, Illinois 60606, so as to be received a reasonable time before the proxy solicitation for that meeting is made. Shareholder proposals that are submitted in a timely manner will not necessarily be included in the Trust’s or the Fund’s proxy materials. Inclusion of such proposals is subject to limitations under the federal securities laws. Shareholders who wish to make a proposal at a shareholder meeting without including the proposal in the Trust’s or Fund’s proxy statement must notify the Trust or Fund of such proposal within a reasonable time before the proxy solicitation for that meeting is made by directing such notice to the Secretary of the Trust at the address set forth above. If a Shareholder fails to give notice to the Trust or Fund within a reasonable time before the proxy solicitation is made, then the persons named as proxies by the Board for such meeting may exercise discretionary voting power with respect to any such proposal.

If a Shareholder wishes to send a communication to the Board, such correspondence should be in writing and addressed to the Board of the Trust c/o the Secretary of the Trust, Mark F. Kemper, at One North Wacker Drive, Chicago, Illinois 60606. The correspondence will be given to the Board for review and consideration.

Additional Information About the Fund

Investment Advisor and Administrator

UBS Global Asset Management (Americas) Inc. is the Fund's investment advisor and administrator. The Advisor, a Delaware corporation located at 1285 Avenue of the Americas, New York, NY 10019, is an investment advisor registered with the SEC. As of [December 31, 2012], the Advisor had approximately $[____billion] in assets under management. UBS Global AM, is wholly-owned by UBS Americas Inc., 677 Washington Boulevard, Stamford, Connecticut 06901. UBS Americas Inc. is a wholly-owned subsidiary of UBS AG, Bahnhofstrasse 45, Zurich Switzerland

.

UBS AG is an internationally diversified organization, with operations in many areas of the financial services industry. The Advisor is responsible for the Fund's investment decisions. The Advisor carries out its duties, subject to the supervision of the Board of Trustees, pursuant to the Current Investment Advisory Agreement that describes the Advisor's responsibilities. UBS Global AM also supervises and manages all other aspects of the Fund’s operation pursuant to an Administration Agreement with the Trust. The names, addresses and principal occupations of the principal executive officers and directors of UBS Global AM, along with the positions held by each, with the Trust, is provided in Exhibit C.

The Trust has entered into a Fund Services Agreement among the Trust, UBS Global AM and JPMorgan Chase Bank ("JPMorgan Chase"). UBS Global AM pays J.P. Morgan Chase for the services that it provides under the Fund Services Agreement. JPMorgan Chase is located at One Beacon Street, Boston, Massachusetts 02108.

Underwriter

UBS Global Asset Management (US) Inc. (“UBS Global AM (US)" or the "Underwriter"), with its principal office located at 1285 Avenue of the Americas, New York, New York 10019, acts as the principal underwriter of the shares of the Fund pursuant to a Principal Underwriting Contract with the Trust ("Principal Underwriting Contract"). The Principal Underwriting Contract requires the Underwriter to use its best efforts, consistent with its other businesses, to sell shares of the Fund.

Transfer Agent

BNY Mellon Investment Servicing (US) Inc., a subsidiary of BNY Mellon Bank, N.A., serves as the Fund's transfer agent. It is located at 760 Moore Road, King of Prussia, Pennsylvania 19406.

Custodian

JPMorgan Chase provides custodian services for the securities and cash of the Funds. UBS Global AM (US) pays JPMorgan Chase for the custodian services it provides to the Funds.

Other Business

Management knows of no business to be presented at the Meeting other than the matters set forth in this Proxy Statement, but should any other matter requiring a vote of Shareholders arise, the proxies will vote thereon according to their best judgment in the interest of the Trust or relevant Fund, as applicable.

By Order of the Board,

Mark F. Kemper

Vice President and Secretary

[ _____ ], 2013

|

It is important that you execute and return your proxy (or vote by telephone or through the Internet) promptly.

|

Exhibit Index

Exhibit A — Amended Investment Advisory Agreement…………………………………………………......A-1

Exhibit B — Beneficial Ownership of Greater Than 5% of the Fund’s Shares as of the Record Date.........B-1

Exhibit C —Information about the Directors and Executive Officers of UBS Global AM……………..…...C-1

SMA Relationship Trust

Exhibit A - Amended Investment Advisory Agreement

INVESTMENT ADVISORY AGREEMENT

AGREEMENT made this ____ day of ____________, 2013, by and between SMA Relationship Trust, a Delaware statutory trust (the “Trust”), and UBS Global Asset Management (Americas) Inc., a Delaware corporation (the “Advisor”).

1.

Duties of the Advisor

. The Trust hereby appoints the Advisor to act as investment advisor to Series S (the “Series”) for the period and on such terms set forth in this Agreement. The Trust employs the Advisor to manage the investment and reinvestment of the assets of the Series, to continuously review, supervise and administer the investment program of the Series, to determine in its discretion the assets to be held uninvested, to provide the Trust with records concerning the Advisor’s activities which the Trust is required to maintain, and to render regular reports to the Trust’s officers and Board of Trustees concerning the Advisor’s discharge of the foregoing responsibilities. The Advisor shall discharge the foregoing responsibilities subject to the control of the officers and the Board of Trustees of the Trust, and in compliance with the objectives, policies and limitations set forth in the Trust’s Prospectus and Statement of Additional Information. The Advisor accepts such employment and agrees to render the services and to provide, at its own expense, the office space, furnishings, equipment and the personnel required by it to perform the services on the terms and for the compensation provided herein. With respect to foreign securities, at its own expense, the Advisor may obtain statistical and other factual information and advice regarding economic factors and trends from its foreign subsidiaries, and may obtain investment services from the investment advisory personnel of its affiliates located throughout the world to the extent permitted under interpretations of the federal securities laws.

2.

Portfolio Transactions

. The Advisor shall provide the Series with a trading department, and with respect to foreign securities, the Advisor is authorized to utilize the trading departments of its foreign affiliates. The Advisor shall select, and with respect to its foreign affiliates or the use of any sub-advisors, shall monitor the selection of, the brokers or dealers that will execute the purchases and sales of securities for the Series and is directed to use its best efforts to ensure that the best available price and most favorable execution of securities transactions for the Series are obtained. Subject to policies established by the Board of Trustees of the Trust and communicated to the Advisor, it is understood that the Advisor will not be deemed to have acted unlawfully, or to have breached a fiduciary duty to the Trust or in respect of the Series, or be in breach of any obligation owing to the Trust or in respect of the Series under this Agreement, or otherwise, solely by reason of its having caused the Series to pay a member of a securities exchange, a broker or a dealer a commission for effecting a securities transaction for the Series in excess of the amount of commission another member of an exchange, broker or dealer would have charged if the Advisor determines in good faith that the commission paid was reasonable in relation to the brokerage or research services provided by such member, broker or dealer, viewed in terms of that particular transaction or the Advisor’s overall responsibilities with respect to the Series and to other funds and advisory accounts for which the Advisor or any Sub-Advisor, as defined in Section 8 hereof, exercises investment discretion. The Advisor will promptly communicate to the officers and trustees of the Trust such information relating to the Series transactions as they may reasonably request.

SMA Relationship Trust

Exhibit A - Amended Investment Advisory Agreement

3.

Compensation of the Advisor

. The Advisor shall not receive a fee for the services rendered to the Series under this Agreement.

4.

Reports

. The Series and the Advisor agree to furnish to each other such information regarding their operations with regard to their affairs as each may reasonably request.

5.

Status of Advisor

. The services of the Advisor to the Series are not to be deemed exclusive, and the Advisor shall be free to render similar services to others so long as its services to the Series are not impaired thereby.

6.

Liability of Advisor

. In the absence of willful misfeasance, bad faith, gross negligence or reckless disregard by the Advisor of its obligations and duties hereunder, the Advisor shall not be subject to any liability whatsoever to the Series, or to any shareholder of the Series, for any error of judgment, mistake of law or any other act or omission in the course of, or connected with, rendering services hereunder including, without limitation, for any losses that may be sustained in connection with the purchase, holding, redemption or sale of any security on behalf of the Series.

7.

Delegation of Responsibilities to Sub-Advisors

. The Trust and the Advisor may operate in accordance with the terms and conditions of a Securities and Exchange Commission exemptive order, which permits, the Advisor with the approval of the Trust's Board of Trustees, including the Trustees that are not “interested persons” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), to retain one or more unaffiliated investment advisors registered under the Investment Advisers Act of 1940 (“Sub-Advisors”) for the Series without receiving the approval of shareholders of the Series.

|

|

(a)The Advisor will provide general management and administrative services to the Trust, and, if applicable, subject to review and approval by the Board, will: (a) set the Series’ overall investment strategies; (b) evaluate, select and recommend Sub-Advisors to manage all or a part of the Series’ assets; (c) allocate and, when the Advisor believes appropriate, reallocate the Series' assets among Sub-Advisors; (d) monitor and evaluate the investment performance of Sub-Advisors; and (e) implement or approve procedures reasonably designed to ensure that the Sub-Advisors comply with the Series’ investment objectives, policies and restrictions. The Advisor will also periodically make recommendations to the Board as to whether the contract with one or more Sub-Advisors should be renewed, modified, or terminated, and will periodically report to the Board regarding the results of its evaluation and monitoring functions.

|

SMA Relationship Trust

Exhibit A - Amended Investment Advisory Agreement

|

|

(b)The Advisor is responsible for informing each Sub-Advisor of the investment objective, policies and restrictions of the Series, for informing or ascertaining that it is aware of other legal and regulatory responsibilities applicable to the Sub-Advisor with respect to the Series, and for monitoring the Sub-Advisors' discharge of their duties. Consistent with the investment objective, policies and restrictions as provided in the registration statement relating to the Series (or such more restrictive guidelines as approved by the Advisor), and applicable law, each Sub-Advisor is authorized to buy, sell, lend and otherwise trade in any stocks, bonds, and other securities, commodities or investments on behalf of the Series.

|

|

|

(c)The Advisor shall enter into an agreement ("Sub-Advisory Agreement") with a Sub-Advisor in substantially the form approved by the Board for each Sub-Advisor.

|

|

|

(d)The Advisor shall be responsible for the fees payable to and shall pay the Sub-Advisor of the Series the fee as specified in the Sub-Advisory Agreement relating thereto.

|

|

|

(e)The Advisor, directly or through a Sub-Advisor, will maintain all books and records required to be maintained by the Advisor pursuant to the 1940 Act and the rules and regulations promulgated thereunder with respect to transactions on behalf of the Series, and will furnish the Board with such periodic and special reports as the Board reasonably may request. In compliance with the requirements of Rule 31a-3 under the 1940 Act, the Advisor hereby agrees that all records which it maintains for the Trust and the Series are the property of the Trust, agrees to preserve for the periods prescribed by Rule 31a-2 under the 1940 Act any records which it maintains for the Trust and which are required to be maintained and preserved by Rule 31a-1 and Rule 31a-2 under the 1940 Act, and further agrees to surrender promptly to the Trust any records which it maintains for the Trust upon request by the Trust.

|

8.

Duration and Termination

. This Agreement shall become effective on the date first above written provided that first it is approved by the Board of Trustees of the Trust, including a majority of those trustees who are not parties to this Agreement or interested persons of any party hereto, in the manner provided in Section 15(c) of the 1940 Act and by the holders of a majority of the outstanding voting securities of the Series; and shall continue in effect for two years from its effective date. Thereafter, this Agreement may continue in effect only if such continuance is approved at least annually by: (i) the Trust’s Board of Trustees; or (ii) by the vote of a majority of the outstanding voting securities of the Series; and in either event by a vote of a majority of those trustees of the Trust who are not parties to this Agreement or interested persons of any such party in the manner provided in Section 15(c) of the 1940 Act. This Agreement may be terminated by the Trust at any time, without the payment of any penalty, by the Board of Trustees of the Trust or by vote of the holders of a majority of the outstanding voting securities of the Series on 60 days’ written notice to the Advisor. This Agreement may be terminated by the Advisor at any time, without the payment of any penalty, upon 60 days’ written notice to the Trust. This Agreement will automatically terminate in the event of its assignment. Any notice under this Agreement shall be given in writing, addressed and delivered or mailed postpaid, to the other party at the principal office of such party.

SMA Relationship Trust

Exhibit A - Amended Investment Advisory Agreement

As used in this Section 8, the terms “assignment,” “interested person,” and “a vote of a majority of the outstanding voting securities” shall have the respective meanings set forth in Section 2(a)(4), Section 2(a)(19) and Section 2(a)(42) of the 1940 Act and Rule 18f-2 thereunder.

9.

Name of Advisor

. The parties agree that the Advisor has a proprietary interest in the names “SMA Relationship Trust” and “SMA*RT,” and the Trust agrees to promptly take such action as may be necessary to delete from its corporate name and/or the name of the Series any reference to the names “SMA Relationship Trust” or “SMA*RT” promptly after receipt from the Advisor of a written request therefor.

10.

Severability

. If any provisions of this Agreement shall be held or made invalid by a court decision, statute, rule or otherwise, the remainder of this Agreement shall not be affected thereby.

11.

Amendment of this Agreement

. No provision of this Agreement may be changed, waived, discharged or terminated orally, but only by an instrument in writing signed by the party against which enforcement of the change, waiver, discharge or termination is sought, and no material amendment of this Agreement shall be effective until approved by vote of a majority of the Series' outstanding voting securities.

SMA Relationship Trust

Exhibit A - Amended Investment Advisory Agreement

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first above written.

|

SMA RELATIONSHIP TRUST

|

SMA RELATIONSHIP TRUST

|

|

|

|

|

|

|

|

By:

|

By:

|

|

Name:

|

Name:

|

|

Title:

|

Title:

|

|

|

|

|

|

|

|

UBS GLOBAL ASSET MANAGEMENT (AMERICAS) INC.

|

UBS GLOBAL ASSET MANAGEMENT (AMERICAS) INC.

|

|

|

|

|

|

|

|

By:

|

By:

|

|

Name:

|

Name:

|

|

Title:

|

Title:

|

Exhibit B - Beneficial Ownership of Greater Than 5% of the

Fund’s Shares as of the Record Date

Name and Address of Account

Share Amount

Percentage of Fund

SMA Relationship Trust

Exhibit C - Information about the directors and Executive

Officers of UBS Global AM

The following are the names, addresses and principal occupations of each principal executive officer and each director of UBS Global AM (Americas), along with their positions with the Trust, if any.

|

Name

|

Principal Occupation

|

Position held with the Trust

|

|

Joseph J. Allessie*

|

Mr. Allessie is an executive director and deputy general counsel at UBS Global AM (US) and UBS Global AM (Americas) (collectively, "UBS Global AM—Americas region"). Mr. Allessie is a vice president and assistant secretary of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Secretary

|

|

Rose Ann Bubloski*

|

Ms. Bubloski is a director and senior manager of the US mutual fund treasury administration department of UBS Global AM—Americas region. She is vice president and assistant treasurer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Treasurer

|

|

Mark E. Carver*

|

Mr. Carver is a managing director and Head of Product Development and Management—Americas for UBS Global AM—Americas region. He is a member of the Americas Management Committee (since 2008) and the Regional Operating Committee (since 2008). Mr. Carver is president of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM or one of its affiliates serves as investment advisor or manager.

|

President

|

|

Thomas Disbrow*

|

Mr. Disbrow is a managing director and head of North Americas Fund Treasury of UBS Global AM—Americas region. Mr. Disbrow is a vice president and treasurer and/or principal accounting officer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President, Treasurer and Principal Accounting Officer

|

SMA Relationship Trust

Exhibit C - Information about the directors and Executive

Officers of UBS Global AM

|

Name

|

Principal Occupation

|

Position held with the Trust

|

|

Michael J. Flook*

|

Mr. Flook is a director and a senior manager of the US mutual fund treasury administration department of UBS Global AM—Americas region. Mr. Flook is a vice president and assistant treasurer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Treasurer

|

|

Christopher S. Ha*

|

Mr. Ha is a director and associate general counsel at UBS Global AM—Americas region. Mr. Ha is a vice president and assistant secretary of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region serves as investment advisor or manager.

|

Vice President and Assistant Secretary

|

|

Mark F. Kemper

**

|

Mr. Kemper is a managing director and head of the legal department of UBS Global AM—Americas region. He has been secretary of UBS Global AM—Americas region, secretary of UBS Global Asset Management Trust Company and secretary of UBS AM Holdings (USA) Inc. Mr. Kemper is vice president and secretary of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Secretary

|

SMA Relationship Trust

Exhibit C - Information about the directors and Executive

Officers of UBS Global AM

|

Name

|

Principal Occupation

|

Position held with the Trust

|

|

Joanne M. Kilkeary

*

|

Ms. Kilkeary is a director and a senior manager of the US mutual fund treasury administration department of UBS Global AM—Americas region. Ms. Kilkeary is a vice president and assistant treasurer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Treasurer

|

|

Tammie Lee

*

|

Ms. Lee is an executive director and associate general counsel of UBS Global AM—Americas region. Ms. Lee is a vice president and assistant secretary of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Secretary

|

|

Shawn Lytle*

|

Mr. Lytle is a Group Managing Director and Head of Americas at UBS Global AM. Mr. Lytle is a member of the UBS Global Asset Management Executive Committee. Mr. Lytle is a trustee of three investment companies (consisting of 47 portfolios) for which UBS Global AM serves as investment advisor or manager.

|

Interested Trustee

|

|

Joseph McGill*

|

Mr. McGill is managing director and chief compliance officer at UBS Global AM—Americas region. Mr. McGill is a vice president and chief compliance officer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Chief Compliance Officer

|

SMA Relationship Trust

Exhibit C - Information about the directors and Executive

Officers of UBS Global AM

|

Nancy D. Osborn

*

|

Mrs. Osborn is a director and a senior manager of the US mutual fund treasury administration department of UBS Global AM—Americas region. Mrs. Osborn is a vice president and assistant treasurer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Treasurer

|

|

Eric Sanders

*

|

Mr. Sanders is a director and associate general counsel of UBS Global AM—Americas region. Mr. Sanders is a vice president and assistant secretary of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Secretary

|

|

Andrew Shoup

*

|

Mr. Shoup is a managing director and global head of the fund treasury administration department of UBS Global AM—Americas region. Mr. Shoup is also a director of UBS (IRL) Fund p.l.c. Mr. Shoup is a vice president and chief operating officer of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Chief Operating Officer

|

SMA Relationship Trust

Exhibit C - Information about the directors and Executive

Officers of UBS Global AM

|

Name

|

Principal Occupation

|

Position held with the Trust

|

|

Keith A. Weller

*

|

Mr. Weller is an executive director and senior associate general counsel of UBS Global AM—Americas region and has been an attorney with affiliated entities since 1995. Mr. Weller is a vice president and assistant secretary of 17 investment companies (consisting of 93 portfolios) for which UBS Global AM—Americas region or one of its affiliates serves as investment advisor or manager.

|

Vice President and Assistant Secretary

|

*

This person's business address is 1285 Avenue of the Americas, New York, NY 10019-6028.

**

This person's business address is One North Wacker Drive, Chicago, IL 60606.

C-5

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Please detach at perforation before mailing.

PROXY SMA RELATIONSHIP TRUST

PROXY

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD [APRIL 10], 2013

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES OF SMA RELATIONSHIP TRUST

The undersigned hereby appoint(s) Joseph J. Allessie and Tammie Lee, or either of them, as Proxies of the undersigned with full power of substitution, to vote and act with respect to all interests in Series S (the “Fund”), a series of SMA Relationship Trust (the “Trust”), with respect to which the undersigned is entitled to vote at the Special Meeting of Shareholders (the “Meeting”) of the Fund to be held at the Trust’s principal executive offices at One North Wacker Drive, Chicago, Illinois 60606, at [12:00] p.m. Central time on [April 10,] 2013, and at any adjournments or postponements thereof.

The undersigned acknowledges receipt of the Notice of Special Meeting of Shareholders and of the accompanying Proxy Statement, and revokes any proxy previously given with respect to such meeting.

This proxy will be voted as instructed.

If no specification is made for a proposal, the proxy will be voted “FOR” the proposal

. The Proxies are authorized in their discretion to vote upon such other matters as may come before the Meeting or any adjournments or postponements thereof.

|

|

|

VOTE VIA THE INTERNET:

www.proxy-direct.com

VOTE VIA THE TELEPHONE

:

[____________]

Note

: Signature(s) should be exactly as name or names appearing on this proxy. If shares are held jointly, each holder should sign. If signing is by attorney, executor, administrator, trustee or guardian, please give full title.

Signature(s)_______________________________

Signature(s)_______________________________

Date ____________________________________

|

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the Fund

Shareholder Meeting to Be Held on [April 10], 2013.

The Proxy Statement for this meeting is available at:

[__________________]

Please detach at perforation before mailing.

THE BOARD RECOMMENDS A VOTE

FOR

THE FOLLOWING PROPOSALS.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS IN THIS EXAMPLE:

x

|

|

|

FOR AGAINST ABSTAIN

|

|

Proposal 1:

|

To adopt a “manager of managers” investment advisory structure whereby UBS Global Asset Management (Americas) Inc. (“UBS Global AM”), the Fund’s investment advisor, will be able to hire, terminate and replace subadvisors of the Fund without shareholder approval.

|

[ ] [ ] [ ]

|

|

|

|

FOR AGAINST ABSTAIN

|

|

Proposal 2:

|

To approve an amended Investment Advisory Agreement between UBS Global AM and the

Trust, on behalf of the Fund, to add provisions regarding UBS Global AM’s responsibilities with respect to subadvisors in a “manager of managers” structure as the Fund’s primary investment advisor.

|

[ ] [ ] [ ]

|

PLEASE VOTE, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

[____________________]

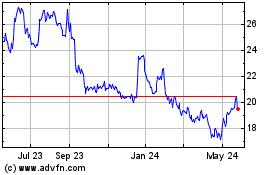

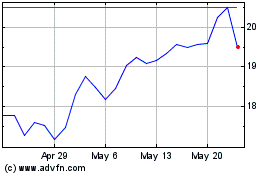

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024