Penns Woods Bancorp, Inc. (NASDAQ:PWOD) today reported that net

income from core operations (�operating earnings�), which is a

non-GAAP measure of net income excluding net securities gains and

losses, remained stable at $2,208,000 and $4,611,000 for the three

and six months ended June 30, 2009 compared to $2,223,000 and

$4,329,000 for the same periods of 2008. Operating earnings per

share for the three months ended June 30, 2009 were $0.58 basic and

dilutive compared to $0.58 and $0.57 basic and dilutive for the

same periods of 2008. Operating earnings for the six months ended

June 30, 2009 resulted in operating earnings per share increasing

7.1% to $1.20 basic and dilutive compared to $1.12 basic and

dilutive for the same period of 2008. Operating earnings for the

three and six months ended June 30, 2009 have been positively

impacted by continued emphasis on credit quality, loan and deposit

growth, solid non-interest operating income, and an increasing net

interest margin. A reconciliation of the non-GAAP financial

measures of operating earnings, operating earnings per share,

operating return on assets, and operating return on equity

described in this paragraph to the comparable GAAP financial

measures is included at the end of this press release.

Net income, as reported under U.S. generally accepted accounting

principles, for the three and six months ended June 30, 2009 was

$832,000 and $1,671,000 compared to $2,057,000 and $4,188,000 for

the same periods of 2008. Comparable results were impacted by an

increase in after-tax securities losses of $1,210,000 (from a loss

of $166,000 to a loss of $1,376,000) and an increase in after-tax

securities losses of $2,799,000 (from a loss of $141,000 to a loss

of $2,940,000) from 2008 to 2009 for the three and six month

periods being compared. Included within the change in after-tax

securities losses are pre-tax other than temporary impairment

charges relating to certain equity securities held in the

investment portfolio for the three and six months ended June 30,

2009 of $2,251,000 and $4,584,000 compared to $366,000 and $574,000

for the three and six months ended June 30, 2008. Basic and

dilutive earnings per share for the three and six months ended June

30, 2009 were $0.22 and $0.44 compared to $0.53 and $1.08 for the

corresponding periods of 2008. Return on average assets and return

on average equity were 0.51% and 5.45% for the three months ended

June 30, 2009 compared to 1.30% and 11.73% for the corresponding

period of 2008. Earnings for the six months ended June 30, 2009

correlate to a return on average assets and return on average

equity of 0.51% and 5.54% compared to 1.33% and 11.87% for the six

month 2008 period.

The net interest margin for the three and six months ended June

30, 2009 was 4.36% and 4.42% compared to 4.01% and 3.95% for the

corresponding periods of 2008. A decrease in the rate paid on

interest bearing liabilities of 62 basis points (bp) and 85 bp for

the three and six months ended June 30, 2009 compared to the same

periods of 2008 positively impacted the net interest margin. A

declining cost of funds is primarily the result of the rate paid on

time deposits decreasing 110 bp and 127 bp for the three and six

month periods ended June 30, 2009 compared to the same periods of

2008. The decreases are the result of Federal Open Market Committee

(FOMC) actions to reduce interest rates coupled with our strategic

decision to shorten the duration of the time deposit portfolio over

the past year. The shortening of the time deposit portfolio has

resulted in an increased repricing frequency which has allowed for

the majority of the portfolio to be repriced downward over the past

twelve months. The duration of the time deposit portfolio is now

beginning to be lengthened due to the apparent bottoming or near

bottoming of deposit rates.

�A catalyst for the sustained high level of operating earnings

is our net interest margin of 4.36% and 4.42% for the three and six

month periods of 2009, which has led to taxable equivalent net

interest income of $6,540,000 and $13,110,000 over the same

periods. The increase of 35 bp and 47 bp in the net interest margin

from the comparable three and six month periods of 2008 can be

attributed to our continued focus on core deposit growth. We have

been able to obtain core deposit relationships based on our quality

service and significant community involvement. Core deposit growth

has been utilized to fund the growth in the loan portfolio and to

reduce our borrowing position by $23,201,000 since June 30, 2008,�

commented Ronald A Walko, President and Chief Executive Officer of

Penns Woods Bancorp, Inc. �While we have placed emphasis on

deposits, we have maintained our focus on sound credit quality and

ensuring an adequate risk/return trade-off. Continuing questions

surrounding the soft economy are impacting our loan credit quality

ratios. However, we continue to compare favorably to other members

of the financial industry. Our commitment to quality can be

illustrated by our nonperforming loans to total loans ratio 0.68%

and net loan charge-offs to average loans of 0.07% for the six

month period ended June 30, 2009,� added Mr. Walko.

Total assets increased $33,357,000 to $667,861,000 at June 30,

2009 compared to June 30, 2008. Net loans increased $25,949,000

despite a softening economy that has in general provided fewer loan

opportunities. However, due to our credit quality position and

overall balance sheet strength, we have been able to aggressively

attract those loans that meet and/or exceed our credit standards.

The investment portfolio decreased $1,433,000 from June 30, 2008 to

2009 primarily due to a decrease in the market value of the

portfolio. During the six months ended June 30, 2009, the equity

segment of the portfolio experienced write downs of $4,584,000

($2,251,000 during the three months ended June 30, 2009) due to the

turbulence in the equity markets, particularly the financial

sector, which has caused several of our investments in regional and

national financial institutions to be classified as other than

temporarily impaired. Continued turmoil in the equity market may

lead to additional write downs as we move forward through 2009 due

to the severity of the market decline. Despite our ability to hold

those investment positions that have depreciated in value, each

position has been and will continue to be evaluated for other than

temporary impairment, and/or a possible exit due primarily to the

ability to carry back tax losses.

Deposits have increased 13.0% or $57,080,000 to $495,001,000 at

June 30, 2009 compared to 2008 with core deposits (total deposits

excluding time deposits) increasing 18.5% or $41,638,000. �The

increase in deposits is a testament to each of our employees and

their community involvement, high level of customer service, and

knowledge. Our employees consistently are able to prepare a package

of services from internet banking to remote deposit capture that

fulfill the needs of those within our market area. We have also

added new features such as electronic delivery of statements to

existing products and are in the testing phase of mobile or cell

phone based banking. Maintaining our high level of customer service

coupled with the addition of technology based delivery channels

will allow us to continue building solid customer relationships,�

commented Mr. Walko.

Shareholders� equity decreased $3,151,000 to $61,371,000 at June

30, 2009 as accumulated comprehensive loss increased $868,000, and

$786,000 in common stock was strategically repurchased as part of

the previously announced stock buyback plan. The increase in

accumulated other comprehensive loss is a result of a reduction in

the net unrealized loss on available for sale securities of

$1,537,000 countered by an increase of $2,405,000 in the net excess

of the projected benefit obligation over the market value of the

plan assets of the defined benefit pension plan due to a decline in

the market value of the plan assets caused by the significant

downturn in the stock and bond markets over the past year. The

current level of shareholders� equity equates to a book value per

share of $16.01 at June 30, 2009 compared to $16.72 at June 30,

2008 and an equity to asset ratio of 9.19% at June 30, 2009. Book

value per share, excluding accumulated other comprehensive loss,

was $18.65 at June 30, 2009 compared to $19.11 at June 30, 2008.

During the three and six months ended June 30, 2009 and 2008 cash

dividends of $0.46 and $0.92 per share were paid to

shareholders.

�The continued negative news surrounding the economy and the

financial sector too often overshadows the solid performance of

many community banks. Our continued strong operating earnings and

well capitalized status provide a solid foundation for the future.

We have also reduced our borrowing level by focusing on and growing

core deposits. Our well capitalized status and level of core

operating earnings have provided the resources to maintain our

dividend and to purchase 29,210 treasury shares over the past

twelve months,� commented Mr. Walko.

Penns Woods Bancorp, Inc. is the parent company of Jersey Shore

State Bank, which operates twelve branch offices providing

financial services in Lycoming, Clinton, and Centre Counties.

Investment and insurance products are offered through the bank�s

subsidiary, The M Group, Inc. D/B/A The Comprehensive Financial

Group.

NOTE: This press release contains financial information

determined by methods other than in accordance with U.S. Generally

Accepted Accounting Principles ("GAAP"). Management uses the

non-GAAP measure of net income from core operations in its analysis

of the company's performance. This measure, as used by the Company,

adjusts net income determined in accordance with GAAP to exclude

the effects of special items, including significant gains or losses

that are unusual in nature such as net securities gains and losses.

Because certain of these items and their impact on the Company�s

performance are difficult to predict, management believes

presentation of financial measures excluding the impact of such

items provides useful supplemental information in evaluating the

operating results of the Company�s core businesses. These

disclosures should not be viewed as a substitute for net income

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented

by other companies.

This press release may contain certain �forward-looking

statements� including statements concerning plans, objectives,

future events or performance and assumptions and other statements,

which are statements other than statements of historical fact. The

Company cautions readers that the following important factors,

among others, may have affected and could in the future affect

actual results and could cause actual results for subsequent

periods to differ materially from those expressed in any

forward-looking statement made by or on behalf of the Company

herein: (i) the effect of changes in laws and regulations,

including federal and state banking laws and regulations, and the

associated costs of compliance with such laws and regulations

either currently or in the future as applicable; (ii) the effect of

changes in accounting policies and practices, as may be adopted by

the regulatory agencies as well as by the Financial Accounting

Standards Board, or of changes in the Company�s organization,

compensation and benefit plans; (iii) the effect on the Company�s

competitive position within its market area of the increasing

consolidation within the banking and financial services industries,

including the increased competition from larger regional and

out-of-state banking organizations as well as non-bank providers of

various financial services; (iv) the effect of changes in interest

rates; and (v) the effect of changes in the business cycle and

downturns in the local, regional or national economies. For a list

of other factors which could affect the Company�s results, see the

Company�s filings with the Securities and Exchange Commission,

including �Item�1A. Risk Factors,� set forth in the Company�s

Annual Report on Form�10-K for the fiscal year ended December�31,

2008.

You should not place undue reliance on any forward-looking

statements. These statements speak only as of the date of this

press release, even if subsequently made available by the Company

on its website or otherwise. The Company undertakes no obligation

to update or revise these statements to reflect events or

circumstances occurring after the date of this press release.

Previous press releases and additional information can be

obtained from the Company�s website at www.jssb.com.

THIS INFORMATION IS SUBJECT TO YEAR-END AUDIT ADJUSTMENT

�

PENNS WOODS BANCORP, INC. CONSOLIDATED BALANCE

SHEET (UNAUDITED) � � � (In Thousands, Except Share

Data) June 30, � 2009 � � 2008 � % Change � ASSETS

Noninterest-bearing balances $ 10,832 $ 17,193 -37.0 %

Interest-bearing deposits in other financial institutions � 7,815 �

� 16 � 48743.8 % Total cash and cash equivalents 18,647 17,209 8.4

% � Investment securities, available for sale, at fair value

207,901 209,284 -0.7 % Investment securities held to maturity (fair

value of $111 and $161) 110 160 -31.3 % Loans held for sale 4,595

3,590 28.0 % Loans 392,074 365,955 7.1 % Less: Allowance for loan

losses � 4,377 � � 4,207 � 4.0 % Loans, net 387,697 361,748 7.2 %

Premises and equipment, net 7,656 7,449 2.8 % Accrued interest

receivable 3,468 3,322 4.4 % Bank-owned life insurance 14,862

13,319 11.6 % Investment in limited partnerships 5,182 5,083 1.9 %

Goodwill 3,032 3,032 0.0 % Deferred tax asset 11,583 8,408 37.8 %

Other assets � 3,128 � � 1,900 � 64.6 % TOTAL ASSETS $ 667,861 � $

634,504 � 5.3 % � LIABILITIES Interest-bearing deposits $ 420,492 $

358,013 17.5 % Noninterest-bearing deposits � 74,509 � � 79,908 �

-6.8 % Total deposits 495,001 437,921 13.0 % � Short-term

borrowings 14,880 48,081 -69.1 % Long-term borrowings, Federal Home

Loan Bank (FHLB) 86,778 76,778 13.0 % Accrued interest payable

1,220 1,463 -16.6 % Other liabilities � 8,611 � � 5,739 � 50.0 %

TOTAL LIABILITIES � 606,490 � � 569,982 � 6.4 % � SHAREHOLDERS'

EQUITY Common stock, par value $8.33, 10,000,000 shares authorized;

4,011,985 and 4,008,833 shares

issued

33,433 33,407 0.1 % Additional paid-in capital 17,983 17,930 0.3 %

Retained earnings 26,322 27,898 -5.6 % Accumulated other

comprehensive loss: Net unrealized loss on available for sale

securities (6,323 ) (7,860 ) 19.6 % Defined benefit plan (3,780 )

(1,375 ) -174.9 % Less: Treasury stock at cost, 179,028 and 149,818

shares � (6,264 ) � (5,478 ) 14.3 % TOTAL SHAREHOLDERS' EQUITY �

61,371 � � 64,522 � -4.9 % TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY $ 667,861 � $ 634,504 � 5.3 % � �

PENNS WOODS BANCORP,

INC. CONSOLIDATED STATEMENT OF INCOME (UNAUDITED)

� � � � � � � (In Thousands, Except Per Share Data) Three Months

Ended Six Months Ended June 30, June 30, �

2009

� � 2008 � % Change � 2009 � � 2008 � % Change � � INTEREST AND

DIVIDEND INCOME: Loans including fees $ 6,349 $ 6,246 1.6 % $

12,568 $ 12,625 -0.5 % Investment securities: Taxable 1,374 1,276

7.7 % 2,737 2,466 11.0 % Tax-exempt 1,249 1,210 3.2 % 2,495 2,436

2.4 % Dividend and other interest income � 41 � � 204 � -79.9 % �

130 � � 457 � -71.6 % TOTAL INTEREST AND DIVIDEND INCOME � 9,013 �

� 8,936 � 0.9 % � 17,930 � � 17,984 � -0.3 % � INTEREST EXPENSE:

Deposits 2,204 2,551 -13.6 % 4,209 5,092 -17.3 % Short-term

borrowings 78 257 -69.6 % 236 686 -65.6 % Long-term borrowings,

FHLB � 926 � � 972 � -4.7 % � 1,843 � � 2,169 � -15.0 % TOTAL

INTEREST EXPENSE � 3,208 � � 3,780 � -15.1 % � 6,288 � � 7,947 �

-20.9 % � NET INTEREST INCOME 5,805 5,156 12.6 % 11,642 10,037 16.0

% � PROVISION FOR LOAN LOSSES � 186 � � 60 � 210.0 % � 312 � � 120

� 160.0 % � NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES �

5,619 � � 5,096 � 10.3 % � 11,330 � � 9,917 � 14.2 % � NON-INTEREST

INCOME: Deposit service charges 541 540 0.2 % 1,066 1,110 -4.0 %

Securities losses, net (2,086 ) (251 ) 731.1 % (4,455 ) (213 )

1991.5 % Bank-owned life insurance 112 91 23.1 % 274 246 11.4 %

Gain on sale of loans 103 212 -51.4 % 221 364 -39.3 % Insurance

commissions 347 486 -28.6 % 701 1,066 -34.2 % Other � 591 � � 543 �

8.8 % � 1,025 � � 962 � 6.5 % TOTAL NON-INTEREST INCOME � (392 ) �

1,621 � -124.2 % � (1,168 ) � 3,535 � -133.0 % � NON-INTEREST

EXPENSE: Salaries and employee benefits 2,595 2,469 5.1 % 5,077

4,920 3.2 % Occupancy, net 318 314 1.3 % 657 652 0.8 % Furniture

and equipment 306 287 6.6 % 613 572 7.2 % Pennsylvania shares tax

172 105 63.8 % 343 210 63.3 % Amortization of investments in

limited partnerships 141 178 -20.8 % 283 356 -20.5 % Other � 1,353

� � 1,158 � 16.8 % � 2,557 � � 2,246 � 13.8 % TOTAL NON-INTEREST

EXPENSE � 4,885 � � 4,511 � 8.3 % � 9,530 � � 8,956 � 6.4 % �

INCOME BEFORE INCOME TAX (BENEFIT) PROVISION 342 2,206 -84.5 % 632

4,496 -85.9 % INCOME TAX (BENEFIT) PROVISION � (490 ) � 149 �

-428.9 % � (1,039 ) � 308 � -437.3 % NET INCOME $ 832 � $ 2,057 �

-59.6 % $ 1,671 � $ 4,188 � -60.1 % � EARNINGS PER SHARE - BASIC $

0.22 � $ 0.53 � -58.5 % $ 0.44 � $ 1.08 � -59.3 % � EARNINGS PER

SHARE - DILUTED $ 0.22 � $ 0.53 � -58.5 % $ 0.44 � $ 1.08 � -59.3 %

� WEIGHTED AVERAGE SHARES OUTSTANDING - BASIC � 3,832,520 � �

3,865,977 � -0.9 % � 3,832,135 � � 3,870,359 � -1.0 % � WEIGHTED

AVERAGE SHARES OUTSTANDING - DILUTED � 3,832,596 � � 3,866,115 �

-0.9 % � 3,832,173 � � 3,870,523 � -1.0 % � DIVIDENDS PER SHARE $

0.46 � $ 0.46 � 0.0 % $ 0.92 � $ 0.92 � 0.0 % � �

PENNS WOODS

BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES � � �

� � � For the Three Months Ended (Dollars in Thousands) June 30,

2009 June 30, 2008 Average Balance Interest Average Rate Average

Balance Interest Average Rate ASSETS: Tax-exempt loans $ 16,934 $

271 6.42 % $ 8,506 $ 135 6.31 % All other loans � 377,324 � 6,170 �

6.56 % � 358,980 � 6,157 6.82 % Total loans � 394,258 � 6,441 �

6.55 % � 367,486 � 6,292 6.81 % � Taxable securities 101,984 1,415

5.55 % 105,295 1,480 5.62 % Tax-exempt securities � 103,848 � 1,892

� 7.29 % � 108,670 � 1,833 6.75 % Total securities � 205,832 �

3,307 � 6.43 % � 213,965 � 3,313 6.19 % � Interest bearing deposits

� 1,371 � - � 0.00 % � 34 � - 0.00 % � Total interest-earning

assets 601,461 � 9,748 � 6.52 % 581,485 � 9,605 6.58 % � Other

assets � 55,793 � 50,186 � TOTAL ASSETS $ 657,254 $ 631,671 �

LIABILITIES AND SHAREHOLDERS' EQUITY: Savings $ 61,383 81 0.53 % $

61,197 115 0.75 % Super Now deposits 56,645 131 0.93 % 54,327 183

1.34 % Money market deposits 64,374 367 2.29 % 26,803 146 2.17 %

Time deposits � 224,918 � 1,625 � 2.90 % � 209,539 � 2,107 4.00 %

Total deposits

� 407,320 � 2,204 � 2.17 % � 351,866 � 2,551 2.88 % � Short-term

borrowings 18,035 78 1.73 % 41,319 257 2.45 % Long-term borrowings

� 86,778 � 926 � 4.22 % � 85,789 � 972 4.43 % Total borrowings �

104,813 � 1,004 � 3.79 % � 127,108 � 1,229 3.79 % � Total

interest-bearing liabilities 512,133 � 3,208 � 2.50 % 478,974 �

3,780 3.12 % � Demand deposits 73,930 73,485 Other liabilities

10,113 9,095 Shareholders' equity � 61,078 � 70,117 � TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 657,254 $ 631,671 Interest

rate spread � 4.02 % 3.46 % Net interest income/margin $ 6,540 �

4.36 % $ 5,825 4.01 % � � For the Three Months Ended June 30, �

2009 2008 � Total interest income $ 9,013 $ 8,936 Total interest

expense � 3,208 � 3,780 � � Net interest income 5,805 5,156 Tax

equivalent adjustment � 735 � 669 � � Net interest income (fully

taxable equivalent) $ 6,540 $ 5,825 � � � � � � � �

PENNS WOODS

BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES � For

the Six Months Ended June 30, 2009 June 30, 2008 Average Balance

Interest Average Rate Average Balance Interest Average Rate ASSETS:

Tax-exempt loans $ 16,420 $ 538 6.61 % $ 8,277 $ 262 6.37 % All

other loans � 375,687 � 12,213 � 6.56 % � 356,830 � 12,453 7.02 %

Total loans � 392,107 � 12,751 � 6.56 % � 365,107 � 12,715 7.00 % �

Taxable securities 101,937 2,867 5.63 % 103,013 2,923 5.68 %

Tax-exempt securities � 102,757 � 3,780 � 7.36 % � 111,630 � 3,691

6.61 % Total securities � 204,694 � 6,647 � 6.49 % � 214,643 �

6,614 6.16 % � Interest bearing deposits � 700 � - � 0.00 % � 19 �

- 0.00 % � Total interest-earning assets 597,501 � 19,398 � 6.53 %

579,769 � 19,329 6.69 % � Other assets � 55,459 � 49,325 � TOTAL

ASSETS $ 652,960 $ 629,094 � LIABILITIES AND SHAREHOLDERS' EQUITY:

Savings $ 60,517 159 0.53 % $ 59,880 224 0.75 % Super Now deposits

55,276 260 0.95 % 50,347 338 1.35 % Money Market deposits 52,888

580 2.21 % 25,064 273 2.19 % Time deposits � 215,069 � 3,210 � 3.01

% � 200,233 � 4,257 4.28 %

Total deposits

� 383,750 � 4,209 � 2.21 % � 335,524 � 5,092 3.05 % � Short-term

borrowings 39,641 236 1.19 % 46,216 686 2.95 % Long-term borrowings

� 86,778 � 1,843 � 4.22 % � 95,661 � 2,169 4.48 % Total borrowings

� 126,419 � 2,079 � 3.27 % � 141,877 � 2,855 3.99 % � Total

interest-bearing liabilities 510,169 � 6,288 � 2.48 % 477,401 �

7,947 3.33 % � Demand deposits 72,633 71,864 Other liabilities

9,870 9,280 Shareholders' equity � 60,288 � 70,549 � TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 652,960 $ 629,094 Interest

rate spread � 4.05 % 3.36 % Net interest income/margin $ 13,110 �

4.42 % $ 11,382 3.95 % � � For the Six Months Ended June 30, � 2009

2008 � Total interest income $ 17,930 $ 17,984 Total interest

expense � 6,288 � 7,947 � � Net interest income 11,642 10,037 Tax

equivalent adjustment � 1,468 � 1,345 � � Net interest income

(fully taxable equivalent) $ 13,110 $ 11,382 � � �

Quarter

Ended � � � � (Dollars in Thousands, Except Per Share Data)

6/30/2009 �

3/31/2009 �

12/31/2008 �

9/30/2008 �

6/30/2008 � � � � � � � � � � � � � � � � � � �

Operating Data � � � � � � � � � � � � � � � � � � � � � � �

� � � � � � � � � � � � � � � Net income $ 832 � � $ 839 � � $

2,263 � � $ 1,552 � � $ 2,057 � Net interest income � 5,805 � � �

5,837 � � � 5,726 � � � 5,513 � � � 5,156 � Provision for loan

losses � 186 � � � 126 � � � 145 � � � 110 � � � 60 � Net security

losses � (2,086 ) � � (2,369 ) � � (314 ) � � (1,504 ) � � (251 )

Non-interest income, ex. net security losses � 1,694 � � � 1,593 �

� � 1,763 � � � 1,976 � � � 1,872 � Non-interest expense � 4,885 �

� � 4,645 � � � 4,542 � � � 4,451 � � � 4,511 � � � � � � � � � � �

� � � � � � � � �

Performance Statistics � � � � � � � � � �

� � � � � � � � � � � � � � � � � � � � � � � � � � � � Net

interest margin � 4.36 % � � 4.47 % � � 4.42 % � � 4.23 % � � 4.01

% Annualized return on average assets � 0.51 % � � 0.52 % � � 1.43

% � � 0.98 % � � 1.30 % Annualized return on average equity � 5.45

% � � 5.64 % � � 15.20 % � � 9.43 % � � 11.73 % Annualized net loan

charge-offs to avg loans � 0.25 % � � 0.04 % � � 0.06 % � � 0.05 %

� � 0.01 % Net charge-offs � 250 � � � 41 � � � 57 � � � 49 � � � 7

� Efficiency ratio � 65.1 % � � 62.5 % � � 60.7 % � � 59.4 % � �

64.2 % � � � � � � � � � � � � � � � � � � �

Per Share Data

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

� � � � Basic earnings per share $ 0.22 � � $ 0.22 � � $ 0.59 � � $

0.40 � � $ 0.53 � Diluted earnings per share � 0.22 � � � 0.22 � �

� 0.59 � � � 0.40 � � � 0.53 � Dividend declared per share � 0.46 �

� � 0.46 � � � 0.46 � � � 0.46 � � � 0.46 � Book value � 16.01 � �

� 15.29 � � � 15.93 � � � 15.47 � � � 16.72 � Common stock price: �

� � � � � � � � � � � � � � � � � � High � 31.81 � � � 25.61 � � �

30.40 � � � 35.00 � � � 33.15 � Low � 24.89 � � � 23.00 � � � 23.00

� � � 29.00 � � � 30.01 � Close � 29.14 � � � 25.42 � � � 23.03 � �

� 29.00 � � � 31.25 � Weighted average common shares: � � � � � � �

� � � � � � � � � � � � Basic � 3,833 � � � 3,832 � � � 3,843 � � �

3,855 � � � 3,866 � Fully Diluted � 3,833 � � � 3,832 � � � 3,843 �

� � 3,855 � � � 3,866 � End-of-period common shares: � � � � � � �

� � � � � � � � � � � � Issued � 4,012 � � � 4,011 � � � 4,011 � �

� 4,010 � � � 4,009 � Treasury � 179 � � � 179 � � � 179 � � � 159

� � � 150 � � �

Quarter Ended � � � � (Dollars in Thousands,

Except Per Share Data)

6/30/2009 �

3/31/2009 �

12/31/2008 �

9/30/2008 �

6/30/2008 � � � � � � � � � �

� � � � � � � � �

Financial Condition Data: � � � � � � � �

� � � � � � � � � � �

General � � � � � � � � � � � � � � �

� � � � Total assets $ 667,861 � � $ 649,612 � � $ 652,803 � � $

632,244 � � $ 634,504 � Loans, net � 387,697 � � � 382,751 � � �

377,122 � � � 367,279 � � � 361,748 � Intangibles � 3,032 � � �

3,032 � � � 3,032 � � � 3,032 � � � 3,032 � Total deposits �

495,001 � � � 448,807 � � � 421,368 � � � 430,571 � � � 437,921 �

Noninterest-bearing � 74,509 � � � 71,963 � � � 76,035 � � � 73,586

� � � 79,908 � � � � � � � � � � � � � � � � � � � � Savings �

61,924 � � � 60,764 � � � 58,668 � � � 62,591 � � � 62,847 � NOW �

58,020 � � � 55,816 � � � 53,821 � � � 56,391 � � � 52,948 � Money

Market � 71,748 � � � 50,476 � � � 35,848 � � � 39,627 � � � 28,860

� Time Deposits � 228,800 � � � 209,788 � � � 196,996 � � � 198,376

� � � 213,358 � Total interest-bearing deposits � 420,492 � � �

376,844 � � � 345,333 � � � 356,985 � � � 358,013 � � � � � � � � �

� � � � � � � � � � � Core deposits* � 266,201 � � � 239,019 � � �

224,372 � � � 232,195 � � � 224,563 � Shareholders' equity � 61,371

� � � 58,584 � � � 61,027 � � � 59,561 � � � 64,522 � � � � � � � �

� � � � � � � � � � � �

Asset Quality � � � � � � � � � � �

� � � � � � � � � � � � � � � � � � � � � � � � � � �

Non-performing assets $ 2,667 � � $ 2,269 � � $ 1,735 � � $ 941 � �

$ 909 � Non-performing assets to total assets � 0.40 % � � 0.35 % �

� 0.27 % � � 0.15 % � � 0.14 % Allowance for loan losses � 4,377 �

� � 4,441 � � � 4,356 � � � 4,268 � � � 4,207 � Allowance for loan

losses to total loans � 1.12 % � � 1.15 % � � 1.14 % � � 1.15 % � �

1.15 %

Allowance for loan losses to

non-performing loans

� 164.12 % � � 195.72 % � � 251.07 % � � 453.56 % � � 462.82 %

Non-performing loans to total loans � 0.68 % � � 0.59 % � � 0.46 %

� � 0.25 % � � 0.25 % � � � � � � � � � � � � � � � � � � �

Capitalization � � � � � � � � � � � � � � � � � � � � � � �

� � � � � � � � � � � � � � � Shareholders' equity to total assets

� 9.19 % � � 9.02 % � � 9.35 % � � 9.42 % � � 10.17 % � * Core

deposits are defined as total deposits less time deposits � �

Reconciliation of GAAP and non-GAAP Financial Measures � � � �

Three Months Ended Six Months Ended June 30, June 30, 2009 2008

2009 2008 GAAP net income 832 2,057 1,671 4,188 Securities losses,

net of tax (1,376 ) (166 ) (2,940 ) (141 ) Non-GAAP operating

earnings 2,208 � 2,223 � 4,611 � 4,329 � � � Three Months Ended Six

Months Ended June 30, June 30, 2009 2008 2009 2008 Return on

average assets (ROA) 0.51 % 1.30 % 0.51 % 1.33 % Adjustment for net

after tax securities losses 0.83 % 0.11 % 0.90 % 0.05 % Non-GAAP

operating ROA 1.34 % 1.41 % 1.41 % 1.38 % � � Three Months Ended

Six Months Ended June 30, June 30, 2009 2008 2009 2008 Return on

average equity (ROE) 5.45 % 11.73 % 5.54 % 11.87 % Adjustment for

net after tax securities losses 9.01 % 0.95 % 9.76 % 0.40 %

Non-GAAP operating ROE 14.46 % 12.68 % 15.30 % 12.27 % � � Three

Months Ended Six Months Ended June 30, June 30, 2009 2008 2009 2008

Basic earnings per share (EPS) 0.22 0.53 0.44 1.08 Adjustment for

net after tax securities losses 0.36 � 0.04 � 0.76 � 0.04 �

Non-GAAP basic operating EPS 0.58 � 0.58 � 1.20 � 1.12 � � � Three

Months Ended Six Months Ended June 30, June 30, 2009 2008 2009 2008

Dilutive EPS 0.22 0.53 0.44 1.08 Adjustment for net after tax

securities losses 0.36 � 0.04 � 0.77 � 0.04 � Non-GAAP dilutive

operating EPS 0.58 � 0.57 � 1.20 � 1.12 � �

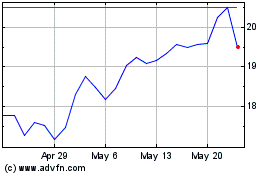

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

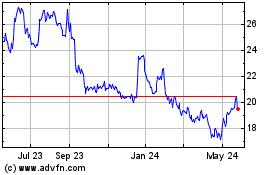

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024