Penns Woods Bancorp, Inc. (NASDAQ:PWOD) today reported net income

for the three and twelve months ended December 31, 2005 of

$2,560,000 and $10,983,000 compared to $2,780,000 and $11,083,000

for the same periods of 2004. Basic and dilutive earnings per share

for the three months ended December 31, 2005 were $0.65 as compared

to $0.70 for the three months ended December 31, 2004. The twelve

months ended December 31, 2005 had basic and diluted earnings per

share of $2.77 and $2.76 as compared to $2.78, basic and diluted,

for the twelve months ended December 31, 2004. Return on average

assets and return on average equity was 1.81% and 13.75% for the

three months ended December 31, 2005 as compared to 2.03% and

15.19% for the corresponding periods of 2004. The twelve months

ended December 31, 2005 earnings results correlate to a return on

average assets and return on average equity of 1.99% and 14.65% as

compared to 2.06% and 15.49% for the twelve months ended December

31, 2004. Net income from core operations ("operating earnings")

for the three and twelve months ended December 31, 2005, excluding

security gains, were $2,338,000 and $9,538,000, respectively as

compared to $2,357,000 and $9,647,000 for the same periods of 2004.

Operating earnings for the year ended December 31, 2005 were

impacted by additional bank-owned life insurance revenue of

$196,000 related to a death benefit received during the year.

Earnings for 2005 have also been impacted by the opening of our new

North Atherton Street branch in State College in May 2005. "Our

insurance and investment product sales company, The M Group,

continued to expand its market during 2005 by aligning with other

banks and credit unions to serve the needs of their customers. The

market area growth coupled with strong customer service has allowed

the company to increase profitability since joining the Penns

Woods' family. In fact, The M Group reported record levels of

revenue and net income for the twelve month period. We are pleased

with the results of The M Group and look forward to the bright

future ahead," commented Ronald A. Walko, President and Chief

Executive Officer of Penns Woods Bancorp, Inc. The net interest

margin decreased for the twelve months ended December 31, 2005 to

4.49% from 4.54% for the corresponding period of 2004. The decrease

is due to several factors including a 40 basis point rise in the

cost of time deposits in addition to a 120 basis point increase in

the cost of short-term borrowings. The increase in the cost of time

deposits and borrowings is directly related to the continued cycle

of rate increases by the Federal Open Market Committee.

Counteracting this increased cost was a shift in the investment

portfolio to tax-exempt bonds that led to a tax equivalent yield on

the investment portfolio of 5.55% for the twelve months ended

December 31, 2005 or an increase over 2004 results of 46 basis

points. Total assets grew $22,090,000 or 4.0% to $568,793,000 at

December 31, 2005. A continued emphasis on quality loan growth has

led to an increase in the gross loan portfolio of $13,933,000 from

December 31, 2004 to 2005. In addition to the loan growth, a

significant investment in low-income housing was undertaken during

2005 as part of the company's investment in the community. "During

the fourth quarter, we began preparing for the addition of a new

branch in Montoursville during 2006. The branch will allow us to

expand our presence in Lycoming County while increasing the

convenience of banking with Jersey Shore State Bank for our

existing customers located east of Williamsport. During the fourth

quarter we evaluated and reorganized our product and service

support departments. The realignment will ultimately allow the

organization to improve efficiency while at the same time preparing

our organization to better serve our customer's needs in terms of

new product development and support and delivery such as cash

management services for our small business customers," stated Mr.

Walko. Shareholders' equity increased $836,000 to $74,001,000 at

December 31, 2005 as earnings outpaced a decline in accumulated

other comprehensive income of $3,481,000. The decrease in

accumulated comprehensive income is a reflection of a decline in

market value, unrealized gains and losses, for our investment

portfolio at December 31, 2005 as compared to December 31, 2004.

The current level of shareholders' equity equates to a book value

per share of $18.61 as compared to $18.36 at December 31, 2004.

During the three months ended December 31, 2005 a dividend of $0.41

per share was paid to shareholders in addition to a 6 for 5 stock

split that occurred in December of this year prior to the cash

dividend payment. The dividend represented a 21% increase over the

regular dividend paid during the comparable period of 2004 and an

increase of 5% over the third quarter 2005 dividend. "During 2005

we strategically set out to increase shareholder value, in part, by

providing a cash dividend for the year that would result in a

return on investment at or exceeding four percent. Our continued

strong earnings performance to date made it possible to accomplish

this. Total cash dividends for the year increased from $1.47 per

share in 2004 to $1.56 in 2005," commented Mr. Walko. The range of

closing prices for Penns Woods Bancorp, Inc. "PWOD" stock was

between $36.67 and $39.76 during the three months ended December

31, 2005 and between $36.67 and $41.67 for the year ended December

31, 2005. Penns Woods Bancorp, Inc. is the parent company of Jersey

Shore State Bank, which operates twelve branch offices providing

financial services in Lycoming, Clinton and Centre Counties.

Investment and insurance products are offered through the bank's

subsidiary, The M Group, Inc. D/B/A The Comprehensive Financial

Group. NOTE: This press release contains financial information

determined by methods other than in accordance with U.S. Generally

Accepted Accounting Principles ("GAAP"). Management uses the

non-GAAP measure of net income from core operations in its analysis

of the company's performance. This measure, as used by PWOD,

adjusts net income determined in accordance with GAAP to exclude

the effects of special items, including significant gains or losses

that are unusual in nature. Because certain of these items and

their impact on PWOD's performance are difficult to predict,

management believes presentation of financial measures excluding

the impact of such items provides useful supplemental information

in evaluating the operating results of PWOD's core businesses.

These disclosures should not be viewed as a substitute for net

income determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented

by other companies. This press release may contain certain

"forward-looking statements" including statements concerning plans,

objectives, future events or performance and assumptions and other

statements, which are other than statements of historical fact.

PWOD cautions readers that the following important factors, among

others, may have affected and could in the future affect actual

results and could cause actual results for subsequent periods to

differ materially from those expressed in any forward-looking

statement made by or on behalf of PWOD herein: (i) the effect of

changes in laws and regulations, including federal and state

banking laws and regulations, and the associated costs of

compliance with such laws and regulations either currently or in

the future as applicable; (ii) the effect of changes in accounting

policies and practices, as may be adopted by the regulatory

agencies as well as by the Financial Accounting Standards Board, or

of changes in the Company's organization, compensation and benefit

plans; (iii) the effect on PWOD's competitive position within its

market area of the increasing consolidation within the banking and

financial services industries, including the increased competition

from larger regional and out-of-state banking organizations as well

as non-bank providers of various financial services; (iv) the

effect of changes in interest rates; and (v) the effect of changes

in the business cycle and downturns in the local, regional or

national economies. Previous press releases and additional

information can be obtained from the company's website at

www.jssb.com. THIS INFORMATION IS SUBJECT TO YEAR-END AUDIT

ADJUSTMENT -0- *T PENNS WOODS BANCORP, INC. CONSOLIDATED BALANCE

SHEET (UNAUDITED) (In Thousands, Except Share Data) December 31,

December 31, 2005 2004 % Change ------------ ------------ ---------

ASSETS: Noninterest-bearing balances $14,065 $12,602 11.6%

Interest-bearing deposits in other financial institutions 25 24

4.2% ------------ ------------ --------- Total cash and cash

equivalents 14,090 12,626 11.6% Investment securities, available

for sale, at fair value 187,018 184,163 1.6% Investment securities

held to maturity (fair value of $238 and $561) 265 558 -52.5% Loans

held for sale 3,545 4,624 -23.3% Loans, net of unearned discount of

$1,062 and $1,096 338,438 324,505 4.3% Less: Allowance for loan and

lease losses 3,679 3,338 10.2% ------------ ------------ ---------

Loans, net 334,759 321,167 4.2% Premises and equipment, net 6,409

4,882 31.3% Accrued interest receivable 2,828 2,246 25.9%

Bank-owned life insurance 10,718 10,976 -2.4% Goodwill 3,032 3,032

0.0% Other assets 6,129 2,429 152.3% ------------ ------------

--------- TOTAL ASSETS $568,793 $546,703 4.0% ============

============ ========= LIABILITIES: Interest-bearing deposits

$281,150 $282,786 -0.6% Noninterest-bearing deposits 71,379 74,050

-3.6% ------------ ------------ --------- Total deposits 352,529

356,836 -1.2% Short-term borrowings 54,003 36,475 48.1% Long-term

borrowings, Federal Home Loan Bank(FHLB) 84,478 75,878 11.3%

Accrued interest payable 1,108 850 30.4% Other liabilities 2,674

3,499 -23.6% ------------ ------------ --------- TOTAL LIABILITIES

494,792 473,538 4.5% ------------ ------------ ---------

SHAREHOLDERS' EQUITY: Common stock, par value $8.33, 10,000,000

shares authorized; 4,002,159 and 3,998,204 shares issued 33,351

33,318 0.1% Additional paid-in capital 17,772 17,700 0.4% Retained

earnings 23,020 18,262 26.1% Accumulated other comprehensive gain

850 4,331 -80.4% Less: Treasury stock at cost, 26,372 and 12,372

shares (992) (446) 122.4% ------------ ------------ --------- TOTAL

SHAREHOLDERS' EQUITY 74,001 73,165 1.1% ------------ ------------

--------- TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $568,793

$546,703 4.0% ============ ============ ========= Share data has

been adjusted for a 6 for 5 stock split that occurred in 2005.

PENNS WOODS BANCORP, INC. CONSOLIDATED STATEMENT OF INCOME

(UNAUDITED) (In Thousands, Except Per Share Data) Three Months

Ended December 31, ------------------------------- 2005 2004 %

Change ---------- ---------- --------- INTEREST AND DIVIDEND

INCOME: Loans including fees $6,051 $5,785 4.6% Investment

Securities: Taxable 931 1,412 -34.1% Tax-exempt 977 575 69.9%

Dividend 305 392 -22.2% ---------- ---------- --------- TOTAL

INTEREST AND DIVIDEND INCOME 8,264 8,164 1.2% INTEREST EXPENSE:

Deposits 1,623 1,231 31.8% Short-term borrowings 386 172 124.4%

Long-term borrowings 965 870 10.9% ---------- ---------- ---------

TOTAL INTEREST EXPENSE 2,974 2,273 30.8% ---------- ----------

--------- NET INTEREST INCOME 5,290 5,891 -10.2% PROVISION FOR LOAN

LOSSES 180 150 20.0% ---------- ---------- --------- NET INTEREST

INCOME AFTER PROVISION FOR LOAN LOSSES 5,110 5,741 -11.0%

---------- ---------- --------- NON-INTEREST INCOME: Service

charges 625 486 28.6% Securities gains, net 336 641 -47.6%

Bank-owned life insurance 93 24 287.5% Insurance commissions 525

486 8.0% Other operating income 290 270 7.4% ---------- ----------

--------- TOTAL NON-INTEREST INCOME 1,869 1,907 -2.0% NON-INTEREST

EXPENSES: Salaries and employee benefits 1,997 2,124 -6.0%

Occupancy expense, net 251 255 -1.6% Furniture and equipment

expense 256 295 -13.2% Pennsylvania shares tax expense 132 131 0.8%

Other operating expenses 1,148 1,077 6.6% ---------- ----------

--------- TOTAL NON-INTEREST EXPENSES 3,784 3,882 -2.5% ----------

---------- --------- INCOME BEFORE INCOME TAX PROVISION 3,195 3,766

-15.2% INCOME TAX PROVISION 635 986 -35.6% ---------- ----------

--------- NET INCOME $2,560 $2,780 -7.9% ========== ==========

========= EARNINGS PER SHARE - BASIC $0.65 $0.70 -7.1% ==========

========== ========= EARNINGS PER SHARE - DILUTED $0.65 $0.70 -7.1%

========== ========== ========= WEIGHTED AVERAGE SHARES

OUTSTANDING- BASIC 3,964,709 3,983,120 -0.5% ========== ==========

========= WEIGHTED AVERAGE SHARES OUTSTANDING- DILUTED 3,966,285

3,987,323 -0.5% ========== ========== ========= DIVIDENDS PER SHARE

$0.41 $0.59 -30.7% ========== ========== ========= Share data has

been adjusted for a 6 for 5 stock split that occurred in 2005. (In

Thousands, Except Per Share Data) Twelve Months Ended December 31,

---------- ---------- --------- 2005 2004 % Change ----------

---------- --------- INTEREST AND DIVIDEND INCOME: Loans including

fees $23,121 $21,363 8.2% Investment Securities: Taxable 4,376

6,690 -34.6% Tax-exempt 3,223 1,708 88.7% Dividend 1,178 1,186

-0.7% ---------- ---------- --------- TOTAL INTEREST AND DIVIDEND

INCOME 31,898 30,947 3.1% INTEREST EXPENSE: Deposits 5,774 4,775

20.9% Short-term borrowings 931 539 72.7% Long-term borrowings

3,676 3,454 6.4% ---------- ---------- --------- TOTAL INTEREST

EXPENSE 10,381 8,768 18.4% ---------- ---------- --------- NET

INTEREST INCOME 21,517 22,179 -3.0% PROVISION FOR LOAN LOSSES 720

465 54.8% ---------- ---------- --------- NET INTEREST INCOME AFTER

PROVISION FOR LOAN LOSSES 20,797 21,714 -4.2% ---------- ----------

--------- NON-INTEREST INCOME: Service charges 2,228 1,983 12.4%

Securities gains, net 2,190 2,176 0.6% Bank-owned life insurance

568 294 93.2% Insurance commissions 2,327 2,282 2.0% Other

operating income 1,254 1,214 3.3% ---------- ---------- ---------

TOTAL NON-INTEREST INCOME 8,567 7,949 7.8% NON-INTEREST EXPENSES:

Salaries and employee benefits 8,320 7,937 4.8% Occupancy expense,

net 1,089 959 13.6% Furniture and equipment expense 973 1,016 -4.2%

Pennsylvania shares tax expense 549 508 8.1% Other operating

expenses 4,183 3,897 7.3% ---------- ---------- --------- TOTAL

NON-INTEREST EXPENSES 15,114 14,317 5.6% ---------- ----------

--------- INCOME BEFORE INCOME TAX PROVISION 14,250 15,346 -7.1%

INCOME TAX PROVISION 3,267 4,263 -23.4% ---------- ----------

--------- NET INCOME $10,983 $11,083 -0.9% ========== ==========

========= EARNINGS PER SHARE - BASIC $2.77 $2.78 -0.2% ==========

========== ========= EARNINGS PER SHARE - DILUTED $2.76 $2.78 -0.5%

========== ========== ========= WEIGHTED AVERAGE SHARES

OUTSTANDING- BASIC 3,971,926 3,990,008 -0.5% ========== ==========

========= WEIGHTED AVERAGE SHARES OUTSTANDING- DILUTED 3,974,055

3,994,352 -0.5% ========== ========== ========= DIVIDENDS PER SHARE

$1.56 $1.47 6.4% ========== ========== ========= Share data has

been adjusted for a 6 for 5 stock split that occurred in 2005.

PENNS WOODS BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES For

the Three Months Ended

----------------------------------------------------- December 31,

2005 December 31, 2004 --------------------------

-------------------------- Average Average Average Average Balance

Interest Rate Balance Interest Rate --------- -------- -------

--------- -------- ------- ASSETS: Tax-exempt loans $7,981 $121

6.01% $1,282 $20 6.19% All other loans 331,159 5,971 7.15% 322,550

5,772 7.10% --------- -------- ------- --------- -------- -------

Total loans 339,140 6,092 7.13% 323,832 5,792 7.10% ---------

-------- ------- --------- -------- ------- Taxable securities

99,063 1,236 4.99% 146,779 1,804 4.92% Tax-exempt securities 89,707

1,480 6.60% 47,469 871 7.34% --------- -------- ------- ---------

-------- ------- Total securities 188,770 2,716 5.76% 194,248 2,675

5.51% --------- -------- ------- --------- -------- ------- Total

interest- earning assets 527,910 8,808 6.64% 518,080 8,467 6.50%

-------- ------- -------- ------- Other assets 37,850 29,623

--------- --------- TOTAL ASSETS: $565,760 $547,703 =========

========= LIABILITIES AND SHAREHOLDERS' EQUITY: Savings $61,609 118

0.76% $69,855 146 0.83% Super Now deposits 48,016 114 0.94% 57,138

115 0.80% Money market deposits 26,110 106 1.61% 34,865 100 1.14%

Time deposits 153,015 1,285 3.33% 130,478 870 2.65% ---------

-------- ------- --------- -------- ------- Total Deposits 288,750

1,623 2.23% 292,336 1,231 1.67% Short-term borrowings 42,501 386

3.60% 32,535 172 2.10% Long-term borrowings 84,478 965 4.53% 75,878

870 4.55% --------- -------- ------- --------- -------- -------

Total borrowings 126,979 1,351 4.22% 108,413 1,042 3.81% ---------

-------- ------- --------- -------- ------- Total interest- bearing

liabilities 415,729 2,974 2.84% 400,749 2,273 2.25% --------

------- -------- ------- Demand deposits 71,049 68,985 Other

liabilities 4,525 4,756 Shareholders' equity 74,457 73,213

--------- --------- TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

$565,760 $547,703 ========= ========= Interest rate spread 3.80%

4.25% ======= ======= Net interest income/margin $5,834 4.40%

$6,194 4.76% ======== ======= ======== ======= For the Three Months

Ended December 31, ----------------- 2005 2004 -------- --------

Total interest income $8,264 $8,164 Total interest expense 2,974

2,273 -------- -------- Net interest income $5,290 $5,891 Tax

equivalent adjustment 544 303 -------- -------- Net interest income

(fully taxable equivalent) $5,834 $6,194 ======== ======== PENNS

WOODS BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES For the

Twelve Months Ended

------------------------------------------------------ December 31,

2005 December 31, 2004 ---------------------------

-------------------------- Average Average Average Average Balance

Interest Rate Balance Interest Rate --------- -------- --------

--------- -------- ------- ASSETS: Tax-exempt loans $5,370 $307

5.72% $1,359 $82 6.03% All other loans 325,177 22,919 7.05% 301,248

21,309 7.07% --------- -------- -------- --------- -------- -------

Total loans 330,547 23,226 7.03% 302,607 21,391 7.07% ---------

-------- -------- --------- -------- ------- Taxable securities

115,041 5,554 4.83% 170,876 7,877 4.61% Tax-exempt securities

72,892 4,882 6.70% 34,665 2,586 7.46% --------- -------- --------

--------- -------- ------- Total securities 187,933 10,436 5.55%

205,541 10,463 5.09% --------- -------- -------- --------- --------

------- Total interest- earning assets 518,480 33,662 6.49% 508,148

31,854 6.27% -------- -------- -------- ------- Other assets 34,181

29,498 --------- --------- TOTAL ASSETS: $552,661 $537,646

========= ========= LIABILITIES AND SHAREHOLDERS' EQUITY: Savings

$64,795 500 0.77% $69,796 578 0.83% Super Now deposits 50,756 438

0.86% 54,690 391 0.71% Money market deposits 29,317 412 1.41%

35,164 392 1.11% Time deposits 146,391 4,424 3.02% 130,340 3,414

2.62% --------- -------- -------- --------- -------- ------- Total

Deposits 291,259 5,774 1.98% 289,990 4,775 1.65% Short-term

borrowings 32,113 931 2.90% 31,653 539 1.70% Long-term borrowings

80,820 3,676 4.55% 75,727 3,454 4.56% --------- -------- --------

--------- -------- ------- Total borrowings 112,933 4,607 4.08%

107,380 3,993 3.72% Total interest- bearing liabilities 404,192

10,381 2.57% 397,370 8,768 2.21% -------- -------- -------- -------

Demand deposits 69,457 64,434 Other liabilities 4,058 4,295

Shareholders' equity 74,954 71,547 --------- --------- TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $552,661 $537,646 =========

========= Interest rate spread 3.92% 4.06% ======== ======= Net

interest income/margin $23,281 4.49% $23,086 4.54% ========

======== ======== ======= For the Twelve Months Ended December 31,

----------------- 2005 2004 -------- -------- Total interest income

$31,898 $30,947 Total interest expense 10,381 8,768 --------

-------- Net interest income $21,517 $22,179 Tax equivalent

adjustment 1,764 907 -------- -------- Net interest income (fully

taxable equivalent) $23,281 $23,086 ======== ======== Quarter Ended

(Dollars in Thousands, Except Per Share Data) 12/31/2005 9/30/2005

6/30/2005 3/31/2005 12/31/2004 ------------- ----------- ----------

---------- ---------- ----------- Operating Data Net income $2,560

$2,948 $2,760 $2,715 $2,780 ----------- ---------- ----------

---------- ----------- Net interest income 5,290 5,412 5,413 5,402

5,891 ----------- ---------- ---------- ---------- -----------

Provision for loan losses 180 180 180 180 150 -----------

---------- ---------- ---------- ----------- Net security gains 336

556 687 611 641 ----------- ---------- ---------- ----------

----------- Non-interest income, excluding net security gains 1,533

1,728 1,610 1,506 1,266 ----------- ---------- ----------

---------- ----------- Non-interest expense 3,784 3,822 3,887 3,621

3,882 ----------- ---------- ---------- ---------- -----------

Performance Statistics Net interest margin 4.40% 4.49% 4.58% 4.57%

4.84% ----------- ---------- ---------- ---------- -----------

Annualized return on average assets 1.81% 2.12% 2.03% 2.01% 2.03%

----------- ---------- ---------- ---------- ----------- Annualized

return on average equity 13.75% 16.54% 14.81% 14.56% 15.10%

----------- ---------- ---------- ---------- ----------- Annualized

net loan charge-offs to avg loans -0.01% 0.22% 0.11% 0.15% 0.09%

----------- ---------- ---------- ---------- ----------- Net

charge- offs (recoveries) (7) 180 87 119 75 ----------- ----------

---------- ---------- ----------- Efficiency ratio 55.5 53.5 55.4

52.4 54.2 ----------- ---------- ---------- ---------- -----------

Per Share Data Basic earnings per share $0.65 $0.74 $0.69 $0.68

$0.70 ----------- ---------- ---------- ---------- -----------

Diluted earnings per share 0.65 0.74 0.69 0.68 0.70 -----------

---------- ---------- ---------- ----------- Dividend declared per

share 0.41 0.39 0.38 0.38 0.59 ----------- ---------- ----------

---------- ----------- Book value 18.61 18.69 19.02 18.04 18.36

----------- ---------- ---------- ---------- ----------- Common

stock price: High 39.76 38.30 41.58 41.67 41.77 -----------

---------- ---------- ---------- ----------- Low 36.67 36.76 37.08

38.58 37.72 ----------- ---------- ---------- ----------

----------- Close 38.87 37.50 38.18 40.84 40.00 -----------

---------- ---------- ---------- ----------- Weighted average

common shares: Basic 3,965 3,973 3,974 3,973 3,983 -----------

---------- ---------- ---------- ----------- Fully Diluted 3,966

3,974 3,977 3,976 3,988 ----------- ---------- ----------

---------- ----------- End-of-period common shares: Issued 4,002

3,998 3,998 3,998 3,998 ----------- ---------- ----------

---------- ----------- Treasury 26 16 12 12 12 -----------

---------- ---------- ---------- ----------- Share data has been

adjusted for a 6 for 5 stock split that occurred in 2005. Quarter

Ended (Dollars in Thousands, Except Per Share Data) 12/31/2005

9/30/2005 6/30/2005 3/31/2005 12/31/2004 ---------- ----------

---------- ---------- ---------- Financial Condition Data: General

Total assets $568,793 $570,419 $573,593 $543,993 $546,703

---------- ---------- ---------- ---------- ---------- Loans, net

334,759 327,159 324,378 319,741 321,167 ---------- ----------

---------- ---------- ---------- Intangibles 3,032 3,032 3,032

3,032 3,032 ---------- ---------- ---------- ---------- ----------

Total deposits 352,529 363,190 382,274 354,301 356,836 ----------

---------- ---------- ---------- ---------- Noninterest- bearing

71,379 72,053 72,087 72,708 74,050 ---------- ---------- ----------

---------- ---------- Savings 61,906 67,858 70,073 69,097 69,807

---------- ---------- ---------- ---------- ---------- NOW 48,678

49,064 54,977 51,831 55,211 ---------- ---------- ----------

---------- ---------- Money Market 24,446 26,757 29,745 31,310

32,377 ---------- ---------- ---------- ---------- ---------- Time

Deposits 146,120 147,458 155,392 129,355 125,391 ----------

---------- ---------- ---------- ---------- Total interest- bearing

deposits 281,150 291,137 310,187 281,593 282,786 ----------

---------- ---------- ---------- ---------- Core deposits* 206,409

215,732 226,882 224,946 231,445 ---------- ---------- ----------

---------- ---------- Shareholders' equity 74,001 74,490 75,795

71,911 73,165 ---------- ---------- ---------- ----------

---------- Asset Quality Non-performing assets $602 $1,056 $1,721

$1,343 $1,725 ---------- ---------- ---------- ----------

---------- Non-performing assets to total assets 0.11% 0.19% 0.30%

0.25% 0.32% ---------- ---------- ---------- ---------- ----------

Allowance for loan losses 3,679 3,492 3,492 3,399 3,338 ----------

---------- ---------- ---------- ---------- Allowance for loan

losses to total loans 1.09% 1.06% 1.07% 1.05% 1.03% ----------

---------- ---------- ---------- ---------- Allowance for loan

losses to non- performing loans 611.13% 330.68% 202.91% 253.09%

193.51% ---------- ---------- ---------- ---------- ----------

Non-performing loans to total loans 0.18% 0.32% 0.52% 0.42% 0.53%

---------- ---------- ---------- ---------- ----------

Capitalization Shareholders' equity to total assets 13.01% 13.06%

13.21% 13.22% 13.38% ---------- ---------- ---------- ----------

---------- * Core deposits are defined as total deposits less time

deposits *T

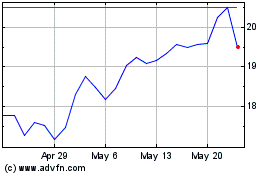

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

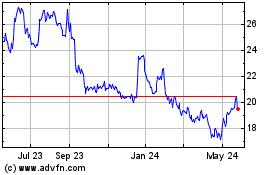

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024