UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION STATEMENT

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☑

|

Definitive Information Statement

|

PATRIOT NATIONAL BANCORP, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which investment applies:

|

|

|

(2)

|

Aggregate number of securities to which investment applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

August 24, 2020

Dear Patriot National Bancorp Shareholder,

We would like to take this opportunity to thank you for your investment in Patriot National Bancorp (NASDAQ: PNBK) on behalf of the Board of Directors and the staff at Patriot. Enclosed within is the Bank’s annual financial report for the fiscal year of 2019.

The recent six-month period has been extremely challenging within our region and across the nation as a result of the COVID-19 pandemic. The lives of many have been significantly altered, which includes our staff, loyal customers and small business owners. Throughout this period, Patriot strived to fulfill our mission as a community bank and worked hard to accommodate and service our customers, while taking appropriate safety precautions to protect our staff and customers. While we expect that these events will have a lasting effect into 2021, our team continues to maintain its business objectives and provide the highest level of service possible to our customers.

For the past several years, Patriot has been investing and working diligently to enhance its technology platform with new product innovations to stay current with the evolving changes in banking. The pandemic put to test many of these online and remote innovations. For the first half of 2020, mobile deposits were up 163%, mobile app banking was up 31%, monthly average log-ins rose 16% and the number of our customers totally new to digital banking services rose by 26%.

The safety of our staff and customers has been paramount. We were safely able to keep all branches operational, with customers directed to our non-contact ATMs and Live Banker ATMs. In-person meetings with customers have continued via scheduled appointments and staff have been available to handle all banking matters. Our expanded customer call center staff has served customers’ needs and met significantly higher transaction volumes from Live Banker ATMs.

Despite the economic impact of the pandemic, in the first half of 2020, Patriot remained focused on balance sheet management and has seen modest growth in earning and total assets. Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 reflects total assets of $979.5 million. At the same time, the Bank’s net loan portfolio ended the quarter at $781.4 million, while deposits were $783.1 million.

For its full-year 2019, the Bank reported a net loss of $2.8 million or $0.72 per share, compared with net income of $3.2 million or $0.82 per share in 2018. Despite the strong metrics reflected above, this was primarily as a result of an additional and significant provision for loan loss related to a single commercial loan and is not reflective of the quality of the Bank’s portfolio or methodology with respect to credit losses.

The Board, after an extensive search process led by the Chairman and two of our Directors, successfully landed a seasoned banking veteran, Robert G. Russell, Jr., to join Patriot as its full-time President and CEO. Mr. Russell brings more than 30 years of community banking experience to Patriot. He previously served as Chief Operating Officer of Millington Bank of Morris and Somerset Counties of New Jersey, and before that as President and Chief Executive Officer of NJM Bank, leading both institutions to significant growth and increases in profitability. Mr. Russell joined Patriot on July 20, 2020 and is focused on adding value to Patriot and leading the organization forward.

Also, in July, Patriot acquired over $50 million of pre-paid debit card deposits from a prominent national provider. We believe that this acquisition will be a significant boost to developing our debit card business platform, while decreasing the Bank’s overall costs of funds. Management and the Board view this acquisition as an excellent platform to further develop additional relationships in this industry and to drive additional revenue streams and lower cost funding.

Since the Bank’s recapitalization in 2010, Patriot has expanded its footprint and now serves communities covering New Haven, Connecticut to Scarsdale, New York.

Like all other banking institutions across the nation, Patriot has continued to support and address the needs of our borrower base, to help them access certain relief provided under the Coronavirus Aid, Relief and Economic Security (“CARES”) Act. This has resulted in requests for payment relief on loan balances totaling approximately $218.2 million, predominately commercial real estate loans and commercial industrial loans. The Bank will continue to work with its borrowers to the extent possible towards a satisfactory outcome for the Bank.

As the organization turns it focus towards the remainder of 2020 and beyond, Patriot is encouraged by the continued loyalty from the communities we serve and the opportunities that are there for us to act upon. The organization remains focused on growing our core businesses efficiently and effectively, with the guiding principle of conservative but profitable operations. As we go forward, we will continue to focus our attention on small business programs, which we believe will be one of the leading factors of economic growth and recovery, and continued development of other business lines, such as our commercial portfolio and our pre-paid debit card partnerships.

We look forward to your participation at our Annual Meeting to be held virtually at 10 a.m. Eastern Time on September 23, 2020.

Sincerely,

|

|

|

Michael A. Carrazza

Chairman

|

Robert G. Russell, Jr.

President and Chief Executive Officer

|

PATRIOT NATIONAL BANCORP, INC.

900 Bedford Street

Stamford, Connecticut 06901

NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Patriot National Bancorp, Inc.:

You are cordially invited to attend the 2020 Annual Meeting of Shareholders (the “Annual Meeting”) of Patriot National Bancorp, Inc., a Connecticut corporation (the “Company”), which will be held on September 23, 2020, starting at 10:00 a.m., Eastern Time, via teleconference by dialing 719-359-9722; access code: 885354. As part of our precautions regarding the coronavirus (or COVID-19), the Annual Meeting will be held solely in the format of remote communication via teleconference.

The Annual Meeting will be held for the following purposes:

|

|

(1)

|

To elect six directors to serve until our Annual Meeting of Shareholders to be held in 2021 and until their successors are elected;

|

|

|

(2)

|

To approve and ratify the appointment of RSM US LLP to serve as the independent registered public accounting firm for Patriot National Bancorp, Inc. for the 2020 fiscal year; and

|

|

|

(3)

|

To transact any other business which may properly come before the meeting.

|

Only shareholders of record of outstanding shares of common stock of the Company at the close of business on August 19, 2020 are entitled to notice of, and to vote, at the Annual Meeting or any adjournment or postponement thereof.

This Notice of 2020 Annual Meeting of Shareholders and the attached Information Statement dated August 24, 2020 should be read in conjunction with the Company’s Annual Report on Form 10-K, as amended, for the year ended December 31, 2019. Collectively, these documents contain all of the information and disclosures required in connection with the 2020 Annual Meeting of Shareholders. Copies of all these materials can be found on the Company’s website at www.bankpatriot.com.

By Order of the Board of Directors,

|

|

|

Michael A. Carrazza

Chairman

|

Robert G. Russell, Jr.

President and Chief Executive Officer

|

August 24, 2020

INFORMATION STATEMENT

For the Annual Meeting of Shareholders to be held on

September 23, 2020

at 10:00 a.m.

via teleconference by dialing 719-359-9722; access code: 885354

As part of our precautions regarding the coronavirus (or COVID-19), the Annual Meeting will be held solely in the format of remote communication via teleconference.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

INTRODUCTION

This Information Statement is being furnished to the shareholders of Patriot National Bancorp, Inc., a Connecticut corporation (“we,” “us,” “our,” the “Company” or “Patriot”). We are the bank holding company of Patriot Bank, N.A. (the “Bank”). This Information Statement relates to our resolutions to (a) elect six directors to serve until our next annual meeting, (b) approve and ratify the appointment of RSM USA LLP as our independent registered public accounting firm for the 2020 fiscal year, and (c) transact any other business which may properly come before the meeting. These resolutions have been adopted by our Board of Directors through a unanimous written consent prior to the 2020 Annual Meeting of Shareholders (the “Annual Meeting”) in accordance with statutes governing Connecticut corporations (the “Connecticut Law”) and will be presented to an annual meeting of our shareholders to be held on September 23, 2020, as outlined in the Notice of Annual Meeting that accompanies this Information Statement.

Our majority shareholder, PNBK Holdings LLC (“Holdings”), which beneficially owns approximately 64.15% of our outstanding voting securities, has indicated that it will vote in favor of these resolutions. Holdings is managed by PNBK Sponsor, LLC (“Sponsor”). Michael A. Carrazza, the Chairman of our Board, is the manager of Sponsor. No other votes are required or necessary to elect directors for the coming year or to retain RSM US LLP as our independent registered public accounting firm for the 2020 fiscal year.

The election of directors and the retention of RSM US LLP as our independent registered public accounting firm are outlined below.

QUORUM AND VOTING REQUIREMENTS

Quorum Requirement

A majority of our outstanding common stock, $0.01 par value per share (the “Common Stock”), represented in person or by proxy, shall constitute a quorum at any meeting of shareholders, unless otherwise provided by law. If less than a quorum is represented at a meeting, a majority of the shares so represented may adjourn the meeting without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified.

Vote Required

If a quorum is present, action by the shareholders on the retention of RSM US LLP as our independent registered public accounting firm is approved if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action. Each outstanding share shall be entitled to one vote on each matter submitted to a vote at a meeting of shareholders.

In the election of directors, shareholders may cumulate their votes. Cumulative voting allows a shareholder to allocate among the director nominees, as the shareholder sees fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares held by the shareholder. For example, if a shareholder owns 100 shares of stock, and there are six directors to be elected at the Annual Meeting, a shareholder may allocate 600 “for” votes (six multiplied by 100) among as few or as many of the six nominees to be voted on at the Annual Meeting as the shareholder chooses. Cumulative voting applies only to the election of directors. For all other matters, each share of Common Stock outstanding as of the close of business on the Record Date (as defined below), is entitled to one vote.

In determining the number of votes cast for or against the election of directors or the retention of RSM US LLP as our independent registered public accounting firm, shares abstaining from voting will not be treated as a vote for or against the proposal or election.

Our majority shareholder has indicated that it will vote in favor of the election of directors and the retention of RSM US LLP as our independent registered public accounting firm. No other votes are required to pass such resolutions. We are not asking shareholders for a proxy, and shareholders are requested not to send us a proxy.

How to Vote at the Annual Meeting

Although no other votes are required to pass the resolutions at the Annual Meeting, shareholders as of the Record Date (as defined below) may continue to submit their votes during the period from the start to the adjournment of the Annual Meeting directly to the Company by e-mail to khoekman@bankpatriot.com.

Additional instructions regarding how to submit votes will be provided at the Annual Meeting.

Dissenters’ Right of Appraisal

Our shareholders do not have dissenters’ rights of appraisal with respect to the proposals to be considered at the Annual Meeting.

Other Business

At the date hereof, our management has no knowledge of any business other than that described in the notice for the Annual Meeting that will be presented for consideration at the Annual Meeting.

BENEFICIAL OWNERSHIP AND OTHER MATTERS

Record Date

The record date for determining the shareholders entitled to vote at the Annual Meeting was the close of business on August 19, 2020 (the “Record Date”), at which time we had issued and outstanding 3,962,436 shares of Common Stock which were owned by 278 shareholders of record. The shares of Common Stock constitute the only outstanding voting securities of the Company entitled to be voted at the Annual Meeting.

Beneficial Ownership

The table below provides certain information about beneficial ownership of Common Stock of the Company as of the Record Date with respect to: (i) each person, or group of affiliated persons, who is known to the Company to own more than five percent (5%) of Company’s Common Stock; (ii) each of the Company’s directors; (iii) each of the Company’s executive officers; and (iv) all of the Company’s directors and executive officers as a group.

Except as otherwise noted, to the knowledge of the Company, all persons listed below have sole voting and dispositive power with respect to all shares of Common Stock they beneficially own, except to the extent authority is shared by spouses under applicable law. Applicable percentage ownership is based on 3,962,436 shares of Common Stock outstanding as of the Record Date. In computing the number of shares of Common Stock beneficially owned by a person and applicable percentage of ownership of that person, we deemed outstanding shares of Common Stock subject to options held by that person that are currently exercisable or exercisable within sixty (60) days of the Record Date. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

Unless otherwise indicated, the address of each shareholder is in care of Patriot National Bancorp, Inc., 900 Bedford Street, Stamford, CT 06901.

|

Name of Beneficial Owner

|

|

Shares of Common

Stock Beneficially

Owned

|

|

|

|

Percent of

Class

|

|

|

Michael A. Carrazza

|

|

|

2,541,781

|

|

(1)

|

|

|

64.15

|

%

|

|

Robert G. Russell, Jr.

|

|

|

0

|

|

|

|

|

0

|

|

|

Joseph D. Perillo

|

|

|

534

|

|

|

|

|

*

|

|

|

Frederick K. Staudmyer

|

|

|

2,659

|

|

|

|

|

*

|

|

|

Judith P. Corprew

|

|

|

1,359

|

|

|

|

|

*

|

|

|

David W. Christiansen

|

|

|

183

|

|

|

|

|

*

|

|

|

Edward N. Constantino

|

|

|

8,805

|

|

(2)

|

|

|

*

|

|

|

Raymond Smyth

|

|

|

9,987

|

|

(3)

|

|

|

*

|

|

|

Emile Van den Bol

|

|

|

26,436

|

|

|

|

|

*

|

|

|

Michael J. Weinbaum

|

|

|

12,867

|

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Directors and Executive Officers

|

|

|

2,604,611

|

|

|

|

|

65.73

|

%

|

|

*

|

Less than one percent (1%)

|

|

|

|

|

(1)

|

Includes 2,520,000 shares held by PNBK Holdings. Mr. Carrazza is the manager of PNBK Sponsor, LLC, which is the manager of PNBK Holdings; therefore, Mr. Carrazza may be deemed to indirectly beneficially own the shares directly owned by PNBK Holdings. PNBK Holdings has sole voting and dispositive power with regard to all 2,520,000 shares; Sponsor and Carrazza have shared voting and shared dispositive power of said shares. Also includes 7,330 shares held by Solaia Capital Management Profit Sharing Plan for the benefit of Mr. Carrazza and 10,951 vested shares directly owned by Mr. Carrazza, with regard to which Mr. Carrazza has sole voting and dispositive power.

|

|

(2)

|

Includes 1,000 shares held in a SEP IRA for the benefit of Mr. Constantino.

|

|

(3)

|

Includes 626 shares held in an IRA for the benefit of Mr. Smyth.

|

Changes in Control

There are no arrangements known to management that may result in a change of control of the Company.

ITEM 1. ELECTION OF DIRECTORS

The first item to be acted upon at the Annual Meeting is the election of six directors to our Board of Directors. Each of the persons elected will serve a term of one year and until the election and qualification of his successor or until his earlier resignation, death or removal. Other than Robert G. Russell, Jr., each nominee is currently serving as one of our directors. We are not aware of any material proceedings to which any of the nominee directors, or any associate of any such director, is a party adverse to us or has a material interest adverse to us. Each nominee has consented to being named as a nominee and to serve if elected.

If any director nominee named in this information statement shall become unable or decline to serve (an event which the Board of Directors does not anticipate), a substitute may be nominated and elected.

Nominees for Election as Directors

The following sets forth information about the nominees for election as directors. Unless otherwise indicated, each person holds the same position(s) of both Patriot and the Bank.

|

Name

|

Age

|

Current Position with the Company

|

|

Michael A. Carrazza

|

54

|

Director and Chairman of the Board of Directors of Patriot and the Bank

|

|

Robert G. Russell, Jr.

|

54

|

President and Chief Executive Officer of Patriot and the Bank

|

|

Edward N. Constantino

|

73

|

Director

|

|

Raymond B. Smyth

|

74

|

Director

|

|

Emile Van den Bol

|

56

|

Director

|

|

Michael J. Weinbaum

|

53

|

Director

|

The nominees for election as directors have provided the following information about themselves:

Michael A. Carrazza

Mr. Carrazza has been Chairman of the Board of Directors of the Company since 2010 and Chief Executive Officer since August 2016. Through PNBK Sponsor, Mr. Carrazza manages PNBK Holdings, LLC (“PNBK Holdings”), the Company’s largest shareholder. Mr. Carrazza is also CEO of Solaia Capital Advisors, an investment management company. In 2012, Mr. Carrazza led the spin-out of the Bank of Ireland’s U.S. Asset-Based Lending Group, now known as Siena Lending Group, and serves as its Chairman. In 2004, he co-founded Bard Capital Group where he sponsored several transactions in the industrial sector. From 2001 until 2003, he was principal at The Glen Rock Group, a middle market investment firm, where he structured and financed the buyout of International Surface Preparation Group, Inc. (“ISPC”) from U.S. Filter/Vivendi. He subsequently worked at ISPC as Vice President in the office of the Chairman, managing the company’s financings, restructure and subsequent sale. Mr. Carrazza led the financing and restructuring of Mitchell Madison Group and served on the firm’s Executive Team, where he assisted in the firm’s global expansion and managed its subsequent sale to US Web/CKS. Mr. Carrazza began his career at Goldman, Sachs & Co. Mr. Carrazza earned his MBA in Finance from The Stern School of Business at New York University and his B.S. in Electrical Engineering from The Pennsylvania State University.

Robert G. Russell, Jr.

Mr. Russell was appointed as President and Chief Executive Officer of the Company and the Bank on July 7, 2020. Mr. Russell has more than 30 years of community banking experience. Prior to joining the Company and the Bank, Mr. Russell served as Executive Vice President and Chief Operating Officer of Millington Bank of Morris and Somerset Counties of New Jersey from 2015 to 2020. Previously, he served as President and Chief Executive Officer of NJM Bank from 2013 to 2014, and before that, as its Chief Financial and Investment Officer from 2003 to 2013. Mr. Russell has led both institutions to achieve significant growth and increases in profitability. During the period of 1990 to 2003, Mr. Russell has also spent part of his career as an Internal Auditor and as a Controller for banking institutions of various asset sizes throughout the state of New Jersey. Mr. Russell earned his bachelor’s degree from Montclair State University and a is a graduate of the Graduate School of Banking at Colorado.

Edward N. Constantino

Mr. Constantino has been a director of the Company since October 2010 and the Lead Independent Director since October 2018. He has over 40 years of audit, advisory and tax experience working for two major accounting firms, Arthur Anderson LLP and KPMG LLP. Mr. Constantino retired from KPMG in late 2009, where he was an Audit Partner in charge of the Firm’s real estate and asset management businesses. Mr. Constantino is a member of the Board of Directors of ARC Property Trust and a member of the Board and Audit Committee Chair of NexPoint Residential Trust. Mr. Constantino also serves as a consultant for the law firm of Skadden Arps. Mr. Constantino’s specific skills include auditing national and multinational organizations, internal control and compliance, financial reporting, regulatory reporting, risk management, asset valuation, accounting and finance and transaction structuring. He is a licensed CPA, a Member of the American Institute of Certified Public Accountants and a Member of the New York State Society of Public Accountants. He is currently a Member of the Board of Trustees and the Audit Committee Chairman of St. Francis College.

Raymond Smyth

Mr. Smyth has served as a director from November 2008 until 2010 and has again been a director of the Company since 2011. He is a retired partner in the accounting firm of Masotti & Masotti. In addition, he is a CPA and a financial expert.

Emile Van den Bol

Mr. Van den Bol has been a director of the Company since October 2010. He is currently the Chief Executive Officer of Brooklawn Capital, LLC. Brooklawn Capital is an investment management company which advises and invests in real estate and securities. Mr. Van den Bol retired in 2010 as Managing Director of the Commercial Real Estate Group of Deutsche Bank Securities, Inc. Mr. Van den Bol joined Deutsche Bank in 2001 as Managing Director and held several executive positions in the Commercial Real Estate Group including Global Co-Head Structured Finance, Global Head Commercial Real Estate CDO Group and Member of the Global Commercial Real Estate Executive Committee. Mr. Van den Bol was from 2005 to 2009 a Governor of the Board of the Commercial Mortgage Securities Association. From 1996 to 2001 Mr. Van den Bol was employed by Lehman Brothers where he held a number of positions including Head of Esoteric Principal Finance Group and Co-Head of Lehman Brothers Franchise Conduit. Mr. Van den Bol was a member of Morgan Stanley’s Structured Finance Group from 1991 to 1996.

Michael J. Weinbaum

Mr. Weinbaum has been a director of the Company since October 2010. He has been the Vice President of Real Estate Operations for United Capital Corp. for more than twenty years. Mr. Weinbaum has extensive experience in real estate operations and transactions. He is a member of the International Council of Shopping Centers and has been a member of United Capital’s Board of Directors since 2005. Mr. Weinbaum currently serves on the Finance Board and Board of Trustees for St. Mary’s Healthcare for Children.

Executive Officers

The following sets forth our executive officers who do not serve as directors and/or who are not nominees for election as directors. Unless otherwise indicated, each person holds the same position(s) of both Patriot and the Bank.

|

Name

|

Age

|

Current Position with the Company

|

|

Joseph D. Perillo

|

64

|

Executive Vice President and Chief Financial Officer

|

|

Frederick K. Staudmyer

|

64

|

Secretary and Chief Human Resources Officer; Executive Vice President and Chief Administrative Officer of the Bank

|

|

Judith P. Corprew

|

58

|

Executive Vice President and Chief Compliance & Risk Officer of the Bank

|

|

David W. Christiansen

|

52

|

Executive Vice President and Chief Credit Officer of the Bank

|

Joseph D. Perillo

Mr. Perillo has served as Executive Vice President and Chief Financial Officer of the Company and the Bank since May 2017. He served as a senior executive consultant for several months beginning in January 2017, tasked with assessing the finance department’s processes and improving operations and internal controls. Mr. Perillo is a recognized finance industry leader with over two decades of experience in the banking industry, having served as Chief Accounting Officer and Chief Financial Officer for iQor Inc., a $1.5 billion global leader in business process outsourcing. He began in public accounting with KPMG and then spent over 20 years in banking with Citibank, NatWest and as Senior Vice President & Controller for GreenPoint Financial, then one of the 50 largest banking companies in the U.S. Mr. Perillo earned his Bachelor of Science in accounting from St. John’s University and is a Certified Public Accountant.

Frederick K. Staudmyer

Mr. Staudmyer has served as the Company’s Secretary and Chief Human Resources Officer since November 2014. He is also the Executive Vice President and Chief Administrative Officer of Patriot Bank, N.A., overseeing human resources, retail banking, retail and deposit operations, corporate governance, the customer support center, property development, facilities management, and marketing. Mr. Staudmyer previously served as Assistant Dean at Cornell University’s Johnson Graduate School of Management. Bringing more than 30 years of human resources, general management and corporate leadership experience, he has served at leading financial institutions where he directed talent acquisition and development, including this role at Chase Manhattan Bank, now JPMorgan Chase. He previously served as Chief Human Resources Officer for Ziff Communications and Ziff Davis Publishing. He also co-founded and served as President and COO at a national legal services and staffing company for over seven years. Mr. Staudmyer earned his MBA from the Johnson Graduate School of Management at Cornell and his Bachelor of Science at Cornell’s School of Industrial & Labor Relations. He has served on the board of directors of the MBA Career Services Council and as an Advisory Council Member of Cornell University’s Entrepreneurial and Personal Enterprise Program.

Judith P. Corprew

Ms. Corprew has served as Executive Vice President and Chief Compliance & Risk Officer of the Bank since March 2015, ensuring compliance with local, state and federal regulations, and risk management. She serves on the management committees for: Regulatory Compliance, Enterprise Risk, Steering and CRA. She holds a Certified Regulator Compliance Manager certification, a highly regarded recognition by the American Bankers Association. With three decades of credit and risk management experience, she has held leadership positions at community-focused financial institutions and mortgage companies throughout the Tri-State area. Early in her banking career, Ms. Corprew was awarded honors for establishing a profitable mortgage center. A staunch advocate for teaching financial literacy skills, Ms. Corprew has led educational seminars and events at local schools, clubs and community organizations. She has also held workshops on first-time home buying, credit and budgeting. She has served as a member of the United Way Stamford Financial Stability Collaborative, and has served as a financial coach for the United Way. She is a member of the Bank Compliance Association of Connecticut, and the Institute of Certified Bankers and Regulatory Compliance Group of Fairfield County. She is also a board member of Housatonic Community College Foundation, serving as Vice President and a member of The Helpers Club Scholarship Foundation of Stamford. Ms. Corprew earned her bachelor’s degree from Rutgers University and a master’s degree in finance from Post University in Waterbury, CT.

David Christiansen

Mr. Christiansen became Executive Vice President and Chief Credit Officer of the Bank in June 2018, overseeing the Bank’s loan portfolio and lending activities as well as establishing and maintaining credit policies, procedures, objectives and goals. He joined the Bank from First American International Bank of New York, where he was also Executive Vice President & Chief Credit Officer from 2017 to 2018. His experience in credit administration, credit risk management, underwriting, closing, loan servicing and portfolio management provides a useful foundation for his role at the Bank. From 2006 to 2016, he previously held senior roles at National Cooperative Bank, Credit Agricole and JPMorgan Chase. As a strategic senior credit risk management officer with extensive commercial banking, capital markets, corporate finance, regulatory & compliance, and business development experience, he has led a strong credit culture while providing excellent customer service for industry-leading multinational companies. Key strengths include: strategic leadership, global perspective, and consultative credit risk management leadership, yielding a broad and deep understanding of the business, management, financial, and competitive risks faced by clients. Mr. Christiansen holds a Bachelor of Arts degree in economics from the University of Virginia.

Certain Relationships, Related Transactions and Director Independence

There are no family relationships among our executive officers and directors. In the ordinary course of business, the Bank has made loans to officers and directors (including loans to members of their immediate families and loans to companies of which a director owns 10% or more). There were $150,000 of loans to officers and directors outstanding as of December 31, 2019. In the opinion of management, all of such loans were made in the ordinary course of business of the Bank on substantially the same terms, including interest rates and collateral requirements, as those then prevailing for comparable transactions with persons not related to the lender. The Bank believes that at the time of origination these loans neither involved more than the normal risk of collectability nor presented any other unfavorable features.

Information about transactions involving related persons is assessed by the Company’s independent directors. Related persons include the Company’s directors and executive officers as well as immediate family members of directors and officers. If the independent directors approve or ratify a material transaction involving a related person, then the transaction would be disclosed in accordance with the SEC rules. If the related person is a director, or a family member of a director, then that director would not participate in those discussions.

Involvement in Certain Legal Proceedings

During the past ten years, none of our current directors or executive officers have been involved in any legal proceedings identified in Item 401(f) of Regulation S-K.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons who own more than ten percent of the issued and outstanding shares of Common Stock to file reports of beneficial ownership and changes in beneficial ownership with the SEC and to furnish copies of all Section 16(a) forms to the Company. Based solely upon a review of Section 16(a) forms furnished to the Company, the Company noted that, during the fiscal year ended December 31, 2019, Edward N. Constantino was late in filing a Form 4.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

Our business affairs are managed under the direction of the Board of Directors in accordance with the Connecticut Business Corporation Act, our certificate of incorporation and our bylaws. Members of our Board of Directors are kept informed of our business through discussions with the Chairman of the Board, our Chief Executive Officer and other officers, by reviewing materials provided to them, and by participating in meetings of the Board of Directors and its committees. Our corporate governance practices are summarized below.

During the fiscal year ended December 31, 2019, our Board of Directors met 15 times. During 2019, each of our directors attended 100% of the meetings of our Board of Directors, except two members who attended approximately 90% of the meetings. All committee members attended 80% or more of the meetings of the committees on which each director served, except two members on the Compliance Committee attended approximately 50% and 60%, respectively, of the meetings of such committee.

Director Attendance at Annual Meetings

We have a policy encouraging attendance by members of the Board of Directors at our Annual Meetings of shareholders. All of our directors attended the 2019 Annual Meeting of Shareholders.

Independence of Board of Directors and Members of Its Committees

We are a controlled company under NASDAQ rules because more than 50% of the voting power for the election of our directors is held by one shareholder. As a result, we are not required to maintain a majority of independent directors on our Board of Directors, nominating committee or compensation committee. The Board of Directors has determined that the following nominees for election as directors at the Annual Meeting are independent: Edward N. Constantino (Lead Independent Director), Emile Van den Bol, Michael J. Weinbaum, and Raymond B. Smyth. The Board of Directors has also determined that the Audit Committee is comprised entirely of independent directors within the meaning of applicable laws and regulations, the listing standards of the NASDAQ stock market and our corporate guidelines set forth in the Audit Committee Charter.

Independence Standards

The Board of Directors examines the independence of the directors annually. For a director to be considered independent, the Board of Directors must determine that the director does not have any relationship with us or any of our affiliates, either directly or as a partner, shareholder or officer of an organization that has such a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Pursuant to NASDAQ Listing Rule 5605(a)(2), a director will not be considered independent if, among other things, the director has:

|

|

●

|

Been employed by the Company or its affiliates at any time in the current year or during the past three years;

|

|

|

●

|

Accepted, or has a family member who accepted, any payments from the Company or its affiliates in excess of $120,000 during any period of twelve consecutive months within the preceding three years (except for Board services, retirement plan benefits, non-discretionary compensation or loans made by the Bank in accordance with applicable banking regulations);

|

|

|

●

|

An immediate family member who is, or has been in the past three years, employed by the Company or its affiliates as an executive officer;

|

|

|

●

|

Been, or has a family member who has been, a partner, controlling shareholder or an executive officer of any “for profit” business to which the Company made or from which it received, payments (other than those which arise solely from investments in the Company’s securities) that exceed 5% of the entity’s or the Company’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the preceding three years;

|

|

|

●

|

Been, or has a family member who has been, employed as an executive officer of another entity where at any time during the past three years any of the Company’s executive officers serve on that entity’s compensation committee; or

|

|

|

●

|

Been, or has a family member been, employed as a partner or employee of the Company’s outside auditors in any of the receding three years.

|

Board Leadership Structure and Role in Risk Oversight

The Board of Directors’ primary responsibility is to seek to maximize long-term shareholder value. The Board of Directors selects our management, monitors management and Company performance, and provides advice and counsel to management. Among other things, the Board of Directors regularly reviews our business strategy and approves our budget. In fulfilling the Board of Directors’ responsibilities, non-employee directors have full access to our management, external auditors and outside advisers.

Committees of the Board of Directors

The members of our Board of Directors devote time and talent to certain standing committees. Among these committees are the Audit Committee, Compensation Committee, Executive Committee, Nominating and Corporate Governance Committee, Asset and Liability Committee and Loan Committee. The principal functions and members of each committee are described below.

The functions of the Audit Committee include (i) reviewing and recommending policies regarding internal audit and credit review, (ii) establishing and implementing policies to comply with applicable regulations, (iii) causing suitable audits to be made by auditors engaged by the Audit Committee on our behalf, and (iv) pre-approving all audit services and permitted non-audit services provided by the auditors. The Audit Committee or its Chairman also discusses with the independent auditors the auditors’ review of our unaudited quarterly financial statements. The Audit Committee operates pursuant to a written charter, as amended by the Board of Directors on September 17, 2013. Shareholders may request a copy of the Audit Committee Charter, without charge, by contacting Joseph D. Perillo, Chief Financial Officer, Patriot National Bancorp, Inc., 900 Bedford Street, Stamford, Connecticut 06901, (203) 252-5954. The current members of the Audit Committee are Messrs. Constantino (Chairman), Smyth and Van den Bol, each of whom is an independent director as defined by SEC and NASDAQ rules. The Board has determined that Messrs. Constantino and Smyth have the professional experience necessary to qualify as Audit Committee financial experts under SEC rules. During 2019, the Audit Committee met 12 times.

The Compensation Committee determines executive compensation. In performing its duties, the Compensation Committee may engage consultants to assist it in determining the amount or form of executive and director compensation. The Compensation Committee consults with our executive officers in determining executive and director compensation. The current members of the Compensation Committee are Messrs. Constantino (Chairman) and Van den Bol. During 2019, the Compensation Committee met 7 times.

The Executive Committee exercises, if needed and when the Board of Directors is not in session, all powers of the Board of Directors that may lawfully be delegated. The current members of the Executive Committee are Messrs. Carrazza (Chairman), Constantino, Smyth and Van den Bol. During 2019, the Executive Committee did not meet.

The principal function of the Nominating and Corporate Governance Committee is to consider and recommend to the full Board of Directors nominees for directors of Patriot and the Bank. The Nominating and Corporate Governance Committee is also responsible for reporting and recommending from time to time to the Board of Directors matters relative to corporate governance. The current members of the Nominating and Corporate Governance Committee are Messrs. Van den Bol (Chairman), Carrazza, Constantino and Weinbaum. During 2019, the Nominating and Corporate Governance Committee met once.

The Asset and Liability Committee has the power and responsibility to ensure adherence to the investment policy, to recommend amendments thereto, to purchase and sell securities, to exercise authority regarding investments and liquidity and to exercise, when the Board is not in session, all other powers of the Board regarding investment securities that may be lawfully delegated. The current members of the Asset and Liability Committee are Messrs. Russell (Chairman), Constantino, Smyth, Van den Bol and Weinbaum. During 2019, the Asset and Liability Committee met 4 times.

The Loan Committee has the power to discount and purchase bills, notes and other evidences of debt, to buy and sell bills of exchange, to examine, review and approve loans and discounts, to exercise authority regarding loans and discounts, and to exercise, when the Board is not in session, all other powers of the Board regarding extensions of credit that may lawfully be delegated. The current members of the Loan Committee are Messrs. Van den Bol (Chairman), Constantino and Smyth. During 2019, the Loan Committee met 34 times.

Nomination Process

The process of reviewing and making recommendations for nominations and appointments to the Board of Directors is the responsibility of the Nominating and Corporate Governance Committee. Our directors have a critical role in guiding our strategic direction and in overseeing management. The Nominating and Corporate Governance Committee will consider candidates for the Board of Directors based upon several criteria, including their broad-based business and professional skills and experiences, concern for the long-term interests of shareholders, personal integrity and judgment. Candidates should have reputations, both personal and professional, consistent with our image and reputation. Directors must have time available to devote to Board activities and to enhance their knowledge of the banking industry. Accordingly, the Board of Directors seeks to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities for us, and who are expected to contribute to an effective Board of Directors.

The Nominating and Corporate Governance Committee utilizes the following process for identifying and evaluating nominees to the Board of Directors. In the case of incumbent directors, each year the Board of Directors informally reviews each director’s overall service to us during the term, including the number of meetings attended, level of participation and performance. In the case of new director candidates, the Nominating and Corporate Governance Committee may solicit from existing directors the names of potential candidates who meet the criteria above; the Nominating and Corporate Governance Committee may discuss candidates suggested by our shareholders; and, if deemed appropriate by the Board of Directors, the Nominating and Corporate Governance Committee may engage a professional search firm. To date, the Nominating and Corporate Governance Committee has not engaged a professional search firm to identify or evaluate potential nominees, but it retains the right to do so in the future, if necessary. The Nominating and Corporate Governance Committee meets to discuss and consider these candidates’ qualifications and then chooses new candidates by majority vote.

Shareholder Nominations

Under our by-laws, nominations for directors may be made by any shareholder of any outstanding class of our capital stock who delivers notice, along with the additional information and materials required by our by-laws and certificate of incorporation, to our President not fewer than 14 days and not more than 50 days before the Annual Meeting. Shareholders may obtain a copy of our certificate of incorporation and by-laws by writing to our Corporate Secretary, 900 Bedford Street, Stamford, Connecticut 06901.

To be considered, the shareholder’s nomination must contain: (i) the name and address of each proposed nominee; (ii) the principal occupation of each proposed nominee; (iii) the total number of shares of our capital stock that will be voted for each proposed nominee; (iv) the name and residence address of the notifying shareholder; and (v) the number of our shares of capital stock owned by the notifying shareholder. In addition, the nomination should include any other information relating to the proposed nominee required to be included in a proxy statement filed pursuant to the proxy rules of the SEC and the nominee’s written consent to serve as a director if elected.

Communications with the Board

Interested parties, including shareholders, wishing to communicate directly with the Board of Directors or any independent directors should send written communications to Michael A. Carrazza, Chairman of the Board, Patriot National Bancorp, Inc., 900 Bedford Street, Stamford, Connecticut 06901. Each communication will be reviewed by Mr. Carrazza who will make appropriate recommendations to the Board of Directors, which may include discussing the matter raised with the Board of Directors as a whole, with only the independent directors, and/or with other members of the senior management team. We believe that this procedure allows the Board of Directors to be responsive to shareholder communications in a timely and appropriate manner.

Code of Conduct

Each of our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer is required to comply with the Patriot National Bancorp, Inc. Code of Conduct for Senior Executive Financial Officers adopted by our Board of Directors. The Code of Conduct was adopted to deter wrongdoing and promote honest and ethical conduct; full, fair, accurate and timely disclosure in public documents; compliance with law; prompt internal reporting of Code of Conduct violations, and accountability for adherence to the Code of Conduct. The Code of Conduct was filed with the SEC as an exhibit to our Annual Report on Form 10-KSB for the fiscal year ended December 31, 2004.

In addition, all of our directors, officers and employees are required to comply with a Code of Ethics and Conflict of Interest Policy adopted by the Company on October 24, 2018, amended as of March 27, 2019, which was filed as Exhibit 14.2 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

Shareholders may request a copy of either Code, without charge, by contacting Joseph D. Perillo, Chief Financial Officer, Patriot National Bancorp, Inc., 900 Bedford Street, Stamford, Connecticut 06901, (203) 252-5920.

EXECUTIVE COMPENSATION

Director Compensation

The following table details the compensation paid to or accrued for each of Patriot’s non-management directors in the year ended December 31, 2019:

|

Name

|

|

Fees Earned or

Paid in Cash

($)

|

|

|

Cash

Awards

($)

|

|

|

Stock

Awards

(1)

($)

|

|

|

Option

Awards

($)

|

|

|

Non-Equity

Incentive Plan Compensation

($)

|

|

|

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Edward N. Constantino

|

|

|

95,525

|

|

|

|

-0-

|

|

|

|

22,077

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

117,602

|

|

|

Raymond Smyth

|

|

|

79,100

|

|

|

|

-0-

|

|

|

|

22,077

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

101,177

|

|

|

Emile Van den Bol

|

|

|

83,325

|

|

|

|

-0-

|

|

|

|

22,077

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

105,402

|

|

|

Michael J. Weinbaum

|

|

|

35,550

|

|

|

|

-0-

|

|

|

|

22,077

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

57,627

|

|

|

Brent M. Ciurlino (2)

|

|

|

120,100

|

|

|

|

-0-

|

|

|

|

4,492

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

124,592

|

|

|

(1)

|

The table provides the dollar value of any restricted stock awards that vested during the period. The awards may have been granted during the current period or prior periods.

|

|

(2)

|

Mr. Ciurlino resigned as a Director of the Company and the Bank as of May 18, 2020.

|

The Company’s directors who are also executive officers do not receive compensation for service on the Board of Directors or any of its committees. Effective July 1, 2015, non-employee directors of the Company received pro-rated compensation increases for board and committee meeting attendance as well as retainer fees. On an annual basis, each non-employee director receives $1,150 for each board meeting in which they participate and annual retainer fees totaling $19,100. They also receive fees ranging from $375 to $750 for each committee meeting in which they participate. In addition, non-employee directors who serve as the chair of a committee receive additional retainer fees ranging from $3,000 to $9,200 per year.

The Company’s directors are also reimbursed for reasonable and necessary out-of-pocket expenses incurred in connection with their service to the Company, including travel expenses.

Summary Compensation Table

The table below sets forth, for the last two fiscal years, the compensation earned by our Chief Executive Officer, Chief Financial Officer and other executive officers who received the highest annual compensation.

|

Name and Principal Position(s)

|

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Restricted Stock

|

|

|

All Other Annual Compensation

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael A. Carrazza

|

2019

|

|

$

|

300,000

|

|

|

$

|

—

|

|

|

$

|

49,980

|

|

|

$

|

7,648

|

|

(1)

|

|

$

|

357,628

|

|

|

Chairman and Interim Chief Executive Officer (2)

|

2018

|

|

$

|

300,000

|

|

|

$

|

440,000

|

|

|

$

|

49,980

|

|

|

$

|

13,656

|

|

(1)

|

|

$

|

803,636

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard A. Muskus (3)

|

2019

|

|

$

|

308,462

|

|

|

$

|

14,250

|

|

|

$

|

18,645

|

|

|

$

|

12,909

|

|

(1)

|

|

$

|

354,266

|

|

|

President and Director

|

2018

|

|

$

|

300,000

|

|

|

$

|

16,000

|

|

|

$

|

18,353

|

|

|

$

|

11,522

|

|

(1)

|

|

$

|

345,875

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frederick K. Staudmyer

|

2019

|

|

$

|

230,077

|

|

|

$

|

8,550

|

|

|

$

|

17,341

|

|

|

$

|

10,858

|

|

(1)

|

|

$

|

266,826

|

|

|

Secretary and Chief Human Resources Officer; Executive Vice President and Chief Administrative Officer of Patriot Bank, N.A.

|

2018

|

|

$

|

225,000

|

|

|

$

|

9,600

|

|

|

$

|

16,744

|

|

|

$

|

12,567

|

|

(1)

|

|

$

|

263,911

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph D. Perillo

|

2019

|

|

$

|

233,462

|

|

|

$

|

8,550

|

|

|

$

|

4,570

|

|

|

$

|

18,158

|

|

(1) (4)

|

|

$

|

264,740

|

|

|

Chief Financial Officer

|

2018

|

|

$

|

225,000

|

|

|

$

|

25,000

|

|

|

$

|

2,494

|

|

|

$

|

16,928

|

|

(1) (4)

|

|

$

|

269,422

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott W. Laughinghouse (5)

|

2019

|

|

$

|

227,539

|

|

|

$

|

4,500

|

|

|

$

|

1,595

|

|

|

$

|

14,956

|

|

(1) (6)

|

|

$

|

248,590

|

|

|

Executive Vice President and Chief Lending Officer

|

2018

|

|

$

|

225,000

|

|

|

$

|

1,600

|

|

|

$

|

413

|

|

|

$

|

11,026

|

|

(1) (6)

|

|

$

|

238,039

|

|

|

(1)

|

Includes company matches for 401(k) contribution, HSA account, and group term life insurance.

|

|

(2)

|

Mr. Carrazza was Interim Chief Executive Officer of the Company and the Bank for the years ended December 31, 2019 and 2018, and until July 7, 2020 when Robert G. Russell, Jr. was appointed as President and Chief Executive Officer of the Company and the Bank.

|

|

(3)

|

Mr. Muskus resigned from the positions of President and Director of the Company and the Bank as of April 17, 2020.

|

|

(4)

|

Includes $6,000 and $6,000 car allowance for the year ended December 31, 2019 and 2018, respectively.

|

|

(5)

|

Mr. Laughinghouse resigned from the position of Chief Lending Officer of the Bank as of April 2, 2020.

|

|

(6)

|

Includes $6,000 and $6,000 car allowance for the year ended December 31, 2019 and 2018, respectively, and $5,000 fringe benefit for the year ended December 31, 2019.

|

Executive Compensation Incentive Plan

In 2017, the Company adopted the Executive Compensation Incentive Plan (the “2017 Plan”). The 2017 Plan applies to the President and all Executive Vice Presidents at Patriot Bank. The 2017 plan was developed in order to attract, retain and motivate key executives by offering compensation incentives for delivering pre-defined budgeted operating results. The 2017 Plan is market competitive and designed to promote safe and sound business practices, where compensation objectives and risk taking are responsible, within policy guidelines and compatible with effective controls and risk-management. The 2017 Plan provides for awards based on a balance of bank results and individual executive performance. Awards are paid 50% in cash and 50% in restricted stock awards vesting over three years.

401(k) Plan

The Bank maintains a tax-qualified 401(k) Plan under Section 401(a) of the Internal Revenue Code with a cash or deferred arrangement under Section 401(k) of the Internal Revenue Code. Employees become eligible to make salary reduction contributions to the 401(k) Plan on the first day of the month coinciding with or next following the date that the employee has attained 21 years of age and completed 1 month of service. Employees become eligible to receive any matching or discretionary contributions made to the 401(k) by the Bank after the completion of six months and at least 500 hours of service.

Under the 401(k) Plan, participants may elect to have the Bank contribute a portion of their compensation each year, subject to certain limitations imposed by the Internal Revenue Code. The 401(k) Plan permits the Bank to make discretionary matching and additional discretionary contributions to the 401(k) Plan. Participants in the 401(k) Plan may direct the investment of their accounts in several types of investment funds.

Participants are always 100% vested in their elective deferrals, matching and discretionary matching contributions and related earnings under the 401(k) Plan.

Patriot National Bancorp, Inc. 2012 Stock Plan

In 2011, the Company adopted the Patriot National Bancorp, Inc. 2012 Stock Plan (the “2012 Plan”). The 2012 Plan is administered by the Compensation Committee of the Company’s Board of Directors. Grants under the 2012 Plan may be made in the form of stock options, restricted stock and phantom stock units. The 2012 Plan authorizes 3,000,000 shares of the Company’s Common Stock for issuance. Phantom stock units may be granted under the 2012 Plan up to 1,000,000 units.

Under the terms of the 2012 Plan, only the Company’s employees and employees of its subsidiaries may receive stock options. The exercise price of the stock options shall be not less than the fair market value of the stock on the date of grant. The Compensation Committee shall determine the dates upon which the options may be exercisable, which shall not exceed 10 years from the date of grant. The options may be exercised on a cashless basis if approved by the Compensation Committee.

Only directors of the Company are eligible to receive grants of restricted stock under the 2012 Plan. The grants of stock options and restricted stock may be subject to vesting, in one or more installments, upon the happening of certain events, upon the passage of a certain period of time. The vesting of restricted stock awards and options may be accelerated in accordance with terms of the plan. The Compensation Committee shall make the terms and conditions applicable to the vesting of restricted stock awards and stock options.

Only the Company’s employees and employees of its subsidiaries are eligible to receive phantom stock units under the 2012 Plan. The phantom stock units entitle the holder to receive upon exercise, in cash or shares of Common Stock, the appreciation in the value of the Common Stock from the date of grant. The Plan Committee shall determine the terms and conditions of each phantom stock unit award. Upon a change of control of the Company, the grantee shall be required to redeem all of his or her phantom stock units. In the event of a sale of substantially all of the Company’s assets, all outstanding phantom stock units will be redeemed.

Under the 2012 Plan, 32,964 shares of restricted stock were awarded in 2013, 73,558 shares of restricted stock were awarded in 2014, 12,700 shares of restricted stock were awarded in 2015, 58,084 shares of restricted stock were awarded in 2016, 5,084 shares of restricted stock were awarded in 2017, 18,323 shares of restricted stock were awarded in 2018, and 9,675 shares of restricted stock were awarded in 2019.

ITEM 2. RATIFICATION OF INDEPENDENT AUDITORS

The second item to be acted upon at the Annual Meeting is the approval and ratification of the Board of Directors’ selection of our independent registered public accounting firm.

The Board of Directors has appointed RSM US LLP (“RSM”) as our independent registered public accounting firm to examine our financial statements for the current fiscal year ending December 31, 2020 and to perform other appropriate accounting services. RSM has been engaged as our independent registered public accounting firm since May 16, 2017, and has no relationship with us other than that arising from their employment as our independent registered public accounting firm.

Audit Fees

The following table sets forth the aggregate amounts of principal accounting fees we paid to our independent registered public accountants for professional services performed in fiscal years ended December 31, 2019 and 2018 for: (i) audit fees – consisting of fees billed for services rendered for the audit of our annual financial statements and the review of our quarterly financial statements; (ii) audit-related fees – consisting of fees billed for services rendered that are reasonably related to the performance of the audit or review of our financial statements and that are not reported as audit fees; (iii) tax fees – consisting of fees billed for services rendered in connection with tax compliance, tax advice and tax planning; and (iv) all other fees – consisting of fees billed for all other services rendered.

|

|

|

Year Ended December 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Audit fees (1)

|

|

$

|

392,710

|

|

|

|

456,304

|

|

|

Audit related fees (2)

|

|

|

15,750

|

|

|

|

80,556

|

|

|

Tax fees (3)

|

|

|

-

|

|

|

|

15,551

|

|

|

All other fees

|

|

|

16,013

|

|

|

|

15,585

|

|

|

|

|

$

|

424,473

|

|

|

|

567,996

|

|

|

|

(1)

|

Audit fees with respect to the year ended December 31, 2019 and 2018 represent fees billed to the Company by RSM for professional services rendered in connection with RSM’s quarterly reviews and annual audits.

|

|

|

(2)

|

Audit-related fees with respect to the year ending December 31, 2018 include payments of $50,000 to BDO USA, LLP, the Company’s previous independent registered public accounting firm, for professional services related to the Company’s 2018 Annual Report on Form 10-K. The remaining balance of the amounts were items paid to RSM.

|

|

|

(3)

|

Tax fees with respect to the year ended December 31, 2018 represent payments made to RSM.

|

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy for pre-approval of audit and permitted non-audit services by the Company’s independent registered public accountants. The Audit Committee will consider annually and, if appropriate, approve the provision of audit services by its external auditor and consider and, if appropriate, pre-approve the provision of certain defined audit and non-audit services. The Audit Committee also will consider on a case-by-case basis and, if appropriate, approve specific engagements that are not otherwise pre-approved.

Any proposed engagement that does not fit within the definition of a pre-approved service may be presented to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, to the Audit Committee or one or more of its members. The member or members to whom such authority is delegated shall report any specific approval of services at its next regular meeting. The Audit Committee will regularly review summary reports detailing all services being provided to the Company by its external auditor.

The Audit Committee approved the audit-related fees, tax fees and all other fees set forth above for the years ended December 31, 2019 and 2018.

REPORT OF AUDIT COMMITTEE

The Audit Committee reviewed and discussed the audited financial statements with management, and discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended. The Audit Committee received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence. Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K, as amended.

Edward N. Constantino

Raymond B. Smyth

Emile Van den Bol

ADDITIONAL INFORMATION

The 2020 Annual Meeting of Shareholders is scheduled to be held on September 23, 2020. Pursuant to Rule 14a-8 promulgated under the Exchange Act, our shareholders may present proper proposals for inclusion in our proxy or information statement and for consideration at the next annual meeting of shareholders by submitting their proposals to our Secretary in a timely manner. In order to be included in the proxy or information statement for the 2021 Annual Meeting of Shareholders, shareholder proposals must be received by our Secretary no later than March 1, 2021 and must otherwise comply with the requirements of Rule 14a-8.

We file annual, quarterly and current reports, information statements and other information with the SEC. You may read and copy any document we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C., 20549. Please call the SEC at 1-800-SEC-0330 for further information on the SEC’s public reference rooms. Our SEC filings are also available to the public at the SEC’s website at http://www.sec.gov and our website at www.bankpatriot.com.

Any person, including any beneficial owner, to whom this Information Statement is delivered may request copies of our periodic reports, information statements or other information concerning us, without charge, by written request, directed to Frederick Staudmyer, Secretary, Patriot National Bancorp, Inc., 900 Bedford Street, Stamford, Connecticut 06901 or by telephone at 203-252-5921. If you would like to request documents, please do so by September 1, 2020 in order to receive them timely before the Annual Meeting.

THIS INFORMATION STATEMENT IS DATED AUGUST 24, 2020. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ABOVE, UNLESS EXPRESSLY PROVIDED, AND THE MAILING OF THIS INFORMATION STATEMENT TO SHAREHOLDERS DOES NOT CREATE ANY IMPLICATION TO THE CONTRARY.

By Order of the Board of Directors,

|

|

|

Michael A. Carrazza

Chairman

|

Robert G. Russell, Jr.

President and Chief Executive Officer

|

August 24, 2020

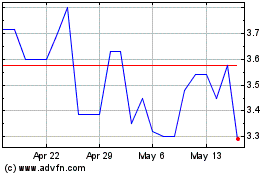

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jul 2023 to Jul 2024