UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of August 2024

Commission File Number: 001-40875

NUVEI CORPORATION

(Exact name of registrant as specified in its charter)

1100 René-Lévesque Boulevard West, Suite 900

Montreal, Quebec H3B 4N4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Exhibit No. | Exhibit Description | |

| | | |

| Nuvei Corporation Condensed Interim Consolidated Financial Statements for the Three Months and Six Months Ended June 30, 2024 | |

| Nuvei Corporation Interim Management's Discussion and Analysis for the Three Months and Six Months Ended June 30, 2024 | |

| Certification of Chief Executive Officer and Chief Financial Officer required by National Instrument 52-109 - Certification of Disclosure in Issuers Annual and Interim Filings | |

| | |

Exhibits 99.1 and 99.2 of this Report on Form 6-K are incorporated by reference into the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on October 18, 2021 (File No. 333-260308), and the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on February 22, 2023 (File No. 333-269901) and the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on August 9, 2023 (File No. 333-273832)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| |

Nuvei Corporation |

| | |

| Date: August 6, 2024 | | By: | | /s/ Lindsay Matthews |

| | | | Name | | Lindsay Matthews |

| | | | Title: | | General Counsel |

EXHIBIT 99.1

Condensed Interim Consolidated Financial Statements

Nuvei Corporation

(Unaudited)

For the three and six months ended June 30, 2024 and 2023

(in thousands of US dollars)

Table of Contents

| | | | | |

| Pages |

| |

| |

| |

Condensed Interim Consolidated Financial Statements | |

| |

| |

| |

| |

Notes to Condensed Interim Consolidated Financial Statements | |

| 1 Reporting entity | |

| 2 Basis of preparation and consolidation | |

| 3 Material accounting policies and new accounting standards | |

| 4 Business combinations | |

| 5 Trade and other receivables | |

| |

| |

| |

| 6 Trade and other payables | |

| |

| 7 Loans and borrowings | |

| 8 Share capital | |

| 9 Revenue and expenses by nature | |

| 10 Net finance cost | |

| 11 Share-based payment arrangements | |

| |

| 12 Income taxes | |

| |

| |

| 13 Net income (loss) per share | |

| 14 Determination of fair values | |

| 15 Related party transactions | |

| |

| 16 Supplementary cash flow disclosure | |

| 17 Contingencies | |

| |

Nuvei Corporation

Consolidated Statements of Financial Position

(Unaudited)

(in thousands of US dollars)

| | | | | | | | | | | |

| Notes | June 30,

2024 | December 31,

2023 |

| | $ | $ |

Assets |

| |

|

|

| |

|

| Current assets |

| |

|

| Cash and cash equivalents |

| 183,037 | | 170,435 | |

| Trade and other receivables | 5 | 146,030 | | 105,755 | |

| Inventory | | 2,661 | | 3,156 | |

| Prepaid expenses |

| 17,262 | | 16,250 | |

| Income taxes receivable | | 948 | | 4,714 | |

| | | |

| Current portion of contract assets |

| 1,441 | | 1,038 | |

| Other current assets | | 930 | | 7,582 | |

|

| |

|

| Total current assets before segregated funds |

| 352,309 | | 308,930 | |

| Segregated funds |

| 1,551,572 | | 1,455,376 | |

|

| |

|

| Total current assets |

| 1,903,881 | | 1,764,306 | |

|

| |

|

| Non-current assets |

| |

|

| | | |

| Property and equipment | | 39,785 | | 33,094 | |

| Intangible assets | | 1,287,185 | | 1,305,048 | |

| Goodwill | | 1,982,292 | | 1,987,737 | |

| Deferred tax assets | | 5,908 | | 4,336 | |

| Contract assets | | 748 | | 835 | |

| Processor and other deposits | | 5,385 | | 4,310 | |

| Other non-current assets | | 36,813 | | 35,601 | |

|

| |

|

Total Assets |

| 5,261,997 | | 5,135,267 | |

Nuvei Corporation

Consolidated Statements of Financial Position

(Unaudited)

(in thousands of US dollars)

| | | | | | | | | | | |

| Notes | June 30,

2024 | December 31,

2023 |

| | $ | $ |

Liabilities |

| |

|

|

| |

|

Current liabilities |

| |

|

| Trade and other payables | 6 | 191,510 | | 179,415 | |

| Income taxes payable | | 28,630 | | 25,563 | |

| Current portion of loans and borrowings | 7 | 14,377 | | 12,470 | |

| | | |

| | | |

| Other current liabilities | | 6,085 | | 7,859 | |

| | | |

| Total current liabilities before due to merchants |

| 240,602 | | 225,307 | |

| Due to merchants |

| 1,551,572 | | 1,455,376 | |

| | | |

Total current liabilities |

| 1,792,174 | | 1,680,683 | |

| | | |

Non-current liabilities |

| |

|

| Loans and borrowings | 7 | 1,244,016 | | 1,248,074 | |

| Deferred tax liabilities | | 133,581 | | 151,921 | |

| Other non-current liabilities | | 4,498 | | 10,374 | |

| | | |

Total Liabilities |

| 3,174,269 | | 3,091,052 | |

|

| |

|

Equity |

| |

|

|

| |

|

Equity attributable to shareholders |

| |

|

| Share capital | 8 | 2,006,801 | | 1,969,734 | |

| Contributed surplus |

| 350,858 | | 324,941 | |

| Deficit |

| (256,480) | | (224,902) | |

| Accumulated other comprehensive loss |

| (35,288) | | (43,456) | |

| | | |

|

| 2,065,891 | | 2,026,317 | |

Non-controlling interest | | 21,837 | | 17,898 | |

| | | |

Total Equity |

| 2,087,728 | | 2,044,215 | |

|

| | |

Total Liabilities and Equity |

| 5,261,997 | | 5,135,267 | |

Contingencies | 17 | | |

| | | |

| | | |

| |

| |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

Nuvei Corporation

Consolidated Statements of Profit or Loss and Comprehensive Income or Loss

(Unaudited)

For the three and six months ended June 30

(in thousands of US dollars, except for per share amounts) | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three months ended

June 30 | Six months ended

June 30 |

| Notes | 2024 | 2023 | 2024 | 2023 |

| | $ | $ | $ | $ |

| Revenue | 9 | 345,478 | | 307,026 | | 680,587 | | 563,524 | |

| Cost of revenue | 9 | 68,039 | | 53,926 | | 132,769 | | 108,522 | |

| Gross profit | | 277,439 | | 253,100 | | 547,818 | | 455,002 | |

| | | | | |

| Selling, general and administrative expenses | 9 | 228,492 | | 221,755 | | 458,593 | | 416,373 | |

| Operating profit | | 48,947 | | 31,345 | | 89,225 | | 38,629 | |

| | | | | |

| Finance income | 10 | (676) | | (961) | | (1,388) | | (6,336) | |

| Finance cost | 10 | 29,625 | | 29,318 | | 59,603 | | 47,786 | |

| Net finance cost | | 28,949 | | 28,357 | | 58,215 | | 41,450 | |

| Loss (gain) on foreign currency exchange | | 8,555 | | (11,115) | | 17,505 | | (12,513) | |

| Income before income tax | | 11,443 | | 14,103 | | 13,505 | | 9,692 | |

| | | | | |

| Income tax expense | 12 | 6,095 | | 2,486 | | 12,964 | | 6,364 | |

| Net income | | 5,348 | | 11,617 | | 541 | | 3,328 | |

| | | | | |

| Other comprehensive income (loss), net of tax | | | | |

| Items that may be reclassified subsequently to profit and loss: | | | |

| Foreign operations – foreign currency translation differences | | 1,958 | | (9,068) | | 2,614 | | (4,010) | |

| Change in fair value of financial instruments designated as cash flow hedges | | 1,540 | | — | | 6,559 | | — | |

| Reclassification of change in fair value of financial instruments designated as cash flow hedges to profit and loss | | (503) | | — | | (1,005) | | — | |

| Comprehensive income (loss) | | 8,343 | | 2,549 | | 8,709 | | (682) | |

| | | | | |

| Net income attributable to: | | | | | |

| Common shareholders of the Company | | 3,465 | | 9,923 | | (3,398) | | 145 | |

| Non-controlling interest | | 1,883 | | 1,694 | | 3,939 | | 3,183 | |

| | 5,348 | | 11,617 | | 541 | | 3,328 | |

| | | | | |

| Comprehensive income (loss) attributable to: | | | | |

| Common shareholders of the Company | | 6,460 | | 855 | | 4,770 | | (3,865) | |

| Non-controlling interest | | 1,883 | | 1,694 | | 3,939 | | 3,183 | |

| | 8,343 | | 2,549 | | 8,709 | | (682) | |

| | | | | |

| Net income (loss) per share | 13 | | | | |

| Net income (loss) per share attributable to common shareholders of the Company | | | | | |

| Basic | | 0.02 | | 0.07 | | (0.02) | — | |

| Diluted | | 0.02 | | 0.07 | | (0.02) | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

Nuvei Corporation

Consolidated Statements of Cash Flows

(Unaudited)

For the six months ended June 30

(in thousands of US dollars)

| | | | | | | | | | | |

| | 2024 | 2023 |

| Notes | $ | $ |

| Cash flow from operating activities | | | |

| Net income | | 541 | | 3,328 | |

| Adjustments for: | | | |

| Depreciation of property and equipment | 9 | 8,603 | | 6,811 | |

| Amortization of intangible assets | 9 | 66,232 | | 56,770 | |

| Amortization of contract assets | | 698 | | 758 | |

| | | |

| Share-based payments | 9 | 50,399 | | 71,442 | |

| Net finance cost | 10 | 58,215 | | 41,450 | |

| Loss (gain) on foreign currency exchange | | 17,505 | | (12,513) | |

| Income tax expense | 12 | 12,964 | | 6,364 | |

| Gain on business combination | 4 | (4,013) | | — | |

| | | |

| | | |

| Loss on disposal | | 528 | | — | |

| Changes in non-cash working capital items: | 16 | (37,011) | | (8,430) | |

| Interest paid | | (58,226) | | (42,769) | |

| Interest received | | 11,001 | 7,560 | |

| Income taxes paid - net of tax received | | (19,336) | | (13,927) | |

| | 108,100 | | 116,844 | |

| Cash flow used in investing activities | | | |

| Business acquisitions, net of cash acquired | 4 | (1,185) | | (1,379,778) | |

| | | |

| | | |

| Acquisition of property and equipment | | (8,601) | | (5,902) | |

| Acquisition of intangible assets | | (27,541) | | (21,143) | |

| Acquisition of distributor commissions | | — | | (20,318) | |

| Acquisition of other non-current assets | | (201) | | (31,816) | |

| Net decrease in processor deposits | | 3,495 | | — | |

| | | |

| Net decrease in advances to third parties | | — | | 245 | |

| | (34,033) | | (1,458,712) | |

| Cash flow from (used in) financing activities | | | |

| Shares repurchased and cancelled | 8 | — | | (56,042) | |

| | | |

| Proceeds from exercise of stock options | 8 | 10,653 | | 6,399 | |

| Repayment of loans and borrowings | 4, 7 | (39,154) | | (76,560) | |

| Proceeds from loans and borrowings | 7 | — | | 852,000 | |

| Financing fees related to loans and borrowings | 7 | (249) | | (14,650) | |

| | | |

| Payment of lease liabilities | 7 | (3,501) | | (2,622) | |

| Dividends paid to shareholders | 8 | (28,112) | | — | |

| | | |

| | | |

| | (60,363) | | 708,525 | |

| Effect of movements in exchange rates on cash | | (1,102) | | 39 | |

| Net increase (decrease) in cash and cash equivalents | | 12,602 | | (633,304) | |

| Cash and cash equivalents – Beginning of period | | 170,435 | | 751,686 | |

| Cash and cash equivalents – End of period | | 183,037 | | 118,382 | |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

Nuvei Corporation

Consolidated Statements of Changes in Equity

(Unaudited)

For the six months ended June 30

(in thousands of US dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to shareholders of the Company | Non-

Controlling interest | Total equity |

| | Share

capital | Contributed

surplus | Deficit | Accumulated Other comprehensive loss |

| Notes | Cumulative translation adjustments | Cash flow hedge reserve |

| | $ | $ | $ | $ | $ | $ | $ |

| | | | | | | | |

| Balance as at January 1, 2023 | | 1,972,592 | | 202,435 | | (166,877) | | (39,419) | | — | | 10,759 | | 1,979,490 | |

| | | | | | | | |

| Contributions and distributions | | | | | | | | |

| Exercise of equity-settled share-based payments | 8, 11 | 16,777 | | (10,378) | | — | | — | | — | | — | | 6,399 | |

| Equity-settled share-based payments | 4, 11 | — | | 81,127 | | — | | — | | — | | — | | 81,127 | |

| Tax effect - equity-settled share-based payments | | — | | 1,707 | | — | | — | | — | | — | | 1,707 | |

| | | | | | | | |

| Effect of share repurchase liability | 8 | (33,378) | | — | | (22,093) | | — | | — | | — | | (55,471) | |

| | | | | | | | |

| | | | | | | | |

| Net income and comprehensive loss |

| — | | — | | 145 | | (4,010) | | — | | 3,183 | | (682) | |

| | | | | | | | |

| Balance as at June 30, 2023 |

| 1,955,991 | | 274,891 | | (188,825) | | (43,429) | | — | | 13,942 | | 2,012,570 | |

| | | | | | | | |

| Balance as at January 1, 2024 | | 1,969,734 | | 324,941 | | (224,902) | | (36,354) | | (7,102) | | 17,898 | | 2,044,215 | |

| | | | | | | | |

| Contributions and distributions | | | | | | | | |

| | | | | | | | |

| Exercise of equity-settled share-based payments | 8, 11 | 37,067 | | (26,414) | | — | | — | | — | | — | | 10,653 | |

| Equity-settled share-based payments | 11 | — | | 50,399 | | — | | — | | — | | — | | 50,399 | |

| Tax effect - equity-settled share-based payments | | — | | 1,932 | | — | | — | | — | | — | | 1,932 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Dividends declared | 8 | — | | — | | (28,180) | | — | | — | | — | | (28,180) | |

| Net income and comprehensive income |

| — | | — | | (3,398) | | 2,614 | | 5,554 | | 3,939 | | 8,709 | |

| | | | | | | | |

| Balance as at June 30, 2024 |

| 2,006,801 | | 350,858 | | (256,480) | | (33,740) | | (1,548) | | 21,837 | | 2,087,728 | |

The accompanying notes are an integral part of these Condensed Interim Consolidated Financial Statements.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

1. Reporting entity

Nuvei Corporation (“Nuvei” or the “Company”) is a global payment technology provider to businesses across North America, Europe, Middle East and Africa, Latin America and Asia Pacific and is domiciled in Canada with its registered office located at 1100 René-Lévesque Blvd., 9th floor, Montreal, Quebec, Canada. Nuvei is the ultimate parent of the group and was incorporated on September 1, 2017 under the Canada Business Corporations Act (“CBCA”).

The Company's Subordinate Voting Shares are listed on the Toronto Stock Exchange ("TSX") and on the Nasdaq Global Select Market ("Nasdaq") both under the symbol "NVEI".

2. Basis of preparation and consolidation

These Condensed Interim Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) applicable to the preparation of interim financial statements, including International Accounting Standard (“IAS”) 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”). Certain information and disclosures have been omitted or condensed. The accounting policies and methods of computation described in the audited annual consolidated financial statements for the year ended December 31, 2023 were applied consistently in the preparation of these condensed interim consolidated financial statements, with the exception of new accounting pronouncements effective January 1, 2024, described below. Accordingly, these Condensed Interim Consolidated Financial Statements should be read together with the Company’s audited annual consolidated financial statements for the year ended December 31, 2023.

The Condensed Interim Consolidated Financial Statements as at and for the three and six months ended June 30, 2024 were authorized for issue by the Company’s Board of Directors on August 6, 2024.

Operating segment

The Company has one reportable segment for the provision of payment technology solutions to merchants and partners.

Seasonality of interim operations

The operations of the Company can be seasonal, and the results of operations for any interim period are not necessarily indicative of operations for the full year or any future period.

Estimates, judgments and assumptions

The preparation of these Condensed Interim Consolidated Financial Statements in conformity with IFRS requires management to make estimates, judgments and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. The significant estimates, judgments and assumptions made by management are the same as those applied and described in the Company's audited annual consolidated financial statements for the year ended December 31, 2023.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

3. Material accounting policies and new accounting standards

The accounting policies used in these Condensed Interim Consolidated Financial Statements are consistent with those applied and disclosed in the Company's audited annual consolidated financial statements for the year ended December 31, 2023, with the exception of new accounting pronouncements effective January 1, 2024, described below.

New accounting standards and interpretations adopted

The following amendments were adopted on January 1, 2024:

Amendments to liability classification

On October 31, 2022, the IASB issued new amendments to IAS 1 in addition to the previous amendment issued in 2020 that clarify requirements when classifying liabilities as non-current and extend the application period to January 1, 2024.

When an entity classifies a liability arising from a loan arrangement as non-current and that liability is subject to the covenants which an entity is required to comply with within twelve months of the reporting date, this amendment requires the entity to disclose information in the notes that enables users of financial statements to understand the risk that the liability could become repayable within twelve months of the reporting period, including:

(a) the carrying amount of the liability;

(b) information about the covenants;

(c) facts and circumstances, if any, that indicate the entity may have difficulty complying with the covenants. Such facts and circumstances could also include the fact that the entity would not have complied with the covenants based on its circumstances at the end of the reporting period.

The amendments described above had no impact on these Condensed Interim Consolidated Financial Statements.

New accounting standards and interpretations issued but not yet adopted

The IASB has issued new standards and amendments to existing standards which are applicable to the Company in future periods.

IFRS 18 Presentation and Disclosure in Financial Statements

On April 9, 2024 the IASB issued IFRS 18 Presentation and Disclosure in Financial Statements to improve reporting of financial performance. IFRS 18 replaces IAS 1 Presentation of Financial Statements. It carries forward many requirements from IAS 1 unchanged. IFRS 18 applies for annual reporting periods beginning on or after January 1, 2027. Earlier application is permitted.

The new Accounting Standard introduces significant changes to the structure of a company's income statement and new principles for aggregation and disaggregation of information. The main impacts of the new Accounting Standard include:

•introducing a newly defined "operating profit" subtotal and a requirement for all income and expenses to be allocated between three distinct categories based on the company's main business activities: Operating, investing and financing;

•disclosure about management performance measures; and,

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

•adding new principles for aggregation and disaggregation of information.

•requiring the cash flow statement to start with operating profit; and

•removal of the accounting policy choice for presentation of dividend and interest.

Amendments to IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures

In May 2024, amendments to IFRS 9, “Financial Instruments” and IFRS 7, “Financial Instruments: Disclosures” were issued. The main impacts of the amendments include:

•clarification of the timing of recognition and derecognition for a financial asset or financial liability, including clarifying that a financial liability is derecognized on the settlement date. In addition to these clarifications, the amendments introduce an accounting policy choice to derecognize financial liabilities settled using an electronic payment system before the settlement date, if criteria are met;

•clarifications regarding the classification of financial assets, including those with features linked to environmental, social and corporate governance and contractual cash flows that are solely payments of principal and interest on the principal amount outstanding; and

•additional disclosures are required for financial instruments with contingent features and investments in equity instruments classified at fair value through other comprehensive income.

These amendments are effective for annual reporting periods beginning on or after January 1, 2026. Early adoption is permitted, with an option to early adopt only the amendments to the classification of financial assets.

The impact of adoption of the amendments has not yet been determined.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

4. Business combinations

Transactions for the six months ended June 30, 2024

Till Payments Inc.

On January 5, 2024, the Company acquired 100% of the shares of Till Payments, an independent software vendor ("ISV") focused payment technology company headquartered in Sydney, Australia, for a total consideration of $36,905, comprised of $30,000 in cash and $6,905 of pre-existing loan with Till Payments being settled as part of the business combination. The Company determined that the transaction met the definition of a business combination. The fair value of net assets acquired was greater than the consideration transferred resulting in a gain on business combination of $4,013 which was recognized in other selling, general and administrative expenses (Note 9). Acquisition costs of $819 have been expensed during the six months ended June 30, 2024. For the period from the acquisition date to June 30, 2024, Till Payments contributed revenue of $17,676 and net loss of $6,935. The net loss includes the amortization of identifiable intangible assets acquired.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

Purchase Price Allocation

The following table summarizes the preliminary amounts of assets acquired and liabilities assumed at the acquisition date for the acquisition:

| | | | | |

| |

| Till Payments

$ |

| Assets acquired | |

| Cash | 28,815 | |

| |

| Trade and other receivables | 19,761 | |

| |

| Prepaid expenses | 1,880 | |

| Property and equipment | 7,309 | |

| Processor deposits | 6,202 | |

| Deferred tax assets | 4,412 | |

| Other non-current assets | 459 | |

| Intangible assets | |

| Software | 1,393 | |

| Trademarks | 875 | |

| Technologies | 23,078 | |

| Partner and merchant relationships | 776 | |

| |

| 94,960 | |

| Liabilities assumed | |

| Trade and other payables | (15,162) | |

| |

| Other current liabilities | (150) | |

| |

| Income taxes payable | (148) | |

| Loans and borrowings | (38,450) | |

| Other non-current liabilities | (132) | |

| 40,918 | |

| Total consideration | |

| Cash paid | 30,000 | |

| Loan settled as part of the business combination | 6,905 | |

| 36,905 | |

| |

| Gain on business combination | 4,013 | |

In the six months ended June 30, 2024, the Company repaid $33,267 of loans and borrowings assumed at the acquisition date.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

Transactions for the six months ended June 30, 2023

Paya Holdings Inc.

On February 22, 2023, the Company acquired 100% of the shares of Paya Holdings Inc. ("Paya"), a leading U.S. provider of integrated payment and frictionless commerce solutions, for a total consideration of $1,401,261, comprised of $1,391,435 in cash and $9,826 of the portion of replacement share-based awards that was considered part of the consideration transferred. The cash consideration included the settlement by the Company of seller-related payments of $51,876 paid by Paya immediately prior to closing and thereby increased the calculated purchase price.

Other

On March 1, 2023, the Company acquired certain assets of a service provider. The Company determined that the transaction met the definition of a business combination. The total cash consideration for this acquisition was $10,000.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

Purchase Price Allocation

The following table summarizes the final amounts of assets acquired and liabilities assumed at the acquisition date for acquisitions in the six months ended June 30, 2023:

| | | | | | | | | | | |

| | | |

| Paya

$ | Other

$ | Total

$ |

| Assets acquired | | | |

| Cash | 21,657 | | — | | 21,657 | |

| Segregated funds | 244,798 | | — | | 244,798 | |

| Trade and other receivables | 23,263 | | — | | 23,263 | |

| Inventory | 293 | | — | | 293 | |

| Prepaid expenses | 2,816 | | — | | 2,816 | |

| Property and equipment | 5,419 | | 12 | | 5,431 | |

| Processor deposits | 385 | | — | | 385 | |

| Intangible assets | | | |

| Software | 3,131 | | — | | 3,131 | |

| Trademarks | 16,607 | | — | | 16,607 | |

| Technologies | 178,173 | | 6,908 | | 185,081 | |

| Partner and merchant relationships | 455,364 | | — | | 455,364 | |

Goodwill1 | 864,172 | | 3,193 | | 867,365 | |

| 1,816,078 | | 10,113 | | 1,826,191 | |

| Liabilities assumed | | | |

| Trade and other payables | (30,037) | | (113) | | (30,150) | |

| Current portion of loans and borrowings | (1,142) | | — | | (1,142) | |

| Other current liabilities | (3,142) | | — | | (3,142) | |

| Due to merchants | (244,798) | | — | | (244,798) | |

| Income taxes payable | (1,696) | | — | | (1,696) | |

| Loans and borrowings | (2,492) | | — | | (2,492) | |

| Other non-current liabilities | (131,510) | | — | | (131,510) | |

| 1,401,261 | | 10,000 | | 1,411,261 | |

| Total consideration | | | |

| Cash paid | 1,391,435 | | 10,000 | | 1,401,435 | |

| Share-based payments (note 16) | 9,826 | | — | | 9,826 | |

| 1,401,261 | | 10,000 | | 1,411,261 | |

1 Goodwill mainly consists of future growth, assembled workforce and expected synergies, which were not recorded separately since they did not meet the recognition criteria for identifiable intangible assets. Goodwill arising from the Paya acquisition is not deductible for income tax purposes.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

5. Trade and other receivables

| | | | | | | | |

| | |

| | |

| June 30, 2024 | December 31, 2023 |

| $ | $ |

| Trade receivables | 127,275 | | 74,409 | |

| Due from processing banks | 9,583 | | 21,403 | |

| Other receivables | 9,172 | | 9,943 | |

| Total | 146,030 | | 105,755 | |

6. Trade and other payables

| | | | | | | | |

| | |

| June 30, 2024 | December 31, 2023 |

| $ | $ |

| Trade payables | 79,388 | | 70,125 | |

| Accrued bonuses and other compensation-related liabilities | 62,273 | | 52,155 | |

| | |

| Sales tax payable | 8,527 | | 7,295 | |

| Interest payable | 1,733 | | 3,982 | |

| | |

| Due to merchants not related to segregated funds | 28,951 | | 29,105 | |

| | |

| Other accrued liabilities | 10,638 | | 16,753 | |

| 191,510 | | 179,415 | |

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

7. Loans and borrowings

The terms and conditions of the Company’s loans and borrowings are as follows:

| | | | | | | | | | | | | | | | | |

| | | |

| | | 2024 | | 2023 |

| Notes | Facility | Carrying

amount | Facility | Carrying

amount |

| | $ | $ | $ | $ |

| Amended and restated credit facilities | (a) | | | | |

| Term loan | | 1,268,625 | | 1,243,920 | | 1,275,000 | | 1,248,270 | |

| Revolving credit facility | | 800,000 | | — | | 800,000 | | — | |

| | | | | |

| Total | | | 1,243,920 | | | 1,248,270 | |

| | | | | |

| Lease liabilities | | | 14,473 | | | 12,274 | |

| | | 1,258,393 | | | 1,260,544 | |

| Current portion of loans and borrowings | | | (14,377) | | | (12,470) | |

| Loans and borrowings | | | 1,244,016 | | | 1,248,074 | |

The facility amount represents the principal amount of each credit facility. The carrying amount of loans and borrowings is presented net of unamortized deferred financing fees. Financing fees relating to the issuance of loans and borrowings are amortized over the term of the debt using the effective interest rate method. The continued availability of the credit facilities is subject to the Company’s ability to maintain a total leverage ratio of less than or equal to 5.00 : 1.00 prior to March 31, 2025 (5.00 : 1.00 as of December 31, 2023), and with the ratio decreasing by 0.25 year over year every March 31, until it reaches 4.00 : 1.00 for the period on or after March 31, 2028. The total leverage ratio considers the Company’s consolidated net debt, calculated as long-term debt less certain unrestricted cash, to consolidated adjusted EBITDA, calculated in accordance with the terms of the credit facility. The Company is in compliance with all applicable covenants as at June 30, 2024 and December 31, 2023.

a) Amended and restated credit facilities

i)Loans drawn in US dollars under the term loan facilities bear interest at the Term SOFR (in addition to a 0.10% credit spread adjustment) plus 3.00% per annum or the ABR1 rate plus 4.00% per annum. Loans drawn in US dollars under the revolving credit facility bear interest at the Term SOFR plus 2.50% per annum or the ABR1 rate plus 1.50% per annum until March 31, 2024. Thereafter, the revolving facility will bear interest at (a) the Term SOFR plus a margin ranging from 2.25% to 2.75% or (b) an alternate base rate plus a margin ranging from 1.25% to 1.75%, in each case, based on a total leverage ratio. As at June 30, 2024, interest rate on the outstanding Term loan facilities was 8.43% or 8.25% after giving effect to the interest rate swap (Note 14) (December 31, 2023 – 8.46% or 8.27% after giving effect to the interest rate swap).

ii)Loans drawn in Canadian dollars under the credit facilities bear interest at the Canadian prime rate plus 1.50% per annum or Term Canadian Overnight Repo Rate Average ("CORRA") rate plus 2.50% per annum. As at June 30, 2024 and December 31, 2023 there was no loan denominated in Canadian dollars.

iii)Loans drawn in Euros under the credit facilities bear interest at the EURO InterBank Offered Rate ("EURIBOR") rate plus 2.50% per annum. As at June 30, 2024 and December 31, 2023, there was no loan denominated in Euros.

iv)Loans drawn in Sterling under the credit facilities bear interest at the Sterling OverNight Index Average ("SONIA") rate plus 2.50% per annum. As at June 30, 2024 and December 31, 2023, there was no loan denominated in Sterling.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

1 The Alternate Base Rate is defined as a rate per annum equal to the higher of a) Federal funds effective rate + 0.50%; b) Adjusted Term SOFR for a one-month tenor plus 1%; c) Prime Rate; and d) 1.00%.

Daylight overdraft credit facility

On May 10, 2024, the Company entered into a daylight overdraft credit facility of $30,000 Canadian dollars (or US dollar equivalent) to assist with intraday merchant settlement requirements. This facility bears interest at CA prime rate plus 3.00% per annum on Canadian dollar overdrafts or US Base rate plus 3.00% per annum on US dollar overdrafts. As of June 30, 2024, the credit facility was undrawn.

Letter of credit

As at June 30, 2024, the Company had letters of credit issued totaling $58,355 (December 31, 2023 - $56,175). Letters of credit do not reduce the amount that can be drawn on the Company's revolving credit facility.

8. Share capital

The Company had the following share capital transactions:

2024

The Company issued 2,289,420 Subordinate Voting Shares for a cash consideration of $10,653 during the six months ended June 30, 2024 following the exercise of stock options and the settlement of Restricted Share Units ("RSUs").

During the six months ended June 30, 2024 the Board of Directors declared total cash dividends of $0.20 per subordinate voting share and multiple voting share.

On August 6, 2024, the Board of Directors approved and declared a regular cash dividend of $0.10 per subordinate voting share and multiple voting share payable on September 5, 2024 to shareholders of record on August 20, 2024.

Proposed take private transaction

On April 1, 2024, the Company entered into a definitive arrangement agreement to be taken private by Advent International, alongside existing Canadian shareholders Philip Fayer, certain investment funds managed by Novacap Management Inc., and Caisse de dépôt et placement du Québec, in an all-cash transaction at $34.00 per Subordinate Voting Share and Multiple Voting Share. On June 20, 2024, final court approval was obtained following the shareholder approval obtained on June 18, 2024. The closing of this transaction remains subject to key regulatory approvals.

A termination fee of $150,000 would be payable by Nuvei in certain circumstances. A reverse termination fee of $250,000 would be payable to Nuvei if the transaction is not completed in certain circumstances.

2023

On March 20, 2023, the Board approved a normal-course issuer bid ("NCIB") to purchase for cancellation a maximum of 5,556,604 Subordinate Voting Shares, representing approximately 10% of the Company’s "public float" (as defined in the TSX Manual) of Subordinate Voting Shares as at March 8, 2023. The Company was authorized to make purchases under the NCIB during the period from March 22, 2023 to March 21, 2024 in accordance with the requirements of the TSX and the Nasdaq and applicable securities laws. During the six months ended June 30, 2023, the Company repurchased and cancelled 1,350,000 Subordinate Voting Shares for a total consideration, including transaction costs, of $56,042.

There were 76,064,619 Multiple Voting Shares and 65,653,141 Subordinate Voting Shares outstanding as at June 30, 2024.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

9. Revenue and expenses by nature

| | | | | | | | | | | | | | |

| | | | |

| Three months ended

June 30 | Six months ended

June 30 |

| 2024 | 2023 | 2024 | 2023 |

| $ | $ | $ | $ |

| Revenues | | | | |

| Merchant transaction and processing services revenue | 335,811 | | 304,935 | | 665,237 | | 559,448 | |

| Other revenue | 3,271 | | 2,091 | | 5,737 | | 4,076 | |

| Interest revenue | 6,396 | | — | | 9,613 | | — | |

| 345,478 | | 307,026 | | 680,587 | | 563,524 | |

| | | | |

| Cost of revenue | | | | |

| Processing cost | 66,335 | | 52,729 | | 129,142 | | 106,223 | |

| Cost of goods sold | 1,704 | | 1,197 | | 3,627 | | 2,299 | |

| 68,039 | | 53,926 | | 132,769 | | 108,522 | |

| | | | |

| Selling, general and administrative expenses | | | | |

| Commissions | 72,315 | | 60,268 | | 137,213 | | 98,567 | |

| Employee compensation | 65,274 | | 53,409 | | 125,595 | | 99,130 | |

| Share-based payments | 20,623 | | 35,869 | | 50,399 | | 71,442 | |

| Depreciation and amortization | 38,005 | | 35,925 | | 74,835 | | 63,581 | |

| Professional fees | 9,104 | | 11,327 | | 24,772 | | 39,992 | |

| Transaction losses | 2,104 | | 1,842 | | 3,914 | | 3,535 | |

| | | | |

| Other | 21,067 | | 23,115 | | 41,865 | | 40,126 | |

| 228,492 | | 221,755 | | 458,593 | | 416,373 | |

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

10. Net finance cost

| | | | | | | | | | | | | | |

| | | | |

| Three months ended

June 30 | Six months ended

June 30 |

| 2024 | 2023 | 2024 | 2023 |

| $ | $ | $ | $ |

| Finance income | | | | |

| Interest income | (676) | | (961) | | (1,388) | | (6,336) | |

| | | | |

| Finance cost | | | | |

| Interest on loans and borrowings (excluding lease liabilities) | 28,385 | | 28,751 | | 58,004 | | 46,358 | |

| Change in fair value of share repurchase liability | — | | — | | — | | 571 | |

| Interest expense on lease liabilities | 214 | | 177 | | 343 | | 349 | |

| Other interest expense | 1,026 | | 390 | | 1,082 | | 508 | |

| | | | |

| | | | |

| | | | |

| Accelerated amortization of deferred financing fees | — | | — | | 174 | | — | |

| 29,625 | | 29,318 | | 59,603 | | 47,786 | |

| | | | |

| Net finance cost | 28,949 | | 28,357 | | 58,215 | | 41,450 | |

11. Share-based payment arrangements

The Omnibus Incentive Plan permits the Board of Directors to grant awards of options, RSUs, Performance Share Units ("PSUs") and Deferred Share Units (“DSUs”) to eligible participants.

RSUs, PSUs and DSUs will be settled by the issuance of shares at the settlement date. DSUs vest immediately as they are granted for past services. The RSUs and PSUs vest over a period of up to three years. RSUs, PSUs and DSUs participants are eligible to receive RSUs, PSUs or DSUs dividend equivalents with the same vesting conditions under the Nuvei Omnibus Incentive Plan. Under the Paya equity plan, RSU holders are eligible to receive dividends in cash, payable upon settlement if all vesting conditions are met.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

Share-based payments continuity

The table below summarizes the changes in the outstanding RSUs, PSUs, DSUs, and stock options for the three and six months ended June 30, 2024:

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Stock options |

| Restricted share units | Performance share units | Deferred share units | Quantity | Weighted

average

exercise

price |

| | | | | $ |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Outstanding, beginning of period | 7,357,279 | | 1,332,903 | | 113,835 | | 8,147,423 | | 57.86 | |

| Forfeited | (206,086) | | (8,671) | | — | | (55,538) | | 42.81 | |

| | | | | |

| Granted | 869,244 | | 290,738 | | 26,450 | | — | | — | |

| Dividend equivalents | 41,186 | | 9,190 | | 709 | | — | | — | |

| Exercised | (540,404) | | — | | (10,146) | | (1,738,870) | | 6.12 | |

| Outstanding, end of period | 7,521,219 | | 1,624,160 | | 130,848 | | 6,353,015 | | 72.15 | |

| | | | | |

| | | | | |

| Exercisable, end of period | 1,607,401 | | 143,457 | | 130,848 | | 2,595,633 | | 43.68 | |

| | | | | |

| | | | | |

Granted - weighted average grant date fair value 2024 | $32.19 | $32.22 | $32.24 | — | — |

The PSUs, RSUs and DSUs grant date fair value was determined by using the quoted share price on the date of issuance. During the three months ended June 30, 2024, 290,738 PSUs awarded included performance conditions and the right to these units will vest upon meeting the related performance criteria.

12. Income taxes

Domestic Pillar Two legislation has been enacted in Canada and Bulgaria, which are main jurisdictions where Pillar Two income tax exposures arise for the Company. Income tax expense for the three and six months ended June 30, 2024 included $3 million of current tax expense related to Pillar Two legislation.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

13. Net income (loss) per share

Diluted net income (loss) per share excludes all dilutive potential shares if their effect is anti-dilutive as well as all potential shares for which performance conditions have not yet been met as of the reporting date. For the three and six months ended June 30, 2024 and 2023, anti-dilutive stock options, RSUs and PSUs were excluded from the calculation of diluted net income (loss) per share when their effect was anti-dilutive.

| | | | | | | | | | | | | | |

| | | | |

| Three months ended

June 30 | Six months ended

June 30 |

| 2024 | 2023 | 2024 | 2023 |

| $ | $ | $ | $ |

| Net income (loss) attributable to common shareholders of the Company (basic and diluted) | 3,465 | | 9,923 | | (3,398) | | 145 | |

| Weighted average number of common shares outstanding – basic | 140,590,664 | | 138,841,224 | | 140,118,586 | | 139,245,992 | |

| Effect of dilutive securities | 5,851,393 | | 4,700,797 | | — | | 4,306,514 | |

| Weighted average number of common shares outstanding – diluted | 146,442,057 | | 143,542,021 | | 140,118,586 | | 143,552,506 | |

| Net income (loss) per share attributable to common shareholders of the Company: | | | | |

| Basic | 0.02 | | 0.07 | | (0.02) | | 0.00 | |

| Diluted | 0.02 | | 0.07 | | (0.02) | | 0.00 | |

14. Determination of fair values

Certain of the Company’s accounting policies and disclosures require the determination of fair value for both financial and non-financial assets and liabilities. Fair values have been determined for measurement and/or disclosure purposes using the following methods.

Financial assets and financial liabilities

In establishing fair value, the Company uses a fair value hierarchy based on levels as defined below:

•Level 1: defined as observable inputs such as quoted prices in active markets.

•Level 2: defined as inputs other than quoted prices in active markets that are either directly or indirectly observable.

•Level 3: defined as inputs that are based on little or no observable market data, therefore requiring entities to develop their own assumptions.

The Company has determined that, excluding the derivative financial instrument, the carrying amounts of its current financial assets and financial liabilities approximate their fair value given the short-term nature of these instruments.

The fair value of the variable interest rate non-current liabilities approximates the carrying amount as the liabilities bear interest at a rate that varies according to the market rate.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

As at June 30, 2024 and December 31, 2023, financial instruments measured at fair value in the Condensed Interim Consolidated Financial Statements of financial position were as follows:

| | | | | | | | | | | | |

| | Fair value hierarchy | June 30, 2024 | December 31, 2023 |

| | | $ | $ |

| Assets | | | | |

| Investments measured at fair value through profit or loss | | Level 1 | 1,263 | | 1,255 | |

| Derivative financial asset - Interest rate swap | | Level 2 | 930 | | 677 | |

| Investments measured at fair value through profit or loss | | Level 3 | 2,231 | | 2,444 | |

| Investments in equity instrument designated at fair value through other comprehensive income | | Level 3 | 27,514 | | 25,862 | |

| | | | |

| | | | |

| Liabilities | | | | |

| | | | |

| Derivative financial liability - Interest rate swap | | Level 2 | 2,481 | | 7,780 | |

| | | | |

| | | | |

Interest rate swap

In September 2023, the Company entered into an interest rate swap agreement maturing September 30, 2026 with a notional amount of $300,000 where the Company pays a fixed interest rate of 4.67% and receives Term SOFR in order to hedge a portion of its future variable interest payments. This derivative is carried at fair value and is presented in other current assets and liabilities and other non-current liabilities in the consolidated statements of financial position.

Fair value of the interest rate swap is calculated as the present value of the estimated future cash flows. Estimated future cash flows are discounted using a yield curve which reflects the relevant benchmark interbank rate used by market participants for this purpose when pricing interest rate swaps.

Level 3 fair value measurement items

The following table presents the changes in level 3 items for the six months ended June 30, 2024:

| | | | | | | | | | | |

| | Investments measured at fair value through profit or loss | | | Investments measured at fair value through other comprehensive income |

| | $ | | | $ |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Balance as at December 31, 2023 | | 2,444 | | | | 25,862 | |

| | | | | |

| Acquisition | | — | | | | 2,500 | |

| Disposal | | (173) | | | | — | |

| | | | | |

| | | | | |

| Effect of movements in exchange rates | | (40) | | | | (848) | |

| | | | | |

| Balance as at June 30, 2024 | | 2,231 | | | | 27,514 | |

Fair value remeasurement of level 3 instruments is recognized in selling, general and administrative expenses. Investments measured at fair value through profit and loss and through other comprehensive income are

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

recognized on the statement of financial position in other non-current assets. Below are the assumptions and valuation methods used in the level 3 fair value measurements:

•On March 15, 2023, the Company acquired an equity interest in a private company for a total cash consideration of $25,000. The company designated this equity investment at fair value through other comprehensive income. The fair value is estimated using a market approach, which is the revenue multiple.

•As at June 30, 2024, the fair value of the contingent consideration for the Mazooma acquisition is nil (nil as at December 2023). The fair value of the contingent consideration is determined using a formula specified in the purchase agreement. The main assumption is the forecast of financial performance. The maximum contingent consideration that could be paid if the future financial targets are met is $331,658 Canadian dollars ($242,493).

15. Related party transactions

Transactions with key management personnel

Key management personnel compensation comprises the following:

| | | | | | | | | | | | | | |

| | | | |

| Three months ended

June 30 | Six months ended

June 30 |

| 2024 | 2023 | 2024 | 2023 |

| $ | $ | $ | $ |

| Salaries and short-term employee benefits | 1,962 | | 2,190 | | 3,995 | | 4,650 | |

| Share-based payments | 16,297 | | 19,050 | | 29,331 | | 37,683 | |

| 18,259 | | 21,240 | | 33,326 | | 42,333 | |

Other related party transactions

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | |

| | Three months ended

June 30 | Six months ended

June 30 | |

| | | | | |

| | 2024 | 2023 | 2024 | 2023 | | |

| | $ | $ | $ | $ | | |

| Expenses – Travel | (i) | 532 | | 469 | | 1,139 | | 947 | | | |

| | | | | | | |

| | | | | | | |

(i)In the normal course of operations, the Company receives services from a company owned by a shareholder of the Company.

Nuvei Corporation

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

June 30, 2024 and 2023

(in thousands of US dollars, except for share and per share amounts)

16. Supplementary cash flow disclosure

| | | | | | | | | |

| | |

| | 2024 | 2023 |

| | $ | $ |

| Changes in non-cash working capital items: | | | |

| Trade and other receivables | | (30,977) | | (16,776) | |

| Inventory | | 465 | | 58 | |

| Prepaid expenses | | 642 | | (1,660) | |

| Contract assets | | (1,046) | | (591) | |

| Trade and other payables | | (4,101) | | 9,185 | |

| Other current and non-current liabilities | | (1,994) | | 1,354 | |

| | (37,011) | | (8,430) | |

17. Contingencies

From time to time, the Company is involved in various litigation matters arising in the ordinary course of its business. The Company is also exposed to possible uncertain tax positions in certain jurisdictions. Management does not expect that the resolution of those matters, either individually or in the aggregate, will have a material effect on the Company’s Condensed Interim Consolidated Financial Statements.

EXHIBIT 99.2

Management’s Discussion & Analysis

Nuvei Corporation

For the three and six months ended June 30, 2024 and 2023

(in thousands of US dollars)

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE THREE MONTHS AND SIX MONTHS ENDED JUNE 30, 2024 and 2023

As used in this management’s discussion and analysis of financial condition and results of operations (“MD&A”), unless the context indicates or requires otherwise, all references to the “Company”, “Nuvei”, “we”, “us” or “our” refer to Nuvei Corporation together with our subsidiaries, on a consolidated basis.

This MD&A dated August 6, 2024, should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements, along with the related notes thereto for the three and six months ended June 30, 2024 and 2023 (the “Interim Financial Statements”), as well as with our consolidated financial statements along with the notes related thereto for the years ended December 31, 2023 and 2022. The financial information presented in this MD&A is derived from the Interim Financial Statements which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) applicable to the preparation of interim financial statements, including International Accounting Standard ("IAS") 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”). All amounts are in US dollars except where otherwise indicated. Additionally, tables included in this MD&A are presented in thousands of US dollars, unless otherwise indicated. This MD&A is presented as of the date of the Interim Financial Statements and is current to that date unless otherwise stated.

We have prepared this MD&A with reference to National Instrument 51-102 – Continuous Disclosure Obligations of the Canadian Securities Administrators. Under the U.S./Canada Multijurisdictional Disclosure System, we are permitted to prepare this MD&A in accordance with Canadian disclosure requirements, which requirements are different than those of the United States.

FORWARD-LOOKING INFORMATION

This MD&A contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Such forward-looking information may include, without limitation, information with respect to our objectives and the strategies to achieve these objectives, as well as information with respect to our beliefs, plans, expectations, anticipations, estimates and intentions. This forward-looking information is identified by the use of terms and phrases such as “may”, “would”, “should”, “could”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe”, or “continue”, the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking information contains these terms and phrases. Particularly, information regarding our expectations of future results, performance, achievements, prospects or opportunities or the markets in which we operate, expectations regarding industry trends and the size and growth rates of addressable markets, our business plans and growth strategies, addressable market opportunity for our solutions, expectations regarding growth and cross-selling opportunities and intention to capture an increasing share of addressable markets, the costs and success of our sales and marketing efforts, intentions to expand existing relationships, further penetrate verticals, enter new geographical markets, expand into and further increase penetration of international markets, intentions to selectively pursue and successfully integrate acquisitions, and expected acquisition outcomes, cost savings, synergies and benefits, including with respect to the acquisition of Paya, future investments in our business and anticipated capital expenditures, our intention to continuously innovate, differentiate and enhance our platform and solutions, expected pace of ongoing legislation of regulated activities and industries, our competitive strengths and competitive position in our industry, and expectations regarding our revenue, revenue mix and the revenue generation potential of our solutions and expectations regarding our margins and future profitability, as well as statements regarding the proposed take private transaction with Advent International L.P. (“Advent”), alongside existing Canadian shareholders Philip Fayer, certain investment funds managed by Novacap Management Inc. and Caisse de dépôt et placement du Québec, including the proposed timing and various steps contemplated in respect of the transaction and statements regarding the plans, objectives, and intentions of Philip Fayer, certain investment funds managed by Novacap Management Inc., Caisse de dépôt et placement du Québec or Advent, are forward-looking information. Economic and geopolitical uncertainties, including regional conflicts and wars, including potential impacts of sanctions, may also heighten the impact of certain factors described herein.

In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

Forward-looking information is based on management's beliefs and assumptions and on information currently available to management, regarding, among other things, assumptions regarding foreign exchange rate, competition, political environment and economic performance of each region where the Company operates and general economic conditions and the competitive environment within our industry, including the following assumptions: (a) the Company will continue to effectively execute against its key strategic growth priorities, without any material adverse impact from macroeconomic or geopolitical headwinds on its or its customers' business, financial condition, financial performance, liquidity or any significant reduction in demand for its products and services, (b) the economic conditions in our core markets, geographies and verticals, including resulting consumer spending and employment, remaining at close to current levels, (c) assumptions as to foreign exchange rates and interest rates, including inflation, (d) the Company's continued ability to manage its growth effectively, (e) the Company's ability to continue to attract and retain key talent and personnel required to achieve its plans and strategies, including sales, marketing, support and product and technology operations, in each case both domestically and internationally, (f) the Company’s ability to successfully identify, complete, integrate and realize the expected benefits of past and recent acquisitions and manage the associated risks, as well as future acquisitions, (g) the absence of adverse changes in legislative or regulatory matters, (h) the Company’s continued ability to upskill and modify its compliance capabilities as regulations change or as the Company enters new markets or offers new products or services, (i) the Company’s continued ability to access liquidity and capital resources, including its ability to secure debt or equity financing on satisfactory terms, and (j) the absence of adverse changes in current tax laws. Unless otherwise indicated, forward-looking information does not give effect to the potential impact of any mergers, acquisitions, divestitures or business combinations that may be announced or closed after the date hereof. Although the forward-looking information contained herein is based upon what we believe are reasonable assumptions, investors are cautioned against placing undue reliance on this information since actual results may vary from the forward-looking information.

Forward-looking information involves known and unknown risks and uncertainties, many of which are beyond our control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, the risk factors described in greater detail under “Risk Factors” of the Company's annual information form ("AIF") and the “Risk Factors" section in this MD&A, such as: risks relating to our business, industry and overall economic uncertainty; the rapid developments and change in our industry; substantial competition both within our industry and from other payments providers; challenges implementing our growth strategy; challenges to expand our product portfolio and market reach; changes in foreign currency exchange rates, interest rates, consumer spending and other macroeconomic factors affecting our customers and our results of operations; challenges in expanding into new geographic regions internationally and continuing our growth within our markets; challenges in retaining existing customers, increasing sales to existing customers and attracting new customers; reliance on third-party partners to distribute some of our products and services; risks associated with future acquisitions, partnerships or joint-ventures; challenges related to economic and political conditions, business cycles and credit risks of our customers, such as wars like the Russia-Ukraine and Middle East conflicts and related economic sanctions; the occurrence of a natural disaster, a widespread health epidemic or pandemic or other similar events; history of net losses and additional significant investments in our business; our level of indebtedness; challenges to secure financing on favorable terms or at all; difficulty to maintain the same rate of revenue growth as our business matures and to evaluate our future prospects; inflation; challenges related to a significant number of our customers being small and medium businesses ("SMBs"); a certain degree of concentration in our customer base and customer sectors; compliance with the requirements of payment networks; reliance on, and compliance with, the requirements of acquiring banks and payment networks; challenges related to the reimbursement of chargebacks from our customers; financial liability related to the inability of our customers (merchants) to fulfill their requirements; our bank accounts being located in multiple territories and relying on banking partners to maintain those accounts; decline in the use of electronic payment methods; loss of key personnel or difficulties hiring qualified personnel; deterioration in relationships with our employees; impairment of a significant portion of intangible assets and goodwill; increasing fees from payment networks; misappropriation of end-user transaction funds by our employees; frauds by customers, their customers or others; coverage of our insurance policies; the degree of effectiveness of our risk management policies and procedures in mitigating our risk exposure; the integration of a variety of operating systems, software, hardware, web browsers and networks in our services; the costs and effects of pending and future litigation; various claims such as wrongful hiring of an employee from a competitor, wrongful use of confidential information of third parties by our employees, consultants or independent contractors or wrongful use of trade secrets by our employees of their former employers; deterioration in the quality of the products and services offered; managing our growth effectively;

challenges from seasonal fluctuations on our operating results; changes in accounting standards; estimates and assumptions in the application of accounting policies; risks associated with less than full control rights of some of our subsidiaries and investments; challenges related to our holding company structure; impacts of climate change; development of AI and its integration in our operations, as well as risks relating to intellectual property and technology, risks related to data security incidents, including cyber-attacks, computer viruses, or otherwise which may result in a disruption of services or liability exposure; challenges regarding regulatory compliance in the jurisdictions in which we operate, due to complex, conflicting and evolving local laws and regulations and legal proceedings and risks relating to our Subordinate Voting Shares. These risks and uncertainties further include (but are not limited to) as concerns the proposed take private transaction with Advent, the failure of the parties to obtain the necessary regulatory approvals or to otherwise satisfy the conditions to the completion of the transaction, failure of the parties to obtain such approvals or satisfy such conditions in a timely manner, significant transaction costs or unknown liabilities, failure to realize the expected benefits of the transaction, and general economic conditions. Failure to obtain the necessary regulatory approvals, or the failure of the parties to otherwise satisfy the conditions to the completion of the transaction or to complete the transaction, may result in the transaction not being completed on the proposed terms, or at all. In addition, if the transaction is not completed, and the Company continues as a publicly-traded entity, there are risks that the announcement of the proposed transaction and the dedication of substantial resources of the Company to the completion of the transaction could have an impact on its business and strategic relationships (including with future and prospective employees, customers, suppliers and partners), operating results and activities in general, and could have a material adverse effect on its current and future operations, financial condition and prospects. Furthermore, in certain circumstances, the Company may be required to pay a termination fee pursuant to the terms of the arrangement agreement which could have a material adverse effect on its financial position and results of operations and its ability to fund growth prospects and current operations.

Our dividend policy is at the discretion of the Board. Any future determination to declare cash dividends on our securities will be made at the discretion of our Board, subject to applicable Canadian laws, and will depend on a number of factors, including our financial condition, results of operations, capital requirements, contractual restrictions (including covenants contained in our credit facilities), general business conditions and other factors that our Board may deem relevant. Further, our ability to pay dividends, as well as make share repurchases, will be subject to applicable laws and contractual restrictions contained in the instruments governing our indebtedness, including our credit facility. Any of the foregoing may have the result of restricting future dividends or share repurchases.

Consequently, all of the forward-looking information contained herein is qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained herein represents our expectations as of the date hereof or as of the date it is otherwise stated to be made, as applicable, and is subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or amend such forward-looking information whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Overview

We are a Canadian fintech company accelerating the business of our customers around the world. Our modular, flexible and scalable technology allows leading companies to accept next-gen payments, offer a multitude of payout options and benefit from card issuing, banking, and risk management services. We believe we are differentiated by our proprietary technology platform, which is purpose-built for high-growth eCommerce, integrated payments and business to business (“B2B”). Our platform enables customers to pay and/or accept payments worldwide regardless of their customers’ location, device or preferred payment method. Our solutions span the entire payments stack and include a fully integrated payments engine with global processing capabilities, a turnkey solution for frictionless payment experiences and a broad suite of data-driven business intelligence tools and risk management services. Connecting businesses to their customers in more than 200 markets worldwide, with local acquiring in 50 of those markets, 150 currencies and 716 alternative payment methods (“APMs”), we provide the technology and insights for customers and partners to succeed locally and globally with one integration – propelling them further, faster.

While global commerce continues to pivot digitally, eCommerce channels are converging and creating new and fast-growing opportunities for businesses of all sizes. Rapidly scaling across these commerce channels,

however, can be complex and costly for businesses that rely on multiple providers in each local market. For example, customers may use disparate and varied systems for gateway services, payment processing, online fraud prevention, business intelligence and more, creating operational distractions and workflow challenges, which result in additional costs and financial inefficiencies. In parallel, consumers expect a consistent and frictionless transaction experience across all channels, whether from a mobile device or computer. As a result, we believe businesses increasingly seek payment providers such as Nuvei who have a unified approach and can offer end-to-end solutions to help them navigate this complex environment.

We distribute our products and technology through three channels: (i) Global Commerce, (ii) B2B, Government and Independent software vendors (“ISV”), and (iii) SMBs. Our approach to distribution is designed to enable us to efficiently market our payments and technology solutions at scale and is customized by both region and vertical to optimize sales. By relying on our local sales teams and partners who act as trusted technology providers to our customers, we believe we are able to serve more customers globally and grow with them as they grow their businesses and expand into new markets. We focus on the needs of our customers and how we can help them grow their sales, and in turn our volume, with them. Due to the scalable nature of our business model and the inherent operating leverage, increases in volume drive profitable revenue growth.

Our revenue is primarily based on sales volume generated from our customers’ daily sales and through various transaction and subscription-based fees for our modular technology. Examples of our modular technology include gateway, global processing, APMs, currency management, global payouts, risk management, card issuing, open banking, data reporting, reconciliation tools, in addition to a long list of other value-added capabilities. Our revenue is largely recurring due to the mission-critical nature of our product and service offerings and deep integration of our payments technology into our customers’ ERP systems. We believe the depth and breadth of our payment capabilities help our customers establish and expand their presence in emerging commerce channels across many markets. This enables us to develop long-standing relationships with our customers, which in turn drive strong retention and significant cross-selling opportunities.

Financial Highlights for the Three Months Ended June 30, 2024 Compared to 2023:

•Total volume(a) increased by 22% to $61.7 billion from $50.6 billion;

•Revenue increased by 13% to $345.5 million from $307.0 million

•Net income decreased by 54% to $5.3 million from $11.6 million;

•Adjusted EBITDA(b) increased by 6% to $116.8 million from $110.3 million;

•Adjusted net income(b) increased by 8% to $62.6 million from $58.1 million;

•Net income per diluted share decreased to $0.02 from $0.07;

•Adjusted net income per diluted share(b) increased by 5% to $0.41 from $0.39 ;

•Adjusted EBITDA less capital expenditures(b) increased to $96.4 million from $95.9 million.

Financial Highlights for the Six Months Ended June 30, 2024 Compared to 2023:

•Total volume(a) increased by 31% to $121.8 billion from $93.0 billion;

•Revenue increased 21% to $680.6 million from $563.5 million;

•Net income decreased by 84% to $0.5 million from $3.3 million;

•Adjusted EBITDA(b) increased by 12% to $231.6 million from $206.6 million;

•Adjusted net income(b) increased by 2% to $125.1 million from $122.5 million;

•Net loss per diluted share was $0.02 compared to net income per diluted share of $0.00;

•Adjusted net income per diluted share(b) was stable at $0.83;

•Adjusted EBITDA less capital expenditures(b) increased by 9% to $195.5 million from $179.5 million; and,

•Cash dividends declared were $28.2 million.

(a)Total volume does not represent revenue earned by the Company, but rather the total dollar value of transactions processed by merchants under contractual agreement with the Company. See "Non-IFRS and Other Financial Measures".

(b)Adjusted EBITDA, Adjusted net income, Adjusted net income per diluted share and Adjusted EBITDA less capital expenditures are non-IFRS financial measures and non-IFRS ratios. These measures are not recognized measures under IFRS and do not have standardized meanings prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. See “Non-IFRS and Other Financial Measures”.

Proposed take private transaction

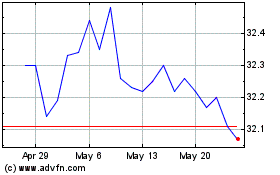

On April 1, 2024, the Company entered into a definitive arrangement agreement to be taken private by Advent, alongside existing Canadian shareholders Philip Fayer, certain investment funds managed by Novacap Management Inc., and Caisse de dépôt et placement du Québec, in an all-cash transaction which values the Company at an enterprise value of approximately $6.3 billion. Subject to certain conditions, Advent will acquire all the issued and outstanding Subordinate Voting Shares and any Multiple Voting Shares that are not Rollover Shares (as defined in the “Risk Factors” section of this MD&A), for a price of $34.00 per share, in cash (“Proposed transaction”). This price represents a premium of approximately 56% to the closing price of the Subordinate Voting Shares on the Nasdaq on March 15, 2024, the last trading day prior to media reports concerning a potential transaction involving the Company, and a premium of approximately 48% to the 90-day volume weighted average trading price1 per Subordinate Voting Share as of such date.

The Proposed transaction will be implemented by way of a statutory plan of arrangement under the Canada Business Corporations Act. The Proposed transaction was approved by shareholders at a special meeting held on June 18, 2024 and received court approval on June 20, 2024. The proposed transaction remains subject to customary closing conditions, including receipt of key regulatory approvals (a number of which were received and/or for which the waiting period has expired as of the date hereof, with several approvals remaining outstanding), is not subject to any financing condition and, assuming the timely receipt of all required key regulatory approvals, is expected to close in late 2024 or the first quarter of 2025.

The Arrangement Agreement (as defined in the “Risk Factors” section of this MD&A) provides for a non-solicitation covenant on the part of Nuvei. Nuvei may in the future be required to pay a termination fee of US$150 million in certain circumstances. A reverse termination fee of US$250 million would be payable to Nuvei if the transaction is not completed in certain circumstances.

Following completion of the transaction, it is expected that the Subordinate Voting Shares will be delisted from each of the Toronto Stock Exchange and the Nasdaq and that Nuvei will cease to be a reporting issuer in all applicable Canadian jurisdictions and will deregister the Subordinate Voting Shares with the U.S. Securities and Exchange Commission (the “SEC”). Please see “Risk Factors” below.

Till Payments acquisition

On January 5, 2024, we acquired 100% of the shares of Till Payments, an ISV focused payment technology company headquartered in Sydney, Australia, for a total consideration of $36.9 million, comprised of $30.0 million in cash and $6.9 million of a loan receivable that was considered part of the consideration transferred.

Quarterly dividend

On August 6, 2024, the Board of Directors approved and declared a quarterly cash dividend of $0.10 per Subordinate Voting Share and Multiple Voting Share payable on September 5, 2024 to shareholders of record on August 20, 2024.

1 Based on Canadian composite (TSX and all Canadian marketplaces) and U.S. composite (Nasdaq and all U.S. marketplaces).

Non-IFRS and Other Financial Measures