UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________________________

SCHEDULE 14A

(RULE 14a-101)

Information Required in Proxy Statement

__________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

__________________________

Filed by the Registrant x

Filed by the Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

NEWTEK BUSINESS SERVICES CORP.

(Exact Name of Company as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| S | | No fee required. |

| | | | | |

| £ | | Fee paid previously with preliminary materials. |

| | | | |

| £ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | |

| |

| 4800 T-Rex Avenue |

| Suite 120 |

| Boca Raton, FL 33431 |

| (855) 284-3722 | www.newtekone.com |

May 16, 2022

To My Fellow Shareholders of Newtek Business Services Corp:

We believe that we have moved past one of the most challenging years in our 21-year history. Not only did we emerge, but we soared and realized some the strongest results in our history, hitting record achievements across several of our metrics and achieving record milestones. We truly could not be more pleased with the operational performance and the related financial results in 2021. We believe that our successful performance over the past year is predicated on the fact that Newtek’s business model is forward-thinking, nimble and adaptable, as well as diversified with multiple streams of income from many sources. To recap, our net investment income of $25.7 million, or $1.13 per share, for the twelve months ended December 31, 2021, did decline by 25.8%, on a per share basis, but our adjusted net investment income reached record levels for the twelve months ended December 31, 2021. In addition, our net asset value (“NAV”) was $403.9 million, or $16.72 per share, at December 31, 2021, which represented an increase of 8.2%, on a per share basis, compared to NAV of $15.45 per share at December 31, 2020. During the first quarter of 2021, Newtek achieved a market capitalization of over $500 million, and by the end of 2021, we reached over $600 million in market capitalization; something of which we are extremely proud, and we believe demonstrates the strength of our management team, and resulting continued support of our shareholder base and their belief in what we do, day in and day out. We believe reaching a market capitalization over $500 million can introduce us to greater acceptance by small-cap investors with investment theses that require a minimum market capitalization of $500 million. In addition, the Company reached the milestone of over $1.0 billion in total assets at December 31, 2021.

Reviewing our lending achievements, I want to highlight that Newtek Small Business Finance (“NSBF”) funded approximately $729 million of PPP loans to 16,000 clients in 2021, while simultaneously funding a record $560.6 million of SBA 7(a) loans, and Newtek Business Lending (“NBL”) funded and/or closed a $90.1 million of SBA 504 loans. We believe that this, on a stand-alone basis, is an incredible feat of which we are extremely proud, and is testament to how our organization remained focused and materially improved our technology, training and capability to scale and grow in lending and other solutions during a challenging year. As an example, we continued to augment our talented team of professionals across NSBF and our portfolio lending companies. In fact, by the end of 2021, we increased our lending staff across NSBF and our portfolio companies by approximately 33% from the end of 2020. In addition, our lending teams received over 2,350 hours of additional training, compliance and management directives in 2021 alone, which we believe bolsters our staff’s effectiveness and ability to serve our clients and enhance our business across our lending ecosystem. As a result, we believe we are a much better company today than we were in early 2020, and believe we will be even better in 2022 and beyond as we continue to leverage all that we have built.

It is no surprise to us that. once again in 2021, NSBF retained its title as the top non-bank SBA 7(a) lender in the U.S. and was the second largest SBA 7(a) lender by dollar volume of loan approvals as of December 31, 2021, as well as at March 31, 2022. In 2021, NSBF funded a record $560.6 million of SBA 7(a) loans which was an increase of 184.9% over 2020.

I would also like to highlight in greater detail the positive developments in our lending portfolio companies during 2021. NBL funded and/or closed $90.1 million in SBA 504 loans in 2021, slightly above the same period in 2020, and a 96.7% increase over the same period in 2019. Moreover, NBL is forecasting a material increase in SBA 504 fundings and/or closings in 2022 of approximately 67% to $150 million. We are optimistic about the growth in this product offering as SBA 504 lending is a fixed-rate alternative to businesses that occupy commercial real estate and can provide an attractive choice in a low interest-rate environment. Furthermore, NBL remains well capitalized and poised for growth with the support of $200 million in credit facilities.

With respect to our joint venture (“JV”) program that funds non-conforming conventional loans, while the pandemic did slow us and our JV partners down, we have several initiatives in place to restart and grow the JV program in 2022. To that end, we are working on forming new JV partnerships to support the growth of the non-conforming conventional loan program in 2022.

In addition, in 2021, the Company and NBL funded $19.4 million of non-conforming conventional loans.

| | | | | |

| |

| 4800 T-Rex Avenue |

| Suite 120 |

| Boca Raton, FL 33431 |

| (855) 284-3722 | www.newtekone.com |

When looking at our overall operating plan as a lender, we should not be viewed solely as an SBA lender, but simply a lender that offers 10- to 25-year amortizing loans to business owners without balloon payments and with minimal covenants that give businesses the ability to grow, as compared to fintech lenders’ which often offer double-digit rates of interest, and six- to 24-month prepayment periods. We believe that we can satisfy a spectrum of borrowers, and as referrals come through, each specific case can be funneled into one of our lending products.

We also continued to successfully access the securitization market. In December 2021, we closed our 11th securitization of SBA 7(a) loans with tremendous investor acceptance, over 4.5x over subscribed, attractive pricing and consistent advance rates. In addition, in January 2022, our JV, Newtek Conventional Lending, closed its first securitization of non-conforming conventional loan originations, which was a milestone for the Company. We believe this is a good template going forward for our business, and we intend to grow this business.

In 2021, we paid a record $3.15 per share in dividends to our shareholders, which represented a 53.7% increase over dividends paid in 2020 and a 46.5% increase over dividends paid in 2019. Additionally, on March 31, 2022, the Company paid its first quarter 2022 dividend of $0.65 per share, which represents a 30% increase over the first quarter 2021 dividend. On April 20, 2022, the Company declared a second quarter 2022 dividend of $0.75 per share, payable on June 30, 2022. Together the first and second quarter dividends equals $1.40 per share for the first six months of 2022. As always, and important to highlight, we have been able to pay our distributions in the form of dividends paid out of taxable income.

During the second half of 2021, our payment processing portfolio company, Newtek Merchant Solutions (“NMS”), continued to rebound from pandemic-related lower processing volumes. NMS experienced a 23.2% increase in monthly sales volume for the fourth quarter of 2021 compared to the same period last year. We believe this is a result of increased consumer spending as the economy continued to reopen across the U.S. NMS anticipates continued growth in processing volumes in 2022 compared to 2021, and has added senior talent to the NMS team to assist in the growth of NMS.

We continue to experience a turnaround in Newtek Technology Solutions (“NTS”) our Phoenix-based cloud-computing portfolio company that primarily provides managed services and technology solutions to our clients to meet their needs. In the first quarter of 2021, we further augmented our technology offering under the Newtek® brand by contributing our technology portfolio companies, IPM and Sidco LLC, d/b/a Cloud Nine Services, to NTS. Our payment processing businesses and managed technology solutions business generated EBITDA of approximately $19.0 million in 2021.

Finally, in our payroll and insurance agency portfolio companies, Newtek Payroll & Benefits Solutions and Newtek Insurance Solutions, respectively, we have implemented several changes including augmenting the management teams to better position both of these portfolio companies for growth under the Newtek brand.

As always, I want to personally thank each and every one of my fellow shareholders for their continued support and investment in Newtek Business Services Corp. We cannot wait to move forward with all of you and, together, experience, Newtek’s next chapter!

Sincerely,

/s

Barry Sloane

President, Chairman, Founder and CEO of Newtek Business Services Corp.

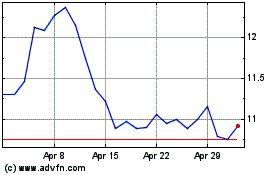

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

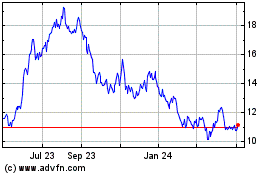

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024