NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)

(“NeuroOne” or the “Company”), a medical technology company focused

on improving surgical care options and outcomes for patients

suffering from neurological disorders, today announces its

operating results for the second quarter fiscal year 2024 ended

March 31, 2024.

Second Quarter Fiscal Year 2024 and Recent Business

Updates

Financial Highlights:

- Product revenue of $1,377,000

in Q2 2024, compared to $466,000 in Q2 2023

- Raised an additional $2.0 million

using the ATM Program in Q2 2024

Evo® sEEG:

- Zimmer Biomet continued to expand

into new accounts

- Product exhibited by Zimmer Biomet

at the American Association of Neurological Surgeons (AANS) in

May

OneRF™ Ablation System:

- Completed site training and

initiated limited commercial launch of the OneRF™ Ablation System

in late March

- Successfully implanted five

patients

- Completed initial manufacturing run

for limited commercial launch

- Presented ICD-10-PCS hospital

inpatient code application to the Centers for Medicare and Medicaid

Services (CMS) in March for the OneRF™ ablation procedure to

support accurate data collection and processing of reimbursement

claims by hospitals for the ablation procedure

- Exhibited the OneRF™ Ablation

System at the AANS meeting in May

Drug Delivery Program:

- Completed feasibility bench top

testing and animal study demonstrating the ability to deliver a

therapeutic agent and provide recording capabilities using the sEEG

drug delivery system

- Continued discussions with

potential strategic partners for use in clinical studies and

research

Spinal Cord Stimulation Program:

- Completed animal study to evaluate

stimulation and battery performance using the Company’s spinal cord

stimulation electrode technology

- Led by our Spinal Cord Stimulation

Advisory Board, completed cadaver study to further advance the

development of the percutaneous implantation technique for

NeuroOne’s thin-film paddle electrodes for spinal cord

stimulation

- Presented posters on pre-clinical

experience with thin-film paddle leads at North American

Neuromodulation Society (NANS) and Gordon Research Conference on

Neuroelectronic Interfaces

Dave Rosa, CEO of NeuroOne, commented, “We made

excellent progress this quarter across multiple fronts. Revenue

growth continued regarding our sEEG product line as new customer

sites were added by Zimmer Biomet. We also initiated the limited

commercial launch of the OneRF™ Ablation System, an exciting

accomplishment given we are the first company to receive FDA 510(k)

clearance to market this novel technology in the United States.

Customer interest has been strong and we believe the OneRF™

Ablation System, with combination diagnostic and therapeutic

functionality, has the capability to create a paradigm shift in

neurosurgical procedures. Moving forward, we will investigate other

applications to leverage our ablation system. We continue to

believe strongly in the market opportunity for our drug delivery

system as we believe it has the potential to create a unique

platform for both identifying the target area in the brain,

delivering the pharmacologic agent and monitoring its

performance.”

Key Upcoming Milestones

OneRF™ Ablation System:

- Transition manufacturing from sEEG

diagnostic electrodes to OneRF electrodes

- Add new centers for our limited

commercial launch

- Exhibit OneRF™ Ablation System and

present posters at the 2024 American Society for Stereotactic and

Functional Neurosurgery (ASSFN) meeting in June

- Continue to explore additional

applications and strategic partnership opportunities for ablation

in neurology and other attractive markets that could benefit from

NeuroOne’s high-resolution, thin-film electrode technology

Drug Delivery Program:

- Refine prototype design and

complete biocompatibility study

- Continue to identify potential

strategic partners to utilize NeuroOne’s drug delivery device in

clinical studies and research

Spinal Cord Stimulation Program:

- Finalize electrode design

- Present poster on feasibility of

implantation of epidural thin-film paddle leads at International

Neuromodulation Society’s (INS) World Congress

Second Quarter Fiscal Year 2024 Financial

Results

Product revenue was $1,377,000 in the

second quarter of fiscal 2024, compared to product revenue of

$466,000 in the second quarter of fiscal 2023. For the first

six months of fiscal 2024, product revenue was $2,355,000, compared

to $581,000 for the same period in fiscal 2023. The Company had no

collaboration revenue in the first six months of fiscal 2024,

compared to collaboration revenue of $1.46 million in the first six

months of fiscal 2023. Collaboration revenue in 2023 was derived

from the Zimmer Development Agreement and represents the portion of

the exclusivity and milestone fee payments eligible for revenue

recognition during the period.

Total operating expenses in the second quarter

of fiscal 2024 were $3.3 million, compared

with $3.5 million in the same period of the prior

fiscal year. Research and Development (R&D) expense in the

second quarter of fiscal 2024 was $1.3 million compared

with $1.7 million in the second quarter of fiscal 2023.

Selling, General and Administrative (SG&A) expense in the

second quarter of fiscal 2024 was $2.0 million compared

with $1.8 million in the prior year period. For the first

six months of fiscal 2024, total operating expenses were $6.9

million, compared with $6.8 million in the same

period of fiscal 2023. R&D expense in the first six months of

fiscal 2024 was $2.8 million compared with $3.3

million in the same period of fiscal 2023. SG&A expense in

the first six months of fiscal 2024 was $4.2

million compared with $3.5 million in the prior year

period.

Net loss was $2.9 million for the

second quarter of fiscal 2024, compared to a net loss of $3.5

million in the second quarter of fiscal 2023. Net loss for the

first six months of fiscal 2024 was $6.2 million compared

with $5.3 million in the same period of fiscal 2023.

In the second quarter of fiscal 2024, the

Company sold common stock under the ATM Program at an average price

of $1.43 per share, from which the Company received net proceeds of

$2.0 million.

As of March 31, 2024, the Company had cash

and cash equivalents of $2.4 million, compared to $5.3

million as of September 30, 2023. The Company had working

capital of $3.2 million as of March 31, 2024, compared to working

capital of $5.5 million as of September 30, 2023.

The Company had no debt outstanding as

of March 31, 2024.

Conference Call and Webcast

Tuesday, May 14, 2024 – 4:30 PM Eastern Time

Participant Dial-In:888-506-0062 / +1 973-528-0011

Access Code: 540724

Live Webcast: Join here.

Phone Replay: 877-481-4010/ +1 919-882-2331Available through May

28, 2024

Webcast Replay:Available for 12 months

About NeuroOne

NeuroOne Medical Technologies Corporation is a

developmental stage company committed to providing minimally

invasive and hi-definition solutions for EEG recording, brain

stimulation and ablation solutions for patients suffering from

epilepsy, Parkinson's disease, dystonia, essential tremors, chronic

pain due to failed back surgeries and other related neurological

disorders that may improve patient outcomes and reduce procedural

costs. The Company may also pursue applications for other areas

such as depression, mood disorders, pain, incontinence, high blood

pressure, and artificial intelligence. For more information, visit

nmtc1.com.

Forward Looking Statements

This press release may include forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Except for statements of historical fact, any

information contained in this press release may be a

forward–looking statement that reflects NeuroOne’s current views

about future events and are subject to known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from the information expressed or implied by these

forward-looking statements. In some cases, you can identify

forward–looking statements by the words or phrases "may," "might,"

"will," "could," "would," "should," "expect," "intend," "plan,"

"objective," "anticipate," "believe," "estimate," "predict,"

"project," "potential," "target," "seek," "contemplate," "continue,

"focused on," "committed to" and "ongoing," or the negative of

these terms, or other comparable terminology intended to identify

statements about the future. Forward–looking statements may include

statements regarding the transition of manufacturing from sEEG

diagnostic electrodes to OneRF electrodes, the addition of new

centers for the Company’s limited commercial launch, potential

strategic partnership opportunities, continued development of the

Company's electrode technology program (including our drug delivery

program and spinal cord stimulation program), business strategy,

market size, potential growth opportunities, future operations,

future efficiencies, and other financial and operating information.

Although NeuroOne believes that we have a reasonable basis for each

forward-looking statement, we caution you that these statements are

based on a combination of facts and factors currently known by us

and our expectations of the future, about which we cannot be

certain. Our actual future results may be materially different from

what we expect due to factors largely outside our control,

including risks that the partnership with Zimmer Biomet may not

facilitate the commercialization or market acceptance of our

technology; whether due to supply chain disruptions, labor

shortages or otherwise; risks that our technology will not perform

as expected based on results of our pre-clinical and clinical

trials; risks related to uncertainties associated with the

Company's capital requirements to achieve its business objectives

and ability to raise additional funds: the risk that we may not be

able to secure or retain coverage or adequate reimbursement for our

technology; uncertainties inherent in the development process of

our technology; risks related to changes in regulatory requirements

or decisions of regulatory authorities; that we may not have

accurately estimated the size and growth potential of the markets

for our technology; risks relate to clinical trial patient

enrollment and the results of clinical trials; that we may be

unable to protect our intellectual property rights; and other

risks, uncertainties and assumptions, including those described

under the heading "Risk Factors" in our filings with the Securities

and Exchange Commission. These forward–looking statements speak

only as of the date of this press release and NeuroOne undertakes

no obligation to revise or update any forward–looking statements

for any reason, even if new information becomes available in the

future.

Caution: Federal law restricts this device to sale by or on the

order of a physician.

Contact:800-631-4030ir@nmtc1.com

NeuroOne Medical Technologies

CorporationCondensed Balance

Sheets(unaudited)

|

|

|

As ofMarch 31, |

|

|

As ofSeptember 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,434,655 |

|

|

$ |

5,322,493 |

|

|

Accounts receivable |

|

|

555,639 |

|

|

|

— |

|

|

Inventory |

|

|

1,311,673 |

|

|

|

1,726,686 |

|

|

Prepaid expenses |

|

|

407,777 |

|

|

|

263,746 |

|

|

Total current assets |

|

|

4,709,744 |

|

|

|

7,312,925 |

|

|

Intangible assets, net |

|

|

78,419 |

|

|

|

89,577 |

|

|

Right-of-use assets |

|

|

110,724 |

|

|

|

169,059 |

|

|

Property and equipment, net |

|

|

496,015 |

|

|

|

525,753 |

|

|

Total assets |

|

$ |

5,394,902 |

|

|

$ |

8,097,314 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

780,839 |

|

|

$ |

685,104 |

|

|

Accrued expenses and other liabilities |

|

|

759,620 |

|

|

|

1,107,522 |

|

|

Total current liabilities |

|

|

1,540,459 |

|

|

|

1,792,626 |

|

|

Operating lease liability, long term |

|

|

— |

|

|

|

55,284 |

|

|

Total liabilities |

|

|

1,540,459 |

|

|

|

1,847,910 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized; no

shares issued or outstanding. |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized;

26,321,750 and 23,928,945 shares issued and outstanding as of March

31, 2024 and September 30, 2023, respectively. |

|

|

26,322 |

|

|

|

23,929 |

|

|

Additional paid–in capital |

|

|

72,714,414 |

|

|

|

68,911,778 |

|

|

Accumulated deficit |

|

|

(68,886,293 |

) |

|

|

(62,686,303 |

) |

|

Total stockholders’ equity |

|

|

3,854,443 |

|

|

|

6,249,404 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

5,394,902 |

|

|

$ |

8,097,314 |

|

NeuroOne Medical Technologies

CorporationCondensed Statements of

Operations(unaudited)

|

|

|

For theThree Months Ended |

|

|

For theSix Months Ended |

|

|

|

|

March 31, |

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Product revenue |

|

$ |

1,377,294 |

|

|

$ |

466,176 |

|

|

$ |

2,354,943 |

|

|

$ |

580,755 |

|

| Cost of product revenue |

|

|

986,875 |

|

|

|

434,673 |

|

|

|

1,698,210 |

|

|

|

561,559 |

|

|

Product gross profit |

|

|

390,419 |

|

|

|

31,503 |

|

|

|

656,733 |

|

|

|

19,196 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Collaborations revenue |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,455,188 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

2,002,949 |

|

|

|

1,821,108 |

|

|

|

4,176,421 |

|

|

|

3,484,845 |

|

|

Research and development |

|

|

1,273,568 |

|

|

|

1,706,314 |

|

|

|

2,756,885 |

|

|

|

3,269,810 |

|

| Total operating expenses |

|

|

3,276,517 |

|

|

|

3,527,422 |

|

|

|

6,933,306 |

|

|

|

6,754,655 |

|

| Loss from operations |

|

|

(2,886,098 |

) |

|

|

(3,495,919 |

) |

|

|

(6,276,573 |

) |

|

|

(5,280,271 |

) |

| Other income (expense),

net |

|

|

31,008 |

|

|

|

(26,909 |

) |

|

|

76,583 |

|

|

|

24,674 |

|

| Loss before income taxes |

|

|

(2,855,090 |

) |

|

|

(3,522,828 |

) |

|

|

(6,199,990 |

) |

|

|

(5,255,597 |

) |

| Provision for income

taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net loss |

|

$ |

(2,855,090 |

) |

|

$ |

(3,522,828 |

) |

|

$ |

(6,199,990 |

) |

|

$ |

(5,255,597 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.32 |

) |

| Number of shares used in per

share calculations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

25,910,478 |

|

|

|

16,414,795 |

|

|

|

24,947,813 |

|

|

|

16,321,891 |

|

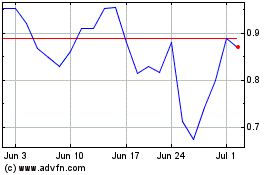

NeuroOne Medical Technol... (NASDAQ:NMTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

NeuroOne Medical Technol... (NASDAQ:NMTC)

Historical Stock Chart

From Feb 2024 to Feb 2025