As

Filed with the Securities and Exchange Commission on September 12, 2023

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

NanoVibronix,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

01-0801232 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

525

Executive Blvd.

Elmsford,

New York 10523

(914)

233-3004

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian

Murphy

Chief

Executive Officer

NanoVibronix,

Inc.

525

Executive Blvd.

Elmsford,

New York

(914)

233-3004

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Rick

A. Werner, Esq.

Jayun

Koo, Esq.

Haynes

and Boone, LLP

30

Rockefeller Plaza, 26th Floor

New

York, New York 10112

(212)

659-7300

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b–2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not

permitted.

Subject

to Completion, dated September 12, 2023

PROSPECTUS

NanoVibronix,

Inc.

8,956,955

Shares of Common Stock

This

prospectus relates to the resale by the selling stockholders named in this prospectus from time to time of up to 8,956,955 shares of

our common stock, par value $0.001 per share. These 8,956,955 shares of common stock consist of:

| ● |

180,000

shares of common stock (the “PIPE Shares”) that were issued pursuant to the securities purchase agreement, dated as of

August 30, 2023, by and among us and the purchaser named therein (the “Purchase Agreement”); |

| |

|

| ● |

2,726,977

shares of common stock (the “Pre-Funded Warrant Shares”) issuable upon the exercise of pre-funded warrants (the “Pre-Funded

Warrants”) that were issued pursuant to the Purchase Agreement; |

| |

|

●

● |

2,906,977

shares of common stock (the “A-1 Warrant Shares”) issuable upon exercise of the

of A-1 Warrants (the “A-1 Warrants”) that were issued pursuant to the Purchase

Agreement;

2,906,977

shares of common stock (the “A-2 Warrant Shares”) issuable upon exercise of the A-2 Warrants (the “A-2 Warrants”)

that were issued pursuant to the Purchase Agreement; |

| |

|

| ● |

218,023

shares of common stock (the “2023 Wainwright Warrant Shares”) issuable upon exercise of warrants (the “2023 Wainwright

Warrants”) that were issued to H.C. Wainwright & Co., LLC (“Wainwright”) or its designees as part of

Wainwright’s compensation for serving as exclusive placement agent in connection with the Purchase Agreement; and |

| |

|

| ● |

18,001

shares of common stock (the “2022 Wainwright Warrant Shares”) issuable upon exercise of warrants (the “2022 Wainwright

Warrants”) that were issued to Wainwright or its designees as part of Wainwright’s compensation for serving as

exclusive placement agent in connection with a securities purchase agreement, dated as of November 29, 2022, by and among us and

the purchasers named therein. |

The

PIPE Shares, the Pre-Funded Warrants, the A-1 Warrants, the A-2 Warrants, the 2023 Wainwright Warrants and the 2022 Wainwright Warrants

were issued in reliance upon the exemption from the registration requirements in Section 4(a)(2) of the Securities Act and/or Regulation

D promulgated thereunder, as applicable. We are registering the resale of the PIPE Shares, Pre-Funded Warrant Shares, the A-1 Warrant

Shares, the A-2 Warrant Shares, the 2023 Wainwright Warrant Shares and the 2022 Wainwright Warrant Shares.

Our

registration of the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell

any of such shares of common stock. The selling stockholders named in this prospectus, or their donees, pledgees, transferees or other

successors-in-interest, may resell the shares of common stock covered by this prospectus through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the possible

methods of sale that may be used by the selling stockholders, you should refer to the section of this prospectus entitled “Plan

of Distribution.”

We

will not receive any of the proceeds from the sale of common stock by the selling stockholders. However, we will receive proceeds from

the exercise of the Pre-Funded Warrants, the A-1 Warrants, the A-2 Warrants, the 2023 Wainwright Warrants, and the 2022 Wainwright Warrants

if such securities are exercised for cash. We intend to use those proceeds, if any, for general corporate purposes including funding

of our development programs, commercial planning and sales and marketing expenses, potential strategic acquisitions, general and administrative

expenses and working capital.

Any

shares of common stock subject to resale hereunder will have been issued by us and acquired by the selling stockholders prior to any

resale of such shares pursuant to this prospectus.

No

underwriter or other person has been engaged to facilitate the sale of the common stock in this offering. We will bear all costs, expenses

and fees in connection with the registration of the common stock. The selling stockholders will bear all commissions and discounts, if

any, attributable to their respective sales of our common stock.

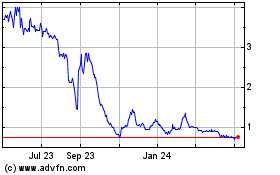

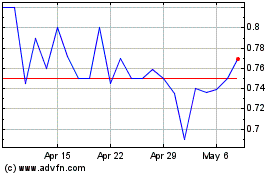

Our

common stock is traded on The Nasdaq Capital Market under the symbol “NAOV.” On September 11, 2023, the closing sale

price of our common stock on The Nasdaq Capital Market was $2.58 per share.

Investment

in our common stock involves risk. See “Risk Factors” contained in this prospectus, in our periodic reports filed from time

to time with the Securities and Exchange Commission, which are incorporated by reference in this prospectus and in any applicable prospectus

supplement. You should carefully read this prospectus and the accompanying prospectus supplement, together with the documents we incorporate

by reference, before you invest in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of the registration statement that we filed with the Securities and Exchange Commission (the “SEC”) pursuant

to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common

stock covered by this prospectus. As permitted by the rules and regulations of the SEC, the registration statement filed by us includes

additional information not contained in this prospectus.

This

prospectus and the documents incorporated by reference into this prospectus include important information about us, the securities being

offered and other information you should know before investing in our securities. You should not assume that the information contained

in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information

we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though

this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to

read and consider all information contained in this prospectus, including the documents incorporated by reference therein, in making

your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

You

should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We

have not, and the selling stockholders have not, authorized anyone to give any information or to make any representation to you other

than those contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

otherwise indicated, information contained or incorporated by reference in this prospectus concerning our industry, including our

general expectations and market opportunity, is based on information from our own management estimates and research, as well as from

industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived

from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we

believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily

uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 4 of this

prospectus. These and other factors could cause our future performance to differ materially from our assumptions and

estimates.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does not

contain all of the information you should consider before investing in our securities. You should carefully read the prospectus, the

information incorporated by reference and the registration statement of which this prospectus is a part in their entirety before investing

in our securities, including the information discussed under “Risk Factors” in this prospectus and the documents incorporated

by reference and our financial statements and related notes that are incorporated by reference in this prospectus. In this prospectus,

unless the context indicates otherwise, “NanoVibronix,” the “Company,” the “registrant,” “we,”

“us,” “our,” or “ours” refer to NanoVibronix, Inc. and its subsidiaries.

Overview

We

are a medical device company focusing on noninvasive biological response-activating devices that target wound healing and pain therapy

and can be administered at home, without the assistance of medical professionals. Our primary products, which are in various stages of

clinical and market development, currently consist of:

| |

● |

UroShield™,

an ultrasound-based product that is designed to prevent bacterial colonization and biofilm in urinary catheters, increase antibiotic

efficacy and decrease pain and discomfort associated with urinary catheter use. |

| |

|

|

| |

● |

PainShield™,

a patch-based therapeutic ultrasound technology to treat pain, muscle spasm and joint contractures by delivering a localized ultrasound

effect to treat pain and induce soft tissue healing in a targeted area; and |

| |

|

|

| |

● |

WoundShield™,

a patch-based therapeutic ultrasound device intended to facilitate tissue regeneration and wound healing by using ultrasound to increase

local capillary perfusion and tissue oxygenation. |

Each

of our PainShield, UroShield, and WoundShield products employs a small, disposable transducer that transmits low frequency, low intensity

ultrasound acoustic waves that seek to repair and regenerate tissue, musculoskeletal and vascular structures, and decrease biofilm formation

on urinary catheters and associated urinary tract infections. Through their size, effectiveness and ease of use, these products are intended

to eliminate the need for technicians and medical personnel to manually administer ultrasound treatment through large transducers, thereby

promoting patient independence and enabling more cost-effective home-based care.

PainShield

is currently cleared for marketing in the United States by the U.S. Food and Drug Administration although to date there has not been

a significant sales and marketing effort. All three of our products have CE Mark approval in the European Union, and a certificate allowing

us to sell PainShield, UroShield and WoundShield in Israel. We are able to sell PainShield, UroShield and WoundShield in India and Ecuador

based on our CE Mark. We have consummated sales of PainShield and UroShield in the relevant markets, although to date sales have been

minimal; WoundShield has not generated significant revenue to date. Outside of the United States we generally apply, through our distributor,

for approval in a particular country for a particular product only when we have a distributor in place with respect to such product.

The

global wound care device market totaled approximately $20.8 billion in 2022 and it is expected to grow to $27.2 billion by 2027 at a

CAGR of 5.4% during 2022-2027 (as reported by Markets and Markets in June 2022).

Nasdaq

Minimum Stockholders’ Equity Requirement

On

May 23, 2023, we received a letter from the Listing Qualifications Department of Nasdaq indicating that we no longer comply with the

minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1) for continued listing on Nasdaq because our stockholders’

equity of approximately $2.2 million as reported in our Quarterly Report on Form 10-Q for the period ended March 31, 2023, is below the

required minimum of $2.5 million, and as of May 22, 2023, we did not meet the alternative compliance standards relating to the market

value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal

year or in two of the last three most recently completed fiscal years.

In

accordance with Nasdaq Listing Rules, we had 45 calendar days, or until July 7, 2023, to submit a plan to regain compliance. On July

7, 2023 we submitted our plan to regain compliance with the Nasdaq minimum stockholders’ equity standard. On July 19, 2023, the

staff of the Listing Qualifications Department of Nasdaq granted our request for continued listing pursuant to an extension through November

20, 2023, to evidence compliance with the minimum stockholders’ equity requirement, conditioned upon achievement of certain milestones

included in the plan of compliance previously submitted to Nasdaq. However, there can be no assurance we will be able to regain compliance.

If we do not regain compliance by the end of the extension granted by Nasdaq, or we fail to satisfy another Nasdaq requirement for continued

listing, Nasdaq staff could provide notice that our common stock will become subject to delisting. In such event, Nasdaq rules permit

us to appeal the decision to reject its proposed compliance plan or any delisting determination to a Nasdaq Hearings Panel. Accordingly,

there can be no guarantee that we will be able to maintain our Nasdaq listing.

CMS

Reimbursement for PainShield Transducer and Supplies

In

addition to the need to obtain regulatory approvals, we anticipate that sales volumes and prices of our UroShield and PainShield products

will depend in large part on the availability of insurance coverage and reimbursement from third party payers. Third party payers include

governmental programs such as Medicare and Medicaid in the United States, private insurance plans and workers’ compensation plans.

We do not currently have reimbursement codes for use of WoundShield in any of the markets in which we have regulatory authority to sell

WoundShield. Of the markets in which we have regulatory authority to sell PainShield, prior to January 2020, we only had reimbursement

codes in the United States (i.e., CPT codes) for clinical use only. Effective as of January 2020, the U.S. Centers for Medicare and Medicaid

Services (“CMS”) approved our PainShield product for reimbursement for Medicare beneficiaries on a national basis, but CMS

did not approve PainShield supplies for reimbursement. We conducted additional longevity testing by an independent laboratory and launching

a direct-to-consumer rental program for PainShield™, as we were denied reimbursement in September 2022 due to a lack of “life-cycle”

testing. In 2023, we provided CMS with additional data. In August 2023, CMS announced the publication of its Healthcare Common Procedure

Coding System Application Summaries, Coding Decisions and Benefit Category & Payment Determinations for the first bi-annual 2023

Non-Drug and Non-Biological Items and Services. As part of its determination, CMS concluded that PainShield does not fall within a Durable

Medical Equipment, Prosthetics, Orthotics and Supplies benefit category and therefore is not reimbursable under Medicare and Medicaid

at this time. We plan to resubmit an application for additional review and continue to work with our legal and technical teams to weigh

our options, as we believe it will be difficult to achieve market success if PainShield supplies are not eligible for reimbursement.

PainShield currently is subject to reimbursement under certain workers’ compensation plans and Veterans Administration facilities.

August

2023 PIPE

On

August 30, 2023, we entered into the Purchase Agreement with an institutional investor for the issuance and sale in a private placement

(the “Private Placement”) of 180,000 PIPE Shares, Pre-Funded Warrants to purchase up to 2,726,977 shares of common stock,

with an exercise price of $0.0001 per share, A-1 Warrants to purchase up to 2,906,977 shares of common stock, with an exercise price

of $1.47 per share, and A-2 Warrants to purchase up to 2,906,977 shares of common stock with an exercise price of $1.47 per share. The

A-1 Warrants are exercisable immediately upon issuance and have a termination date of March 1, 2029. The A-2 Warrants are exercisable

immediately upon issuance and have a termination date of October 1, 2024. The combined purchase price for one PIPE Share and the accompanying

Warrants was $1.72, and the combined purchase price for one Pre-Funded Warrant and the accompanying Warrants was $1.7199.

A

holder of the Pre-Funded Warrants, the A-1 Warrants, and the A-2 Warrants may not exercise any portion of such holder’s Pre-Funded

Warrants, the A-1 Warrants, or the A-2 Warrants to the extent that the holder, together with its affiliates, would beneficially own more

than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of common stock immediately after exercise, except that

upon at least 61 days’ prior notice from the holder to the us, the holder may increase the beneficial ownership limitation to up

to 9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise.

In

connection with the Private Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”),

dated as of August 30, 2023, with the investor, pursuant to which we agreed to prepare and file a registration statement with the SEC

registering the resale of the PIPE Shares and the shares of common stock underlying the Pre-Funded Warrants, the A-1 Warrants and the

A-2 Warrants no later than 15 days after the date of the Registration Rights Agreement, and to use best efforts to have the registration

statement declared effective as promptly as practical thereafter, and in any event no 45 days following the date of the Registration

Rights Agreement (or 75 days following the date of the Registration Rights Agreement in the event of a “full review” by the

SEC).

Wainwright

served as the exclusive placement agent in connection with the Private Placement, pursuant to that certain engagement letter, dated as

of July 5, 2023, as amended, between us and Wainwright (the “Engagement Letter”). Pursuant to the Engagement Letter, we issued

to Wainwright or its designees the 2023 Wainwright Warrants to purchase up to an aggregate of 218,023 shares of common stock at an exercise

price equal to $2.15 per share. The Wainwright Warrants are exercisable immediately upon issuance and have a termination date of March

1, 2029.

November

2022 Offering

On

November 29, 2022, we entered into a securities purchase agreement with certain institutional investors, pursuant to which we sold to

the purchasers in a registered direct offering 240,000 shares of our common stock. In connection with this offering, on December 1, 2022,

we issued to Wainwright or its designees as partial compensation, the 2022 Wainwright Warrants to purchase up to an aggregate of 18,001

shares of common stock at an exercise price of $12.50 per share, pursuant to an engagement letter, dated October 6, 2022, between us

and Wainwright. The 2022 Wainwright Warrants expire on November 29, 2027.

Corporate

information

We

were organized in the State of Delaware on October 20, 2003. Our principal executive offices are located at 525 Executive Boulevard,

Elmsford, New York 10523. Our telephone number is (914) 233-3004. Our website address is www.nanovibronix.com. Information accessed through

our website is not incorporated into this prospectus and is not a part of this prospectus.

THE

OFFERING

| Common

Stock to be Offered by the Selling Stockholders |

|

Up

to 8,956,955 shares of our common stock, which are comprised of (i) 180,000 PIPE Shares, (ii) 2,726,977 Pre-Funded Warrant Shares

(iii) 2,906,977 A-1 Warrant Shares, (iv) 2,906,977 A-2 Warrant Shares (v) 218,023 2023 Wainwright Warrant Shares and (iv) 18,001

2022 Wainwright Warrant Shares. |

| |

|

|

| Use

of Proceeds |

|

All

shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders and we will

not receive any proceeds from the sale of these shares. However, we will receive proceeds from the exercise of the Pre-Funded Warrants,

the A-1 Warrants, the A-2 Warrants, the 2023 Wainwright Warrants and the 2022 Wainwright Warrants if such warrants are exercised

for cash. We intend to use those proceeds, if any, for general corporate purposes, including funding of our development programs,

commercial planning and sales and marketing expenses, potential strategic acquisitions, general and administrative expenses and working

capital. See “Use of Proceeds” beginning on page 6 of this prospectus for additional information. |

| |

|

|

| Registration

Rights |

|

Under

the terms of the Registration Rights Agreement, we agreed to file this registration statement

with respect to the registration of the resale by the selling stockholders of the PIPE Shares,

the Pre-Funded Warrant Shares, the A-1 Warrant Shares and the A-2 Warrant Shares, as applicable,

by the 15th calendar day following the date of the Registration Rights Agreement,

and to use best efforts to have the registration statement declared effective as promptly

as practical, and in any event, no later than the 45th calendar day following the date of

the Registration Rights Agreement or in the event of a full review by the SEC, 75 days. In

addition, we agreed that, upon the registration statement being declared effective under

the Securities Act of 1933, as amended (the “Securities Act”), we will use our

best efforts to maintain the effectiveness of the registration statement until the date that

(i) the selling stockholders have sold all of the shares of common stock issuable under the

Registration Rights Agreement or (ii) such shares may be resold by the selling stockholders

pursuant to Rule 144 of the Securities Act, without the requirement for us to be in compliance

with the current public information required under such rule and without volume or manner-of-sale

restriction.

See

“Selling Stockholders” on page 6 of this prospectus for additional information. |

| |

|

|

| Plan

of Distribution |

|

The

selling stockholders named in this prospectus, or their pledgees, donees, transferees, distributees,

beneficiaries or other successors-in-interest, may offer or sell the shares of common stock

from time to time through public or private transactions at prevailing market prices, at

prices related to prevailing market prices or at privately negotiated prices. The selling

stockholders may also resell the shares of common stock to or through underwriters, broker-dealers

or agents, who may receive compensation in the form of discounts, concessions or commissions.

See

“Plan of Distribution” beginning on page 8 of this prospectus for additional information on the methods of sale

that may be used by the selling stockholders. |

| |

|

|

| Nasdaq

Capital Market Symbol |

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “NAOV.” |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves significant risks. See “Risk Factors” beginning on page 4 of this prospectus and

the documents incorporated by reference in this prospectus. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. In addition to the other information contained in this prospectus and in the documents

we incorporate by reference, you should carefully consider the risks discussed below and under the heading “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 as well as any amendment or update to our risk factors

reflected in subsequent filings with the SEC, before making a decision about investing in our securities. The risks and uncertainties

discussed below and in the documents incorporated by reference are not the only ones facing us. Additional risks and uncertainties not

presently known to us, or that we currently see as immaterial, may also harm our business. If any of these risks occur, our business,

financial condition and operating results could be harmed, the trading price of our common stock could decline and you could lose part

or all of your investment.

The

sale of a substantial amount of our shares in the public market could adversely affect the prevailing market price of our securities.

We

are registering for resale up to 8,956,955 shares of our common stock held by the selling stockholders, which is a significant number

of shares compared to the current number of total shares of common stock issued and outstanding. Sales of substantial amounts of shares

of our common stock in the public market, or the perception that such sales might occur, could adversely affect the market price of our

common stock. We cannot predict if and when selling stockholders may sell such shares of our common stock in the public markets. Furthermore,

in the future, we may issue additional shares of our common stock or other equity or debt securities convertible into shares of our common

stock. Any such issuance could result in substantial dilution to our existing stockholders and could cause the market price of our securities

to decline.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the information incorporated by reference in this prospectus contain “forward-looking statements,” which include

information relating to future events, future financial performance, strategies, expectations, competitive environment and regulation.

Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” and similar expressions, as well as statements in future tense, are intended to identify

forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not

be accurate indications of when such performance or results will actually be achieved. Forward-looking statements are based on information

we have when those statements are made or our management’s good faith belief as of that time with respect to future events, and

are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or

suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| |

● |

Our

history of losses and expectation of continued losses. |

| |

|

|

| |

●

|

Global

economic and political instability and conflicts, such as the conflict between Russia and Ukraine, could adversely affect our business,

financial condition or results of operations. |

| |

|

|

| |

● |

Increasing

inflation could adversely affect our business, financial condition, results of operations or cash flows. |

| |

|

|

| |

● |

The

geographic, social and economic impact of COVID-19 on the Company’s business operations. |

| |

|

|

| |

● |

Our

ability to raise funding for, and the timing of, clinical studies and eventual U.S. Food and Drug Administration (“FDA”)

approval of our product candidates. |

| |

|

|

| |

● |

Regulatory

actions that could adversely affect the price of or demand for our approved products. |

| |

|

|

| |

● |

Market

acceptance of existing and new products. |

| |

● |

Favorable

or unfavorable decisions about our products from government regulators, insurance companies or other third-party payers (including

CMS). |

| |

|

|

| |

● |

Risks

of product liability acclaims and the availability of insurance. |

| |

|

|

| |

● |

Our

ability to generate internal growth. |

| |

|

|

| |

● |

Risks

related to computer system failures and cyber-attacks. |

| |

|

|

| |

● |

Our

ability to obtain regulatory approval in foreign jurisdictions. |

| |

|

|

| |

● |

Uncertainty

regarding the success of our clinical trials for our products in development. |

| |

|

|

| |

● |

Risks

related to our operations in Israel, including political, economic and military instability. |

| |

|

|

| |

● |

The

price of our securities is volatile with limited trading volume. |

| |

|

|

| |

● |

Our

ability to regain compliance with the continued listing requirements of Nasdaq and the risk that our common stock will be delisted

if we cannot do so. |

| |

● |

Our

ability to maintain effective internal control over financial reporting and to remedy identified material weaknesses. |

| |

|

|

| |

● |

We

are a “smaller reporting company” and have reduced disclosure obligations that may make our stock less attractive to

investors. |

| |

|

|

| |

● |

Our

intellectual property portfolio and our ability to protect our intellectual property rights. |

| |

|

|

| |

● |

Our

ability to recruit and retain qualified regulatory and research and development personnel. |

| |

|

|

| |

● |

Unforeseen

changes in healthcare reimbursement for any of our approved products. |

| |

|

|

| |

● |

The

adoption of health policy changes and health care reform. |

| |

● |

Lack

of financial resources to adequately support our operations. |

| |

|

|

| |

● |

Difficulties

in maintaining commercial scale manufacturing capacity and capability. |

| |

|

|

| |

● |

Changes

in our relationship with key collaborators. |

| |

|

|

| |

● |

Changes

in the market valuation or earnings of our competitors or companies viewed as similar to us. |

| |

|

|

| |

● |

Our

failure to comply with regulatory guidelines. |

| |

|

|

| |

● |

Uncertainty

in industry demand and patient wellness behavior. |

| |

|

|

| |

● |

General

economic conditions and market conditions in the medical device industry. |

| |

|

|

| |

● |

Future

sales of large blocks of our common stock, which may adversely impact our stock price. |

| |

|

|

| |

● |

Depth

of the trading market in our common stock. |

You

should read this prospectus and any related free-writing prospectus and the documents incorporated by reference in this prospectus with

the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different

from what we expect. The forward-looking statements contained or incorporated by reference in this prospectus are expressly qualified

in their entirety by this cautionary statement. We do not undertake any obligation to publicly update any forward-looking statement to

reflect events or circumstances after the date on which any such statement is made or to reflect the occurrence of unanticipated events.

USE

OF PROCEEDS

All

shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders and we will not

receive any proceeds from the sale of these shares. However, will receive proceeds from the exercise of the Pre-Funded Warrants, the

A-1 Warrants, the A-2 Warrants, the 2023 Wainwright Warrants and the 2022 Wainwright Warrants if such warrants are exercised for cash.

We intend to use those proceeds, if any, for general corporate purposes, including funding of our development programs, commercial planning

and sales and marketing expenses, potential strategic acquisitions, general and administrative expenses and working capital.

SELLING

STOCKHOLDERS

The

common stock being offered by the selling stockholders are those previously issued to the selling stockholders, and those issuable to

the selling stockholders, upon exercise of the warrants, as applicable. For additional information regarding the issuances of those shares

of common stock and the warrants, see “August 2023 PIPE” and “November 2022 Offering” above. We are registering

the shares of common stock in order to permit the selling stockholders to offer the shares for resale from time to time. Except as described

below under “Relationships with the Selling Stockholders,” the selling stockholders have not had any material relationship

with us within the past three years.

The

table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by

each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholders,

based on its ownership of the shares of common stock and warrants, as of September 7, 2023, assuming exercise of the warrants held by

the selling stockholders on that date, without regard to any limitations on exercises.

The

third column lists the shares of common stock being offered by this prospectus by the selling stockholders.

In

accordance with the terms of the Registration Rights Agreement with the selling stockholders, this prospectus generally covers the resale

of the sum of (i) the number of shares of common stock issued to the selling stockholders in the “August 2023 PIPE” described

above and (ii) the maximum number of shares of common stock issuable upon exercise of the Pre-Funded Warrants, the A-1 Warrants, the

A-2 Warrants, the 2023 Wainwright Warrants and the 2022 Wainwright Warrants, determined as if such outstanding warrants were exercised

in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of

the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the Registration

Rights Agreement, without regard to any limitations on the exercise of the warrants. The fourth column assumes the sale of all of the

shares offered by the selling stockholders pursuant to this prospectus.

Under

the terms of the A-1 Warrants, the A-2 Warrants, the 2023 Wainwright Warrants and the 2022 Wainwright Warrants, a selling stockholder

may not exercise applicable warrants to the extent such exercise would cause such selling stockholder, together with its affiliates and

attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% (or, at the election of the holder,

9.99%) of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock

issuable upon exercise of the warrants which have not been exercised. The number of shares in the second column does not reflect this

limitation. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

Name of Selling Stockholder | |

Number of shares of common stock owned prior to offering | | |

Maximum number of shares of common stock to be sold pursuant to this Prospectus | | |

Number of shares of common stock owned after offering | | |

Percentage of common stock owned after offering | |

| | |

| | |

| | |

| | |

| |

| Armistice Capital, LLC (1)(3) | |

| 8,720,931 | (3) | |

| 8,720,931 | (2)(3) | |

| 0 | | |

| 84 | %(3) |

| Michael Vasinkevich (4) | |

| 151,350 | | |

| 151,350 | (5) | |

| 0 | | |

| * | |

| Noam Rubinstein (4) | |

| 91,946 | (6) | |

| 89,206 | (7) | |

| 17,598 | | |

| * | |

| Craig Schwabe (4) | |

| 7,966 | | |

| 7,966 | (8) | |

| 0 | | |

| * | |

| Charles Worthman (4) | |

| 2,360 | | |

| 2,360 | (9) | |

| 0 | | |

| * | |

*

Less than 1%

| (1) |

The shares are directly

held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”) and may be deemed to

be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the

Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. As of the date of this registration statement, the

A-1 Warrants and the A-2 Warrants are subject to a beneficial ownership limitation of 4.99%, and the Pre-Funded Warrants are subject

to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion

of the A-1 Warrants, A-2 Warrants or the Pre-Funded Warrants, as applicable, that would result in the selling stockholder and its

affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address

of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| |

|

| (2) |

The shares that may be

sold under this prospectus are comprised of 180,000 PIPE Shares, 2,726,977 Pre-Funded Warrant Shares, 2,906,977 A-1 Warrant Shares,

and 2,906,977 A-2 Warrant Shares. |

| |

|

| (3) |

As

of the date of this registration statement, the Master Fund may not (i) exercise the Pre-Funded Warrants to the extent such exercise

would cause the Master Fund, together with its affiliates and attribution parties, to beneficially own a number of shares of common

stock which would exceed 9.99% of our then outstanding common stock following such exercise, or (ii) exercise the A-1 Warrants or

the A-2 Warrants to the extent such exercise would cause the Master Fund, together with its affiliates and attribution parties, to

beneficially own a number of shares of common stock which would exceed 4.99%, or, upon notice to us, 9.99%, of our then outstanding

common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise

of such securities which have not been so exercised.

|

| (4) |

The selling stockholder

was issued compensation warrants as a designee of Wainwright in connection with the Private Placement and a registered direct offering

in 2022. Each selling stockholder is affiliated with Wainwright, a registered broker dealer with a registered address of H.C. Wainwright

& Co., LLC, 430 Park Ave, 3rd Floor, New York, NY 10022, and has sole voting and dispositive power over the securities held.

Each selling stockholder may not exercise the 2023 Wainwright Warrants or the 2022 Wainwright Warrants to the extent such exercise

would cause each selling stockholder, together with his affiliates and attribution parties, to beneficially own a number of shares

of common stock which would exceed 4.99% of our then outstanding common stock following such exercise, or, upon notice to us, 9.99%

of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock

issuable upon exercise of such securities which have not been so exercised. The selling stockholder acquired the placement agent

warrants in the ordinary course of business and, at the time the placement agent warrants were acquired, the selling stockholder

had no agreement or understanding, directly or indirectly, with any person to distribute such securities. |

| |

|

| (5) |

Represents (i) 139,807

2023 Wainwright Warrant Shares and (ii) 11,543 2022 Wainwright Warrant Shares. |

| |

|

| (6) |

Represents

(i) 68,678 2023 Wainwright Warrant Shares, (ii) 5,670 2022 Wainwright Warrant Shares and (iii) 17,598 shares of common stock issuable

upon exercise of certain warrants issued in 2020.

|

| (7) |

Represents (i) 68,678 2023

Wainwright Warrant Shares and (ii) 5,670 2022 Wainwright Warrant Shares. |

| |

|

| (8) |

Represents (i) 7,358 2023

Wainwright Warrant Shares and (ii) 608 2022 Wainwright Warrant Shares. |

| |

|

| (9) |

Represents (i) 2,180 2023

Wainwright Warrant Shares and (ii) 180 2022 Wainwright Warrant Shares. |

Relationships

with the Selling Stockholders

Each

of Noam Rubinstein, Craig Schwabe, Michael Vasinkevich, and Charles Worthman, are associated persons of Wainwright, which served as

our exclusive placement agent in connection with the Private Placement and the registered direct offering discussed above, for which

Wainwright received compensation.

Armistice

Capital Master Fund Ltd. purchased securities in the Private Placement.

PLAN

OF DISTRIBUTION

Each

selling stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which

the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use

any one or more of the following methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in

which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the broker-dealer will attempt

to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker-dealer as principal and resale

by the broker-dealer for its account; |

| |

● |

an exchange distribution in accordance with the rules

of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

settlement of short sales; |

| |

● |

in transactions through broker-dealers that agree with

the Selling Stockholders to sell a specified number of such securities at a stipulated price per security; |

| |

● |

through the writing or settlement of options or other

hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such methods of sale; or |

| |

● |

any other method permitted pursuant to applicable law. |

The

selling stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA 2121.

In

connection with the sale of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The selling stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify

the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the selling stockholders

without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for

us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect

or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar

effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state

securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

LEGAL

MATTERS

The

validity of the securities offered by this prospectus will be passed upon for us by Haynes and Boone, LLP, New York, New York.

EXPERTS

The

consolidated financial statements of NanoVibronix, Inc. and its subsidiary as of December 31, 2022, and December 31, 2021, and for each

of the two years in the period ended December 31, 2022, included in the Annual Report on Form 10-K for the year ended December 31, 2022,

and incorporated in this prospectus by reference, have been so incorporated in reliance on the report (which contains an explanatory

paragraph relating to the Company’s ability to continue as a going concern as described in Note 2 to the financial statements)

of Marcum LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered by this

prospectus. This prospectus, filed as part of the registration statement, does not contain all the information set forth in the registration

statement and its exhibits and schedules, portions of which have been omitted as permitted by the rules and regulations of the SEC. For

further information about us, we refer you to the registration statement and to its exhibits and schedules.

We

file annual, quarterly and current reports and other information with the SEC. The SEC maintains an internet website at www.sec.gov

that contains periodic and current reports, proxy and information statements, and other information regarding registrants that are

filed electronically with the SEC.

These

documents are also available, free of charge, through the Investors section of our website, which is located at www.nanovibronix.com.

Information contained on our website is not incorporated by reference into this prospectus and you should not consider information on

our website to be part of this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we have filed with it, which means that we can disclose important

information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus,

and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future documents (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we

file with the SEC pursuant to Sections l3(a), l3(c), 14 or l5(d) of the Exchange Act subsequent to the date of this prospectus and prior

to the termination of the offering:

| |

● |

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on April 17, 2023; |

| |

|

|

| |

● |

Our Definitive Proxy Statement

on Schedule 14A, filed with the SEC on May 1, 2023; |

| |

|

|

| |

● |

Our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 15, 2023; |

| |

|

|

| |

● |

Our Quarterly Report on

Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 11, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC on February 8, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC on March 3, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC on April 19, 2023; |

| |

|

|

| |

● |

Our

Current Report on Form

8-K, filed with the SEC on May 25, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC

on June 21, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC

on July 20, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC

on August 23, 2023; |

| |

|

|

| |

● |

Our Current Report on Form 8-K, filed with the SEC

on September 1, 2023; and |

| |

|

|

| |

● |

The description of our common stock contained in our

Registration Statement on Form 8-A, filed on October 19, 2017 pursuant to Section 12(b) of the Exchange Act, which incorporates by

reference the description of the shares of our common stock contained in the “Description of Securities” filed as Exhibit

4.15 to our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on April 17, 2023, and any amendment

or report filed with the SEC for purposes of updating such description. |

You

should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else to provide

you with different information. Any statement contained in a document incorporated by reference into this prospectus will be deemed to

be modified or superseded for the purposes of this prospectus to the extent that a later statement contained in this prospectus or in

any other document incorporated by reference into this prospectus modifies or supersedes the earlier statement. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You should not assume

that the information in this prospectus is accurate as of any date other than the date of this prospectus or the date of the documents

incorporated by reference in this prospectus.

8,956,955

Shares

COMMON

STOCK

PROSPECTUS

PART

II:

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution

The

following table sets forth the various costs and expenses payable by us in connection with the sale of the securities being registered.

All such costs and expenses shall be borne by us. Except for the Securities and Exchange Commission registration fee, all the amounts

shown are estimates.

| Securities and Exchange Commission Registration Fee | |

$ | 2,280.10 | |

| Printing and engraving costs | |

$ | 3,000 | |

| Legal fees and expenses | |

$ | 25,000 | |

| Accounting fees and expenses | |

$ | 15,000 | |

| Miscellaneous Fees and Expenses | |

$ | 2,000 | |

| | |

| | |

| Total | |

$ | 47,280.10 | |

Item

15. Indemnification of Directors and Officers

Section

145 of the General Corporation Law of the State of Delaware provides, in general, that a corporation incorporated under the laws of the

State of Delaware, as we are, may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending

or completed action, suit or proceeding (other than a derivative action by or in the right of the corporation) by reason of the fact

that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee or agent of another enterprise, against expenses (including attorneys’ fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if

such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the

corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s conduct was

unlawful. In the case of a derivative action, a Delaware corporation may indemnify any such person against expenses (including attorneys’

fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person

acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation,

except that no indemnification will be made in respect of any claim, issue or matter as to which such person will have been adjudged

to be liable to the corporation unless and only to the extent that the Court of Chancery of the State of Delaware or any other court

in which such action was brought determines such person is fairly and reasonably entitled to indemnity for such expenses.

Our

certificate of incorporation and bylaws provide that we will indemnify our directors, officers, employees and agents to the extent and

in the manner permitted by the provisions of the General Corporation Law of the State of Delaware, as amended from time to time, subject

to any permissible expansion or limitation of such indemnification, as may be set forth in any stockholders’ or directors’

resolution or by contract. Any repeal or modification of these provisions approved by our stockholders will be prospective only and will

not adversely affect any limitation on the liability of any of our directors or officers existing as of the time of such repeal or modification.

We

are also permitted to apply for insurance on behalf of any director, officer, employee or other agent for liability arising out of his

actions, whether or not the General Corporation Law of the State of Delaware would permit indemnification.

Item

16. Exhibits

| (b) |

All schedules have been

omitted because they are not required, are not applicable or the information is otherwise set forth in the financial statements and

related notes thereto. |

Exhibit

No. |

|

Description |

| 4.1 |

|

Form of Common Stock Certificate (incorporated by reference to Exhibit 4.2 to Amendment No. 1 to the Registration Statement on Form S-1 filed with the Securities and Exchange Commission on March 6, 2014) |

| 4.2 |

|

Form of May 10 and May 15, 2019 Warrants (incorporated by reference to Exhibit 4.1 to the Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 20, 2019) |

| 4.3 |

|

Form of Warrant (incorporated by reference to Exhibit 4.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on June 26, 2019) |

| 4.4 |

|

Form of Preferred Warrant (incorporated by reference to Exhibit 4.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 31, 2019) |

4.5 |

|

Form of Common Warrant (incorporated by reference to Exhibit 4.3 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 31, 2019) |

| 4.6 |

|

Form of Warrant Amendment (incorporated by reference to Exhibit 4.10 to the Annual Report on Form 10-K filed with the Securities and Exchange Commission on May 20, 2020) |

| 4.7 |

|

Form of Underwriter Common Stock Purchase Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on August 26, 2020). |

| 4.8 |

|

Form of Underwriter Common Stock Purchase Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 24, 2020). |

| 4.9 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on December 7, 2020). |

| 4.10 |

|

Form of Placement Agent Warrant (incorporated by reference to Exhibit 4.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on December 7, 2020). |

4.11 |

|

Form of Placement Agent Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on December 1, 2020). |

| 4.12 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 1, 2023). |

| 4.13 |

|

Form of Warrant (incorporated by reference to Exhibit 4.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 1, 2023). |

| 4.14 |

|

Form of Placement Agent Warrant (incorporated by reference to Exhibit 4.3 to the Current Report on Form 8-K filed with the Securities Exchange Commission on September 1, 2023). |

| 5.1* |

|

Opinion of Haynes and Boone, LLP. |

| 23.1* |

|

Consent of Marcum LLP, independent registered public accounting firm. |

| 23.2* |

|

Consent of Haynes and Boone, LLP (included in Exhibit 5.1). |

| 24.1* |

|

Power of Attorney (contained in the signature page to this registration statement). |

| 107 * |

|

Calculation of Filing Fee. |

| |

|

|

| * |

|

Filed herewith |

Item

17. Undertakings

The

undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

Provided,

however, that:

Paragraphs

(1)(i), (1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by

those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form

of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)

If the registrant is relying on Rule 430B (§230.430B of this chapter):

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by section 10 (a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the

offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date

an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the

registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date.

(6)

That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit

plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant

of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the

registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and

will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of Elmsford, State of New York, on September 12, 2023.

| |

NanoVibronix, Inc. |

| |

|

|

| |

By: |

/s/ Brian

Murphy |

| |

Name: |

Brian Murphy |

| |

Title: |

Chief Executive Officer |

POWER

OF ATTORNEY

Each

person whose signature appears below hereby appoints each of Brian Murphy and Stephen Brown, severally, acting alone and without the

other, his or her true and lawful attorney-in-fact, with full power of substitution, and with the authority to execute in the name of

each such person, any and all amendments (including without limitation, post-effective amendments) to this registration statement on

Form S-3, to sign any and all additional registration statements relating to the same offering of securities as this registration statement

that are filed pursuant to Rule 462(b) of the Securities Act of 1933, and to file such registration statements with the Securities and

Exchange Commission, together with any exhibits thereto and other documents therewith, necessary or advisable to enable the registrant

to comply with the Securities Act of 1933, and any rules, regulations and requirements of the Securities and Exchange Commission in respect

thereof, which amendments may make such other changes in the registration statement as the aforesaid attorney-in-fact executing the same

deems appropriate.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in

the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Brian Murphy |

|

Chief

Executive Officer and Director |

|

September

12, 2023 |

| Brian

Murphy |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Stephen Brown |

|

Chief

Financial Officer |

|

September

12, 2023 |

| Stephen

Brown |

|

(Principal