As

filed with the Securities and Exchange Commission on July 17, 2023

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

NanoVibronix,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

3842 |

|

01-0801232 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

525

Executive Blvd.

Elmsford,

New York 10523

(914)

233-3004

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian

Murphy

Chief

Executive Officer

NanoVibronix,

Inc.

525

Executive Blvd.

Elmsford,

New York

(914)

233-3004

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Rick

A. Werner, Esq.

Jayun

Koo, Esq.

Haynes

and Boone, LLP

30

Rockefeller Plaza, 26th Floor

New

York, New York 10112

(212)

659-7300

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

|

|

|

|

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

|

|

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does

it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated July 17, 2023

Preliminary

Prospectus

NanoVibronix,

Inc.

Up

to Shares of Common Stock

Prefunded

Warrants to purchase up to

Shares of Common Stock

Common

Warrants to purchase up to Shares of Common Stock

Shares

of Common Stock underlying Prefunded Warrants and Common Warrants

Placement

Agent Warrants to Purchase up to Shares of Common Stock

Shares

of Common Stock Underlying the Placement Agent Warrants

We

are offering shares of common stock, together with warrants to

purchase shares of common stock, each a Common Warrant, at an

assumed combined public offering price of $ per share and Common Warrant, which

is equal to the closing price per share of our common stock on The Nasdaq Capital Market (“Nasdaq”), on ,

2023 (and the shares issuable from time to time upon exercise of the Common Warrants), pursuant to this prospectus. The shares of common

stock and Common Warrants will be separately issued but must be purchased together in this offering. Each share of common stock

is being offered together with a Common Warrant to purchase share of common stock. Each Common Warrant will have an exercise price

of $ per share, (representing

% of the price at which a share of common stock and accompanying Common Warrant are sold to the public in this offering), will be exercisable

upon issuance and will expire years from the date of issuance.

We

are also offering prefunded warrants, or Prefunded Warrants, to purchase up to an aggregate of

shares of common stock to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together

with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of

our outstanding common stock following the consummation of this offering in lieu of the shares of our common stock that would result

in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%). Each Prefunded Warrant will be exercisable for

one share of common stock at an exercise price of $0.0001 per share. Each Prefunded Warrant is being offered together with

the same Common Warrant described above being offered with each share of common stock. The assumed combined public offering price

for each such Prefunded Warrant, together with the Common Warrant, is $

which is equal to the closing price of our common stock on Nasdaq on , 2023, less

the $0.0001 per share exercise price of each such Prefunded Warrant. Each Prefunded Warrant will be exercisable

upon issuance and will expire when exercised in full. The Prefunded Warrants and Common Warrants are immediately separable and

will be issued separately in this offering, but must be purchased together in this offering. For each Prefunded Warrant we sell,

the number of shares of common stock we are offering will be decreased on a one-for-one basis. This offering also relates to the shares

of common stock issuable upon the exercise of the Prefunded Warrants and the Common Warrants.

This

offering will terminate on , unless we decide to terminate the offering (which

we may do at any time in our discretion) prior to that date. We will have one closing for all the securities purchased in this offering.

The combined public offering price per share (or Prefunded Warrant) and Common Warrant will be fixed for the duration of this

offering.

We

have engaged , or the placement agent to act as our exclusive placement agent in connection with this offering. The placement agent has

agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is

not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale

of any specific number or dollar amount of securities. We have agreed to pay to the placement agent the placement agent fees set forth

in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to

be received in escrow, trust or similar arrangement. There is no minimum offering requirement. We will bear all costs associated with

the offering. See “Plan of Distribution” on page 17 of this prospectus for more information regarding these arrangements.

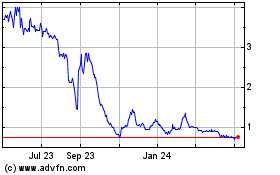

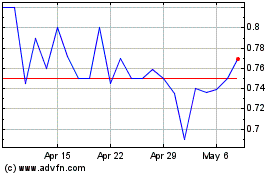

Our

common stock is listed on Nasdaq under the symbol “NAOV.” The closing price of our common stock on Nasdaq on July 14,

2023 was $3.35 per share.

All share, Common Warrant, and Prefunded Warrant

numbers are based on an assumed combined public offering price of $ per share and the accompanying Common Warrant and $ per Prefunded

Warrant and the accompanying Common Warrant. The actual combined public offering price per share and Common Warrant and the actual combined

public offering price per Prefunded Warrant and Common Warrant will be determined through negotiation among us, the placement agent

and the investors in the offering based on market conditions at the time of pricing, and may be at a discount to the current market price

of our common stock. Therefore, the recent market price per share of common stock used throughout this prospectus as an assumed combined

public offering price may not be indicative of the final offering price. There is no established trading market for the Prefunded

Warrants or the Common Warrants, and we do not expect a market to develop. We do not intend to apply for a listing of the Prefunded

Warrants or the Common Warrants on any securities exchange or other nationally recognized trading system. Without an active trading

market, the liquidity of the Prefunded Warrants and the Common Warrants will be limited.

You

should read this prospectus, together with additional information described under the headings “Information Incorporated by Reference”

and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a discussion

of risks that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | |

Per Share and

Accompanying

Common

Warrant | | |

Per Pre-

Funded

Warrant and

Accompanying

Common

Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement agent’s fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses(2) | |

$ | | | |

$ | | | |

$ | | |

(1)

We have also agreed to pay the placement agent a management fee of % of the aggregate gross proceeds raised

in this offering and to reimburse the placement agent for certain of its offering-related expenses. In addition, we have agreed to issue

the placement agent or its designees warrants, or the placement agent warrants, to purchase a number of shares of common stock

equal to % of the shares of common stock sold in this offering (including the shares of common stock issuable

upon the exercise of the Prefunded Warrants), at an exercise price of $ per share, which represents

% of the public offering price per share of common stock and accompanying Common Warrant. See “Plan

of Distribution” for a description of the compensation to be received by the placement agent.

(2)

Because there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual

public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less

than the total maximum offering amounts set forth above. For more information, see “Plan of Distribution”.

Delivery

of the securities offered hereby is expected to be made on or about , 2023, subject to satisfaction of customary closing conditions.

The

date of this prospectus is , 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement of which this prospectus forms a part that we filed with the Securities and Exchange Commission (the “SEC”)

includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with

the SEC, together with the additional information described under the headings “Where You Can Find Additional Information”

and “Information Incorporated by Reference” before making your investment decision. You should rely only on the information

provided in or incorporated by reference in this prospectus, in any prospectus supplement or in a related free writing prospectus, or

documents to which we otherwise refer you. In addition, this prospectus contains summaries of certain provisions contained in some of

the documents described herein, but reference is made to the actual documents for complete information.

This

prospectus includes important information about us, the securities being offered and other information you should know before investing

in our securities. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the

date set forth on the front cover of this prospectus, even though this prospectus is delivered or securities are sold or otherwise disposed

of on a later date. It is important for you to read and consider all information contained in this prospectus in making your investment

decision. All of the summaries in this prospectus are qualified in their entirety by the actual documents. Copies of some of the documents

referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which

this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find

Additional Information.”

We

have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than those

contained or incorporated by reference in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which

we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. The information contained in this prospectus or incorporated by reference in this prospectus or contained in any

applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities.

Our business, financial condition, results of operations and prospects may have changed since that date.

For

investors outside the United States: We have not, and the placement agent has not, done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the securities and the distribution of this prospectus outside the United States.

Unless

otherwise indicated, information contained in this prospectus or incorporated by reference in this prospectus concerning our industry,

including our general expectations and market opportunity, is based on information from our own management estimates and research, as

well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are

derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which

we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily

uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 5 of this prospectus.

These and other factors could cause our future performance to differ materially from our assumptions and estimates.

This

prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful

to do so. We are not, and the placement agent is not, making an offer to sell these securities in any state or jurisdiction where the

offer or sale is not permitted.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained in other parts of this prospectus or incorporated by reference into this

prospectus from our filings with the SEC and does not contain all of the information you should consider before investing in our securities.

You should carefully read the prospectus and the information incorporated by reference herein in their entirety before investing in our

securities, including the information discussed under “Risk Factors” and our financial statements and notes thereto that

are included elsewhere in this prospectus or incorporated herein by reference. Some of the statements in this prospectus constitute forward-looking

statements that involve risks and uncertainties. See information set forth under the section “Special Note Regarding Forward-Looking

Statements.” As used in this prospectus, unless the context otherwise indicates, the terms “we,” “our,”

“us,” or the “Company” refer to NanoVibronix, Inc., a Delaware corporation, and its subsidiaries taken as a whole.

Overview

We

are a medical device company focusing on noninvasive biological response-activating devices that target wound healing and pain therapy

and can be administered at home, without the assistance of medical professionals. Our primary products, which are in various stages of

clinical and market development, currently consist of:

| |

● |

UroShield™,

an ultrasound-based product that is designed to prevent bacterial colonization and biofilm in urinary catheters, increase antibiotic

efficacy and decrease pain and discomfort associated with urinary catheter use. |

| |

|

|

| |

● |

PainShield™,

a patch-based therapeutic ultrasound technology to treat pain, muscle spasm and joint contractures by delivering a localized ultrasound

effect to treat pain and induce soft tissue healing in a targeted area; and |

| |

|

|

| |

● |

WoundShield™,

a patch-based therapeutic ultrasound device intended to facilitate tissue regeneration and wound healing by using ultrasound to increase

local capillary perfusion and tissue oxygenation. |

Each

of our PainShield, UroShield, and WoundShield products employs a small, disposable transducer that transmits low frequency, low intensity

ultrasound acoustic waves that seek to repair and regenerate tissue, musculoskeletal and vascular structures, and decrease biofilm formation

on urinary catheters and associated urinary tract infections. Through their size, effectiveness and ease of use, these products are intended

to eliminate the need for technicians and medical personnel to manually administer ultrasound treatment through large transducers, thereby

promoting patient independence and enabling more cost-effective home-based care.

PainShield

is currently cleared for marketing in the United States by the U.S. Food and Drug Administration although to date there has not been

a significant sales and marketing effort. All three of our products have CE Mark approval in the European Union, and a certificate allowing

us to sell PainShield, UroShield and WoundShield in Israel. We are able to sell PainShield, UroShield and WoundShield in India and Ecuador

based on our CE Mark. We have consummated sales of PainShield and UroShield in the relevant markets, although to date sales have been

minimal; WoundShield has not generated significant revenue to date. Outside of the United States we generally apply, through our distributor,

for approval in a particular country for a particular product only when we have a distributor in place with respect to such product.

Intellectual

Property – Patents

We

seek patent protection for our inventions not only to differentiate our products and technologies, but also to develop opportunities

for licensing and securing our rights to profits therefrom. With the aim of optimizing commercial and regulatory success, our proprietary

technology and innovative applications thereof are protected by a variety of patent claims. We believe that our granted patents and pending

applications collectively protect our technology, both in terms of our existing products, as well as our anticipated pipeline of new

offerings.

Our

patent portfolio includes at least the following issued patents, as well as a number of corresponding foreign patents in relevant jurisdictions:

(1) U.S. Patent No. 7,393,501 to “Method, Apparatus and System for Treating Biofilms Associated With Catheters” (expiring

on December 19, 2023); (2) U.S. Patent No. 7,829,029 to “Acoustic Add-On Device for Biofilm Prevention in Urinary Catheter”

(expiring on October 27, 2025); (3) U.S. Patent No. 9,028,748 to “System and Method for Surface Acoustic Wave Treatment of Medical

Devices” (expiring on July 11, 2030); and (4) U.S. Patent No. 9,585,977 directed to “System and Method for Surface

Acoustic Waves Treatment of Skin” (expiring on August 20, 2033). These patents cover a wide range of embodiments and applications

of our proprietary surface acoustic wave (SAW) technology, including our commercialized Painshield, Painshield Plus, Woundshield and

Uroshield devices. Specifically, the patents provide for methods of generating surface acoustic waves on surfaces of indwelling medical

devices and to topical and urological applications therefor, for alleviating pain and for wound healing, and for preventing formation

of bacterial biofilms on catheters. Pending patent applications related to Uroshield devices are directed to Multiple Frequency Surface

Acoustic Waves for Internal Medical Device and System, Device, and Method for Mitigating Bacterial Biofilms Associated with Indwelling

Medical Devices which covers the next generation of Uroshield devices operating at multiple frequencies and devices which are compatible

in portable and wireless systems. Another pending patent application related to Uroshield devices is directed to System, Device, and

Method for Mitigating Bacterial Biofilms Associated with Indwelling Medical Devices (US patent application US 17/646,715 filed on

December 31, 2021).

Pending

patent applications related to Painshield, Painshield Plus, Woundshield devices are directed to Transdermal Patch of a Portable Ultrasound-Generating

System for Improved Delivery of Therapeutic Agents and Associated Methods of Treatment (US patent application 17/025,969 filed on

September 18, 2020); Portable Ultrasound System and Methods of Treating Facial Skin by Application of Surface Acoustic Waves (US

patent application 17/646,753 filed on January 3, 2022) and Improved Injection Needle Assembly (US patent application 17/646,804

filed on December 31, 2021).

Nasdaq

Minimum Stockholders’ Equity Requirement

On

May 23, 2023, we received a letter from the Listing Qualifications Department of Nasdaq indicating that we no longer comply with the

minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1) for continued listing on Nasdaq because our stockholders’

equity of approximately $2.2 million as reported in our Quarterly Report on Form 10-Q for the period ended March 31, 2023, is below the

required minimum of $2.5 million, and as of May 22, 2023, we did not meet the alternative compliance standards relating to the market

value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal

year or in two of the last three most recently completed fiscal years.

In

accordance with Nasdaq Listing Rules, we had 45 calendar days, or until July 7, 2023, to submit a plan to regain compliance. On

July 7, 2023 we submitted our plan to regain compliance with the Nasdaq minimum stockholders’ equity standard. If our plan

is accepted, Nasdaq may grant us an extension of up to 180 calendar days from the date of the notification letter to evidence compliance. However, there

can be no assurance that our plan will be accepted or that if it is, we will be able to regain compliance. If our plan to regain compliance

with the minimum stockholders’ equity standard is not accepted or if it is accepted but we do not regain compliance by the end

of the extension granted by Nasdaq, or we fail to satisfy another Nasdaq requirement for continued listing, Nasdaq staff could provide

notice that our common stock will become subject to delisting. In such event, Nasdaq rules permit us to appeal the decision to reject

its proposed compliance plan or any delisting determination to a Nasdaq Hearings Panel. Accordingly, there can be no guarantee that we

will be able to maintain our Nasdaq listing.

Mio-Guard

Agreement

On

June 14, 2023 we announced that we entered into a distribution agreement with Mio-Guard, LLC (“Mio-Guard”) for the sale and

distribution of our PainShield MD product. Under the terms of the multi-year agreement, Mio-Guard has the exclusive right to sell and

distribute the PainShield MD product to its customers throughout the United States in the areas of athletic team sports and sports medicine.

CMS

Reimbursement

In

addition to the need to obtain regulatory approvals, we anticipate that sales volumes and prices of our UroShield and PainShield, products

will depend in large part on the availability of insurance coverage and reimbursement from third party payers. Third party payers include

governmental programs such as Medicare and Medicaid in the United States, private insurance plans and workers’ compensation plans.

We do not currently have reimbursement codes for use of WoundShield in any of the markets in which we have regulatory authority to sell

WoundShield. Of the markets in which we have regulatory authority to sell PainShield, prior to January 2020, we only had reimbursement

codes in the United States (i.e., CPT codes) for clinical use only. Effective as of January 2020, the U.S. Centers for Medicare and Medicaid

Services (“CMS”) approved our PainShield™ for reimbursement for Medicare beneficiaries on a national basis. We have

been actively taking steps to work toward having CMS assign a reimbursement value, including conducting additional longevity testing

by an independent laboratory and launching a direct-to-consumer rental program for PainShield™, as we were denied reimbursement

in September 2022 due to a lack of “life-cycle” testing. We have recently provided CMS with additional data and continue

to work with qualified legal representation to achieve our goal. The latest CMS application included PainShield products

and supplies. PainShield™ currently is subject to reimbursement under certain workers’ compensation plans and Veterans Administration

facilities.

Protrade

Proceeding

On

February 26, 2021, Protrade Systems, Inc. (“Protrade”) filed a Request for Arbitration (the “Request”) with the

International Court of Arbitration (the “ICA”) of the International Chamber of Commerce alleging that we were in breach of

an Exclusive Distribution Agreement dated March 7, 2019 (the “Distribution Agreement”) between Protrade and the Company.

Protrade alleges, in part, that we breached the Distribution Agreement by discontinuing the manufacture of the DV0057 Painshield MD device

in favor of an updated 10-100-001 Painshield MD device. Protrade claims damages estimated at $3 million.

On

March 15, 2022, the arbitrator issued a final award, which, determined that (i) we had the right to terminate the Distribution Agreement;

(ii) we did not breach the duty of good faith and fair dealing with regard to the Distribution Agreement; and (iii) we did not breach

any confidentiality obligations to Protrade.

Nevertheless the arbitrator determined that we did not comply with the obligation to supply Protrade with a year’s supply of patches,

and awarded Protrade $1,500,250, which consists of $1,432,000 for “lost profits” and $68,250 as reimbursement of

arbitration costs, on the grounds that we allegedly failed to supply Protrade with certain patches utilized by users of DV0057 Painshield

MD device. The arbitrator based the decision on the testimony of Protrade’s president who asserted that a user would use in excess

of 33 patches per each device. We believe that the number of patches per device alleged by Protrade is grossly inflated, and that these

claims were not properly raised before the arbitrator. Accordingly, on April 13, 2022, we

submitted an application for the correction of the award which the arbitrator denied on June 22, 2022.

On

April 5, 2022, Protrade filed a Petition with the Supreme Court of New York Nassau County seeking to confirm the Award. On April 13,

2022, we submitted an application to the ICA seeking to correct an error in the award based on the evidence that we only sold 2-3 reusable

patches per device contrary to the 33 reusable patches claimed by Protrade. The same arbitrator who issued the award, denied the application.

On

July 22, 2022, we filed a cross-motion seeking to vacate arbitration award on the grounds that the arbitrator exceeded her authority,

that the award was procured by fraud, and that the arbitrator failed to follow procedures established by New York law. In particular,

we averred in our motion that Protrade’s witness made false statements in arbitration, and that the arbitrator resolved a claim

that was never raised by Protrade and that has no factual basis.

On

October 3, 2022, the court issued a decision granting Protrade its petition to confirm the Award and

denying the cross-motion.

On

November 9, 2022, we filed a motion to re-argue and renew our cross-motion to vacate the arbitration decision based on newer information

that was not available during the initial hearing. On the same day, we also filed a notice of appeal with the Appellate Division, Second

Department. On March 21, 2023, the Court denied the motion to re-argue and renew. We filed a notice of appeal of this decision with the

Appellate Division, Second Department on April 5, 2023.

On

July 10, 2023, we filed our appeal with the Appellate Division, Second Department. We intend to continue to vigorously pursue our opposition

to the award in all appropriate fora.

Corporate

Information

We

were organized in the State of Delaware on October 20, 2003. Our principal executive offices are located at 525 Executive Boulevard,

Elmsford, New York 10523. Our telephone number is (914) 233-3004. Our website address is www.nanovibronix.com. Information accessed through

our website is not incorporated into this prospectus and is not a part of this prospectus.

THE OFFERING

| Common

Stock to be Offered |

|

shares

based on the sale of our common stock at an assumed combined public offering price of $

per share of common stock and accompanying Common Warrant, which is the closing price of

our common stock on Nasdaq on ,

2023, and assuming no sale of any Prefunded Warrants. |

| |

|

|

Prefunded

Warrants

to be Offered |

|

We

are also offering to certain purchasers whose purchase of shares of common stock in this

offering would otherwise result in the purchaser, together with its affiliates and certain

related parties, beneficially owning more than 4.99% (or, at the election of the purchaser,

9.99%) of our outstanding common stock immediately following the consummation of this offering,

the opportunity to purchase, if such purchasers so choose, Prefunded Warrants to purchase

shares of common stock, in lieu of shares of common stock that would otherwise result in

any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding common stock. Each Prefunded Warrant will be

exercisable for one share of our common stock. The purchase price of each Prefunded

Warrant and accompanying Common Warrant will equal the price at which the share of common

stock and accompanying Common Warrant are being sold to the public in this offering, minus

$0.0001, and the exercise price of each Prefunded Warrant will be $0.0001

per share. The Prefunded Warrants will be exercisable immediately and may be exercised

at any time until all of the Prefunded Warrants are exercised in full.

This

offering also relates to the shares of common stock issuable upon exercise of the Prefunded Warrants sold in this offering.

For each Prefunded Warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one

basis. Because we will issue a Common Warrant for each share of our common stock and for each Prefunded Warrant sold in this

offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of

our common stock and Prefunded Warrants sold. |

| |

|

|

| Common

Warrants to be Offered |

|

Each

share of our common stock and each Prefunded Warrant to purchase one share of our

common stock is being sold together with a Common Warrant to purchase

share of our common stock. Each Common Warrant will have an exercise price of $ per share

(representing % of the price at which a share of common stock and accompanying Common

Warrant are sold to the public in this offering), will be immediately exercisable and

will expire on the anniversary of the original

issuance date.

The

shares of common stock and Prefunded Warrants, and the accompanying Common Warrants, as the case may be, can only be purchased

together in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates

to the offering of the shares of common stock issuable upon exercise of the Common Warrants. |

| Lock-up

Agreements |

|

We

and all of our executive officers and directors will enter into lock-up agreements with the placement agent. Under these agreements,

we and each of these persons may not, without the prior written approval of the placement agent, offer, sell, contract to

sell or otherwise dispose of or hedge common stock or securities convertible into or exchangeable for common stock, subject to certain

exceptions. The restrictions contained in these agreements will be in effect for a period of days

after the date of the closing of this offering. For more information, see “Plan of Distribution.” |

| |

|

|

| Placement Agent Warrants |

|

We

have agreed to issue to the placement agent or its designees placement agent warrants to

purchase up to % of the aggregate number of shares of common stock sold in this offering

(including the shares of common stock issuable upon the exercise of the Prefunded Warrants)

at an exercise price equal to % of the combined public offering price per share and accompanying

Common Warrant to be sold in this offering. The placement agent warrants will be exercisable

upon issuance and will expire years from the commencement of sales under this offering.

|

| |

|

|

| Common

Stock Outstanding After This Offering(1) |

|

shares (assuming

we sell only shares of common stock and no Prefunded Warrants and assuming no exercise

of the Common Warrants). |

| |

|

|

| Use

of Proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $

million, based on an assumed combined public offering price of $ per share of common stock

and accompanying Common Warrant which was the closing price of our common stock on Nasdaq

on , 2023, after deducting the

placement agent fees and estimated offering expenses payable by us, and assuming we sell

only shares of common stock and no Prefunded Warrants and excluding the proceeds,

if any, from the exercise of the Common Warrants in this offering.

We

currently intend to use the net proceeds from the offering for general corporate purposes, including funding of our development programs,

commercial planning and sales and marketing expenses, potential strategic acquisitions, general and administrative expenses

and working capital. See “Use of Proceeds” beginning on page 10. |

| Risk

Factors |

|

See

“Risk Factors” beginning on page 5 of this prospectus and other information included and incorporated by reference in this

prospectus for a discussion of the risk factors you should consider carefully when making an investment decision. |

| |

|

|

| Nasdaq

Symbol |

|

Our

common stock is listed on Nasdaq under the symbol “NAOV.” There is no established trading market for the Common Warrants

or the Prefunded Warrants, and we do not expect a trading market to develop. We do not intend to list the Common Warrants

or the Prefunded Warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the

Common Warrants and the Prefunded Warrants will be extremely limited. |

(1)

The number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 1,662,377

shares of common stock outstanding as of July 7, 2023 and, unless otherwise indicated, excludes, as of that date:

| |

● |

142,160

shares of common stock issuable upon the exercise of stock options issued under the 2014 Long-Term Incentive Plan (the “2014

Plan”), at a weighted-average exercise price of $25.31 per share; |

| |

● |

86,375 shares of common stock available for issuance under the 2014 Plan; |

| |

● |

78,252 shares of common stock issuable upon the exercise of warrants outstanding at a weighted average exercise

price of $58.10 per share; and |

| |

● |

up to shares of common stock issuable upon the exercise

of the placement agent warrants at an exercise price of $ per share to be issued to the placement

agent or its designees as compensation in connection with this offering. |

Except

as otherwise indicated, the information in this prospectus assumes: (i) no sale of the Prefunded Warrants in this offering, which,

if sold, would reduce the number of shares of common stock that we are offering on an one-for-one basis; (ii) no exercise of any Common

Warrants issued in this offering; (iii) no exercise of the warrants to be issued to the placement agent or its designees in connection

with this offering; and (iv) no exercise of the options or warrants described above.

RISK

FACTORS

An

investment in our securities involves certain risks. You should not invest unless you are able to bear the complete loss of your investment.

You should carefully consider the risks described below and discussed under the section entitled “Risk Factors” in our most

recent Annual Report on Form 10-K which is incorporated herein by reference, together with other information in this prospectus and the

information and documents incorporated by reference in this prospectus, including our future reports on Form 10-K and 10-Q. Our business,

business prospects, financial condition or results of operations could be seriously harmed as a result of these risks, which could cause

the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial also may materially and adversely affect our business, financial condition

and results of operations. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

Our

financial statements have been prepared on a going concern basis, and do not include adjustments that might be necessary if we are unable

to continue as a going concern. Management has substantial doubt about our ability to continue as a going concern.

Our

unaudited condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization

of assets and the satisfaction of liabilities in the normal course of business. During the three months ended March 31, 2023, our cash

used in operations was $1.2 million leaving a cash balance of approximately $1.5 million as of March 31, 2023. Because we do not have

sufficient resources to fund our operations for the next twelve months from the date of this filing, management has substantial doubt

about our ability to continue as a going concern. The consolidated financial statements do not include any adjustments relating to the

recoverability and classification of asset amounts or the classification of liabilities that might be necessary should we be unable to

continue as a going concern.

We

will need to raise additional capital to finance its losses and negative cash flows from operations and may continue to be dependent

on additional capital raising as long as our products do not reach commercial profitability. There are no assurances that we would be

able to raise additional capital on terms favorable to it. If we are unsuccessful in commercializing our products and raising capital,

we will need to reduce activities, curtail, or cease operations.

If

we fail to comply with the continued listing requirements of Nasdaq, our common stock may be delisted and the price of our common stock

and our ability to access the capital markets could be negatively impacted.

Our

common stock is currently listed for trading on Nasdaq. We must satisfy Nasdaq’s continued listing requirements, including, among

other things, a minimum stockholders’ equity of $2.5 million and a minimum closing bid price of $1.00 per share or risk

delisting, which would have a material adverse effect on our business. A delisting of our common stock from Nasdaq could materially reduce

the liquidity of our common stock and result in a corresponding material reduction in the price of our common stock. In addition, delisting

could harm our ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in

the potential loss of confidence by investors, suppliers, customers and employees and fewer business development opportunities.

On

May 23, 2023, we received a letter from the Listing Qualifications Department of Nasdaq indicating that we no longer comply with the

minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1) for continued listing on Nasdaq because our stockholders’

equity of approximately $2.2 million as reported in our Quarterly Report on Form 10-Q for the period ended March 31, 2023, is below the

required minimum of $2.5 million, and as of May 22, 2023, we did not meet the alternative compliance standards relating to the market

value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal

year or in two of the last three most recently completed fiscal years.

In

accordance with Nasdaq Listing Rules, we had 45 calendar days, or until July 7, 2023, to submit a plan to regain compliance. On

July 7, 2023 we submitted our plan to regain compliance with the Nasdaq minimum stockholders’ equity standard. If our plan is accepted,

Nasdaq may grant us an extension of up to 180 calendar days from the date of the notification letter to evidence compliance.

However,

there can be no assurance that our plan will be accepted or that if it is, we will be able to regain compliance. If our plan to regain

compliance with the minimum stockholders’ equity standard is not accepted or if it is accepted but we do not regain compliance

by the end of the extension granted by Nasdaq, or we fail to satisfy another Nasdaq requirement for continued listing, Nasdaq staff could

provide notice that our common stock will become subject to delisting.

There is no assurance that we can regain compliance with such minimum listing requirements. If our common stock were delisted from Nasdaq,

trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the

OTCQB or the Pink Market maintained by OTC Markets Group Inc. An investor would likely find it less convenient to sell, or to obtain

accurate quotations in seeking to buy, our common stock on an over-the-counter market, and many investors would likely not buy or sell

our common stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed

on a national exchange or other reasons. In addition, as a delisted security, our common stock would be subject to SEC rules as a “penny

stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with

the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing

a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade

in our common stock. In addition, delisting could harm our ability to raise capital through alternative financing sources on terms acceptable

to us, or at all, and may result in the potential loss of confidence by investors, suppliers, customers and employees and fewer business

development opportunities. For these reasons and others, delisting would adversely affect the liquidity, trading volume and price of

our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition

and results of operations, including our ability to attract and retain qualified employees and to raise capital.

We

have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds, including for any of the purposes described in the section

of this prospectus entitled “Use of Proceeds.” You will be relying on the judgment of our management with regard to

the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net

proceeds are being used appropriately. The failure by our management to apply these funds effectively could result in financial losses

that could have a material adverse effect on our business, cause the price of our securities to decline and delay the development of

our product candidates. Pending the application of these funds, we may invest the net proceeds from this offering in a manner that does

not produce income or that loses value.

You

will experience immediate and substantial dilution in the net tangible book value of the shares you purchase in this offering and may

experience additional dilution in the future.

The

combined public offering price per share of common stock and related Common Warrant, and the combined public offering price of each Prefunded

Warrant and related Common Warrant, will be substantially higher than the as adjusted net tangible book value per share of our common

stock after giving effect to this offering.

Assuming

the sale of shares of our common stock and Common Warrants to purchase up to shares

of common stock at an assumed combined public offering price of $ per share and related Common Warrant,

the closing sale price per share of our common stock on Nasdaq on , 2023, assuming no sale of any

Prefunded Warrants in this offering, no exercise of the Common Warrants being offered in this offering and after deducting the

placement agent fees and commissions and estimated offering expenses payable by us, you will incur immediate dilution of approximately

$ per share. As a result of the dilution in net tangible book value to investors purchasing securities

in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of

the liquidation of our company. See the section entitled “Dilution” below for a more detailed discussion of the dilution

you will incur if you participate in this offering. To the extent shares are issued under outstanding options and warrants at exercise

prices lower than the public offering price of our common stock in this offering, including the shares underlying the Prefunded

Warrants, holders will incur further dilution.

Purchasers

who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers

that purchase without the benefit of a securities purchase agreement.

In

addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that

enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue

a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the

securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for

year from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for days from closing;

and (iv) indemnification for breach of contract.

There

may be future sales of our securities or other dilution of our equity, which may adversely affect the market price of our common stock.

Even

with the proceeds from this offering, we expect we will need to raise additional capital, potentially shortly after this offering. In

order to raise additional capital in the future, we may offer additional shares of common stock or other securities convertible into

or exchangeable for our common stock. We are generally not restricted from issuing additional securities, including shares of common

stock, securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or substantially

similar securities. The issuance of securities in future offerings may cause further dilution to our stockholders, including investors

in this offering. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or

greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future

could have rights superior to existing stockholders. The price per share at which we sell additional shares of common stock or securities

convertible into shares of common stock in future transactions may be higher or lower than the price per share in this offering. You

will also incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares of common stock under

our stock incentive programs. In addition, the sale of shares of common stock in this offering and any future sales of a substantial

number of shares of common stock in the public market, or the perception that such sales may occur, could adversely affect the price

of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those

shares for sale will have on the market price of our common stock.

There

is no public market for the Common Warrants or Prefunded Warrants being offered by us in this offering.

There

is no established public trading market for the Common Warrants or the Prefunded Warrants, and we do not expect a market to develop.

In addition, we do not intend to apply to list the Common Warrants or Prefunded Warrants on any national securities exchange or

other nationally recognized trading system. Without an active market, the liquidity of the Common Warrants and Prefunded Warrants

will be limited.

The

Common Warrants and Prefunded Warrants are speculative in nature.

The

Common Warrants and Prefunded Warrants offered hereby do not confer any rights of share of common stock ownership on their holders,

such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a

fixed price. Specifically, commencing on the date of issuance, holders of the Common Warrants may acquire the shares of common stock

issuable upon exercise of such warrants at an exercise price of $ per share of

common stock, and holders of the Prefunded Warrants may acquire the shares of common stock issuable upon exercise of such warrants

at an exercise price of $0.0001 per share of common stock. Moreover, following this offering, the market value of the Common Warrants is uncertain and there can be no assurance that the market value of the Common Warrants,

if any, will equal or exceed their public offering prices. There can be no assurance that the market price of the shares of

common stock will ever equal or exceed the exercise price of the Common Warrants, and consequently, whether it will ever be profitable

for holders of Common Warrants to exercise the Common Warrants.

Holders

of the Prefunded Warrants and the Common Warrants offered hereby will have no rights as common stockholders with respect to the

shares our common stock underlying the warrants until such holders exercise their warrants and acquire our common stock, except as otherwise

provided in the Prefunded Warrants and the Common Warrants.

Until

holders of the Common Warrants and the Prefunded Warrants acquire shares of our common stock upon exercise thereof, such holders

will have no rights with respect to the shares of our common stock underlying such warrants, except to the extent that holders of such

Common Warrants and Prefunded Warrants will have certain rights to participate in distributions or dividends paid on our common

stock as set forth in the Common Warrants and the Prefunded Warrants. Upon exercise of the Common Warrants and the Prefunded

Warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date

occurs after the exercise date.

This

is a best efforts offering, with no minimum amount of securities is required to be sold, and we may not raise the amount of capital we

believe is required for our business plans, including our near-term business plans.

The

placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement

agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar

amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering.

Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement

agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above.

We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and

investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our

continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required

for our operations in the short-term and may need to raise additional funds, which may not be available or available on terms acceptable

to us.

A

more active, liquid trading market for our common stock may not develop, and the price of our common stock may fluctuate significantly.

Historically,

the market price of our common stock has fluctuated over a wide range. There has been relatively limited trading volume in

the market for our common stock, and a more active, liquid public trading market may not develop or may not be sustained. Limited liquidity

in the trading market for our common stock may adversely affect a stockholder’s ability to sell its shares of common stock at the

time it wishes to sell them or at a price that it considers acceptable. If a more active, liquid public trading market does not develop

we may be limited in our ability to raise capital by selling shares of common stock and our ability to acquire other companies or assets

by using shares of our common stock as consideration. In addition, if there is a thin trading market or “float” for our stock,

the market price for our common stock may fluctuate significantly more than the stock market as a whole. Without a large float, our common

stock would be less liquid than the stock of companies with broader public ownership and, as a result, the trading prices of our common

stock may be more volatile and it would be harder for a stockholder to liquidate any investment in our common stock. Furthermore, the

stock market is subject to significant price and volume fluctuations, and the price of our common stock could fluctuate widely in response

to several factors, including:

| |

● |

our

quarterly or annual operating results; |

| |

● |

changes

in our earnings estimates; |

| |

● |

investment

recommendations by securities analysts following our business or our industry; |

| |

● |

additions

or departures of key personnel; |

| |

● |

changes

in the business, earnings estimates or market perceptions of our competitors; |

| |

● |

our

failure to achieve operating results consistent with securities analysts’ projections; |

| |

● |

changes

in industry, general market or economic conditions; and |

| |

● |

announcements

of legislative or regulatory changes. |

The

stock market has experienced extreme price and volume fluctuations in recent years that have significantly affected the quoted prices

of the securities of many companies, including companies in the medical device industry. The changes often appear to occur without regard

to specific operating performance. The price of our common stock could fluctuate based upon factors that have little or nothing to do

with us and these fluctuations could materially reduce our stock price.

We

have never declared or paid any cash dividends on our common stock and, accordingly, stockholders must rely on stock appreciation for

any return on their investment.

We

have never declared or paid any cash dividends on our common stock, and we do not intend to pay any cash dividends on our common stock.

Rather, we currently intend to retain all available funds and any future earnings, if any, to fund the development and expansion of our

business and for general corporate purposes, and we do not anticipate paying any cash dividends in the foreseeable future. Consequently,

investors must rely on sales of their common stock after price appreciation, which may never occur, as the primary way to realize any

gains on their investment.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the information incorporated by reference in this prospectus contain “forward-looking statements,” which include

information relating to future events, future financial performance, strategies, expectations, competitive environment and regulation.

Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” and similar expressions, as well as statements in future tense, are intended to identify

forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not

be accurate indications of when such performance or results will actually be achieved. Forward-looking statements are based on information

we have when those statements are made or our management’s good faith belief as of that time with respect to future events, and

are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or

suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| |

● |

Our

history of losses and expectation of continued losses. |

| |

|

|

| |

●

|

Global

economic and political instability and conflicts, such as the conflict between Russia and Ukraine, could adversely affect our business,

financial condition or results of operations. |

| |

|

|

| |

● |

Increasing

inflation could adversely affect our business, financial condition, results of operations or cash flows. |

| |

|

|

| |

● |

The

geographic, social and economic impact of COVID-19 on the Company’s business operations. |

| |

|

|

| |

● |

Our

ability to raise funding for, and the timing of, clinical studies and eventual U.S. Food and Drug Administration (“FDA”)

approval of our product candidates. |

| |

|

|

| |

● |

Regulatory

actions that could adversely affect the price of or demand for our approved products. |

| |

|

|

| |

● |

Market

acceptance of existing and new products. |

| |

|

|

| |

● |

Favorable

or unfavorable decisions about our products from government regulators, insurance companies or other third-party payers (including

CMS). |

| |

|

|

| |

● |

Risks

of product liability acclaims and the availability of insurance. |

| |

|

|

| |

● |

Our

ability to generate internal growth. |

| |

|

|

| |

● |

Risks

related to computer system failures and cyber-attacks. |

| |

|

|

| |

● |

Our

ability to obtain regulatory approval in foreign jurisdictions. |

| |

|

|

| |

● |

Uncertainty

regarding the success of our clinical trials for our products in development. |

| |

|

|

| |

● |

Risks

related to our operations in Israel, including political, economic and military instability. |

| |

|

|

| |

● |

The

price of our securities is volatile with limited trading volume. |

| |

|

|

| |

● |

Our

ability to regain compliance with the continued listing requirements of Nasdaq and the risk that our common stock will be delisted

if we cannot do so. |

| |

● |

Our

ability to maintain effective internal control over financial reporting and to remedy identified material weaknesses. |

| |

|

|

| |

● |

We

are a “smaller reporting company” and have reduced disclosure obligations that may make our stock less attractive to

investors. |

| |

|

|

| |

● |

Our

intellectual property portfolio and our ability to protect our intellectual property rights. |

| |

|

|

| |

● |

Our

ability to recruit and retain qualified regulatory and research and development personnel. |

| |

|

|

| |

● |

Unforeseen

changes in healthcare reimbursement for any of our approved products. |

| |

|

|

| |

● |

The

adoption of health policy changes and health care reform. |

| |

● |

Lack

of financial resources to adequately support our operations. |

| |

|

|

| |

● |

Difficulties

in maintaining commercial scale manufacturing capacity and capability. |

| |

|

|

| |

● |

Changes

in our relationship with key collaborators. |

| |

|

|

| |

● |

Changes

in the market valuation or earnings of our competitors or companies viewed as similar to us. |

| |

|

|

| |

● |

Our

failure to comply with regulatory guidelines. |

| |

|

|

| |

● |

Uncertainty

in industry demand and patient wellness behavior. |

| |

|

|

| |

● |

General

economic conditions and market conditions in the medical device industry. |

| |

|

|

| |

● |

Future

sales of large blocks of our common stock, which may adversely impact our stock price. |

| |

|

|

| |

● |

Depth

of the trading market in our common stock. |

You

should read this prospectus and any related free-writing prospectus and the documents incorporated by reference in this prospectus with

the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different

from what we expect. The forward-looking statements contained or incorporated by reference in this prospectus are expressly qualified

in their entirety by this cautionary statement. We do not undertake any obligation to publicly update any forward-looking statement to

reflect events or circumstances after the date on which any such statement is made or to reflect the occurrence of unanticipated events.

USE

OF PROCEEDS

We

estimate that we will receive net proceeds of approximately $ million from

the sale of the securities offered by us in this offering, assuming a combined public offering price of $

per share of common stock and accompanying Common Warrant, the closing price per share of our common stock on Nasdaq on ,

2023, after deducting the placement agent fees and estimated offering expenses payable by us and assuming no sale of any Prefunded

Warrants offered in this offering. However, because this is a best efforts offering with no minimum number of securities or amount

of proceeds as a condition to closing, the actual offering amount, the placement agent’s fees and net proceeds to us are not presently

determinable and may be substantially less than the maximum amounts set forth on the cover page of this prospectus, and we may not sell

all or any of the securities we are offering. As a result, we may receive significantly less in net proceeds.

We

intend to use the net proceeds from this offering for general corporate purposes, including funding of our development programs, commercial

planning and sales and marketing expenses, potential strategic acquisitions, general and administrative expenses and working capital.

The amounts and timing of our actual expenditures will depend upon numerous factors, including the progress of our development and

commercialization efforts, the status of and results from our clinical trials, whether or not we enter into strategic collaborations

or partnerships, and our operating costs and expenditures. In addition, while we have not entered into any binding agreements or commitments

relating to any significant transaction as of the date of this prospectus that we expect to use the net proceeds from this offering,

we may use a portion of the net proceeds to pursue acquisitions, joint ventures and other strategic transactions.

A

$1.00 increase or decrease in the assumed combined public offering price of $ per common stock and accompanying Common Warrant would

increase or decrease the net proceeds from this offering by approximately $ million, assuming that the number of shares of common stock

and Common Warrants offered by us, as set forth on the cover page of this prospectus, remains the same and assuming no sale of Prefunded

Warrants and after deducting the estimated placement agent fees and estimated offering expenses payable by us. An increase or decrease

of 100,000 in the number of shares of common stock and accompanying Common Warrants offered by us would increase or decrease our proceeds

by approximately $ million, assuming the assumed combined public offering price of $ per common stock and accompanying Common Warrant

remains the same, and after deducting placement agent fees and estimated offering expenses payable by us.

Our

management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways

that do not improve our results of operations or enhance the value of our common stock. Accordingly, you will be relying on the judgment

of our management on the use of net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether

the proceeds are being used appropriately. Our failure to apply these funds effectively could have a material adverse effect on our business

and cause the price of our common stock to decline.

Pending

other uses, we intend to invest the proceeds to us in investment-grade, interest-bearing securities such as money market funds, certificates

of deposit, or direct or guaranteed obligations of the U.S. government, or hold as cash. We cannot predict whether the proceeds invested

will yield a favorable, or any, return.

DILUTION

If

you invest in our securities in this offering, your interest will be diluted immediately to the extent of the difference between the

public offering price paid by the purchasers in this offering and the as adjusted net tangible book value per shares of common stock

after this offering.

Our

net tangible book value of our common stock as of March 31, 2023, was approximately $2.2 million or approximately $1.33

per share of our common stock, based upon 1,662,330 shares of our common stock outstanding as of that date. Net tangible book value per

share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding

as of March 31, 2023. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers

in this offering and the net tangible book value per share of our common stock immediately after this offering.

After

giving effect to the sale by us in this offering of shares of our common stock and accompanying Common

Warrants in this offering at an assumed combined public offering price of $ per share and Common

Warrant, based on the closing price of our common stock on Nasdaq on , 2023, assuming no sale of

any Prefunded Warrants in this offering, no exercise of any of the Common Warrants being offered in this offering, including the

warrants issued to the placement agent or its designees, and after deducting the placement agent fees and estimated offering expenses

payable by us, our as adjusted net tangible book value as of March 31, 2023 would have been approximately $

million, or approximately $ per share of common stock. This represents an immediate increase in net

tangible book value of approximately $ per share of common stock to our existing security holders

and an immediate dilution in as adjusted net tangible book value of approximately $ per share to

purchasers of our securities in this offering, as illustrated by the following table:

| Assumed public offering price per share and accompanying Common Warrant | |

| | | |

$ | | |

| Historical net tangible book value per share as of March 31, 2023 | |

$ | 1.33 | | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

$ | | | |

| | |

| As adjusted net tangible book value per share after giving effect to this offering as of March 31, 2023 | |

| | | |

$ | | |

| Dilution per share to investors participating in this offering | |

| | | |

$ | | |

A

$0.10 increase in the assumed combined public offering price of $ per share and Common Warrant would increase our as adjusted net tangible

book value after this offering by $ million, or $ per share, and the dilution per share to investors purchasing securities in this offering

would be approximately $ per share, assuming that the maximum number of securities offered by us, as set forth on the cover page of this

prospectus, remains the same and after deducting the placement agent fees and estimated offering expenses payable by us. Similarly, a

$0.10 decrease in the assumed combined public offering price of $ per share and Common Warrant would decrease our as adjusted net tangible

book value after this offering by $ million, or $ per share, and the dilution per share to investors purchasing securities in this offering

would be $ per share, assuming that the maximum number of securities offered by us, as set forth on the cover page of this prospectus,

remains the same and after deducting the placement agent fees and estimated offering expenses payable by us.

We

may also increase or decrease the number of securities we are offering from the assumed maximum number of securities set forth above.

An increase of 100,000 shares from the assumed maximum number of shares set forth on the cover page of this prospectus would increase

our as adjusted net tangible book value after this offering by $ million, or $ per share, and the dilution per share to investors purchasing

securities in this offering would be approximately $ per share, assuming that the assumed public offering price remains the same and

after deducting the placement agent fees and estimated offering expenses payable by us. Similarly, a decrease of 100,000 shares from

the assumed maximum number of shares set forth on the cover page of this prospectus would decrease our as adjusted net tangible book

value after this offering by $ million, or $ per share, and the dilution per share to investors purchasing securities in this offering

would be approximately $ per share, assuming that the assumed public offering price remains the same and after deducting the placement

agent fees and estimated offering expenses payable by us.

The

information discussed above is illustrative only and will adjust based on the actual combined public offering price, the actual number

of securities that we offer in this offering, and other terms of this offering determined at pricing. The foregoing discussion and table

assumes no sale of Prefunded Warrants, which if sold, would reduce the number of shares of common stock that we are offering on

a one-for-one basis and does not take into account further dilution to investors in this offering that could occur upon the exercise

of outstanding options and warrants having a per share exercise price less than the public offering price per share and Common Warrant

in this offering.

The