UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

| (Check

one): |

☒

Form 10-K ☐ Form 20-F ☐ Form 11-K ☐ Form 10-Q ☐ Form 10D ☐ Form N-CEN |

| |

☐

Form N-CSR |

| |

For

Period Ended: December 31, 2022 |

| |

|

| |

☐ Transition

Report on Form 10-K |

| |

☐ Transition

Report on Form 20-F |

| |

☐ Transition

Report on Form 11-K |

| |

☐ Transition

Report on Form 10-Q |

| |

For

the Transition Period Ended:______________________________________________________ |

Read

Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein.

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I – REGISTRANT INFORMATION

NanoVibronix,

Inc.

Full

Name of Registrant

Former

Name if Applicable

525

Executive Blvd.

Address

of Principal Executive Office (Street and Number)

Elmsford,

New York 10523

City,

State and Zip Code

PART

II – RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed. (Check box if appropriate)

| |

(a) |

The

reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense |

| ☒ |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the

fifth calendar day following the prescribed due date; and |

| |

(c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III – NARRATIVE

State

below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not

be filed within the prescribed time period.

NanoVibronix,

Inc. (the “Company”) is unable, without unreasonable effort or expense, to file its Annual Report on Form 10-K for the fiscal

year ended December 31, 2022 (the “Form 10-K”) within the time period due to delays in compiling information required to

be included in the Form 10-K, including information relating to the preparation and audit of its financial statements.

The

Company expects to file the Form 10-K within the extension period of 15 calendar days, as provided under Rule 12b -25 promulgated under

the Securities Exchange Act of 1934, as amended.

PART

IV – OTHER INFORMATION

| (1)

|

Name

and telephone number of person to contact in regard to this notification |

| Stephen

Brown |

|

(914) |

|

233-3004 |

| (Name) |

|

(Area

Code) |

|

(Telephone

Number) |

| (2)

|

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment

Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s)

been filed? If answer is no, identify report(s). |

| |

Yes

☒ No ☐ |

| |

|

| |

|

| (3)

|

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be

reflected by the earnings statements to be included in the subject report or portion thereof? |

Yes

☒ No ☐

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why

a reasonable estimate of the results cannot be made.

The

Company’s anticipated significant changes in its results of operations based on its preliminary unaudited results of operations

are as follows:

For

the years ended December 31, 2022 and 2021, the Company’s revenues were approximately $752,000 and $1,695,000, respectively, a

decrease of approximately 56%, or $943,000, between the periods. The decrease was mainly attributable to absence of sales from our Ultra

Pain Products distributor in the third and fourth quarter of 2022 due to suspension of PainShield Plus by the FDA.

For

the years ended December 31, 2022 and 2021, gross profit was approximately $167,000 and $770,000, respectively. The decrease was mainly

due to the large decrease in revenues in the third and fourth quarter of 2022 which usually produced higher margins in the prior years,

production delays caused by the suspension of Painshield Plus by the FDA and increases in certain components of our devices and to a

lesser degree obsolescence costs pertaining to certain components that were changed to regain compliance with the FDA, and inventory

repurchased from a former customer pursuant to an agreement to cancel a contract that had certain exclusive international distribution

rights.

For

the years ended December 31, 2022 and 2021, research and development expenses were approximately $283,000 and $293,000, respectively,

a decrease of approximately 3%, or $10,000 between the periods. This decrease was mainly due to studies performed in the prior year and

development of an over-the-counter PainShield product and a CBD application for our PainShield product in 2021 that did not occur in

2022.

For

the years ended December 31, 2022 and 2021, there was a change in fair value of derivative liabilities resulting in a loss of approximately

$0 and $6,956,000, respectively. The loss in 2021 was derived from the Company’s total potentially dilutive shares exceed the Company’s

authorized share limit.

For

the years ended December 31, 2022 and 2021, warrant modification expense was approximately $0 and $1,627,000, respectively. The warrant

modification expense was due to the resolution of the overissuance shares matter. The overissuance shares matter resulted in a reclassification

of derivative liabilities to equity during 2021. There was no warrant modification in 2022.

For

the years ended December 31, 2022 and 2021, the Company’s income tax expense was approximately $35,000 and $32,000, respectively.

The low tax expense for 2021 was a result of favorable adjustments due to lapses of statutes of limitations on its Israel tax positions.

In 2022, there was no such adjustment.

The

Company’s net loss decreased by approximately $8,834,000 or 62%, to approximately $5,448,000 for the years ended December 31, 2022

from approximately $14,282,000 during the same period in 2021. The decrease in net loss resulted primarily from the factors described

above.

The

Company believes that its results contained herein are materially correct; however, because review is ongoing, there can be no assurance

that the financial and accounting information referred to in this filing will not change upon completion of the audit and filing of the

Company’s Annual Report on Form 10-K.

NanoVibronix,

Inc.

(Name

of registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: |

March

31, 2023 |

|

By:

|

/s/

Stephen Brown |

| |

|

|

Name:

|

Stephen Brown |

| |

|

|

Title: |

Chief

Financial Officer |

ATTENTION

Intentional

misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

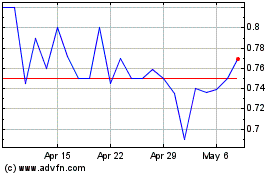

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jul 2024 to Aug 2024

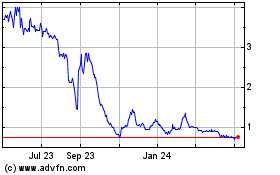

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Aug 2023 to Aug 2024