|

|

|

FORM

12b-25

|

|

SEC

FILE NUMBER

001-35963

|

|

|

|

|

|

|

|

|

|

NOTIFICATION

OF LATE FILING

|

|

CUSIP

NUMBER

63008J108

|

|

(Check One):

|

☐ Form 10-K

|

☐ Form

20-F

|

☐ Form

11-K

|

☒ Form

10-Q

|

☐ Form

10-D

|

☐ Form

N-SAR

|

|

|

☐ Form N-CSR

|

|

|

|

|

|

For

Period Ended: September 30, 2019

☐

Transition Report on Form 10-K

☐

Transition Report on Form 20-F

☐

Transition Report on Form 11-K

☐

Transition Report on Form 10-Q

☐

Transition Report on Form N-SAR

For

the Transition Period Ended: ________________________________________________________

|

Read

Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

NanoVibronix,

Inc.

Full Name of Registrant

Former

Name if Applicable

525 Executive Blvd.

Address

of Principal Executive Office (Street and Number)

Elmsford, New York 10523

City, State and Zip Code

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule

12b-25(b), the following should be completed. (Check box if appropriate)

|

|

(a)

|

The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

☒

|

(b)

|

The subject annual

report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K, Form N-SAR or Form N-CSR, or portion thereof,

will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report of

transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before

the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The accountant's

statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART

III — NARRATIVE

State

below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, N-SAR, or the transition report or portion thereof, could

not be filed within the prescribed time period.

NanoVibronix, Inc. (the “Company,” “we,”

“our,” or “us”) was unable to complete its Quarterly Report on Form 10-Q for the quarterly period ended

September 30, 2019 (the “Quarterly Report”) prior to the filing deadline for the Quarterly Report as a result of the

need to complete quarterly end closing procedures and financial statement preparation, and a delay in completing the disclosures

to be included in the Quarterly Report. As a result of this delay, the Company was unable to file its Quarterly Report by the prescribed

filing date without unreasonable effort or expense.

The

Company expects to file the Quarterly Report within the extension period of five calendar days as provided under Rule 12b-25 under

the Securities Exchange Act of 1934, as amended.

The

Company’s expectation regarding the timing of the filing of the Quarterly Report and the description of anticipated material

changes from the results of operation from the corresponding period of the last fiscal year are forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995, and actual events may differ from those contemplated by these

forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties, including the inability

of the Company or its independent registered public accounting firm to complete the work necessary in order to file the Quarterly

Report in the time frame that is anticipated or unanticipated changes being reported in the Company’s operating results

as reported in the Quarterly Report as filed. The Company undertakes no obligation to revise or update any forward-looking statements

to reflect events or circumstances after the date hereof.

|

PART IV — OTHER INFORMATION

|

|

|

|

(1)

|

Name and telephone number of person to contact in regard to this notification:

|

|

|

|

|

|

Brian Murphy

|

|

914

|

|

233-3004

|

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

|

|

|

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). YES [X] No [_]

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? YES ☒ No ☐

|

|

|

|

|

|

|

If so, attach an explanation of the anticipated change, both

narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of results cannot be made.

Three Months Ended September 30,

2019 Compared to Three Months Ended September 30, 2018

Revenues. For the three months ended

September 30, 2019 and 2018, our revenues were approximately $101,000 and $54,000 respectively, an increase of approximately 87%,

or $47,000 between the periods. The increase was mainly attributable to customer additions. Our revenues may fluctuate as we add

new consumers or when existing distributors or consumers make large purchases of our products during one period and no purchases

during another period. Our revenues may fluctuate from quarter-to-quarter and any growth or decrease in revenues by quarter may

not be linear or consistent.

For the three months ended September 30,

2019, the percentage of revenues attributable to our products was: PainShield - 100% and UroShield 0%. For the three months ended

September 30, 2018, the percentage of revenues attributable to our products was: PainShield - 72% and UroShield - 28%. For the

three months ended September 30, 2019 and 2018, the percentage of revenues attributable to our disposable products was 12% and

23%, respectively. For the three months ended September 30, 2019 and 2018, the portion of our revenues that was derived from distributors

was 93% and 64%, respectively.

Gross Profit. For the three months

ended September 30, 2019 and 2018, gross profit was approximately $47,000 and $8,000, respectively, an increase of approximately

488%, mainly due to increased sales.

Gross profit as a percentage of

revenues was approximately 47% and 15% for the three months ended September 30, 2019 and 2018, respectively. The increase in gross

profit as a percentage is mainly due to sales with nonrefundable deposits.

|

Research and Development Expenses.

For the three months ended September 30, 2019 and 2018, research and development expenses were approximately $79,000 and $121,000,

respectively between the periods. The decrease was due to there being no clinical trials during the three months ended September

30, 2019.

Research and development expenses as a

percentage of total revenues were approximately 78% and 224% for the three months ended September 30, 2019 and 2018, respectively.

Our research and development expenses consist

mainly of payroll expenses to employees involved in research and development activities, stock-based compensation expenses, expenses

related to subcontracting, patents application and registration, clinical trial and facilities expenses associated with and allocated

to research and development activities.

Selling and Marketing Expenses.

For the three months ended September 30, 2019 and 2018, selling and marketing expenses were approximately $228,000 and $345,000,

respectively, a decrease of approximately 34%, or $117,000, between the periods. The decrease was primarily due to bonuses and

vacation payouts in 2018.

Selling and marketing expenses as a percentage

of total revenues were approximately 226% and 639% for the three months ended September 30, 2019 and 2018, respectively.

Selling and marketing expenses consist

mainly of payroll expenses to direct sales and marketing employees, stock-based compensation expenses, travel expenses, advertising

and marketing expenses, rent and facilities expenses associated with and allocated to selling and marketing activities.

General and Administrative Expenses.

For the three months ended September 30, 2019 and 2018, general and administrative expenses were approximately $533,000 and $868,000,

respectively, a decrease of approximately 39%, or $335,000, between the periods. The decrease was primarily due to higher compensation

costs and public company expenses in 2018.

General and administrative expenses as

a percentage of total revenues were approximately 528% and 1,607% for the three months ended September 30, 2019 and 2018, respectively.

Our general and administrative expenses

consist mainly of payroll expenses for management and administrative employees, share-based compensation expenses, accounting,

legal and facilities expenses associated with general and administrative activities and costs associated with being a publicly

traded company.

Financial expenses, net. For the

three months ended September 30, 2019 and 2018, financial expenses, net was approximately $20,000 compared to a $7,000, respectively,

an increase of approximately $13,000, between the periods. The increase in 2019 was derived primarily from exchange rate adjustments.

Tax expenses. For the three

months ended September 30, 2019 and 2018, tax expenses were $2,000 and $11,000. The tax expense is computed by multiplying income

before taxes at our Israeli subsidiary by the appropriate tax rate.

Net loss. Our net loss decreased

by approximately $529,000, or 39%, to approximately $815,000 for the three months ended September 30, 2019 from approximately $1,344,000

in the same period of 2018. The decrease in net loss resulted primarily from the factors described above.

Nine Months Ended September 30, 2019

Compared to Nine Months Ended September 30, 2018

Revenues. For the nine months ended

September 30, 2019 and 2018, our revenues were approximately $443,000 and $264,000, respectively, an increase of approximately

68%, or $179,000, between the periods. The increase was mainly attributable to new royalty agreement in the nine months ended September

30, 2019. Our revenues may fluctuate as we add new consumers or when existing distributors or consumers make large purchases of

our products during one period and no purchases during another period. Our revenues may fluctuate from quarter-to-quarter and any

growth or decrease in revenues by quarter may not be linear or consistent.

For the nine months ended September 30,

2019, the percentage of revenues attributable to our products was: PainShield - 54% and UroShield 46%. For the nine months ended

September 30, 2018, the percentage of revenues attributable to our products was: PainShield - 75% and UroShield - 25%. For the

nine months ended September 30, 2019 and 2018, the percentage of revenues attributable to our disposable products was 5% and 53%,

respectively. For the nine months ended September 30, 2019 and 2018, the portion of our revenues that was derived from distributors

was 59% and 52%, respectively.

Gross Profit. For the nine months

ended September 30, 2019 and 2018, gross profit was approximately $307,000 and $141,000, respectively, an increase of approximately

118%, or $166,000.

Gross profit as a percentage of revenues

was approximately 69% and 53% for the nine months ended September 30, 2019 and 2018, respectively. The increase in gross profit

as a percentage is mainly due to the nonrefundable deposit received from the royalty agreement.

Research and Development Expenses.

For the nine months ended September 30, 2019 and 2018, research and development expenses were approximately $381,000 and $408,000,

respectively, a decrease of approximately 7%, or $27,000 between the periods. The decrease is due to less clinical trials done

in 2019.

Research and development expenses as a

percentage of total revenues were approximately 86% and 155% for the nine months ended September 30, 2019 and 2018, respectively.

Our research and development expenses consist

mainly of payroll expenses to employees involved in research and development activities, stock-based compensation expenses, expenses

related to subcontracting, patents application and registration, clinical trial and facilities expenses associated with and allocated

to research and development activities.

Selling and Marketing Expenses.

For the nine months ended September 30, 2019 and 2018, selling and marketing expenses were approximately $820,000 and $871,000,

respectively, a decrease of approximately 6%, or $51,000, between the periods. The decrease was primarily due to higher compensation

costs and public company expenses in 2018.

Selling and marketing expenses as a percentage

of total revenues were approximately 185% and 330% for the nine months ended September 30, 2019 and 2018, respectively.

Selling and marketing expenses consist

mainly of payroll expenses to direct sales and marketing employees, stock-based compensation expenses, travel expenses, advertising

and marketing expenses, rent and facilities expenses associated with and allocated to selling and marketing activities.

General and Administrative Expenses.

For the nine months ended September 30, 2019 and 2018, general and administrative expenses were approximately $3,018,000 and $1,802,000,

respectively, an increase of approximately 681%, or $1,216,000, between the periods. The increase is due to stock compensation

cost and higher professional fees.

General and administrative expenses as

a percentage of total revenues were approximately 681% and 683% for the nine months ended September 30, 2019 and 2018, respectively.

Our general and administrative expenses

consist mainly of payroll expenses for management and administrative employees, share-based compensation expenses, accounting,

legal and facilities expenses associated with general and administrative activities and costs associated with being a publicly

traded company.

Financial expenses, net. For the

nine months ended September 30, 2019 and 2018, financial income and (expenses), net was approximately ($71,000) compared to a $16,000,

respectively, a decrease of approximately ($87,000), between the periods.

Change in fair value of derivative liabilities.

For the nine months ended September 30, 2019 and 2018, there was a change in fair value of derivative liabilities resulting in

a gain of approximately $102,000 compared to a $0, respectively, an increase of approximately $102,000, between the periods. The

income in 2019 was derived from the valuation of derivative liabilities.

Loss on extinguishment of derivative

liability. For the nine months ended September 30, 2019 and 2018, there was a loss on extinguishment of derivative liability

of approximately ($288,000) compared to a $0, respectively, a decrease of approximately $288,000, between the periods. The income

in 2019 was derived from the elimination of derivative liabilities.

Warrant modification expenses. For

the nine months ended September 30, 2019 and 2018, warrant modification expense was approximately $412,000 compared to a $0, respectively,

and was related to warrant modification.

Tax expenses. For the nine months

ended September 30, 2019 and 2018, tax expenses was approximately $20,000 compared to $33,000, respectively. The tax expense is

computed by multiplying income before taxes at our Israeli subsidiary by the appropriate tax rate.

Net loss. Our net

loss increased by approximately $1,644,000, or 56%, to approximately $4,601 for the nine months ended September 30, 2019 from

approximately $2,957,000 in the same period of 2018.

|

|

NanoVibronix, Inc.

|

|

|

(Name of Registrant as Specified in Charter)

|

|

|

|

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

November

14, 2019

|

|

By:

|

/s/

Brian Murphy

|

|

|

|

|

|

Brian

Murphy, Chief Executive Officer

|

|

INSTRUCTION: The

form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and

title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf

of the registrant by an authorized representative (other than an executive officer), evidence of the representative's authority

to sign on behalf of the registrant shall be filed with the form.

|

|

|

ATTENTION

|

|

|

Intentional

misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

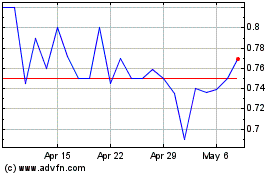

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jun 2024 to Jul 2024

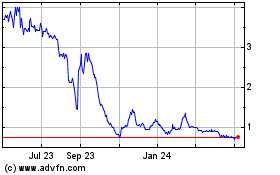

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jul 2023 to Jul 2024