SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| x |

Preliminary

Information Statement |

| |

|

| ¨ |

Confidential, for Use

of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ¨ |

Definitive Information

Statement |

Mustang Bio, Inc.

(Name of Registrant as Specified

in its Charter)

Payment of Filing Fee (Check

the appropriate box):

| x |

No

fee required. |

| |

|

| ¨ |

Fee

paid previously with preliminary materials. |

| |

|

| ¨ |

Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act

Rules 14c-5(g) and 0-11 |

NOTICE

OF STOCKHOLDER ACTION BY WRITTEN CONSENT

THIS INFORMATION STATEMENT IS BEING PROVIDED TO THE

STOCKHOLDERS OF MUSTANG BIO, INC.

WE ARE NOT

ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL INFORMATION

This Notice and the accompanying

Information Statement (the “Information Statement”) are being furnished by Mustang Bio, Inc., a Delaware corporation (“Mustang,”

“we,” “our,” “us,” or the “Company”), to the holders of shares of our common stock, par

value $0.0001 per share, to inform you that, on January 10, 2025, the holders of a majority in voting power of issued and outstanding

shares of our common stock and issued and outstanding shares of our Class A Preferred Stock, par value $0.0001 (together, the “Majority

Holders”), approved, by written consent in lieu of a meeting (the “Written Consent”) the issuance of an aggregate of

up to 34,767,934 shares of our common stock underlying certain outstanding warrants issued by us pursuant to (A) that certain previously

disclosed Investor Inducement Letter Agreement, dated as of October 24, 2024 (the “Inducement Letter”), with a certain institutional

investor (the “Investor”), and (B) that certain previously disclosed engagement letter, dated as of October 23, 2024 (the

“Engagement Letter’), with H.C. Wainwright & Co., LLC (the “Placement Agent”), in an amount equal to or in

excess of 20% of the number of shares of common stock outstanding immediately prior to the issuance of such warrants (collectively, the

“Warrant Share Issuance”), as described in further detail in the Information Statement.

The

accompanying Information Statement is being furnished only to inform stockholders in accordance with Rule 14c-2 promulgated under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), of the actions taken by Written Consent described in the

Information Statement before the Warrant Share Issuance takes effect. We are also furnishing the Information Statement to our

stockholders in satisfaction of the notice requirement under Section 228 of the General Corporation Law of the State of Delaware (“DGCL”).

Because the Written Consent of the Majority Holders satisfies all applicable stockholder voting requirements, the Board is not soliciting

your proxy or consent in connection with the matters discussed above. You are urged to read the Information Statement carefully and in

its entirety for further information regarding the Warrant Share Issuance.

This

Information Statement is first being mailed to you on or about ,

2025. The approval of Warrant Share Issuance will become effective on the 20th day after this definitive information statement

is mailed to our stockholders.

This is not a notice of

special meeting of stockholders and no stockholder meeting will be held to consider any matter which is described herein. We are not

asking you for a consent or proxy and you are requested not to send us a consent or proxy.

| ,

2025 |

By Order of the Board of Directors, |

| |

|

| |

|

| |

Manuel Litchman, M.D. |

| |

President, Chief Executive Officer and Interim Chief Financial Officer |

MUSTANG BIO, INC.

377 Plantation Street, 1st Floor

Worcester, MA 01605

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF

THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

This Information Statement

(this “Information Statement”) is being mailed to the holders of record at the close of business on January 10, 2025 (the

“Record Date”) of the shares of common stock, par value $0.0001 per share, of Mustang Bio, Inc., a Delaware corporation (“Mustang,”

“we,” “our,” “us,” or the “Company”), in connection with the actions taken by written

consent of the Majority Holders in lieu of a meeting to approve the actions described in this Information Statement.

The

Majority Holders, beneficially owning 6,552,781 shares of our issued and outstanding common stock and 250,000 shares of our issued and

outstanding Class A Preferred Stock, have executed the Written Consent approving the Warrant Share Issuance. The Majority Holders

held of record on the Record Date approximately 57% of the voting power necessary to approve the proposed Warrant Share Issuance. Dissenting

stockholders do not have any statutory appraisal rights as a result of the actions taken. The Board does not intend to solicit any proxies

or consents from any other stockholders in connection with this action. All necessary corporate approvals have been obtained, and this

Information Statement is furnished solely to advise stockholders of the action taken by the Written Consent.

Section 228 of the DGCL generally

provides in substance that unless a company’s certificate of incorporation provides otherwise, stockholders may take any action

without a meeting of stockholders, without prior notice and without a vote if a consent or consents in writing, setting forth the action

so taken, is signed by holders of the outstanding stock having not less than the minimum number of votes that would be necessary to authorize

and take such action at a meeting at which all shares entitled to vote thereon were present voted. In order to eliminate the costs and

management time involved in obtaining proxies and to effect the above action as early as possible in order to accomplish the purposes

of the Company as herein described, the Board determined to pursue stockholder action by written consent and successfully obtained written

consent of the Majority Holders.

This

Information Statement is being distributed pursuant to the requirements of the Exchange Act to our stockholders of record on the Record

Date. The Warrant Share Issuance will not become effective before the date which is 20 days after this Information Statement is first

mailed to our stockholders. The 20-day period is expected to conclude on or about ,

2025.

The entire cost of furnishing

this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other

like parties to forward this Information Statement to the beneficial owners of the common stock held of record by them and will reimburse

such persons for their reasonable charges and expenses in connection therewith.

THE ATTACHED MATERIAL IS FOR INFORMATIONAL

PURPOSES ONLY.

NO VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS

IS SOLICITED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A

PROXY.

FORWARD-LOOKING INFORMATION

This Information Statement

and other reports that we file with the Securities and Exchange Commission (the “SEC”) contain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Exchange Act, which are often indicated by terms such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “goal,” “intend,” “look forward to,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would”

and similar terms, variations of such terms or the negative of such terms. These statements are only predictions and involve known and

unknown risks, uncertainties and other factors, including those risks discussed elsewhere herein. All forward-looking statements included

in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking

statements. Our business and financial performance are subject to substantial risks and uncertainties. Actual results could differ materially

from those projected in the forward-looking statements.

RECORD DATE AND VOTE REQUIRED

The close of business on

January 10, 2025 has been fixed as the Record Date. As of January 10, 2025, we had (i) 64,768,830 shares of our common stock outstanding

and entitled to vote, (ii) 845,385 shares of our Class A common stock, par value $0.0001 per share (“Class A Common Stock”),

outstanding and entitled to vote, and (iii) 250,000 shares of our Class A Preferred Stock outstanding and entitled to vote. Each share

of common stock and Class A Common Stock is entitled to one vote on each matter to be voted upon at a meeting or via written consent.

Each share of Class A Preferred

Stock is entitled to the number of votes that is equal to one and one-tenth times a fraction, the numerator of which is the sum of (A)

the shares of outstanding common stock and (B) the whole shares of common stock into which the shares of outstanding Class A Common Stock

and Class A Preferred Stock are convertible and the denominator of which is the number of shares of outstanding Class A Preferred Stock.

As of the record date, there were a total of 136,151,230 votes outstanding (64,768,830 common stock votes plus 56,359 Class A Common

Stock votes plus 71,326,041 Class A Preferred Stock votes).

Pursuant to Section 228 of

the DGCL, unless otherwise provided in the certificate of incorporation, any corporate action required to be taken at a meeting of stockholders

may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action

so taken, shall be signed by stockholders having not less than the minimum number of votes that would be necessary to authorize or take

such action at a meeting at which all members having a right to vote thereon were present and voted. The Majority Holders, who held in

the aggregate the equivalent of 77,878,822 votes, or approximately 57% of the voting equity of the Company, voted in favor of the Warrant

Share Issuance by executing the Written Consent in lieu of a meeting in accordance with our Bylaws and the DGCL. The Written Consent

is sufficient under the DGCL and our Bylaws to approve and adopt the actions described in this Information Statement. Consequently, no

further stockholder action is required.

ITEM I: WARRANT SHARE ISSUANCE

On

October 24, 2024, the Company completed an induced warrant exercise of outstanding warrants to purchase the Company’s common

stock, par value $0.0001 per share (the “Induced Warrant Exercise”), and in connection with the Induced Warrant Exercise,

entered into (i) that certain Engagement Letter, dated as of October 23, 2024, with the Placement Agent and (ii) that certain Investor

Inducement Letter, dated as of October 24, 2024 (together with the Engagement Letter, the “Agreements”), with the Investor,

pursuant to which the Company agreed to issue Series B-1, Series B-2, and Placement Agent warrants to purchase up to an aggregate of

34,767,934 shares of the Company’s common stock.

The Investor held

certain outstanding Series A-3 warrants to purchase up to an aggregate of 16,877,638 shares of the Company’s common stock, par

value $0.0001 per share, originally issued to the Investor on May 2, 2024 (the “Existing Warrants”). The Existing Warrants

had an exercise price of $0.237 per share. Pursuant to the Inducement Letter, the Investor agreed to exercise in full, for cash,

the Existing Warrants in consideration for the Company’s agreement to issue in a private placement (x) new Series B-1 common stock

purchase warrants (the “New Series B-1 Warrants”) to purchase up to 16,877,638 shares of common stock (the “New Series

B-1 Warrant Shares”) and (y) new Series B-2 common stock Purchase Warrants (the “New Series B-2 Warrants” and, together

with the New Series B-1 Warrants, the “New Warrants”) to purchase up to 16,877,638 shares of common stock (the “New

Series B-2 Warrant Shares”).

The closing of the transactions

contemplated pursuant to the Inducement Letter occurred on October 25, 2024 (the “Closing Date”). The Company received aggregate

gross proceeds of approximately $4 million from the exercise of the Existing Warrants by the Investor, before deducting placement agent

fees and other expenses payable by the Company. The Company intends to use the net proceeds for working capital and general corporate

purposes.

The Company engaged H.C.

Wainwright & Co., LLC (“H.C. Wainwright”) to act as its exclusive placement agent in connection with the transactions

summarized above and paid H.C. Wainwright a cash fee equal to 7.0% of the aggregate gross proceeds from the exercise of the Existing

Warrants. In addition, the Company (i) reimbursed H.C. Wainwright for $50,000 of the fees and expenses of H.C. Wainwright’s legal

counsel and other of its out-of-pocket expenses, (ii) reimbursed H.C. Wainwright for its non-accountable expenses in the amount of $25,000,

and (iii) paid a management fee equal to 1.0% of the gross proceeds raised. The Company also issued to H.C. Wainwright or its designees

(“PA Warrant Holders”) placement agent warrants (the “Placement Agent Warrants”) to purchase up to 1,012,658

shares of common stock (the “Placement Agent Warrant Shares,” and, together with the New Series B-1 Warrant Shares and the

New Series B-2 Warrant Shares, the “New Warrant Shares”). The Placement Agent Warrants have the same terms as the New Series

B-1 Warrants, except that the Placement Agent Warrants have an exercise price equal to $0.2963 per share.

The Company filed a registration

statement on Form S-3 (File No. 333-283420) under the Securities Act providing for the resale of the New Warrant Shares (the “Resale

Registration Statement”) on November 22, 2024, which was declared effective by the SEC on November 27, 2024. The Company will use

best efforts to keep the Resale Registration Statement effective at all times until the Investor no longer owns any New Warrants or New

Warrant Shares.

Effect of the Issuance of the Warrant Shares

The potential issuance of

the Warrant Shares would result in a substantial and significant increase in the number of shares of our common stock outstanding, and

our stockholders will incur substantial dilution of their percentage ownership to the extent that the Holders of the Warrants exercise

their Warrants.

Reasons

for Stockholder Approval of the Warrant Share Issuance

Nasdaq

Listing Rule 5635(d) requires us to obtain stockholder approval, prior to the issuance of securities, of a transaction other than a public

offering involving the sale, issuance or potential issuance by us of shares of our common stock (or securities convertible into or exercisable

for our common stock) in an amount equal to 20% or more of the Company’s outstanding common stock or voting power outstanding immediately

before the issuance will be sold at a price less than (i) the Nasdaq Official Closing Price immediately preceding the signing of the

binding agreement in connection with such transaction or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected

on Nasdaq.com) for the five trading days immediately preceding the signing of such binding agreement (the “Minimum Price”).

In the case of the Offerings, the 20% threshold is determined based on the number of shares of our common stock outstanding immediately

preceding the issuance of the Warrants in the Offerings.

Prior to the execution of

the Agreements, we had 41,060,312 shares of common stock issued and outstanding on October 24, 2024. Therefore, the potential issuance

of 34,767,934 Warrant Shares will constitute greater than 20% of the shares of common stock outstanding immediately prior to the execution

of the Agreements.

Additionally, under the terms

of the Agreements, we agreed to seek approval as may be required by the applicable rules and regulations of the Nasdaq Stock Market LLC

(or any successor entity) from the stockholders of the Company with respect to the issuance of the Warrant Shares upon the exercise of

the Warrants.

Approval of the Issuance of the Warrant Shares

We obtained stockholder approval

from the Majority Holders by Written Consent to comply with Nasdaq Listing Rule 5635(d) for the sale, issuance or potential issuance

by us of shares of our common stock (or securities exercisable for our common stock) in excess of 20% of the shares of common stock outstanding

immediately prior to the execution of the Agreements.

We cannot predict whether

or when the Holders will exercise their Warrants. For these reasons, we are unable to accurately forecast or predict with any certainty

the total amount of Warrant Shares that may ultimately be issued. Under certain circumstances, however, it is possible, that we will

issue more than 20% of our outstanding shares of common stock to the Holders. Therefore, we sought stockholder approval from the Majority

Holders to issue more than 20% of our outstanding shares of common stock, if necessary, to the Holders.

Any transaction requiring

approval by our stockholders under Nasdaq Listing Rule 5635(d) would likely result in a significant increase in the number of shares

of our common stock outstanding, and, as a result, our current stockholders will own a smaller percentage of our outstanding shares of

common stock.

Further Information

The terms of the Agreements

and Warrants are only briefly summarized above. For further information, please refer to the full text of the Inducement Letter, form

of Series B-1 and B-2 Warrant, and form of Placement Agent Warrant, copies of which were filed with the SEC as exhibits to our Current

Reports on Form 8-K on October 25, 2024, and are incorporated herein by reference. The discussion herein is qualified in its entirety

by reference to the filed documents. We will furnish without charge to you a copy of any or all of the documents incorporated by reference,

including exhibits to these documents, upon written or oral request. Direct your written request to: Corporate Secretary, Mustang Bio,

Inc., 377 Plantation Street, Worcester, Massachusetts 01605, or (781) 652-4500.

No Appraisal Rights

Under the DGCL, stockholders

are not entitled to appraisal rights with respect to the authorization of the Warrant Share Issuance.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE

ACTED UPON

None of our directors, executive

officers or any associate of a director or executive officer has a substantial interest, direct or indirect, by security holdings or

otherwise, in any matter described in this Information Statement.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The

following table shows information, as of January 10, 2025, concerning the beneficial ownership of our common stock by:

| · |

each person we know to be the beneficial owner of more than 5% of our common stock; |

| · |

each of our current directors; |

| · |

each of our Named Executive Officers (“NEOs”); and |

| · |

all current directors and NEOs as a group. |

As

of January 10, 2025, there were 64,768,830 shares of our common stock, 845,385 shares of our Class A Common Stock, and 250,000

shares of our Class A Preferred Stock outstanding. In order to calculate a stockholder’s percentage of beneficial ownership, we

include in the calculation those shares underlying options or warrants beneficially owned by that stockholder that are vested or that

will vest within 60 days of January 10, 2025. Shares of restricted stock are deemed to be outstanding. Options or warrants held by other

stockholders that are not attributed to the named beneficial owner are disregarded in this calculation. Beneficial ownership is determined

in accordance with the rules of the SEC and includes voting or investment power with respect to the shares of our common stock. Unless

we have indicated otherwise, each person named in the table below has sole voting power and investment power for the shares listed opposite

such person’s name, except to the extent authority is shared by spouses under community property laws.

| | |

Shares | | |

Shares

Under

Exercisable

Options

and

Unvested

Restricted

Stock | | |

Total

Shares

Beneficially | | |

% of total | |

| Name of Beneficial Owner (1) | |

owned | | |

Units (2) | | |

Owned | | |

CS | |

| Michael S. Weiss (3) | |

| 49,637 | | |

| - | | |

| 49,637 | | |

| * | % |

| Manuel Litchman, M.D | |

| 76,223 | | |

| 50,024 | | |

| 126,427 | | |

| * | % |

| Lindsay A. Rosenwald, M.D (3) | |

| 60,525 | | |

| - | | |

| 60,525 | | |

| * | % |

| Neil Herskowitz | |

| 19,703 | | |

| - | | |

| 19,703 | | |

| * | % |

| David Jin | |

| 1,994 | | |

| - | | |

| 1,994 | | |

| * | % |

| Adam J. Chill | |

| 19,170 | | |

| - | | |

| 19,170 | | |

| * | % |

| Michael J. Zelefsky, M.D | |

| 18,970 | | |

| - | | |

| 18,970 | | |

| * | % |

| All current executive officers and directors as a group (7

persons) | |

| 246,222 | | |

| 50,204 | | |

| 296,426 | | |

| * | % |

| 5% or Greater Stockholders: | |

| | | |

| | | |

| | | |

| | |

| Fortress Biotech, Inc (4) | |

| 6,552,781 | | |

| - | | |

| 6,552,781 | | |

| 10.1 | % |

* Less than 1% of our common stock outstanding

The address of each of the directors and executive officers

is c/o Mustang Bio, Inc., 377 Plantation Street, Worcester,

| (1) | Massachusetts

01605, and the address of Fortress Biotech, Inc. is c/o Fortress Biotech, Inc., 1111 Kane

Concourse, Suite 301, Bay Harbor Island, FL 33154. |

| (2) | Includes

only options exercisable within 60 days of January 10, 2025 and unvested restricted stock

units. |

| (3) | Includes

33,334 warrants issued by Fortress to each of Mr. Weiss and Dr. Rosenwald that cover shares

of our common stock that are owned by Fortress. These do not represent equity compensation

by us to either Mr. Weiss or Dr. Rosenwald. |

| (4) | Includes

shares underlying 33,334 warrants issued to each of Mr. Weiss and Dr. Rosenwald, and excludes

250,000 of Class A Preferred Stock, which are convertible into 16,666 shares of common stock. |

| | |

| Class

A Common Stock

Beneficially Owned | |

| Name

and Address of Beneficial Owner(1) | |

| Number

of

Shares and

Nature of

Beneficial

Ownership | | |

| Percentage

of

Total

Class A

Common

Stock | |

| City of Hope National Medical Center | |

| 845,385 | | |

| 100 | % |

(1) The address of City of Hope National Medical Center is 1500 East

Duarte Road, Duarte, California 91010.

| | |

| Class

A Preferred Stock

Beneficially Owned | |

| Name

and Address of Beneficial Owner(1) | |

| Number

of

Shares and

Nature of

Beneficial

Ownership | | |

| Percentage

of

Total

Class A

Preferred

Stock | |

| Fortress Biotech, Inc. | |

| 250,000 | | |

| 100 | % |

(1) The address of Fortress Biotech Inc. is c/o Fortress Biotech,

Inc., 1111 Kane Concourse, Suite 301, Bay Harbor Islands, Florida 33154.

ADDITIONAL INFORMATION

We

file reports with the SEC on an annual basis using Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The SEC

maintains a website that contains annual, quarterly, and current reports, proxy statements, and other information that issuers (including

us) file electronically with the SEC. The SEC’s website address is www.sec.gov. You can also obtain copies of materials

we file with the SEC from our Internet website found at www.mustangbio.com. Our common stock is listed on the Nasdaq Capital Market

under the symbol “MBIO.”

EFFECTIVE DATE

Pursuant to Rule 14c-2 under

the Exchange Act, the above action to approve the Warrant Share Issuance will not be effective until a date at least 20 days after the

date on which the definitive Information Statement has been mailed to the stockholders.

HOUSEHOLDING OF STOCKHOLDER MATERIALS

Some banks, brokers and other

nominee record holders may be participating in the practice of “householding” information statements. This means that only

one copy of this Information Statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate

copy of the Information Statement to you if you contact us at: Mustang Bio, Inc., 377 Plantation Street, Worcester, Massachusetts 01605,

Attn: Corporate Secretary. You may also contact us at (781) 652-4500.

If you want to receive separate

copies of Information Statements in the future, or if you are receiving multiple copies and would like to receive only one copy for your

household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or phone

number.

MISCELLANEOUS MATTERS

The entire cost of furnishing

this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other

like parties to forward this Information Statement to the beneficial owners of the common stock held of record by them and will reimburse

such persons for their reasonable charges and expenses in connection therewith. The Board has fixed the close of business on January

10, 2025 as the record date for the determination of stockholders who are entitled to receive this Information Statement.

This Information Statement is being mailed on

or about ,

2025 to all stockholders of record as of the Record Date.

CONCLUSION

As a matter of regulatory

compliance, we are sending you this Information Statement that describes the purpose and effect of the above actions. Your consent to

the above action is not required and is not being solicited in connection with this action. This Information Statement is intended to

provide our stockholders information required by the rules and regulations of the Exchange Act.

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| |

|

| ,

2025 |

By: |

|

| |

|

Manuel Litchman, M.D. |

| |

|

President, Chief Executive Officer and Interim Chief Financial Officer |

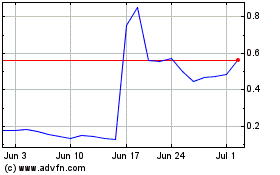

Mustang Bio (NASDAQ:MBIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mustang Bio (NASDAQ:MBIO)

Historical Stock Chart

From Jan 2024 to Jan 2025