Cooperative Bankshares Reports 15% Increase in Second Quarter Earnings

July 25 2007 - 10:47AM

Business Wire

Cooperative Bankshares, Inc. (NASDAQ: COOP) (the �Company�)

reported net income for the quarter ended June 30, 2007 of $2.1

million or $0.31 per diluted share, an increase of 14.8% over the

same quarter last year. Net income for the quarter ended June 30,

2006 was $1.8 million or $0.27 per diluted share. Net income for

the six months ended June 30, 2007 was $4.2 million or $0.63 per

diluted share, an increase of 28.2% over the same period last year.

Net income for the six months ended June 30, 2006 was $3.3 million

or $0.49 per diluted share. The increase in net income from the

prior year period was mainly due to an increase in net interest

income caused primarily by growth in loans and a reduction to the

provision for loan losses. Net income for the six months ended June

30, 2007 was also affected by a gain of $275,000 recognized on the

sale of a branch office that was relocated in Morehead City. Loans

increased to $792.4 million at June 30, 2007 representing a 4.1%

increase from December 31, 2006 and a 9.2% increase from June 30,

2006. For the six-month period ended June 30, 2007, the bulk of the

increase in the loan portfolio occurred in construction and land

development loans, which grew $27.6 million (16.7%), and

one-to-four family loans, which grew $12.3 million (3.4%). For the

twelve-month period ended June 30, 2007, the majority of loan

growth occurred in one-to-four family loans, which grew $62.1

million (19.7%), and construction and land development loans, which

grew $19.6 million (11.3%). Loan growth was primarily attributable

to the growth of the markets in which the Company�s wholly owned

subsidiary, Cooperative Bank (the �Bank�), conducts its business,

the Bank�s improved branch network and a continued emphasis on

increasing overall loan production. The provision for loan losses

decreased to $350,000 for the quarter ended June 30, 2007

representing a 54.8% decrease from the quarter ended June 30, 2006.

For the six months ended June 30, 2007, the provision for loan

losses decreased to $650,000, representing a 52.2% decrease when

compared to the six months ended June 30, 2006. This decrease in

the provision for loan losses was primarily the result of slower

loan growth in the three and six months ended June 30, 2007 as

compared to the three and six months ended June 30, 2006,

respectively. Total assets increased to $891.6 million at June 30,

2007, an increase of 3.7% compared to $860.1 million at December

31, 2006 and an increase of 7.7% compared to $827.7 million at June

30, 2006. Asset growth was primarily the result of continued loan

growth, which was mostly funded by deposit growth. Deposits at June

30, 2007 increased to $690.8 million from $661.9 million at

December 31, 2006 and from $633.4 million at June 30, 2006,

primarily as a result of the Bank�s improved branch network,

increasing brokered deposits and the Bank being located in markets

experiencing growth. At June 30, 2007, stockholders� equity was

$61.4 million, or $9.37 per share, and represented 6.88% of assets,

compared to $57.6 million, or $8.85 per share, representing 6.70%

of assets at December 31, 2006 and compared to $53.3 million, or

$8.19 per share, representing 6.44% of assets at June 30, 2006. On

July 2, 2007, the Company completed the acquisition of Bank of

Jefferson located in Chesterfield County, South Carolina. At June

30, 2007, Bank of Jefferson had $9.4 million of deposits and $6.8

million in loans. The financial information presented in this news

release does not include Bank of Jefferson. Cooperative Bankshares,

Inc. is the parent company of Cooperative Bank in North Carolina

and Bank of Jefferson in Chesterfield County, South Carolina.

Chartered in 1898, Cooperative Bank provides a full range of

financial services through twenty three offices in Eastern North

Carolina. Chartered in 1946, Bank of Jefferson operates one office

in Jefferson, South Carolina. Cooperative Bank�s subsidiary, Lumina

Mortgage, Inc., is a mortgage banking firm, originating and selling

residential mortgage loans through two offices in North Carolina.

Statements in this news release that are not historical facts are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements,

which contain words such as �expects,� �intends,� �believes� or

words of similar import, are subject to numerous risks and

uncertainties disclosed from time to time in documents the Company

files with the Securities and Exchange Commission (the �SEC�),

which could cause actual results to differ materially from the

results currently anticipated. Undue reliance should not be placed

on such forward-looking statements. The Company has filed a Form

8-K with the SEC containing additional financial information.

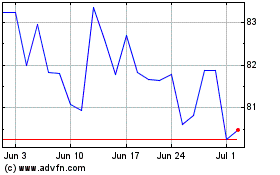

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jun 2024 to Jul 2024

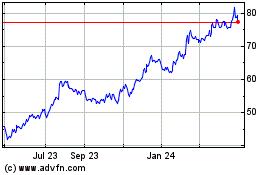

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jul 2023 to Jul 2024