Mogo Announces Partnership with Canada’s Largest News Media Company to Create go-to Educational Wealth Content Channel for Canadians

June 13 2024 - 7:56AM

Business Wire

- Aimed at educating Canadians on how to invest,

accumulate wealth, and manage it effectively to achieve their

financial goals

- New digital wealth partnership to leverage

Postmedia’s approximately 17.8 million monthly unique audience

- Mogo to issue 500k warrants to Postmedia

Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) (“Mogo” or the “Company”), a

digital wealth and payments business, today announced a new

strategic partnership with Postmedia Network Inc. (“Postmedia”), a

Canadian news media company representing more than 130 brands

across multiple print, online, and mobile platforms, to launch a

new content channel with news and information on wealth-building.

The channel will be aimed at educating Canadians on how to invest,

accumulate wealth, and manage it effectively to achieve their

financial goals, addressing a gap in the availability of quality

educational content from existing financial services providers.

According to the J.D. Power 2023 Canada Retail Banking Advice

Satisfaction Study, “Investment and retirement advice is the most

frequent type of advice both desired and received by bank customers

and interest for this topic is on the rise”1.

With a joint focus on educating current and future investors,

Postmedia is establishing a new digital channel on the Financial

Post platform, with distribution extending to other Postmedia

properties. Postmedia reaches approximately 17.8 million Canadians

each month across its platforms. Postmedia will independently

operate the channel with Mogo as its founding sponsor. Mogo will

also contribute its own branded educational content and tools on

wealth-building, including its patent-pending wealth

calculator.

“It’s clear that the vast majority of Canadians are nowhere

close to being on the right path to achieving financial freedom. In

fact, recent surveys show that 75% of pre-retirees between the ages

of 55-65 have less than $100,000 saved versus the $1.7 million

estimated average Canadians believe they need to retire2,” said

Dave Feller, Founder & CEO of Mogo. “A big part of the problem

comes down to the products that many Canadians find themselves in

like high-fee underperforming mutual funds, when the data clearly

shows that they would be far better off investing in low-cost ETFs

such as those that track the S&P 500. There’s an estimated $2

trillion sitting in these mutual funds today, and assuming an

average of about 2%, that’s $40 billion a year in fees that could

be going towards Canadians wealth building. The right educational

content is going to be a key driver of disrupting the status quo,

and helping all Canadians get on a much better path. We couldn’t

think of a better organization to partner with than Postmedia, as

they have always been a leader in this area, especially through

properties like the Financial Post.”

“This new initiative reinforces Postmedia’s longstanding

commitment to bringing Canadians high-value editorial and content

so they can understand the economy, the financial markets, and the

investment solutions and strategies available to them,” said Erika

Tustin, Vice President, Content Monetization, Postmedia. “We’re

excited to partner with a company like Mogo to help deliver on this

commitment and create unique content that brings value to our

readers, subscribers and customers.”

“We’re very pleased to be renewing our long-running partnership

with Mogo as part of this unique initiative,” said Andrew MacLeod,

President and Chief Executive Officer, Postmedia. “This new channel

represents the perfect alignment between Mogo’s vision for the

future and Postmedia’s commitment to delivering indispensable,

trusted content to Canadians.”

Under the new agreement, Mogo will issue 500,000 warrants to

Postmedia, each such warrant entitling Postmedia to acquire one

Mogo share at a price of $2.15 for a period of three years from the

date of issue. Issuance of the warrants is subject to TSX

approval.

About Mogo

Mogo Inc. (NASDAQ:MOGO; TSX:MOGO) is a digital wealth and

payments company headquartered in Vancouver, Canada with more than

2 million members, $9.9B in annual payments volume and a ~13%

equity stake in Canada’s leading Crypto Exchange WonderFi

(TSX:WNDR). Mogo offers simple digital solutions to help its

members dramatically improve their path to wealth-creation and

financial freedom. MOGO offers commission-free stock trading that

helps users thoughtfully invest based on a Warren Buffett approach

to long-term investing – while also making a positive impact with

every investment. Moka offers Canadians a real alternative to

mutual funds and wealth managers that overcharge and underperform

with a fully managed investing solution based on the proven

outperformance of an S&P 500 strategy, and at a fraction of the

cost. Through its wholly owned digital payments subsidiary, Carta

Worldwide, Mogo also offers a low-cost payments platform that

powers next-generation card programs for companies across Europe

and Canada. The Company, which was founded in 2003, has

approximately 200 employees across its offices in Vancouver,

Toronto, London & Casablanca.

1) 2023 Canada Retail Banking Advice Satisfaction Study | J.D.

Power (jdpower.com) 2)

https://newsroom.bmo.com/2023-02-07-BMO-Annual-Retirement-Study-Canadians-Believe-They-Need-1-7M-to-Retire-Up-20-Per-Cent-from-2020

Forward-Looking Statements

This news release may contain "forward-looking statements"

within the meaning of applicable securities legislation, including

statements regarding the launch a new content channel on

Postmedia’s platform, and receipt of TSX approval for the issuance

of 500,000 warrants to Postmedia. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by management at the time of

preparation, are inherently subject to significant business,

economic and competitive uncertainties and contingencies, and may

prove to be incorrect. Forward-looking statements are typically

identified by words such as "may", "will", "could", "would",

"anticipate", "believe", "expect", "intend", "potential",

"estimate", "budget", "scheduled", "plans", "planned", "forecasts",

"goals" and similar expressions. Forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause actual financial results, performance or achievements to be

materially different from the estimated future results, performance

or achievements expressed or implied by those forward-looking

statements and the forward-looking statements are not guarantees of

future performance. Mogo’s growth, its ability to expand into new

products and markets and its expectations for its future financial

performance are subject to a number of conditions, many of which

are outside of Mogo’s control. For a description of the risks

associated with Mogo’s business please refer to the “Risk Factors”

section of Mogo’s current annual information form, which is

available at www.sedarplus.com and www.sec.gov. Except as required

by law, Mogo disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240613278079/en/

For further information: US Investor Relations Contact

Lytham Partners, LLC Ben Shamsian New York | Phoenix

shamsian@lythampartners.com (646) 829-9701 Craig Armitage Investor

Relations investors@mogo.ca (416) 347-8954

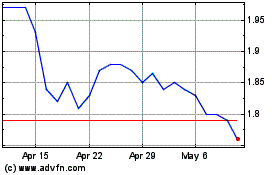

Mogo (NASDAQ:MOGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mogo (NASDAQ:MOGO)

Historical Stock Chart

From Jan 2024 to Jan 2025