0000807863FALSE00008078632023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2023

MITEK SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35231 | 87-0418827 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | |

| 600 B Street, Suite 100 | | |

| San Diego, | California | | 92101 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (619) 269-6800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MITK | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On December 7, 2023, Mitek Systems, Inc. (the “Company”, “we”, “us” and “our”) issued a press release announcing the Company’s preliminary financial results for the full fiscal year ended September 30, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The Company’s condensed consolidated financial statements as of and for the fiscal year ended September 30, 2023 are not yet available and the Company has not yet completed its year end audit for the period ended September 30, 2023. As such, the information contained in the press release reflects the Company’s estimates with respect to revenue, operating margins and net revenue retention and is based on currently available information, which is preliminary, unaudited and subject to change. The Company’s actual results may differ from these preliminary estimates after the completion of the Company’s year end audit by its independent registered public accounting firm, and related final adjustments and review by the Company’s staff and management, and such estimates are not indicative of the results to be expected for any future period. These estimates should not be viewed as a substitute for full financial statements prepared in accordance with generally accepted accounting principles in the U.S. and these estimates are not necessarily indicative of the results to be achieved for the stated period, or any other period. The Company does not undertake any obligation to publicly update or revise these preliminary estimates, except as required by law. Accordingly, undue reliance should not be placed on these preliminary financial results. See “Risk Factors,” “Important Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022 and Quarterly Reports on Form 10-Q for the quarters ended December 31, 2022, March 31, 2023 and June 30, 2023 for a discussion of certain factors that could result in differences between these preliminary unaudited estimates and the actual results.

These preliminary unaudited estimates of the Company’s revenue, operating margins and net revenue retention have been prepared by and are the responsibility of management. The Company’s independent registered public accounting firm has not conducted a review of and does not express an opinion or any other form of assurance with respect to these preliminary estimates. This information should be read in conjunction with the Company’s consolidated and combined financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022 and Quarterly Reports on Form 10-Q for the quarters ended December 31, 2022, March 31, 2023 and June 30, 2023.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

We previously announced that we expected to hold our 2024 annual meeting of stockholders (the “2024 Annual Meeting”) on March 6, 2024. However, as noted in the press release attached hereto as Exhibit 99.1, we currently anticipate that, as a result of our previously delayed (but now filed) Quarterly Reports on Form 10-Q for fiscal 2023, we will also be delayed in the filing of our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 (the “Form 10-K”). As a result of the anticipated delay of the filing of the Form 10-K, we no longer expect to hold the 2024 Annual Meeting on March 6, 2024. As of the filing of this Current Report on Form 8-K, we do not have an estimated date for the 2024 Annual Meeting.

Pursuant to Rule 14a-8 under the Exchange Act, stockholders may present proper proposals for inclusion in our proxy statement and for consideration at our next annual meeting of stockholders. As we expect our 2024 Annual Meeting to convene more than 30 days before the anniversary of our 2023 annual meeting of stockholders, to be eligible for inclusion in our 2024 proxy statement, a stockholder’s proposal received by us must otherwise comply with Rule 14a-8 under the Exchange Act, and must be received by us a reasonable time before we begin to print and send our proxy materials for the 2024 Annual Meeting. While our Board of Directors will consider stockholder proposals that are properly brought before the annual meeting, we reserve the right to omit from our 2024 proxy statement stockholder proposals that we are not required to include under the Exchange Act, including Rule 14a-8 thereunder. We will announce the specific date by which such proposals must be received by us in a Current Report on Form 8-K or in the Form 10-K as soon as reasonably practicable following the date on which our Board of Directors determines the date for the 2024 Annual Meeting.

Pursuant to the terms of our Second Amended and Restated Bylaws (our “Bylaws”), stockholders wishing to submit proposals or director nominations, including those that are not to be included in our 2024 proxy statement and proxy, must provide timely notice in writing to our Secretary. As we expect our 2024 Annual Meeting to convene more than 30 days before the anniversary of our 2023 annual meeting of stockholders, to be timely, notice by the stockholder must be so delivered, or mailed and received, not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the 90th day prior to such annual meeting or, if later, the 10th day following the day on which public disclosure of the date of such annual meeting was first made. Stockholders are advised to review our Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

In addition to satisfying the requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than those nominated by us must provide timely notice in the manner prescribed by, and that sets forth the information required by, Rule 14a-19 under the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File, formatting Inline Extensible Business Reporting Language (iXBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Mitek Systems, Inc. |

| | | | |

| December 7, 2023 | | By: | /s/ Fuad Ahmad |

| | | | Fuad Ahmad |

| | | | Interim Chief Financial Officer |

Mitek Reports Preliminary Fiscal 2023 Full Year Financial Results and

Provides Guidance for Fiscal 2024

SAN DIEGO, CA, December 7, 2023 - Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek” or the “Company”), a global leader in digital identity and fraud prevention, today reported preliminary financial results for its full fiscal year ended September 30, 2023, and provides guidance for its 2024 fiscal year ending September 30, 2024.

Preliminary Fiscal 2023 Full-Year Financial Highlights

•Total revenue increased 19% year over year to $171.9 million.

•GAAP net income was $7.8 million, or $0.17 per diluted share.

•Non-GAAP net income was $43.8 million, or $0.94 per diluted share.

•Cash flow from operations was $31.4 million.

•Total cash and investments were $134.9 million on September 30, 2023.

These preliminary unaudited financial results for the fiscal year ended September 30, 2023 are estimates based on currently available information and the Company has not yet completed its year end audit of such financial results. These preliminary unaudited estimates of the Company’s revenue, net income, cash flow and cash and investments have been prepared by and are the responsibility of management. The Company’s actual results may differ from these preliminary estimates after the completion of our year end audit by our independent registered public accounting firm, and related final adjustments and review by the Company’s staff and management. The Company’s independent registered public accounting firm has not conducted a review of and does not express an opinion or any other form of assurance with respect to these preliminary estimates.

Mitek CEO Max Carnecchia’s Comments

"We are happy to announce that we exceeded our fiscal 2023 revenue guidance and delivered full-year revenue growth of 19% and a non-GAAP operating margin of 31% for our fiscal year ended September 30, 2023. Our Deposits revenue grew 21% for our full fiscal year, while Identity revenue grew 18% year over year. Also, for the full fiscal year 2023, Mitek’s net revenue retention rate was over 115%, which again underscores the value our solutions deliver in the growing markets we serve. We also generated significant cash flow and strengthened our balance sheet in fiscal 2023, and with our market leading product portfolio in place, we believe that we do not need to do additional acquisitions to further penetrate the significant market opportunities we address. Instead, we are focused on using our cash flow to drive shareholder value in other ways, and we routinely assess all capital allocation alternatives, including opportunistic share repurchase programs. At this time, we are in a blackout period as we finalize our year-end audit and are thus limited in the actions we can take until we are outside of our blackout period."

Fiscal 2024 Full Year Guidance

For its fiscal year ending September 30, 2024, Mitek expects full-year revenue to be in the range of $180.0 million to $185.0 million and its non-GAAP operating margin for fiscal 2024 to be in the range of 30.0% to 31.0%.

Mitek Interim CFO Fuad Ahmad’s Comments

"In fiscal 2023, we signed a large multi-year mobile deposit reorder that locked in favorable pricing over a four year period. Due to the unique terms of this contract we recognized additional license revenue relating to future years of approximately $7.0 million in fiscal 2023. If we back out the future year revenue from our preliminary fiscal 2023 revenue, and attribute the portion of the $7.0 million that would have

been recognized in fiscal 2024 to the midpoint of our guidance, our fiscal 2024 revenue guidance would represent growth of 12% at the midpoint. Additionally, we are committed to our Identity business reaching at least breakeven from a profitability standpoint by the end of fiscal 2024, which ends September 30, 2024.”

Filing Status

As a result of delays in filing its Quarterly Reports on Form 10-Q for fiscal 2023 (all of which are now on file), the Company was late in starting its year-end audit for fiscal 2023, and therefore currently anticipates that it will be delayed in filing its Annual Report on Form 10-K for the year ended September 30, 2023, which is due on December 14, 2023. If the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2023 is not filed on time, Nasdaq will likely issue a delist determination letter and the Company will have an opportunity to request a new hearing and an extension to complete the filing of such report. The Company plans to request such a hearing following receipt of a delist determination letter.

About Mitek Systems, Inc.

Mitek (NASDAQ: MITK) is a global leader in digital access, founded to bridge the physical and digital worlds. Mitek’s advanced identity verification technologies and global platform make digital access faster and more secure than ever, providing companies new levels of control, deployment ease and operation, while protecting the entire customer journey. Trusted by 99% of U.S. banks for mobile check deposits and

7,900 of the world’s largest organizations, Mitek helps companies reduce risk and meet regulatory requirements. Learn more at www.miteksystems.com. [(MITK-F)]

Follow Mitek on LinkedIn and YouTube, and read Mitek’s latest blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the Company or its management’s intentions, hopes, beliefs, expectations or predictions of the future, including, but not limited to, statements relating to the Company’s preliminary results for the year ended September 30, 2023 and its fiscal 2024 guidance, long-term prospects and market opportunities of the Company, the Company’s anticipated delay in the filing of its Annual Report on Form 10-K for the fiscal year ended September 30, 2023, and its related plan to request an extension from Nasdaq, the Company’s belief that it does not need additional acquisitions to further penetrate the significant market opportunities it addresses, the Company’s focus on using its cash flow to drive shareholder value and the Company’s expectations regarding profitability of its Identity business. Such forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, risks related to the Company’s ability to withstand negative conditions in the global economy, a lack of demand for or market acceptance of the Company’s products, the impact of the Company’s acquisition of HooYu Ltd. including any operational or cultural difficulties associated with the integration of the businesses of Mitek and HooYu Ltd., the Company’s ability to continue to develop, produce and introduce innovative new products in a timely manner, the Company’s ability to capitalize on a growing market, quarterly variations in revenue, the profitability of certain sectors of the Company, the performance of the Company’s growth initiatives, the outcome of any pending or threatened litigation, and the timing of the implementation and launch of the Company’s products by the Company’s signed customers.

Additional risks and uncertainties faced by the Company are contained from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (SEC), including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022, as filed with the SEC on July 31, 2023 and its quarterly reports on Form 10-Q and current reports on Form 8-K, which you may obtain for free on the SEC’s website at www.sec.gov. Collectively, these risks and uncertainties

could cause the Company’s actual results to differ materially from those projected in its forward-looking statements and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company disclaims any intention or obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Investor Contact:

Todd Kehrli or Jim Byers

MKR Investor Relations, Inc.

mitk@mkr-group.com

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted accounting principles (“GAAP”) financial measures for non-GAAP net income and non-GAAP net income per share that exclude amortization and acquisition-related costs, intellectual property litigation costs, executive transition costs, stock compensation expense, non-recurring audit fees, restructuring costs, amortization of debt discount and issuance costs, income tax effect of pre-tax adjustments, and the cash tax difference. These financial measures are not calculated in accordance with GAAP and are not based on any comprehensive set of accounting rules or principles. In evaluating the Company’s performance, management uses certain non-GAAP financial measures to supplement financial statements prepared under GAAP. Management believes these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management and the Board of Directors of the Company utilize these non-GAAP financial measures to gain a better understanding of the Company’s comparative operating performance from period-to-period and as a basis for planning and forecasting future periods. Management believes these non-GAAP financial measures, when read in conjunction with the Company’s GAAP financial statements, are useful to investors because they provide a basis for meaningful period-to-period comparisons of the Company’s ongoing operating results, including results of operations against investor and analyst financial models, which helps identify trends in the Company’s underlying business and provides a better understanding of how management plans and measures the Company’s underlying business.

The Company has not provided a reconciliation of its forward outlook for non-GAAP operating margin with its forward-looking GAAP operating margin in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company is unable, without unreasonable efforts, to quantify share-based compensation expense, which is excluded from our non-GAAP operating margin, as it requires additional inputs such as the number of shares granted and market prices that are not ascertainable due to the volatility of the Company’s share price. Additionally, a significant portion of the Company’s operations are in foreign countries and the transactional currencies are primarily Euros and British pound sterling and the Company is not able to predict fluctuations in those currencies without unreasonable efforts.

Key Business Metrics

We monitor net revenue retention to help us evaluate our business, identify trends affecting our business, formulate business plans, and make strategic decisions.

To calculate net revenue retention, the Company first calculates total revenue (including expansion revenue) and reduce that amount by revenue churn (e.g. contract expirations, cancellations, downgrades, or other reductions). To calculate net revenue retention rate, the Company specifies a measurement period consisting of the trailing 12 months from its current period end. The Company then calculates its net revenue retention rate as the quotient obtained by dividing its total revenue in the second year of the measurement period by its revenue in the first year of the measurement period (i.e. the numerator

excludes revenue generated by customers newly acquired in the second year of measurement). The net revenue retention rate is subject to adjustments for acquisitions, consolidations, spin-offs, and other market activity, and the Company presents its net revenue retention rate for historical periods reflecting these adjustments.

MITEK SYSTEMS, INC.

NON-GAAP NET INCOME RECONCILIATION

(Unaudited)

(amounts in thousands except per share data)

| | | | | | | | | | | | | | | |

| | | Twelve Months Ended September 30, |

| | | | | 2023 | | 2022 |

| Net income (loss) | | | | | $ | 7,813 | | | $ | 3,032 | |

| Non-GAAP adjustments: | | | | | | | |

Amortization and acquisition-related costs(2) | | | | | 19,046 | | | 15,533 | |

| Intellectual property litigation costs | | | | | 1,262 | | | 1,446 | |

| | | | | | | |

| | | | | | | |

| Executive transition costs | | | | | 679 | | | — | |

| Stock compensation expense | | | | | 10,433 | | | 13,363 | |

| Non-recurring audit fees | | | | | 3,451 | | | — | |

| Restructuring costs | | | | | 2,114 | | | 1,800 | |

| Amortization of debt discount and issuance costs | | | | | 7,546 | | | 7,053 | |

| Income tax effect of pre-tax adjustments | | | | | (11,207) | | | (9,799) | |

| | | | | | | |

Cash tax difference(1) | | | | | 2,651 | | | 7,210 | |

| Non-GAAP net income | | | | | 43,788 | | | 39,638 | |

| Non-GAAP income per share—basic | | | | | $ | 0.96 | | | $ | 0.89 | |

| Non-GAAP income per share—diluted | | | | | $ | 0.94 | | | $ | 0.87 | |

| Shares used in calculating non-GAAP net income per share—basic | | | | | 45,651 | | | 44,595 | |

| Shares used in calculating non-GAAP net income per share—diluted | | | | | 46,343 | | | 45,780 | |

(1)The Company’s non-GAAP net income is calculated using a cash tax rate of 20% in fiscal 2023 and 3% in fiscal 2022. The estimated cash tax rate is the estimated annual tax payable on the Company’s tax returns as a percentage of estimated annual non-GAAP pre-tax net income. The Company uses an estimated cash tax rate to adjust for the historical variation in the effective book tax rate associated with the reversal of valuation allowances. The fiscal 2022 cash tax rate includes a beneficial impact of reduced taxes payable due to the utilization of research and development tax credits and the utilization of loss carryforward. The Company believes that the cash tax rate provides a more transparent view of the Company’s operating results. The Company’s effective tax rate used for the purposes of calculating GAAP net income for fiscal 2023 and 2022 was 25% and negative 11%, respectively.

(2)Included in acquisition-related costs and expenses in fiscal 2022 is $0.3 million of foreign exchange and investment losses incurred in connection with the acquisition of HooYu Ltd. which is included in other income (expense), net in the consolidated statements of operations.

v3.23.3

Cover

|

Dec. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 07, 2023

|

| Entity Registrant Name |

MITEK SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35231

|

| Entity Tax Identification Number |

87-0418827

|

| Entity Address, Address Line One |

600 B Street, Suite 100

|

| Entity Address, City or Town |

San Diego,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92101

|

| City Area Code |

619

|

| Local Phone Number |

269-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MITK

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000807863

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

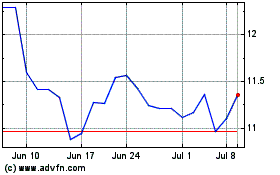

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitek Systems (NASDAQ:MITK)

Historical Stock Chart

From Apr 2023 to Apr 2024