UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-39458

Medicenna Therapeutics Corp.

(Translation of registrant’s name into

English)

2 Bloor St. W. 7th Floor

Toronto, Ontario M4W 3E2

Canada

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

The information attached as Exhibits 99.1 and 99.2 shall be deemed

to be incorporated by reference into the registration statements on Form F-3 (File Number 333-269868) and Form S-8 (File Number 333-240225), and related prospectuses, as such registration statements and prospectuses may be amended from time to time, and to be a

part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Medicenna Therapeutics Corp. |

| |

(Registrant) |

| |

|

| |

|

| |

|

| Date: November 8, 2023 |

By: |

/s/ Fahar Merchant |

| |

|

Name: Fahar Merchant, PhD |

| |

|

Title: Chief Executive Officer |

Form 6-K Exhibit Index

Exhibit 99.1

Medicenna

Announces Nasdaq Delisting

and Cutback of Management Team

The Company’s

listing on the Toronto Stock Exchange will not be impacted

TORONTO and HOUSTON,

October 27, 2023 -- Medicenna Therapeutics Corp. (“Medicenna” or “the Company”) (NASDAQ, TSX: MDNA),

a clinical-stage immunotherapy company focused on the development of engineered cytokines, announced today that the Company received a

Staff Delisting Determination from the Listing Qualifications Department of the Nasdaq Stock Market, LLC (“Nasdaq”), which

notified the Company of the delisting of its securities from the Nasdaq Capital Market as a result of the Company’s failure to comply

with the US$1.00 per share minimum bid price requirement.

The Company informed

Nasdaq that it would not appeal the delisting decision or try to regain compliance by executing a reverse stock split. The Company’s

common shares will continue to trade on the Toronto Stock Exchange (“TSX”).

“To better position

Medicenna for the benefit of all our shareholders, we undertook a thorough and thoughtful review of our cost structure, including costs

associated with being a Nasdaq-listed company,” said Fahar Merchant, Ph.D., President and CEO at Medicenna. “Our Board of

Directors concluded that within the context of the current biotech markets, the Company and its stockholders do not benefit from a Nasdaq

listing considering the associated significant costs and resources required. We remain in good standing with our TSX listing, have no

debt and have sufficient cash to potentially fund the company well beyond key value inflection milestones from the MDNA11 Phase 2 monotherapy

and combination trial. We look forward to sharing additional new data at major conferences next month for the MDNA11, BiSKITs and bizaxofusp

programs.”

After careful consideration,

the Board of Directors of Medicenna (the “Board”) determined that it is in the overall best interests of the Company not to

appeal Nasdaq’s delisting decision and delist its common shares from Nasdaq. The Board’s decision was based on several factors,

including the continuing volatility of the financial markets in the life science sector and, accordingly, in the Company’s current

share price and market value, and an analysis of the benefits of continued listing on Nasdaq weighed against the regulatory burdens and

costs associated with maintaining such listing. The Company anticipates significant financial savings as a result of this decision. With

the common shares concurrently trading on the TSX, the Company believes that the significant costs associated with a continued Nasdaq

listing, as well as the administrative burdens and extensive amount of management’s time, attention and resources expended on regulatory

compliance to maintain a Nasdaq listing, are not justified at this time. Following the delisting of the Company’s common shares

on the Nasdaq, the Company will also seek to have its common shares traded on the OTC Markets as soon as possible thereafter.

Nasdaq has notified the

Company that trading of its common shares will be suspended as of the opening of business on November 2, 2023, and a Form 25-NSE

will be filed with the United States Securities and Exchange Commission, which will remove the Company’s securities from listing

and registration on Nasdaq.

As previously announced,

on October 25, 2022, the Nasdaq Listing Qualifications Department notified the Company that the bid price of its listed securities

had closed at less than US$1.00 per share over the previous 30 consecutive business days, and, as a result, did not comply with Nasdaq

Listing Rules. Therefore, the Company was provided 180 calendar days, or until April 25, 2023, to regain compliance. Subsequently,

the Company was provided an additional 180 calendar days, or until October 23, 2023, to demonstrate compliance.

Cutback to Management

Team

In connection with the

Nasdaq delisting and in effort to further preserve capital, the Board decided to reduce the size of its management team as well as its

presence in the United States. Consequently, the Company also today announced the departure of Jeff

Caravella as Chief Financial Officer, and Brent Meadows as Chief Business Officer,

effective October 26th, 2023. The Company has started a search for a CFO familiar with the TSX.

About Medicenna

Medicenna is a clinical-stage immunotherapy company

focused on developing novel, highly selective versions of IL-2, IL-4 and IL-13 Superkines and first in class class-empowered superkines.

Medicenna’s long-acting IL-2 Superkine, MDNA11, is a next-generation IL-2 with superior CD122 (IL-2 receptor beta) binding without

CD25 (IL-2 receptor alpha) affinity thereby preferentially stimulating cancer-killing effector T cells and NK cells. Medicenna’s

IL-4 Empowered Superkine, bizaxofusp (formerly MDNA55), has been studied in 5 clinical trials, including a Phase 2b trial for recurrent

GBM, the most common and uniformly fatal form of brain cancer. Bizaxofusp has obtained FastTrack and Orphan Drug status from the FDA and

FDA/EMA, respectively. Medicenna’s early-stage BiSKITs™ program (Bifunctional SuperKine ImmunoTherapies)

is designed to enhance the ability of Superkines to treat immunologically “cold” tumors.

Forward-Looking Statements

This news release contains forward-looking statements

within the meaning of applicable securities laws that relate to the future operations of the Company, plans and projections and other

statements that are not historical facts, including, without limitation, statements on the stock market volatility, the timing of the

delisting of the Company’s common shares from Nasdaq, the anticipated cost savings in connection with such delisting, the estimated

costs associated with maintaining a dual listing, the anticipated listing of the Company’s common shares on the OTC Markets, and

the Company’s requirements for, and its ability to obtain, future funding on favourable terms or at all. Forward-looking statements

are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expect”,

“believe”, “seek”, “potentially” and similar expressions and are subject to risks and uncertainties.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially

from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s

expectations include the risks detailed in the latest Annual Report on Form 20-F of the Company and in other filings made by the

Company with the applicable securities regulators from time to time in Canada and the United States.

The reader is cautioned that assumptions used

in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ

materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are

beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information,

although considered reasonable by management, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date hereof and except as required by law, we do not intend and do not assume any obligation

to update or revise publicly any of the included forward-looking statements.

Further

Information & Investor Contact:

For

further information about the Company, please contact:

Fahar

Merchant

President

and CEO

Phone:

604-671-6673

fmerchant@medicenna.com

Exhibit 99.2

FORM 51-102F3

MATERIAL CHANGE REPORT

| 1. | Name and Address of Company |

Medicenna Therapeutics Corp. (the “Company”)

2 Bloor Street West, 7th Floor

Toronto, Ontario

M4W 3E2

| 2. | Date of Material Change |

October 27, 2023

On October 27, 2023, the Company

issued a news release through the services of Globe Newswire with respect to the material change described below.

| 4. | Summary of Material Change |

On October 27, 2023, the Company

announced that it had received a Staff Delisting Determination from the Listing Qualifications Department of the Nasdaq Stock Market,

LLC (“Nasdaq”), which notified the Company of the delisting of its securities from the Nasdaq Capital Market as a result of

the Company’s failure to comply with the US$1.00 per share minimum bid price requirement. The Company informed Nasdaq that it would

not appeal the delisting decision or try to regain compliance by executing a reverse stock split. In connection with the Nasdaq delisting

and in effort to further preserve capital, the board of directors of the Company (the “Board”) decided to reduce the size

of its management team as well as its presence in the United States.

| 5. | Full Description of Material Change |

5.1 Full

Description of Material Change

On October 27, 2023, the Company

announced that it had received a Staff Delisting Determination from the Listing Qualifications Department of the Nasdaq, which notified

the Company of the delisting of its securities from the Nasdaq Capital Market as a result of the Company’s failure to comply with

the US$1.00 per share minimum bid price requirement. The Company informed Nasdaq that it would not appeal the delisting decision or try

to regain compliance by executing a reverse stock split. The Company’s common shares will continue to trade on the Toronto Stock

Exchange (“TSX”).

After careful consideration, the Board

determined that it is in the overall best interests of the Company not to appeal Nasdaq’s delisting decision and delist its common

shares from Nasdaq. The Board’s decision was based on several factors, including the continuing volatility of the financial markets

in the life science sector and, accordingly, in the Company’s current share price and market value, and an analysis of the benefits

of continued listing on Nasdaq weighed against the regulatory burdens and costs associated with maintaining such listing. The Company

anticipates significant financial savings as a result of this decision. With the common shares concurrently trading on the TSX, the Company

believes that the significant costs associated with a continued Nasdaq listing, as well as the administrative burdens and extensive amount

of management’s time, attention and resources expended on regulatory compliance to maintain a Nasdaq listing, are not justified

at this time. Following the delisting of the Company’s common shares on the Nasdaq, the Company will also seek to have its common

shares traded on the OTC Markets as soon as possible thereafter.

Nasdaq has notified the Company that trading

of its common shares will be suspended as of the opening of business on November 2, 2023, and a Form 25-NSE will be filed

with the United States Securities and Exchange Commission, which will remove the Company’s securities from listing and registration

on Nasdaq.

As previously announced, on October 25,

2022, the Nasdaq Listing Qualifications Department notified the Company that the bid price of its listed securities had closed

at less than US$1.00 per share over the previous 30 consecutive business days, and, as a result, did not comply with Nasdaq

Listing Rules. Therefore, the Company was provided 180 calendar days, or until April 25, 2023, to regain compliance. Subsequently,

the Company was provided an additional 180 calendar days, or until October 23, 2023, to demonstrate compliance.

In connection with the Nasdaq delisting

and in effort to further preserve capital, the Board decided to reduce the size of its management team as well as its presence in the

United States. Consequently, the Company also announced the departure of Jeff Caravella as Chief Financial Officer, and Brent

Meadows as Chief Business Officer, effective October 26, 2023. The Company has started a search for a CFO familiar with

the TSX.

5.2 Forward-Looking

Statements

This material change report contains forward-looking

statements within the meaning of applicable securities laws that relate to the future operations of the Company, plans and projections

and other statements that are not historical facts, including, without limitation, statements on the stock market volatility, the timing

of the delisting of the Company’s common shares from Nasdaq, the anticipated cost savings in connection with such delisting, the

estimated costs associated with maintaining a dual listing, the anticipated listing of the Company’s common shares on the OTC Markets,

and the Company’s requirements for, and its ability to obtain, future funding on favourable terms or at all. Forward-looking statements

are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expect”,

“believe”, “seek”, “potentially” and similar expressions and are subject to risks and uncertainties.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially

from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s

expectations include the risks detailed in the latest Annual Report on Form 20-F of the Company and in other filings made by the

Company with the applicable securities regulators from time to time in Canada and the United States. The reader is cautioned

that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause

actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors,

many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information.

Such information, although considered reasonable by management, may prove to be incorrect and actual results may differ materially from

those anticipated. Forward-looking statements contained in this material change report are expressly qualified by this cautionary statement.

The forward-looking statements contained in this material change report are made as of the date of this report and except as required

by law, the Company does not intend and does not assume any obligation to update or revise publicly any of the included forward-looking

statements.

| 6. | Reliance on Section 7.1(2) of National Instrument 51-102 |

Not applicable.

Not applicable.

For additional information with respect

to the material change referred to herein, the following person may be contacted:

Fahar Merchant

President and Chief Executive Officer

(604) 671-6673

fmerchant@medicenna.com

November 3, 2023

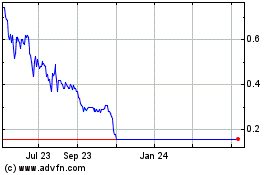

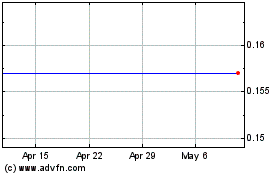

Medicenna Therapeutics (NASDAQ:MDNA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Medicenna Therapeutics (NASDAQ:MDNA)

Historical Stock Chart

From Nov 2023 to Nov 2024