Japan's Online-Shopping King Gets Lift From IPO -- WSJ

March 30 2019 - 3:02AM

Dow Jones News

By Mayumi Negishi

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 30, 2019).

TOKYO -- The debut of Lyft Inc. shares at a valuation of $24

billion marks the arrival of Japanese billionaire Hiroshi Mikitani

to the list of Silicon Valley's venture-capital heavyweights.

Mr. Mikitani leads Japanese e-commerce company Rakuten Inc.,

which has steadily built on its first $300 million investment in

Lyft in 2015. Its accumulation of a 13% stake turned Rakuten into

the biggest investor in the ride-hailing company. It will earn an

unrealized profit of about $1.5 billion from the Lyft public share

offering, according to estimates based on VentureSource data.

Often outshone in Japan by SoftBank Group Corp.'s founder

Masayoshi Son -- a backer of Lyft rival Uber Technologies Inc.

through SoftBank's near-$100 billion Vision Fund -- Mr. Mikitani

has been more cautious in his investments.

Mr. Mikitani founded Rakuten in 1997 and soon built Japan's

biggest e-commerce site and online bank, promising rapid overseas

expansion. But the bulk of Rakuten's revenues still remain in

Japan, where it is fighting for its lead against an ascendant

Amazon.com Inc.

To find growth, Rakuten has taken minority stakes in companies

including image-search company Pinterest Inc. and Middle Eastern

ride-hailing firm Careem Networks FZ. It has also sponsored the

Golden State Warriors basketball team and the FC Barcelona soccer

team to raise its profile in Silicon Valley and around the

world.

Four years ago, Rakuten made its first investment in Lyft at a

valuation of roughly $2.5 billion. At the time, Lyft was burning

through cash in its fight against market pioneer Uber.

The Japanese company later invested at valuations of up to $7.5

billion, according to VentureSource.

The Lyft initial public offering means Mr. Mikitani notches a

win over Mr. Son, whom he once advised on acquisitions while

working at the Industrial Bank of Japan, which later merged into

Mizuho Financial Group Inc.

Mr. Son's SoftBank Vision Fund, backed with money from Saudi

Arabia and Abu Dhabi, has invested billions in ride-hailing

companies, including China's Didi Chuxing Technology Co., India's

ANI Technologies Pvt.-owned Ola, and Southeast Asia's Grab Holdings

Inc., in addition to Uber. SoftBank itself has invested in Brazil's

99, which competes with Cabify, which has an investment from

Rakuten. None have yet launched an IPO -- a move that Mr. Son is

betting will validate the big valuations the Vision Fund has

paid.

The areas in which Messrs. Mikitani and Son compete have grown

over time. Rakuten plans to move into Japan's mobile-phone carrier

sector later this year, fighting for the same users that constitute

the core of SoftBank's cash-churning investment apparatus.

For its part, SoftBank-backed Yahoo Japan Corp. has been trying

to woo vendors and buyers away from Rakuten's e-commerce

operations.

SoftBank and Rakuten are also locked in a battle on multiple

fronts for dominance in Japan's mobile payments, which involves

messaging apps, banks and convenience store chains -- a fight in

which SoftBank has enlisted China's Alibaba Group Holding Ltd. and

India's Paytm.

Rakuten and SoftBank even operate rival professional baseball

teams in Japan.

The Lyft IPO creates a war chest for Rakuten's push to build out

its services in mobile phones, payments, logistics, and insurance.

The planned foray into mobile phones could be especially costly.

Major market incumbent NTT Docomo Inc. has pledged to use its scale

to lower costs by up to 40% at a time when operators are lifting

investment for faster 5G networks. Those costs come as Rakuten's

margins in e-commerce have halved in the last two years as it

battles Amazon and others.

David Gibson, chief investment adviser for Astris Advisory

Japan, says it is highly likely Rakuten will sell some of its

investments, which could include a part of its stakes in Lyft and

Dubai-based Careem. This week, Uber said it is acquiring Careem for

$3.1 billion.

Rakuten declined to make Mr. Mikitani available for an interview

and a company spokeswoman declined to comment on its plans for its

Lyft stake ahead of Lyft's IPO. It also declined to comment on its

Careem stake.

Write to Mayumi Negishi at mayumi.negishi@wsj.com

(END) Dow Jones Newswires

March 30, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

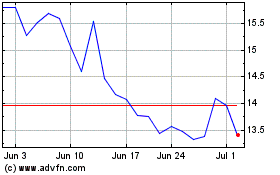

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Jul 2023 to Jul 2024