0001721484

false

0001721484

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 14, 2023

Longeveron Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40060 |

|

47-2174146 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1951 NW 7th Avenue, Suite 520, Miami,

Florida 33136

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (305) 909-0840

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share |

|

LGVN |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

On August 14, 2023, Longeveron

Inc. issued a press release regarding its previously-announced rights offering. A copy of the press release is filed as Exhibit 99.1 to

this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Item 9.01. Financial Statements and Exhibits.

The exhibit listed in the following Exhibit Index is filed as part

of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LONGEVERON INC. |

| |

|

| Date: August 14, 2023 |

/s/

Wa’el Hashad |

| |

Name: |

Wa’el Hashad |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Longeveron Announces Pricing for Rights Offering

and Expected Calendar

MIAMI, August 14, 2023 (GLOBE NEWSWIRE) -- Longeveron

Inc. (NASDAQ: LGVN) (“Longeveron” or “Company”), a clinical stage biotechnology company developing cellular therapies

for life-threatening and chronic aging-related conditions such as hypoplastic left heart syndrome (HLHS), Alzheimer’s disease and

Aging-related Frailty, announced today that it has filed an amended registration statement with the Securities and Exchange Commission

to conduct a tradable subscription rights offering to holders of its Class A common stock, Class B common stock and warrants to purchase

its Class A common stock.

The rights

offering is being made through a distribution of five tradable subscription rights (to be listed on The NASDAQ Capital Market under the

ticker symbol LGVNR) to purchase shares of Class A common stock, for each share of common stock and warrant to purchase common stock owned

on the record date, at a $3.00 subscription price per share. The distribution of the subscription rights must be settled within two business

days of the transaction date. So, to be considered a stockholder of record, you must own the stock in your brokerage account as of 5:00

PM Eastern Time on Wednesday, August 16, 2023, which is two trading days before the record date of Friday, August 18, 2023.

The rights

offering also includes an over-subscription privilege, entitling each rights holder that exercises all of its basic subscription rights

in full the ability to purchase additional shares of Class A common stock that remain unsubscribed at the expiration of the rights offering,

subject to the availability and pro rata allocation of shares among those exercising this over-subscription privilege.

The amended registration statement also covers

the placement of unsubscribed shares of Class A common stock for an additional period of up to 45 days following expiration of the offering,

as well as the potential resale by the Company’s principal stockholders, directors and executive officers of subscription rights

during the period for which the subscription rights may be transferred in accordance with the terms of the rights offering.

The calendar for the rights offering is

as follows assuming an August 14, 2023 effective date:

| Wednesday, August 16 |

|

Ownership Day – Shares must be acquired by 5:00 PM ET to be considered a stockholder of record on the Record Date |

| |

|

|

| Thursday, August 17 |

|

Ex-Rights Day - LGVN shares trade without the rights attached |

| |

|

|

| Friday, August 18 |

|

Record Date – This is the cutoff date that determines the eligibility of stockholders to receive rights |

| |

|

|

| Tuesday, August 22 |

|

Subscription Period Begins & LGVNR Rights begin to trade |

| |

|

|

| Thursday, September 21 |

|

Subscription Period Ends – 5:00 PM ET unless

extended at the Company’s sole discretion |

See our Securities and Exchange Commission filings

here for more details about the rights offering as well as information on the Company. EDGAR Search Results (sec.gov)

If you have any questions or need further information

about the rights offering, please call Okapi Partners, Longeveron’s information agent for the rights offering, at (212) 297-0720

(bankers and brokers) or (844) 201-1170 (all others) or email at info@okapipartners.com

The registration statement

has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration

statement becomes effective. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities,

nor will there be any sale of any securities referred to in this press release in any state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. The rights offering

is being made only by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. The prospectus and related

rights offering materials will be provided to all stockholders and participating warrant holders of record on the record date.

About Longeveron Inc.

Longeveron is a clinical stage biotechnology company

developing regenerative medicines to address unmet medical needs. The Company’s lead investigational product is Lomecel-B™

an allogeneic medicinal signaling cell (MSC) therapy product isolated from the bone marrow of young, healthy adult donors. Lomecel-B™

has multiple potential mechanisms of action encompassing pro-vascular, pro-regenerative, anti-inflammatory, and tissue repair and healing

effects with broad potential applications across a spectrum of disease areas. Longeveron is currently advancing Lomecel-B™ through

clinical trials in three indications: hypoplastic left heart syndrome (HLHS), Alzheimer’s disease, and Aging-related Frailty. Additional

information about the Company is available at www.longeveron.com.

Forward-Looking Statements

Certain statements in this press release that

are not historical facts are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, which reflect management’s current expectations, assumptions, and estimates of future operations, performance and

economic conditions, and involve risks and uncertainties that could cause actual results to differ materially from those anticipated by

the statements made herein. Forward-looking statements are generally identifiable by the use of forward-looking terminology such as “believe,”

“expects,” “may,” “looks to,” “will,” “should,” “plan,” “intend,”

“on condition,” “target,” “see,” “potential,” “estimates,” “preliminary,”

or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals or other future events,

circumstances, or effects. Factors that could cause actual results to differ materially from those expressed or implied in any forward-looking

statements in this release include, but are not limited to, statements regarding the offer and sale of securities, the terms of the offering,

about the ability of Longeveron’s clinical trials to demonstrate safety and efficacy of the Company’s product candidates,

and other positive results; the timing and focus of the Company’s ongoing and future preclinical studies and clinical trials and

the reporting of data from those studies and trials; the size of the market opportunity for the Company’s product candidates, including

its estimates of the number of patients who suffer from the diseases being targeted; the success of competing therapies that are or may

become available; the beneficial characteristics, safety, efficacy and therapeutic effects of the Company’s product candidates;

the Company’s ability to obtain and maintain regulatory approval of its product candidates in the U.S., Japan and other jurisdictions;

the Company’s plans relating to the further development of its product candidates, including additional disease states or indications

it may pursue; the Company’s plans and ability to obtain or protect intellectual property rights, including extensions of existing

patent terms where available and its ability to avoid infringing the intellectual property rights of others; the need to hire additional

personnel and the Company’s ability to attract and retain such personnel; the Company’s estimates regarding expenses, future

revenue, capital requirements and needs for additional financing; the Company’s need to raise additional capital, and the difficulties

it may face in obtaining access to capital, and the dilutive impact it may have on its investors; the Company’s financial performance

and ability to continue as a going concern, and the period over which it estimates its existing cash and cash equivalents will be sufficient

to fund its future operating expenses and capital expenditure requirements. Additionally, Longeveron makes no assurance that any public

offering of its securities as described herein will occur at all, or that any such transaction will occur on the timelines, in the manner

or on the terms anticipated due to numerous factors. Further information relating to factors that may impact the Company’s results and

forward-looking statements are disclosed in the Company’s filings with the Securities and Exchange Commission, including Longeveron’s

Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission on March 14, 2023 and

its Quarterly Report on Form 10-Q for the second quarter of 2023 filed with the SEC on August 11, 2023. The forward-looking statements

contained in this press release are made as of the date of this press release, and the Company disclaims any intention or obligation,

other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events,

or otherwise.

Investor Contact

Mike Moyer

LifeSci Advisors

Tel: 617-308-4306

Email: mmoyer@lifesciadvisors.com

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-40060

|

| Entity Registrant Name |

Longeveron Inc.

|

| Entity Central Index Key |

0001721484

|

| Entity Tax Identification Number |

47-2174146

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1951 NW 7th Avenue,

|

| Entity Address, Address Line Two |

Suite 520

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33136

|

| City Area Code |

305

|

| Local Phone Number |

909-0840

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.001 par value per share

|

| Trading Symbol |

LGVN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

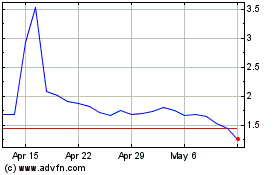

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

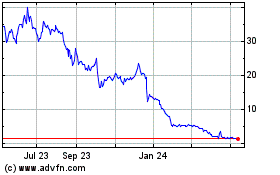

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Apr 2023 to Apr 2024