0001074902FALSE00010749022022-01-012022-09-30

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2023

LCNB CORP.

(Exact name of Registrant as specified in its Charter)

| | | | | | | | |

| Ohio | 001-35292 | 31-1626393 |

| (State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer Identification Number) |

2 North Broadway, Lebanon, Ohio 45036

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (513) 932-1414

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, No Par Value | | LCNB | | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2023, LCNB Corp. issued an earnings release announcing its financial results for the three months ended September 30, 2023. A copy of the earnings release (Exhibit 99.1) and unaudited financial highlights (Exhibit 99.2) are attached and are furnished under this Item 2.02.

Item 7.01 Regulation FD Disclosure.

On October 23, 2023, LCNB Corp. issued an earnings release announcing its financial results for the three months ended September 30, 2023. A copy of the earnings release (Exhibit 99.1) and unaudited financial highlights (Exhibit 99.2) are attached and are furnished under this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | LCNB CORP. | |

| | | | | |

| | | | | | |

Date: October 23, 2023 | | By: /s/ Robert C. Haines II | |

| | | Robert C. Haines II

Chief Financial Officer | |

| | | |

Exhibit 99.1

Press Release

Two North Broadway

Lebanon, Ohio 45036

| | | | | |

Company Contact: Eric J. Meilstrup President and Chief Executive Officer LCNB National Bank (513) 932-1414 shareholderrelations@lcnb.com | Investor and Media Contact: Andrew M. Berger Managing Director SM Berger & Company, Inc. (216) 464-6400 andrew@smberger.com |

LCNB CORP. REPORTS FINANCIAL RESULTS FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023

Ended the Third Quarter with a Stable Deposit Base and a 90.20% Loan-to-Deposit Ratio

Net Loans Increased 5.8% Year-over-Year to a Record of $1.45 Billion

Asset Quality Remains Excellent with Total Nonperforming Loans to Total Loans of 0.02% at September 30, 2023

LCNB Wealth Management Assets Up 18.9% Year-over-Year to $1.10 Billion

Cincinnati Bancorp, Inc. Acquisition Expected to Close in November 2023

LEBANON, Ohio--LCNB Corp. ("LCNB") (NASDAQ: LCNB) today announced financial results for the three and nine months ended September 30, 2023.

Commenting on the financial results, LCNB President and Chief Executive Officer Eric Meilstrup said, “LCNB achieved another solid quarter of growth, as total assets increased 4.0% from the same period a year ago to a record $1.98 billion, primarily due to a 5.8% increase in net loans. Significant competition for deposits and higher year-over-year levels of borrowings continue to increase our cost of funds and impact profitability and we expect these trends to continue over the near term. As we approach the end of 2023, we remain focused on managing non-interest expenses as well as maintaining excellent asset quality and strong liquidity levels. I am pleased with the progress our team continues to make in 2023 and their ability to execute our strategic objectives and deliver solid results. I want to thank our dedicated employees for all their hard work.”

Mr. Meilstrup continued, “Upon completion of the Cincinnati Bancorp acquisition, LCNB expects to have approximately $2.3 billion in total assets, $1.7 billion in loans and $1.8 billion in deposits. In addition, Cincinnati Bancorp expands our presence throughout the greater Cincinnati market and allows us to enter the Northern Kentucky market with one branch office. We believe the acquisition of Cincinnati Bancorp will enhance LCNB’s long-term profitability by providing our local, community-oriented financial services to more customers throughout Cincinnati and Northern Kentucky, leveraging Cincinnati Bancorp’s mortgage platform, and allowing us to offer Cincinnati Bancorp’s customers more financial products, including our Wealth Management solutions. We look forward to completing the acquisition in the coming weeks and welcoming Cincinnati Bancorp customers, employees, and shareholders to LCNB.”

Income Statement

Net income for the 2023 third quarter was $4,070,000, compared to $5,579,000 for the same period last year. Earnings per basic and diluted share for the 2023 third quarter were $0.37, compared to $0.49 for the same period last year. Net income for the nine-month period ended September 30, 2023 was $12,921,000, compared to $15,720,000 for the same period last year. Earnings per basic and diluted share for the nine-month period ended September 30, 2023 were $1.16, compared to $1.36 for the same period last year.

Adjusted net income for the 2023 third quarter was $4,309,000, or $0.40 per diluted share, compared to $5,579,000, or $0.49 per diluted share, for the same period last year. Adjusted net income accounts for the impact of one-time merger-related expenses, net of tax, associated with the Cincinnati Bancorp, Inc. acquisition. Adjusted net income for the nine-month period ended September 30, 2023 was $13,507,000, or $1.22 per diluted share, compared to $15,720,000, or $1.36 per diluted share, in the prior year period.

Net interest income for the three months ended September 30, 2023 was $13,571,000, compared to $15,444,000 for the comparable period in 2022. Net interest income for the nine-month period ended September 30, 2023 was $41,690,000, as compared to $44,834,000 in the same period last year. Contributing to the variances for both the three and nine-month periods were increases in the amount of long and short-term borrowings combined with higher interest expense associated with the rapid year-over-year increase in the Effective Federal Funds Rate. An increase in interest income from loans due to increases in the volume of average loans outstanding and the average rates earned on these loans partially offset the borrowings and deposit variances. For the 2023 third quarter, LCNB’s tax equivalent net interest margin was 3.04%, compared to 3.54% for the same period last year. For the 2023 nine-month period, LCNB’s tax equivalent net interest margin was 3.20%, compared to 3.48% for the same period last year.

Non-interest income for the three months ended September 30, 2023 was $3,578,000, compared to $3,581,000 for the same period last year. For the nine months ended September 30, 2023, non-interest income increased $146,000, or by 1.4%, to $10,805,000, compared to $10,659,000 for the same period last year. The increase in non-interest income for the nine-month period was primarily due to higher fiduciary income and a decrease in net losses recognized on equity securities, partially offset by decreased service charges and fees on deposit accounts and lower gains on sales of loans.

Non-interest expense for the three months ended September 30, 2023 was $106,000 less than the comparable period in 2022 primarily due to the absence of losses recognized on the sale of a decommissioned office building during the 2022 quarter, partially offset by $302,000 in one-time merger-related expenses recognized during the third quarter. For the nine months ended September 30, 2023, non-interest expense was $778,000 higher than the comparable period in 2022, partially due to $742,000 in merger-related expenses, partially offset by gains recognized on the sale of a decommissioned office building during the second quarter 2023 and the absence of losses recognized on the sale of two decommissioned office buildings during the 2022 period. In addition, non-interest expense for the 2022 nine-month period was lower than it otherwise would have been because of an $889,000 gain recognized during the second quarter 2022 from the sale of other real estate owned.

Capital Allocation

During the nine months ended September 30, 2023, LCNB invested $3.3 million to repurchase 199,913 shares of its outstanding stock at an average price of $16.47 per share. This equates to approximately 1.78% of the Company’s outstanding common stock prior to the repurchase. At September 30, 2023, LCNB had 315,047 shares remaining under its February 2023 share repurchase program.

For the third quarter ended September 30, 2023, LCNB paid $0.21 per share in dividends, a 5.0% increase from $0.20 per share for the third quarter last year. Year-to-date, LCNB has paid $0.63 per share in dividends, compared to $0.60 per share for the nine-month period last year.

Balance Sheet

Total assets at September 30, 2023 increased 4.0% to a record $1.98 billion from $1.90 billion at September 30, 2022. Net loans at September 30, 2023 increased 5.8% to a record $1.45 billion, compared to $1.37 billion at September 30, 2022.

Total deposits at September 30, 2023 decreased 2.4% to $1.62 billion, compared to $1.66 billion at September 30, 2022. While LCNB continues to experience greater competition for deposit accounts, total deposits at September 30, 2023 increased 1.3% from June 30, 2023.

Assets Under Management

Total assets managed at September 30, 2023 were a record $3.23 billion, compared to $3.03 billion at September 30, 2022. The year-over-year increase in total assets managed was primarily due to increases in LCNB Corp. total assets, trust and investments, and brokerage accounts. Trust and investments and brokerage accounts increased due to a higher number of new LCNB Wealth Management customer accounts opened over the past twelve months and an increase in the fair value of managed assets, partially offset by decreases in cash management accounts.

Asset Quality

For the 2023 third quarter, LCNB recorded a total net recovery of credit losses of $114,000, compared to a total net recovery of credit losses of $157,000 for the 2022 third quarter. For the nine months ended September 30, 2023, LCNB recorded a total net recovery of credit losses of $141,000, compared to a total provision for credit losses of $269,000 for the nine months ended September 30, 2022.

Net charge-offs for the 2023 third quarter were $33,000, or 0.01% of average loans, compared to net charge-offs of $32,000, or 0.01% of average loans, for the same period last year. For the 2023 nine-month period, net charge-offs were $82,000, or 0.01% of average loans, compared to net charge-offs of $131,000, or 0.01% of average loans, for the 2022 nine-month period.

Total nonperforming loans, which include non-accrual loans and loans past due 90 days or more and still accruing interest, decreased $204,000 from $465,000 or 0.03% of total loans at September 30, 2022, to $261,000 or 0.02% of total loans at September 30, 2023. Nonperforming assets to total assets was 0.01% at September 30, 2023, compared to 0.02% at September 30, 2022.

Merger Agreement With Cincinnati Bancorp, Inc.

LCNB and Cincinnati Bancorp, Inc. (“CNNB”), the holding company for Cincinnati Federal, a federally chartered stock

savings and loan association, signed a definitive merger agreement on May 18, 2023, whereby LCNB will acquire CNNB in a stock-and-cash transaction. CNNB operates five full-service branch offices in Cincinnati, Ohio and Northern Kentucky.

Pursuant to the terms of the merger agreement, which has been approved by the Board of Directors of each company, CNNB shareholders had the opportunity to elect to receive either 0.9274 shares of LCNB stock or $17.21 per share in cash for each share of CNNB common stock owned, subject to 80% of all CNNB shares being exchanged for LCNB common stock. The transaction is anticipated to close in November 2023. Closure is subject to customary closing conditions as described in the merger agreement, including receipt of certain regulatory approvals.

About LCNB Corp.

LCNB Corp. is a financial holding company headquartered in Lebanon, Ohio. Through its subsidiary, LCNB National Bank (the “Bank”), it serves customers and communities in Southwest and South-Central Ohio. A financial institution with a long tradition for building strong relationships with customers and communities, the Bank offers convenient banking locations in Butler, Clermont, Clinton, Fayette, Franklin, Hamilton, Montgomery, Preble, Ross, and Warren Counties, Ohio. The Bank continually strives to exceed customer expectations and provides an array of services for all personal and business banking needs including checking, savings, online banking, personal lending, business lending, agricultural lending, business support, deposit and treasury, investment services, trust and IRAs and stock purchases. LCNB Corp. common shares are traded on the NASDAQ Capital Market Exchange® under the symbol “LCNB.” Learn more about LCNB Corp. at www.lcnb.com.

Forward-Looking Statements

Certain statements made in this news release regarding LCNB’s financial condition, results of operations, plans, objectives, future performance and business, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are identified by the fact they are not historical facts and include words such as “anticipate”, “could”, “may”, “feel”, “expect”, “believe”, “plan”, and similar expressions. Please refer to LCNB’s Annual Report on Form 10-K for the year ended December 31, 2022, as well as its other filings with the SEC, for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements.

These forward-looking statements reflect management's current expectations based on all information available to management and its knowledge of LCNB’s business and operations. Additionally, LCNB’s financial condition, results of operations, plans, objectives, future performance and business are subject to risks and uncertainties that may cause actual results to differ materially. These factors include, but are not limited to:

1.the success, impact, and timing of the implementation of LCNB’s business strategies;

2.LCNB’s ability to integrate future acquisitions may be unsuccessful or may be more difficult, time-consuming, or costly than expected;

3.LCNB may incur increased loan charge-offs in the future and the allowance for credit losses may be inadequate;

4.LCNB may face competitive loss of customers;

5.changes in the interest rate environment, which may include further interest rate increases, may have results on LCNB’s operations materially different from those anticipated by LCNB’s market risk management functions;

6.changes in general economic conditions and increased competition could adversely affect LCNB’s operating results;

7.changes in regulations and government policies affecting bank holding companies and their subsidiaries, including changes in monetary policies, could negatively impact LCNB’s operating results;

8.LCNB may experience difficulties growing loan and deposit balances;

9.United States trade relations with foreign countries could negatively impact the financial condition of LCNB's customers, which could adversely affect LCNB 's operating results and financial condition;

10.difficulties with technology or data security breaches, including cyberattacks, could negatively affect LCNB's ability to conduct business and its relationships with customers, vendors, and others;

11.adverse weather events and natural disasters and global and/or national epidemics could negatively affect LCNB’s customers given its concentrated geographic scope, which could impact LCNB’s operating results; and

12.government intervention in the U.S. financial system, including the effects of legislative, tax, accounting and regulatory actions and reforms, including the Coronavirus Aid, Relief, and Economic Security ("CARES") Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Jumpstart Our Business Startups Act, the Consumer Financial Protection Bureau, the capital ratios of Basel III as adopted by the federal banking authorities, the Tax Cuts and Jobs Act, changes in deposit insurance premium levels, and any such future regulatory actions or reforms.

Forward-looking statements made herein reflect management's expectations as of the date such statements are made. Such information is provided to assist shareholders and potential investors in understanding current and anticipated financial operations of LCNB and is included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. LCNB undertakes no obligation to update any forward-looking statement to reflect events or circumstances that arise after the date such statements are made.

Exhibit 99.2

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

LCNB Corp. and Subsidiaries Financial Highlights (Dollars in thousands, except per share amounts) (Unaudited) | | | |

| Three Months Ended | | Nine Months Ended | |

| 09-30-2023 | | 06-30-2023 | | 03-31-2023 | | 12-31-2022 | | 09-30-2022 | | 09-30-2023 | | 09-30-2022 | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Condensed Income Statement | | | | | | | | | | | | | | | | |

Interest income | $ | 19,668 | | | 18,703 | | | 17,918 | | | 17,719 | | | 16,704 | | | 56,289 | | 48,034 | | | |

Interest expense | 6,097 | | | 4,526 | | | 3,976 | | | 1,511 | | | 1,260 | | | 14,599 | | 3,200 | | | |

Net interest income | 13,571 | | | 14,177 | | | 13,942 | | | 16,208 | | | 15,444 | | | 41,690 | | 44,834 | | | |

Provision for (recovery of) credit losses | (114) | | | 30 | | | (57) | | | (19) | | | (157) | | | (141) | | 269 | | | |

Net interest income after provision for (recovery of) credit losses | 13,685 | | | 14,147 | | | 13,999 | | | 16,227 | | | 15,601 | | | 41,831 | | 44,565 | | | |

Non-interest income | 3,578 | | | 3,646 | | | 3,581 | | | 3,629 | | | 3,581 | | | 10,805 | | 10,659 | | | |

Non-interest expense | 12,244 | | | 12,078 | | | 12,525 | | | 12,065 | | | 12,350 | | | 36,847 | | 36,069 | | | |

Income before income taxes | 5,019 | | | 5,715 | | | 5,055 | | | 7,791 | | | 6,832 | | | 15,789 | | 19,155 | | | |

Provision for income taxes | 949 | | | 1,021 | | | 898 | | | 1,383 | | | 1,253 | | | 2,868 | | 3,435 | | | |

Net income | $ | 4,070 | | | $ | 4,694 | | | $ | 4,157 | | | $ | 6,408 | | | 5,579 | | | 12,921 | | | 15,720 | | | | |

| | | | | | | | | | | | | | | | |

| Supplemental Income Statement Information | | | | | | | | | | | | | | | |

Amort/Accret income on acquired loans | $ | — | | | — | | | 75 | | | 249 | | | 144 | | 75 | | 271 | | | |

Tax-equivalent net interest income | $ | 13,617 | | | 14,223 | | | 13,989 | | | 16,257 | | | 15,495 | | 41,829 | | 44,985 | | | |

| | | | | | | | | | | | | | | | |

Per Share Data | | | | | | | | | | | | | | | | |

Dividends per share | $ | 0.21 | | | 0.21 | | | 0.21 | | | 0.21 | | | 0.20 | | 0.63 | | 0.60 | | | |

Basic earnings per common share | $ | 0.37 | | | 0.42 | | | 0.37 | | | 0.57 | | | 0.49 | | 1.16 | | 1.36 | | | |

Diluted earnings per common share | $ | 0.37 | | | 0.42 | | | 0.37 | | | 0.57 | | | 0.49 | | 1.16 | | 1.36 | | | |

Book value per share | $ | 18.10 | | | 18.20 | | | 18.22 | | | 17.82 | | | 17.31 | | 18.10 | | 17.31 | | | |

Tangible book value per share | $ | 12.72 | | | 12.81 | | | 12.86 | | | 12.48 | | | 11.97 | | 12.72 | | 11.97 | | | |

Weighted average common shares outstanding: | | | | | | | | | | | | | | | |

Basic | 11,038,720 | | | 11,056,308 | | | 11,189,170 | | | 11,211,328 | | | 11,284,225 | | 11,094,185 | | 11,478,256 | | | |

Diluted | 11,038,720 | | | 11,056,308 | | | 11,189,170 | | | 11,211,328 | | | 11,284,225 | | 11,094,185 | | 11,478,256 | | | |

Shares outstanding at period end | 11,123,382 | | | 11,116,080 | | | 11,202,063 | | | 11,259,080 | | | 11,293,639 | | 11,123,382 | | 11,293,639 | | | |

| | | | | | | | | | | | | | | | |

Selected Financial Ratios | | | | | | | | | | | | | | | | |

Return on average assets | 0.82% | | 0.98% | | 0.88% | | 1.34% | | 1.15% | | 0.89% | | 1.09% | | | |

Return on average equity | 7.92% | | 9.22% | | 8.33% | | 12.90% | | 10.80% | | 8.49% | | 9.91% | | | |

| Return on average tangible common equity | 11.21% | | 13.07% | | 11.85% | | 18.59% | | 15.30% | | 12.04% | | 13.86% | | | |

Dividend payout ratio | 56.76% | | 50.00% | | 56.76% | | 36.84% | | 40.82% | | 54.31% | | 44.12% | | | |

Net interest margin (tax equivalent) | 3.04% | | 3.28% | | 3.28% | | 3.77% | | 3.54% | | 3.20% | | 3.48% | | | |

Efficiency ratio (tax equivalent) | 71.21% | | 67.59% | | 71.29% | | 60.67% | | 64.74% | | 70.01% | | 64.82% | | | |

| | | | | | | | | | | | | | | | |

Selected Balance Sheet Items | | | | | | | | | | | | | | | | |

Cash and cash equivalents | $ | 43,422 | | | 26,020 | | | 31,876 | | | 22,701 | | | 29,460 | | | | | | | | |

Debt and equity securities | 309,094 | | | 314,763 | | | 328,194 | | | 323,167 | | | 325,801 | | | | | | | | |

| | | | | | | | | | | | | | | | |

Loans: | | | | | | | | | | | | | | | | |

| Commercial and industrial | $ | 125,751 | | | 127,553 | | | 124,240 | | | 120,236 | | | 114,694 | | | | | | | | |

| Commercial, secured by real estate | 981,787 | | | 961,173 | | | 932,208 | | | 938,022 | | | 908,130 | | | | | | | | |

| Residential real estate | 313,286 | | | 312,338 | | | 303,051 | | | 305,575 | | | 316,669 | | | | | | | | |

| Consumer | 27,018 | | | 29,007 | | | 28,611 | | | 28,290 | | | 29,451 | | | | | | | | |

| Agricultural | 11,278 | | | 9,955 | | | 7,523 | | | 10,054 | | | 8,630 | | | | | | | | |

| Other, including deposit overdrafts | 80 | | | 69 | | | 62 | | | 81 | | | 52 | | | | | | | | |

| Deferred net origination fees | (796) | | | (844) | | | (865) | | | (980) | | | (937) | | | | | | | | |

Loans, gross | 1,458,404 | | | 1,439,251 | | | 1,394,830 | | | 1,401,278 | | | 1,376,689 | | | | | | | | |

Less allowance for credit losses on loans | 7,932 | | | 7,956 | | | 7,858 | | | 5,646 | | | 5,644 | | | | | | | | |

Loans, net | $ | 1,450,472 | | | $ | 1,431,295 | | | $ | 1,386,972 | | | $ | 1,395,632 | | | $ | 1,371,045 | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | |

| 09-30-2023 | | 06-30-2023 | | 03-31-2023 | | 12-31-2022 | | 09-30-2022 | | 09-30-2023 | | 09-30-2022 | | | |

Selected Balance Sheet Items, continued | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Allowance for Credit Losses on Loans: | | | | | | | | | | | | | | | | |

| Allowance for credit losses, beginning of period | $ | 7,956 | | | 7,858 | | | 5,646 | | | 5,644 | | | 5,833 | | | | | | | | |

Cumulative change in accounting principle - ASC 326 | — | | | — | | | 2,196 | | | — | | | — | | | | | | | | |

| Provision for (recovery of) credit losses | 9 | | | 131 | | | 32 | | | (19) | | | (157) | | | | | | | | |

| Losses charged off | (57) | | | (49) | | | (36) | | | (60) | | | (53) | | | | | | | | |

| Recoveries | 24 | | | 16 | | | 20 | | | 81 | | | 21 | | | | | | | | |

| Allowance for credit losses, end of period | $ | 7,932 | | | 7,956 | | | 7,858 | | | 5,646 | | | 5,644 | | | | | | | | |

| | | | | | | | | | | | | | | | |

Total earning assets | $ | 1,787,796 | | | 1,756,157 | | | 1,736,829 | | | 1,726,902 | | | $ | 1,714,196 | | | | | | | | |

Total assets | 1,981,668 | | | 1,950,763 | | | 1,924,808 | | | 1,919,398 | | | 1,904,975 | | | | | | | | |

Total deposits | 1,616,890 | | | 1,596,709 | | | 1,603,881 | | | 1,604,970 | | | 1,657,370 | | | | | | | | |

Short-term borrowings | 30,000 | | | 112,289 | | | 76,500 | | | 71,455 | | | 4,000 | | | | | | | | |

Long-term debt | 112,641 | | | 18,122 | | | 18,598 | | | 19,072 | | | 24,539 | | | | | | | | |

Total shareholders’ equity | 201,349 | | | 202,316 | | | 204,072 | | | 200,675 | | | 195,439 | | | | | | | | |

Equity to assets ratio | 10.16 | % | | 10.37 | % | | 10.60 | % | | 10.46 | % | | 10.26 | % | | | | | | | |

Loans to deposits ratio | 90.20 | % | | 90.14 | % | | 86.97 | % | | 87.31 | % | | 83.06 | % | | | | | | | |

| | | | | | | | | | | | | | | | |

Tangible common equity (TCE) | $ | 141,508 | | | 142,362 | | | 144,006 | | | 140,498 | | | 135,140 | | | | | | | | |

Tangible common assets (TCA) | 1,921,827 | | | 1,890,809 | | | 1,864,742 | | | 1,859,221 | | | 1,844,676 | | | | | | | | |

TCE/TCA | 7.36 | % | | 7.53 | % | | 7.72 | % | | 7.56 | % | | 7.33 | % | | | | | | | |

| | | | | | | | | | | | | | | | |

Selected Average Balance Sheet Items | | | | | | | | | | | | | | | | |

Cash and cash equivalents | $ | 36,177 | | | 30,742 | | | 35,712 | | | 24,330 | | | $ | 35,763 | | | $ | 34,234 | | | $ | 32,393 | | | | |

Debt and equity securities | 313,669 | | | 321,537 | | | 327,123 | | | 323,195 | | | 338,299 | | | 320,706 | | | 339,051 | | | | |

| | | | | | | | | | | | | | | | |

Loans | $ | 1,451,153 | | | 1,405,939 | | | 1,389,385 | | | 1,383,809 | | | $ | 1,384,520 | | | $ | 1,415,719 | | | $ | 1,379,080 | | | | |

Less allowance for credit losses on loans | 7,958 | | | 7,860 | | | 7,522 | | | 5,647 | | | 5,830 | | | 7,782 | | | 5,623 | | | | |

Net loans | $ | 1,443,195 | | | 1,398,079 | | | 1,381,863 | | | 1,378,162 | | | $ | 1,378,690 | | | $ | 1,407,937 | | | $ | 1,373,457 | | | | |

| | | | | | | | | | | | | | | | |

Total earning assets | $ | 1,775,713 | | | 1,737,256 | | | 1,729,008 | | | 1,711,524 | | | 1,736,031 | | | 1,747,476 | | | 1,728,677 | | | | |

Total assets | 1,971,269 | | | 1,927,956 | | | 1,922,031 | | | 1,903,626 | | | 1,929,155 | | | 1,940,591 | | | 1,919,804 | | | | |

Total deposits | 1,610,508 | | | 1,604,346 | | | 1,583,857 | | | 1,637,201 | | | 1,669,932 | | | 1,599,668 | | | 1,657,401 | | | | |

Short-term borrowings | 63,018 | | | 79,485 | | | 94,591 | | | 21,433 | | | 5,728 | | | 78,916 | | | 12,140 | | | | |

Long-term debt | 72,550 | | | 18,514 | | | 18,983 | | | 23,855 | | | 24,920 | | | 36,878 | | | 15,907 | | | | |

Total shareholders’ equity | 203,967 | | | 204,085 | | | 202,419 | | | 197,014 | | | 205,051 | | | 203,496 | | | 212,064 | | | | |

Equity to assets ratio | 10.35 | % | | 10.59 | % | | 10.53 | % | | 10.35 | % | | 10.63 | % | | 10.49 | % | | 11.05 | % | | | |

Loans to deposits ratio | 90.11 | % | | 87.63 | % | | 87.72 | % | | 84.52 | % | | 82.91 | % | | 88.50 | % | | 83.21 | % | | | |

| | | | | | | | | | | | | | | | |

Asset Quality | | | | | | | | | | | | | | | | |

Net charge-offs (recoveries) | $ | 33 | | | 33 | | | 16 | | | (21) | | | 32 | | | 82 | | 131 | | | |

Other real estate owned | — | | | — | | | — | | | — | | | — | | | — | | — | | | |

| | | | | | | | | | | | | | | | |

Non-accrual loans | $ | 85 | | | 451 | | | 701 | | | 391 | | | 465 | | | 85 | | | 465 | | | | |

Loans past due 90 days or more and still accruing | 176 | | | 256 | | | — | | | 39 | | | — | | | 176 | | | — | | | | |

Total nonperforming loans | $ | 261 | | | 707 | | | 701 | | | 430 | | | 465 | | | 261 | | | 465 | | | | |

| | | | | | | | | | | | | | | | |

Net charge-offs (recoveries) to average loans | 0.01 | % | | 0.01 | % | | 0.00 | % | | (0.01) | % | | 0.01 | % | | 0.01 | % | | 0.01 | % | | | |

Allowance for credit losses on loans to total loans | 0.54 | % | | 0.55 | % | | 0.56 | % | | 0.40 | % | | 0.41 | % | | | | | | | |

Nonperforming loans to total loans | 0.02 | % | | 0.05 | % | | 0.05 | % | | 0.03 | % | | 0.03 | % | | | | | | | |

Nonperforming assets to total assets | 0.01 | % | | 0.04 | % | | 0.04 | % | | 0.02 | % | | 0.02 | % | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | | |

| 09-30-2023 | | 06-30-2023 | | 03-31-2023 | | 12-31-2022 | | 09-30-2022 | | 09-30-2023 | | 09-30-2022 | | | |

| | | | | | | | | | | | | | | | |

Assets Under Management | | | | | | | | | | | | | | | | |

LCNB Corp. total assets | $ | 1,981,668 | | | 1,950,763 | | | 1,924,808 | | | 1,919,398 | | | 1,904,975 | | | | | | | | |

Trust and investments (fair value) | 731,342 | | | 744,149 | | | 716,578 | | | 678,366 | | | 611,409 | | | | | | | | |

Mortgage loans serviced | 146,483 | | | 143,093 | | | 142,167 | | | 148,412 | | | 145,317 | | | | | | | | |

Cash management | 2,445 | | | 2,668 | | | 1,831 | | | 1,925 | | | 53,199 | | | | | | | | |

Brokerage accounts (fair value) | 368,854 | | | 384,889 | | | 374,066 | | | 347,737 | | | 314,144 | | | | | | | | |

Total assets managed | 3,230,792 | | | 3,225,562 | | | 3,159,450 | | | 3,095,838 | | | 3,029,044 | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Reconciliation of Net Income Less Tax-Effected Merger-Related Costs | | | | | | | | | | | |

| Net income | $ | 4,070 | | | 4,694 | | | 4,157 | | | 6,408 | | | 5,579 | | | 12,921 | | | 15,720 | | | | |

| Merger-related costs | 302 | | | 415 | | | 25 | | | — | | | — | | | 742 | | | — | | | | |

| Tax effect | (63) | | | (88) | | | (5) | | | — | | | — | | | (156) | | | — | | | | |

| Adjusted net income | $ | 4,309 | | | 5,021 | | | 4,177 | | | 6,408 | | | 5,579 | | | 13,507 | | | 15,720 | | | | |

| | | | | | | | | | | | | | | | |

| Adjusted basic and diluted earnings per share | $ | 0.40 | | | 0.45 | | | 0.37 | | | 0.57 | | | 0.49 | | | 1.22 | | 1.36 | | | |

| Adjusted return on average assets | 0.87 | % | | 1.04 | % | | 0.88 | % | | 1.34 | % | | 1.15 | % | | 0.93 | % | | 1.09 | % | | | |

| Adjusted return on average equity | 8.38 | % | | 9.87 | % | | 8.37 | % | | 12.90 | % | | 10.79 | % | | 8.87 | % | | 9.91 | % | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Three Months Ended June 30, |

| | 2023 | | 2022 | | 2023 |

| | Average

Outstanding

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate | | Average

Outstanding

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate | | Average

Outstanding

Balance | | Interest

Earned/

Paid | | Average

Yield/

Rate |

| Loans (1) | | $ | 1,451,153 | | | 17,875 | | | 4.89 | % | | $ | 1,384,520 | | | 15,026 | | | 4.31 | % | | $ | 1,405,939 | | | 16,763 | | | 4.78 | % |

| | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | | 10,891 | | | 152 | | | 5.54 | % | | 13,212 | | | 80 | | | 2.40 | % | | 9,780 | | | 144 | | | 5.91 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Federal Reserve Bank stock | | 4,652 | | | — | | | — | % | | 4,652 | | | — | | | — | % | | 4,652 | | | 140 | | | 12.07 | % |

| Federal Home Loan Bank stock | | 7,007 | | | 134 | | | 7.59 | % | | 4,369 | | | 65 | | | 5.90 | % | | 6,713 | | | 121 | | | 7.23 | % |

| Investment securities: | | | | | | | | | | | | | | | | | | 0 |

| Equity securities | | 3,382 | | | 38 | | | 4.46 | % | | 4,387 | | | 20 | | | 1.81 | % | | 3,386 | | | 38 | | | 4.50 | % |

| Debt securities, taxable | | 274,494 | | | 1,296 | | | 1.87 | % | | 297,001 | | | 1,323 | | | 1.77 | % | | 282,325 | | | 1,323 | | | 1.88 | % |

| Debt securities, non-taxable (2) | | 24,134 | | | 219 | | | 3.60 | % | | 27,890 | | | 241 | | | 3.43 | % | | 24,461 | | | 220 | | | 3.61 | % |

| Total earnings assets | | 1,775,713 | | | 19,714 | | | 4.40 | % | | 1,736,031 | | | 16,755 | | | 3.83 | % | | 1,737,256 | | | 18,749 | | | 4.33 | % |

| Non-earning assets | | 203,514 | | | | | | | 198,954 | | | | | | | 198,560 | | | | | |

| Allowance for credit losses | | (7,958) | | | | | | | (5,830) | | | | | | | (7,860) | | | | | |

| Total assets | | $ | 1,971,269 | | | | | | | $ | 1,929,155 | | | | | | | $ | 1,927,956 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Interest-bearing demand and money market deposits | | $ | 541,487 | | | 2,298 | | | 1.68 | % | | $ | 539,228 | | | 422 | | | 0.31 | % | | $ | 521,422 | | | 1,597 | | | 1.23 | % |

| Savings deposits | | 379,515 | | | 129 | | | 0.13 | % | | 453,420 | | | 159 | | | 0.14 | % | | 395,367 | | | 134 | | | 0.14 | % |

| IRA and time certificates | | 230,030 | | | 1,999 | | | 3.45 | % | | 168,358 | | | 398 | | | 0.94 | % | | 215,403 | | | 1,604 | | | 2.99 | % |

| Short-term borrowings | | 63,018 | | | 830 | | | 5.23 | % | | 5,728 | | | 71 | | | 4.92 | % | | 79,485 | | | 1,008 | | | 5.09 | % |

| Long-term debt | | 72,550 | | | 841 | | | 4.60 | % | | 24,920 | | | 210 | | | 3.34 | % | | 18,514 | | | 183 | | | 3.96 | % |

| Total interest-bearing liabilities | | 1,286,600 | | | 6,097 | | | 1.88 | % | | 1,191,654 | | | 1,260 | | | 0.42 | % | | 1,230,191 | | | 4,526 | | | 1.48 | % |

| Demand deposits | | 459,476 | | | | | | | 508,926 | | | | | | | 472,154 | | | | | |

| Other liabilities | | 21,226 | | | | | | | 23,524 | | | | | | | 21,526 | | | | | |

| Equity | | 203,967 | | | | | | | 205,051 | | | | | | | 204,085 | | | | | |

| Total liabilities and equity | | $ | 1,971,269 | | | | | | | $ | 1,929,155 | | | | | | | $ | 1,927,956 | | | | | |

| Net interest rate spread (3) | | | | | | 2.52 | % | | | | | | 3.41 | % | | | | | | 2.85 | % |

| Net interest income and net interest margin on a taxable-equivalent basis (4) | | | | 13,617 | | | 3.04 | % | | | | 15,495 | | | 3.54 | % | | | | 14,223 | | | 3.28 | % |

| Ratio of interest-earning assets to interest-bearing liabilities | | 138.02 | % | | | | | | 145.68 | % | | | | | | 141.22 | % | | | | |

| | | | | |

| (1) | Includes non-accrual loans. |

| (2) | Income from tax-exempt securities is included in interest income on a taxable-equivalent basis. Interest income has been divided |

| (3) | The net interest spread is the difference between the average rate on total interest-earning assets and interest-bearing liabilities. |

| (4) | The net interest margin is the taxable-equivalent net interest income divided by average interest-earning assets. |

Exhibit 99.2

| | | | | | | | | | | |

LCNB CORP. AND SUBSIDIARIES CONSOLIDATED CONDENSED BALANCE SHEETS (Dollars in thousands) |

| September 30, 2023

(Unaudited) | | December 31, 2022 |

| ASSETS: | | | |

| Cash and due from banks | $ | 23,124 | | | 20,244 | |

| Interest-bearing demand deposits | 20,298 | | | 2,457 | |

| Total cash and cash equivalents | 43,422 | | | 22,701 | |

| | | |

| Investment securities: | | | |

| Equity securities with a readily determinable fair value, at fair value | 1,254 | | | 2,273 | |

| Equity securities without a readily determinable fair value, at cost | 2,099 | | | 2,099 | |

| Debt securities, available-for-sale, at fair value | 274,500 | | | 289,850 | |

| Debt securities, held-to-maturity, at cost, net | 19,006 | | | 19,878 | |

| Federal Reserve Bank stock, at cost | 4,652 | | | 4,652 | |

| Federal Home Loan Bank stock, at cost | 7,583 | | | 4,415 | |

| Loans, net | 1,450,472 | | | 1,395,632 | |

| Premises and equipment, net | 33,288 | | | 33,042 | |

| Operating lease right-of-use assets | 6,093 | | | 6,525 | |

| Goodwill | 59,221 | | | 59,221 | |

| Core deposit and other intangibles, net | 1,351 | | | 1,827 | |

| Bank-owned life insurance | 45,128 | | | 44,298 | |

| Interest receivable | 8,087 | | | 7,482 | |

| Other assets, net | 25,512 | | | 25,503 | |

| TOTAL ASSETS | $ | 1,981,668 | | | 1,919,398 | |

| | | |

| LIABILITIES: | | | |

| Deposits: | | | |

| Noninterest-bearing | $ | 453,146 | | | 505,824 | |

| Interest-bearing | 1,163,744 | | | 1,099,146 | |

| Total deposits | 1,616,890 | | | 1,604,970 | |

| Short-term borrowings | 30,000 | | | 71,455 | |

| Long-term debt | 112,641 | | | 19,072 | |

| Operating lease liabilities | 6,317 | | | 6,647 | |

| Accrued interest and other liabilities | 14,471 | | | 16,579 | |

| TOTAL LIABILITIES | 1,780,319 | | | 1,718,723 | |

| | | |

| COMMITMENTS AND CONTINGENT LIABILITIES | — | | | — | |

| | | |

| SHAREHOLDERS' EQUITY: | | | |

| Preferred shares – no par value, authorized 1,000,000 shares, none outstanding | — | | | — | |

| Common shares – no par value; authorized 19,000,000 shares; issued 14,334,765 and 14,270,550 shares at September 30, 2023 and December 31, 2022, respectively; outstanding 11,123,382 and 11,259,080 shares at September 30, 2023 and December 31, 2022, respectively | 144,865 | | | 144,069 | |

| Retained earnings | 143,211 | | | 139,249 | |

| Treasury shares at cost, 3,211,383 and 3,011,470 shares at September 30, 2023 and December 31, 2022, respectively | (56,015) | | | (52,689) | |

| Accumulated other comprehensive loss, net of taxes | (30,712) | | | (29,954) | |

| TOTAL SHAREHOLDERS' EQUITY | 201,349 | | | 200,675 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 1,981,668 | | | $ | 1,919,398 | |

Exhibit 99.2

| | | | | | | | | | | | | | | | | | | | | | | |

LCNB CORP. AND SUBSIDIARIES CONSOLIDATED CONDENSED STATEMENTS OF INCOME (Dollars in thousands, except per share data) (Unaudited) |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| INTEREST INCOME: | | | | | | | |

| Interest and fees on loans | $ | 17,875 | | | 15,026 | | | 50,781 | | | 43,360 | |

| Dividends on equity securities: | | | | | | | |

| With a readily determinable fair value | 9 | | | 14 | | | 34 | | | 40 | |

| Without a readily determinable fair value | 29 | | | 6 | | | 79 | | | 16 | |

| Interest on debt securities: | | | | | | | |

| Taxable | 1,296 | | | 1,323 | | | 3,962 | | | 3,672 | |

| Non-taxable | 173 | | | 190 | | | 523 | | | 567 | |

| Other investments | 286 | | | 145 | | | 910 | | | 379 | |

| TOTAL INTEREST INCOME | 19,668 | | | 16,704 | | | 56,289 | | | 48,034 | |

| | | | | | | |

| INTEREST EXPENSE: | | | | | | | |

| Interest on deposits | 4,426 | | | 979 | | | 10,217 | | | 2,493 | |

| Interest on short-term borrowings | 830 | | | 71 | | | 3,142 | | | 320 | |

| Interest on long-term debt | 841 | | | 210 | | | 1,240 | | | 387 | |

| TOTAL INTEREST EXPENSE | 6,097 | | | 1,260 | | | 14,599 | | | 3,200 | |

| NET INTEREST INCOME | 13,571 | | | 15,444 | | | 41,690 | | | 44,834 | |

| | | | | | | |

| PROVISION FOR (RECOVERY OF) CREDIT LOSSES | (114) | | | (157) | | | (141) | | | 269 | |

| NET INTEREST INCOME AFTER PROVISION FOR (RECOVERY OF) CREDIT LOSSES | 13,685 | | | 15,601 | | | 41,831 | | | 44,565 | |

| | | | | | | |

| NON-INTEREST INCOME: | | | | | | | |

| Fiduciary income | 1,736 | | | 1,513 | | | 5,263 | | | 4,851 | |

| Service charges and fees on deposit accounts | 1,397 | | | 1,706 | | | 4,324 | | | 4,658 | |

| | | | | | | |

| Bank-owned life insurance income | 282 | | | 269 | | | 830 | | | 803 | |

| Gains from sales of loans | 29 | | | — | | | 38 | | | 188 | |

| Other operating income | 134 | | | 93 | | | 350 | | | 159 | |

| TOTAL NON-INTEREST INCOME | 3,578 | | | 3,581 | | | 10,805 | | | 10,659 | |

| | | | | | | |

| NON-INTEREST EXPENSE: | | | | | | | |

| Salaries and employee benefits | 7,044 | | | 7,062 | | | 21,454 | | | 21,291 | |

| Equipment expenses | 397 | | | 398 | | | 1,175 | | | 1,234 | |

| Occupancy expense, net | 805 | | | 790 | | | 2,367 | | | 2,300 | |

| State financial institutions tax | 396 | | | 439 | | | 1,189 | | | 1,312 | |

| Marketing | 223 | | | 215 | | | 735 | | | 845 | |

| Amortization of intangibles | 113 | | | 113 | | | 336 | | | 365 | |

| FDIC insurance premiums, net | 224 | | | 137 | | | 663 | | | 397 | |

| Contracted services | 671 | | | 613 | | | 1,978 | | | 1,902 | |

| Other real estate owned, net | 1 | | | 5 | | | 3 | | | (874) | |

| Merger-related expenses | 302 | | | — | | | 742 | | | — | |

| Other non-interest expense | 2,068 | | | 2,578 | | | 6,205 | | | 7,297 | |

| TOTAL NON-INTEREST EXPENSE | 12,244 | | | 12,350 | | | 36,847 | | | 36,069 | |

| INCOME BEFORE INCOME TAXES | 5,019 | | | 6,832 | | | 15,789 | | | 19,155 | |

| PROVISION FOR INCOME TAXES | 949 | | | 1,253 | | | 2,868 | | | 3,435 | |

| NET INCOME | $ | 4,070 | | | 5,579 | | | 12,921 | | | 15,720 | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic | 0.37 | | | 0.49 | | | 1.16 | | | 1.36 | |

| Diluted | 0.37 | | | 0.49 | | | 1.16 | | | 1.36 | |

| | | | | | | | | | | | | | | | | | | | | | | |

LCNB CORP. AND SUBSIDIARIES CONSOLIDATED CONDENSED STATEMENTS OF INCOME (Dollars in thousands, except per share data) (Unaudited) |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 11,038,720 | | | 11,284,225 | | | 11,094,185 | | | 11,478,256 | |

| Diluted | 11,038,720 | | | 11,284,225 | | | 11,094,185 | | | 11,478,256 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

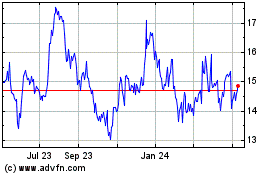

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

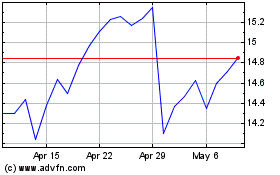

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Apr 2023 to Apr 2024